Electric Heat Tracing Market by Type (Self-regulating, Constant Wattage, Mineral-insulated, Skin Effect), Application (Freeze Protection & Process Temperature Maintenance, Roof & Gutter De-icing), Vertical and Region - Global Forecast to 2027

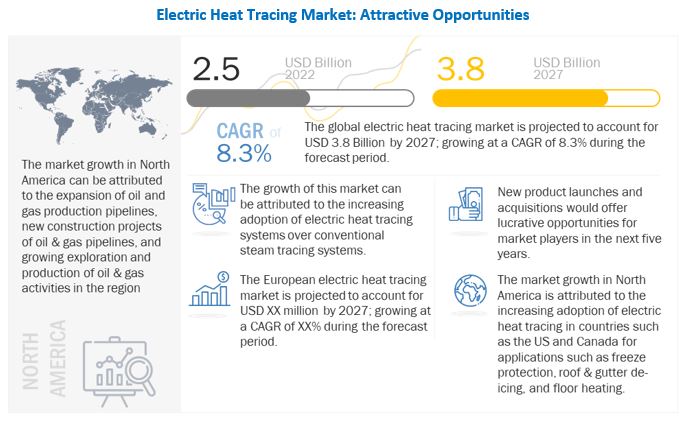

The Electric Heat Tracing market is projected to grow from USD 2.5 Billion in 2022 to USD 3.8 Billion in 2027; it is expected to grow at a CAGR of 8.3% from 2022 to 2027.

The growth of the market is attributed to the increasing adoption of electric heat tracing systems over conventional steam tracing systems, the rising demand for energy-efficient electric heat tracing systems, and low maintenance cost of electric heat tracing systems are the factors driving the growth of the electric heat tracing market.

Additionally, growing demand for heat tracing systems from various end-user industries, rising adoption of heat tracing systems in power plants are factors expected to create growth opportunities during the forecast period. However, devastating effects of overlapping of heating cables and installation of heat tracing systems for tanks and large vessels are restraining and challenging the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Low maintenance costs associated with electric heat tracing systems

In electric heat tracing , the electrical heating elements flows in physical contact along the length of a pipe. The heating elements keeps temperatures high within the pipe so that the fluid stays in its liquid form. This process benefits plants with no access to steam and may be looking for a smaller initial investment than installing a boiler systems. Electric heat systems offer more variety in temperature ranges than steam heat tracing systems, have lower maintenance costs than steam heat tracing systems, and can be monitored remotely. Electric heat tracing systems are relatively easy to install and efficiently utilize energy . The incurred costs of electric heat tracing are only costs for control systems and electricity. Minimum maintenance is required for operating heat tracing systems, and any replacemens can be done without disturbing any current structures.

Adverse effects of overlapping of heating cables

The main use of electric heat tracing system is to prevent the vessels, tanks and pipes from freezing, heat loss and maintain the process temperature as per the requirement. An electric heat tracing system uses the electric panels and heat cables for heating. Hence, the heating cables should not overcross, overlap or touch themselves after the installation since overlapping of the heating cables can result in overheating. Due to overheating, if even one section in these cables breaks, then it may cause an entire system failure. Hence after getting the design ready, special care must be taken during the installation phase.

Growing demand for heat tracing systems from various end-user industries

End-user industries of heat tracing systems range from oil & gas, power & energy, chemicals to food & beverages, oil & gas, refineries, and petrochemical industries are the major contributors to the market growth of electric heat tracing systems. The oil & gas industry is one of the major industries in which electric heat tracing systems are deployed for several applications such as upstream, midstream, and downstream components of oil and gas production: processing, storage, and distribution applications which needs to be kept at certain temperature for peak performance. Similarly, while extracting the oil and natural gas for the first time from the ground high temperature being used to bring them to the ground. Therefore, Heat tracing is used during the processing of gas, heavy oils and petrochemicals to keep the refinement process running smoothly. The demand for heat tracing equipment is expected to increase in the coming years due to the increase in exploration and production activities in the oil & gas industry, once the industry recovers from the economic downturn. Oil and gas exploration companies seek for highly technical and eco-friendly solutions. In the Arctic polar region, the extremely low ambient air temperature and strong wind create snow and ice conditions that require unique operational heat tracing solutions for oil and gas-carrying pipelines.

Installation of heat tracing systems for tanks and large vessels can be challenging

Tanks and large vessels are used to store water, chemicals, ammonia, resisns, and oil in various process industries, such chemical, food & Beverage, pharmaceutical, and oil & gas, among others. Installing heat tracing systems on large tanks can be challenging. For instance, if the tank size increases, the chances of significant heat loss are also high. Thus, electric heat tracing solutions are required to balance the heat lost with the heat supplied to the tanks and large vessels. Installing heat tracing systems is difficult and expensive for large tanks as heat tracing repairs heat losses from tanks and vessels as thermal insulation is not always enough to compensate for such heat losses. Thus, installing heat tracing systems for large tanks incurs significant cost. Additionally, repairs or replacements are time-consuming once the tank is insulated.

Self-regulating cables to dominate electric heat tracing market by type throughout the forecast period

Self-regulating heat tracing cables are highly energy efficient because of their unique self-regulating feature built-in tracers. As temperature increases, the resistance of the polymer, constituting the core of tracer, increases, which causes a decrease in the power output. The energy output, therefore, always matches the requirements of the system. The self-regulating feature of the system prevents the creation of high surface temperature. Hence, there are negligible chances of any fire hazard even in the presence of inflammable gases or liquids in and around the pipelines. These systems do not overheat or burn out even in the case of self-overlapping of cables. Due to various advantages, self-regulating cables are increasingly being adopted across various verticals such as oil & gas, chemicals, commercial, and residential among others. These cables are used for applications including freeze protection & process temperature maintenance, roof & gutter de-icing, and floor heating. This is expected to propel the demand for self-regulating cables during the forecast period.

Oil & Gas to grow at a highest CAGR during the forecast period

The electric heat tracing industry for the oil & gas industry is expected to grow at a highest CAGR during the forecast period. The oil & gas industry use electric heat tracing for various applications such as freeze protection, viscosity controls, temperature maintenance, etc. The heat tracing maintain the temperature or viscosity of the fluid and preventing the components from seperating or gases from condensing. Therefore, in oil & gas industry, heat tracing is used to prevent the pipes, vessels and tanks from freezing in the cold region and maintain the process temperature in different ranges as per the requirement.

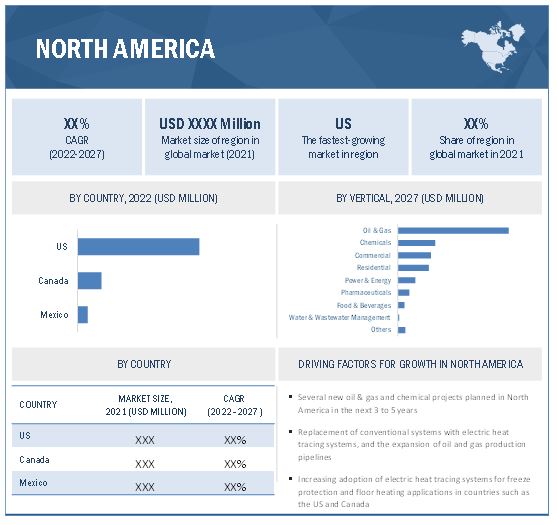

Market in North America to grow significantly during the forecast period

The electric heat tracing market in North America is expected to grow significantly during the forecast period. North America is the coldest region compared to Asia Pacific and the Middle East & Africa; therefore, there is an increasing demand for electric heat tracing to prevent pipes and vessels from freezing. Electric heat tracing finds increasing adoption in these countries for applications such as freeze protection, roof & gutter de-icing, and floor heating. The US is expected to be the major contributor to the market in North America. The presence of major players in the US is expected to drive the electric heat tracing market growth in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players in the electric heat tracing companies are nVent Electric plc (UK), Thermon Group Holding, Inc. (US), Spirax-Sarco Engineering plc (UK), NIBE Industrier AB (Sweden), BARTEC Top Holding GmbH (Germany), Danfoss (Germany), eltherm GmbH (Germany), Emerson Electric Co. (US), Watlow Electric Manufacturing Company (US), Drexan Energy System, Inc. (Canada).

Electric Heat Tracing Market report scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 2.5 Billion |

|

Projected Market Size |

USD 3.8 Billion |

|

Growth Rate |

8.3% |

|

Market size available for years |

2018—2027 |

|

Base year |

2021 |

|

Forecast period |

2022—2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Market Leaders |

nVent Electric plc (UK), Spirax-Sarco Engineering plc (UK), NIBE Industrier AB (Sweden), BARTEC Top Holding GmbH (Germany), Danfoss (Germany), eltherm GmbH (Germany), Drexan Energy System, Inc. (Canada) are the major players in the market. |

|

Top Companies in North America |

Thermon Group Holding, Inc. (US), Emerson Electric Co. (US), Watlow Electric Manufacturing Company (US) |

| Key Market Opportunity | Growing demand for heat tracing systems from various end-user industries |

| Highest CAGR Segment | Oil & Gas to grow at a highest CAGR |

| Largest Growing Region | North America |

| Largest Market Share Segment | Freeze protection & process temperature maintenance |

This report categorizes the Electric heat tracing market based on by type, Electric Heat Tracing System Components, by application, by vertical and region.

Electric Heat Trace Market, By Type:

- Self-Regulating

- Constant Wattage

- Mineral-insulated

- Skin Effect

Electric Heat Tracing System Components

- Electric Heat Tracing Cables

- Power Connection Kits

- Control and Monitoring Systems

- Thermal Insulation Materials

- Others

Electric Heat Trace Market, By Application:

- Freeze Protection & Process Temperature Maintenance

- Roof & Guttering De-icing

- Floor Heating

- Others

Electric Heat Trace Market, By Vertical:

- Oil & Gas

- Chemical

- Commercial

- Residential

- Power & Energy

- Food & Beverage

- Pharmaceutical

- Water & Wastewater Treatment

- Others

Electric Heat Trace Market, By Region:

-

North America

- US

- Canada

-

Mexico

- Europe

- Russia

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments

- In April 2022, nVent Electric plc has launched nVent RAYCHEM STS-HV cable which is a latest addition to the nVent RAYCHEM STS Skin-effect Tracing System portfolio of longline heating solutions. It delivers circuit length up to 50 km with operating temperature up to 150 degrees Celsius.

- In March 2022, Thermon Group Holding, Inc. has launched the new version of the Visi Trace design system, it provides superior system visualization and enhanced change management.

- In February 2022, Thermon Group Holding, Inc. has launched the Genesis Network Software Version 1.3 that delivers full operational awareness and supervisory control on heat trace system.

- In July 2021, NIBE Industrier AB acquired 100% shares of Heat Trace Holding Ltd (UK), a developer and manufacturer of electric heating cables. This acquisition helped NIBE Industrier AB to expand its footprints in the electric heat tracing market.

- In May 2021, Emerson launched a new smart thermostat, Warm Tiles, to control in-floor heating systems easily, including a WiFi-enabled version, which gives consumers remote access to their system from a mobile device or web browser.

Frequently Asked Questions (FAQs):

Which are the major companies in the Electric heat tracing market? What are their major strategies to strengthen their market presence?

nVent Electric plc (UK), Thermon Group Holding, Inc. (US), Spirax-Sarco Engineering plc (UK), NIBE Industrier AB (Sweden), BARTEC Top Holding GmbH (Germany), Danfoss (Germany), eltherm GmbH (Germany), Emerson Electric Co. (US), Watlow Electric Manufacturing Company (US), Drexan Energy System, Inc. (Canada)are the major players in the market. These companies have adopted organic as well as inorganic growth strategies such as product launches, and partnerships to gain competitive advantage in the market.

Which is the potential market for Electric heat tracing market in terms of the region?

North America is the region with high growth opportunities owing to the presence of countries such as US and Canada, which are among the coldest countries in the world. Electric heat tracing finds increasing adoption in these countries for applications such as freeze protection, roof & gutter de-icing, and floor heating.

What are the opportunities for new market entrants?

Factors such as growing demand for heat tracing systems from various end-user industries, rising adoption of heat tracing systems in power plants are creating opportunities for the players in the market.

Which applications are expected to drive the growth of the market in the next six years?

Freeze protection & process temperature maintenance are expected to drive the growth of the market in the next six years. Especially in the Americas and Europe, the temperature reaches below 32°F and stays below 32°F for months. During such low-temperature conditions, it becomes important for various end-user industries to protect their products or materials carrying pipelines and preserve vessels and tanks against freezing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.4 INCLUSIONS AND EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 ELECTRIC HEAT TRACING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for deriving market size by bottom-up analysis (demand side)

FIGURE 2 ELECTRIC HEAT TRACING MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for deriving market size by top-down analysis (supply side)

FIGURE 3 MARKET: TOP-DOWN APPROACH

FIGURE 4 SUPPLY-SIDE ESTIMATION TO ARRIVE AT MARKET SIZE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 6 SELF-REGULATING SEGMENT TO DOMINATE ELECTRIC HEAT TRACING MARKET DURING FORECAST PERIOD

FIGURE 7 FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 OIL & GAS VERTICAL TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICAN MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 10 RISING DEMAND FOR ENERGY-EFFICIENT ELECTRIC HEAT TRACING SYSTEMS

4.2 NORTH AMERICAN MARKET, BY COUNTRY AND VERTICAL

FIGURE 11 US AND OIL & GAS VERTICAL HELD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2021

4.3 ELECTRIC HEAT TRACING MARKET, BY COUNTRY

FIGURE 12 US TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 ELECTRIC HEAT TRACING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of electric heat tracing systems over conventional steam tracing systems

5.2.1.2 Rising demand for energy-efficient electric heat tracing systems

5.2.1.3 Low maintenance costs associated with electric heat tracing systems

5.2.2 RESTRAINTS

5.2.2.1 Adverse effects of overlapping heating cables

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for heat tracing systems in various verticals

5.2.3.2 Rising adoption of heat tracing systems in power plants

5.2.4 CHALLENGES

5.2.4.1 Installation of heat tracing systems on tanks and large vessels

5.3 VALUE CHAIN ANALYSIS

FIGURE 14 ELECTRIC HEAT TRACING MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

5.5 AVERAGE SELLING PRICE ANALYSIS

FIGURE 15 AVERAGE SELLING PRICE OF ELECTRIC HEAT TRACING CABLES, 2017–2027

5.6 TECHNOLOGY ANALYSIS

5.7 CASE STUDY ANALYSIS

5.7.1 OIL & GAS

5.7.2 ENERGY & POWER

5.7.3 CHEMICAL

5.7.4 COMMERCIAL

5.8 PATENT ANALYSIS

FIGURE 16 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 17 PATENT ANALYSIS RELATED TO MARKET

TABLE 1 TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 2 PATENT ANALYSIS FOR ELECTRIC HEAT TRACING MARKET

6 ELECTRIC HEAT TRACING SYSTEM COMPONENTS (Page No. - 57)

6.1 INTRODUCTION

6.2 ELECTRIC HEAT TRACING CABLES

6.3 POWER CONNECTION KITS

6.4 CONTROL AND MONITORING SYSTEMS

6.4.1 THERMOSTATS

6.4.2 RESISTANCE TEMPERATURE DETECTORS

6.4.3 THERMOCOUPLES

6.5 THERMAL INSULATION MATERIALS

6.6 OTHERS

7 DIFFERENT MODES OF ELECTRIC HEAT TRACING (Page No. - 59)

7.1 INTRODUCTION

7.2 PIPES

7.3 VESSELS AND TANKS

7.4 RAIL TRACKS AND ROADS

7.5 ROOFS

7.6 OTHERS

8 MAXIMUM MAINTENANCE TEMPERATURES OF VARIOUS ELECTRIC HEAT TRACING CABLES (Page No. - 61)

8.1 INTRODUCTION

8.2 UP TO 100°C

TABLE 3 ELECTRIC HEAT TRACING CABLES WITH MAXIMUM MAINTENANCE TEMPERATURE OF UP TO 100°C

8.3 101–250°C

TABLE 4 ELECTRIC HEAT TRACING CABLES WITH MAXIMUM MAINTENANCE TEMPERATURE FROM 101°C TO 250°C

8.4 ABOVE 250°C

TABLE 5 ELECTRIC HEAT TRACING CABLES WITH MAXIMUM MAINTENANCE TEMPERATURE ABOVE 250°C

9 ELECTRIC HEAT TRACING MARKET, BY TYPE (Page No. - 65)

9.1 INTRODUCTION

FIGURE 18 SELF-REGULATING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 6 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 7 MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 SELF-REGULATING

9.2.1 GROWING ADOPTION OF SELF-REGULATING CABLES FOR TEMPERATURE MAINTENANCE

TABLE 8 SELF-REGULATING: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 9 SELF-REGULATING: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 10 SELF-REGULATING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 11 SELF-REGULATING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 CONSTANT WATTAGE

9.3.1 INCREASING ADOPTION OF CONSTANT WATTAGE CABLES FOR FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE

TABLE 12 CONSTANT WATTAGE: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 13 CONSTANT WATTAGE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 14 CONSTANT WATTAGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 CONSTANT WATTAGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 MINERAL-INSULATED

9.4.1 GROWING USE OF MINERAL-INSULATED CABLES IN HIGH-TEMPERATURE, HIGH-WATTAGE APPLICATIONS

TABLE 16 MINERAL-INSULATED: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 17 MINERAL-INSULATED: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 18 MINERAL-INSULATED: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MINERAL-INSULATED: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 SKIN EFFECT

9.5.1 RISING USE OF SKIN EFFECT CABLES TO TRACE LONG PIPELINES

TABLE 20 SKIN EFFECT: ELECTRIC HEAT TRACING MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 21 SKIN EFFECT: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 22 SKIN EFFECT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 SKIN EFFECT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ELECTRIC HEAT TRACING MARKET, BY APPLICATION (Page No. - 78)

10.1 INTRODUCTION

FIGURE 19 FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 FREEZE PROTECTION AND PROCESS TEMPERATURE MAINTENANCE

10.2.1 RISING USE OF ELECTRIC HEAT TRACING SYSTEM TO PREVENT FREEZING OF FLUIDS IN PIPES USED IN INDUSTRIAL, COMMERCIAL, AND RESIDENTIAL APPLICATIONS

10.2.2 VISCOSITY CONTROL

10.3 ROOF AND GUTTER DE-ICING

10.3.1 INCREASING INSTALLATION OF HEAT TRACE CABLES ON ROOFS AND INSIDE GUTTERS AND DOWNSPOUTS TO MAINTAIN DRAIN PATHS FOR WATER

10.4 FLOOR HEATING

10.4.1 HIGH ENERGY EFFICIENCY AND COST-EFFECTIVENESS OF ELECTRIC HEAT TRACING IN FLOOR HEATING

10.5 OTHERS

11 ELECTRIC HEAT TRACING MARKET, BY VERTICAL (Page No. - 83)

11.1 INTRODUCTION

FIGURE 20 OIL & GAS VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 OIL & GAS

11.2.1 GROWING ADOPTION OF ELECTRIC HEAT TRACING TO FACILITATE PROCESSING, TRANSPORTATION, AND FREEZE PROTECTION OF ENERGY PRODUCTS IN UPSTREAM AND DOWNSTREAM APPLICATIONS

TABLE 28 OIL & GAS: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 29 OIL & GAS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 30 OIL & GAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 OIL & GAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 CHEMICAL

11.3.1 RISING APPLICATIONS OF ELECTRIC HEAT TRACING SYSTEMS IN PROCESS TEMPERATURE MAINTENANCE AND FREEZE PROTECTION

TABLE 32 CHEMICAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 CHEMICAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 34 CHEMICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 CHEMICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 COMMERCIAL

11.4.1 RISING INSTALLATION OF HEAT TRACING SYSTEMS IN SCHOOLS, HOSPITALS, HOTELS, AND OFFICES

TABLE 36 COMMERCIAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 COMMERCIAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 38 COMMERCIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 COMMERCIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 RESIDENTIAL

11.5.1 GROWING USE OF ELECTRIC HEAT TRACING CABLES IN ROOF DE-ICING AND FLOOR HEATING APPLICATIONS

TABLE 40 RESIDENTIAL: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 RESIDENTIAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 RESIDENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 RESIDENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 POWER & ENERGY

11.6.1 INCREASING DEPLOYMENT OF ELECTRIC HEAT TRACING SYSTEMS IN COAL-FIRED POWER PLANTS

TABLE 44 POWER & ENERGY: ELECTRIC HEAT TRACING MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 POWER & ENERGY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 POWER & ENERGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 POWER & ENERGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 FOOD & BEVERAGE

11.7.1 GROWING USE OF ELECTRIC HEAT TRACING SYSTEMS TO MAINTAIN DESIRED TEMPERATURE

TABLE 48 FOOD & BEVERAGE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 49 FOOD & BEVERAGE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 50 FOOD & BEVERAGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 FOOD & BEVERAGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 PHARMACEUTICAL

11.8.1 RISING ADOPTION OF ELECTRIC HEAT TRACING SYSTEMS TO MAINTAIN TEMPERATURE OF DRUGS AND MEDICINES IN SPECIFIC RANGES AND PREVENT DECOMPOSITION

TABLE 52 PHARMACEUTICAL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 PHARMACEUTICAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 PHARMACEUTICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 PHARMACEUTICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 WATER & WASTEWATER TREATMENT

11.9.1 HIGH USE OF ELECTRIC HEAT TRACING SYSTEMS TO PROTECT VALVES, PIPES, TANKS, AND INSTRUMENTATION LINES FROM FREEZING

TABLE 56 WATER & WASTEWATER TREATMENT: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 57 WATER & WASTEWATER TREATMENT: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 WATER & WASTEWATER TREATMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 WATER & WASTEWATER TREATMENT: ELECTRIC HEAT TRACING MARKET, BY REGION, 2022–2027 (USD MILLION)

11.1 OTHERS

11.10.1 PULP & PAPER

11.10.1.1 Use of electric heat tracing systems to maintain temperature of chemicals and compounds used in paper production

11.10.2 TRANSPORTATION

11.10.2.1 Use of electric heat tracing systems to avoid freezing of rail tracks in cold regions

11.10.3 TEXTILE

11.10.3.1 Use of skin effect heat tracing to trace molten polymer pipes

TABLE 60 OTHERS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 OTHERS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 ELECTRIC HEAT TRACING MARKET, BY REGION (Page No. - 101)

12.1 INTRODUCTION

FIGURE 21 NORTH AMERICA TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 64 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: SNAPSHOT OF ELECTRIC HEAT TRACING MARKET

TABLE 66 NORTH AMERICA: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Expanding oil & gas, chemical, power & energy, and commercial verticals

12.2.2 CANADA

12.2.2.1 Growing use of use electric heat tracing systems by transmission pipeline companies operating in petroleum industry

12.2.3 MEXICO

12.2.3.1 Abundance of oil & gas reserves and high energy export

12.3 EUROPE

FIGURE 23 EUROPE: SNAPSHOT OF ELECTRIC HEAT TRACING MARKET

TABLE 72 EUROPE: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.1 RUSSIA

12.3.1.1 Wide network of oil and gas pipelines

12.3.2 UK

12.3.2.1 Growing commercial and residential verticals

12.3.3 GERMANY

12.3.3.1 Rising installation of heat tracing systems in residential and commercial verticals

12.3.4 FRANCE

12.3.4.1 High demand for heat tracing systems in oil & gas, chemical, commercial, and residential verticals

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: SNAPSHOT OF ELECTRIC HEAT TRACING MARKET

TABLE 78 ASIA PACIFIC: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Growing use of electric heat tracing systems to maintain fluid temperature of pipelines in oil & gas vertical

12.4.2 JAPAN

12.4.2.1 Increasing demand for heat tracing systems in various applications

12.4.3 SOUTH KOREA

12.4.3.1 Rising requirement for heat tracing systems in process temperature maintenance applications

12.4.4 REST OF ASIA PACIFIC

12.5 REST OF THE WORLD

TABLE 84 ROW: ELECTRIC HEAT TRACING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 ROW: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 87 ROW: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 88 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 89 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.1 SOUTH AMERICA

12.5.1.1 Growing use of electric heat tracing systems for freeze protection, viscosity control, snow melting, and de-icing applications

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 High growth of oil & gas vertical and rising use of electric heat tracing systems for process temperature maintenance

13 COMPETITIVE LANDSCAPE (Page No. - 123)

13.1 OVERVIEW

13.2 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 25 ELECTRIC HEAT TRACING MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

13.3 MARKET SHARE ANALYSIS: ELECTRIC HEAT TRACING MARKET, 2021

FIGURE 26 MARKET: MARKET SHARE ANALYSIS, 2021

13.4 COMPETITIVE LEADERSHIP MAPPING

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE PLAYERS

13.4.4 PARTICIPANTS

FIGURE 27 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

13.5 COMPETITIVE SCENARIOS AND TRENDS

13.5.1 ELECTRIC HEAT TRACING MARKET: PRODUCT LAUNCHES, 2019–2022

13.5.2 ELECTRIC HEAT TRACING MARKET: DEALS, 2019–2021

14 COMPANY PROFILES (Page No. - 130)

(Business overview, Products offered, Recent Developments, MNM view)*

14.1 KEY PLAYERS

14.1.1 NVENT ELECTRIC PLC

TABLE 90 NVENT ELECTRIC PLC.: COMPANY OVERVIEW

FIGURE 28 NVENT ELECTRIC PLC: COMPANY SNAPSHOT

TABLE 91 NVENT ELECTRIC PLC: PRODUCTS OFFERED

TABLE 92 NVENT ELECTRIC PLC: PRODUCT LAUNCHES

14.1.2 THERMON GROUP HOLDINGS, INC.

TABLE 93 THERMON GROUP HOLDINGS, INC.: COMPANY OVERVIEW

FIGURE 29 THERMON GROUP HOLDINGS, INC.: COMPANY SNAPSHOT

TABLE 94 THERMON GROUP HOLDINGS, INC.: PRODUCTS OFFERED

TABLE 95 THERMON GROUP HOLDINGS, INC: PRODUCT LAUNCHES

14.1.3 SPIRAX-SARCO ENGINEERING PLC

TABLE 96 SPIRAX SARCO ENGINEERING PLC: COMPANY OVERVIEW

FIGURE 30 SPIRAX-SARCO ENGINEERING PLC: COMPANY SNAPSHOT

TABLE 97 SPIRAX-SARCO ENGINEERING PLC: PRODUCTS OFFERED

14.1.4 NIBE INDUSTRIER AB

TABLE 98 NIBE INDUSTRIER AB: COMPANY OVERVIEW

FIGURE 31 NIBE INDUSTRIER AB: COMPANY SNAPSHOT

TABLE 99 NIBE INDUSTRIER AB: PRODUCTS OFFERED

TABLE 100 NIBE INDUSTRIER AB: PRODUCT LAUNCHES

14.1.5 BARTEC TOP HOLDING GMBH

TABLE 101 BARTEC TOP HOLDING GMBH: COMPANY OVERVIEW

TABLE 102 BARTEC TOP HOLDING GMBH: PRODUCTS OFFERED

14.1.6 DANFOSS

TABLE 103 DANFOSS: COMPANY OVERVIEW

FIGURE 32 DANFOSS: COMPANY SNAPSHOT

TABLE 104 DANFOSS: PRODUCTS OFFERED

14.1.7 ELTHERM GMBH

TABLE 105 ELTHERM GMBH: COMPANY OVERVIEW

FIGURE 33 ELTHERM GMBH: COMPANY SNAPSHOT

TABLE 106 ELTHERM GMBH: PRODUCTS OFFERED

14.1.8 EMERSON ELECTRIC CO.

TABLE 107 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

FIGURE 34 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 108 EMERSON ELECTRIC CO: PRODUCTS OFFERED

TABLE 109 EMERSON ELECTRIC CO: PRODUCT LAUNCHES

14.1.9 WATLOW ELECTRIC MANUFACTURING COMPANY

TABLE 110 WATLOW ELECTRIC MANUFACTURING COMPANY: COMPANY OVERVIEW

TABLE 111 WATLOW ELECTRIC MANUFACTURING COMPANY: PRODUCTS OFFERED

14.1.10 DREXAN ENERGY SYSTEMS, INC.

TABLE 112 DREXAN ENERGY SYSTEMS, INC.: COMPANY OVERVIEW

TABLE 113 DREXAN ENERGY SYSTEMS, INC.: PRODUCTS OFFERED

14.2 OTHER PLAYERS

14.2.1 DREXMA INDUSTRIES INC.

TABLE 114 DREXMA INDUSTRIES INC.: COMPANY OVERVIEW

14.2.2 EBECO

TABLE 115 EBECO: COMPANY OVERVIEW

14.2.3 HEAT TRACE PRODUCTS, LLC

TABLE 116 HEAT TRACE PRODUCTS, LLC: COMPANY OVERVIEW

14.2.4 KING ELECTRICAL MFG. CO.

TABLE 117 KING ELECTRICAL MFG. CO.: COMPANY OVERVIEW

14.2.5 NEXANS

TABLE 118 NEXANS: COMPANY OVERVIEW

14.2.6 SST GROUP

TABLE 119 SST GROUP: COMPANY OVERVIEW

14.2.7 TRASOR CORP.

TABLE 120 TRASOR CORP.: COMPANY OVERVIEW

14.2.8 URECON LTD.

TABLE 121 URECON LTD.: COMPANY OVERVIEW

14.2.9 WARMUP

TABLE 122 WARMUP: COMPANY OVERVIEW

14.2.10 HEAT-LINE

TABLE 123 HEAT-LINE.: COMPANY OVERVIEW

14.2.11 VULCANIC GROUP

TABLE 124 VULCANIC GROUP: COMPANY OVERVIEW

14.2.12 KLOPPER-THERM GMBH & CO. KG

TABLE 125 KLOPPER-THERM GMBH & CO. KG: COMPANY OVERVIEW

14.2.13 GENERI, S.R.O.

TABLE 126 GENERI, S.R.O.: COMPANY OVERVIEW

14.2.14 TEMPCO ELECTRIC HEATER CORPORATION

TABLE 127 TEMPCO ELECTRIC HEATER CORPORATION: COMPANY OVERVIEW

14.2.15 VALIN CORPORATION

TABLE 128 VALIN CORPORATION: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 175)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE

TABLE 129 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 130 UNDERFLOOR HEATING MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

15.4 NEW INSTALLATIONS/NEW BUILDING

15.4.1 HIGHER ADOPTION OF UNDERFLOOR HEATING SYSTEMS IN NEW INFRASTRUCTURES DUE TO ENERGY EFFICIENCY STANDARDS LAID BY GOVERNMENTS

TABLE 131 UNDERFLOOR HEATING MARKET FOR NEW INSTALLATIONS, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 132 UNDERFLOOR HEATING MARKET FOR NEW INSTALLATION, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

15.5 RETROFIT INSTALLATIONS/EXISTING BUILDING

15.5.1 HIGH ADOPTION OF HYDRONIC UNDERFLOOR HEATING SYSTEMS IN COMPLETE RENOVATION PROJECTS

TABLE 133 UNDERFLOOR HEATING MARKET FOR RETROFIT INSTALLATIONS, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 134 UNDERFLOOR HEATING MARKET FOR RETROFIT INSTALLATIONS, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

16 APPENDIX (Page No. - 179)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

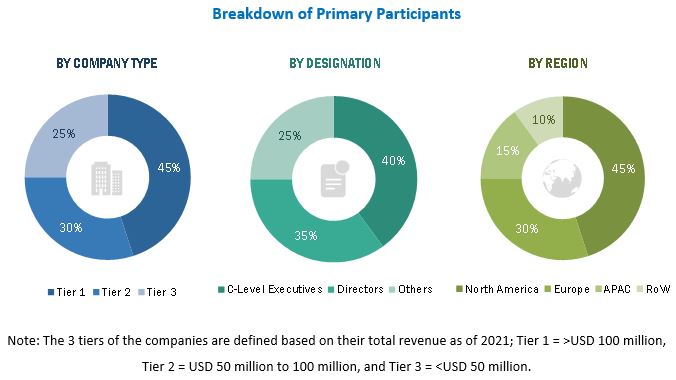

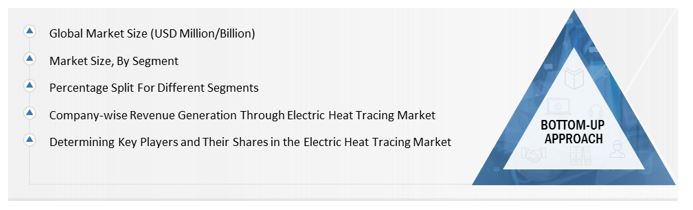

The study involved four major activities in estimating the size for Electric heat tracing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, Electric heat tracing-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the Electric heat tracing market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the Electric heat tracing market.

- Identifying entities in the electric heat tracing market that influence the entire market, along with the related component players

- Analyzing major manufacturers of electric heat tracing systems, studying their portfolios, and understanding different components and products.

- Analyzing trends pertaining to the use of electric heat tracing devices for different kinds of verticals

- Tracking the ongoing and upcoming developments in the market, such as investments made, R&D activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand different types of electric heat tracing cables, components, and applications and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing revenues of companies generated and then combining the same to get the market estimate

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

The Top-Down procedure has been employed to arrive at the overall size of the electric heat tracing market.

- Focusing initially on top-line investments and expenditures being made in the ecosystems of the electric heat tracing market

- Calculating the market size considering revenues generated by major players through the sale of electric heat tracing systems

- Conducting multiple on-field discussions with key opinion leaders across major companies involved in the development of electric heat tracings to understand the market scenarios

- Estimating the geographic split using secondary sources based on various factors, such as the number of OEMs in a specific country and region, the role of major players in the market for the development of innovative products, and adoption and penetration rates in a particular country for various end-user applications

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the electric heat tracing market, in terms of value, by type, application, and vertical

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain pertaining to the electric heat tracing ecosystem, along with the average selling price trends.

- To strategically analyze the ecosystem, patent landscape, and various case studies pertaining to the electric heat tracing market.

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the electric heat tracing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Heat Tracing Market

I want to check weather this report includes information on Russia? If yes, then can I buy Russian part - and cost associated with it.