EV Battery Market by Battery Capacity (<50, 50-110, 111-200, 201-300 and >300), Method (Wire, Laser), Propulsion (BEV, PHEV, HEV, FCEV), Battery Type, Material Type, Li-ion Battery Component, Battery Form, Vehicle Type & Region - Global Forecast to 2027

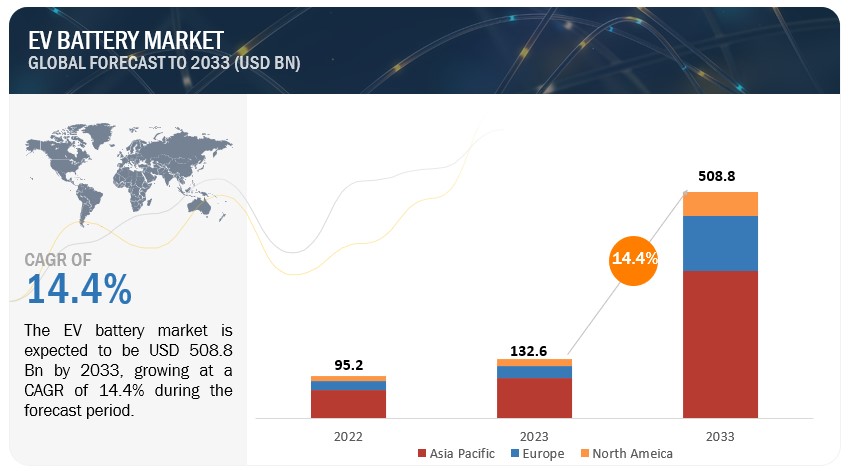

The global EV battery market size was valued at $56.4 billion in 2022 and is projected to reach $134.6 billion by 2027, growing at a CAGR of 19.9% from 2022 to 2027.

The market for EV batteries is being driven by factors such as rising demand for electric vehicles, advancements in battery technology, favourable government policies and regulations, and the introduction of new plug-in EV models.

Governments all over the world are promoting the adoption of vehicles utilising alternative fuels as a result of the rising concerns regarding the environmental impact of conventional automobiles. EVS are zero-emission cars that are becoming more and more popular for eco-friendly public transportation worldwide. To promote the use of EVs, several national governments provide financial incentives such tax exemptions and refunds, subsidies, decreased parking/toll rates for EVs, and free charging. As a result, the demand for EV batteries is increasing quickly across the board.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing demand for electric vehicles

Governments all across the world are promoting the use of vehicles that run on alternative fuels as environmental worries about conventional automobiles continue to rise. EVs are zero-emission vehicles that are becoming more and more popular for eco-friendly public transportation worldwide. To promote the use of EVS, several national governments provide financial incentives such tax exemptions and refunds, subsidies, decreased parking/toll rates for EVs, and free charging.

Leading EV markets like China, the US, and Germany are spending heavily in EV charging infrastructure in addition to R&D for quicker and more effective charging techniques. Automakers are anticipated to make large expenditures to meet the growing demand for EVs and to shape the industry. For the development of EVs, companies like Tesla, Volkswagen, Ford, Nissan, BMW, and General Motors have large R&D budgets.

OEMs provide a wide selection of electric vehicles, ranging from compact hatchbacks like the Leaf to luxurious sedans like the Tesla Model 3. Due to the large number of consumers drawn by the variety of product options, the market for electric vehicles has grown. For instance, GM announced plans to invest USD 35 billion in October 2021, with the goal of developing and selling more than one million EVs and other technologies by 2025. By 2035, the corporation wants to be all electric. Ford said in November 2021 that it would boost its annual EV production capacity to 600,000 by 2023. By 2030, it intends to provide 40% electric vehicles. Volkswagen also disclosed intentions to invest USD 86.3 billion to advance its EV aspirations by 2030. Other businesses have also made substantial advancements and plans for the anticipated EV demand in the next 5–10 years, including Tesla, Nissan, and BMW.

Restraint: Concerns over battery safety Procurement concerns related to raw materials

- Cobalt extraction facilities are concentrated in Congo and China. Together, both countries extract around 70–80% of the total cobalt mined. This increases the risk of supply disruption of cobalt in case of any uncertainty in these countries.

- Cobalt currently presents the greatest procurement risks of all the battery raw materials. This is due to the expected dynamic growth in demand and the resulting potential supply bottlenecks.

- In lithium-ion batteries, graphite is utilised as the anode material. Of all the battery raw materials, it has the biggest volumetric proportion and contributes significantly to the cost of making cells. China has dominated practically the whole supply chain for many years and produces 70% of the flake graphite, which needs to be treated before being used in batteries, and approximately 50% of the synthetic graphite utilised in those batteries. Exploration has gotten more and more active in recent years, especially in Africa. New extraction locations in Tanzania, Madagascar, and Mozambique could ease the strain on the heavily consolidated global market.

- Currently, just a few firms and Australia, Chile, and Argentina are allowed to harvest lithium, and only four companies control over 60% of the world's supply. However, the recent lithium boom has shown that the lithium industry is undergoing significant upheaval. Large-scale projects are being planned and carried out in other nations, like Canada, Mexico, and Bolivia, in addition to the expansion of current facilities.

- The market for nickel is heavily reliant on the supply of primary nickel from Southeast Asia, particularly from Indonesia, which is the nation that produces the vast majority of nickel. In order to ensure that a significant portion of the value chain stayed within Indonesia, Indonesia placed a prohibition on the export of nickel ore in 2020.

Opportunity: Introduction of the battery-as-a-service model (BaaS)

Companies are coming up with business models like battery swapping and battery-as-a-service (BaaS) that allow users to change/swap EV batteries once discharged. This saves users the time spent on recharging the batteries, thereby improving customer satisfaction and addressing one of the main reasons consumers refrain from opting for EVs.

battery swapping at EV charging stations has grown as it eliminates the time for charging batteries for EV users. While the market is still developing for EV cars outside China, it has shown its potential due to high demand in China. While Level 3 EV charging can charge an EV in around 30 mins to one hour and ultra-fast charging can also provide charging in 15-30 minutes, their long-term use damages the EV batteries. Thus, battery swapping came up as an alternative for fast charging stations and its demand has grown over the past few years. NIO, for instance, installed over 300 battery swapping stations by July 2021 and plans to install around 4,000 more by 2025 in China. Its swapping stations have already been in use around 2.9 million times by July 2021 in the global market, with around 1,000 battery swapping stations planned outside China. Shell signed an agreement with NIO in November 2021 to jointly develop such battery swapping EV charging stations. This has created a new opportunity for the battery as a service in EV charging.

Challenge: High cost of electric vehicles compared to ICE

The high manufacturing cost of EVs has been a major concern in their widespread adoption. The expected decline in battery prices and reduced R&D costs are likely to decrease the overall cost of purchasing electric hatchbacks, crossovers, or SUVs to reach the levels of ICE vehicles, leading to the rising demand for EVs. The cost of EVs is significantly high compared to that of ICE vehicles due to the high price of rechargeable lithium-ion batteries required for these vehicles. The cathode price affects the price of the batteries to a great extent because raw materials such as cobalt, nickel, lithium, and magnesium are expensive. The cost of EV production is also significantly high compared to ICE vehicles due to the expensive process involved in developing these vehicles. The cost of developing higher range EVs is significantly higher due to the requirement of higher specification batteries, advanced technology used for production, and highly expensive components used in the vehicles.

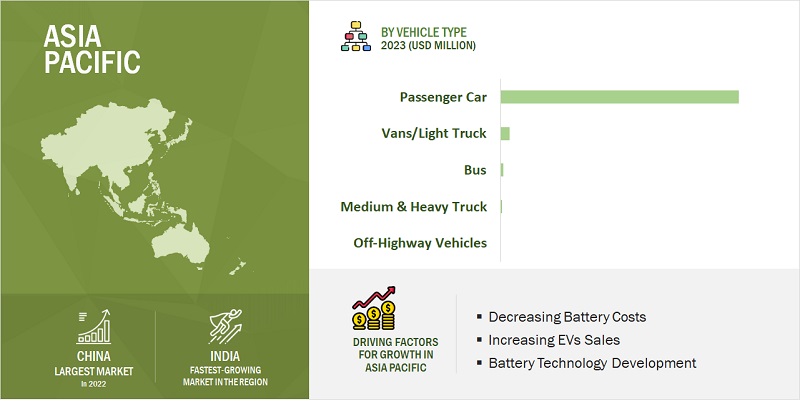

The passenger cars segment is expected to be the largest vehicle type market

By vehicle type, the passenger cars segment is expected to dominate the EV battery market during the forecast period. The adoption of electric passenger cars in different cities is expected to accelerate at a fast rate.

The country's abundance of major EV producers like BYD, Byton, BAIC, and Geely, who produce EV passenger cars in significant quantities, can also be credited with the fast growth of the passenger car market. Due to the introduction of emission standards by numerous governments throughout the world, the passenger car category is anticipated to dominate the EV battery market over the forecast period. The prospect for growth for batteries grows since the production of electric passenger cars continues to be the highest among all other EV kinds.

The 50-110 kWh segment in battery capacity will be leading the EV battery market during the forecast period

The 50-110 KWh segment of the market is estimated to be the largest. Most of the batteries used in electric vehicles operate at a range from 50-110 kilowatt-hours (kWh). Generally, the battery capacity usage depends on the development of the EV fleet as well as the required battery capacity per vehicle, which is generally above 50 kWh and 12 kWh for BEVs and PHEVs, respectively. A major advantage of the 50-110 kWh battery is the fast charging at a low price and high energy efficiency. As a result, major players of the EV market have deployed 50-110 kWh of battery capacity to stay in the competition. For example, Tesla Model S, Tesla Model X, Tesla Model 3, and Chevrolet’s Bolt EV have their battery capacity range between 50-110 kWh.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global EV battery market is dominated by major players CATL (China), Panasonic Holdings Corporation (Japan), LG Chem (South Korea), BYD (China), and Samsung SDI (South Korea). The key strategies adopted by these companies to sustain their market position are new product developments,mergers & acquisitions, supply contracts, partnerships, expansions, collaborations, acquisitions, and contracts & agreements.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 56.4 Billion |

|

Estimated Value by 2027 |

USD 134.6 Billion |

|

Growth Rate |

Poised to grow at a CAGR of 19.9% |

|

Market Segmentation |

Battery Type, Li-Ion Battery Component, Propulsion, Vehicle Type, Method, Battery Capacity, Material Type, Battery Form, And Region |

|

Market Driver |

Increasing demand for electric vehicles |

|

Market Opportunity |

Introduction of the battery-as-a-service model (BaaS) |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

This research report categorizes the EV battery market based on battery type, li-ion battery component, propulsion, vehicle type, method, battery capacity, material type, battery form, and region.

Based on the Battery Type:

- Lead-acid

- Lithium-ion

- Nickel-metal Hydride

- Sodium-ion

- Solid-state

Based on the Li-ion battery component:

-

- Positive Electrode

- Negative Electrode

- Electrolyte

- Separator

Based on the propulsion:

- BEV

- HEV

- PHEV

- FCEV

Based on the vehicle type:

- Passenger Cars

- Vans/Light Trucks

- Medium & Heavy Trucks

- Buses

- Off-highway Vehicles

Based on the method:

- Wire Bonding

- Laser Bonding

Based on the battery capacity:

- <50 kWh

- 50-110 kWh

- 111-200 kWh

- 201-300 kWh

- >300 kWh

Based on the battery form:

- Prismatic

- Cylindrical

- Pouch

Based on the material type:

- Lithium

- Cobalt

- Manganese

- Natural Graphite

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

-

North America

- US

- Canada

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Sweden

- Denmark

- Norway

Recent Developments

- In July 2022 Samsung SDI began the construction of its second battery production facility in Seremban, Malaysia. This plant will start producing PRiMX 21700 cylindrical batteries in 2024. The company will invest USD 1.4 billion in stages till 2025. The batteries produced at the plant will be primarily used for electric vehicles (EV), micro mobility, and various other applications.

- In June 2022 Heilongjiang Transport Development Co., Ltd. (Heilongjiang Transport) announced a partnership with Contemporary Amperex Technology Co., Ltd. (CATL). Both the players are conducting surveys in several sectors for cooperation, involving battery charging and swapping for heavy trucks, battery swapping for online ride-hailing cabs, battery charging and swapping for cruising cabs, and photovoltaic power.

- In May 2022 CATL partnered with European leading electric bus manufacturer Solaris to promote electrification of city transportation in Europe. CATL will be supplying lithium iron phosphate (LFP) batteries equipped with novel Cell to Pack (CTP) technology to Solaris to power its bus models.

- In December 2021 CATL and Fisker Inc. has signed an agreement. Under the agreement, CATL will provide two battery solutions for the Fisker Ocean SUV from 2023 to 2025 with an initial battery capacity of over 5GWh annually. The battery packs provided by CATL will include large NMC (nickel manganese cobalt) battery packs and small LFP (lithium-ion phosphate) battery packs.

- In August 2020, CATL announced to develop a new EV battery with no nickel or cobalt in it. The company focuses to save a major portion of the cost with this development as cobalt is one of the most expensive components in an EV battery.

- In November 2020, Samsung SDI announced that it will be commercializing a li-ion battery product that would replace liquid electrolyte in a battery cell with a solid electrolyte, which improves battery performance.

- In March 2020, BYD announced the launch of a blade battery system, which consists of thin individual batteries. The thickness of a single battery is around 1.35 cm and occupies 50% less space than earlier products.

- In July 2020, Panasonic Holdings Corporation announced the development of a technique to visualize lithium-ion dynamics in all-solid-state batteries on a nanometer scale in real-time, in collaboration with Japan Fine Ceramics Center (JFCC) and Institute of Materials and Systems for Sustainability, Nagoya University. The technique, which makes use of scanning transmission electron microscopy (STEM) and machine learning, was applied to both bulk-type and thin-film-type all-solid-state lithium-ion batteries.

- In December 2019, Samsung SDI acquired an additional 15% stake in Samsung SDI-ARN (Xi'an) Power Battery Co., Ltd (SAPB) making it the majority stakeholder in the company with 65% of ownership. SAPB was initially found in 2014 by Samsung SDI Anqing Ring New Group and Xi’an Gaoke Group.

- In July 2020, LG Chem declared that it would reuse and recycle its used batteries proactively. LG Chem would research and develop technologies to predict the remaining life by collecting the batteries supplied to customers.

- In October 2020, CATL and RCS Global Group announced a partnership that would identify CATL’s cobalt, lithium, and graphite suppliers. The partnership would expand to cover aluminum, copper manganese, and nickel suppliers in the future. RCS Global would assess the suppliers for conformance with environmental and human rights requirements and work with CATL and the suppliers to develop a responsible supply chain.

Frequently Asked Questions (FAQ):

How big is the EV battery market?

The global EV battery market is projected to grow at a CAGR of 19.0% from USD 56.4 billion in 2022 to USD 134.6 billion by 2027.

Who are the winners in the global market?

CATL (China), Panasonic (Japan), LG Chem (South Korea), BYD (China), and Samsung SDI (South Korea) are the leaders of market. The key strategies adopted by these companies to sustain their market position are new product developments, mergers & acquisitions, partnerships, expansions, collaborations, acquisitions, and contracts & agreement.

What are the different types of battery types for electric vehicles?

Battery types are usually segmented into lithium-ion, lead-acid, solid-state, and nickel-metal hydride.

What are the different battery forms considered in the market?

The market has been segmented by battery forms into cylindrical, prismatic, and pouch. The prismatic cell form is the most commonly used cell form in the EV battery. Although cylindrical and pouch cells are among the oldest types of battery forms, prismatic cells account for a large market share in the current scenario. Prismatic cells result from a slight modification of both forms with internal layer structure like that of the cylindrical cell and space utilization as much as the pouch cells. Recently, Tesla Motors announced a new ‘Tab-less’ battery, which is a modification of the cylindrical battery structure on the Tesla Battery Day. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 EV BATTERY MARKET DEFINITION, BY BATTERY TYPE

1.2.2 MARKET DEFINITION, BY LI-ION BATTERY COMPONENT

1.2.3 MARKET DEFINITION, BY PROPULSION

1.2.4 MARKET DEFINITION, BY VEHICLE TYPE

1.2.5 MARKET DEFINITION, BY MATERIAL TYPE

1.2.6 MARKET DEFINITION, BY METHOD

1.2.7 MARKET DEFINITION, BY BATTERY FORM

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR MARKET

1.4 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: MARKET

1.4.1 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 CURRENCY EXCHANGE RATES (PER USD)

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.4 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 GLOBAL EV BATTERY MARKET SIZE: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 8 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF SAMSUNG SDI REVENUE ESTIMATION

2.3.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.4 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ASSESSMENT

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 10 PASSENGER CARS SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 11 EV BATTERY MARKET, BY REGION, 2022–2027

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 12 INCREASING ADOPTION OF ELECTRIC VEHICLES AND GROWING GOVERNMENT INCENTIVES TO DRIVE MARKET

4.2 MARKET, BY VEHICLE TYPE

FIGURE 13 PASSENGER CARS SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 MARKET, BY PROPULSION

FIGURE 14 FCEV SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY BATTERY FORM

FIGURE 15 PRISMATIC SEGMENT EXPECTED TO LEAD MARKET FROM 2022 TO 2027

4.5 MARKET, BY MATERIAL

FIGURE 16 LITHIUM SEGMENT ESTIMATED TO LEAD MARKET IN 2022

4.6 MARKET, BY LI-ION BATTERY COMPONENT

FIGURE 17 ELECTROLYTE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.7 MARKET, BY BATTERY CAPACITY

FIGURE 18 50–110 KWH SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.8 MARKET, BY BATTERY TYPE

FIGURE 19 LITHIUM-ION BATTERY SEGMENT ESTIMATED TO BE LARGEST BATTERY TYPE SEGMENT IN 2022

4.9 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

TABLE 3 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 21 EV BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for electric vehicles

FIGURE 22 BEV, HEV, AND PHEV SALES DATA FOR MAJOR COUNTRIES, THOUSAND UNITS (2019–2021)

5.2.1.2 Improvements in battery technology

TABLE 4 EV BATTERY IMPROVEMENTS/INNOVATIONS

FIGURE 23 DAWN OF EUROPEAN GIGAFACTORIES: ANNOUNCED LITHIUM-ION BATTERY CELL PRODUCTION SITES

5.2.1.3 Faster charging speed to enable plug and charge use of EVs

FIGURE 24 TIME REQUIRED TO CHARGE ELECTRIC VEHICLES

5.2.1.4 Government policies and regulations

FIGURE 25 EV-RELATED POLICIES ACROSS MAJOR MARKETS

TABLE 5 GOVERNMENT INITIATIVES (2019–2022)

5.2.1.5 Launch of new plug-in models by major EV manufacturers

TABLE 6 LATEST EV MODELS BY OEMS

TABLE 7 PARTNERSHIPS AND SUPPLY CONTRACTS BY OEMS

5.2.2 RESTRAINTS

5.2.2.1 Procurement concerns related to raw materials

FIGURE 26 COBALT RESERVES, BY COUNTRY

FIGURE 27 LITHIUM RESERVES, BY COUNTRY

5.2.2.2 Lack of charging infrastructure

FIGURE 28 RATIO OF PUBLIC CHARGERS PER EV STOCK, BY COUNTRY (2020)

5.2.3 OPPORTUNITIES

5.2.3.1 Rising electric micromobility

TABLE 8 COUNTRY-WISE GOVERNMENT INCENTIVES AND SUBSIDIES

5.2.3.2 Introduction of battery-as-a-service (BaaS) models

FIGURE 29 BATTERY-AS-A-SERVICE IN EV CARS

5.2.4 CHALLENGES

5.2.4.1 High initial investments and high cost of electricity

TABLE 9 GLOBAL AVERAGE ELECTRICITY COST, 2020–2021

5.2.4.2 Bottlenecks in battery charging

FIGURE 30 OVERVIEW OF FAST AND SLOW PUBLIC CHARGERS, BY COUNTRY (2015–2021)

5.2.4.3 Concerns over battery safety

5.2.4.4 High cost of electric vehicles compared to ICE

FIGURE 31 COST COMPARISON OF ELECTRIC VEHICLES AND ICE VEHICLES

5.3 TRENDS AND DISRUPTIONS

FIGURE 32 TRENDS AND DISRUPTIONS

5.4 PATENT ANALYSIS

TABLE 10 PATENT ANALYSIS: MARKET (ACTIVE PATENTS)

FIGURE 33 NUMBER OF ACTIVE PATENTS RELATED TO EV BATTERIES (2010–2022)

FIGURE 34 PATENTS PUBLISHED BY MAJOR COMPANIES IN EV ECOSYSTEM (2012–2021)

5.5 VALUE CHAIN ANALYSIS

FIGURE 35 MARKET: VALUE CHAIN ANALYSIS

FIGURE 36 LITHIUM-ION BATTERY MARKET: VALUE CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 IMPROVEMENT IN BATTERY COMPOSITION

5.6.3 IMPROVEMENT IN BATTERY CHARGING RATE

FIGURE 37 CHARGING TIME FOR CARS, BY MODEL (IN HOURS)

5.6.4 BATTERY DESIGN AND LOCATION IN EV

5.6.5 BATTERY-RELATED SERVICES

5.6.6 BATTERY OPTIMIZATION

5.6.7 CELL-TO-PACK TECHNOLOGY

5.6.8 AB BATTERY SYSTEM

5.6.9 SODIUM-ION BATTERY

5.7 AVERAGE SELLING PRICE FOR EV BATTERY RAW MATERIALS

FIGURE 38 PRICE OF EV BATTERY PER KWH

FIGURE 39 COST PER KWH OF MAJOR RAW MATERIALS USED IN EV BATTERIES (2021)

FIGURE 40 COST BREAKDOWN OF CELL, BY MATERIALS/COMPONENTS (2021)

FIGURE 41 TOTAL COST OF LITHIUM-ION BATTERY CELL (2021)

FIGURE 42 LITHIUM-ION BATTERY PRICE TREND, 2013–2021 (USD/KWH)

5.8 TRADE/SALES DATA

TABLE 11 ELECTRIC VEHICLE MARKET: TRADE DATA FOR MOTOR VEHICLES IN 2021 (HS 8703)

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 43 PORTER’S FIVE FORCES: MARKET

TABLE 12 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.1.1 Major automobile giants entering EV market

5.9.1.2 Emergence of new companies

5.9.1.3 Incentives by governments for EV battery manufacturing

5.9.1.4 Strict safety regulations

5.9.2 THREAT OF SUBSTITUTES

5.9.2.1 Types of automobile batteries

5.9.2.2 Threat of substitution of lithium-ion batteries

5.9.2.3 Development of new types of batteries

5.9.2.4 Development of alternative clean-fuel vehicles

5.9.3 BARGAINING POWER OF BUYERS

5.9.3.1 Declining prices of EV batteries

5.9.3.2 Increased demand for EV batteries

5.9.3.3 Major buyers of EV batteries

5.9.3.4 Increasing demand for micromobility

5.9.3.5 Demand for EVs for public transportation

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.4.1 Change in demand for major raw materials

5.9.4.2 Prices of major raw materials

5.9.4.3 Emphasis on eliminating requirement of certain raw materials

5.9.4.4 Limited sources and non-uniform distribution of raw materials

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.9.5.1 Currently limited number of major players

5.9.5.2 Exceptional growth of certain companies

5.9.5.3 Heavy R&D in battery technology

5.9.5.4 Requirement of technical know-how

5.9.5.5 Entry of large automakers into EV market

5.9.6 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 13 INFLUENCE OF KEY STAKEHOLDERS IN BUYING EV BATTERIES

5.9.7 BUYING CRITERIA

TABLE 14 KEY BUYING CRITERIA

5.10 MACROECONOMIC INDICATORS

5.10.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 15 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES, 2018–2026 (USD BILLION)

TABLE 16 REAL GDP GROWTH RATE (ANNUAL PERCENTAGE CHANGE AND FORECAST) FOR MAJOR ECONOMIES, 2022–2026

TABLE 17 GDP PER CAPITA TRENDS AND FORECASTS FOR MAJOR ECONOMIES, 2022–2026 (USD)

5.11 EV BATTERY MARKET, MARKET SCENARIOS (2022–2027)

5.11.1 MOST LIKELY SCENARIO

TABLE 18 MARKET: MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD BILLION)

5.11.2 OPTIMISTIC SCENARIO

TABLE 19 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.11.3 PESSIMISTIC SCENARIO

TABLE 20 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD BILLION)

5.12 EV MARKET ECOSYSTEM

FIGURE 44 EV MARKET: ECOSYSTEM ANALYSIS

5.12.1 EV CHARGING PROVIDERS

5.12.2 TIER I SUPPLIERS

5.12.3 OEMS

5.12.4 END USERS

TABLE 21 ELECTRIC VEHICLE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

TABLE 22 TOP ELECTRIC VEHICLES WITH BATTERY SPECIFICATION

5.13 CASE STUDY ANALYSIS

5.13.1 TESLA CLAIMS TO REDUCE BATTERY COSTS THROUGH INNOVATION

5.13.2 INDIAN OIL CORPORATION LIMITED (IOCL) LAUNCHES BATTERY SWAPPING SERVICE

5.13.3 CATL DEVELOPING NO NICKEL, NO COBALT EV BATTERY

5.13.4 PANASONIC ANNOUNCES DEVELOPMENT OF SOLID-STATE BATTERY

5.13.5 MERCEDES BENZ TO MANUFACTURE BATTERY CELLS

5.13.6 VOLKSWAGEN TO CONSIDER IN-HOUSE MANUFACTURING OF BATTERY CELLS

5.14 REGULATORY OVERVIEW

TABLE 23 CHANGE IN REGULATORY ENVIRONMENT GLOBALLY

TABLE 24 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY PERFORMANCE

TABLE 25 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY DURABILITY

TABLE 26 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY SAFETY

TABLE 27 REGULATIONS/VOLUNTARY PROCEDURES FOR EV BATTERY RECYCLING

5.15 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 28 EV BATTERY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.16 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 29 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 30 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 31 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 EV BATTERY MARKET, BY BATTERY FORM (Page No. - 113)

6.1 INTRODUCTION

FIGURE 45 MARKET, BY BATTERY FORM, 2022 VS. 2027

TABLE 32 MARKET, BY BATTERY FORM, 2018–2021 (THOUSAND UNITS)

TABLE 33 MARKET, BY BATTERY FORM, 2022–2027 (THOUSAND UNITS)

6.1.1 CHARACTERISTICS

TABLE 34 EV BATTERY CELL CHARACTERISTICS

6.1.2 ASSUMPTIONS

TABLE 35 ASSUMPTIONS, BY BATTERY FORM

FIGURE 46 BATTERY FORMS

6.1.3 RESEARCH METHODOLOGY

6.2 PRISMATIC

6.2.1 ADOPTION OF EVS TO DRIVE SEGMENT

FIGURE 47 PRISMATIC CELL BATTERY PACK

TABLE 36 PRISMATIC MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 37 PRISMATIC MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

6.3 POUCH

6.3.1 OPTIMUM UTILIZATION FOR BATTERY SPACE TO DRIVE SEGMENT

TABLE 38 POUCH MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 39 POUCH MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

6.4 CYLINDRICAL

6.4.1 LOW-COST MANUFACTURING TO DRIVE FASTER ADOPTION OF CYLINDRICAL CELLS

FIGURE 48 CROSS-SECTION OF LITHIUM-ION CYLINDRICAL CELL

TABLE 40 CYLINDRICAL MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 41 CYLINDRICAL MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

6.5 KEY PRIMARY INSIGHTS

7 EV BATTERY MARKET, BY METHOD (Page No. - 125)

7.1 INTRODUCTION

FIGURE 49 MARKET, BY METHOD, 2022 VS. 2027

FIGURE 50 APPLICATION OF INTERCONNECTION TECHNOLOGIES

TABLE 42 MARKET, BY METHOD, 2018–2021 (THOUSAND UNITS)

TABLE 43 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

7.1.1 OPERATIONAL DATA

TABLE 44 DIFFERENT BATTERY ASSEMBLY METHODS

7.1.2 ASSUMPTIONS

TABLE 45 ASSUMPTIONS, BY METHOD

7.1.3 RESEARCH METHODOLOGY

7.2 WIRE BONDING

7.2.1 ADOPTION OF WIRE BONDING BY OEMS TO FURTHER BOOST SEGMENT

TABLE 46 WIRE BONDING: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 47 WIRE BONDING: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

7.3 LASER BONDING

7.3.1 HIGHER ACCURACY AND FASTER PROCESS RESULT IN HIGHER ADOPTION OF LASER BONDING

TABLE 48 LASER BONDING: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 49 LASER BONDING: MARKET, BY REGION, 2022–2027(THOUSAND UNITS)

7.4 KEY PRIMARY INSIGHTS

8 EV BATTERY MARKET, BY BATTERY TYPE (Page No. - 133)

8.1 INTRODUCTION

FIGURE 51 MARKET, BY BATTERY TYPE, 2022 VS. 2027 (UNITS)

TABLE 50 MARKET, BY BATTERY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 51 MARKET, BY BATTERY TYPE, 2022–2027 (THOUSAND UNITS)

8.1.1 OPERATIONAL DATA

TABLE 52 ELECTRIC VEHICLE MODELS, BY BATTERY TYPE

8.1.2 RESEARCH METHODOLOGY

8.1.3 ASSUMPTIONS

TABLE 53 ASSUMPTIONS, BY BATTERY TYPE

8.2 LITHIUM-ION

8.2.1 HIGH ENERGY DENSITY AND LONG LIFE CYCLE TO DRIVE SEGMENT

FIGURE 52 COMPARATIVE EVALUATION OF ELECTRIC VEHICLES USING LITHIUM-ION BATTERIES

TABLE 54 LITHIUM-ION BATTERY MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 55 LITHIUM-ION BATTERY MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.3 LEAD-ACID

8.3.1 DEVELOPMENT OF ADVANCED LEAD-ACID BATTERIES TO DRIVE MARKET

8.4 NICKEL-METAL HYDRIDE

8.4.1 LONG LIFE CYCLE AND HIGH TOLERANCE TO DRIVE DEMAND FOR NICKEL-METAL HYDRIDE BATTERIES

8.5 SOLID-STATE

8.5.1 HIGH ENERGY STORAGE CAPABILITY TO FUEL DEMAND FOR SOLID-STATE BATTERIES

TABLE 56 US TRANSIT AGENCIES USING BATTERY-POWERED ELECTRIC BUSES

TABLE 57 SOLID-STATE BATTERY MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.6 SODIUM-ION BATTERY

8.6.1 ADOPTION OF SOLID-ION BATTERIES TO BOOST DEMAND

8.7 OTHERS

TABLE 58 OTHERS: EV BATTERY MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.8 KEY PRIMARY INSIGHTS

9 EV BATTERY MARKET, BY MATERIAL TYPE (Page No. - 143)

9.1 INTRODUCTION

FIGURE 53 MARKET, BY MATERIAL TYPE, 2022 VS. 2027

TABLE 59 MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 61 TYPES OF LITHIUM-ION BATTERY CHEMISTRIES

FIGURE 54 ELECTRIC VEHICLE PACTS – JOINT VENTURES BETWEEN AUTOMAKERS AND LI-ION BATTERY MAKERS

9.1.2 RESEARCH METHODOLOGY

9.1.3 ASSUMPTIONS

TABLE 62 ASSUMPTIONS, BY MATERIAL TYPE

9.2 COBALT

9.2.1 RESISTANCE TOWARD HIGH TEMPERATURE TO DRIVE DEMAND FOR COBALT

TABLE 63 COBALT IN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 COBALT IN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LITHIUM

9.3.1 HIGHER ENERGY DENSITY TO FUEL DEMAND FOR LITHIUM

TABLE 65 LITHIUM IN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 LITHIUM IN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 NATURAL GRAPHITE

9.4.1 EXPLORATION OF NEW EXTRACTION SITES EXPECTED TO BOOST MARKET

TABLE 67 NATURAL GRAPHITE IN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 NATURAL GRAPHITE IN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 MANGANESE

9.5.1 ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE MARKET

TABLE 69 MANGANESE IN MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MANGANESE IN MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 KEY PRIMARY INSIGHTS

10 EV BATTERY MARKET, BY PROPULSION (Page No. - 152)

10.1 INTRODUCTION

FIGURE 55 MARKET, BY PROPULSION, 2022 VS. 2027

TABLE 71 MARKET, BY PROPULSION, 2018–2021 (THOUSAND UNITS)

TABLE 72 MARKET, BY PROPULSION, 2022–2027 (THOUSAND UNITS)

10.1.1 OPERATIONAL DATA

TABLE 73 POPULAR EVS WORLDWIDE

TABLE 74 ELECTRIC COMMERCIAL VEHICLE DATA, BY COMPANY, MODEL, AND PROPULSION

10.1.2 RESEARCH METHODOLOGY

10.1.3 ASSUMPTIONS

TABLE 75 ASSUMPTIONS, BY PROPULSION

10.2 BATTERY ELECTRIC VEHICLE (BEV)

10.2.1 HIGHER BEV SALES LIKELY TO DRIVE MARKET

TABLE 76 BEV: EV BATTERY MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 77 BEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.3 HYBRID ELECTRIC VEHICLE (HEV)

10.3.1 RISING ADOPTION OF HEVS TO FURTHER BOOST MARKET

TABLE 78 HEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 79 HEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

10.4.1 DEMAND FOR PHEVS TO SUPPORT MARKET GROWTH

TABLE 80 PHEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 81 PHEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.5 FUEL CELL ELECTRIC VEHICLE (FCEV)

10.5.1 EXPECTED INCREASE IN DEMAND FOR FCEV TO DRIVE SEGMENT

TABLE 82 FCEV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 83 FCEV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.6 KEY PRIMARY INSIGHTS

11 EV BATTERY MARKET, BY VEHICLE TYPE (Page No. - 162)

11.1 INTRODUCTION

FIGURE 56 MARKET, BY VEHICLE TYPE, 2022 VS. 2027

TABLE 84 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 85 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 86 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 87 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

11.1.1 OPERATIONAL DATA

TABLE 88 ELECTRIC VEHICLES, BY MODEL, VEHICLE TYPE, & PROPULSION

11.1.2 RESEARCH METHODOLOGY

11.1.3 ASSUMPTIONS

TABLE 89 ASSUMPTIONS, BY VEHICLE TYPE

11.2 PASSENGER CARS

11.2.1 GROWING EMISSION NORMS FOR PASSENGER CARS TO BOOST DEMAND FOR EV BATTERIES

TABLE 90 EV BATTERY MARKET IN PASSENGER CARS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 91 MARKET IN PASSENGER CARS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 92 MARKET IN PASSENGER CARS, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 MARKET IN PASSENGER CARS, BY REGION, 2022–2027 (USD MILLION)

TABLE 94 MARKET IN PASSENGER CARS, BY BATTERY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 95 MARKET IN PASSENGER CARS, BY BATTERY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 96 <50 KWH: MARKET IN PASSENGER CARS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 97 <50 KWH: MARKET IN PASSENGER CARS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 98 50–110 KWH: MARKET IN PASSENGER CARS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 99 50–110 KWH: MARKET IN PASSENGER CARS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 100 111–200 KWH: MARKET IN PASSENGER CARS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 101 111–200 KWH: MARKET IN PASSENGER CARS, BY REGION, 2022–2027 (THOUSAND UNITS)

11.3 VANS/LIGHT TRUCKS

11.3.1 INCREASING DEMAND FROM LOGISTICS SECTOR TO DRIVE SEGMENT

TABLE 102 ELECTRIC VAN MODELS

TABLE 103 MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 104 MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 105 MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 MARKET IN VANS/LIGHT TRUCKS, BY BATTERY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 108 MARKET IN VANS/LIGHT TRUCKS, BY BATTERY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 109 <50 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 110 <50 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 111 50–110 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 112 50–110 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 113 111–200 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 114 111–200 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 115 201–300 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 116 201–300 KWH: MARKET IN VANS/LIGHT TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

11.4 MEDIUM & HEAVY TRUCKS

11.4.1 ADOPTION OF ELECTRIC MEDIUM AND HEAVY TRUCKS FOR SHORT AND LONG RANGES TO BOOST MARKET

TABLE 117 MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 118 MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 119 MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2022–2027 (USD MILLION)

TABLE 121 MARKET IN MEDIUM & HEAVY TRUCKS, BY BATTERY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 122 MARKET IN MEDIUM & HEAVY TRUCKS, BY BATTERY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 123 50–110 KWH: MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 124 50–110 KWH: MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 125 111–200 KWH: MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 126 111–200 KWH: MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 127 201–300 KWH: MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 128 201–300 KWH: MARKET IN MEDIUM & HEAVY TRUCKS, BY REGION, 2022–2027 (THOUSAND UNITS)

11.5 BUSES

11.5.1 HIGH DEMAND FROM MAJOR OEMS IN ASIA PACIFIC TO DRIVE MARKET SIGNIFICANTLY

TABLE 129 ELECTRIC BUS DATA BASED ON PROPULSION

TABLE 130 MARKET IN BUSES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 131 MARKET IN BUSES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 132 MARKET IN BUSES, BY REGION, 2018–2021 (USD MILLION)

TABLE 133 MARKET IN BUSES, BY REGION, 2022–2027 (USD MILLION)

TABLE 134 MARKET IN BUSES, BY BATTERY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 135 MARKET IN BUSES, BY BATTERY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 136 111–200 KWH: MARKET IN BUSES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 137 111–200 KWH: MARKET IN BUSES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 138 201–300 KWH: MARKET IN BUSES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 139 201–300 KWH: MARKET IN BUSES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 140 >300 KWH: MARKET IN BUSES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 141 >300 KWH: MARKET IN BUSES, BY REGION, 2022–2027 (THOUSAND UNITS)

11.6 OFF-HIGHWAY VEHICLES

11.6.1 DEMAND FOR HIGH-POWER HEAVY-DUTY ELECTRIC TRUCKS IN AGRICULTURE AND CONSTRUCTION INDUSTRIES TO DRIVE MARKET

TABLE 142 MAJOR OFF-HIGHWAY VEHICLE MODELS

TABLE 143 MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 144 MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 145 MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (USD MILLION)

TABLE 146 MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (USD MILLION)

TABLE 147 MARKET IN OFF-HIGHWAY VEHICLES, BY BATTERY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 148 MARKET IN OFF-HIGHWAY VEHICLES, BY BATTERY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 149 <50 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 150 <50 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 151 50–110 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 152 50–110 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 153 111–200 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 154 111–200 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 155 201–300 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 156 201–300 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 157 >300 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 158 >300 KWH: MARKET IN OFF-HIGHWAY VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

11.7 KEY PRIMARY INSIGHTS

12 EV BATTERY MARKET, BY BATTERY CAPACITY (Page No. - 191)

12.1 INTRODUCTION

FIGURE 57 MARKET, BY BATTERY CAPACITY, 2022 VS. 2027

TABLE 159 MARKET, BY BATTERY CAPACITY, 2018–2021 (THOUSAND UNITS)

TABLE 160 MARKET, BY BATTERY CAPACITY, 2022–2027 (THOUSAND UNITS)

TABLE 161 MARKET, BY BATTERY CAPACITY, 2018–2021 (USD MILLION)

TABLE 162 MARKET, BY BATTERY CAPACITY, 2022–2027 (USD MILLION)

12.1.1 OPERATIONAL DATA

TABLE 163 ELECTRIC VEHICLE DATA, BY MODEL & BATTERY CAPACITY

FIGURE 58 TESLA’S NEW TABLESS BATTERY CELL '4680'

12.1.2 RESEARCH METHODOLOGY

12.1.3 ASSUMPTIONS

TABLE 164 ASSUMPTIONS, BY BATTERY CAPACITY

12.2 <50 KWH

12.2.1 COST FACTOR TO DRIVE MARKET FOR BATTERY WITH <50 KWH CAPACITY

TABLE 165 <50 KWH: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 166 <50 KWH: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 167 <50 KWH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 168 <50 KWH: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 50–110 KWH

12.3.1 INCREASED DEMAND FOR ELECTRIC VANS/LIGHT TRUCKS TO FUEL MARKET FOR BATTERIES WITH 50–110 KWH CAPACITY

TABLE 169 50–110 KWH: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 170 50–110 KWH: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 171 50–110 KWH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 172 50–110 KWH: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 111–200 KWH

12.4.1 DEMAND FOR ELECTRIC COMMERCIAL TRUCKS & BUSES EXPECTED TO DRIVE SEGMENT

TABLE 173 111–200 KWH: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 174 111–200 KWH: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 175 111–200 KWH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 176 111–200 KWH: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 201–300 KWH

12.5.1 BUSES AND TRUCKS WITH 201–300 KWH BATTERY CAPACITY DOMINATE CHINESE PUBLIC TRANSPORT FLEET

TABLE 177 201–300 KWH: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 178 201–300 KWH: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 179 201–300 KWH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 180 201–300 KWH: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.6 >300 KWH

12.6.1 INCREASED DEMAND FOR HEAVY COMMERCIAL AND OFF-HIGHWAY VEHICLES TO DRIVE MARKET FOR BATTERIES WITH >300 CAPACITY

TABLE 181 >300 KWH: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 182 >300 KWH: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 183 >300 KWH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 184 >300 KWH: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.7 KEY PRIMARY INSIGHTS

13 EV BATTERY MARKET, BY LI-ION BATTERY COMPONENT (Page No. - 205)

13.1 INTRODUCTION

FIGURE 59 MARKET, BY LI-ION BATTERY COMPONENT, 2022 VS. 2027

TABLE 185 MARKET, BY LI-ION BATTERY COMPONENT, 2018–2021 (USD MILLION)

TABLE 186 MARKET, BY LI-ION BATTERY COMPONENT, 2022–2027 (USD MILLION)

TABLE 187 ELECTROLYTE SOLVENTS, BY TEMPERATURE & FLASHPOINT

TABLE 188 MOST COMMONLY USED LITHIUM-ION BATTERIES AND THEIR SPECIFICATIONS

TABLE 189 LIST OF VEHICLE MODELS AND CATHODE MATERIAL SUPPLIERS

TABLE 190 LIST OF VEHICLE MODELS AND ANODE MATERIAL SUPPLIERS

FIGURE 60 LITHIUM-ION BATTERY WORKING PRINCIPLE

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

TABLE 191 ASSUMPTIONS, BY LI-ION BATTERY COMPONENT

13.2 NEGATIVE ELECTRODE

13.2.1 HIGH PRESENCE OF NEGATIVE ELECTRODE COMPANIES DRIVES MARKET IN ASIA PACIFIC

TABLE 192 NEGATIVE ELECTRODE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 193 NEGATIVE ELECTRODE MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 POSITIVE ELECTRODE

13.3.1 DEMAND FOR HIGH-PERFORMANCE AND LONG LIFE CYCLE CELLS TO DRIVE MARKET

TABLE 194 POSITIVE ELECTRODE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 195 POSITIVE ELECTRODE MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 ELECTROLYTE

13.4.1 SAFETY AND HIGH PERFORMANCE OF BATTERIES TO DRIVE MARKET FOR ELECTROLYTES

TABLE 196 ELECTROLYTE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 197 ELECTROLYTE MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5 SEPARATOR

13.5.1 NEED FOR SEPARATORS IN BATTERIES TO ATTAIN TEMPERATURE STABILITY TO DRIVE MARKET

TABLE 198 SEPARATOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 199 SEPARATOR MARKET, BY REGION, 2022–2027 (USD MILLION)

13.6 KEY PRIMARY INSIGHTS

14 EV BATTERY MARKET, BY REGION (Page No. - 216)

14.1 INTRODUCTION

TABLE 200 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 201 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 202 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 203 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 61 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 204 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 205 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027(THOUSAND UNITS)

TABLE 206 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 207 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.1 CHINA

14.2.1.1 Presence of global leaders and rising EV demand drive market

TABLE 208 EV MOBILITY LANDSCAPE IN CHINA

TABLE 209 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 210 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 211 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 212 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.2 JAPAN

14.2.2.1 Electrification of commercial vehicles expected to drive market

TABLE 213 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 214 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 215 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 216 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.3 INDIA

14.2.3.1 Government subsidies and incentives to drive market

TABLE 217 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 218 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 219 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 220 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.4 SOUTH KOREA

14.2.4.1 Increasing focus on electrifying public transport to boost market

TABLE 221 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 222 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 223 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 224 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.5 THAILAND

TABLE 225 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 226 THAILAND: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 227 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 228 THAILAND: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3 EUROPE

TABLE 229 EUROPE: MAJOR EV MODELS

FIGURE 62 EUROPE: MARKET SNAPSHOT

TABLE 230 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 231 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 232 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 233 EUROPE: MARKET, BY COUNTRY, 2022–2027(USD MILLION)

FIGURE 63 EXPANSION PLANS FOR BATTERY PLANTS IN EUROPE

14.3.1 FRANCE

14.3.1.1 Rise in e-logistics transport to drive market

TABLE 234 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 235 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 236 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 237 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.2 GERMANY

14.3.2.1 Presence of leading companies and higher demand for BEVs expected to drive market

TABLE 238 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 239 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 240 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 241 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.3 SPAIN

14.3.3.1 Growing commercial vehicle production projected to drive market

TABLE 242 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 243 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 244 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 245 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.4 ITALY

14.3.4.1 Technological advancement in EVs to drive market

TABLE 246 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 247 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 248 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 249 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.5 UK

14.3.5.1 Increased demand for electric public fleets to drive market

TABLE 250 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 251 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 252 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 253 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

TABLE 254 UK: MARKET, BY PROPULSION, 2018–2021 (THOUSAND UNITS)

TABLE 255 UK: MARKET, BY PROPULSION, 2022–2027 (THOUSAND UNITS)

14.3.6 DENMARK

14.3.6.1 Favorable EV regulations to drive market

TABLE 256 DENMARK: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 257 DENMARK: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 258 DENMARK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 259 DENMARK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.7 NORWAY

14.3.7.1 Replacement of conventional vehicles with advanced EVs to drive market

TABLE 260 NORWAY: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 261 NORWAY: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 262 NORWAY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 263 NORWAY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.8 SWEDEN

14.3.8.1 Presence of OEMs to boost demand for EV batteries

TABLE 264 SWEDEN: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 265 SWEDEN: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 266 SWEDEN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 267 SWEDEN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 64 NORTH AMERICA EV BATTERY INITIATIVES TILL 2022

TABLE 268 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021(THOUSAND UNITS)

TABLE 269 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 270 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021(USD MILLION)

TABLE 271 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.4.1 US

14.4.1.1 Growing demand for electric trucks to drive market

TABLE 272 US: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 273 US: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 274 US: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 275 US: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4.2 CANADA

14.4.2.1 Government support to promote EVs to drive market

TABLE 276 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 277 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 278 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 279 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 258)

15.1 OVERVIEW

15.2 MARKET SHARE ANALYSIS FOR MARKET, 2021

TABLE 280 MARKET SHARE ANALYSIS, 2021

FIGURE 65 MARKET SHARE ANALYSIS, 2021

15.2.1 CATL

15.2.2 LG CHEM

15.2.3 PANASONIC HOLDINGS CORPORATION

15.2.4 BYD

15.2.5 SAMSUNG SDI

15.3 KEY PLAYER STRATEGIES

TABLE 281 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MARKET

15.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021

FIGURE 66 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET DURING LAST FIVE YEARS

15.5 COMPETITIVE SCENARIO

15.5.1 NEW PRODUCT LAUNCHES

TABLE 282 NEW PRODUCT LAUNCHES, 2018–2022

15.5.2 DEALS

TABLE 283 DEALS, 2018–2022

TABLE 284 OTHERS, 2018–2022

15.6 COMPANY EVALUATION QUADRANT

15.6.1 STARS

15.6.2 EMERGING LEADERS

15.6.3 PERVASIVE COMPANIES

15.6.4 PARTICIPANTS

FIGURE 67 MARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 285 MARKET: COMPANY FOOTPRINT, 2021

TABLE 286 MARKET: PRODUCT FOOTPRINT, 2021

TABLE 287 MARKET: REGIONAL FOOTPRINT, 2021

15.7 SME EVALUATION QUADRANT

15.7.1 PROGRESSIVE COMPANIES

15.7.2 RESPONSIVE COMPANIES

15.7.3 DYNAMIC COMPANIES

15.7.4 STARTING BLOCKS

FIGURE 68 MARKET: SME EVALUATION QUADRANT, 2021

TABLE 288 MARKET: DETAILED LIST OF KEY SMES

TABLE 289 MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

16 COMPANY PROFILES (Page No. - 275)

(Business overview, Products offered, Recent developments & MnM View)*

16.1 KEY PLAYERS

16.1.1 CATL

TABLE 290 CATL: BUSINESS OVERVIEW

FIGURE 69 CATL: COMPANY SNAPSHOT

TABLE 291 CATL: SUPPLY AGREEMENTS

TABLE 292 CATL: PRODUCTS OFFERED

TABLE 293 CATL: NEW PRODUCT DEVELOPMENTS

TABLE 294 CATL: DEALS

TABLE 295 CATL: OTHERS

16.1.2 SAMSUNG SDI

TABLE 296 SAMSUNG SDI: BUSINESS OVERVIEW

TABLE 297 SAMSUNG SDI: SUPPLY AGREEMENTS

FIGURE 70 SAMSUNG SDI: COMPANY SNAPSHOT

TABLE 298 SAMSUNG SDI: PRODUCTS OFFERED

TABLE 299 SAMSUNG SDI: NEW PRODUCT DEVELOPMENTS

TABLE 300 SAMSUNG SDI: DEALS

TABLE 301 SAMSUNG SDI: OTHERS

16.1.3 PANASONIC HOLDINGS CORPORATION

TABLE 302 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

TABLE 303 PANASONIC HOLDINGS CORPORATION: SUPPLY AGREEMENTS

FIGURE 71 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

TABLE 304 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

TABLE 305 PANASONIC HOLDINGS CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 306 PANASONIC HOLDINGS CORPORATION: DEALS

TABLE 307 PANASONIC HOLDINGS CORPORATION: OTHERS

16.1.4 LG CHEM

TABLE 308 LG CHEM: BUSINESS OVERVIEW

TABLE 309 LG CHEM: R&D OVERVIEW

TABLE 310 LG CHEM.: SUPPLY AGREEMENTS

FIGURE 72 LG CHEM: COMPANY SNAPSHOT

TABLE 311 LG CHEM: PRODUCTS OFFERED

TABLE 312 LG CHEM: NEW PRODUCT DEVELOPMENTS

TABLE 313 LG CHEM: DEALS

TABLE 314 LG CHEM: OTHERS

16.1.5 BYD COMPANY LIMITED

TABLE 315 BYD COMPANY LIMITED: BUSINESS OVERVIEW

FIGURE 73 BYD COMPANY LIMITED: COMPANY SNAPSHOT

TABLE 316 BYD: NEW PRODUCT DEVELOPMENTS

TABLE 317 BYD: DEALS

TABLE 318 BYD: OTHERS

16.1.6 SK INNOVATION CO. LTD.

TABLE 319 SK INNOVATION CO. LTD.: BUSINESS OVERVIEW

TABLE 320 SK INNOVATION CO. LTD.: SUPPLY AGREEMENTS

FIGURE 74 SK INNOVATION CO. LTD.: GLOBAL BATTERY PRODUCTION

FIGURE 75 SK INNOVATION CO. LTD.: COMPANY SNAPSHOT

TABLE 321 SK INNOVATION CO. LTD.: PRODUCTS OFFERED

TABLE 322 SK INNOVATION CO. LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 323 SK INNOVATION CO. LTD.: DEALS

TABLE 324 SK INNOVATION CO. LTD.: OTHERS

16.1.7 VEHICLE ENERGY JAPAN CO. LTD.

TABLE 325 VEHICLE ENERGY JAPAN CO. LTD.: BUSINESS OVERVIEW

TABLE 326 VEHICLE ENERGY JAPAN CO. LTD.: SUPPLY AGREEMENTS

TABLE 327 VEHICLE ENERGY JAPAN CO. LTD.: PRODUCTS OFFERED

TABLE 328 VEHICLE ENERGY JAPAN CO. LTD.: DEALS

TABLE 329 VEHICLE ENERGY JAPAN CO. LTD.: OTHERS

16.1.8 TOSHIBA CORPORATION

TABLE 330 TOSHIBA CORPORATION: BUSINESS OVERVIEW

TABLE 331 TOSHIBA CORPORATION: SUPPLY AGREEMENTS

TABLE 332 TOSHIBA CORPORATION: PRODUCTS OFFERED

TABLE 333 TOSHIBA CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 334 TOSHIBA CORPORATION: DEALS

TABLE 335 TOSHIBA CORPORATION: OTHERS

16.1.9 MITSUBISHI CORPORATION

TABLE 336 MITSUBISHI CORPORATION: BUSINESS OVERVIEW

TABLE 337 MITSUBISHI CORPORATION: PRODUCTS OFFERED

TABLE 338 MITSUBISHI CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 339 MITSUBISHI CORPORATION: DEALS

TABLE 340 MITSUBISHI CORPORATION: OTHERS

16.1.10 ENERSYS

TABLE 341 ENERSYS: BUSINESS OVERVIEW

TABLE 342 ENERSYS: PRODUCTS OFFERED

TABLE 343 ENERSYS: NEW PRODUCT DEVELOPMENTS

TABLE 344 ENERSYS: DEALS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16.2 OTHER PLAYERS

16.2.1 EXIDE INDUSTRIES LIMITED

TABLE 345 EXIDE INDUSTRIES LIMITED: BUSINESS OVERVIEW

16.2.2 PRIMEARTH EV ENERGY CO., LTD.

TABLE 346 PRIMEARTH EV ENERGY CO., LTD.: BUSINESS OVERVIEW

16.2.3 E-ONE MOLI ENERGY CORP.

TABLE 347 E-ONE MOLI ENERGY CORP: BUSINESS OVERVIEW

16.2.4 TARGRAY TECHNOLOGY INTERNATIONAL INC.

TABLE 348 TARGRAY TECHNOLOGY INTERNATIONAL INC.: BUSINESS OVERVIEW

16.2.5 ALTAIR NANOTECHNOLOGIES INC.

TABLE 349 ALTAIR NANOTECHNOLOGIES INC.: BUSINESS OVERVIEW

16.2.6 CLARIOS

TABLE 350 CLARIOS: BUSINESS OVERVIEW

16.2.7 NORTHVOLT AB

TABLE 351 NORTHVOLT AB: BUSINESS OVERVIEW

16.2.8 LECLANCHÉ SA

TABLE 352 LECLANCHÉ SA: BUSINESS OVERVIEW

16.2.9 APTIV PLC

TABLE 353 APTIV PLC: BUSINESS OVERVIEW

16.2.10 ENVISION AESC

TABLE 354 ENVISION AESC: BUSINESS OVERVIEW

16.2.11 A123 SYSTEMS (SUBSIDIARY OF WANXIANG GROUP)

TABLE 355 A123 SYSTEMS: BUSINESS OVERVIEW

16.2.12 GS YUASA

TABLE 356 GS YUASA CORPORATION: BUSINESS OVERVIEW

16.2.13 GOTION HIGH TECH CO LTD.

TABLE 357 GOTION HIGH TECH CO LTD.: BUSINESS OVERVIEW

16.2.14 AUTOMOTIVE ENERGY SUPPLY CORPORATION

TABLE 358 AUTOMOTIVE ENERGY SUPPLY CORPORATION: BUSINESS OVERVIEW

16.2.15 RUIPU LANJUN ENERGY CO., LTD.

TABLE 359 RUIPU LANJUN ENERGY CO., LTD.: BUSINESS OVERVIEW

17 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 333)

17.1 IMPROVEMENTS IN EV BATTERY TECHNOLOGY TO PROVIDE IMPETUS TO EV BATTERY MARKET

17.2 SKEWED SUPPLY OF CRITICAL COMPONENTS POSES A CHALLENGE

17.3 CONCLUSION

18 APPENDIX (Page No. - 335)

18.1 KEY INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.4 CUSTOMIZATION OPTIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include publications from government sources [such as country level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; free and paid automotive databases The International Energy Agency, EV-volumes, Alternative Fuels Data Center (AFDC), the European Alternative Fuels Observatory (EAFO), and other associations/organizations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated by primary research.

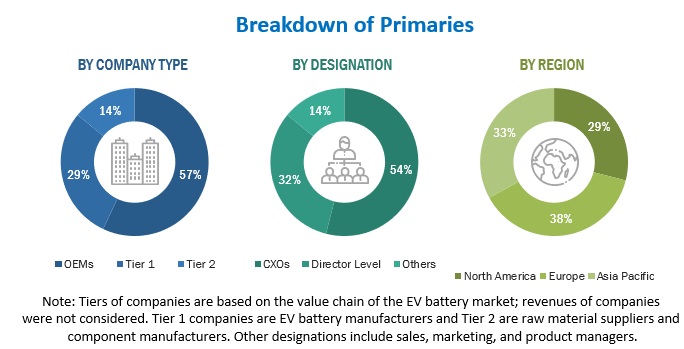

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global EV battery market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, and trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (EV battery manufacturers, EV component manufacturers, and raw material suppliers) side across three major regions, namely, North America, Europe, and Asia Pacific. 23% of the experts involved in primary interviews were from the demand side, and 77% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global EV battery market. In these approaches, the electric vehicle sales statistics for each vehicle type (passenger cars, vans/light trucks, medium & heavy trucks, buses, and off-highway vehicles) at a country level were considered.

In the bottom-up approach, the number of electric vehicle sales of each vehicle type at the country level was considered. The number of batteries per vehicle was identified through model mapping and secondary research. The sale of electric vehicles at the country level was then multiplied with the number of batteries in each vehicle type to determine the market size of the EV battery market in terms of volume. An average battery capacity was identified for each vehicle type through secondary and primary research. The country-level market size, in terms of volume, by vehicle type, was then multiplied with the country-level average battery price per kWh (ABP) of each vehicle type and average battery capacity to determine the market size in terms of value for each vehicle type. The summation of the country-level market size for each vehicle type, by volume and value, would give the regional level market size. The summation of the regional markets provides the global EV battery market size. The market size for vehicle type was derived from the global market.

The top-down approach was used to estimate and validate the size of the EV battery market, by battery type, battery form, method, material type, and li-ion battery component. To derive the market size by type, the global market size in terms of volume and value was divided into lead-acid, nickel-metal hydride, solid-state, and li-ion using the penetration and percentage split respectively. The global market was further segmented at the regional level. A similar approach was used to derive the market size of battery type, battery form, method, material type, and li-ion battery component segments in terms of volume and value.

Data Triangulation

After arriving at the overall market size of the global market through the abovementioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To define, describe, and project the EV battery market, by volume (units) and value (USD million)

- To define, describe, and forecast the market based on battery type, li-ion battery component, propulsion, vehicle type, method, battery capacity, material type, battery form, and region.

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze and forecast market size, in terms of volume, based on battery type (lead-acid, lithium-ion, nickel-metal hydride, solid-state, and others)

- To analyze and forecast the market size, in terms of value, based on lithium-ion battery component (positive electrode, negative electrode, electrolyte, and separator)

- To analyze and forecast the market size, in terms of volume, based on propulsion {battery electric vehicles (BEV), hybrid electric vehicles (HEV), plug-hybrid electric vehicles (PHEV), and fuel cell electric vehicles (FCEV)}

- To analyze and forecast the market size, in terms of volume and value, based on vehicle type (passenger cars, vans/light trucks, medium & heavy trucks, buses, and off-highway vehicles)

- To analyze and forecast the market size, by volume and value, based on battery capacity (<50 kWh, 50-110 kWh, 111-200 kWh, 201-300 kWh, and >300 kWh)

- To analyze and forecast the market size, in terms of value, based on material type (cobalt, lithium, natural graphite, and manganese)

- To analyze and forecast the market size, in terms of volume, based on battery form (prismatic, pouch, and cylindrical)

- To analyze and forecast the market size, in terms of volume, based on method (wire bonding and laser bonding)

- To forecast the size of various segments of the EV battery market based on three regions—North America, Europe, and Asia Pacific, along with major countries in each region

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To track and analyze competitive developments, such as new product developments, deals, and others in the EV battery market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- EV Battery Market, by vehicle type at country-level (for countries covered in the report)

- EV Battery Market, by battery type at country-level (for countries covered in the report)

-

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Battery Market

Which factors are majorly influencing the global growth of EV Battery Market?

We need details on the passenger cars segment for this market in Asia & Africa