Electrolyzers Market by Technology (Alkaline Electrolyzer (AE), Proton Exchange Membrane (PEM), SOE, AEM), Application (Energy, Mobility, Industrial, Grid Injection), Power Rating (<500 kW, 500-2,000 kW, >2,000 kW) and Region - Global Forecast to 2028

[206 Pages Report] The global electrolyzers market in terms of revenue was estimated to be worth $1.2 billion in 2023 and is poised to reach $23.6 billion by 2028, growing at a CAGR of 80.3% from 2023 to 2028. The increasing investments in green hydrogen production and surge in demand for the electrolyzer based green ammonia for fertilizers production are some of the key factors accelerating the growth of the electrolyzers market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

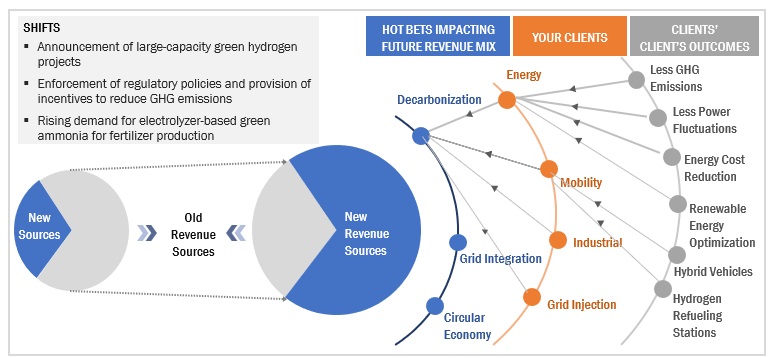

Driver: Increased investments in large-capacity green hydrogen projects

Increasing investments in green hydrogen projects have spurred the electrolyzers market growth. Currently, there is a renewed interest in green hydrogen projects as the possible uses of hydrogen are expanding across multiple sectors, including power generation, manufacturing processes in industries such as steelmaking and cement production, fuel cells for electric vehicles, heavy transport such as shipping, green ammonia production for fertilizers, cleaning products, refrigeration, and electricity grid stabilization. As more projects are being set up, companies plan to accommodate and utilize green hydrogen in their value chain, and this, in turn, is providing lucrative opportunities for the use of electrolyzers. More private players would venture into the field with such projects and attract new and innovative companies to advance the technologies. Asia, Europe, and Australia are at the forefront of developing green hydrogen and associated technologies. Moreover, as the sizes of projects have been increasing, so is the investment required for them.

Restraints: Underdeveloped electrolyzer supply chain

Geographies such as North America, rely on imports for procuring platinum, iridium, and graphite, which are crucial components for electrolyzers. The nascent electrolyzers market is made up of limited suppliers. Many key players are large companies (Cummins Inc., Siemens Energy, etc.), but the electrolyzer business is only a small portion of their business profiles. Some large electrolyzer manufacturers produce most of the subcomponents (i.e., gas diffusion layer, bipolar plates, and electrolyte membrane) in-house. Other suppliers typically produce one or two subcomponents in the supply chain. Additionally, suppliers do lack the capacity to produce electrolyzers and components at high manufacturing rates.

Opportunities: Growing demand for the electrolyzer based on-site hydrogen fueling stations

The requirement to construct hydrogen refueling stations is growing as there is a rise in use of fuel cell vehicles.. The emissions from vehicles account for more than 15% of global greenhouse emissions. Hence, governments all over the world are finding alternative power sources for use in the transportation sector. The adoption of fuel cell vehicles (FCVs) in the sector is expected to increase in the near future owing to the absence of CO2 emissions during vehicle operations. Therefore, many automotive manufacturers are making considerable investments to incorporate fuel cell vehicles in their product offerings. Fuel cell electric vehicles (FCEVs) can convert hydrogen stored in the vehicle via fuel cells into electricity to power the electric motor. Due to high fuel and purchase prices, the cost of owning and operating FCEVs is more than electric vehicles. However, governments of various countries worldwide are deploying fuel cell-powered public buses and garbage trucks as they are environment-friendly. FCEVs have been commercially available since 2014, and according to IEA, the number of FCEVs increased by 40% in 2020.

Challenges: High initial setup cost and insufficient hydrogen infrastructure

In the present scenario, hydrogen is produced at locations where it is to be used. Hydrogen delivery and storage infrastructure will need to grow to support a large hydrogen market. Pipelines are the most energy-efficient approach to transporting hydrogen. However, their deployment is challenged by their high capital costs. The lack of need for transportation has hence left the hydrogen market unexplored. Additionally, The setup costs of hydrogen fuel stations and other infrastructure are quite high compared to petroleum, diesel, and other fuels. This high cost is due to the expensive equipment required for the fuel stations, along with necessary precautions and safety measures, as hydrogen is highly combustible.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

By technology, alkaline electrolyzers segment to witness largest electrolyzers market share during forecast period

The alkaline electrolyzers segment is expected to witness the largest market share from 2023 to 2028. The growth of the alkaline electrolyzer is attributed by the fact that it is relatively mature technology and cost-effective segment as compared to other technologies during the forecasted period. Europe led the electrolyzers market for alkaline electrolyzer technology in 2022. The high growth and market share of alkaline electrolyzer technology are attributed to its key advantages over other manufacturing technologies in the region. The region is a competitive market for electrolyzers.

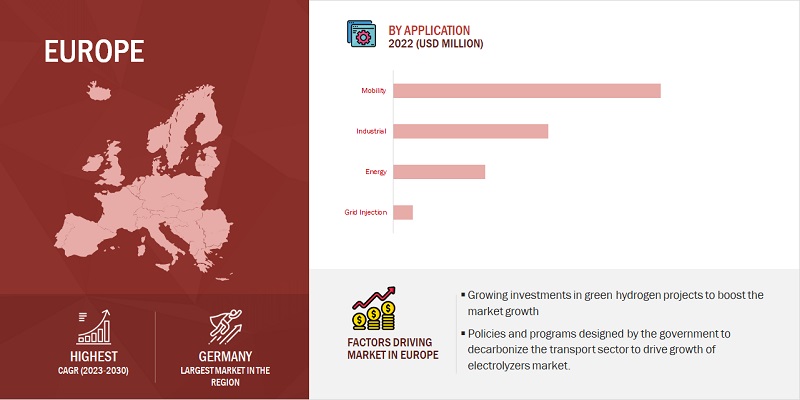

By application, grid injection segment to witness highest CAGR during forecast period

By application, grid injection segment is expected to grow at highest rate during the forecast period. The segment's growth is attributed to increased penetration of renewables in energy systems. In the grid injection sector in 2022, Europe dominated the electrolyzers market. This is because the preexisting grids for natural gas, carbon dioxide, petroleum, and other resources can be repurposed. This is increasing grid injection as well as the region's investment in electrolyzers

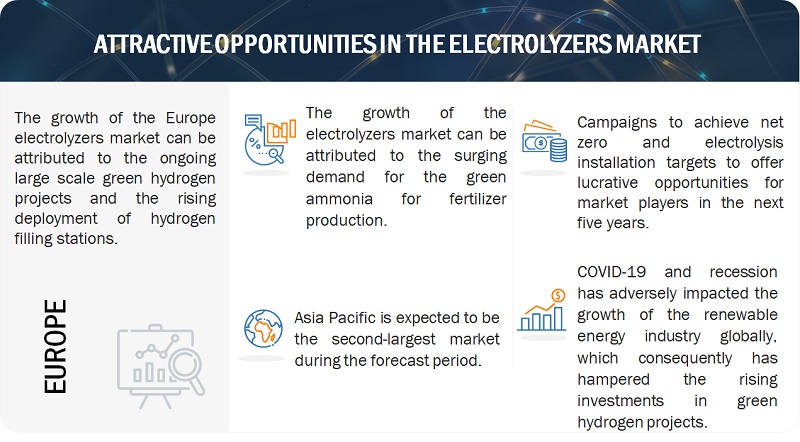

Europe is expected to be the largest electrolyzers market during the forecast period.

Europe is expected to be the largest market share in the electrolyzers market during the forecast period. The European market has been studied for Germany, the UK, France, Denmark, Austria, Spain, the Netherlands, Norway, and Rest of Europe. Currently, less than 2% of Europe’s energy consumption comes from hydrogen, mainly used for making products such as plastics and fertilizers, and 96% is made from natural gas, emitting a significant amount of CO2 in the process. The growth of the Europe electrolyzers market is characterized by the increase in the production of green electricity for small-scale applications in rural areas and green fuel due to higher demand for fuel cell vehicles.

Key Market Players

The major players in the global electrolyzers market are Siemens Energy (Germany), Nel ASA (Norway), Plug Power Inc. (US), Enapter S.r.l. (Italy), and Cummins Inc. (US).

Electrolyzers Market Report Scope

|

Report Attributes |

Details |

|

Market size: |

USD 1.2 billion in 2023 to USD 23.6 billion by 2028 |

|

Growth Rate: |

80.3% |

|

Largest Market: |

Europe |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2023-2028 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Power Rating, Technology, Application, and Region |

|

Geographies Covered: |

Europe, North America, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Growing demand for the electrolyzer based on-site hydrogen fueling stations |

|

Key Market Drivers: |

Increased investments in large-capacity green hydrogen projects |

This research report categorizes the electrolyzers market by power rating, technology, application, and region.

On the basis of technology, the electrolyzers market has been segmented as follows:

- Alkaline Electrolyzer (AE)

- Proton Exchange Membrane (PEM)

- Solid Oxide Electrolyzer (SOE)

- Anion Exchange Membrane (AEM)

On the basis of application, the electrolyzers market has been segmented as follows:

-

Energy

- Power Generation

- CHP

- Mobility

-

Industrial

- Chemical

- Industries

- Grid Injection

On the basis of power rating, the electrolyzers market has been segmented as follows:

- <500 KW

- 500-2,000 KW

- >2,000 KW

Based on region, the electrolyzers market has been segmented as follows:

- Europe

- Asia Pacific

- North America

- Rest of the World

Recent Developments

- In January 2023, Enapter S.r.l received a contract from Adsensys, one of the leading suppliers of fuels, for supplying an AEM Multicore electrolyzer. This electrolyzer can produce about 450 kilograms of green hydrogen per day.

- In December 2022, Cummins Inc. received a contract from Linde plc for supplying a 35-megawatt (MW) proton exchange membrane (PEM) electrolyzer system for Linde’s new hydrogen production plant in Niagara Falls, New York.

- In June 2022, Siemens Energy and Air Liquide formed a joint venture for the production of industrial-scale renewable hydrogen electrolyzers in Europe.

- In May 2022, Nel ASA has officially opened a 20 MW PEM electrolyzer plant in Spain, Europe. It will be utilized to generate green hydrogen, which can reduce CO2 emissions from fertilizer production.

Frequently Asked Questions (FAQ):

What is the current size of the electrolyzers market?

The current market size of the global electrolyzers market is estimated at USD 1.2 billion in 2023.

What are the major drivers for the electrolyzers market?

Announcements of large capacity green hydrogen projects

Which is the fastest-growing region during the forecasted period in the electrolyzers market?

Europe is the fastest-growing region during the forecasted period in the electrolyzers market.

Which is the largest segment, by technology during the forecasted period in the electrolyzers market?

The alkaline electrolyzer segment is estimated to be the largest segment, by technology.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

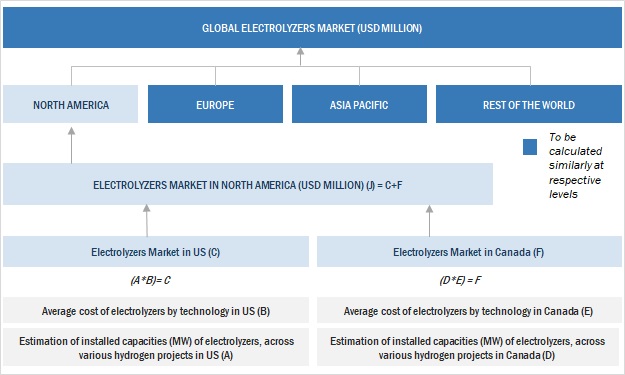

This study involved four major activities in estimating the current market size of the electrolyzers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, and UNESCO Institute of Statistics to identify and collect information useful for a technical, market-oriented, and commercial study of the utility communication market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

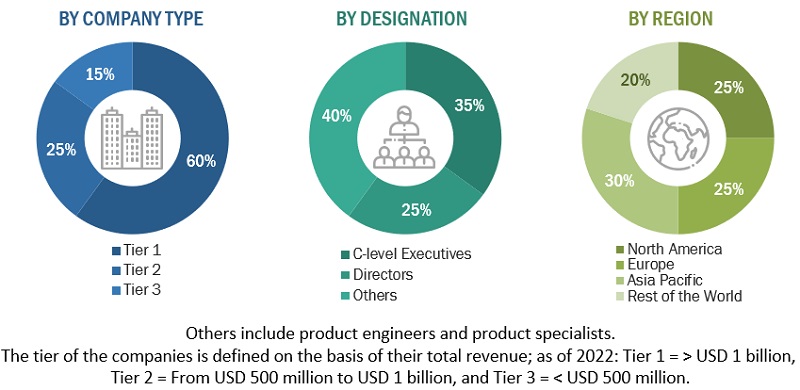

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all the segments of the electrolyzer industry. In-depth interviews were conducted with various primary respondents, including key industry participants, C-level executives, directors of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global electrolyzers market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Electrolyzers Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the electrolyzer market.

Objectives of the Study

- To forecast and describe the electrolyzers market size, by technology, application, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micro markets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the market with respect to four major regions, namely, Europe, Asia Pacific, North America, and Rest of the World

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, contracts & agreements, and joint ventures & collaborations in the electrolyzers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrolyzers Market