Electric Powertrain Market by Component (Motor, 12V, HV/48V Battery, BMS, 48V ISG, Controller, PDM, DC/AC Inverter, DC/DC Converter & Others), Type (BEV, MHEV, Series, Parallel & Parallel-Series), Vehicle Type, and Region - Global Forecast to 2027

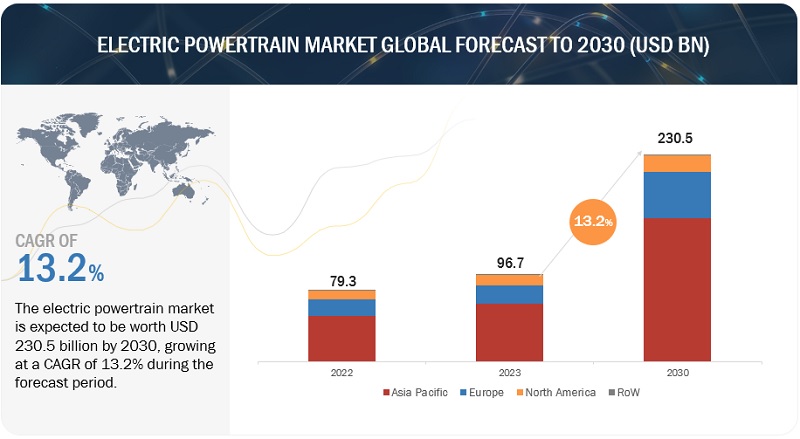

The global Electric Powertrain Market is projected to be valued at USD 191.4 billion by 2027 from an estimated USD 62.9 billion in 2019, growing at a CAGR of 14.9%.

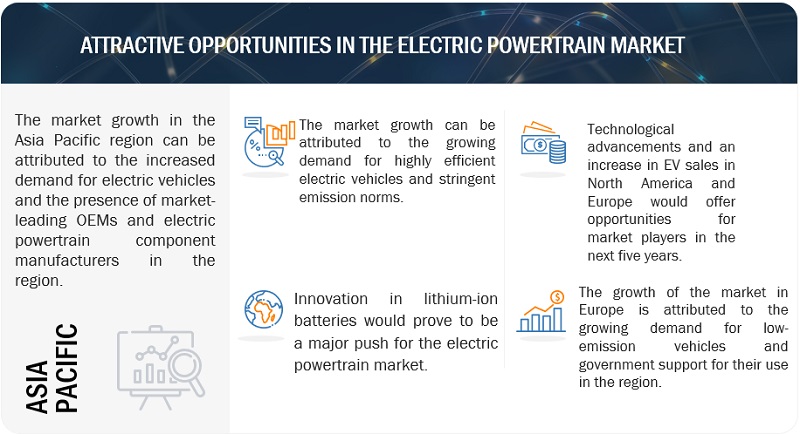

Attractive incentives by governments for mass adoption and domestic production of electric vehicles, increasing demand for electric vehicles, and stringency in regulations will drive the global market.

The Asia Pacific and North America are the regions where the electric powertrain market is experiencing the highest growth rate due to the increasing government regulations on emission norms, allocations of funds by the respective governments for incentivizing sales of electric vehicles, and developments in powertrain components, such as lithium-ion batteries, battery management systems, and motors. Furthermore, continuous R&D and collaborations among automotive companies in these regions are expected to stimulate market growth for the electric powertrain.

MHEV powertrain is estimated to be the fastest growing segment in the electric powertrain market during the forecast period

48V MHEV is estimated to be the fastest-growing market for the period 2019–2027. The slowdown of diesel-powered vehicles and restrictions on CO2 targets have driven the 48V MHEV powertrain market. According to Emission Analytics, the mass adoption of mild hybrids over BEVs is an effective solution to cut down on emissions. Also, developments and drop in Lithium-ion battery prices have driven the MHEV powertrain component market. Easy integration of 48V MHEV powertrain into an existing ICE vehicle architecture is also driving this market in mild hybrid vehicles.

Asia Pacific is expected to register the fastest growth during the forecast period

Implementation of stringent emission norms such as China VI and BS-VI is driving the Asia Pacific market. Joint ventures between various organizations to build charging infrastructure have also been a major driving factor. For instance, China's DiDi Chuxing (DiDi) and BP, the British gas, oil, and energy company, announced a joint venture to build the electric vehicle charging infrastructure in China. China has lithium reserves that are paving the way for increased investments in battery production. Initiatives by the Indian government such as ‘Make in India’ to encourage domestic production of electric vehicles are also driving the market. Investments by players to tap the market potential of the region are propelling the Asia Pacific electric powertrain market further. For instance, Nissan is investing USD 33 million in Tochigi Prefecture in Japan for manufacturing electric vehicle components. Tesla launched its Model 3 in the South Korean market with a significant decrease in the price range because of the respective government incentives.

Motor/generator is expected to grow at the fastest CAGR in the BEV powertrain component market

Motor/generator is the fastest growing segment in the BEV powertrain component market. The primary reason for the growth is the increasing number of electric vehicles every year. According to the IEA, in 2018, China deployed 1.7 million BEVs, Europe deployed 0.6 million BEVs, the US deployed 0.6 million BEVs, and RoW deployed 0.3 million BEVs. Another reason is the product developments by various major players. Cascadia Motion, a BorgWarner-owned company, developed a rear-wheel-drive system featuring two separate BorgWarner High-voltage Hairpin (HVH) 250 electric motors and eGearDrive gear sets, each one independently controlling a rear wheel. In high performance vehicles, use of two or more motors for improved performance is also driving the motor/generator segment. For instance, Tesla Model S has two motors, one on the front axle and the other on the rear axle. Therefore, using more number of motors for high performance BEVs will drive the BEV powertrain component market for motors/generators.

Key Market Players

The global electric powertrain market is dominated by major players such as Bosch (Germany), Mitsubishi Electric (Japan), Magna (Canada), Continental AG (Germany), and Hitachi (Japan). These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Thousand Units) & Value (USD Million) |

|

Segments covered |

By vehicle type, HEV/PHEV powertrain component, BEV powertrain component, 48V MHEV powertrain component, powertrain type, region |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies covered |

Bosch (Germany), Mitsubishi Electric(Japan), Magna (Canada), Continental AG (Germany), and Hitachi (Japan) A total of 20 major players covered |

The electric powertrain market research report categorizes the given market based on vehicle type, HEV/PHEV powertrain component, BEV powertrain component, 48V MHEV powertrain component, powertrain type, and region.

Based on the vehicle type:

- Hybrid And Plug-In Hybrid Vehicle (HEV/PHEV)

- Battery Electric Vehicle (BEV)

- 48V Mild Hybrid Vehicle (MHEV)

Based on the HEV/PHEV powertrain component:

- Motor/Generator

- HV Battery

- 12V Battery

- Battery Management System

- Controller

- DC/AC Inverter

- DC/DC Converter

- Power Distribution Module

- Idle Start-Stop

- On-board Charger

- Regenerative Braking

Based on BEV powertrain component:

- Motor/Generator

- HV Battery

- 12V Battery

- Battery Management System

- Controller

- DC/DC Converter

- DC/AC Inverter

- Power Distribution Module

- On-board Charger

- Regenerative Braking

Based on 48V MHEV powertrain component:

- 48V Battery

- 12V Battery

- Battery Management System

- DC/AC Inverter

- DC/DC Converter

- 48V BSG/ISG

- Idle Start-Stop

- Regenerative Braking

Based on powertrain type:

- BEV Powertrain

- MHEV Powertrain

- Series Hybrid Powertrain

- Parallel Hybrid Powertrain

- Series-Parallel Hybrid Powertrain

Based on region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Netherlands

- Norway

- Spain

- Sweden

- UK

- Russia

-

Rest of the World

- Brazil

- South Africa

Critical Questions:

- Many companies are operating in the electric powertrain market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

- Fast-paced developments in electric powertrain BEV components (such as motor/generator, power distribution module, battery management system, and inverter/converter) offered by leading providers are expected to change the dynamics of electric powertrain market. How will this transform the overall market?

- Which leading companies are working on electric powertrain components, and what organic and inorganic strategies have they adopted?

- Analysis of your competition that includes major players in the electric powertrain ecosystem. The major players include Bosch (Germany), Mitsubishi Electric (Japan), Magna (Canada), Continental AG (Germany), and Hitachi (Japan), among others.

- Discussion on your client’s imperatives based on our existing research on the electric powertrain market and its ecosystems.

Frequently Asked Questions (FAQ):

What is the market size of the Electric Powertrain Market?

The global electric powertrain market size is projected to reach USD 191.4 billion by 2027, from an estimate of USD 62.9 billion in 2019, at a CAGR of 14.9%.

Who are the frontrunners in the EV powertrain market, and what strategies have been adopted by them?

The global electric powertrain market is dominated by major players such as Bosch (Germany), Mitsubishi Electric (Japan), Magna (Canada), Continental AG (Germany), and Hitachi (Japan). These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

What are the upcoming technologies in the EV powertrain market?

Introduction of 48V mild-hybrid vehicles and powertrain components related to 48V mild-hybrid vehicles such as 48V ISG and regenerative braking are some of the upcoming technologies.

Which is the most promising vehicle type for suppliers?

With their increasing demand in BEV, EV powertrain components are likely to have a major share in 48V mild hybrid vehicles.

How is the industry handling the decrease in battery prices and challenges related to battery thermal management?

With advancements in technologies and growing demand, the equilibrium price of batteries has gone down. Suppliers are dealing with battery thermal management challenges with changes in battery technology and battery composition (decrease in cobalt content, for example).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives

1.2 Product Definition

1.2.1 Inclusions & Exclusions

1.3 Electric Powertrain Market Scope

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Electric Vehicle Sales

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Electric Powertrain Market Size Estimation

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions & Associated Risks

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in the Electric Powertrain Market

4.2 Market, By Region

4.3 HEV/PHEV Powertrain Market, By Component

4.4 BEV Powertrain Market, By Component

4.5 MHEV Powertrain Market, By Component

4.6 Market, By Powertrain Type

4.7 Market, By Vehicle Type

5 Electric Powertrain Market Overview (Page No. - 45)

5.1 Introduction

5.2 Years Considered for the Study

5.3 Package Size

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Stringent Emission Norms

5.4.1.2 Growing Vehicle Electrification Demand in Automotive Industry

5.4.1.3 Lack of Infrastructure for Electric Vehicle Charging

5.4.1.4 Emerging Competing Technologies in Conventional Engines

5.4.2 Opportunities

5.4.2.1 Developments in Lithium-Ion Batteries

5.4.3 Challenges

5.4.3.1 High Cost of Electrical Components

5.4.3.2 Technological Challenges With Electric Powertrains

5.5 Revenue Missed: Opportunities for Electric Powertrain Manufacturers

5.6 Eletric Powertrain Market, Scenarios (2018–2027)

5.6.1 Electric Powertrain Market, Most Likely Scenario

5.6.2 Market, Optimistic Scenario

5.6.3 Market, Pessimistic Scenario

5.7 Revenue Shift Driving Market Growth

6 Electric Powertrain Market, By Vehicle Type (Page No. - 55)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions

6.1.3 Industry Insights

6.2 Operational Data

6.2.1 Lithium-Ion Batteries Requirement for Various Vehicle Type

6.3 HEV/PHEV

6.3.1 Higher Fuel Efficiency and Incresing Demand of Downsized Engines Will Drive the HEV/PHEV Powertrain Segment

6.4 BEV

6.4.1 Innovations in Batteries Will Drive the BEV Powertrain Segment

6.5 48v Mild Hybrid Vehicle

6.5.1 Easier Integration of MHEV Architecture Will Drive the 48v MHEV Powertrain Segment

7 HEV/PHEV Powertrain Market, By Component (Page No. - 62)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions

7.1.3 Industry Insights

7.2 Motor/Generator

7.2.1 Developments in Motor/Generator Will Drive the Motor/ Generator Market

7.3 Battery

7.3.1 Ongoing Developments in Batteries Will Drive the Battery Market

7.4 Battery Management System (BMS)

7.4.1 Safety Risks Associated With Battery Will Drive the Battery Management System Market

7.5 Controller

7.5.1 Inovations in Motor Electronics Will Drive the Controller Market

7.6 Inverter/Converter

7.6.1 Rapid Technological Developments Will Drive the Inverter/ Converter Market

7.7 Power Distribution Module

7.7.1 Need Or Proper Maintenance of Different Control Units Will Drive the Power Distribution Module Market

7.8 Idle Start-Stop

7.8.1 Demand for Reduction of Vehicular Emissions Will Drive the Idle Start-Stop Market

7.9 On-Board Charger

7.9.1 Dual Role of On-Board Chargers Will Drive the On-Board Charger Market

7.1 Regenerative Braking

7.10.1 Inovations in Types of Braking Systems Will Drive the Regenerative Braking Market

8 BEV Powertrain Market, By Component (Page No. - 75)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Industry Insights

8.2 Motor/Generator

8.2.1 Increase in Number of Motors/Generators Will Drive the Motor/Generator Market

8.3 Battery Pack

8.3.1 Ongoing Developments in Lithium-Ion Batteries Will Drive the Battery Pack Market

8.4 Battery Management System (BMS)

8.4.1 Innovations Will Drive the Battery Management Market

8.5 Controller

8.5.1 Increase in Number of Motors Used to Improve BEV Performance Will Drive the Controller Market

8.6 Inverter/Converter

8.6.1 Innovations in Inverters/Converters Will Drive the Inverter/Converter Market

8.7 Power Distribution Module

8.7.1 Safety of Drivers and Proper Functioning of Electronic Components Will Drive the Market

8.8 On-Board Charger

8.8.1 Need for Safe and Effective Charging of the Battery Will Drive the On-Board Charger Market

8.9 Regenerative Braking

8.9.1 Demand for Improved Fuel Performance Will Drive Regenerative Braking Market

9 48v MHEV Powertrain Market, By Componen 87 (Page No. - )

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions

9.1.3 Industry Insights

9.2 Operational Data

9.2.1 MHEV Passenger Car Sales By Region

9.3 Battery

9.3.1 Developments in Lithium-Ion Battery Technology Will Drive the Battery Market for 48v MHEV Architecture

9.4 Battery Management System

9.4.1 Necessity to Maintain Optimum Temperature and Pressure Will Drive the Market for Battery Management System

9.5 Inverter/Converter

9.5.1 Innovations in Power Electronics Will Drive the Inverter/ Converter Market

9.6 48v Isg/Bsg

9.6.1 Increase in Demand for Engine Performance Will Drive the 48v Isg/Bsg Market

9.7 Idle Start-Stop

9.7.1 Demand for Higher Fuel Economy Will Drive the Idle Start Stop Market

9.8 Regenerative Braking

9.8.1 Electrification in Braking Systems Will Drive the Regenerative Braking Market

10 Electric Powertrain Market, By Powertrain Type (Page No. - 97)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Assumptions

10.1.3 Industry Insights

10.2 BEV Powertrain

10.2.1 Increase in BEV Sales Will Drive the BEV Powertrain Market

10.3 MHEV Powertrain

10.3.1 Ease of Integration of 48v MHEV Powertrain Architecture in Existing Ice Architecture Will Drive This Segment

10.4 Series Hybrid Powertrain

10.4.1 Higher Power Applications in the Future Will Drive the Series Hybrid Powertrain Market

10.5 Parallel Hybrid Powertrain

10.5.1 Better Performance During Highway Driving Will Drive the Parallel Hybrid Powertrain Market

10.6 Series-Parallel Hybrid

10.6.1 Advantage of Dual Operation Mode Will Drive the Series-Parallel Powertrain Market

11 Electric Powertrain Market, By Region (Page No. - 106)

The Chapter is Further Segmented By Component at Regional and Country Level

11.1 Introduction

11.1.1 Research Methodology

11.1.2 Assumptions/Limitations

11.1.3 Industry Insights

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Stringent Emission Norms Will Drive the Market

11.2.1.2 China Electric Vehicle Sales Data

11.2.2 India

11.2.2.1 Rolling Out of Bs Vi Norms Will Drive the Indian Electric Powertrain Market

11.2.2.2 India Electric Vehicle Sales Data

11.2.3 Japan

11.2.3.1 Contribution By Major Players to Electromobility Will Drive the Japanese Market

11.2.3.2 Japan Electric Vehicle Sales Data

11.2.4 South Korea

11.2.4.1 Attractive Government Incentives Will Drive the South Korean Electric Vehicles Market

11.2.4.2 South Korea Electric Vehicle Sales Data

11.3 Europe

11.3.1 France

11.3.1.1 Increasing Investment in the Production of Electrified Powertrain Components Will Drive the French Electric Powertrain Market

11.3.1.2 France Electric Vehicle Sales Data

11.3.2 Germany

11.3.2.1 Government Funding for Developing Charging Infrastructure Will Drive the German Market

11.3.2.2 Germany Electric Vehicle Sales Data

11.3.3 Italy

11.3.3.1 Agreements Between Electrified Powertrain Component Players Will Drive the Italian Powertrain Market

11.3.3.2 Italy Electric Vehicle Sales Data

11.3.4 The Netherlands

11.3.4.1 Partnerships Between Institutions and the Government Will Drive the Netherlands Market

11.3.4.2 Netherlands Electric Vehicle Sales Data

11.3.5 Norway

11.3.5.1 High Demand for Pure Electric Vehicles Will Drive the Norway Electric Powertrain Market

11.3.5.2 Norway Electric Vehicle Sales Data

11.3.6 Spain

11.3.6.1 Identification of Low-Emission Zones and Awareness Campaigns Will Drive the Market

11.3.6.2 Spain Electric Vehicle Sales Data

11.3.7 Sweden

11.3.7.1 Experimentation in Innovative Electric Charging Technology Will Drive the Swedish Electric Powertrain Market

11.3.7.2 Sweden Electric Vehicle Sales Data

11.3.8 UK

11.3.8.1 Initiatives By the UK Government Toward Establishing Charging Infrastructure and Encouraging Startups Will Drive the Market

11.3.8.2 UK Electric Vehicle Sales Data

11.3.9 Russia

11.3.9.1 Successful Attempts to Domestically Produce Electric Cars Will Drive the Russian Electric Powertrain Market

11.3.9.2 Russia Electric Vehicle Sales Data

11.4 North America

11.4.1 US

11.4.1.1 Increasing R&D on Lithium-Ion Batteries and Partnerships Between Major Players Will Drive the US Electric Powertrain Market

11.4.1.2 US Electric Vehicle Sales Data

11.4.2 Canada

11.4.2.1 Government Incentives to Promote the Adoption of Electric Vehicles Will Drive the Market

11.4.2.2 Canada Electric Vehicle Sales Data

11.4.3 Mexico

11.4.3.1 Government Incentives to Encourage Domestic Production of Electric Vehicles Will Drive the Mexican Electric Powertrain Market

11.4.3.2 Mexico Electric Vehicle Sales Data

11.5 RoW

11.5.1 Brazil

11.5.1.1 Stringent Emission Norms With Increasing Presence of Electric Vehicle Manufacturers Will Drive the Brazilian Electric Powertrain Market

11.5.1.2 Brazil Electric Vehicle Sales Data

11.5.2 South Africa

11.5.2.1 Adoption of Stricter Emission Norms and Local Manufacturing Will Drive the Market for Evs

11.5.2.2 South Africa Electric Vehicle Sales Data

12 Competitive Landscape (Page No. - 147)

12.1 Overview

12.2 Electric Powertrain Market: Market Ranking Analysis

12.3 Competitive Leadership Mapping

12.3.1 Terminology

12.3.2 Visionary Leaders

12.3.3 Innovators

12.3.4 Dynamic Differentiators

12.3.5 Emerging Companies

12.3.6 Strength of Product Portfolio

12.3.7 Business Strategy Excellence

12.4 Competitive Scenario

12.4.1 New Product Developments/Launch

12.4.2 Expansions

12.4.3 Acquisitions

12.4.4 Partnerships/Contracts

12.5 Right to Win

13 Company Profiles (Page No. - 158)

13.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1.1 Bosch

13.1.2 Mitsubishi Electric

13.1.3 Magna

13.1.4 Continental AG

13.1.5 Hitachi

13.1.6 Borgwarner

13.1.7 ZF

13.1.8 Denso

13.1.9 Dana Incorporated

13.1.10 Valeo Group

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13.2 Asia Pacific

13.2.1 Nidec Corporation

13.2.2 Magneti Marelli Ck Holdings

13.2.3 Toyota Industries Corporation

13.2.4 Panasonic

13.3 Europe

13.3.1 Brusa Electronik

13.3.2 Cc Power Electronics

13.4 North America

13.4.1 Curtis Instruments

13.4.2 Kelly Controls

13.4.3 Filtran Llc

13.5 RoW

13.5.1 Moura Batteries

14 Recommendations By Marketsandmarkets (Page No. - 189)

14.1 Asia Pacific Will Be the Major Market for Electric Powertrains

14.2 BEV Powertrain Components Can Be A Key Focus for Manufacturers

14.3 Conclusion

15 Appendix (Page No. - 190)

15.1 Currency & Pricing

15.2 Key Insights of Industry Experts

15.3 Discussion Guide

15.4 Knowledge Store: Marketsandmarkets Subscription Portal

15.5 Available Customizations

15.5.1 Electric Powertrain Market, By Vehicle Type Country Wise Data

15.5.1.1 BEV

15.5.1.2 HEV/PHEV

15.5.2 Electric Powertrain Market, By Type Country Wise Data

15.5.2.1 BEV Powertrain

15.5.2.2 Series Hybrid Powertrain

15.5.2.3 Parallel Hybrid Powertrain

15.5.2.4 Series-Parallel Powertrain

15.6 Related Reports

15.7 Author Details

List of Tables (162 Tables)

Table 1 Segment-Wise Inclusions & Exclusions

Table 2 Electric Powertrain Market (Most Likely), By Region, 2017–2027 (USD Million)

Table 3 Market (Optimistic), By Region, 2017–2027 (USD Million)

Table 4 Market (Pessimistic), By Region, 2017–2027 (USD Million)

Table 5 Requirement of Lithium-Ion Batteries Sizes for Vehicle Type

Table 6 Market, By Vehicle Type, 2017–2027 (‘000 Units)

Table 7 Market, By Vehicle Type, 2017–2027 (USD Million)

Table 8 HEV/PHEV Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 9 HEV/PHEV Powertrain Market, By Region, 2017–2027 (USD Million)

Table 10 BEV Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 11 BEV Powertrain Market, By Region, 2017–2027 (USD Million)

Table 12 MHEV Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 13 MHEV Powertrain Market, By Region, 2017-2017 (USD Million)

Table 14 HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 15 Motor/Generator Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 16 Motor/Generator Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 17 Battery Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 18 Battery Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 19 Battery Management System Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 20 Battery Management System Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 21 Controller Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 22 Controller Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 23 Inverter/Converter Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 24 Inverter/Converter Market (HEV/PHEV), By Region, By Component, 2017–2027 (USD Million)

Table 25 Power Distribution Module Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 26 Power Distribution Module Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 27 Idle Start-Stop Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 28 Idle Start-Stop Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 29 On-Board Charger Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 30 On-Board Charger Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 31 Regenerative Braking Market (HEV/PHEV), By Region, 2017–2027 (‘000 Units)

Table 32 Regenerative Braking Market (HEV/PHEV), By Region, 2017–2027 (USD Million)

Table 33 BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 34 Motor/Generator Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 35 Motor/Generator Market (BEV), By Region, 2017–2027 (USD Million)

Table 36 Battery Pack Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 37 Battery Pack Market (BEV), By Region, 2017–2027 (USD Million)

Table 38 Battery Management System Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 39 Battery Management System Market (BEV), By Region, 2017–2027 (USD Million)

Table 40 Controller Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 41 Controller Market (BEV), By Region, 2017–2027 (USD Million)

Table 42 Inverter/Converter Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 43 Inverter/Converter Market (BEV), By Region, 2017–2027 (USD Million)

Table 44 Power Distribution Module Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 45 Power Distribution Module Market (BEV), By Region, 2017–2027 (USD Million)

Table 46 On-Board Charger Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 47 On-Board Charger Market (BEV), By Region, 2017–2027 (USD Million)

Table 48 Regenerative Braking Market (BEV), By Region, 2017–2027 (‘000 Units)

Table 49 Regenerative Braking Market (BEV), By Region, 2017–2027 (USD Million)

Table 50 MHEV Passenger Car Sales, 2017–2018, By Region (’000 Units)

Table 51 MHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 52 Battery Market (MHEV), By Region, 2017–2027 (’000 Units)

Table 53 Battery Market (MHEV), By Region, 2017–2027 (USD Million)

Table 54 Battery Management System Market (MHEV), By Region, 2017–2027 (’000 Units)

Table 55 Battery Management System Market (MHEV), By Region, By Region, 2017–2027 (USD Million)

Table 56 Inverter/Converter Market (MHEV), By Region, 2017–2027 (’000 Units)

Table 57 Inverter/Converter Market (MHEV), By Region, 2017–2027 (USD Million)

Table 58 48v Isg/Bsg Market (MHEV), By Region, 2017–2027 (’000 Units)

Table 59 48v Isg/Bsg Market (MHEV), By Region, 2017–2027 (USD Million)

Table 60 Idle Start-Stop Market (MHEV), By Region, 2017–2027 (’000 Units)

Table 61 Idle Start-Stop Market (MHEV), By Region, 2017–2027 (USD Million)

Table 62 Regenerative Braking Market (MHEV), By Region, 2017–2027 (’000 Units)

Table 63 Regenerative Braking Market (MHEV), By Region, 2017–2027 (USD Million)

Table 64 Electric Powertrain Market, By Type, 2017–2027 (‘000 Units)

Table 65 Electric Powertrain Market, By Type, 2017–2027 (USD Million)

Table 66 BEV Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 67 BEV Powertrain Market, By Region, 2017–2027 (USD Million)

Table 68 MHEV Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 69 MHEV Powertrain Market, By Region, 2017–2027 (USD Million)

Table 70 Series Hybrid Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 71 Series Hybrid Powertrain Market, By Region, 2017–2027 (USD Million)

Table 72 Parallel Hybrid Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 73 Parallel Hybrid Powertrain Market, By Region, 2017–2027 (USD Million)

Table 74 Series-Parallel Hybrid Powertrain Market, By Region, 2017–2027 (‘000 Units)

Table 75 Series-Parallel Hybrid Powertrain Market, By Region, 2017–2027 (USD Million)

Table 76 Electric Powertrain Market, By Region, 2017–2027 (’000 Units)

Table 77 Electric Powertrain Market, By Region, 2017–2027 (USD Million)

Table 78 Asia Pacific: EV Powertrain Market, By Country, 2017–2027 (’000 Units)

Table 79 Asia Pacific: EV Powertrain Market, By Country, 2017–2027 (USD Million)

Table 80 China: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 81 China: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 82 China: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 83 India: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 84 India: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 85 India: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 86 Japan: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 87 Japan: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 88 Japan: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 89 South Korea: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 90 South Korea: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 91 South Korea: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 92 Europe: EV Powertrain Market, By Country, 2017–2027 (’000 Units)

Table 93 Europe: EV Powertrain Market, By Country, 2017–2027 (USD Million)

Table 94 France: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 95 France: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 96 France: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 97 Germany: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 98 Germany: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 99 Germany: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 100 Italy: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 101 Italy: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 102 Italy: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 103 Netherlands: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 104 Netherlands: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 105 Netherlands: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 106 Norway: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 107 Norway: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 108 Norway: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 109 Spain: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 110 Spain: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 111 Spain: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 112 Sweden: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 113 Sweden: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 114 Sweden: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 115 UK: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 116 UK: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 117 UK: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 118 Russia: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 119 Russia: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 120 Russia: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 121 North America: EV Powertrain Market, By Country, 2017–2027 (’000 Units)

Table 122 North America: EV Powertrain Market, By Country, 2017–2027 (USD Million)

Table 123 US: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 124 US: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 125 US: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 126 Canada: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 127 Canada: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 128 Canada: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 129 Mexico: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 130 Mexico: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 131 Mexico: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 132 RoW: EV Powertrain Market, By Country, 2017–2027 (’000 Units)

Table 133 RoW: EV Powertrain Market, By Country, 2017–2027 (USD Million)

Table 134 Brazil: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 135 Brazil: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 136 Brazil: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 137 South Africa: Electric Vehicle Sales, 2017–2018 (’000 Units)

Table 138 South Africa: HEV/PHEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 139 South Africa: BEV Powertrain Market, By Component, 2017–2027 (USD Million)

Table 140 New Product Developments/Launch

Table 141 Expansions

Table 142 Acquisitions

Table 143 Partnerships/Contracts

Table 144 Bosch: Organic Developments

Table 145 Bosch: Inorganic Developments

Table 146 Mitsubishi Electric: Organic Developments

Table 147 Magna:Organic Developments

Table 148 Magna:Inorganic Developments

Table 149 Continental AG: Organic Developments

Table 150 Continental AG: Inorganic Developments

Table 151 Hitachi:Organic Developments

Table 152 Hitachi:Inorganic Developments

Table 153 Borgwarner:Organic Developments

Table 154 Borgwarner:Inorganic Developments

Table 155 ZF:Organic Developments

Table 156 ZF:Inorganic Developments

Table 157 Denso:Organic Developments

Table 158 Denso:Inorganic Developments

Table 159 Dana Incorporated: Oranic Developments

Table 160 Dana Incorporated:Inorganic Developments

Table 161 Valeo:Inorganic Developments

Table 162 Currency Exchange Rates (Wrt Per USD)

List of Figures (53 Figures)

Figure 1 Market Segmentation: Electric Powertrain Market

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach: Market

Figure 6 Top-Down Approach: Market

Figure 7 Data Triangulation

Figure 8 Electric Powertrain: Market Outlook

Figure 9 Electric Powertrain Market, By Region, 2019 vs. 2027 (USD Million)

Figure 10 Stringent Emission Norms and Expansion of Electrified Powertrain Players All Over the World are Driving the Market, 2019–2027 (USD Billion)

Figure 11 Asia Pacific is Expected to Dominate the EV Powertrain Market

Figure 12 Battery Segment to Hold the Largest Market By 2027

Figure 13 Battery Pack is Projected to Remain the Largest Market By 2027

Figure 14 Inverter/Converter Segment to Hold the Largest Market During the Forcast Period

Figure 15 BEV Powertrain to Hold the Largest Market During the Forcast Period

Figure 16 BEV Segment to Hold the Largest Market During the Forcast Period

Figure 17 Electric Powertrain: Market Dynamics

Figure 18 Euro Emission Norms Limits of Nox: Euro V vs. Euro Vi

Figure 19 China Emission Norms Limits of Nox: China V vs. China Vi

Figure 20 Wireless Charging for Electric Vehicle Market, By Vehicle Type, 2020 vs. 2027 (USD Thousand)

Figure 21 Share of Biofuel in Transport, 2017 vs. 2023 (‘000 Tons)

Figure 22 High Voltage Battery Market, By Battery Type, 2018 vs. 2025 (’000 Units)

Figure 23 Battery Material Cost Distribution

Figure 24 Electric Powertrain Market, By Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 25 HEV/PHEV Powertrain Market, By Component, 2019 vs. 2027 (USD Million)

Figure 26 BEV Powertrain Market, By Component, 2019 vs. 2027 (USD Million)

Figure 27 MHEV Powertrain Market, By Component, 2019 vs. 2027 (USD Million)

Figure 28 Market, By Powertrain Type, 2019 vs. 2027 (USD Million)

Figure 29 Market, By Region, 2019–2027 (USD Million)

Figure 30 Asia Pacific: EV Powertrain Market Snapshot

Figure 31 Europe: EV Powertrain Market, 2019 vs. 2027 (USD Million)

Figure 32 North America: EV Powertrain Market Snapshot

Figure 33 RoW: EV Powertrain Market, 2019 vs. 2027 (USD Million)

Figure 34 Electric Powertrain Market Ranking Analysis, 2018

Figure 35 Electric Powertrain: Competitive Leadership Mapping (2018)

Figure 36 Electric Powertrain: Company-Wise Product Offering Analysis

Figure 37 Electric Powertrain: Company-Wise Business Strategy Analysis

Figure 38 Companies Adopted New Product Development & Partnerships/ Agreements/Supply Contracts/Collaborations/Joint Ventures as the Key Growth Strategy, 2017–2019

Figure 39 Bosch: Company Snapshot

Figure 40 SWOT Analysis: Bosch

Figure 41 Mitsubishi Electric: Company Snapshot

Figure 42 Mitsubishi Electric: SWOT Analysis

Figure 43 Magna: Company Snapshot (2018)

Figure 44 Magna: SWOT Analysis

Figure 45 Continental AG: Company Snapshot (2018)

Figure 46 Continental AG: SWOT Analysis

Figure 47 Hitachi: Company Snapshot (2018)

Figure 48 SWOT Analysis: Hitachi

Figure 49 Borgwarner: Company Snapshot (2018)

Figure 50 ZF: Company Snapshot (2018)

Figure 51 Denso: Company Snapshot (2018)

Figure 52 Dana Incorporated: Company Snapshot (2018)

Figure 53 Valeo: Company Snapshot (2018)

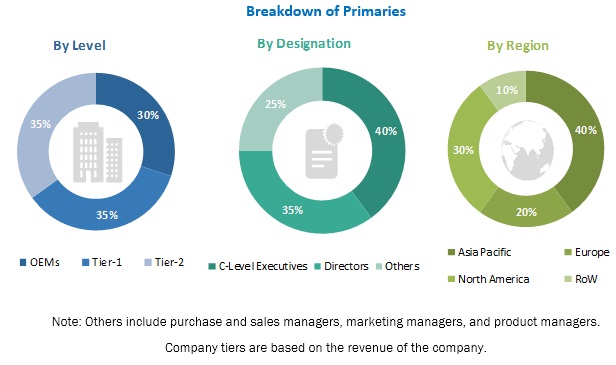

The study involved four major activities in estimating the current size of the electric powertrain market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of electric vehicle sales’ OEMs, EEA (European Energy Agency), IEA (International Energy Agency), ACEA (European Automobile Manufacturers Association), T&E (Transport and Environmnet), country-level automotive associations, trade organizations, and the US Department of Transportation (DOT)], articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global electric powertrain market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as electric vehicle sales forecast, electric powertrain market forecast, future technology trends, and upcoming technologies in the electric powertrain industry. Data triangulation of all these points was done with the information gathered from secondary research as well as model mapping. Stakeholders from demand as well as supply side have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (electric powertrain solution and service providers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of the electric powertrain market report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total electric powertrain market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall electric powertrain market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the electric powertrain market in terms of value (USD million) and volume (thousand units), which includes the following segments:

- By HEV/PHEV component [motor/generator, battery (12V battery and HV battery), battery management system, controller, power distribution module, inverter/converter (DC/AC inverter and DC/DC converter), idle-start stop, on-board charger, and regenerative braking]

- By BEV component [motor/generator, battery pack (12V battery and HV battery), battery management system, controller, power distribution module, inverter/converter (DC/AC inverter and DC/DC converter), on-board charger, and regenerative braking)]

- By 48V MHEV component [battery (12V battery and 48V battery), battery management system, inverter/converter (DC/DC converter and DC/AC inverter), 48V BSG/ISG, idle start-stop, and regenerative braking]

- By powertrain type (series hybrid powertrain, parallel hybrid powertrain, series-parallel powertrain, BEV powertrain, and MHEV powertrain)

- By vehicle type (HEV/PHEV, BEV, and MHEV)

- By region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the global market

- To analyze the market ranking of key players operating in this market

- To understand the dynamics of the electric powertrain market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Electric Powertrain Market, By Vehicle Type Country Wise Data

- BEV

- HEV/PHEV

Note: North America (US, Canada, and Mexico), Europe (France, Germany, Spain, Sweden, Norway, Netherlands, Italy, and UK), Asia Pacific (China, India, South Korea, and Japan), RoW (Brazil and South Korea)

Electric Powertrain Market, By Type Country Wise Data

- Bev Powertrain

- Series Hybrid Powertrain

- Parallel Hybrid Powertrain

- Series-Parallel Powertrain

Note: North America (US, Canada, and Mexico), Europe (France, Germany, Spain, Sweden, Norway, Netherlands, Italy, and UK), Asia Pacific (China, India, South Korea, and Japan), RoW (Brazil and South Korea)

Growth opportunities and latent adjacency in Electric Powertrain Market