Electric Commercial Vehicle Market by Propulsion (BEVs & FCEVs), Vehicle Type (Pickups, Medium and Heavy-Duty Trucks & Vans), Range, Battery Type, Power Output, Battery Capacity, Component, End User, Body Construction and Region - Global Forecast to 2030

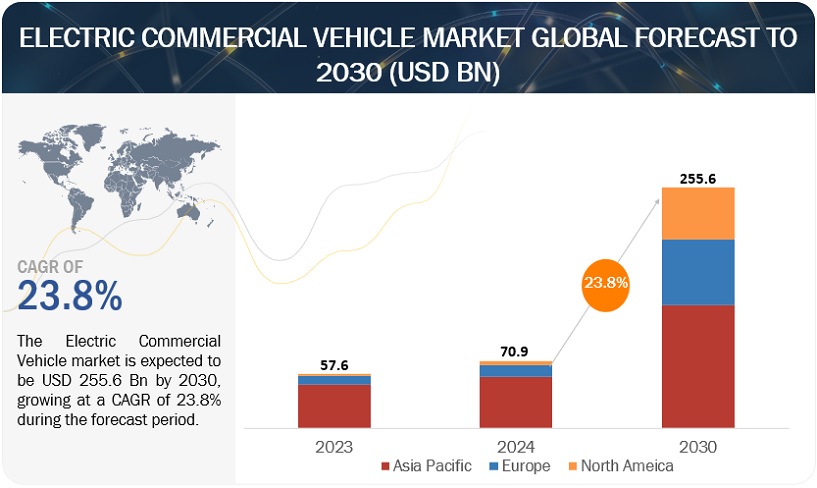

[286 Pages Report] The global electric commercial vehicle market size is projected to grow from 519.4 thousand units in 2023 to 2,155.1 thousand units by 2030, at a CAGR of 22.5%.

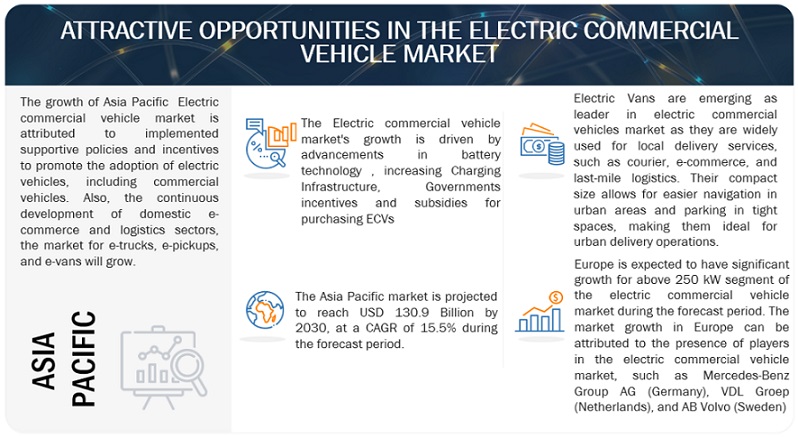

Governments across the globe are implementing policies and subsidies to promote the electric commercial vehicles. These measures include grants, tax credits, and exemptions from certain charges or fees. Increasing popularity of electric pickup trucks will drive the electric commercial vehicle market. Higher focus to develop EV charging stations and hydrogen fueling stations and incentives offered to buyers will create opportunities for OEMs to expand their revenue stream and geographical presence by offering electric commercial vehicles.

Meanwhile, the European ECV market will be led by electric van sales with major countries planning to switch to all electric by 2030-2035. Further, the North American ECV market will be growing with the number of electric pickup sales in the region. Electric trucks will also gain a considerable traction towards the end of this decade.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Reducing price of EV batteries to increase demand for ECVs

Decreasing cost of EV batteries due to technological advancements and the production of EV batteries on a mass scale in large volumes. This has led to a decrease in the cost of electric vehicles as EV batteries constitute most expensive components of the vehicle. For example, in 2010, the price of an EV battery was USD 1,100 per kWh. However, according to Bloomberg, the price fell to USD 138 per kWh in 2022. It is due to the reducing manufacturing costs of EV batteries, reduced cathode material prices, higher production, etc. The prices of EV batteries are expected to fall to approximately USD 60 per kWh by 2030, which is expected to significantly reduce the prices of ECVs, making them cheaper than conventional ICE commercial vehicles. In April-2022, Samsung SDI announced to develop cobalt free battery to secure price competitiveness of its electric vehicle (EV) batteries. Battery cost is directly proportional to battery capacity. Initially, the prices were high for large-capacity batteries, but over the period, prices have reduced, making high-capacity batteries more affordable for end-users. Various policies and economies of scale have led to a reduction in the battery cost/kWh. Advancements in technology have also enabled wireless charging while driving, which is a dynamic charging technology that can also help reduce vehicle weight and optimize energy use.

Restraint: High initial investment in electric commercial vehicle production

The initial investment required to produce electric trucks is much higher compared to that of petroleum, diesel, or CNG trucks as of 2022. The price of parts and machinery used for production is also quite high. This is largely due to the high cost of batteries used in electric trucks. Once battery technology improves and prices reduce, the price of electric trucks will get lower than trucks using other fuel types. In February-2022, AB Volvo announced to establish a large-scale production plant for battery cells to meet a growing demand for zero-emission transportation. The batteries will be used for commercial vehicles such as trucks, buses, construction equipment and other electric drivelines. Currently, as mass production of these vehicles is done on a limited scale, the cost of production of these vehicles is still quite high compared to other trucks.

Opportunity: Development of wireless EV charging technology for on-the-go charging to fuel market

The wireless technology for on-the-go charging has been under development for the past few years. Once this technology matures, people will not need to charge their vehicles as these are expected to be automatically charged while in use. This technology is currently significantly high priced but may be used in the coming decades. It is expected to significantly impact the EV market as the sales are expected to increase at a high rate when this technology is applied. As of 2022, wireless EV charging is available for stationary charging. In Norway, a trial of wireless on-the-go EV charging is undertaken, which is expected to cater to a 25 Oslo-based fleet of Jaguar I-pace taxis and enable charging. The Norwegian capital has launched an initiative called ElectriCity, which aims to make its taxi system emission-free by 2024. In August-2022, Siemens and MAHLE announced to develop wireless inductive charging system to wirelessly transfer electricity from an on-ground transmitter to a receiver installed under an EV.

Challenge: Limited battery capacity to challenge market growth

The batteries of current electric vehicles have low capacities and limited distances per charge. The performance and service life of batteries directly affect the performance and cost of electric vehicles. Presently, lead-acid, nickel-cadmium, nickel-metal hydride, and lithium-ion batteries are used to power electric vehicles. Lithium-ion batteries are gradually replacing lead-acid, nickel-cadmium, and nickel-metal hydride batteries in electric vehicles as they offer a longer life. However, the capacity of lithium-ion batteries is too low to power commercial vehicles. In cold climates, the charging-discharging performance of batteries declines significantly, making it difficult for them to provide maximum power. The time required to charge an electric vehicle with the available equipment is high, leading to consumer dissatisfaction. The average time required to charge an electric commercial vehicle from 0% to 100% with a 7-kW charger is more than 6-8 hours. Also, most charging stations are equipped with low-capacity chargers. These challenges need to be overcome to facilitate the growth of the electric commercial vehicle market. The EV charging time is much higher compared to the fueling time of other fuel alternatives. The majority of public stations have Level 2 chargers. Level 1 and 2 charging can take 8-16 hours to charge vehicles from 0-100%. A Level 3 charger can take ~60 mins to charge an EV from 0-80%.

Electric Commercial Vehicle Market Ecosystem

The ecosystem analysis highlights various players in the electric commercial vehicle market which is represented by OEMs, Tier 1 suppliers, Tier 2 suppliers and charging infrastructure. Top companies include BYD (China), Mercedes Benz Group AG (Germany), AB Volvo (Sweden), Tesla, Inc (US) and PACCAR Inc (US).

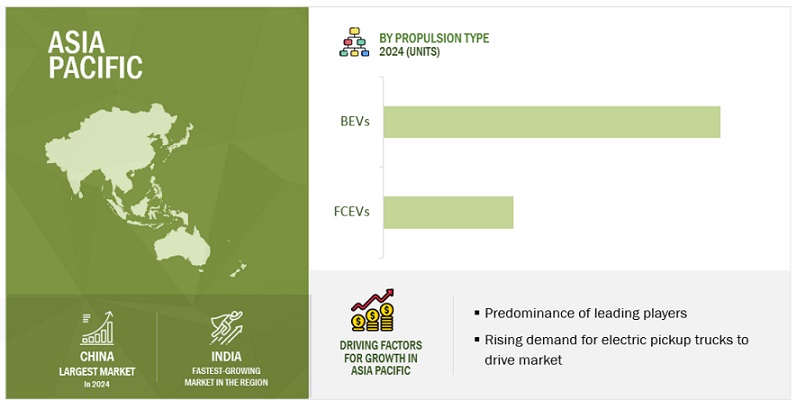

The BEV segment to be the largest segment during the forecast period

An electric vehicle that runs completely on a battery is termed a BEV. The vehicle runs with the help of a permanent magnet motor powered by a battery installed in the vehicle. The average range of BEVs is 150 to 200 miles and varies based on battery type installation. With advancements in battery technology and a continuous decrease in battery prices, the overall costs of BEVs are expected to decrease in the near future. In addition, maintenance costs for electric motors are much lower because they have far fewer moving parts than conventional motors and are far more efficient. The average range of BEVs is 150 to 250 miles and varies based on battery type installation as of 2022. Scania AB, Mercedes Benz Group AG, and Nikola Corporation have variants in the BEV electric trucks segment. Mercedes -Benz offers heavy-duty electric truck eActros, which has a battery capacity of 420 kWh. Rivian offers a semi-autonomous electric pickup truck R1T with battery capacity of 135 kWh. Tesla, Inc. launched the electric pickup truck Cybertruck with a range of 500 miles and a battery capacity of 200 kWh.

The Asia Pacific market is projected to hold the largest share by 2030

Asia Pacific region for electric commercial vehicles will increase due to the need to reduce pollution and the dependence on petrol/diesel. The market in developing economies such as China will also increase due to the increasing disposable income. In January-2022, Dongfeng Motor Corporation announced to establish a new production facility for electric off-road vehicles in Wuhan. This is scheduled to start production in 2023 with a planned capacity of 10,000 vehicles. In March 2023, BYD announced to launch electric pickup truck under a new brand. Furthermore, several European and American automobile manufacturers, such as Volkswagen (Germany), Mercedes Benz Group AG (Germany), and General Motors (US), have shifted their production plants to emerging economies.

Key Market Players

The electric commercial vehicle market is dominated by established players such as BYD (China), Mercedes Benz Group AG (Germany), AB Volvo (Sweden), Tesla, Inc (US), and PACCAR Inc (US). The market ranking has been derived by considering ECV sales and a certain percentage of segmental revenue for each of the companies mentioned above. These companies also offer extensive products and solutions for the automotive industry. These companies have strong distribution networks at the global level, and they invest heavily in R&D to develop new products.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Volume (Units) and Value (USD Million/Billion) |

|

Segments covered |

Vehicle type, propulsion, by body construction, battery type, range, power output, component, battery capacity, end use, and region |

|

Geographies covered |

Asia Pacific, Europe and North America |

|

Companies Covered |

BYD (China), Mercedes Benz Group AG (Germany), AB Volvo (Sweden), Tesla, Inc (US), PACCAR Inc (US) among others. |

This research report categorizes the electric commercial vehicle market based on vehicle type, body construction, propulsion, battery type, range, power output, component, battery capacity, end use, and region

Based on Components:

- Battery Packs

- Onboard Charger

- Electric Motor

- Inverter

- DC DC Converter

- Fuel Cell Stack

Based on Vehicle Type:

- Pickup Truck

- Medium Duty Truck

- Heavy Duty Truck

- Light Van

- Full Size Van

Based on Battery Type:

- Lithium-iron-phosphate (LFP)

- Nickel-manganese-cobalt (NMC)

- Solid-state battery

- Others

Based on Battery Capacity:

- Less than 60 kWh

- 60-120 kWh

- 121-200 kWh

- 201-300 kWh

- 301-500 kWh

- 501-1000 kWh

Based on Propulsion:

- Battery Electric Vehicles (BEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Based on End User:

- Last Mile Delivery

- Distribution Services

- Field Services

- Long Haul Transportation

- Refuse Trucks

Based on Power Output:

- Less than 100 kW

- 100-250 kW

- Above 250 kW

Based on Range:

- Less than 150 Miles

- 150-300 Miles

- Above 300 Miles

Based on Body Construction:

- Integrated

- Semi-integrated/Rigid Truck

- Full Size

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- Canada

- US

-

Europe

- Austria

- France

- Germany

- Netherland

- Norway

- Spain

- Sweden

- UK

- Italy

- Others

Recent Developments

- In March 2023, Volvo Trucks and Boliden announced to collaborate on deployment of underground electric trucks for mining

- In December 2022, AB Volvo announced the launch of rigid versions of its heavy electric trucks for distribution in urban and rural areas. The new heavy rigid trucks are designed to carry electric superstructures for a wide range of specialized transport assignments, including goods distribution, refuse collection and construction work

- In December 2022, Tesla, Inc officially launched the Semi, the heavy duty electric truck. The Semi is currently the only electric commercial vehicle that offers a range of 800 Km on a single charge.

- In October 2022, Electric truck rental company Sixt announced to purchase 100,000 electric vehicles from BYD through 2028. Sixt will deploy the vehicles to Germany, France, the Netherlands, and the U.K.

- In September 2022, Mercedes Benz Group AG launched its long-range electric truck eActros Long Haul. It is equipped with battery capacity of 600 kWh, uses LFP battery cells and has range of 500 kms.

- In September 2022, DAF launched electric trucks for distribution and logistical purposes. The electric truck offers battery pack of 315 kWh to 525 kWh and offers range of over 500 kms

Frequently Asked Questions (FAQ):

What is the market size of the global electric commercial vehicle market and its projection?

The global electric commercial vehicle market is estimated from 519.4 thousand units in 2023 to 2,155.1 thousand units by 2030, at a CAGR of 22.5%.

Who are the winners in the global electric commercial vehicle market?

The electric commercial vehicle market is dominated by established players such as BYD (China), Mercedes Benz Group AG (Germany), AB Volvo (Sweden), Tesla, Inc (US), and PACCAR Inc (US). These companies have high presence at the global level, and they invest heavily in R&D to develop new electric commercial vehicles.

What are the new market trends impacting the growth of the electric commercial vehicle market?

EV battery price reductions, connencted vehicles, battery management system, wireless charging, battery swapping are the key market trends or technologies which will have a major impact on the electric commercial vehicle market in the future.

What are the different components used in the electric commercial vehicle market?

Electric-powered commercial vehicles are gaining a rapid market share due to the emission reduction measures by countries worldwide. Electric commercial vehicles are very efficient as they consume less energy and have significantly low emissions, making them environment-friendly automobiles. The sales of electric commercial vehicles have increased the demand for various components such as batteries, instrument clusters, infotainment systems, and onboard chargers. Batteries are the most important part of any electric commercial vehicle as they provide power to the drivetrain. They are also the costliest part of the electric commercial vehicle. The Battery Management System (BMS) is also known as the brain of a vehicle as it manages the output, charging, and discharging of the battery. They control power output from battery packs to the ECV. Each electric commercial vehicle has an inbuilt rechargeable battery.

Which region is expected to be the largest market during forecast period?

Asia Pacific is expected to be the largest market during forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

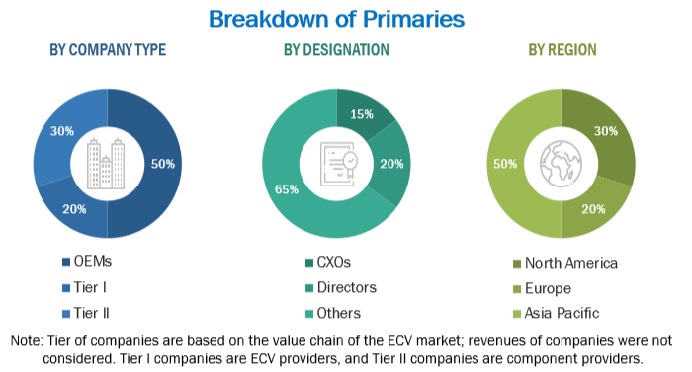

The study involved four major activities in estimating the current size of the electric commercial vehicle market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of electric commercial vehicle manufacturers, International Energy Agency (IEA), Alternative Fuel Data Center (AFDC), European Alternate Fuels Observatory (EAFO), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level vehicle associations and trade organizations, and the US Department of Transportation (DOT)], EV related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global electric commercial vehicle market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, Asia Pacific, Europe and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

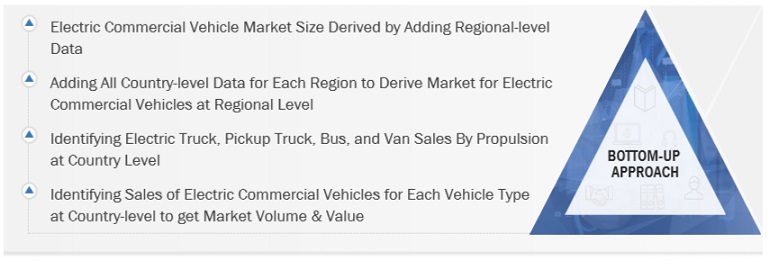

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets have been identified through extensive secondary research

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Electric Commercial Vehicle Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

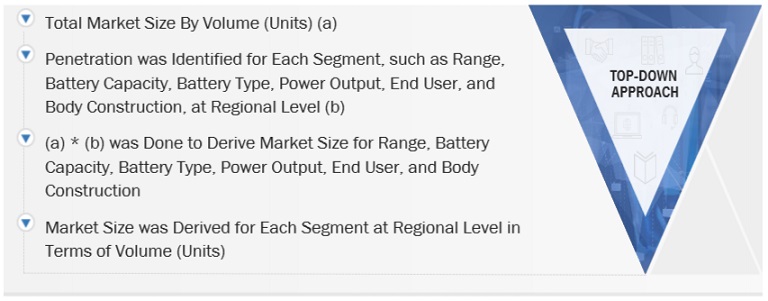

The top-down approach has been used to estimate and validate the size of the electric commercial vehicle market by range battery type, battery capacity and power output in terms of volume. In this approach, the ket range of the electric commercial vehicle is identified for each vehicle type (trucks, vans and pickup trucks) at country level.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Electric Commercial Vehicle: Electric commercial vehicles include commercial vehicles such as pickup trucks, trucks, and vans that use electric motors for propulsion. An electric commercial vehicle is an electric vehicle powered by batteries designed to transport cargo, carry specialized payloads, or perform other utilitarian work. These vehicles use electricity stored in batteries or obtained from an external source, such as charging stations, to propel the vehicle and provide the necessary power for its operations. The range and carrying capacity of electric commercial vehicles can vary depending on the size and configuration of the vehicle, as well as the battery technology used.

Key Stakeholders

- Associations, Forums, and Alliances related to Electric Trucks

- Automobile Manufacturers

- Automotive Component Manufacturers

- Automotive Investors

- Automotive Software Manufacturers and Providers

- Battery Distributors

- Battery Manufacturers

- Charging Infrastructure Providers

- Charging Service Providers

- Companies Operating in Autonomous Vehicle Ecosystem

- Electric Pickup Truck Manufacturers

- Electric Van Manufacturers

- Electric Medium and Heavy-duty Truck Manufacturers

- Distributors and Retailers

- EV Battery Manufacturers

- EV Charging Equipment Manufacturers

- EV Charging Infrastructure Service Providers

- EV Component Manufacturers

- EV Distributors and Retailers

- Government Agencies and Policy Makers

- Original Equipment Manufacturers

- Raw Material Suppliers for Automotive Software or Components

- Transport Authorities

- Technology Providers

- Vehicle Electronics Manufacturers

- Technology providers

Report Objectives

-

To segment and forecast the size of the global electric commercial vehicle market in terms of volume and value.

- To segment and forecast the size of the global electric commercial vehicle market, by volume, based on propulsion type [battery electric vehicle (BEV) and fuel cell electric vehicle (FCEV)]

- To segment and forecast the size of the global electric commercial vehicle market, by volume & value at regional level, based on vehicle type [pickup truck (3 tons to 7 tons), truck (medium-duty trucks (>7 tons to 14 tons) & heavy-duty trucks (above 14 tons) and vans (light vans (less than 3.5 tons) & full-size vans (above 3.5 tons and less than 7 tons)]

- To segment and forecast the size of the global electric commercial vehicle market, by volume, based on body construction (integrated, semi-integrated/rigid truck and full size)

- To segment and forecast the size of the global electric commercial vehicle market, by volume, based on range (less than 150 miles, 150-300 miles and above 300 miles)

- To segment and forecast the size of the global electric commercial vehicle market, by volume , based on battery type [lithium-iron-phosphate (LFP), nickel-manganese-cobalt (NMC), solid-state batteries (SSB) and others]

- To segment and forecast the size of the global electric commercial vehicle market, by volume & value, based on battery capacity (less than 60 kWh, 60−120 kWh, 121−200 kWh, 201−300 kWh, 301−500 kWh and 501−1,000 kWh)

- To segment and forecast the size of the global electric commercial vehicle market, by volume & value, based on power output (less than 100 kW, 100−250 kW and above 250 kW)

- To segment and forecast the size of the global electric commercial vehicle market, by volume, based on end use (last mile delivery, field services, distribution services, long haul transportation and refuse trucks)

- To segment and forecast the size of the global electric commercial vehicle market, based on component (battery packs, onboard charger, electric motor, inverter, DC DC converter and fuel cell stack)

- To segment and forecast the market size, by volume & value, based on region [Asia Pacific, Europe and North America]

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically shortlist and profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs.

- Electric Commercial Vehicle Market, By Range, at the Country Level (For countries covered in the report)

- Electric Commercial Vehicle Market, By Battery Type, at the Country Level (For countries covered in the report)

- Electric Commercial Vehicle Market, By Battery Capacity, at the Country Level (For countries covered in the report)

- Electric Commercial Vehicle Market, By Power Output, at the Country Level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Commercial Vehicle Market