Electronic Toll Collection Market by Technology (RFID, DSRC, Video Analytics, ANPR/ALPR, GNSS/GPS), Offering (Hardware, and Back-Office), Application (Highways, Urban Area), Type, and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

How Big is the Electronic Toll Collection Market Size?

| Report Metrics | Details |

| Curent Market Size | USD 8.3 Billion |

| Market Size by 2027 | USD 11.4 Billion |

Forecast Range and Growth Rate

| Report Metrics | Details |

|

Market size available for years |

2021 - 2027 |

|

Growth Rate |

6.5% CAGR |

What is New in the Report?

- Coverage of new market players.

- change in the market share of existing players.

- Updated financial information/product portfolio of players.

- Growth drivers, restraints, opportunities, and challenges.

Updated on : April 24, 2023

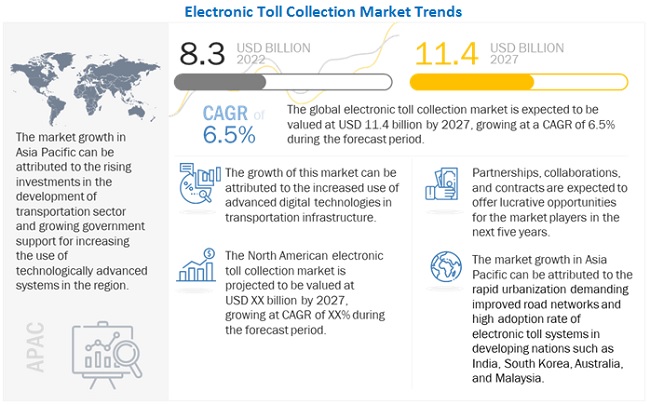

The Electronic toll collection market is projected to reach USD 11.4 billion by 2027, Growing at the CAGR of 6.5% during the forecast period. The driving factors which fuel the market’s growth are - reduction in traffic congestion, accidents, and environmental pollution, high government support for increasing deployment of electronic toll collection systems, increased convenience due to cashless payments, and technological advancements in transportation infrastructure.

To know about the assumptions considered for the study, Request for Free Sample Report

Electronic Toll Collection Market Dynamics

Driver: Technological advancements in transportation infrastructure

Electronic tolling systems encompass multiple leading-edge technologies, such as analytics, mobility, data communications, and smart sensors. Adopting these technologies in recent years has enabled better connectivity of devices and sensors, resulting in improved accuracy in toll collection. Advancements in communication technologies allow connectivity of nearly all real-world objects with the internet. Moreover, advanced sensors, radars, high-definition surveillance cameras, and various data processing techniques enable a better understanding of the traffic’s behavior and result in improved decision-making.

Further developments in IoT technology are expected to drive the growth of the electronic toll collection market. Technological advancements would make smart connectivity and control devices more intelligent and self-governing. The electronic toll collection systems will collect data regarding the vehicle count of the day, date, time, and so on from multiple sources and share it with a centralized control center for optimum decision-making. Hence, technological advancements tend to be the driving force for the growth of the electronic toll collection market.

Restraint: Low adoption of satellite-based GPS technologies

Each region and country cannot afford to adopt satellite-based GNSS and GPS, which helps track the vehicles’ locations and charge them according to the distance covered. The lack of use of these technologies will lead to inaccurate tolling charges in electronic toll collection systems.

GPS-based electronic toll collection systems use GPS technology for electronic toll charging. GPS is a satellite-based navigation system that can operate under any climatic condition. Vehicle owners must first install interfacing hardware devices in their vehicles, which costs higher than other tolling systems.

When a vehicle crosses the toll area, the interfacing hardware checks the vehicle’s current position by coordinating with the GPS. This interfacing hardware device then sets up the wireless communication channel through the global system for mobile communications (GSM) module. After checking with the control system, it stores the toll data and sends the transaction information to the interfacing hardware device. Finally, this device receives and displays the result of the transaction. The adoption of satellite-based technology is lower because of the high initial cost and requirement for additional hardware to use satellite-based electronic toll collection systems.

Opportunity: Growing adoption of all-electronic tolling systems

All-electronic tolling (AET) systems are installed on most roads in developed and developing countries. Observing the benefits of AET systems, the adoption rate of these systems is much higher than that of manual and coin-based tolling systems. The AET system allows free-flow tolling and avoids the necessity of tollbooths at toll plazas. This not only reduces the infrastructure and labor costs but also helps in avoiding traffic congestion. According to subject matter experts (SMEs), most upcoming toll projects in different countries are based on AET. In May 2020, the Maryland Transportation Authority, an independent state agency in the US, launched a new permanent AET system at the Bay Bridge, including three highway-speed traffic lanes.

Manual and coin-based machines require labor for operations; hence, with the increased adoption of AET systems, transitioning from manual or coin-based machines is a growth opportunity for the market players.

Challenge: Issues related to the selection of toll technology

Technology selection directly impacts interoperability. The decision about the technology that needs to be adopted for collecting tolls is often made after considering several factors, such as the number of lanes to be tolled, type of road infrastructure, targeted type of vehicles and their volume, and expected scalability of the system. Each state and toll agency has its legislative context; goals for establishing schemes. These varying contexts make it extremely challenging to compare the implementation of a tolling solution in one country to another. If a toll agency selects a different RFID protocol, it might not be able to read customers from agencies that are away. A benchmark for different technologies that are used in tolling systems for enforcement purposes can be made only by considering the whole life cost of a system and not just the investment. Governments and local toll authorities should collaborate to create a compatible system throughout the state.

By application, electronic toll collection market, the application of the highways to register higher growth rate

Highways play an important role in making our everyday lives easier. They provide an essential means of getting from one location to another quickly and efficiently. However, high-speed traffic also brings certain challenges. On roads built for high-speed traffic, safety is of vital importance. The more real-time information motorists receive on the current traffic situation, the safer they are while driving. Vehicles are driven at high speeds on highways; electronic toll collection systems help vehicle owners carry out a convenient digital transaction without needing to stop at tollbooths. This system has brought a new revolution, making the toll collection process simple, faster, and effective.

By type, electronic toll collection market, the transponder-/tag-based tolling system to register higher growth rate.

Transponders have been widely used for vehicle identification. In this method, an RFID chip (electronic tag) is mounted on the vehicle, especially near the rear view of the vehicle mirror. The transponder or tag responds to radio signals sent from gantries built on high-traffic urban areas or highways. Vehicle owners can pay the toll through their credit/debit cards. On-board units that are DSRC technology-based transponders deployed on or in vehicles communicate with roadside DSRC technology-based transponder units, which alert the driver regarding safety risks, toll payments, and parking payments. GNSS-based electronic toll collection systems and transponders are also available in the market.

The electronic toll collection market to have large market share in North America.

North America is expected to continue to lead the electronic toll collection market by capturing the largest market share throughout the forecast period, owing to the replacement of legacy payment systems with digital tags. Developments in minimizing component size and the emergence of new technologies such as RFID can boost the demand in the region. The rising number of government initiatives to achieve congestion-free transportation, rapidly increasing vehicle demand and production in North America, and adoption of the latest technological solutions, such as GPS and GNSS toll collection and tracking solutions, are driving the growth of the regional electronic toll collection market.

Key Market Players

The Electronic toll collection market is dominated by a few globally established players such as Kapsch TrafficCom AG (Austria), Conduent, Inc. (US), EFKON GmbH (Austria), TransCore (US), Thales (France), Raytheon Technology Corporation (US), Cubic Corporation (US), and Siemens (Germany).

These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the market.

Electronic Toll Collection Market Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 8.3 Billion |

| Projected Market Size | USD 11.4 Billion |

| CAGR | 6.5% |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Type, By Offering, By Technology, By Application, By Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, RoE |

|

Companies Covered |

The major players include Kapsch TrafficCom AG (Austria), Conduent, Inc. (US), EFKON GmbH (Austria), TransCore (US), Thales (France), Raytheon Technology Corporation (US), Cubic Corporation (US), and Siemens (Germany) (Total 25 companies) |

This report categorizes the electronic toll collection market based on type, offering, technology, application, and region available at the regional and country level.

Electronic Toll Collection Market, By Type

- Transponder-/Tag-based Tolling Systems

- Other Tolling Systems

By Offering

- Hardware

- Back-office and Other Services

By Technology

- RFID

- DSRC

- Others

By Application

- Highways

- Urban Areas

Electronic Toll Collection Market, By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- EU5

- Western Europe

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Rest of Asia Pacific

-

RoW

- Middle East & Africa

- South America

Recent Developments

-

In November 2021, SiVA, a Grupo Marhnos company, selected Thales to revolutionize toll collection in Guatemala. Thales is implementing its market-proven solution PITZ (Peage Intelligent Transport Zero) electronic toll collection system along Guatemala’s vital Palin-Escuintla toll corridor. PITZ solution can integrate various payment forms, including cash, electronic toll, or bank cards, whether contactless or not. It can swiftly and securely handle more than 120 vehicles per minute. The outcome of the contract will be a real-time saver for over 22,000 vehicles per day that use Guatemala’s Palin-Escuintla toll road corridor.

-

In October 2021, TransCore announced the launch of a new product that allows RVers to travel across the country using only one transponder to pay tolls electronically without stopping at a toll booth. RV Toll Pass will change how RVers travel across the country through different tolling jurisdictions. With TransCore’s multi-protocol National Pass technology, RV Toll Pass is available for all RV configurations, including motor homes and trailers, and allows users to be tolled at the electronic rate, typically lower than the cash or video toll rate.

-

In December 2020, In Mexico, Kapsch has been awarded a contract to implement an electronic toll collection system for the “MRO Paquete Noreste” highways in the country’s northeastern region. This is one of the busiest highway networks in the country. The company will upgrade the current system over a distance of 350 km with twelve plazas and 64 lanes by eliminating cash payments, implementing electronic toll collection, and ensuring safer and faster transit.

-

In November 2020, Raytheon Technologies developed a system that is well suited for unclogging streets in large metro areas. The Optical Detection Intelligent Network, or ODIN, does the work of a traditional overhead gantry in a more compact package that can mount on existing infrastructure. The congestion management is done with the help of a traditional gantry, camera, and an illuminator for front and rear plates. ODIN rolls all of those together into a single camera and sensor to make it robust.

-

In November 2020, The first Multi-Lane Free-Flow (MLFF) toll system in Ecuador was installed with Kapsch TrafficCom’s technology at one of the main access routes to the country’s capital, Quito. This development has improved mobility in the area by allowing electronic toll collection without drivers stopping to make toll payments.

Frequently Asked Questions (FAQ):

What is the current size of the Electronic toll collection market?

The Electronic toll collection market is projected to grow from USD 8.3 billion in 2022 to USD 11.4 billion by 2027; it is expected to grow at a CAGR of 6.5% from 2022 to 2027.

Who are the key players in the Electronic toll collection market?

Companies such as Kapsch TrafficCom AG (Austria), Conduent, Inc. (US), EFKON GmbH (Austria), TransCore (US), Thales (France), Raytheon Technology Corporation (US), Cubic Corporation (US), and Siemens (Germany). These companies cater to the requirements of their customers by providing advanced electronic toll collection products and software/applications with a presence in multiple countries.

What are the opportunities for the existing players and for those who are planning to enter various stages of the Electronic toll collection value chain?

There are various opportunities for the existing players to enter the value chain of electronic toll collection industry. Some of these include rising integration of blockchain technology into toll collection systems, rising number of public–private partnership (PPP) agreements in transportation sector, and growing adoption of all-electronic tolling systems.

What are the challenges for the existing players and for those who are planning to enter various stages of the electronic toll collection value chain?

There are various challenges for the existing players to enter the value chain of electronic toll collection industry. One of these include issues related to selection of toll technology.

Which is the potential market for electronic toll collection in terms of region?

Asia Pacific is expected to witness a considerable growth rate during the forecast period. Factors providing growth opportunities to the electronic toll collection market in this region include government initiatives to introduce and promote the use of electronic toll collection systems, rapid urbanization demanding improved road networks, and high adoption rate of electronic toll systems in developing nations such as India, South Korea, Australia, and Malaysia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 ELECTRONIC TOLL COLLECTION MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 ELECTRONIC TOLL COLLECTION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary data

2.1.2.4 Key industry insights

2.1.2.5 Secondary and primary data

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for deriving market size by top-down analysis (supply side)

FIGURE 4 TOP-DOWN APPROACH: MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - SUPPLY SIDE

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for deriving market size by bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - DEMAND SIDE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 7 ELECTRONIC TOLL COLLECTION MARKET, 2018–2022

FIGURE 8 TRANSPONDER-/TAG-BASED TOLLING SYSTEMS SEGMENT TO DOMINATE THE MARKET DURING FORECAST PERIOD

FIGURE 9 RFID TECHNOLOGY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 BACK-OFFICE AND OTHER SERVICES SEGMENT TO HOLD LARGER SHARE OF THE MARKET DURING FORECAST PERIOD

FIGURE 11 HIGHWAYS SEGMENT TO HOLD LARGER SHARE OF THE MARKET DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRONIC TOLL COLLECTION MARKET

FIGURE 13 GOVERNMENT-LED INITIATIVES TO REDUCE TRAFFIC CONGESTION TO DRIVE GROWTH OFTHE MARKET

4.2 ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION

FIGURE 14 HIGHWAYS SEGMENT TO HOLD LARGER SHARE OF ELECTRONIC TOLL COLLECTION MARKET DURING FORECAST PERIOD

4.3 ELECTRONIC TOLL COLLECTION MARKET, BY TYPE

FIGURE 15 TRANSPONDER-/TAG-BASED TOLLING SYSTEMS SEGMENT TO DOMINATE THE MARKET DURING FORECAST PERIOD

4.4 ELECTRONIC TOLL COLLECTION MARKET IN NORTH AMERICA, BY TECHNOLOGY AND OFFERING

FIGURE 16 RFID AND BACK-OFFICE AND OTHER SERVICES SEGMENTS HELD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2021

4.5 COUNTRY-WISE GROWTH RATE OFTHE MARKET

FIGURE 17 CHINA TO RECORD HIGHEST CAGR IN GLOBAL ELECTRONIC TOLL COLLECTION MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 ELECTRONIC TOLL COLLECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased use of electronic toll collection systems to reduce traffic congestion, accidents, and environmental pollution

5.2.1.2 High government support for increasing deployment of electronic toll collection systems

5.2.1.3 Increased convenience due to cashless payments

5.2.1.4 Technological advancements in transportation infrastructure

5.2.2 RESTRAINTS

5.2.2.1 Implementation constraints in developing countries

5.2.2.2 Low adoption of satellite-based GPS technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of blockchain technology into toll collection systems

5.2.3.2 Rising number of public–private partnership (PPP) agreements in transportation sector

5.2.3.3 Growing adoption of all-electronic tolling systems

5.2.4 CHALLENGES

5.2.4.1 Issues related to selection of toll collection technology

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN: ELECTRONIC TOLL COLLECTION MARKET

5.3.1 RESEARCH AND DEVELOPMENT

5.3.2 SUPPLY OF COMPONENTS AND SOLUTIONS

5.3.3 SYSTEM INTEGRATION

5.3.4 MAINTENANCE OF DEVICES OR SYSTEMS

5.3.5 BACK-OFFICE OPERATIONS

5.4 ECOSYSTEM/MARKET MAP

TABLE 2 ELECTRONIC TOLL COLLECTION MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 DISTANCE-BASED TOLLING

5.5.2 POINT-BASED TOLLING

5.5.3 TIME-BASED TOLLING

5.5.4 PERIMETER-BASED TOLLING

5.5.5 WEIGHT-BASED TOLLING

FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES RELATED TO ELECTRONIC TOLL COLLECTION MARKET

5.6 TECHNOLOGY ANALYSIS

5.6.1 TOLL PAYMENT METHODS

5.6.1.1 Pre-paid toll payment method

5.6.1.2 Post-paid toll payment method

5.6.1.3 Combination of pre-paid and post-paid toll payment methods

5.6.2 RFID TECHNOLOGY

5.6.3 DSRC TECHNOLOGY

5.6.4 GNSS/GPS-BASED ELECTRONIC TOLL COLLECTION SYSTEMS

5.6.5 ALPR AND ANPR SYSTEMS

5.7 PORTER’S FIVE FORCES MODEL

TABLE 3 IMPACT OF PORTER’S FIVE FORCES

FIGURE 21 ELECTRONIC TOLL COLLECTION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 BARGAINING POWER OF SUPPLIERS

5.7.2 BARGAINING POWER OF BUYERS

5.7.3 THREAT OF NEW ENTRANTS

5.7.4 THREAT OF SUBSTITUTES

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY APPLICATION

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY APPLICATION (%)

5.8.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR APPLICATIONS

TABLE 5 KEY BUYING CRITERIA FOR APPLICATIONS

5.9 CASE STUDY ANALYSIS

5.9.1 MASSACHUSETTS DEPARTMENT OF TRANSPORTATION (MASSDOT)

5.9.2 MINISTRY OF ROAD TRANSPORT AND HIGHWAYS AND NATIONAL HIGHWAYS AUTHORITY OF INDIA

5.9.3 PROMOTORA Y OPERADORA DE INFRAESTRUCTURA (PINFRA)

5.9.4 GOVERNMENT OF BRAZIL

5.9.5 DIGITAL TOLLING SOLUTION BENCHMARK OF ERC

5.9.6 USE OF TAPWAY’S AI AND NVIDIA GPUS BY PLUS IN RFID-BASED TOLL TRACKING SYSTEMS

5.10 TRADE DATA

5.10.1 IMPORT DATA

TABLE 6 IMPORT DATA FOR HS CODE 8530, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.10.2 EXPORT DATA

TABLE 7 EXPORT DATA FOR HS CODE 8530, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.11 PATENT ANALYSIS

TABLE 8 NOTABLE PATENTS PERTAINING TO ELECTRONIC TOLL COLLECTION MARKET

TABLE 9 NUMBER OF PATENTS REGISTERED RELATED TO ELECTRONIC TOLL COLLECTION MARKET IN LAST 10 YEARS

FIGURE 24 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 25 NO. OF PATENTS GRANTED PER YEAR, 2012–2021

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 ELECTRONIC TOLL COLLECTION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 REGULATORY LANDSCAPE

5.13.1 NORTH AMERICA

5.13.2 EUROPE

5.13.3 ASIA PACIFIC

5.13.4 ROW

5.14 PRICING ANALYSIS

5.14.1 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY MARKET PLAYERS

FIGURE 26 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT

TABLE 11 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT (USD)

6 ELECTRONIC TOLL COLLECTION MARKET, BY TYPE (Page No. - 92)

6.1 INTRODUCTION

FIGURE 27 TRANSPONDER-/TAG-BASED TOLLING SYSTEM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 12 ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 13 ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 TRANSPONDER-/TAG-BASED TOLLING SYSTEMS

6.2.1 RISING USE OF TRANSPONDERS FOR VEHICLE IDENTIFICATION TO DRIVE MARKET GROWTH

TABLE 14 TRANSPONDER-/TAG-BASED TOLLING SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 TRANSPONDER-/TAG-BASED TOLLING SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 OTHER TOLLING SYSTEMS

6.3.1 CASE STUDY: SANTIAGO USES ELECTRONIC TOLLING ON URBAN HIGHWAYS TO GENERATE SIGNIFICANT INFRASTRUCTURE REVENUE WITHOUT IMPEDING TRAFFIC FLOW

TABLE 16 OTHER TOLLING SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 OTHER TOLLING SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY (Page No. - 98)

7.1 INTRODUCTION

FIGURE 28 RFID TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGEST SHARE OF THE MARKET DURING FORECAST PERIOD

TABLE 18 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 RADIO FREQUENCY IDENTIFICATION (RFID)

7.2.1 HIGH ADOPTION OF RFID-BASED TOLL COLLECTION SYSTEMS TO DRIVE MARKET GROWTH

TABLE 20 RFID TECHNOLOGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 RFID TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 DEDICATED SHORT-RANGE COMMUNICATION (DSRC)

7.3.1 INCREASING DEPLOYMENT OF DSRC-BASED ELECTRONIC TOLL COLLECTION SYSTEMS IN EUROPE TO FUEL MARKET GROWTH

TABLE 22 DSRC TECHNOLOGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 DSRC TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 OTHERS

TABLE 24 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING (Page No. - 107)

8.1 INTRODUCTION

FIGURE 29 BACK-OFFICE AND OTHER SERVICES SEGMENT TO HOLD LARGER MARKET SHARE AND GROW AT FASTER RATE DURING FORECAST PERIOD

TABLE 26 ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 27 ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

8.2 HARDWARE

8.2.1 RISING DEMAND FOR ADVANCED TOLLING SYSTEMS TO BOOST MARKET GROWTH

8.2.2 CASE STUDY: USE OF RFID-BASED TRANSPORTATION SYSTEMS

TABLE 28 HARDWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 HARDWARE: MARKET, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 31 HARDWARE: MARKET, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

8.3 BACK-OFFICE AND OTHER SERVICES

8.3.1 INCREASING REQUIREMENT FOR PROCESSING HIGH-VOLUME TRANSACTIONS TO FUEL DEMAND FOR BACK-OFFICE AND OTHER SERVICES

8.3.2 CASE STUDY: USE OF EXADEL’S SERVICES

TABLE 32 BACK-OFFICE AND OTHER SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 BACK-OFFICE AND OTHER SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION (Page No. - 114)

9.1 INTRODUCTION

FIGURE 30 HIGHWAYS APPLICATION SEGMENT TO HOLD LARGER SHARE OF ELECTRONIC TOLL COLLECTION MARKET DURING FORECAST PERIOD

TABLE 34 ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 35 ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 HIGHWAYS

9.2.1 GOVERNMENT PLANS TO PROMOTE FASTER DIGITAL PAYMENTS AT TOLL PLAZAS TO INCREASE INSTALLATION OF ELECTRONIC TOLL COLLECTION SYSTEMS ON HIGHWAYS

TABLE 36 HIGHWAYS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 HIGHWAYS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 URBAN AREAS

9.3.1 RISING DEPLOYMENT OF ELECTRONIC TOLL COLLECTION SOLUTIONS TO ENSURE CONGESTION-FREE TRAFFIC FLOW IN URBAN AREAS TO PROPEL MARKET GROWTH

TABLE 38 URBAN AREAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 URBAN AREAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ELECTRONIC TOLL COLLECTION MARKET, BY REGION (Page No. - 120)

10.1 INTRODUCTION

FIGURE 31 ASIA PACIFIC ELECTRONIC TOLL COLLECTION MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 40 ELECTRONIC TOLL COLLECTION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 ELECTRONIC TOLL COLLECTION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: SNAPSHOT OF ELECTRONIC TOLL COLLECTION MARKET

TABLE 42 NORTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate North American electronic toll collection market during forecast period

TABLE 52 US: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 US: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 55 US: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 56 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 57 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Rising implementation of electronic toll collection systems on major highways and bridges to drive Canadian market growth

TABLE 58 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 60 CANADA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 61 CANADA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 62 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 63 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Increasing number of projects for connecting neighboring countries to propel market growth

TABLE 64 MEXICO: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 65 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 66 MEXICO: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 67 MEXICO: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 68 MEXICO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 33 EUROPE: SNAPSHOT OF ELECTRONIC TOLL COLLECTION MARKET

TABLE 70 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 EU5

10.3.1.1 Increasing collaborations between automobile companies and technology providers to fuel market growth

TABLE 80 EU5: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 81 EU5: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 EU5: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 83 EU5: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 84 EU5: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 85 EU5: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.2 WESTERN EUROPE

10.3.2.1 New installations and modifications of electronic toll collection systems in Western Europe to fuel market growth

TABLE 86 WESTERN EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 87 WESTERN EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 88 WESTERN EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 89 WESTERN EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 90 WESTERN EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 WESTERN EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 REST OF EUROPE

TABLE 92 REST OF EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 REST OF EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 95 REST OF EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 96 REST OF EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 REST OF EUROPE: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: SNAPSHOT OF ELECTRONIC TOLL COLLECTION MARKET

TABLE 98 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to be prominent market for electronic toll collection in Asia Pacific during forecast period

TABLE 108 CHINA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 109 CHINA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 CHINA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 111 CHINA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 112 CHINA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 113 CHINA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Growing need for reducing traffic congestion near tollgates and providing convenience to drivers to fuel market growth

TABLE 114 JAPAN: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 115 JAPAN: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 JAPAN: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 117 JAPAN: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 118 JAPAN: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 JAPAN: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Technological advancements in electronic toll collection systems to drive market growth

TABLE 120 SOUTH KOREA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 121 SOUTH KOREA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 122 SOUTH KOREA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 123 SOUTH KOREA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 124 SOUTH KOREA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 125 SOUTH KOREA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 126 REST OF ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 REST OF ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 129 REST OF ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 130 REST OF ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 ROW

TABLE 132 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 133 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 134 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 135 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 136 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 137 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 138 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 139 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 140 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 141 ROW: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Growing need to streamline traffic flow on highways and urban roads to propel market growth

TABLE 142 MIDDLE EAST & AFRICA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Wide network of roads to fuel deployment of electronic toll collection systems

TABLE 148 SOUTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 149 SOUTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 SOUTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 151 SOUTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 152 SOUTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 153 SOUTH AMERICA: ELECTRONIC TOLL COLLECTION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 161)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 154 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET SHARE ANALYSIS: ELECTRONIC TOLL COLLECTION MARKET, 2021

TABLE 155 ELECTRONIC TOLL COLLECTION MARKET: DEGREE OF COMPETITION, 2021

11.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 35 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN ELECTRONIC TOLL COLLECTION MARKET

11.5 COMPANY EVALUATION QUADRANT: ELECTRONIC TOLL COLLECTION MARKET

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 36 ELECTRONIC TOLL COLLECTION COMPANY EVALUATION QUADRANT, 2021

11.6 COMPANY FOOTPRINT

TABLE 156 OVERALL COMPANY FOOTPRINT

TABLE 157 COMPANY: TECHNOLOGY FOOTPRINT

TABLE 158 OFFERING: COMPANY FOOTPRINT

TABLE 159 REGION: COMPANY FOOTPRINT

11.7 STARTUP EVALUATION MATRIX: ELECTRONIC TOLL COLLECTION MARKET

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

TABLE 160 LIST OF STARTUPS IN ELECTRONIC TOLL COLLECTION MARKET

FIGURE 37 ELECTRONIC TOLL COLLECTION MARKET, STARTUP/SME EVALUATION MATRIX, 2021

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 161 PRODUCT LAUNCHES, 2019–2022

11.8.2 DEALS

TABLE 162 DEALS, 2020–2022

12 COMPANY PROFILES (Page No. - 178)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

12.2.1 KAPSCH TRAFFICCOM AG

TABLE 163 KAPSCH TRAFFICCOM AG: COMPANY SNAPSHOT

FIGURE 38 KAPSCH TRAFFICCOM AG: COMPANY SNAPSHOT

TABLE 164 KAPSCH TRAFFICCOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 165 KAPSCH TRAFFICCOM AG: DEALS

12.2.2 CONDUENT, INC.

TABLE 166 CONDUENT, INC.: COMPANY SNAPSHOT

FIGURE 39 CONDUENT, INC.: COMPANY SNAPSHOT

TABLE 167 CONDUENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 CONDUENT, INC.: DEALS

12.2.3 EFKON GMBH

TABLE 169 EFKON GMBH: COMPANY SNAPSHOT

TABLE 170 EFKON GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 EFKON GMBH: PRODUCT LAUNCHES

TABLE 172 EFKON GMBH: OTHERS

12.2.4 TRANSCORE

TABLE 173 TRANSCORE: COMPANY SNAPSHOT

TABLE 174 TRANSCORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 175 TRANSCORE: PRODUCT LAUNCHES

TABLE 176 TRANSCORE: DEALS

12.2.5 THALES

TABLE 177 THALES: COMPANY SNAPSHOT

FIGURE 40 THALES: COMPANY SNAPSHOT

TABLE 178 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 THALES: DEALS

12.2.6 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 180 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FIGURE 41 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 181 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 182 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

12.2.7 CUBIC CORPORATION

TABLE 183 CUBIC CORPORATION: COMPANY SNAPSHOT

FIGURE 42 CUBIC CORPORATION: COMPANY SNAPSHOT

TABLE 184 CUBIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 185 CUBIC CORPORATION: PRODUCT LAUNCHES

12.2.8 SIEMENS

TABLE 186 SIEMENS: COMPANY SNAPSHOT

FIGURE 43 SIEMENS: COMPANY SNAPSHOT

TABLE 187 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 SIEMENS: PRODUCT LAUNCHES

TABLE 189 SIEMENS: DEALS

12.2.9 NEOLOGY, INC.

TABLE 190 NEOLOGY, INC.: COMPANY SNAPSHOT

TABLE 191 NEOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 NEOLOGY, INC.: DEALS

12.2.10 FEIG ELECTRONIC

TABLE 193 FEIG ELECTRONIC: COMPANY SNAPSHOT

TABLE 194 FEIG ELECTRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 FEIG ELECTRONIC: PRODUCT LAUNCHES

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 TOSHIBA CORPORATION

12.3.2 MITSUBISHI HEAVY INDUSTRIES, LTD.

12.3.3 Q-FREE

12.3.4 QUARTERHILL INC. (INTERNATIONAL ROAD DYNAMICS)

12.3.5 PERCEPTICS LLC.

12.3.6 STAR SYSTEMS INTERNATIONAL LTD.

12.3.7 G.E.A.

12.3.8 ARH INC.

12.3.9 SICE

12.3.10 JENOPTIK AG

12.3.11 FAR EASTERN ELECTRONIC TOLL COLLECTION CO. LTD. (FETC)

12.3.12 TOLL COLLECT GMBH

12.3.13 GEOTOLL

12.3.14 INDRA SISTEMAS, S.A.

12.3.15 KISTLER GROUP

13 APPENDIX (Page No. - 227)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORT

13.5 AUTHOR DETAILS

The study involved four major activities for estimating the size of the electronic toll collection market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the electronic toll collection market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the electronic toll collection market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involves electronic toll collection magazines, journals. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the electronic toll collection market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

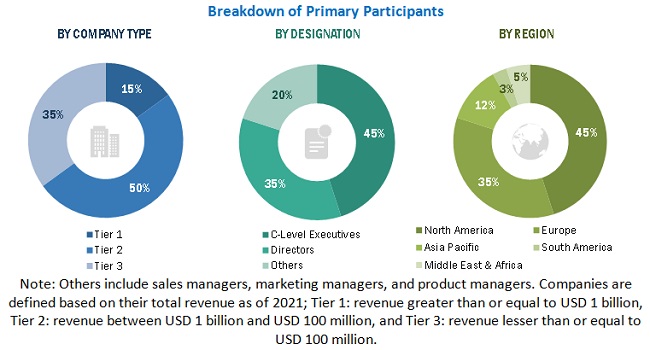

Extensive primary research has been conducted after acquiring an understanding of the electronic toll collection market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and Middle East, Africa, and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of electronic toll collection market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The supply chain and the size of the electronic toll collection market, in terms of value, have been determined through primary and secondary research processes.

- Several primary interviews have been conducted with key opinion leaders related to electronic toll collection market including key OEMs, IDMs, and Tier I suppliers and software developers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size

Global Electronic Toll Collection Market Size: Bottom-up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the electronic toll collection market.

Report Objectives

- To describe and forecast the electronic toll collection market based on type, technology, offering, and application, in terms of value

- To describe and forecast the electronic toll collection market by offering, in terms of volume

- To describe and forecast the market size for four major regions: North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To analyze the qualitative aspects such as parameters and payment methods pertaining to electronic toll collection, value chain, and industry trends

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To provide key technology trends and patent analysis related to the electronic toll collection market

- To provide information regarding trade data related to the electronic toll collection market

- To strategically profile key players in the market and comprehensively analyze their market rankings and core competencies

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market rankings/shares and product portfolios

- To analyze competitive developments such as contracts, product launches, expansions, and research and development (R&D) activities conducted by players in the electronic toll collection market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

- Additional country-level analysis of electronic toll collection market

- Estimation of the market size of the segments of the electronic toll collection market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electronic Toll Collection Market

very nice study for Electronic Toll Collection (ETC) system.

I am looking for a section of this report that specifies what % of toll roads by country/region are using electronic tolling. As an example for the India and Australia, I would like to know how many toll transactions are processed a year (in any form) and how many of those are processed through electronic tolling. Is that included within this report?

I am a technology provider for ETC in the Europe region. I am interested in your overview of the international ETC market and what market trends you have identified. Does your report include information specific to top regional countries in each region such as UK, Germany, France, Italy,US, Canada, China, India, Australia, Japan, Middle Eastern countries etc.?

I am a consultant working on RFID technology. Could your report help me in analyzing the newest RFID based toll collection solutions currently used? Is there a solution that can be made to secure encryption / decryption on the servers of the relevant authority without the need to install an encryption key to the RFID reader with the software and network infrastructure to be produced within the scope of the project?

I am looking for latest e-toll market report that informs about market dynamics, company profiles and shares, tecnological trends etc. Does the report provide infromation about countrywise ETC projects, entities involved, cost of project and other related information?

More Information is required on Global Electronic Toll Collection systems

We are the biggest back office service providers in the Central Europe. Looking forward to information about the competitive landscape of the major players in the back-office segment of the ETC. Could you provide market share/ranking of such companies globally? Also, could you share the list of contracts of these companies for last 2-3 years?