E-bike Market by Class (Class I, II, & III), Battery (Li-ion, Li-ion Polymer, Lead Acid), Motor (Mid, Hub), Mode (Throttle, Pedal Assist), Usage (Mountain/Trekking, City/Urban, Cargo), Speed, Battery Capacity, Component, Region - Global Forecast to 2028

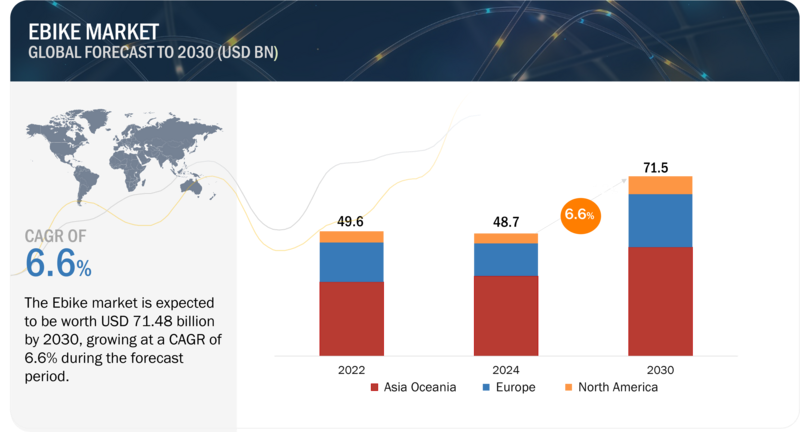

The global E-bike market was valued at USD 77.2 billion by 2028 and is expected to reach USD 51.5 billion in 2023, at a CAGR of 8.4% from 2023 to 2028. The worldwide demand for e-Bikes is growing rapidly as customers see e-Bikes as an eco-friendly solution for commutes, with rising fuel prices adding to support the inclination. Government bodies in various cities worldwide have undertaken initiatives to build bicycle highway lanes for e-Bikes.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Government support to increase e-bike sales to lower CO2 emissions

The electric bicycle (e-bike) is a low-emission mode of transportation that offers benefits in the areas of health, time, cost, safety, congestion, air & noise pollution, and energy security. Over short distances, e-Bikes are a more efficient alternative to other means of transportation. E-bike riders save money and with contribute to less environmental impact. However, the production of e-bike components such as battery batteries or drives, cause more emissions. In everyday life, the eBikes can be used instead of the cars in many situations, such as going shopping with a cargo bike. The energy requirement of an e-bike is around 11.2 Wh of electricity per mile travelled, which is very low. According to the Federal Environment Agency, a car emits about 240 g CO2 per passenger mile (pkm), while public transportation emits between 80 and 176 g CO2 per passenger mile. The bicycles and the eBikes have significantly lower emissions, as compared to other modes of transportation.

Hence, to meet the carbon emission targets and to encourage more and more people to opt for cycling, government across the globe are introducing various incentives and rebate programs. Countries like The Netherlands, Germany, Belgium, Brussels, UK, France, Paris, Denmark, etc. are taking initiatives to boost e-bike sales.

RESTRAINT:Government regulations and lack of infrastructure

Government laws and terminologies are diverse regarding e-Bikes. Some countries have national regulations, but states and provinces decide the authority and legal road use regulations. Therefore, any change/update in the regulation of e-Bikes impacts the market demand. For example, China announced a regulation on e-Bikes wherein bicycles are classified as e-Bikes only if they can pedal assist, have a maximum speed of up to 25 km/h, and have a motor power of up to 400 watts. Any e-Bike offering a speed above 25 km/h is considered a moped.

Similarly, Class-II and Class-III e-Bikes are restricted in some European and Asia Oceanic regions due to their high speed and throttle to avoid traffic complications (except in India, which allows Class-II). Except for Italy and the UK, most European countries have banned Class-II e-Bikes per European Union regulations. Class-III e-Bikes have a limited presence in Europe. California does not allow class 3 e-bikes with throttle, and Colorado & Washington do not allow e-bikes with electric motors above 750 watts.

One of the other restraining factors for the development and growth of the e-Bike market is the lack of infrastructures, such as bike paths and bike lanes, in emerging countries of Asia Oceanic and North American regions, such as India, Japan, Canada, and Mexico. Some cities in North America are making efforts to overcome these restraints. For instance, New York City has seen a dramatic drop in vehicular traffic, opened 12 miles of roadways to pedestrians in May 2020, and added nine more miles of protected bike lanes to overcome these restraints.

Therefore, the regulations and lack of infrastructure restrain the growth of e-Bikes, especially in the emerging markets of North America and Asia Oceanic.

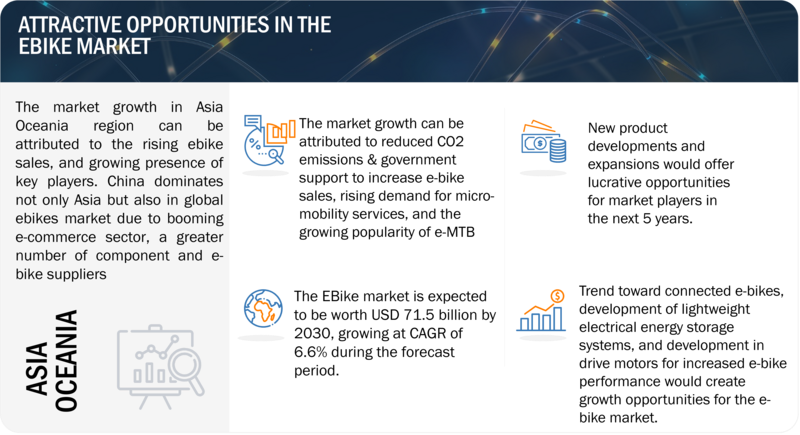

OPPORTUNITY: The trend toward connected e-bikes

Connected e-bikes are intelligent and omniscient bikes capable of communicating key data on their condition and use. In some cases, connected bikes can also receive information and commands remotely. Connected e-bike systems allow both data gathering and data mining. Companies are coming forward to develop connected solutions, like Specialized Bicycle Components Inc (US), which has developed mission control and ride features in its product offerings. Shimano Inc (Japan) has developed an e-tube ride feature. Thus, apart from e-Bikes, manufacturers focus on developing technologies and services to support customers in an advanced manner.

According to a United Nations report, ~70% of the world’s population will live in cities, resulting in more road traffic congestion by 2050. Megatrends such as urbanization, digitalization, and sustainability are emerging. Therefore, the trend for connected e-Bikes would create an opportunity for the e-Bikes market to develop and grow during the forecasted period.

CHALLENGE: High cost of E-Bikes

Price is one of the determining factors during the purchase of an e-Bike. Traditional bicycles, on average, costs nearly USD 400, whereas e-Bikes are expensive, as their cost ranges between USD 1,500 and USD 1,700 and can go up to USD 5,000, with some premium models almost double that. The price of an e-Bike varies across regions. For example, Europe and North America are more technologically advanced and tech-oriented, resulting in the high cost of e-Bikes. This bike is price sensitive in the Asia Oceanic region, which can be a potential buyer challenge.

Earlier, lead acid-equipped e-Bikes were prevalent in China. Their price ranged between USD 400 and 500. However, according to the new regulation announced in China in 2019, all e-Bikes must be equipped with lithium-ion batteries, increasing the cost of e-Bikes to USD 700-800. Therefore, with increased e-Bike prices, consumers would prefer electric two-wheelers or scooters, which fall under the same price range. This might result in a decline in e-Bike sales. According to a survey by Shimano, almost 40% of the respondents cited this issue.

Therefore, manufacturers face a challenge to reduce the costs of e-Bikes without declining the build quality and enhancing the performance. However, offering pricing incentives for purchasing e-Bikes may effectively promote e-Bikes and tackle the cost challenges.

E-Bike market Ecosystem

The ecosystem analysis highlights various e-Bike market players, primarily represented by raw material suppliers, component manufacturers, e-Bike manufacturers, and end users. There are two major motor drive technologies used in e-Bikes. First, a hub motor drive is positioned on the front or rear of an e-Bike, with the motor placed in the wheel hub. The second is the mid-drive motor, a frame specifically designed to incorporate the motor in the bottom bracket of the bicycle, which provides a good balance to the rider. Lithium-ion batteries are the most widely used in e-Bikes. Lead acid batteries, popular in the Asia Oceanic due to their low cost and easy availability, have been phased out.

Growing demand for electric mountain bike (e-MTB)

e-MTB has witnessed a rapid increase in demand compared to other types, such as city/urban and cargo e-Bikes, in recent years. The e-MTB market is led by Europe and followed by North America and Asia-Oceanic. Interest in mountain biking is also increasing in Europe. According to Eurobike, almost every third e-Bike sold in Germany is an e-mountain bike. Europe is the largest market for mountain e-Bikes, owing to an increase in the percentage of trips made by bicycles. The growth in the number of trips by e-Bikes has been witnessed among young adults between 18 and 30. This age group mostly prefers mountain e-Bikes as they are robust. In e-Bike riding, the European region is dominated by males, with 90%.

In North America, mountain biking is one of the off-road sports gaining popularity. Crossroad biking is also popular in this region due to the rising number of women and kids entering this sport, which became male dominated earlier. Many cyclist organizations, such as League of America Wheelman, IMBA, and Bike Centennial, have undertaken initiatives and projects to encourage more individuals to enter this sport. The Asia Oceanic region is also growing, and e-MTB is the preferred segment of e-Bikes in countries like India. People's interest in adventure and fitness has led to the popularity of e-mountain bikes.

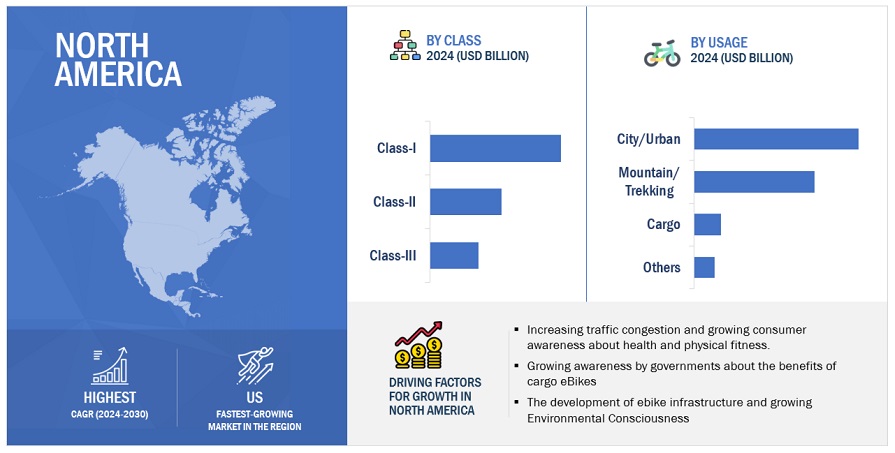

The Class-I segment is projected to be the largest in the e-Bike market

The market for Class-I e-Bikes would grow during the forecast period. With the inclination of customer preference toward easy and effortless riding methods, the Class-II e-Bikes market is predicted to increase its market share during the forecast period. Class-I e-bikes are projected to be the largest e-bike market during the forecast but are projected to witness the slowest growth during the forecast period. Class-I are expected to lead the market in countries such as China, Japan, South Korea, and Taiwan. These countries allow only class-I e-Bikes. This results in class-I e-Bikes occupying the largest market share in the Asia Oceanic region.

North America is growing at the fastest rate during the forecast period, as in the US, various incentives and rebate programs are being implemented by the government. For instance, On February 2022, the US House of Representatives passed a bill proposing a 30% tax credit for purchasing new electric bicycles in the US. The goal is to make it easier for Americans to afford electric bikes. Hence the demand for class-I e-bikes is growing across the globe.

North American E-Bike market by value is projected to grow during the forecast year 2023-2028

In North America, city E-Bikes are expected to account for the largest market share, due to the increased adoption of electric bikes for daily commuting, recreation, and fitness activities. Trekking and mountain biking is one of the off-road sports and recreational activity mediums gaining popularity in the region which is why the demand for e-MTBs is increasing. Crossroad biking has also gained popularity due to the rising number of women and kids entering this sport. Several cyclist organizations, such as League of America Wheelman, IMBA, and Bike Centennial, have undertaken initiatives and projects to encourage more individuals to enter this sport. Thus, all these factors lead to an increase in the demand for mountain and trekking E-Bikes. To reduce emissions, governments in North America are offering incentives to purchase cargo E-Bikes. These factors would increase the demand for E-Bikes in North America during the forecast period.

After the reduction in the severity of the pandemic, things gradually returned to their initial state. The US and Canada witnessed an increase in E-Bike sales by 19% and 3%, respectively, in 2020 compared to 2019. The US was the largest market for E-Bikes in 2021 in the North American countries.

E-Bikes prove to be a sustainable source for commuting and even protecting the green environment. The quest to maintain the ecosystem and reduce the release of toxic elements into the atmosphere and carbon footprint is significant for the rapid response to North American E-Bike adoption. The government’s involvement in using sustainable E-Bikes has also acted as a catalyst to increase market demand for E-Bikes in North America. Government bodies in various cities worldwide have undertaken initiatives to build bicycle highway lanes for E-Bikes. The emphasis has also been laid on improving biking infrastructure.

Key Market Players

The key players in the E-Bike market are Accell Group NV (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings., Ltd. (China), Yamaha Motor Company (Japan), and Pedego (US). Major companies' key strategies to maintain their position in the global market are strong global networking, mergers and acquisitions, partnerships, and technological advancement.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attribute |

Details |

|

Base year for estimation |

2028 |

|

Forecast period |

2023 - 2028 |

|

Market Growth forecast |

USD 77.2 Billion by 2028 from USD 51,479.9 million at 8.4% CAGR |

|

Top Players |

Accell Group NV (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings., Ltd. (China), Yamaha Motor Company (Japan) and Pedego (US) |

|

Segments covered |

|

|

By Class |

Class-I, Class-II, Class-III |

|

By Speed |

Up to 25 Km/h, 25-45 Km/h |

|

By Motor type |

Mid, Hub |

|

By Mode |

Pedal Assist, Throttle |

|

By Component |

Batteries, Electric Motors, Frames with Forks, Crank Gears, Wheels, Motor Controllers, and Brake Systems |

|

By Usage |

Mountain/Trekking, City/Urban, Cargo, and Others |

|

By Battery type |

Lithium-ion, Lithium-ion Polymer, Lead Acid, and Others |

|

By Battery Capacity |

<250W, >250 & <450W, >450 & <650W, and >650W |

|

By Ownership |

Shared and Personal |

|

By Motor Weight |

<2 kg, >2 kg & <2.4 kg, >2.4 kg |

|

By Region |

North America, Europe, Asia Oceanic |

Market Definition

e-Bike refers to a bicycle with a small electric motor and a rechargeable battery to assist the power provided by the rider. Batteries of an e-bike can be recharged by connecting them to a plug. A typical e-bike needs 6 to 8 hours to charge the battery and has a range of travel of 35 to 50 km at a speed of about 20 km/h.

Recent Developments

- In Oct 2022, Yadea Group launched the Y80 e-bike feature with a 350W engine delivering 100Nm torque powered by a 36V 10.5Ah large-capacity battery that can reach up to 80km of range.

- In April 2022, Pedego Electric Bikes opened a store in Orlando, Florida, which offers sales, rentals, and services for the growing market in the region.

- In Jan 2022, Yamaha introduced two new models of an e-bike for all-terrain mobility under the sports electric-assist bicycle product range.

- In Sep 2022, Pedego launched the Pedego Avenue features with 500-watt motor features, balanced frame geometry, and an integrated battery, which gives the rider comfort on pesky hills.

- In Jan 2022, Giant unveiled the all-new Trance X E+, a versatile and adaptable E-MTB designed to extend the rider's capabilities on various terrains.

Frequently Asked Questions (FAQ):

What is the current size of the global e-Bike market?

The global e-bike market is projected to reach USD 77.2 billion by 2028 from USD 51.5 billion in 2023, with Asia Oceania dominating the market.

Which class type is currently leading the e-bike market?

Class-I is leading the class-type segment of the electric bike market.

Many companies are operating in the e-Bike market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The mobility as a service market is dominated by major players such as Accell Group NV (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings., Ltd. (China), Yamaha Motor Company (Japan), and Pedego (US). Major companies' key strategies to maintain their position in the global e-bike market are strong global networking, mergers and acquisitions, partnerships, and technological advancement.

How is the demand for e-bike varies by region?

Asia Oceanic is the largest e-Bike market in terms of manufacturing and selling. In Asia Oceanic, China was the largest market for e-Bikes in 2022, followed by Japan, India, South Korea, Taiwan, and Australia.

What are the drivers and opportunities for the electric bike manufacturer?

The growth in the E-Bike industry is expected mainly due to driving factors for the market like growing traffic congestions in the city, growing popularity of electric mountain bikes (e-MTB), and government support to increase e-bike sales in support of lower emission transportation commute.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

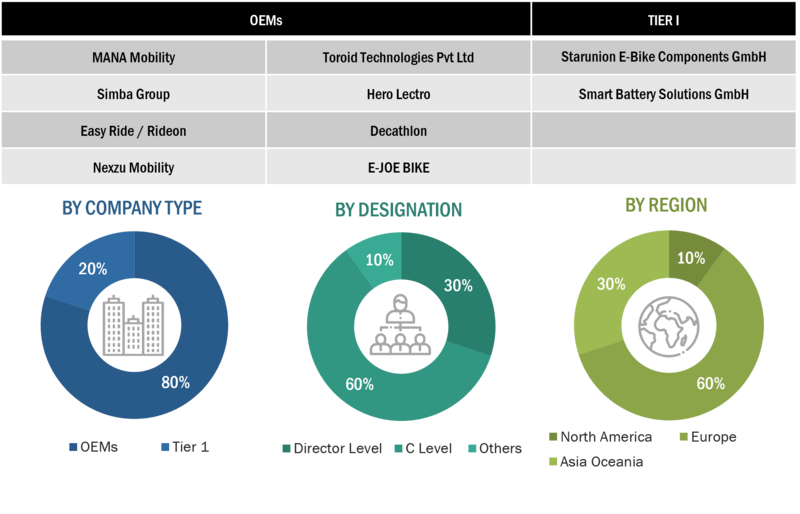

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, e-Bike magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, were used to identify and collect information for an extensive study of the e-Bike market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information, as well as to assess prospects and market estimations.

Secondary Research

Secondary sources for this research study included the e-Bike industry association; corporate filings (such as annual reports, investor presentations, and financial statements); and data from trade and business. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, several primary interviews were conducted with market experts from the demand and supply sides across 3 major regions, North America, Europe, and Asia Oceanic . 30% and 70% of primary interviews were conducted with the OEMs and Tier-1, respectively.

Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to validate the findings from the primaries. This, along with insights by in-house subject-matter experts, led to the findings described in the remainder of this report.

Breakdown Of Primary Interviews: By Company Type & Designation

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was followed to derive the market size in terms of volume and value. This is followed by primary interviews and feature mapping on a regional basis from the MarketsandMarkets repository.

The market size was validated through in-depth interviews with industry experts—excerpts of which are available in the discussion guide in the appendix—and secondary research. After arriving at the final numbers for the market size, the report-writing phase begins.

Bottom-Up Approach: By Region, Class and Usage

The bottom-up approach was used to estimate and validate the size of the e-Bike market by region, class, and usage. Country-level sales of e-Bikes (in units) were derived from secondary sources and paid databases and validated through primary interviews to determine the size of the market, by class and usage, in terms of volume. Country-level penetration of class type (Class-I, Class-II, and Class-III) and Usage Type (mountain/trekking bikes, city/urban, cargo, and others) were derived from secondary sources and paid databases and validated through primary interviews.

The country-level sales of e-Bikes (in units) were multiplied by the penetration of each class type and usage type. Through this, the e-Bike market volume, by class type and by usage, was derived. The average OE price of class type and by usage was derived from secondary sources, and the same was validated by primaries. The market volume, by class type and by usage, was multiplied by the average OE price of class type and usage. Themarket, by class type and usage type, in terms of value (USD million), was derived through this. The summation of country-level markets provided the regional-level market. Further summation of the regional-level markets provided the global market in terms of volume (million units) and value (USD million) by region, class type, and usage.

To know about the assumptions considered for the study, Request for Free Sample Report

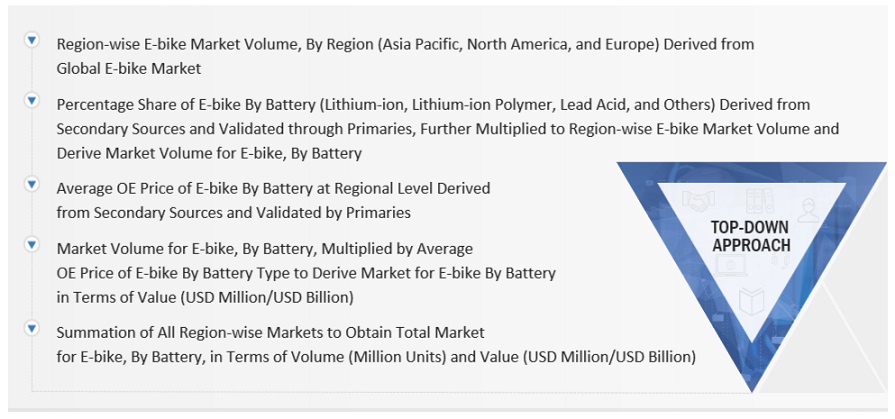

Top Down Approach – By Battery Type

While estimating the regional market size for e-Bikes by battery type-Bike was derived from the global e-Bike market in terms of volume. The percentage share of e-Bikes by battery type (lithium-ion, lithium-ion polymer, lead-acid, and others) was derived from secondary sources and validated through primaries. It was multiplied by region-wise market volume. Through this, the market volume for e-Bikes, by battery type, was derived. The average OE price of e-Bike by battery type at the regional level was derived from secondary sources, and the same was validated by primaries. The market volume for e-Bikes, by battery type, was multiplied by the average OE price of e-Bikes, by battery type. The market for e-Bikes by battery type was derived in terms of value (USD million). The summation of all region-wise markets was carried out to obtain the total market for e-Bikes, by battery type, in terms of volume (Million units) and value (USD million).

A similar approach was followed to obtain the e-Bike market, by motor type, mode, battery type, component, and speed.

Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that are expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report

Report Objectives

-

To define, describe, and forecast the size of the global e-Bike market in terms of value (USD million) and volume (million units)

- By Class (Class-I, Class-II, Class-III) at the regional level

- By Speed (up to 25 km/h, 25-45 km/h) at the regional level

- By Battery Type (Lithium-ion, Lithium-ion Polymer, Lead Acid, and Others) at the regional level

- By Motor Type (Hub and Mid) at the regional level

- By Mode (Pedal Assist and Throttle) at the regional level

- By Component (Batteries, Electric Motors, Frames With Forks, Wheels, Crank Gears, Brake Systems, and Motor Controller) at the regional level

- By Usage (Mountain/Trekking, City/Urban, Cargo, and Others) at the regional level

- By Ownership (Shared and Personal)

- By Battery Capacity (<250W, >250 & <450W, >450 & <650W, and >650W)

- By Motor Weight (<2 kg, >2 kg & <2.4 kg, >2.4 kg)

- Country-level analysis of class-wise and usage-wise segments (Asia Oceanic, Europe, and North America)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking

- To analyze the competitive leadership mapping of the global e-bike manufacturers and e-bike component suppliers in the market

- To analyze recent developments, including expansions and new product launches, undertaken by key industry participants in the market

- To strategically analyze the market with Porter’s five forces analysis, trade analysis, case studies, patent analysis, technology analysis, regulatory analysis, and the COVID-19 impact.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

By Design

- Foldable

- Unfoldable

By Frame Material

- Carbon Fiber

- Carbon Steel

- Aluminum

- Aluminum Alloy

Note: This will be further segmented by region.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in E-bike Market

Merida Industry Co., Ltd is a Taiwan-based company

We are an electric bike brand and we are interested in obtaining this report.

Is it possible to discuss the market segmentation by the country-level?

Market Segment is already discussed at country level. Do you have any specific requirement?

Profiles of key players in U.S market, their product portfolio analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and all other key development including SWOT analysis will be provided. Similarly, for the E-Scooter and E- Motorcycles market we will provide the historical units sales data and revenues and growth forecast. Profiles of key players in U.S market, their product portfolio analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and all other key development including SWOT analysis will be provided. Demographic analysis is only done from qualitative standpoint, and we have covered the buyer behaviour analysis by age, however we have provided the market size and growth forecast by Usage – (Mountain, Trekking, City/Urban, Cargo, Others), at a regional level and country level. for the E-Scooter and E- Motorcycles market we will provide the historical units sales data and revenues and growth forecast.

E-Bike market report was published early this year, and this new version has an improved scope and we have provided the regional and country level market size and growth forecast in terms of unit sales and revenues further broken down by By Class, By Usage, By Battery, By Speed, By Motor and By Mode and Average Selling Price by segments.Market share analysis of key players, including their revenue analysis for last three years, product and business revenues, key financial analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and expansions plans in terms of production and market penetration, and all other key development including SWOT analysis are provided for all global and regional players.

There is no reference to RAD BIkes in the report and yet they appear to be taking the US market by storm.... am I missing something?

I may be interested in buying your E-bike market report and like to get a better idea of scope and contents.

Looking for e-bike market potential and forecasting data. To analyse and size the market for investment potential for Valeo.

The following are the specific items that we are looking to gather from the e-bike report: 1) market size ($) breakdown by geography 2) market size forecast overall and by geography 3) volume (units) breakdown by geography 4) Market share breakdown by key buyers (e.g. OEMs) 5) Total available market for connected services overall and by geography 6) Connected Services market share by competition 7) Percentage of OEMs producing connected solutions in-house vs outsourcing 8) What jobs are OEMs trying to accomplish with connected services 9) What are some pains OEMs are experiencing with connected services, how are they trying to solve them 10) What are some gains that OEMs are creating through connected service solutions Please let me know which items would be available in the report and which portion(s) of the report they would be contained in. If this would be best addressed in a conversation, do you have availability to speak, preferably tomorrow - my phone number should be attached. Thank you

We are building a global e-bike brand and we would like to have access to the report to get more information and identify opportunities to prepare our master plan for the next five years

We are the biggest lead-acid battery in North America and we are seeing the market for electric bikes growing. So, we would like to understand more about this market in South America.

Would like to know the current Global Market scenario in E-bike and accordingly what is the future of this category in India

I`m trying to make a general view of the electro bikes and other electric two wheels vehicles, use in mexican cities and their potential to reduce criteria pollutants as a substitute of internal combustion engines vehicles.