Elevators & Escalators Market by Type (Elevators, Escalators, Moving walkways), Service(New installation, Maintenance & Repair, and Modernization), Elevator Technology (Traction, Machine-Room-Less, & Hydraulic), & End-use Industry (2022 - 2026)

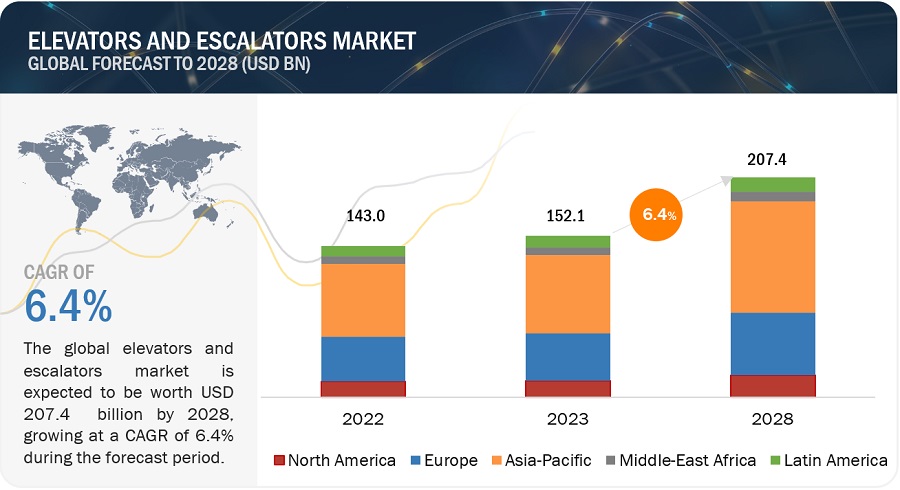

The elevators & escalators market is projected to reach USD 183.2 billion by 2026, at a CAGR of 6.4%. The elevators and escalators market is expected to witness significant growth in the coming years due to its increased demand across the residential, commercial and infrastructure industries.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Elevators & Escalators Market

With the surge of COVID-19 instances, emergency measures were implemented, as well as there was suspension of numerous activities and facilities in 2020. Since most worldwide elevators & escalators firms have their headquarters in APAC, European, and North American countries, the COVID-19 epidemic in it has hampeed the elevator and escalator markets. The impact of COVID-19 produced a disturbance in the supply chain, which delayed market expansion owing to a scarcity of raw materials and a personnel shortage. The COVID-19 pandemic had a little influence on the elevators and escalators industry in 2020, with a minor reduction in CAGR. Reduced raw material output and supply chain issues have impacted the market.

Elevators & Escalators Market Dynamics

Driver: Growing need for reducing energy consumption in buildings

Owing to rapid industrialization and urbanization, a high amount of energy is consumed across the globe. According to the US Energy Information Administration, commercial buildings consumed ~20% of the energy in 2020, an increase of 72% in the energy consumption since 1980. Besides, cities across the globe are responsible for 75% of CO2 (carbon dioxide) emissions and the consumption of three-quarters of natural resources. Owing to these factors, effective and smart energy utilization has been mandated by various governments across the globe.

The US Green Buildings Council developed the Leadership in Energy and Environmental Design (LEED) rating system for reducing environmental burden and promoting the concept of sustainable buildings. A similar trend has been witnessed in the European region, where European Green Building Councils announced the development of 10 national roadmaps and an EU policy roadmap for decarbonizing the building environments.

-

The adoption of smart elevators would reduce this dependency and consumption rate. Elevator manufacturers are manufacturing elevators for mid- and high-rise buildings that are energy-efficient and are incorporating smart controls, hardware, and other systems that consume low energy..

Restraint: Uncertainty and risk regarding global economy

The elevators & escalators market is influenced by the global economy and the construction industry. The demand for these products is primarily driven by residential and non-residential construction activities. Although the global economy is showing some recovery from the COVID-19 pandemic, uncertainty and risks still remain prominent.

Economic slowdown directly impacts several macroeconomic factors, such as employment level, business activities, consumer confidence, disposable income, and interest rates in the country. This may negatively impact investment level in the construction industry and hence, impact the growth of the elevators & escalators market.

Opportunity: Adoption of green building codes and energy-efficient products

The growing environmental concerns have increased the demand for green products that are sustainable and environment-friendly. Consumer expectations for value-added products are steadily shifting toward premium green building materials for elevators, escalators, and moving walkways. The use of green building materials can help reduce emissions, significantly. These materials help save energy. Attain sustainability, reduce emissions, and conserve the environment.

According to Urban Hub, an interactive platform for people working on the future of smart cities and mobility, the global energy demand is expected to increase by 20%-35% in the next 15 years, with cities accounting for approximately two-thirds of the projected energy consumption. By 2030, buildings is expected to be the largest consumer sector, accounting for 31% of the global energy consumed. According to a study conducted by the American Council for an Energy-efficient Economy (ACEEE), Elevators and escalators can consume 2%-5% of the energy used in buildings, which may reach 50% during peak operational times. This represents an important alternative through which global energy consumption can be reduced and sustainability can be attained.

Rating systems, such as Building Research Establishment’s Environmental Assessment Method (BREEAM) And Leadership in Energy and Environmental Design (LEED) monitor building specifications, design, construction, and use. These rating systems aim to encourage clients, designers, and others to consider low-impact design and low carbon emission, which, eventually, is expected to result in the minimization of energy demand created by the buildings.

Challenge: Compliance with standards and regulations

Elevators and escalators are subject to stringent restrictions and standards, which may stifle the market. Compliance with rules and standards is essential since even the tiniest flaw in a product might endanger a user's life. The American Society of Mechanical Engineers (ASME), the Elevator and Escalator Safety Trust, the Elevator Escalator Safety Foundation, and the Texas Health and Safety Code Safety's Elevator Advisory Board (Board) have all outlined several rules and regulations in the industry to ensure public safety. The ASME, for example, has created important regulations covering escalator, elevator, moving walkway, and related equipment safety in design, installation, operation, inspection, testing, maintenance, alteration, and repair. One of the bi-national codes for the elevators and escalators sector is ASME A17.7-2007/CSA B44.7-07. Manufacturers are required to follow these regulations, as a single defect in the working of these equipment may result in accidents, further impacting a company's profit.

In terms of value & volume, machine-room-less traction elevator dominated the elevators and escalators market in 2020

machine-room-less traction elevator, by elevator technology, accounted for the largest share in the elevators and escalators market The machine-room-less elevator technology is a relatively new technology and is the result of technological advancements. This technology has resulted into a significant reduction in the size of electric motors used with traction equipment. This equipment possesses newly designed permanent magnet motors (PMM). They also eliminate the cost and environmental concerns that are usually associated with a buried hydraulic cylinder filled with hydraulic oil. Machine room-less elevators also utilize a gearless traction type machine. This results in superior performance and ride quality.

Significant increase in the demand for elevators and escalators in the residential industry

Residential, by end-use industry, accounted for the largest share in elevators and escalators in 2020, in terms of value and volume. The global residential market is being driven by the growing sophistication of living standards in emerging economies. Emerging economies, such as India, China, and Southeast Africa, are witnessing unprecedented growth in urbanization as the population in these countries is migrating to cities for employment. Consequently, the construction of high-rise buildings—that almost invariably are equipped with smart elevators—has become rather necessary to accommodate a sizeable population in cities. The growth of the real estate industry in developing countries is also a key metric for the growth of the segment.

APAC region to lead the global elevators and escalators market by 2026.

The APAC region is projected to lead the elevators and escalators market, in terms of both value and volume from 2021 to 2026. The market in Asia Pacific is led by the growing demand from China and India. The easy availability of raw materials, low labor costs, and a moderately stringent regulatory framework in these developing countries are some of the factors driving the market. In Asia Pacific, China, India, and Japan are the key markets, whereas the US is the major market in North America. The increasing scope of elevators and escalators in the residential, commercial and infrastructure industries in the region is expected to drive the elevators and escalators market in APAC. Industrialization, growing middle-class population, rising disposable income, and changing lifestyles are expected to drive the demand for elevators and escalators during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Elevators & Escalators Market

Key manufacturers in the elevators and escalators market are Schindler Group (Switzerland), Otis Elevator (US), Thyssenkrupp AG (Germany), KONE Corporation (Finland), and Hitachi Ltd. (Japan), amongst others.

Elevators & Escalators Market Report Scope

Report Metric

Details

Market size available for years

2019-2026

Base year considered

2020

Forecast period

2021-2026

Forecast units

Value (USD Million) and Volume (Million Units)

Segments covered

Type, Service, Elevator Technology, End-use Industry, And Region

Geographies covered

North America, APAC, Europe, Middle East & Africa, and South America

Companies covered

Schindler Group (Switzerland), Otis Elevator (US), Thyssenkrupp AG (Germany), KONE Corporation (Finland), and Hitachi Ltd. (Japan), among others.

25 manufacturers are covered in the elevators and escalators market.This research report categorizes the elevators and escalators market based on type, service, elevator technology, end-use industry and region.

Based on Type:

- Elevator

- Escalator

- Moving Walkways

Based on Service:

- New installation

- Maintenance & repair

- Modernization

Based on Elevator Technology:

- Traction elevator

- Machine room less traction elevator

- Hydraulic

Based on End-use Industry:

- Residential

- Commercial

- Institutional

- Infrastructure

- Others

Based on region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments in Elevators & Escalators Market

- In February 2021, Schindler signed a partnership agreement with citizenM hotels, the leading Netherlands-based boutique hotel chain, to provide service and modernization for escalators and elevators in all of the Group’s existing buildings across the globe, as well as the installation of future vertical mobility solutions in the chain’s new hotels.

- In October 2020, Hitachi Ltd. acquired 9.99% share in Yungtay Engineering (Taiwan) to strengthen its elevator and escalator business. To date, Hitachi has acquired ~51% share in Yungtgay.

- In July 2020, CCL Industries Inc. acquired InTouch Labels and Packaging Co., Inc. (InTouch), near Boston, Massachusetts. InTouch is a specialized short-run digital label converter and was added to Avery’s direct-to-consumer operations.

- In August 2020, Otis acquired Bay State Elevator to expand in the northeast US. The acquisition includes the company service portfolio and operations in Massachusetts, Connecticut, Vermont, and upstate New York.

Frequently Asked Questions (FAQ):

What is the current size of the global elevators and escalators market?

The global elevators and escalators market size is projected to grow from USD 134.4 billion in 2021 to USD 183.2 billion by 2026, at a CAGR of 6.4% from 2021 to 2026.

Who are the key players in the global elevators and escalators market?

Key manufacturers in the elevators and escalators market are Schindler Group (Switzerland), Otis Elevator (US), Thyssenkrupp AG (Germany), KONE Corporation (Finland), and Hitachi Ltd. (Japan), amongst others.

What are the factors driving the growth of the elevators and escalators market?

The growth of the elevators and escalators market is attributed to the increase in demand for elevators and escalators in end-use industries, particularly for the residential industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 ELEVATORS & ESCALATORS MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 ELEVATORS & ESCALATORS MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

FIGURE 3 APPROACH 1: BOTTOM-UP APPROACH

FIGURE 4 APPROACH 2: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

FIGURE 5 DATA TRIANGULATION

2.4 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.5.3 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 7 NEW INSTALLATION TO BE LARGEST SERVICE SEGMENT OF ELEVATORS & ESCALATORS MARKET

FIGURE 8 RESIDENTIAL TO BE FASTEST-GROWING END-USE INDUSTRY MARKET SEGMENT

FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING ELEVATORS & ESCALATORS MARKET

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ASIA PACIFIC TO GROW AT A HIGHER RATE DUE TO RAPID INDUSTRIALIZATION AND INCREASING END-USE INDUSTRIES

FIGURE 10 EXPANSIONS AND ACQUISITIONS TO OFFER LUCRATIVE OPPORTUNITIES IN ELEVATORS & ESCALATORS MARKET

4.2 ELEVATORS & ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY

FIGURE 11 MACHINE-ROOM-LESS TRACTION ELEVATOR SEGMENT TO BE THE FASTEST-GROWING ELEVATOR TECHNOLOGY

4.3 ELEVATORS & ESCALATORS MARKET, BY TYPE

FIGURE 12 ELEVATORS TYPE SEGMENT TO LEAD ELEVATORS & ESCALATORS MARKET

4.4 ELEVATORS & ESCALATORS MARKET, BY REGION AND END-USE INDUSTRY

FIGURE 13 ASIA PACIFIC AND RESIDENTIAL LED THEIR RESPECTIVE SEGMENTS IN ELEVATORS & ESCALATORS MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ELEVATORS & ESCALATORS MARKET

5.2.1 DRIVERS

5.2.1.1 Increased construction of high-rise buildings equipped with smart vertical transportation systems due to rapid urbanization

FIGURE 15 URBAN AND RURAL POPULATION 1950–2050

5.2.1.2 Growing need for reducing energy consumption in buildings

5.2.1.3 Growing aging population to facilitate development of better infrastructure within buildings

FIGURE 16 NUMBER OF PEOPLE AGED 65 YEARS AND ABOVE, BY REGION, 2019 AND 2050

5.2.2 RESTRAINTS

5.2.2.1 Uncertainty and risk regarding global economy

5.2.2.2 High maintenance cost

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of green building codes and energy-efficient products

5.2.3.2 Development of innovative technologies and rising demand for smart elevators

5.2.4 CHALLENGES

5.2.4.1 Compliance with standards and regulations

5.2.4.2 Economic slowdown

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 ELEVATORS & ESCALATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 3 ELEVATORS & ESCALATORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN

FIGURE 18 ELEVATORS & ESCALATORS MARKET: VALUE CHAIN

5.4.1 RESEARCH & DEVELOPMENT

5.4.2 COMPONENT MANUFACTURER

5.4.3 MANUFACTURER

5.4.4 SOFTWARE & SERVICE

5.4.5 INTEGRATOR

5.4.6 END-USE APPLICATION

5.5 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS

5.5.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR ELEVATORS & ESCALATORS MANUFACTURERS

FIGURE 19 REVENUE SHIFT FOR ELEVATORS & ESCALATORS MANUFACTURERS

5.6 REGULATORY LANDSCAPE

5.6.1 CONTAINER COMPLIANCE OPTIONS FOR SAFETY AND ACCESSIBILITY IN EUROPE

5.6.2 LIFT/ELEVATOR STANDARDS IN ASIA PACIFIC (INDIA)

5.7 TECHNOLOGY TRENDS

5.7.1 ADOPTION OF ECO-FRIENDLY PRODUCTS

5.7.2 ARTIFICIAL INTELLIGENCE

5.7.3 INTUITIVE ELEVATOR TECHNOLOGY

5.7.4 INTERNET OF THINGS

5.7.5 CONNECTIVITY 5G TECHNOLOGY

5.8 CASE STUDY ANALYSIS

5.8.1 CASE STUDY 1: ELEVATORS GURGAON MEDANTA

5.8.2 CASE STUDY 2: ENERGY-EFFICIENT BUILDING INITIATIVE MUMBAI- THE RUBY BUILDING SYSTEMS – ELEVATORS

5.8.3 CASE STUDY 3: HONEYWELL- CORPORATE OFFICE RENOVATIONS

5.8.4 CASE STUDY 4: KONE CORPORATION- 180 BRISBANE COMMERCIAL OFFICES, AUSTRALIA

5.9 ECOSYSTEM

FIGURE 20 ECOSYSTEM FOR ELEVATORS & ESCALATORS MARKET

5.10 PRICING ANALYSIS

TABLE 4 AVERAGE PRICES OF ELEVATORS & ESCALATORS, BY REGION (USD/UNIT)

5.11 TRADE ANALYSIS

TABLE 5 ELEVATORS & ESCALATORS IMPORT TRADE DATA, 2020 (USD THOUSAND)

TABLE 6 ELEVATORS & ESCALATORS EXPORT TRADE DATA, 2020 (USD THOUSAND)

5.12 PATENT ANALYSIS

5.12.1 INTRODUCTION

5.12.2 METHODOLOGY

5.12.3 DOCUMENT TYPE

FIGURE 21 TOTAL PATENTS- LAST 10 YEARS

FIGURE 22 PUBLICATION TRENDS - LAST 10 YEARS

5.12.4 INSIGHT

5.12.5 LEGAL STATUS OF THE PATENTS

FIGURE 23 LEGAL STATUS OF THE PATENTS

5.12.6 JURISDICTION ANALYSIS

FIGURE 24 JURISDICTION ANALYSIS

5.12.7 TOP COMPANIES/APPLICANTS

FIGURE 25 TOP COMPANIES/APPLICANTS

TABLE 7 LIST OF PATENTS BY MITSUBISHI ELECTRIC CORPORATION.

TABLE 8 LIST OF PATENTS BY OTIS ELEVATOR COMPANY

TABLE 9 LIST OF PATENTS BY KONE CORPORATION

TABLE 10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.13 COVID-19 IMPACT ON ELEVATORS & ESCALATORS MARKET

5.13.1 COVID-19 IMPACT ON CONSTRUCTION INDUSTRY

6 ELEVATORS & ESCALATORS MARKET, BY TYPE (Page No. - 68)

6.1 INTRODUCTION

FIGURE 26 ELEVATOR TYPE SEGMENT TO LEAD ELEVATORS & ESCALATORS MARKET

TABLE 11 ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

6.2 ELEVATORS

6.2.1 ELEVATORS SEGMENT TO DOMINATE THE MARKET

6.2.2 PASSENGER ELEVATOR

6.2.2.1 Bed elevator

6.2.2.2 Service elevator

6.2.2.3 Observation elevator

6.2.2.4 Residential elevator

6.2.3 FREIGHT ELEVATOR

6.2.3.1 Dumbwaiters

6.2.3.2 Vehicle elevators

6.2.4 OTHERS

6.3 ESCALATORS

6.3.1 BOOM IN REAL ESTATE SECTOR AND NEED FOR EFFICIENT & RAPID TRANSIT SYSTEMS ARE DRIVING MARKET

6.4 MOVING WALKWAYS

6.4.1 MUSHROOMING OF AIRPORTS AND SHOPPING MALLS IS DRIVING MARKET

7 ELEVATORS & ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY (Page No. - 73)

7.1 INTRODUCTION

FIGURE 27 MACHINE-ROOM-LESS TRACTION ELEVATOR SEGMENT TO BE THE FASTEST-GROWING SEGMENT

TABLE 13 ELEVATORS & ESCALATORS MARKET SIZE, BY ELEVATOR TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 14 ELEVATORS & ESCALATORS MARKET SIZE, BY ELEVATOR TECHNOLOGY, 2019–2026 (THOUSAND UNITS)

7.2 TRACTION ELEVATOR

7.2.1 LIGHTWEIGHT PROPERTIES DRIVE MARKET GROWTH

7.3 MACHINE-ROOM-LESS TRACTION ELEVATOR

7.3.1 COST-EFFECTIVENESS AND SUPERIOR PERFORMANCE OF TECHNOLOGY DRIVE SEGMENT

7.4 HYDRAULIC

7.4.1 TECHNICAL SPECIALITIES OF TECHNOLOGY HAS LED TO INCREASE IN DEMAND FOR SEGMENT

8 ELEVATORS & ESCALATORS MARKET, BY SERVICE (Page No. - 76)

8.1 INTRODUCTION

FIGURE 28 NEW INSTALLATION TO BE LARGEST SERVICE SEGMENT DURING FORECAST PERIOD

TABLE 15 ELEVATORS & ESCALATORS MARKET SIZE, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 16 ELEVATORS & ESCALATORS MARKET SIZE, BY SERVICE, 2019–2026 (THOUSAND UNITS)

8.2 NEW INSTALLATION

8.2.1 SURGE IN URBANIZATION AND RISE IN CONSTRUCTION ACTIVITIES TO DRIVE THE SEGMENT

8.3 MAINTENANCE & REPAIR

8.3.1 GROWING CONCERN TOWARD AGING ELEVATORS IS DRIVING SEGMENT

8.4 MODERNIZATION

8.4.1 INNOVATIVE TECHNOLOGIES AND NEED TO REPLACE AGING AND OBSOLETE SYSTEMS ARE DRIVING MARKET FOR SEGMENT

9 ELEVATORS & ESCALATORS MARKET, BY END-USE INDUSTRY (Page No. - 79)

9.1 INTRODUCTION

FIGURE 29 RESIDENTIAL TO BE FASTEST-GROWING END-USE INDUSTRY SEGMENT

TABLE 17 ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 18 ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

9.2 RESIDENTIAL

9.2.1 GROWING HIGH-RISE RESIDENTIAL BUILDING CONSTRUCTION IS FUELING DEMAND FOR ENERGY-EFFICIENT ELEVATORS

9.3 COMMERCIAL

9.3.1 NEED TO OPTIMIZE TRAFFIC FLOW IN ELEVATORS IN COMMERCIAL SPACES TO RAISE DEMAND FOR SMART ELEVATORS

9.4 INSTITUTIONAL

9.4.1 RISING DEMAND FOR NEW INSTITUTIONS IS LEADING TO GROWTH OF SEGMENT

9.5 INFRASTRUCTURAL

9.5.1 RAPID URBANIZATION IS DRIVING GROWTH OF SEGMENT

9.6 OTHERS

10 ELEVATORS & ESCALATORS MARKET, BY REGION (Page No. - 83)

10.1 INTRODUCTION

TABLE 19 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 30 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 20 ELEVATORS & ESCALATORS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 ELEVATORS & ESCALATORS MARKET SIZE, BY REGION, 2019–2026 (THOUSAND UNITS)

10.2 ASIA PACIFIC

10.2.1 IMPACT OF COVID-19 IN ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SNAPSHOT

TABLE 22 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 24 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 25 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 26 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 27 ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.2 CHINA

10.2.2.1 China to continue leading in Asia Pacific elevators & escalators market

TABLE 28 CHINA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 29 CHINA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 30 CHINA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 31 CHINA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.3 INDIA

10.2.3.1 Government initiatives for 100 smart cities to fuel growth

TABLE 32 INDIA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 33 INDIA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 34 INDIA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 35 INDIA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.4 JAPAN

10.2.4.1 Surging adoption of smart technologies to boost market

TABLE 36 JAPAN: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 JAPAN: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 38 JAPAN: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 39 JAPAN: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.5 SOUTH KOREA

10.2.5.1 Increasing government initiatives for smart cities is boosting the market

TABLE 40 SOUTH KOREA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 SOUTH KOREA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 42 SOUTH KOREA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 43 SOUTH KOREA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.6 REST OF ASIA PACIFIC

TABLE 44 REST OF ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 REST OF ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 46 REST OF ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 47 REST OF ASIA PACIFIC: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3 EUROPE

TABLE 48 EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 49 EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 50 EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 52 EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.1 UK

10.3.1.1 Market is growing due to innovation in development of smart cities and new technologies

TABLE 54 UK: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 UK: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 56 UK: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 57 UK: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.2 GERMANY

10.3.2.1 Germany leads elevators & escalators market in Europe

TABLE 58 GERMANY: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 GERMANY: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 60 GERMANY: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 61 GERMANY: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.3 FRANCE

10.3.3.1 Upgradation in elevator technology to boost market

TABLE 62 FRANCE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 FRANCE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 64 FRANCE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 65 FRANCE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.4 ITALY

10.3.4.1 Increasing investment in construction industry to drive the market

TABLE 66 ITALY: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 ITALY: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 68 ITALY: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 69 ITALY: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.5 SPAIN

10.3.5.1 Sustainability in construction industry to drive the market

TABLE 70 SPAIN: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 SPAIN: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 72 SPAIN: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 73 SPAIN: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.6 REST OF EUROPE

TABLE 74 REST OF EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 REST OF EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 76 REST OF EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 77 REST OF EUROPE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4 NORTH AMERICA

TABLE 78 NORTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 80 NORTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: ELEVATORS &ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 82 NORTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.1 US

10.4.1.1 US to lead market in North America by 2026

TABLE 84 US: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 US: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 86 US: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 87 US: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.2 CANADA

10.4.2.1 Investment in residential segment to have growth opportunities

TABLE 88 CANADA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 CANADA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 90 CANADA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 91 CANADA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.3 MEXICO

10.4.3.1 Growth of commercial constructions to accelerate market growth

TABLE 92 MEXICO: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 MEXICO: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 94 MEXICO: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 95 MEXICO: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5 MIDDLE EAST & AFRICA

10.5.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

TABLE 96 MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 98 MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 100 MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.2 UAE

10.5.2.1 Growing demand from commercial and infrastructure industries to boost market

TABLE 102 UAE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 UAE: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 104 UAE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 105 UAE: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.3 SAUDI ARABIA

10.5.3.1 Increasing infrastructural spending to drive market

TABLE 106 SAUDI ARABIA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 SAUDI ARABIA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 108 SAUDI ARABIA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 109 SAUDI ARABIA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 110 REST OF MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 REST OF MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 112 REST OF MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 113 REST OF MIDDLE EAST & AFRICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6 SOUTH AMERICA

10.6.1 IMPACT OF COVID-19 IN SOUTH AMERICA

TABLE 114 SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 115 SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 116 SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 118 SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 119 SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6.2 BRAZIL

10.6.2.1 Increasing demand for residential & nonresidential construction is driving market growth

TABLE 120 BRAZIL: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 BRAZIL: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 122 BRAZIL: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 123 BRAZIL: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6.3 ARGENTINA

10.6.3.1 Residential to be the largest segment of elevators & escalators market in the country

TABLE 124 ARGENTINA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 ARGENTINA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 126 ARGENTINA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 127 ARGENTINA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6.4 REST OF SOUTH AMERICA

TABLE 128 REST OF SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 REST OF SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNITS)

TABLE 130 REST OF SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: ELEVATORS & ESCALATORS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 133)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 32 COMPANIES ADOPTED PRODUCT DEVELOPMENT AS KEY GROWTH STRATEGY, 2016–202O

11.3 MARKET RANKING

FIGURE 33 MARKET RANKING OF KEY PLAYERS, 2020

11.3.1 SCHINDLER GROUP

11.3.2 OTIS ELEVATOR

11.3.3 THYSSENKRUPP AG

11.3.4 KONE CORPORATION

11.3.5 HITACHI LTD.

11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS FOR KEY COMPANIES IN ELEVATORS & ESCALATORS MARKET

11.5 MARKET SHARE ANALYSIS

TABLE 132 ELEVATOR AND ESCALATOR MARKET: MARKET SHARES OF KEY PLAYERS

FIGURE 35 SHARE OF LEADING COMPANIES IN ELEVATORS & ESCALATORS MARKET

11.6 COMPANY EVALUATION QUADRANT

FIGURE 36 ELEVATORS & ESCALATORS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

11.6.1 STAR

11.6.2 PERVASIVE

11.6.3 EMERGING LEADER

11.6.4 PARTICIPANT

11.7 COMPETITIVE BENCHMARKING

FIGURE 37 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 38 BUSINESS STRATEGY EXCELLENCE

TABLE 133 COMPANY SERVICE FOOTPRINT

TABLE 134 COMPANY TYPE FOOTPRINT

TABLE 135 COMPANY REGION FOOTPRINT

11.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 STARTING BLOCKS

11.8.4 DYNAMIC COMPANIES

FIGURE 39 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

11.9 COMPETITIVE SCENARIO AND TRENDS

11.9.1 DEALS

TABLE 136 ELEVATOR AND ESCALATOR MARKET: DEALS, MAY 2018 NOVEMBER 2021

11.9.2 OTHERS

TABLE 137 ELEVATOR AND ESCALATOR MARKET: OTHERS, MAY 2018 NOVEMBER 2021

12 COMPANY PROFILES (Page No. - 152)

12.1 KEY COMPANIES

(Business Overview, Products and solutions, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 SCHINDLER GROUP

TABLE 138 SCHINDLER GROUP: BUSINESS OVERVIEW

FIGURE 40 SCHINDLER GROUP: COMPANY SNAPSHOT

TABLE 139 VOESTALPINE AG: PRODUCT OFFERED

TABLE 140 SCHINDLER GROUP: DEALS

TABLE 141 SCHINDLER GROUP: OTHERS

12.1.2 OTIS ELEVATOR

TABLE 142 OTIS ELEVATOR: BUSINESS OVERVIEW

FIGURE 41 OTIS ELEVATOR: COMPANY SNAPSHOT

TABLE 143 OTIS ELEVATOR: PRODUCT OFFERED

TABLE 144 OTIS ELEVATOR: DEALS

12.1.3 THYSSENKRUPP AG

TABLE 145 THYSSENKRUPP AG: BUSINESS OVERVIEW

FIGURE 42 THYSSENKRUPP AG: COMPANY SNAPSHOT

TABLE 146 THYSSENKRUPP AG: PRODUCT OFFERED

TABLE 147 THYSSENKRUPP AG: DEALS

12.1.4 KONE CORPORATION

TABLE 148 KONE CORPORATION: BUSINESS OVERVIEW

FIGURE 43 KONE CORPORATION: COMPANY SNAPSHOT

TABLE 149 KONE CORPORATION: PRODUCT OFFERED

TABLE 150 KONE CORPORATION: OTHERS

12.1.5 HITACHI LTD.

TABLE 151 HITACHI LTD.: BUSINESS OVERVIEW

FIGURE 44 HITACHI LTD.: COMPANY SNAPSHOT

TABLE 152 HITACHI LTD.: PRODUCT OFFERED

TABLE 153 HITACHI LTD.: DEALS

12.1.6 HYUNDAI ELEVATOR

TABLE 154 HYUNDAI ELEVATOR: BUSINESS OVERVIEW

FIGURE 45 HYUNDAI ELEVATOR: COMPANY SNAPSHOT

TABLE 155 HYUNDAI ELEVATOR: PRODUCT OFFERED

TABLE 156 HYUNDAI ELEVATOR: OTHERS

12.1.7 FUJITEC CO., LTD.

TABLE 157 FUJITEC CO., LTD.: BUSINESS OVERVIEW

FIGURE 46 FUJITEC CO., LTD.: COMPANY SNAPSHOT

TABLE 158 FUJITEC CO., LTD.: PRODUCT OFFERED

12.1.8 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION

TABLE 159 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: BUSINESS OVERVIEW

FIGURE 47 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: COMPANY SNAPSHOT

TABLE 160 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: PRODUCT OFFERED

12.1.9 MITSUBISHI ELECTRIC CORPORATION

TABLE 161 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 48 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 162 MITSUBISHI ELECTRIC CORPORATION: PRODUCT OFFERED

TABLE 163 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

12.2 OTHER KEY PLAYERS

12.2.1 KLEEMANN

TABLE 164 KLEEMANN: COMPANY OVERVIEW

12.2.2 SIGMA ELEVATOR COMPANY

TABLE 165 SIGMA ELEVATOR COMPANY: COMPANY OVERVIEW

12.2.3 ELECTRA ELEVATORS

TABLE 166 ELECTRA ELEVATORS: COMPANY OVERVIEW

12.2.4 ESCON ELEVATORS

TABLE 167 ESCON ELEVATORS: COMPANY OVERVIEW

12.2.5 SHENYANG YUANDA INTELLECTUAL INDUSTRY GROUP CO., LTD.

TABLE 168 SHENYANG YUANDA INTELLECTUAL INDUSTRY GROUP CO., LTD: COMPANY OVERVIEW

12.2.6 ORONA

TABLE 169 ORONA: COMPANY OVERVIEW

12.2.7 EITA ELEVATOR

TABLE 170 EITA ELEVATOR: COMPANY OVERVIEW

12.2.8 GLARIE ELEVATOR GROUP

TABLE 171 GLARIE ELEVATOR GROUP: COMPANY OVERVIEW

12.2.9 AARON INDUSTRIES LTD.

TABLE 172 AARON INDUSTRIES LTD.: COMPANY OVERVIEW

12.2.10 LEO ELEVATORS

TABLE 173 LEO ELEVATORS: COMPANY OVERVIEW

12.2.11 TRIO ELEVATORS CO (INDIA) PRIVATE LIMITED

TABLE 174 TRIO ELEVATORS CO (INDIA) PRIVATE LIMITED: COMPANY OVERVIEW

12.2.12 STANNAH GROUP

TABLE 175 STANNAH GROUP: COMPANY OVERVIEW

12.2.13 CIBES LIFT GROUP AB

TABLE 176 CIBES LIFT GROUP AB: COMPANY OVERVIEW

12.2.14 WALTON GROUP

TABLE 177 WALTON GROUP: COMPANY OVERVIEW

12.2.15 EXPEDITE TECHNOLOGIES

TABLE 178 EXPEDITE TECHNOLOGIES: COMPANY OVERVIEW

*Details on Business Overview, Products and solutions, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 191)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

Overview on Vertical Transportation Market

The vertical transportation market, also known as the elevator and escalator market, involves the design, manufacturing, installation, and maintenance of elevators, escalators, and moving walkways. The market is driven by the growth of the construction industry and urbanization, particularly in developing countries. Increasing demand for efficient and sustainable transportation systems, advancements in technology, and focus on safety and security are also driving the market growth.

The vertical transportation market is essentially synonymous with the elevators and escalators market. Both terms are used interchangeably to describe the same industry. The elevator and escalator market is a subset of the vertical transportation market, which also includes moving walkways, dumbwaiters, and other similar transportation systems.

The vertical transportation market, including elevators and escalators, is expected to grow significantly in the coming years, driven by the growth of the construction industry and increasing urbanization. The focus on sustainability, energy efficiency, and safety is also expected to have an impact on the market. Advancements in technology, such as the development of smart elevators and escalators, will also influence the market growth.

Futuristic Growth Use-Cases

The vertical transportation market is expected to see growth in several areas in the future. One of the major growth drivers is the increasing adoption of smart elevators and escalators, which use artificial intelligence and data analytics to optimize energy efficiency, reduce waiting times, and improve passenger experience. The market is also expected to see growth in the maintenance and modernization of existing systems, as well as the development of new transportation systems that are more efficient and sustainable.

Top Players

Some of the top players in the vertical transportation market include Otis Elevator Company, Schindler Group, KONE Corporation, ThyssenKrupp Elevator AG, Mitsubishi Electric Corporation, and Hitachi Ltd.

Impact on Other Industries

The growth of the vertical transportation market is expected to have an impact on several other industries, including the construction industry, real estate industry, and hospitality industry. As more buildings are constructed and renovated with elevators and escalators, demand for these systems is likely to increase, which will create opportunities for manufacturers, suppliers, and service providers in these industries.

Speak to our Analyst today to know more about Vertical Transportation Market!

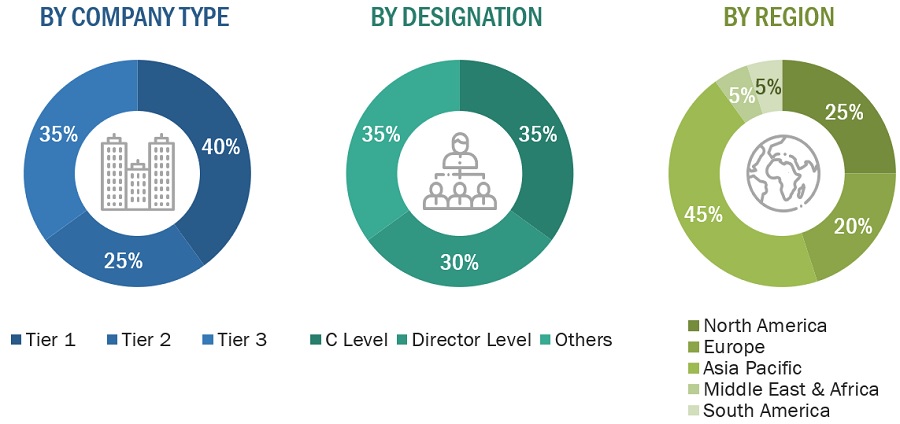

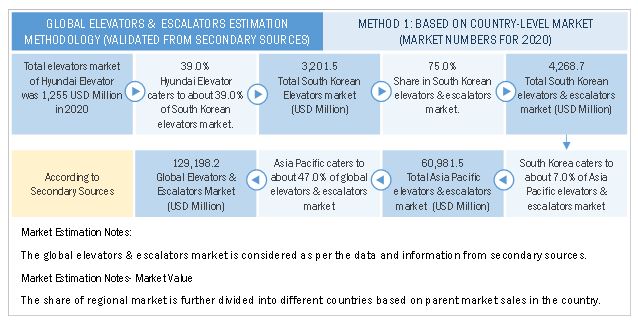

The study involved four major activities for estimating the current global size of the elevators and escalators market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of elevators and escalators through primary research. The bottom-up approach was employed to estimate the overall size of the elevators and escalators market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the elevators and escalators market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the elevators and escalators market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the elevators and escalators industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The above approach was used to estimate and validate the global size of the elevators and escalators market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the elevators and escalators market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the elevators and escalators market in terms of value and volume based on type, nature, printing technology, application and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the elevators and escalators report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis

- Further analysis of the elevators and escalators market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Elevators & Escalators Market