Electric Scooter and Motorcycle Market by Vehicle (E-Scooters/Mopeds & E-Motorcycles), Battery (Lead Acid & Li-Ion), Distance, Voltage (36V, 48V, 60V, 72V, Above 72V), Technology Usage(Private, Commercial), Vehicle Class & Region - Global Forecast to 2028

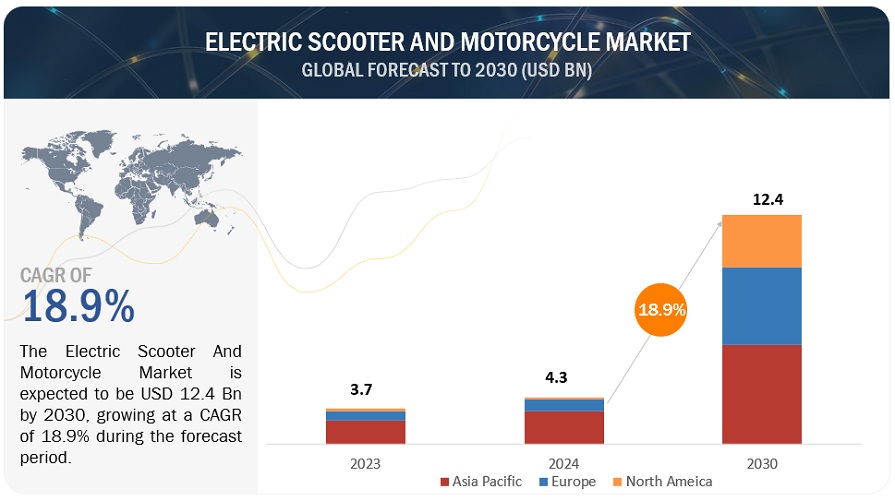

[392 Pages Report] The global electric scooter and motorcycle market, by value, is estimated to be USD 4.9 billion in 2023 and is projected to reach USD 14.7 billion by 2028, at a CAGR of 24.8% from 2023 to 2028. With rising emission levels, increasing prices, and the limited availability of petroleum, the demand for zero-emission alternative fuel vehicles has increased. This has, in turn, increased the demand for electric two-wheelers during the last few years.

The most important part of any electric two wheeler is its battery. The performance, efficiency, and price of electric two wheelers are dependent on the battery installed. Till 2020, most electric scooters and motorcycles were offered with lead-acid batteries. However, two wheeler manufacturers are now focused on the development and installation of more advanced li-ion batteries in new electric scooters and motorcycles to overcome the disadvantages of lead-acid batteries. The economic growth and a rapidly growing population in India have made it imperative for the country to enhance its commuting media. The Indian Government offers buyers incentives to promote electric two-wheelers in the region. Asia Pacific region has major market players such as NIU International (China), Okinawa Autotech Internationall Private Limited (India), Jiangsu Xinri E-Vehicle Co., Ltd (China), Hero Electric (India), Yadea Technology Group Co.,Ltd. (China) and others that offer a wide range of electric scooters with advanced connectivity features for end-use applications. The implementation of new technologies and the establishment of new government regulations drive the electric scooter and motorcycle market in this region. In January 2023, Exicom, entered into an agreement with Hero Electric to supply Battery Management Systems (BMS) for the latter’s electric two-wheelers in India.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Implementation of Battery Swapping Technology

Battery swapping is a new technology that allows owner of electric vehicle to swap out their dying or dead battries with fully charged one. This development could completely transform the E2W market and improve the comfort and ease of long-distance driving for motorists. Automatic and manual battery switching are the two main methods that are use in battery swapping. The automated approach involves changing batteries with a robotic arm, much like changing of oil at a gas station. In manual technique where drained battery must be removed from the car and replaced with the fully charged.

The fact that range anxiety, a typical worry among EV users, is eliminated is one of the main advantages of battery swapping. With this technology in place, drivers won't have to worry about becoming stuck without a charge because all they have to do is stop at a switch station when they run out of power. Furthermore, because battery-swapping stations are far less expensive to construct than conventional gas stations, they are more accessible to communities that might not otherwise have access to fuelling choices. This may have a significant impact, especially in rural areas and underdeveloped nations where EV use is growing. In addition to this, Government are making policies and investment for development of battart sanpping station. For Instance, In February 2023, Indian Government in financial budget 2023 announced to introduce a Battery Swapping Policy and interoperability standards to improve efficiency in the EV ecosystem. Such quick investments and advancements in battery technology will solve the problem of range limitation in electric two-wheelers, which positively encouraging customers to favour electric scooters and motorcycles.

Restraint: Lack of power output and limited range

The market for electric scooters and motorcycles is still in its early stages of development. Although manufacturers employ cutting-edge design and technology, these vehicles have not yet reached the efficiency and power levels of traditional two-wheelers. The majority of the electric bikes and scooters that have recently been released don't have the power output that customers want. A few concept models that meet the performance and design parameters have been developed by manufacturers.

Range limitation is another significant issue that is seen as a barrier in the market for electric scooters and motorcycles. Electric two-wheelers lack fuel tanks, in contrast to traditional two-wheelers. The range that a completely charged battery can reach is considerably less than that of traditional two-wheelers. Most electric two-wheelers currently available have a range of up to 100–120 miles. Because of this, consumers are wary of buying electric two-wheelers, especially those who make frequent long distance trips.

Opportunity: Use of IoT and Smart Infrastructure in Electric Two Wheelers Charging Station for Load Management

The increasing adoption of smartphones and connectivity solutions has inspired electric two wheelers manufacturers to integrates smartphones with the velectric two wheelers and infrastructure instruments clusters for more enhanced operation. Smartphones can be easily connected Via wireless LAN (WLAN), USB, or Bluetooth. Most Electric Two Wheelers charging station manufacturers have been developing Smart electric two wheelers charging stations, Which come with IoT based feature for load management and smart connectivity. Home charging stations these days come with software for charging analysis of electric two wheelers. Meanwhile, public and semi-public electric two wheelers charging station come with smart payments and power managements features for better power control and ease of electric two wheeler charging by customers combined with automated payment features.

Challenge: Initial investments and high cost of electricity

Electric two wheelers have lower operating costs than ICE two wheelrs in the long term. However, initial investment are higher than those for conventional two wheelers. The components used in electric two wheelers such as batteries, motors, and other electric components are more expensive than conventional mechanical parts. The electric two wheeler battery cost 40-50% of the overall production cost. At present, most manufacturers offer electric two wheelers along with charging solutions, making it can expensive initial investment for buyers. The high cost involved in developing electric two wheelers and relatated components such as batteries and monitoring systems is a major restraint for electric two wheeler adopting. The electric two wheeler battery need frequent and fast charging through additional equipment such as electric chargers, which are only aavailable at EV charging stations. The battery, charger, and installation cost of the charger add to the cost of the electric two wheelers, making them costlier than traditional ICE two wheelers.

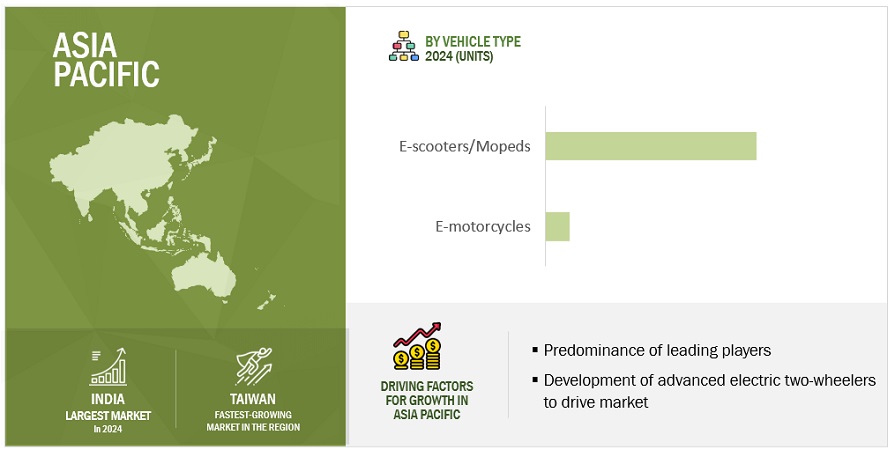

The E-scooter/moped segment is expected to be the largest segment during the forecast period

E-scooter/moped is projected to form the largest segment in the electric scooter and motorcycle market during the forecast period due to the lower initial price than e-motorcycles and growing demand for affordable commuting. For instance, Nexzu Mobility has evolved into a holistic electric mobility company that operates in both B2B and B2C segments for electric two wheeler with the intention of bringing stylish and futuristic eco-friendly vehicles to consumers at an affordable price the segment is also estimated to be the fastest growing due to the higher adoption rate in the market across the globe. Electric scooters are suited for multiple end-use applications, making them preferable to electric motorcycles.

Electric scooters/mopeds offer the benefit of energy-efficient daily commuting and help reduce pollution. Several well-established two-wheeler manufacturers have entered the electric scooters/mopeds segment. For instance, In January 2023, Damon Motors, announced a partnership with PT Indika Energy Tbk., Indonesia’s leading diversified energy company. Indika has also made an undisclosed investment in Damon and will serve as the distributor for Damon’s line of motorcycles in the Indonesian market. Several other players have developed new models of electric scooters.

Silence Urban Ecomobility (Spain), NIU International (China), Okinawa (India), Jiangsu Xinri E-Vehicle Co., Ltd (China), Hero electric (India), Yadea (China), etc., offer a wide range of electric scooters with advanced connectivity features for end-use applications. So, the electric scooters/mopeds market is estimated to grow significantly over the forecast period.

The Asia Pacific market is projected to hold the largest share by 2028

Electric scooters for short-distance commuting, and governments promoting electric two-wheelers are expected to drive the Asia Pacific market during the forecast period. Key Asian manufacturers such as NIU International (China), Yadea Technology Group Co.,Ltd. (China), Jiangsu Xinri (China), Hero Electric (India), and Okinawa Autotech Internationall Private Limited (India) and others key players in the region. In April-2022, Init Esports, the Esports Powerhouse that specializes in sim racing events & motorcycle tournaments, announced its partnership with NIU Technologies, the world’s leading provider of smart urban mobility solutions. The market in Europe would be driven by the rising adoption of electric two wheelers and a strong policy environment, including various tax breaks and subsidies supporting the growth of the market. So, these are the key factors that will drive the growth of the market over the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global electric scooter and motorcycle market is dominated by major players such as Yadea Technology Group Co.,Ltd. (China), Jiangsu Xinri E-Vehicle Co., Ltd (China), NIU International (China), Hero Electric (India), and Okinawa Autotech Internationall Private Limited (India). These companies offer extensive products and solutions for the electric two-wheeler industry; and have strong distribution networks at the global level, and they invest heavily in R&D to develop new products.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million) |

|

Segments covered |

Vehicle Type, Battery, Distance Covered, Voltage, Technology, Vehicle Class Usage, and Region |

|

Geographies covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

Yadea Technology Group Co.,Ltd. (China), Jiangsu Xinri E-Vehicle Co., Ltd (China), NIU International (China), Hero Electric (India), and Okinawa Autotech Internationall Private Limited (India). |

This research report categorizes the electric scooter and motorcycle market based on vehicle type, battery, distance covered, technology, voltage, vehicle class, usage and region.

Based on the vehicle type:

- E-Scooter/Moped

- E-Motorcycle

Based on the battery type:

- Sealed lead acid

- Lithium-ion

Based on the distance covered:

- Below 75 miles

- 75-100 Miles

- Above 100 Miles

Based on the technology:

- Plug-in

- Battery

Based on the voltage:

- 36V

- 48V

- 60V

- 72V

- Above 72V

Based on the vehicle class:

- Economy

- Luxury

Based on the usage

- Commercial

- Private

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Indonesia

- Thailand

- Malaysia

- Vietnam

- Phillipines

-

North America

- US

- Canada

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Austria

- Belgium

- Netherlands

- Poland

- Denmark

Recent Developments

- In January 2023 Yadea Group (China) launched Yadea Keeness VFD atConsumer Electronics Show (CES) in Las Vegas, Nevada. Keeness VFD model is equipped with a 10KW mid-mounted high-performance motor and features a maximum speed of 100km/h, and an acceleration from 0-50km/h in just 4 seconds.

- In January 2023 Yadea Group (China) launched new model Volrguard. The scooter is powered by an ATL lithium battery pack (72V27Ah*2), featured with ultra-high density, which outputs higher power at the same time.

- January 2023, hero electric has entered into a long-term partnership with maxwell energy systems for the supply of advanced battery management systems. Under the partnership, maxwell will supply more than 10 lakh units of its battery management systems (bms) over the next three years to hero electric.

- October 2022, NIU International announced to launch of their newest kick scooter, the KQi3 Max. With a top speed of 20 MPH, and a 40.4-mile range, the KQi3 Max kick scooter offers maximum performance, comfort, and stability.

- April 2022, Init Esports, the Esports Powerhouse that specializes in sim racing events & motorcycle tournaments, announced its partnership with NIU Technologies, the world’s leading provider of smart urban mobility solutions.

- July 2022, The Silence Urban Ecomobility launched new model S01+. Scooter is equipped with 7.5 kWh of battery with vehicle range of 137 km/charge. The scooter has a top speed of 109 kmph.

- December 2022, Astara has signed a strategic partnership with Silence Urban Ecomobility to distribute their electric scooters and vehicles for micro mobility in Belgium and Luxembourg.

Frequently Asked Questions (FAQ):

What is the current size of the electric scooter and motorcycle market?

The current size of the electric scooter and motorcycle market is estimated at USD 4.9 billion in 2023.

What are different countries covered in Asia Pacific region for electric scooter and motorcycle market?

The countries covered in report for electric scooter and motorcycle market are China, Japan, India, South Korea, Taiwan, Indonesia, Thailand, Malaysia, Vietnam, and Phillipines.

Who are major players in the global electric scooter and motorcycle market?

Companies such as Yadea Technology Group Co.,Ltd. (China), Jiangsu Xinri E-Vehicle Co., Ltd (China), NIU International (China), Hero Electric (India), and Okinawa Autotech Internationall Private Limited (India). fall under the winners' category.

What are the new market trends impacting the growth of the electric scooter and motorcycle market?

The key market trends or technologies that will have a significant impact on the electric scooter and motorbike market in the future include battery swapping, loT in cars & charging infrastructure, regenerative braking, shared mobility, Solid-State Battery (SSB), and smart charging systems. In addition, use of Electric scooters are also produced for use in delivery services. For instance, e-scooters are used by the postal services in Taiwan, Austria, Spain, and Unipost (Spain).

What are the different batterries used in the electric scooter and motorcycle market?

As of 2022, Lead acid batteries, one of the more traditional types of batteries, are typically available with electric scooters and motorbikes. To counteract the drawbacks of lead acid batteries, two-wheeler manufacturers concentrate on developing new electric bikes and scooters with more sophisticated Li-ion batteries. Throughout the forecasted period, the lithium-ion sector is expected to experience the quickest growth in the market for electric motorcycles and scooters. Manufacturers are working to create electric motorcycles and scooters with cutting-edge lithium-ion batteries. Throughout the forecast period, lithium-ion batteries are anticipated to gain popularity and replace lead-acid batteries as the primary power source due to their shorter lifecycle and greater useful capacity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

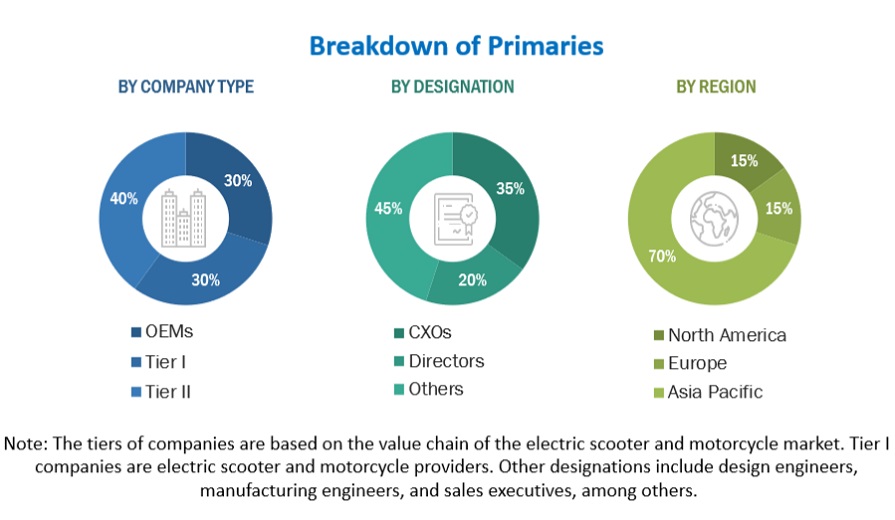

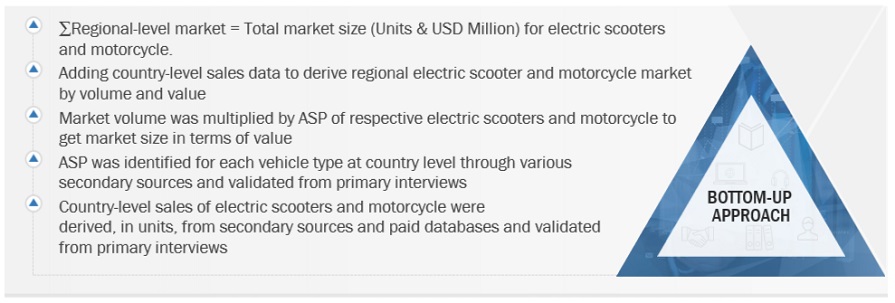

The study involved four major activities in estimating the current size of the electric scooter and motorcycle market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of electric vehicle manufacturers, Organisation Internationale des Constructeurs d'Automobiles (OICA), the Alternative Fuels Data Center (AFDC),International Energy Agency (IEA), Federal Transit Administration (FTA), Regional Transportation Authority (RTA), country-level vehicle associations and trade organizations, and the US Department of Transportation (DOT)], electric two-wheeler magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global electric scooter and motorcycle market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the electric scooter and motorcycle market. The first approach involves estimating the market size by summation of revenue generated through the sale of electric scooters and motorcycles. The top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets in the overall market. The research methodology used to estimate the market size includes the following details. The key players in the market were identified through secondary research, and their market shares in respective regions were determined through primary and secondary research. The entire procedure includes studying the annual and financial reports of top market players and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Bottom-Up Approach: Electric Scooter And Motorcycle Market

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach: Electric Scooter And Motorcycle Market

Data Triangulation

- After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Electric scooters and motorcycles are plug-in two-wheeled vehicles that use electric motors to attain locomotion. The electricity is stored in a rechargeable battery, which drives the electric motors. These vehicles are zero-emission electric motor-driven vehicles. The operating speed and top speed of electric two-wheelers are based on battery technology.

A scooter/moped is an easy-to-operate two-wheeler with a step-through frame and a platform for the user’s feet. These two-wheelers are affordable, lightweight, and easy to commute. On the other hand, a motorcycle is a heavier, faster, and bigger two-wheeler than scooters/mopeds. Depending on the requirement, these two wheelers have different body designs and frames from scooters/mopeds. The electric versions of scooters and motorcycles are powered by electricity stored in the batteries.

Key Stackholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- End User/Operator

Report Objectives

- To segment and forecast the electric scooter and motorcycle market size in terms of volume (thousand units) and value (USD million/billion)

- To define, describe, and forecast the market based on vehicle type, battery type, voltage type, vehicle class, technology type, distance covered, usage, and region.

-

To segment and forecast the market by battery type [sealed lead acid (SLA) and lithium-ion

(li-ion)] - To segment and forecast the market by vehicle type (e-scooters/mopeds and e-motorcycles)

- To segment and forecast the market by voltage type (36V, 48V, 60V, 72 V, and above 72V)

- To segment and forecast the market by technology type (plug-in and batteries)

- To segment and forecast the market by distance covered (below 75 miles, 75–100 miles, and above 100 miles)

- To segment and forecast the market by vehicle class (economy and luxury)

- To segment and forecast the market by usage (private and commercial)

- To forecast the market size with respect to key regions, namely, North America, Europe, and Asia Pacific

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To analyze technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders in the electric scooter and motorcycle market

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market.

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Porter’s Five Forces Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Conference and Events

- Macro-economic Factor

- Average Selling Price Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market share and their core competencies.

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product development, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Electric Scooter and Motorcycle Market, By technology Type at country level (For countries covered in the report)

- Electric Scooter and Motorcycle Market, By battery type at country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Scooter and Motorcycle Market

What are Electric Scooter and Motorcycle Market Newer business models like sustainable and profitable revenue streams in the future?