Electric Motors Market by Type (AC, DC), Power Rating (<1 kW, 1–2.2 kW, 2.2–375 kW, >375 kW), End User (Industrial, Commercial, Residential, Transportation, and Agriculture), Voltage, Rotor Type, Output Power and Region - Global Forecast to 2027

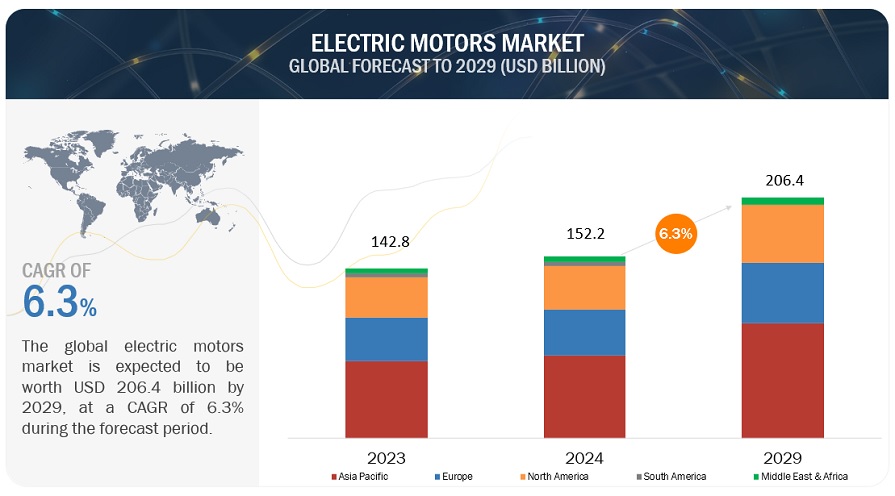

[306 Pages Report] The global electric motors market is expected to grow from an estimated USD 134.0 billion in 2022 to USD 186.0 billion by 2027, at a CAGR of 6.8% during the forecast period. Increasing demand for HVAC systems among residential, commercial, and industrial end-users, and growing demand for electric motors in manufacturing industries are the major driving factor for the electric motor market.

To know about the assumptions considered for the study, Request for Free Sample Report

Electric motors Market Dynamics

Driver: Rising demand for energy-efficient motors

Energy demand is expected to increase by 37% by 2035, with an average growth rate of 1.4% per annum. According to the US Department of Energy (DOE), in March 2020, electric motors were responsible for half of the energy usage in the US manufacturing sector. Electric and other motors used in industrial and infrastructure applications are responsible for 53% of the world’s total electricity consumption. Thus, several regulations have been implemented to ensure efficient and effective energy utilization. Currently, the International Electrotechnical Commission (IEC), a regulatory authority in Europe, has set energy efficiency norms. Most countries have started implementing such regulations to improve the energy efficiency of electric motors. IEC has developed a set of motor efficiency regulations, namely, IE1, IE2, IE3, and IE4, for reducing carbon emissions.

According to Control Engineering Europe (CEE), efficiency regulations for electric motors came into force in January 2017, requiring all AC motors with a rated output of 0.75–375 kW to operate efficiently. Over the years, energy-efficient electric motors using superior magnetic materials and displaying higher levels of tolerance have been developed. High-performance IE4 and IE5 motors offer immediate benefits to OEMs, as well as end-users. Electric motors generally require low maintenance and can produce high torque even at low speeds. Thus, the demand for electric motors has increased, especially in the power range of 0.75–375 kW.

In July 2021, the European Union implemented the Rules on Eco-design for Electric Motors and Variable Speed Drives. They are mandatory to be followed by all manufacturers and suppliers selling their products in the EU. The scope of this new regulation covers single-speed, 50 Hz, 60 Hz, or 50/60 Hz induction motors.

Restraint: Fluctuating prices of raw materials

The electric motor pricing is dependent on the price of raw materials such as permanent magnets, steel bars, copper wires, and precision thin metals such as specialty alloys. Many of these raw materials are sourced from China, Africa, and South American countries. In an electric motor market, the price of the product determines the dominance of certain suppliers. Any fluctuation in raw material prices will have a direct impact on the motor prices. Hence, the resulting price fluctuations have to be borne by the other manufacturers/suppliers in the market. Currently, neodymium magnet accounts for the largest share of the market and is expected to be the fastest-growing magnetic material segment during the forecast period. The high energy product and high residual flux density of neodymium make it a compulsive choice of material for industrial applications.

Currently, China supplies more than 95% of rare-earth oxides, thereby effectively dominating the market. similarly, china also has over 65% of hard ferrite and nearly half of aluminum nickel cobalt, and samarium cobalt of global production. The Chinese government has enforced export quotas and tariffs of up to 25% for these rare earth elements. Due to these factors, the price of raw materials in the global market is unstable and imposes a restraint on the global electric motor market.

Opportunities: Emerging robotics technology will increase demand for electric motors

The emerging robotics technology is likely to offer several opportunities for players in the electric motors market in the near future. Robots are extensively used in industries for simple repetitive tasks and also used in hazardous environments involving direct exposure to explosive chemicals and radioactive substances. This technology is used to perform specific tasks such as assembly-line work, space exploration, military services, warehouse delivery, surgical assistance, clearing mines, underwater exploration, duct cleaning, and commercialized agricultural activities. Electric motors such as brushless DC motors, AC motors, and stepping motors are used in portable and industrial robots to operate their wheels, tracks, legs, sensor turrets, or weapon systems. According to the International Federation of Robotics (IFR), 1.7 million new robots are expected to transform the world’s factories by the end of 2020. This will spur the demand for electric motors used in robotics.

Small and medium enterprises (SMEs) are playing a major role in the business world. About 90% of the businesses in the world are SMEs. Several manufacturing companies in the SME category have been concentrating on features such as quality, speed, and flexibility in industrial machinery. Digitalization allows industrial SMEs to implement effective processes to mass produce high-quality products at low costs. Industry 4.0 modifies the industrial processes of SMEs by integrating automation to improve the productivity of the companies. Technologies such as the Internet of Things, Big Data and analytics, additive manufacturing, and robotics are common trends. A survey by Automation, which is a subsidiary of the International Society of Automation has found that prices of robot technologies will be reduced by 76% by 2025 from that of 2010. This trend will eliminate the major barrier of cost for SMEs. The International Federation of Robotics has published a report on world robotics 2022, in which it stated that small and medium-sized enterprises (SMEs) have embraced automation in their infrastructure, which has enhanced the productivity and quality of SMEs.

Challenges: Shortage of components and supply chain issues leading to the higher product cost

The most significant near-term impact on electric motors that are already contracted or in the manufacturing process will be felt through supply chains. Industry executives are anticipating delivery and construction slowdowns, due to economic downturns, higher inflation, and unstable energy prices. Several components and parts for manufacturing electric motors come from China, the US, and a few parts of Europe. Manufacturing disruptions in China and the US could contribute to the stagnant growth in the electric motors market over the next one or two years.

Due to the inflation and economic crisis, the local currencies of several countries have depreciated. There is a misalignment of supply and demand, leading to financial losses for component/part manufacturers. Key components used in manufacturing electric motors are typically procured in US dollars, which results in increased component costs.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

DC electric motors segment, by type, is expected to grow at the highest CAGR during the forecast period

These DC motors have excellent starting torque capability with good speed regulation. They are used extensively in small DC motors and, to an increasing extent, in traction applications. A characteristic of series motors is that the motor develops a large amount of starting torque. However, speed varies widely between no load and full load. Series motors cannot be used where a constant speed is required under varying loads. They are best suited to traction applications, crane applications, small electrical appliances, mobile electric equipment, hoists, and winches. Shunt motors are used where constant speed is required, and starting conditions are not severe. They find application in lathe machines, centrifugal pumps, fans, blowers, conveyors, lifts, weaving machines, and spinning machines. The series field provides better starting torque, and the shunt field provides better speed regulation. Compound motors are used where higher starting torque and constant speed are required, for example, in presses, shears, conveyors, elevators, rolling mills, and heavy planners.

By output power, the < 1 HP motors segment is expected to be the largest during the forecast period

This report segments the electric motor market based on output power into two types: <1 hp motors (fractional horsepower) and >1 hp motors (integral horsepower). The <1 HP motors are used in a wide variety of industries and applications. The automotive sector is one of the major contributors of the revenue for these motors, where they are used in electric windows, powered seats, wing mirrors, central locking systems, and roof, and trunk openers. <1 hp motors are also used in upstream, midstream, and downstream applications in the oil & gas industry. In the upstream sector, they are used for pumping well and artificial lift systems. They are used for transportation and storage purposes in midstream applications and for refining crude oil in downstream applications. The <1 HP motors are also used in small appliances to drive pumps and compressors in pump motors, vertical thrust handling motors, and hazardous location motors.

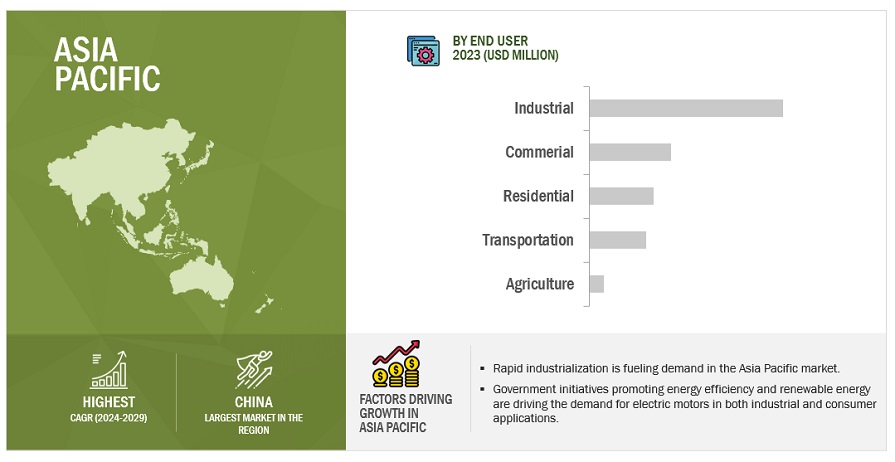

“Asia Pacific: The largest and fastest electric motors market”

Asia Pacific is expected to dominate the electric motors market between 2022–2027, followed by Europe and North America. The government regulations and mandates about motor efficiency and rapid industrialization are the reasons for the region’s significant market size.

Key Market Players

The electric motor market is dominated by a few major players that have a wide regional presence. The major players in the electric motors market are ABB (Switzerland), Siemens (Germany), Wolong Electric (China), NIDEC Corporation (Japan), and WEG S.A (Brazil). Between 2018 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the electric motor market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Coverage |

Details |

|

Market size: |

USD 134.0 billion in 2022 to USD 186.0 billion by 2027 |

|

Growth Rate: |

6.8% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Type, End-user, Power Rating, Voltage, Rotor, Output Power, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Emerging robotics technology will increase demand for electric motors |

|

Key Market Drivers: |

Rising demand for energy-efficient motors |

This research report categorizes the electric motors market by type, power rating, voltage, rotor type, output power, end user, and region

On the basis of by type, the market has been segmented as follows:

- AC motors

- DC motors

On the basis of end-user, the market has been segmented as follows:

- Industrial

- Commercial

- Residential

- Agriculture

- Transportation

On the basis of power rating, the market has been segmented as follows:

- <1 kW Motors

- 1–2.2 kW Motors

- 2.2–375 kW Motors

- >375 kW Motors

On the basis of voltage, the market has been segmented as follows:

- Low Voltage Motors

- Medium Voltage Motors

- High Voltage Motors

On the basis of rotor type, the market has been segmented as follows:

- Inner Rotor

- Outer Rotor

On the basis of output power, the market has been segmented as follows:

- <1 HP

- >1 HP

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2022, ABB announced that it has signed an acquisition to purchase Siemen's low-voltage NEMA motor business. With manufacturing operations in Guadalajara, Mexico, this acquisition provides a well-regarded product portfolio, a longstanding North American customer base, and an experienced operations, sales, and management team.

- In July 2022, WEG launched the W12 electric motor, which is designed for use in high-performance industrial applications while offering versatility and efficiency

- In May 2021, Siemens and Schaeffler Group collaborated to provide intelligent diagnostics for drive and electric motor systems. The collaboration enabled Siemens to combine its IIoT platform Sidrive IQ with Schaeffler Group’s expertise in designing, manufacturing, and servicing bearings.

- In March 2020, Wolong Electric acquired GE's small industrial motors business for USD 160 million. This acquisition is expected to help Wolong gain a leading position in terms of market share.

Frequently Asked Questions (FAQ):

What is the current size of the electric motors market?

The current market size of the electric motors market is USD 125.0 billion in 2021.

What are the major drivers for the electric motors market?

Increasing demand for HVAC systems among residential, commercial, and industrial end-users, and growing demand for electric motors in manufacturing industries of developing countries are some of the major driving factors for the electric motors market

Which is the fastest-growing region during the forecasted period in the electric motors market?

Asia Pacific is expected to dominate the electric motors market between 2022–2027, followed by Europe and North America. The government regulations and mandates about motor efficiency and rapid industrialization are the reasons for the region’s significant market size.

Which is the largest segment, by power rating during the forecasted period in the electric motors market?

The <1 kW segment is expected to be the largest segment during the forecast period. Rapid industrial development, especially in the oil & gas, petrochemical, and automobile industries, will create a demand for <1 kW electric motor applications such as pumps, machine tools, and power tools. Increasing demand for machinery worldwide and advantages offered by < 1 kW motors due to their efficient nature are expected to drive < 1 kW motors during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 ELECTRIC MOTORS MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY VOLTAGE: INCLUSIONS AND EXCLUSIONS

1.3.4 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.3.5 MARKET, BY ROTOR TYPE: INCLUSIONS AND EXCLUSIONS

1.3.6 MARKET, BY OUTPUT POWER: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 ELECTRIC MOTOR MARKET: SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 UNITS CONSIDERED

1.7 CURRENCY CONSIDERED

1.8 LIMITATIONS

1.9 STAKEHOLDERS

1.1 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 1 ELECTRIC MOTORS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 MARKET SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR ELECTRIC MOTOR MARKET

2.4 MARKET SIZE ESTIMATION

2.4.1 DEMAND-SIDE ANALYSIS

FIGURE 4 MARKET: REGION-WISE ANALYSIS

2.4.1.1 Calculations

2.4.1.2 Assumptions

2.4.2 SUPPLY-SIDE ANALYSIS

FIGURE 5 MARKET: SUPPLY-SIDE ANALYSIS

2.4.2.1 Calculations

FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF ELECTRIC MOTORS

2.4.2.2 Assumptions

FIGURE 7 COMPANY REVENUE ANALYSIS, 2021

2.4.3 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 60)

TABLE 1 ELECTRIC MOTORS MARKET SNAPSHOT

FIGURE 8 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 9 AC MOTORS TO HOLD LARGER MARKET SHARE THAN DC MOTORS IN 2027

FIGURE 10 <1 KW SEGMENT TO HOLD LARGEST SIZE OF MARKET, BY POWER RATING, DURING FORECAST PERIOD

FIGURE 11 MEDIUM VOLTAGE MOTORS TO COMMAND MARKET DURING FORECAST PERIOD

FIGURE 12 INNER ROTORS TO HOLD LARGER MARKET SHARE COMPARED WITH OUTER ROTORS DURING FORECAST PERIOD

FIGURE 13 >1 HP MOTORS SEGMENT TO HOLD LARGEST SIZE OF MARKET, BY OUTPUT POWER, DURING FORECAST PERIOD

FIGURE 14 INDUSTRIAL ELECTRIC MOTORS TO COMMAND MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN ELECTRIC MOTORS MARKET

FIGURE 15 GOVERNMENT INITIATIVES TO MAXIMIZE ENERGY EFFICIENCY TO DRIVE ELECTRIC MOTOR MARKET DURING 2022–2027

4.2 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN ELECTRIC MOTOR MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TYPE

FIGURE 17 AC MOTORS DOMINATED ELECTRIC MOTOR MARKET, BY TYPE, IN 2027

4.4 MARKET, BY POWER RATING

FIGURE 18 ELECTRIC MOTORS WITH <1 KW ACCOUNTED FOR LARGEST MARKET SHARE IN 2027

4.5 MARKET, BY VOLTAGE

FIGURE 19 MEDIUM VOLTAGE MOTORS HELD LARGEST SHARE OF MARKET IN 2027

4.6 MARKET, BY ROTOR TYPE

FIGURE 20 INNER ROTORS DOMINATED MARKET, BY ROTOR TYPE, IN 2027

4.7 MARKET, BY OUTPUT POWER

FIGURE 21 ELECTRIC MOTORS WITH <1 HP ACCOUNTED FOR LARGEST MARKET SHARE IN 2027

4.8 MARKET, BY END USER

FIGURE 22 INDUSTRIAL ELECTRIC MOTORS HELD LARGEST SHARE OF ELECTRIC MOTOR MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 71)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 ELECTRIC MOTORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for HVAC systems among residential, commercial, and industrial end users

FIGURE 24 PERCENTAGE OF HOUSEHOLDS EQUIPPED WITH AIR CONDITIONING, 2022

5.2.1.2 Growing demand for electric motors in manufacturing industries

5.2.1.3 Rising demand for energy-efficient motors

FIGURE 25 PERCENTAGE SHARE OF ELECTRICITY CONSUMPTION OF MOTORS SYSTEMS, BY INDUSTRY SUBSECTOR, 2020

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating prices of raw materials

5.2.3 OPPORTUNITIES

5.2.3.1 Transition of global automotive industry toward electric vehicles

FIGURE 26 WORLDWIDE EV SALES, 2016–2021 (THOUSAND UNITS)

5.2.3.2 Emerging robotics technology to increase demand for electric motors

FIGURE 27 OPERATIONAL ROBOTICS, 2015–2020

5.2.4 CHALLENGES

5.2.4.1 Easy availability of low-quality and inexpensive electric motors

5.2.4.2 Shortage of components and supply chain issues leading to higher product cost

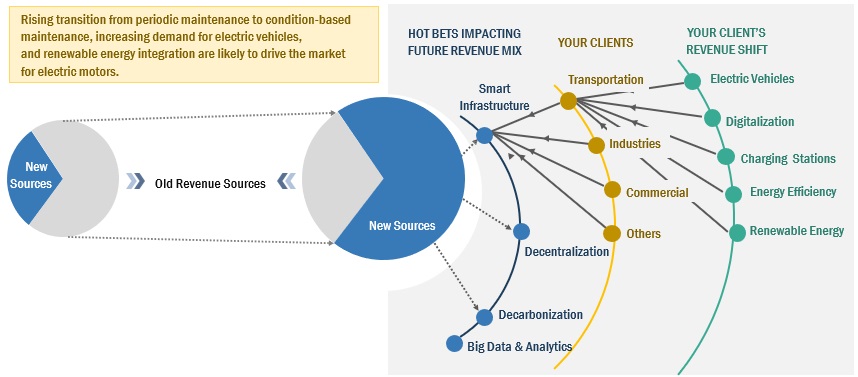

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRIC MOTORS MANUFACTURERS

FIGURE 28 REVENUE SHIFT FOR ELECTRIC MOTORS

5.4 AVERAGE SELLING PRICE TREND

FIGURE 29 AVERAGE SELLING PRICES OF KEY PLAYER OFFERINGS, BY POWER RATING

TABLE 2 AVERAGE SELLING PRICE OF KEY PLAYER OFFERINGS, BY POWER RATING (USD)

5.5 MARKET MAP

FIGURE 30 MARKET MAP FOR ELECTRIC MOTOR MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 31 ELECTRIC MOTORS VALUE CHAIN

5.6.1 RAW MATERIAL PROVIDERS

5.6.2 ORIGINAL EQUIPMENT MANUFACTURERS

5.6.3 ASSEMBLERS/MANUFACTURERS

5.6.4 DISTRIBUTORS

5.6.5 END USERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 TECHNOLOGY TRENDS OF VARIOUS MOTOR TECHNOLOGIES

TABLE 3 COMPARISON OF DIFFERENT COMMERCIALLY AVAILABLE MOTORS TECHNOLOGIES

5.8 CASE STUDY ANALYSIS

5.8.1 ELECTRIC MOTORS FOR AIRCRAFT

5.8.1.1 Parker used AMETEK’s hydraulic pump motor for US Airforce’s next-generation T-X jet trainer aircraft

5.8.2 COST-EFFECTIVE MEPS LEVELS FOR MOTORS

5.8.2.1 Energy Research Centre of Netherlands developed market transformation program for Indonesia

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 CODES AND REGULATIONS RELATED TO ELECTRIC MOTORS

TABLE 9 NORTH AMERICA: CODES AND REGULATIONS

TABLE 10 ASIA PACIFIC: CODES AND REGULATIONS

TABLE 11 EUROPE: CODES AND REGULATIONS

TABLE 12 GLOBAL: CODES AND REGULATIONS

5.10 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 13 ELECTRIC MOTORS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 TRADE DATA STATISTICS

TABLE 14 ELECTRIC MOTORS: IMPORT STATISTICS, 2018–2021 (USD MILLION)

TABLE 15 ELECTRIC MOTORS: EXPORT STATISTICS, 2018–2021 (USD MILLION)

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 16 ELECTRIC MOTOR MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

5.13.2 BUYING CRITERIA

FIGURE 34 KEY BUYING CRITERIA FOR END USERS

TABLE 18 KEY BUYING CRITERIA, BY END USER

6 ELECTRIC MOTORS MARKET, BY TYPE (Page No. - 93)

6.1 INTRODUCTION

FIGURE 35 MARKET SHARE, BY TYPE, 2021

TABLE 19 ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (MILLION UNITS)

6.2 AC MOTORS

6.2.1 LOW MAINTENANCE AND HIGH POWER EXPECTED TO DRIVE MARKET

TABLE 20 AC MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 DC MOTORS

6.3.1 EXCELLENT SPEED CONTROL AND HIGH STARTING TORQUE TO PROPEL DEMAND

TABLE 21 DC MOTORS: MARKET, BY REGION, 2020–2027(USD MILLION)

7 ELECTRIC MOTORS MARKET, BY POWER RATING (Page No. - 97)

7.1 INTRODUCTION

FIGURE 36 MARKET SHARE, BY POWER RATING, 2021

TABLE 22 MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

7.2 <1 KW MOTORS

7.2.1 RISING NEED FOR LOW-MAINTENANCE AND HIGHLY EFFICIENT MOTORS EXPECTED TO DRIVE MARKET

TABLE 23 <1 KW MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 1–2.2 KW MOTORS

7.3.1 GROWTH OF WATER & WASTEWATER TREATMENT INDUSTRIES EXPECTED TO BOOST MARKET

TABLE 24 1–2.2 KW MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 2.2–375 KW MOTORS

7.4.1 INCREASING DEMAND FOR SUCH MOTORS ACROSS HEAVY INDUSTRIES TO DRIVE MARKET

TABLE 25 2.2– 375 KW MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 > 375 KW MOTORS

7.5.1 RISING DEPLOYMENT OF SUCH MOTORS IN INDUSTRIAL AND TRANSPORTATION SECTORS TO DRIVE MARKET

TABLE 26 > 375 KW MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 ELECTRIC MOTORS MARKET, BY VOLTAGE (Page No. - 102)

8.1 INTRODUCTION

FIGURE 37 MEDIUM VOLTAGE SEGMENT TO HOLD LARGEST SHARE OF ELECTRIC MOTOR MARKET FROM 2022 TO 2027

TABLE 27 ELECTRIC MOTORS MARKET, BY VOLTAGE, 2020–2027 (USD BILLION)

8.2 LOW VOLTAGE (BELOW 690 V)

8.2.1 EASE OF OPERATION AND LOW SETUP AND MAINTENANCE COSTS TO DRIVE MARKET

TABLE 28 LOW VOLTAGE: ELECTRIC MOTORS MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 MEDIUM VOLTAGE (BETWEEN 690 V AND 45 KV)

8.3.1 MEDIUM VOLTAGE MOTORS OFFER BENEFITS SUCH AS ECONOMIES OF SCALE AND HIGH RELIABILITY

TABLE 29 MEDIUM VOLTAGE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 HIGH VOLTAGE (ABOVE 45 KV)

8.4.1 RISING AUTOMATION AND INDUSTRIALIZATION IN DEVELOPING COUNTRIES TO DRIVE MARKET

TABLE 30 HIGH VOLTAGE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 ELECTRIC MOTORS MARKET, BY END USER (Page No. - 107)

9.1 INTRODUCTION

FIGURE 38 MARKET SHARE, BY END USER, 2021

TABLE 31 ELECTRIC MOTORS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 INDUSTRIAL

9.2.1 WIDE APPLICATIONS OF ELECTRIC MOTORS IN VARIOUS INDUSTRIES TO DRIVE MARKET

TABLE 32 INDUSTRIAL: ELECTRIC MOTORS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2.1.1 Mining & metals

9.2.1.2 Chemical & petrochemical

9.2.1.3 Oil & gas

9.2.1.4 Cement

9.2.1.5 Manufacturing

9.2.1.6 Utilities

9.2.1.7 Renewables

9.2.1.8 Aerospace & defense

9.2.1.9 Food & beverage

9.2.1.10 Automation

9.2.1.11 Water & wastewater treatment

TABLE 33 MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

9.3 COMMERCIAL

9.3.1 INCREASING SMART INFRASTRUCTURE IN DEVELOPED COUNTRIES TO DRIVE MARKET

TABLE 34 COMMERCIAL: ELECTRIC MOTOR MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3.1.1 Hospitals

9.3.1.2 Offices

9.3.1.3 Educational institutions

9.3.1.4 Hotels

9.3.1.5 Others

TABLE 35 MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

9.4 RESIDENTIAL

9.4.1 RAPID URBANIZATION AND GROWING POPULATION WORLDWIDE TO INCREASE USE OF ELECTRIC MOTORS

TABLE 36 RESIDENTIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4.1.1 Apartments

9.4.1.2 Single households

TABLE 37 MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

9.5 TRANSPORTATION

9.5.1 INCORPORATION OF NEW ICT TECHNOLOGIES IN VEHICLES TO INCREASE USE OF ELECTRIC MOTORS

TABLE 38 TRANSPORTATION: ELECTRIC MOTOR MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5.1.1 Marine

9.5.1.2 Automotive

9.5.1.3 Railways

9.5.1.4 Others

TABLE 39 MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

9.6 AGRICULTURE

9.6.1 CONVERSION OF TRADITIONAL AGRICULTURE SYSTEMS INTO ORGANIC ONES TO INCREASE USAGE OF ELECTRIC MOTORS

TABLE 40 AGRICULTURE: ELECTRIC MOTOR MARKET, BY REGION, 2020–2027 (USD MILLION)

9.6.1.1 Crop farming

9.6.1.2 Livestock farming

TABLE 41 MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

10 ELECTRIC MOTORS MARKET, BY ROTOR TYPE (Page No. - 118)

10.1 INTRODUCTION

FIGURE 39 MARKET SHARE, BY ROTOR TYPE, 2021

TABLE 42 MARKET, BY ROTOR TYPE, 2020–2027 (USD MILLION)

10.2 INNER ROTORS

10.2.1 DEMAND FOR INNER ROTORS IN DIFFERENT APPLICATIONS TO DRIVE MARKET

TABLE 43 INNER ROTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 OUTER ROTORS

10.3.1 DEVELOPMENT OF MEDICAL EQUIPMENT MARKET TO CREATE DEMAND FOR OUTER ROTOR MOTORS

TABLE 44 OUTER ROTORS: MARKET, BY REGION, 2020–2027(USD MILLION)

11 ELECTRIC MOTORS MARKET, BY OUTPUT POWER (Page No. - 121)

11.1 INTRODUCTION

FIGURE 40 MARKET SHARE, BY OUTPUT POWER, 2021

TABLE 45 MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

11.2 <1 HP MOTORS

11.2.1 WIDE APPLICATIONS OF <1 HP MOTORS IN DIFFERENT END-USER INDUSTRIES TO DRIVE MARKET

TABLE 46 <1 HP MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 >1 HP MOTORS

11.3.1 GROWTH IN INDUSTRIAL SEGMENT EXPECTED TO BOOST DEMAND

TABLE 47 >1 HP MOTORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

12 ELECTRIC MOTORS MARKET, BY REGION (Page No. - 124)

12.1 INTRODUCTION

FIGURE 41 REGIONAL SNAPSHOT: ELECTRIC MOTORS MARKET

TABLE 48 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2020–2027 (MILLION UNITS)

12.2 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: ELECTRIC MOTOR MARKET SNAPSHOT

TABLE 50 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET, BY ROTOR TYPE, 2020–2027 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.2.1 BY COUNTRY

TABLE 61 ASIA PACIFIC: ELECTRIC MOTORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.2.1.1 China

12.2.1.1.1 Increasing manufacturing activities to contribute to electric motor market growth

TABLE 62 CHINA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 64 CHINA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 65 CHINA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 66 CHINA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 67 CHINA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 68 CHINA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.2.1.2 India

12.2.1.2.1 Ongoing industrialization to drive demand for electric motors

TABLE 69 INDIA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 71 INDIA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 72 INDIA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 73 INDIA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 74 INDIA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 75 INDIA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.2.1.3 Japan

12.2.1.3.1 Growing focus on technologically advanced industrial equipment to boost demand for electric motors

TABLE 76 JAPAN: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 78 JAPAN: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 79 JAPAN: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 80 JAPAN: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 81 JAPAN: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 82 JAPAN: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.2.1.4 South Korea

12.2.1.4.1 Increasing electronic and automobile manufacturing to drive growth of electric motor market

TABLE 83 SOUTH KOREA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 SOUTH KOREA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 85 SOUTH KOREA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 86 SOUTH KOREA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 87 SOUTH KOREA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 88 SOUTH KOREA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 89 SOUTH KOREA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.2.1.5 Australia

12.2.1.5.1 Growing mining & automotive industries expected to provide growth

TABLE 90 AUSTRALIA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 92 AUSTRALIA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 93 AUSTRALIA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 94 AUSTRALIA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 95 AUSTRALIA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 96 AUSTRALIA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.2.1.6 Rest of Asia Pacific

TABLE 97 REST OF ASIA PACIFIC: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 103 REST OF ASIA PACIFIC: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3 EUROPE

FIGURE 43 EUROPE: ELECTRIC MOTORS MARKET SNAPSHOT

TABLE 104 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY ROTOR TYPE, 2020–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1 BY COUNTRY

TABLE 115 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.3.1.1 Germany

12.3.1.1.1 Increasing electric vehicle and medical equipment production to fuel demand for electric motors

TABLE 116 GERMANY: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 118 GERMANY: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 119 GERMANY:MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 120 GERMANY: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 122 GERMANY: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.2 Russia

12.3.1.2.1 Ongoing modernization of manufacturing sector to contribute to growth of electric motors

TABLE 123 RUSSIA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 RUSSIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 125 RUSSIA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 126 RUSSIA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 127 RUSSIA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 128 RUSSIA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 129 RUSSIA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.3 Italy

12.3.1.3.1 Rising demand for electric vehicles leading to growth of electric motor market

TABLE 130 ITALY: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 132 ITALY: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 133 ITALY: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 134 ITALY: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 135 ITALY: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 136 ITALY: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.4 France

12.3.1.4.1 Implementation of zero carbon emission policies to increase electric vehicles and wind power generation

TABLE 137 FRANCE: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 139 FRANCE: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 140 FRANCE: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 141 FRANCE: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 142 FRANCE: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 143 FRANCE: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.5 UK

12.3.1.5.1 Surging sales of vehicles and flourishing aerospace & defense industry to drive market growth

TABLE 144 UK: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 146 UK: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 147 UK: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 148 UK: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 149 UK: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 150 UK: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.6 Sweden

12.3.1.6.1 Increasing industrial and infrastructure demand to drive growth of electric motor market

TABLE 151 SWEDEN: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 SWEDEN: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 153 SWEDEN: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 154 SWEDEN: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 155 SWEDEN: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 156 SWEDEN: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 157 SWEDEN: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.7 Norway

12.3.1.7.1 New zero emission policy to boost renewables sector and drive growth of electric motor market

TABLE 158 NORWAY: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 NORWAY: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 160 NORWAY: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 161 NORWAY: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 162 NORWAY: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 163 NORWAY: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 164 NORWAY: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.8 Denmark

12.3.1.8.1 Increasing adoption of electric vehicles to drive electric motor market

TABLE 165 DENMARK: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 DENMARK: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 167 DENMARK: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 168 DENMARK: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 169 DENMARK: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 170 DENMARK: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 171 DENMARK: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.3.1.9 Rest of Europe

TABLE 172 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 175 REST OF EUROPE: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 176 REST OF EUROPE: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 177 REST OF EUROPE: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 178 REST OF EUROPE: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.4 NORTH AMERICA

TABLE 179 NORTH AMERICA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 NORTH AMERICA: MARKET, BY ROTOR TYPE, 2020–2027 (USD MILLION)

TABLE 181 NORTH AMERICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

TABLE 182 NORTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 183 NORTH AMERICA: ELECTRIC MOTORS MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

TABLE 184 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 185 NORTH AMERICA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 186 NORTH AMERICA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 187 NORTH AMERICA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 188 NORTH AMERICA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 189 NORTH AMERICA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.4.1 BY COUNTRY

TABLE 190 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.4.1.1 US

12.4.1.1.1 Investment plans toward development of advanced manufacturing technologies to drive market

TABLE 191 US: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 193 US: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 194 US: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 195 US: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 196 US: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 197 US: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.4.1.2 Canada

12.4.1.2.1 Investments in automotive and aircraft to benefit Canadian electric motor market

TABLE 198 CANADA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 199 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 200 CANADA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 201 CANADA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 202 CANADA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 203 CANADA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 204 CANADA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.4.1.3 Mexico

12.4.1.3.1 Growing transportation sector to support market growth

TABLE 205 MEXICO: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 206 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 207 MEXICO: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 208 MEXICO: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 209 MEXICO: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 210 MEXICO: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 211 MEXICO: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

TABLE 212 MIDDLE EAST & AFRICA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY ROTOR TYPE, 2020–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.5.1 BY COUNTRY

TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.5.1.1 Saudi Arabia

12.5.1.1.1 Increasing investments in oil & gas and automotive sectors expected to drive demand for electric motors

TABLE 223 SAUDI ARABIA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 225 SAUDI ARABIA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 226 SAUDI ARABIA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 227 SAUDI ARABIA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 228 SAUDI ARABIA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 229 SAUDI ARABIA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.5.1.2 UAE

12.5.1.2.1 Growing share of automobile sector in economy to drive demand for electric motors

TABLE 230 UAE: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 231 UAE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 232 UAE: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 233 UAE: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 234 UAE: ELECTRIC MOTORS MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 235 UAE: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 236 UAE: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.5.1.3 South Africa

12.5.1.3.1 Increasing investments to boost transportation sector contribute to demand for electric motors

TABLE 237 SOUTH AFRICA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 239 SOUTH AFRICA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 240 SOUTH AFRICA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 241 SOUTH AFRICA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 242 SOUTH AFRICA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 243 SOUTH AFRICA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.5.1.4 Rest of Middle East & Africa

TABLE 244 REST OF MIDDLE EAST & AFRICA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 246 REST OF MIDDLE EAST & AFRICA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 247 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST & AFRICA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 249 REST OF MIDDLE EAST & AFRICA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 250 REST OF MIDDLE EAST & AFRICA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 251 SOUTH AMERICA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 252 SOUTH AMERICA: MARKET, BY ROTOR TYPE, 2020–2027 (USD MILLION)

TABLE 253 SOUTH AMERICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

TABLE 254 SOUTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 255 SOUTH AMERICA: MARKET, BY VOLTAGE, 2020–2027 (USD MILLION)

TABLE 256 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 257 SOUTH AMERICA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 258 SOUTH AMERICA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 259 SOUTH AMERICA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 260 SOUTH AMERICA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 261 SOUTH AMERICA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.6.1 BY COUNTRY

TABLE 262 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.6.1.1 Brazil

12.6.1.1.1 Growth of automotive and aerospace sectors to fuel demand for electric motors

TABLE 263 BRAZIL: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 264 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 265 BRAZIL: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 266 BRAZIL: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 267 BRAZIL: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 268 BRAZIL: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 269 BRAZIL: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.6.1.2 Argentina

12.6.1.2.1 Growing investments in electronic equipment manufacturing expected to fuel market growth

TABLE 270 ARGENTINA: ELECTRIC MOTORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 271 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 272 ARGENTINA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 273 ARGENTINA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 274 ARGENTINA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 275 ARGENTINA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 276 ARGENTINA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

12.6.1.3 Rest of South America

TABLE 277 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 278 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 279 REST OF SOUTH AMERICA: MARKET, BY INDUSTRIAL END USER, 2020–2027 (USD MILLION)

TABLE 280 REST OF SOUTH AMERICA: MARKET, BY COMMERCIAL END USER, 2020–2027 (USD MILLION)

TABLE 281 REST OF SOUTH AMERICA: MARKET, BY RESIDENTIAL END USER, 2020–2027 (USD MILLION)

TABLE 282 REST OF SOUTH AMERICA: MARKET, BY AGRICULTURE END USER, 2020–2027 (USD MILLION)

TABLE 283 REST OF SOUTH AMERICA: MARKET, BY TRANSPORTATION END USER, 2020–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 217)

13.1 KEY PLAYERS’ STRATEGIES

TABLE 284 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

13.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 285 ELECTRIC MOTOR MARKET: DEGREE OF COMPETITION

FIGURE 44 MARKET SHARE ANALYSIS, 2021

13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 45 TOP PLAYERS IN MARKET FROM 2017 TO 2021

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STARS

13.4.2 PERVASIVE PLAYERS

13.4.3 EMERGING LEADERS

13.4.4 PARTICIPANTS

FIGURE 46 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

13.5 START-UP/SME EVALUATION QUADRANT, 2021

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 47 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

13.5.5 COMPETITIVE BENCHMARKING

TABLE 286 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 287 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

13.6 ELECTRIC MOTORS MARKET: COMPANY FOOTPRINT

TABLE 288 BY TYPE: COMPANY FOOTPRINT

TABLE 289 BY POWER RATING: COMPANY FOOTPRINT

TABLE 290 BY VOLTAGE: COMPANY FOOTPRINT

TABLE 291 BY END USER: COMPANY FOOTPRINT

TABLE 292 BY REGION: COMPANY FOOTPRINT

TABLE 293 COMPANY FOOTPRINT

13.7 COMPETITIVE SCENARIO

TABLE 294 MARKET: NEW PRODUCT LAUNCHES, JANUARY 2018–OCTOBER 2022

TABLE 295 MARKET: DEALS, JANUARY 2018–OCTOBER 2022

TABLE 296 MARKET: OTHERS, JANUARY 2018–OCTOBER 2022

14 COMPANY PROFILES (Page No. - 236)

14.1 KEY PLAYERS

(Business and financial overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

14.1.1 ABB

TABLE 297 ABB: BUSINESS OVERVIEW

FIGURE 48 ABB: COMPANY SNAPSHOT

TABLE 298 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 299 ABB: PRODUCT LAUNCHES

TABLE 300 ABB: DEALS

TABLE 301 ABB: OTHERS

14.1.2 SIEMENS

TABLE 302 SIEMENS: BUSINESS OVERVIEW

FIGURE 49 SIEMENS: COMPANY SNAPSHOT, 2021

TABLE 303 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 304 SIEMENS: DEALS

TABLE 305 SIEMENS: OTHERS

14.1.3 WEG

TABLE 306 WEG: COMPANY OVERVIEW

FIGURE 50 WEG: COMPANY SNAPSHOT, 2021

TABLE 307 WEG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 308 WEG: PRODUCT LAUNCHES

TABLE 309 WEG: OTHERS

14.1.4 WOLONG ELECTRIC

TABLE 311 WOLONG ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 312 WOLONG ELECTRIC: PRODUCT LAUNCHES

TABLE 313 WOLONG ELECTRIC: DEALS

14.1.5 NIDEC CORPORATION

TABLE 314 NIDEC CORPORATION: COMPANY OVERVIEW

FIGURE 51 NIDEC CORPORATION: COMPANY SNAPSHOT, 2021

TABLE 315 NIDEC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 316 NIDEC CORPORATION: PRODUCT LAUNCHES

TABLE 317 NIDEC CORPORATION: DEALS

TABLE 318 NIDEC CORPORATION: OTHERS

14.1.6 REGAL REXNORD CORPORATION

TABLE 319 REGAL REXNORD CORPORATION: BUSINESS OVERVIEW

FIGURE 52 REGAL REXNORD CORPORATION: COMPANY SNAPSHOT, 2021

TABLE 320 REGAL REXNORD CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 321 REGAL REXNORD CORPORATION: PRODUCT LAUNCHES

14.1.7 TOSHIBA CORPORATION

TABLE 322 TOSHIBA CORPORATION: BUSINESS OVERVIEW

FIGURE 53 TOSHIBA CORPORATION: COMPANY SNAPSHOT, 2021

TABLE 323 TOSHIBA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 324 TOSHIBA CORPORATION: DEALS

14.1.8 HYOSUNG HEAVY INDUSTRIES

TABLE 325 HYOSUNG HEAVY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 54 HYOSUNG HEAVY INDUSTRIES: COMPANY SNAPSHOT, 2021

TABLE 326 HYOSUNG HEAVY INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.1.9 TECO ELECTRIC & MACHINERY

TABLE 327 TECO ELECTRIC & MACHINERY: BUSINESS OVERVIEW

FIGURE 55 TECO ELECTRIC & MACHINERY: COMPANY SNAPSHOT, 2021

TABLE 328 TECO ELECTRIC & MACHINERY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.1.10 HITACHI

TABLE 329 HITACHI: COMPANY OVERVIEW

FIGURE 56 HITACHI: COMPANY SNAPSHOT, 2021

TABLE 330 HITACHI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.1.11 ROBERT BOSCH GMBH

TABLE 331 ROBERT BOSCH GMBH: COMPANY OVERVIEW

FIGURE 57 ROBERT BOSCH GMBH: COMPANY SNAPSHOT, 2021

TABLE 332 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.1.12 JOHNSON ELECTRIC

TABLE 333 JOHNSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 58 JOHNSON ELECTRIC: COMPANY SNAPSHOT

TABLE 334 JOHNSON ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 335 JOHNSON ELECTRIC: PRODUCT LAUNCHES

TABLE 336 JOHNSON ELECTRIC: DEALS

14.1.13 AMETEK

TABLE 337 AMETEK: BUSINESS OVERVIEW

FIGURE 59 AMETEK: COMPANY SNAPSHOT

TABLE 338 AMETEK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 339 AMETEK: PRODUCT LAUNCHES

TABLE 340 AMETEK: DEALS

14.1.14 ALLIED MOTION

TABLE 341 ALLIED MOTION: BUSINESS OVERVIEW

FIGURE 60 ALLIED MOTION TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 342 ALLIED MOTION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 343 ALLIED MOTION: PRODUCT LAUNCHES

TABLE 344 ALLIED MOTION: DEALS

14.1.15 BUHLER MOTOR

TABLE 345 BUHLER MOTOR: BUSINESS OVERVIEW

TABLE 346 BUHLER MOTOR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

14.1.16 FAULHABER GROUP

TABLE 347 FAULHABER GROUP: BUSINESS OVERVIEW

TABLE 348 FAULHABER GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 349 FAULHABER GROUP: DEALS

14.1.17 MAXON MOTOR

TABLE 350 MAXON MOTOR: BUSINESS OVERVIEW

TABLE 351 MAXON MOTOR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 352 MAXON MOTOR: PRODUCT LAUNCHES

TABLE 353 MAXON MOTOR: DEALS

14.2 ARC SYSTEMS

14.3 BROOK CROMPTON

14.4 ROCKWELL AUTOMATION

14.5 YASKAWA

14.6 FRANKLINE ELECTRIC

14.7 SHANDONG HUALI

14.8 WINDINGS INC

*Details on Business and financial overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 297)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 CUSTOMIZATION OPTIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

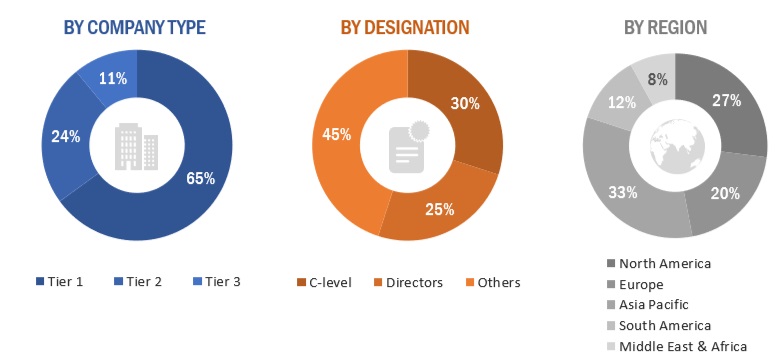

The study involved major activities in estimating the current size of the electric motors market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The electric motors market comprises several stakeholders such as electric motors manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for electric motors in, marine, oil & gas, metal & mining, power generation, chemical & petrochemical, food, beverage, & agriculture, glass, pharmaceutical, water & wastewater, agriculture, and other end-user industries. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electric motors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Electric motors Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the electric motors market on the basis of type, power rating, voltage, rotor type, output power, end user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the electric motor market with respect to individual growth trends, future expansions, and the contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the electric motor market with respect to the main regions (Asia Pacific, Europe, North America, South America, and Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments in the electric motor market, such as contracts and agreements, investments and expansions, new product developments, and mergers and acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for a report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Motors Market