EV Charging Station Market by Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, Electric Bus Charging, DC Fast Charging, Connectivity, Connection Phase, Service, Installation and Region - Global Forecast to 2027

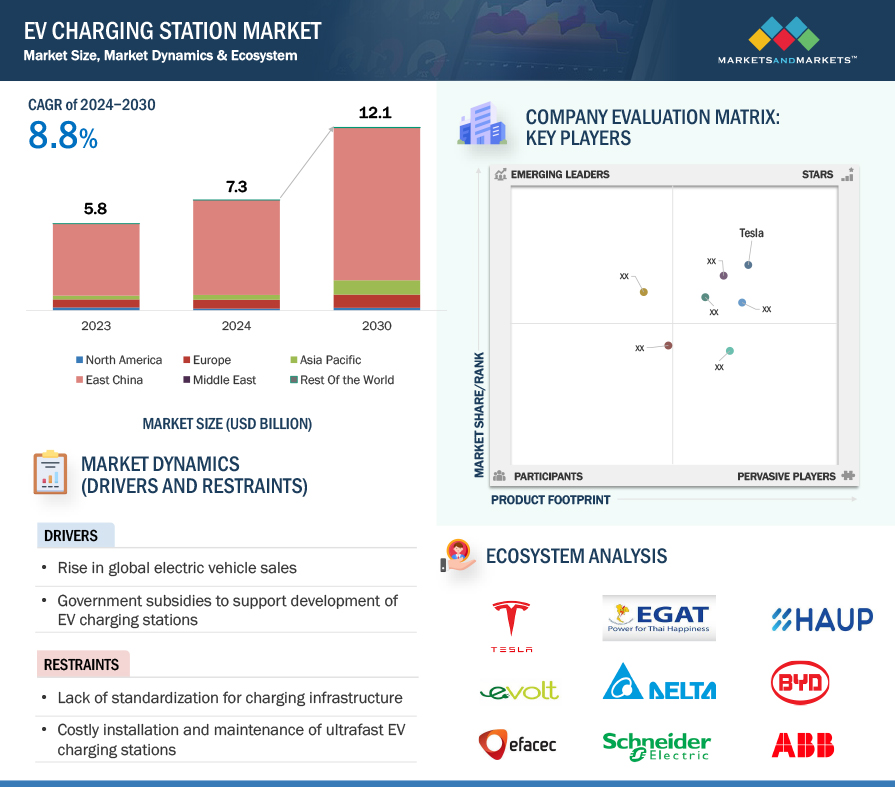

[418 Pages Report] The global EV Charging Station Market was valued at $11.9 billion in 2022 and is expected to reach $76.9 billion by 2027, at a CAGR of 45.0% during the forecast period 2022-2027. OEMs and charge point operators are collaborating to establish widespread charging infrastructure for electric vehicles. This involves identifying suitable locations, installing and maintaining the charging points, and ensuring a seamless payment and user experience. They are also developing open standards and protocols for interoperability across different charging networks. The partnership between OEMs and charge point operators is essential to support growing EVs on the roads and promote widespread adoption globally.

To know about the assumptions considered for the study, Request for Free Sample Report

EV Charging Station Market Dynamics:

Driver: Increase in EV sales Worldwide

The surge in the adoption and usage of electric vehicles has highlighted the necessity to develop charging infrastructure. The top markets for electric vehicles, including China, US, and Germany, are investing substantially in EV charging infrastructure and R&D for faster and more efficient charging methods. With the continuous rise in EV adoption, the demand for charging infrastructure is expected to increase exponentially, particularly in areas with high concentrations of EV owners. This has spurred investments in deploying additional public charging stations by governments, businesses, and other organizations, to cater to the needs of EV owners. Most EV owners also install their home charging stations, further fueling the demand for charging infrastructure. In 2022, global EV sales experienced a significant increase, representing more than 10% of all vehicle sales. China was the largest market for EV sales, followed by Europe and the US.

Restraint: Installing and maintaining EV charging stations in remote locations

Building and operating EV charging stations can be expensive, particularly in areas with low traffic or limited electricity supply. Installing charging stations requires a significant initial investment, including the cost of equipment, installation, and electrical infrastructure upgrades. In some cases, the cost of electricity supply upgrades and installation of the necessary infrastructure, such as high-power transformers or cabling, can be very high, especially in remote locations where the necessary grid infrastructure does not exist. For example, building a high-powered EV charging station in a remote location might require laying new power cables and installing transformers, which can be very expensive. Low traffic in these areas may not justify the high cost of installing and maintaining charging stations. As a result, it can be difficult to find investors willing to invest in EV charging stations in these remote locations, leaving potential owners with limited charging options.

Opportunity: Plans for smart city deployment

A smart city uses technology and data to improve the quality of life for its citizens. This includes using advanced technologies to manage resources efficiently, provide public services, and enhance communication and connectivity. The EV charging station market is one area where smart city deployment presents an opportunity.

Electric vehicles are becoming increasingly popular as people seek ways to reduce their carbon footprint and lower transportation costs. However, one of the major challenges facing EV adoption is the availability of charging infrastructure. Smart cities can help overcome this challenge by deploying a network of charging stations connected to a centralized system, making it easier for drivers to locate and use them. Smart city infrastructure can also support the growth of the EV charging station market by providing a platform for new business models. For example, companies can leverage the data generated by intelligent city infrastructure to offer innovative services like dynamic pricing, reservation systems, and personalized recommendations to EV drivers.

Challenge: Dependence on fossil fuels and their limited production

The dependence on fossil fuels for electricity generation can impact EV growth. For instance, EVs are often marketed as a cleaner alternative to traditional gasoline-powered vehicles. Still, EVs' environmental benefits depend on the electricity source used to charge them. In regions that rely heavily on fossil fuels for electricity generation, the environmental benefits of EVs may be limited. This can create a disincentive for consumers to adopt EVs and may slow the growth of the EV charging station market. The cost of electricity is an important factor in the growth of the market. In regions with high electricity prices, charging an EV may be more expensive than fueling a gasoline-powered vehicle. Several factors, including the cost of generation, transmission, and distribution, influence the cost of electricity. Dependence on fossil fuels for electricity generation can create price volatility and uncertainty, making it difficult for EV charging station operators to plan and invest in their businesses.

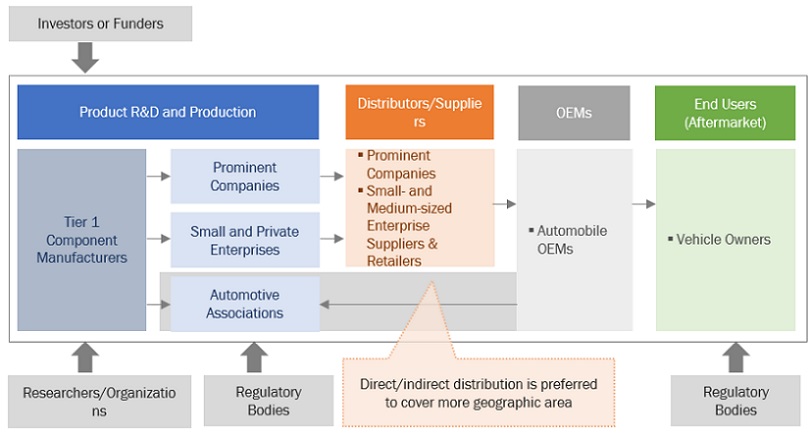

EV Charging Station Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of EV charging station manufacturers and EV charging station operators. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ABB (Switzerland), Shell (Netherlands), Tesla (US), ChargePoint (US), and BYD (China).

To know about the assumptions considered for the study, download the pdf brochure

Based on Operation, Mode 3 is expected to have significant market share during forecast period

Mode 3 EV charging stations are becoming increasingly popular as the demand for electric vehicles grows. These stations are equipped with a Type 2 socket that provides AC charging to the vehicle. They can be installed in public places, workplaces, and apartment complexes. Mode 3 is not used for private use. Mode 3 is a type of electric vehicle (EV) charging that is commonly found in public charging stations. This charging mode involves a level 2 AC charger, which provides higher charging power than a standard household outlet.

Recent developments in mode 3 EV charging include the introduction of faster charging rates, improved safety features, and more user-friendly interfaces. Many countries are investing heavily in mode 3 charging infrastructure to support the growth of the EV market. In Europe, the EU has set a target of installing one million public charging points by 2025. In US, major automakers and utilities have partnered to build the charging network, and several states have set targets for EV adoption and charging infrastructure deployment.

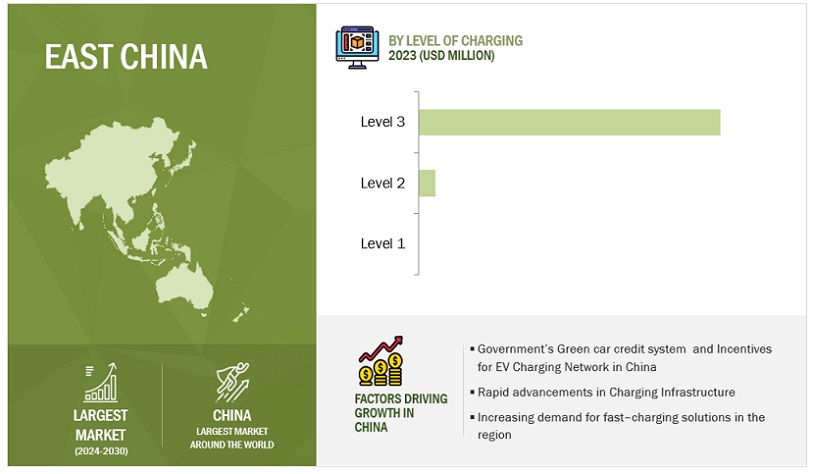

Level 3 segment is the fastest growing segment during the forecast period

Level 3 DC charge ranges from 200 V to 600 V with a typical 25 kW + off-board charger. It is currently the fastest available recharging station and adds an average of 80 to 130 Km in a 30-minute charge. Tesla superchargers can add up to 270 Km in a 30-minute charge. These chargers use 480 V, a current of 400 Amp, and provide 240 KW power. They can charge a vehicle from fully drained to 80% in less than 15 minutes. Level 3 is a highly-powered charging option with the potential to fully recharge an EV in less than 30 minutes. However, they are highly expensive. Level 3 charging stations cost approximately USD 30,000 to USD 50,000 on average, as the equipment cost is significantly higher and requires a transformer to be installed. In a DC fast charging system, the AC/DC conversion occurs in the charging equipment instead of the AC/DC converter, so the vehicle's power is already in DC. Unlike the steady flow of electricity, DC chargers charge rapidly when the battery is empty, but the rate slows down as they start to charge fully. DC fast chargers use three different kinds of plug types that are not interchangeable. Japanese automakers use the CHAdeMO standard, European and US makers use the CCS system, while Tesla supercharger uses its proprietary connector specific to their vehicles.

Sem-Public Segmen to witness significant growth rate during the forecast period

Semi-public charging stations, which are situated in public areas like parks, shopping centers, businesses, restaurants, and private tourist spots, are a crucial component of the EV charging infrastructure. Although they are accessible to the public, private entities usually own and operate them. These stations may be Level 2 (240V) or DC fast chargers (480V or higher) and provide a convenient and accessible charging option for EV drivers without a home charger.

Semi-public charging stations enhance the availability and accessibility of charging infrastructure for EV drivers, making them a vital aspect of the EV charging network. They offer a convenient charging option for drivers on the go or need to charge while running errands or shopping. These stations can benefit local businesses by attracting EV drivers to their establishments, increasing foot traffic and sales. In general, semi-public charging stations are essential for the transition to electric mobility and play a critical role in the growth and success of the EV industry. Companies are doing partnerships for the installation of semi-public charging stations.

China to be the largest market by volume during the forecast period

China is estimated to account for the largest market share by 2027, followed by Europe and Asia Pacific. China's EV charging station market has experienced remarkable growth due to the government's push for electric vehicle adoption. This has led to a surge in demand for charging infrastructure, resulting in China with the largest network with over 1.8 million charging points, controlled by leading players such as State Grid, China Southern Power Grid, and Star Charge. The government aims to deploy 4.8 million charging points by 2025, implementing EV charging infrastructure requirements in new buildings.

China has ceased providing subsidies to EV buyers as of January 2023, but other measures are expected to maintain the industry's momentum. The subsidies were initially intended to compensate for the price difference between EVs and combustion vehicles and promote commercialization. Experts believe the EV market will continue to expand as consumer interest increases and car companies invest in EV development. The green car credit system by the government is in place to encourage EV production. Some experts suggest that a ban on the sale of combustion vehicles could be another powerful policy, with some local governments already considering such a move.

Key Market Players

The electric vehicle charging station market is dominated by major charging providers, including ABB (Switzerland), Shell (Netherlands), ChargePoint (US), Tesla (US), and BYD (China). They develop products and provide service offerings for the electric vehicle charging ecosystem. They have initiated partnerships to develop their EV charging technology and provide finished products and charging services to their respective customers for the electric vehicle charging station market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$11.9 Billion |

|

Estimated Revenue by 2027 |

$76.9 Billion |

|

Revenue Rate |

Projected to grow at a CAGR of 45.0% |

|

Market Driver |

Increase in EV sales Worldwide |

|

Market Opportunity |

Plans for smart city deployment |

|

Key Market Players |

The electric vehicle charging station market is dominated by major charging providers, including ABB (Switzerland), Shell (Netherlands), ChargePoint (US), Tesla (US), and BYD (China). |

This research report categorizes the electric vehicle charging station market based on charging point type, level of charging, installation type, charging infrastructure type, application, DC fast charging type, connectivity, electric bus charging type, charging service type, operation, connection phase and region

Based on Level of Charging:

- Level 1

- Level 2

- Level 3

Based on Charging Point Type:

- AC (Normal Charging)

- DC (Super Charging)

Based on Installation Type:

- Fixed

- Portable

Based on Application:

- Private

- Semi-Public

- Public

Based on Charging Service:

- EV Charging Service

- Battery Swapping Service

Based on Charging Infrastructure Type:

- Normal Charging

- Type 2

- CCS

- CHAdeMO

- Tesla SC

- GB/T Fast

Based on DC Fast Charging Type:

- Slow DC (<49 kW)

- Fast DC (50-149 kW)

- Level 1 Ultra Fast DC (150-349 KW)

- Level 2 Ultra Fast DC (>349 kW)

Based on Electric Bus Charging Type:

- Off-board Top-down Pantograph

- On-board Bottom-up Pantograph

- Charging Via Connector

Based on Connectivity:

- Non-connected Charging Stations

- Smart Connected Charging Stations

Based on Connection Phase:

- Single Phase

- Three Phase

Based on Operation:

- Mode 1

- Mode 2

- Mode 3

- Mode 4

Based on the region:

- China

-

Asia Pacific (APAC)

- India

- South Korea

- Japan

- Taiwan

- Thailand

- Singapore

- Indonesia

-

North America (NA)

- US

- Canada

-

Europe (EU)

- Austria

- Denmark

- France

- Germany

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- UK

-

Middle East (ME)

- Saudi Arabia

- UAE

- Israel

-

Rest of the World (RoW)

- South Africa

- Brazil

- Mexico

- Other Countries

Recent Developments

- In January 2023, ABB E-mobility revealed its innovative Terra Home charging solution at CES 2023, the world's foremost technology event held in Las Vegas. It is set to be available for purchase around mid-2023. With its unique design, Terra Home empowers users to optimize their renewable energy usage, ultimately reducing their carbon impact.

- In November 2022, ABB formed a strategic alliance with Tallarna Ltd. to expand its user-friendly energy management technologies offerings. The solution leverages AI-powered data analytics to make it easier to undertake decarbonization projects for large real estate portfolios and energy infrastructure. The platform provides a one-stop-shop for customers, showcasing energy optimization options, performance insurance, and third-party financing options.

- In October 2022, Chargepoint launched the CP6000 charger. This comprehensive charging solution caters to the needs of European businesses and fleets, providing them with the tools they need to transition to electric mobility. It combines station hardware, network software, and customer support to offer a seamless experience. The CP6000 is designed to be scalable, flexible, reliable, and provide a superior driver experience, capable of charging 1 or 3-phase power with an adjustable output ranging from 3.7 to 22kw per port.

- In October 2022, Eaton expanded its contract with the General Services Administration (GSA) to cover electric vehicle supply equipment (EVSE) and related services. This move is crucial in achieving the US goal of reaching net-zero emissions by 2050 and advancing the development of EV charging infrastructure.

- In May 2022, Tata Power entered into a strategic partnership with Hyundai to build a robust EV charging network and accelerate the adoption of EVs across India

Frequently Asked Questions (FAQ):

Which are the major companies in the EV charging station market? What are their major strategies to strengthen their market presence?

The electric vehicle charging station market is dominated by major EV charging players, including ABB (Switzerland), Shell (Netherlands), ChargePoint (US), Tesla (US) and BYD (China). They develop products and provide service offerings for the electric vehicle charging ecosystem. They have initiated partnerships to develop their EV charging technology and provide finished products and charging services to their respective customers for the electric vehicle charging station market.

Which region is expected to grow at fastest rate during the forecast period?

China will be the fastest-growing market in the EV charging station market vehicles due to the huge volume of investments and the country's high EV sales.

Which are the key technology trends prevailing in the EV charging station market?

The key technologies affecting the EV charging station market are the V2G, EVs, smart charging, and Megawatt charging.

What is the total CAGR expected to be recorded for the EV charging station market during 2022-2027?

The CAGR is expected to record a CAGR of 45.0% from 2022-2027.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

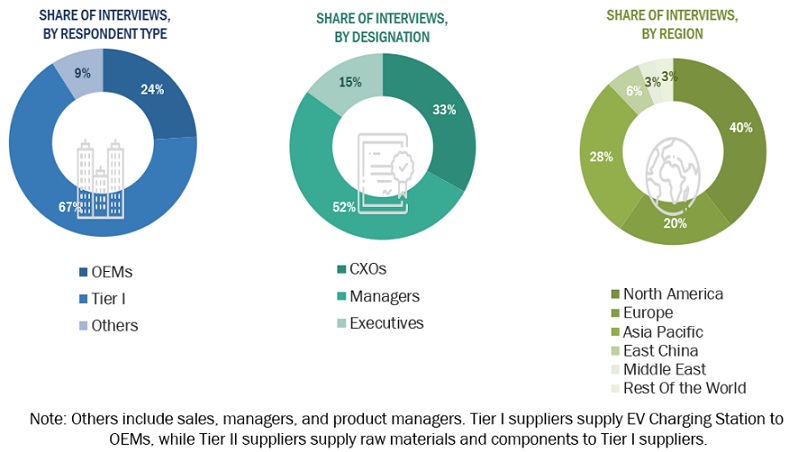

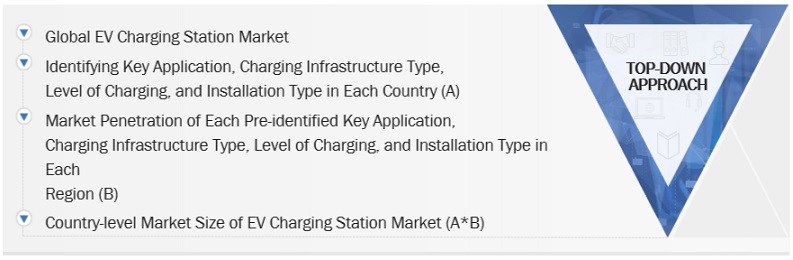

The study involved 4 major activities in estimating the current size of the electric vehicle charging station market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering EV Charging station and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the EV Charging Station market, which primary respondents validated.

Primary Research

Extensive primary research was conducted after obtaining information regarding the EV Charging Station market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from EV charging station operators; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various technology, application, vertical, and region trends. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using EV charging stations were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of EV charging stations and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the electric vehicle charging station market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global EV Charging station Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

EV charging station is electrical equipment used to charge plug-in electric vehicles. This equipment can charge an electric vehicle in 6-20 hours for normal charging (Level 1 & Level 2 charging) and ~15-60 minutes for fast/supercharging (Level 3 charging). Different EVs have different charging requirements and can be used with the required chargers. They allow the conversion of current for the vehicle to be easily charged and set up at homes, semi-public places, public charging stations, and a portable charging system. Most EV motorcycles use level 1 and level 2 charging due to battery limitations.

strong>Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To segment and forecast the electric vehicle charging station market size in terms of volume (Thousand Units) and value (USD Million)

- To define, describe, and forecast the electric vehicle charging station market based on level of charging, charging service type, connectivity, charging infrastructure type, charging point type, installation type, connection phase, electric bus charging type, application, DC fast charging type, operation, and region

- To segment and forecast the market size, by volume (thousand units) and value (USD million), based on level of charging (level 1, level 2, and level 3)

- To segment and forecast the market size, by volume (thousand units), based on application (Private, Semi-Public and Public)

- To segment and forecast the market size, by volume (thousand units), based on charging point type (AC (normal charging), DC (supercharging), and inductive charging)

- To segment and forecast the market size, by volume (thousand units), based on charging infrastructure type (CCS, CHADEMO, Normal charger, Tesla super charger, GB/T fast and Type 2)

- To provide qualitative insights on electric bus charging type (off-board top-down pantograph, on-board bottom-up pantograph, and charging via connector)

- To provide qualitative insights on charging service type (EV charging service and battery swapping service)

- To segment and forecast the market size, by volume (thousand units), based on connectivity (non-connected charging stations and smart connected charging stations)

- To segment and forecast the market size, by volume (thousand units), based on installation type (portable charger and fixed charger)

- To provide qualitative insights for the market by DC fast charging type [Slow DC (<49 kW), Fast DC (50-149 kW) and Level 1 Ultra Fast DC (150-349 KW), and Level 2 Ultra Fast DC (>349 kW)]

- To segment and forecast the market size, by volume (thousand units) based on operation (mode 1, mode 2, mode 3, and mode 4)

- To segment and forecast the market size, by volume (thousand units) based on connection phase (single phase and three phase)

- To forecast the market size with respect to key regions, namely, China, Asia Pacific, North America, Europe, Middle East and Rest of the World

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Further breakdown for the electric vehicle charging station market, by charging level, at the country level (for countries covered in the report)

- Further breakdown of the electric vehicle charging station market, by DC charging, at the country-level (for countries covered in the report)

Company Information

- Profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Charging Station Market

I would like to know more about the investments and policies expected to help boost the growth of the electric vehicle charging station market

The global electric vehicle charging station market size is projected to grow from 2,354 thousand units in 2022 to 14,623 thousand units by 2027, at a CAGR of 44.1. Factors such as rising sales of EVs around the world, along with the growing demand for zero-emission transport will boost the demand for the electric vehicle charging station market. Developments in technologies like portable charging stations, bi-directional charging, smart charging with load management, usage-based analytics, and automated payment, and the development of ultra-fast charging technology will create new opportunities for this market.

This is a brand-new study published couple e of weeks ago and the report covers the industry statistics considering the actual sales volumes and revenue for the year 2021 as the base year data to estimate and forecast the market to 2027. Yes, we have covered the post-COVID19 impact analysis and Supply Chain disruption of the market and also since we track the EV market, we have drawn parallels from the EV sales growth report to estimate the growth rates for the EVSE market.