Emission Monitoring System (EMS) Market by System Type (CEMS, PEMS), Offering (Hardware, Software, Services), Industry (Power Generation, Oil & Gas, Chemicals, Petrochemicals) and Region (2022-2027)

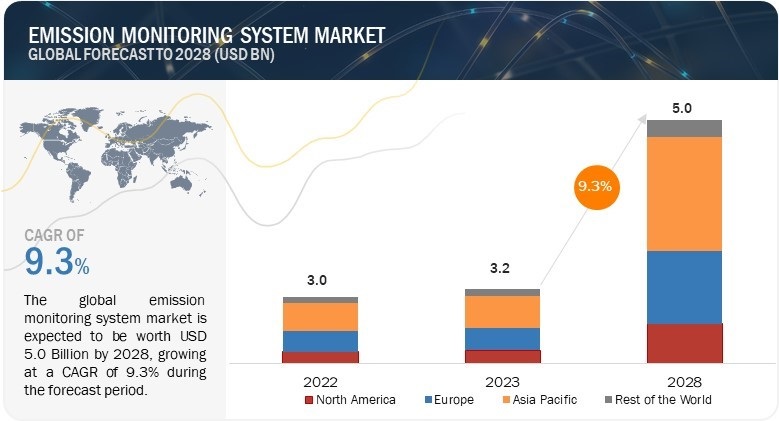

[188 Pages Report] The global EMS market size was valued at USD 3.0 billion in 2022 and is projected to reach USD 4.5 billion by 2027. It is expected to grow at a CAGR of 8.8% during the forecast period. The growth of the EMS market is driven by high dependency of countries worldwide on coal-fired power plants to generate electricity, stringent emission norms and standards enforced by North American and European governments, and increased need for environmental protection. Moreover, growing number for coal-fired power generation plants in APAC is likely to fuel the growth of the emission monoitoring system industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global EMS Market

In 2020, with the onset of the COVID-19 crisis, the world witnessed both health and economic impacts. The worldwide spread of this virus led to the closure of various manufacturing facilities and temporary halts in business operations. The COVID-19 pandemic has badly affected the major end-user industries, such as the oil & gas industry, with oil prices slashing drastically. The major decline in the demand for oil and gas due to various restrictions imposed by governments worldwide in 2020 resulted in a massive gap between supply and demand. Additionally, power generation and chemicals, petrochemicals, refineries, and fertilizers industries are also among the key end users of EMS. These industries also witnessed reduced demand due to the global pandemic. There were restrictions on foreign trades due to the lockdown of international borders, non-operational distribution channels, and various precautionary measures undertaken for public health and safety. An increase in demand from the energy and power sector and chemicals industries is likely to drive the EMS market for these end-user industries gradually from 2022 to 2027.

Market Dynamics:

Driver: High dependency of countries worldwide on coal-fired power plants to generate electricity

A coal-burning power plant is a thermal power station that uses coal to generate electricity. According to a report by Carbon Brief, in 2020, coal nearly generated 40% of the world’s electricity. Similarly, according to the Coal Association of Canada, in 2020, the country produced roughly 62 million tons of coal, with 51% being thermal coal used for electricity generation. The burned coal releases several airborne toxins and pollutants, such as mercury, lead, sulfur dioxide, nitrogen oxides, particulates, and other heavy metals. Exposure to these pollutants can cause many health effects, including asthma and breathing difficulties, brain damage, heart problems, cancer, neurological disorders, and premature death. These pollutants can also damage the lungs, kidneys, respiratory, and nervous systems. Therefore, various regulatory authorities have made continuous or preventive emission monitoring systems mandatory to keep track of pollutant emission rates.

Restraint: Growing focus on clean energy

Renewables are becoming the fastest-growing source of electricity production. Countries are developing renewable energy sources, such as hydropower, offshore and onshore wind, solar photovoltaic, and bioenergy. These renewable energy sources are being used increasingly due to their zero-carbon emissions. According to a report published by the International Energy Agency in 2021, the share of renewables in global electricity generation reached almost 29% in 2020, with solar photovoltaic (PV) technology being dominant. Thus, to reduce CO2 emissions and local air pollution, the world needs to rapidly shift toward low carbon energy sources, such as nuclear and renewable technologies. However, since hydro, solar, and wind power plants produce electricity with little or no emissions, it eliminates the requirement for emission monitoring systems.

Opportunity: Growing number of coal-fired power generation plants in APAC

APAC is one of the primary regions using coal for power generation. APAC countries such as China and India are among the largest users of coal for power generation. According to the International Energy Agency, in 2020, coal remained a primary fuel in global energy systems and accounted for almost 38% of electricity generation. The highest increase in coal-based power generation occurred in China, followed by India. According to the US Energy Information Administration, China is the world’s largest coal consumer and draws more than 70% of its electricity from coal. Additionally, the country plans to construct new coal-fired power plants in South Africa, Pakistan, and Bangladesh. Similarly, India’s coal-fired power generation capacity is expected to rise by 22.4% to 238 GW by 2022, according to India’s Ministry of Power. Coal-fired plants are the main emitters of sulfur oxides. Thus, China and India’s involvement in establishing new coal-fired plants to bring electrification to the developing world and ensure the growth of their economies is likely to create lucrative opportunities for the players in the emission monitoring system market.

Challenge: Technical challenges in adhering to regulatory norms

Strict regulatory frameworks create certain technical challenges for emission monitoring systems. These challenges are associated with the maintenance of instruments and designs. Emission monitoring systems operate under harsh environments and even extreme conditions (dust, fog, rain, etc.). They are prone to accuracy and performance-related issues in such environments. Additionally, they are often used in different critical industries, such as chemicals, petrochemicals, and oil & gas, which creates further challenges in providing highly accurate and reliable data as equipment such as analyzers are installed at hard-to-reach locations. This may cause difficulty in calibration, maintenance, and replacements of such devices that can create further problems.

The hardware segment to hold the largest size of the EMS market by 2027

The growth of the hardware EMS market can be attributed as they are used in both CEMS and PEMS to collect emissions data. The CEMS functions through its hardware components, whereas the PEMS is a software-powered system and uses hardware components like sensors to predict gas emissions. Hardware-based continuous emission monitoring systems boost the demand for hardware devices as the majority of plants have installed continuous emission monitoring systems.

The CEMS to account for the largest size of the EMS market in 2022

Steel CEMS are used for collecting data regarding emission levels of gases from various industries, such as power generation, oil & gas, chemicals, and waste incineration. Moreover, an increase in the number of stringent rules and regulations regarding pollution monitoring across industries is expected to create demand for CEMS.

APAC projected to be the largest market for a EMS from 2022 to 2027

APAC is projected to hold the largest size of the EMS market during the forecast period. China and India are the major contributors to the EMS market growth in APAC. It can also be attributed to the growing power generation and chemicals industries, which are the key users of emission monitoring systems, in the region. Moreover, the increasing capacities of coal-fired power plants is another reason for the growing demand for emission monitoring systems. COVID-19 forced lockdowns across APAC. Supply chains in and around APAC were disrupted owing to only limited permissible transportation. Under lockdown, Asian countries suffered tremendous loss of business and revenue due to the shutdown of many manufacturing units.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

A few of the key players in the EMS companies such as ABB Ltd. (Switzerland), AMETEK, Inc. (US), Emerson Electric Company (US), Baker Hughes (US), Siemens AG (Germany), Parker-Hannifin (US), Rockwell Automation (US), SICK (Germany), Teledyne Technologies, Inc. (US), and Thermo Fisher Scientific Inc. (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By system type, offering, and industry |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

ABB Ltd. (Switzerland), AMETEK, Inc. (US), Emerson Electric Company (US), Baker Hughes (US), Siemens AG (Germany), Parker-Hannifin (US), Rockwell Automation (US), SICK (Germany), Teledyne Technologies, Inc. (US), and Thermo Fisher Scientific Inc. (US) are the key players in the EMS market. A total of 25 players are covered. |

This research report categorizes the EMS market, by system type, offering, industry, and region

By System Type:

- Continuous Emission Monitoring System (CEMS)

- Predictive Emission Monitoring System (PEMS)

By Offering:

- Hardware

- Software

- Service

By Industry:

- Power Generation

- Oil & Gas

- Chemicals, Petrochemicals, Refineries, & Fertilizers

- Building Materials

- Pulp & Paper

- Pharmaceuticals

- Metals

- Mining

- Marine & Shipping

- Waste Incineration

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East

- Africa

- South America

Recent Developments

- In October 2021, ABB launched ABB Ability Genix Datalyzer, a cloud-based data analytics solutions. Introduced for industries, such as cement, steel, chemicals, and power generation, it enables fleet-wide management and optimization of emissions monitoring equipment.

- In October 2021, ENVEA introduced Mercury CEMS (SM-5). It allows continuous, accurate, and reliable measurement of very low concentrations of mercury in flue gas emissions.

- In September 2021, Emerson launched the Rosemount XE10 CEMS. It is designed to help industrial plants meet increasingly strict environmental regulations and evolving sustainability demands.

- In January 2021, ABB introduced CEMcaptain, an emission monitoring system designed to help the maritime industry comply with regulations and become more sustainable.

- In February 2020, Baker Hughes launched System 1 Predictive Emission Monitoring System (PEMS) that predicts the level of stack emissions generated by combustion equipment based on ambient conditions, fuel composition, and machine operating conditions.

Frequently Asked Questions (FAQ):

Which are the major companies in the EMS market? What are their major strategies to strengthen their market presence?

The major companies in the EMS market are - ABB Ltd. (Switzerland), AMETEK, Inc. (US), Emerson Electric Company (US), Baker Hughes (US), Siemens AG (Germany). Players in this market have adopted product launches and developments strategy to increase their market share.

Which is the potential market for EMS in terms of the region?

APAC held the largest share of the EMS market in 2021. The largest share is attributed to growing power generation and chemicals industries, which are the key users of emission monitoring systems.

What are the opportunities for new market entrants?

There are significant opportunities in the EMS market such as the growing number of coal-fired power generation plants in APAC and expanding refineries and petrochemicals plants across the globe.

Which industries are expected to drive the growth of the market in the next five years?

Major end-user industries for the EMS market include – power generation; oil & gas; chemicals, petrochemicals, refineries, and fertilizers; building materials; pulp and paper; pharmaceuticals; metals; mining; marine and shipping; and waste incineration. The power generation industry held the largest size of the EMS market in 2021. The power generation industry is one of the key consumers of emission monitoring systems. Stringent regulations pertaining to monitoring emissions and pollution from coal-fired power plants are accelerating the demand for EMS in the power generation industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 EMS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 EMS MARKET: GEOGRAPHIC SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 EMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size through bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size through top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 EMS MARKET: SUPPLY-SIDE APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 EMS MARKET SIZE, 2018–2027

FIGURE 9 CONTINUOUS EMISSION MONITORING SYSTEMS (CEMS) TO HOLD LARGER MARKET SHARE IN 2027

FIGURE 10 HARDWARE TO CAPTURE LARGEST SHARE OF EMS MARKET, BY OFFERING, IN 2027

FIGURE 11 CHEMICALS, PETROCHEMICALS, REFINERIES, AND FERTILIZERS TO BE FASTEST-GROWING INDUSTRY DURING FORECAST PERIOD

FIGURE 12 APAC TO HOLD LARGEST SHARE OF EMS MARKET IN 2027

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN EMS MARKET

FIGURE 13 STRINGENT ENVIRONMENTAL REGULATIONS AND EMISSION NORMS TO FUEL GROWTH OF EMS MARKET FROM 2022 TO 2027

4.2 EMS MARKET, BY SYSTEM TYPE

FIGURE 14 CONTINUOUS EMISSION MONITORING SYSTEMS (CEMS) TO HOLD LARGER MARKET SHARE IN 2027

4.3 EMS MARKET, BY OFFERING

FIGURE 15 HARDWARE TO HOLD LARGEST MARKET SIZE IN 2027

4.4 EMS IN APAC, BY COUNTRY AND INDUSTRY

FIGURE 16 CHINA AND POWER GENERATION INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARES IN APAC IN 2027

4.5 EMS MARKET, BY COUNTRY

FIGURE 17 CHINA TO ACCOUNT FOR LARGEST SHARE OF GLOBAL EMS MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 EMISSION MONITORING SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High dependency of countries worldwide on coal-fired power plants to generate electricity

5.2.1.2 Stringent emission norms and standards enforced by North American and European governments

5.2.1.3 Increased need for environmental protection

FIGURE 19 DRIVERS OF EMISSION MONITORING SYSTEM MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Growing focus on clean energy

5.2.2.2 High cost of continuous emission monitoring systems

FIGURE 20 RESTRAINTS OF EMISSION MONITORING SYSTEM MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing number of coal-fired power generation plants in APAC

5.2.3.2 Expansion of refineries and petrochemical plants

FIGURE 21 OPPORTUNITIES FOR EMISSION MONITORING SYSTEM MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Technical challenges in adhering to regulatory norms

FIGURE 22 CHALLENGES FOR EMISSION MONITORING SYSTEM MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: EMISSION MONITORING SYSTEM MARKET

5.4 TECHNOLOGY ANALYSIS

5.4.1 BIG DATA ANALYTICS

5.4.2 EDGE AND DIAGNOSTICS ANALYTICS

5.5 ECOSYSTEM ANALYSIS

FIGURE 24 EMISSION MONITORING SYSTEM MARKET: ECOSYSTEM

TABLE 2 EMISSION MONITORING SYSTEM MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.7 PRICING ANALYSIS

TABLE 3 INDICATIVE PRICES EMS

5.7.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY OFFERING

FIGURE 25 AVERAGE SELLING PRICES OF KEY PLAYERS FOR PRODUCT OFFERINGS

TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS FOR PRODUCT OFFERINGS

5.8 CASE STUDIES

5.8.1 TEXTILES INDUSTRY IN GUJARAT, INDIA, INSTALLED EMS TO CONTINUOUSLY MONITOR EMISSIONS

5.8.2 GENERAL ELECTRIC PROVIDED EMISSION MONITORING SYSTEMS TO MINISTRY OF MINES AND ENERGY, CAMBODIA

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON EMISSION MONITORING SYSTEM MARKET, 2021

5.10 TRADE ANALYSIS

FIGURE 26 IMPORTS DATA, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 27 EXPORTS DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENTS ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 6 TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 7 LIST OF FEW PATENTS IN EMISSION MONITORING SYSTEM MARKET, 2019–2020

5.12 REGULATIONS AND STANDARDS

5.12.1 SULFUR CONTROL REGULATIONS, BY GEOGRAPHY

TABLE 8 SO2 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS

5.13 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 9 EMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 INITIATIVES TO CONTROL INDUSTRIAL EMISSIONS

TABLE 10 INITIATIVES TO CONTROL INDUSTRIAL EMISSIONS

5.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 SOURCES OF EMISSIONS (Page No. - 70)

6.1 INTRODUCTION

6.2 OXYGEN

6.3 CARBON MONOXIDE

6.4 CARBON DIOXIDE

6.5 AMMONIA

6.6 HYDROGEN SULFIDE

6.7 NITROGEN OXIDE

6.8 HYDROCARBONS

7 EMISSION MONITORING SYSTEM MARKET, BY SYSTEM TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 30 EMS MARKET, BY SYSTEM TYPE

FIGURE 31 CONTINUOUS EMISSION MONITORING SYSTEMS TO HOLD LARGER MARKET SIZE IN 2027

TABLE 15 EMS MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 16 EMS MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

7.2 CONTINUOUS EMISSION MONITORING SYSTEMS (CEMS)

7.2.1 CEMS TO HOLD LARGER SIZE OF GLOBAL EMS MARKET IN 2027

TABLE 17 CEMS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 18 CEMS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 19 CEMS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 20 CEMS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 21 CEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 CEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PREDICTIVE EMISSION MONITORING SYSTEM (PEMS)

7.3.1 POWER GENERATION INDUSTRY IS MAJOR END USER OF PREDICTIVE EMISSION MONITORING SYSTEMS

TABLE 23 PEMS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 24 PEMS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 25 PEMS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 26 PEMS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 27 PEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 PEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 EMISSION MONITORING SYSTEM MARKET, BY OFFERING (Page No. - 80)

8.1 INTRODUCTION

FIGURE 32 EMS MARKET, BY OFFERING

FIGURE 33 HARDWARE OFFERINGS TO ACCOUNT FOR LARGEST SIZE OF EMS MARKET IN 2027

TABLE 29 EMS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 30 EMS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

8.2 HARDWARE

8.2.1 CEMS IS KEY CONTRIBUTOR TO INCREASED DEMAND FOR HARDWARE

8.2.1.1 Gas analyzers

8.2.1.2 Gas sampling systems

8.2.1.3 Flow and opacity monitors

8.2.1.4 Sample probes

8.2.1.5 Sample lines

8.2.1.6 Data controllers

8.2.1.7 Filters

TABLE 31 EMS MARKET FOR HARDWARE, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 32 EMS MARKET FOR HARDWARE, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

8.3 SOFTWARE

8.3.1 AVAILABILITY OF CUSTOMIZED SOFTWARE ACCORDING TO REQUIREMENTS WOULD DRIVE MARKET GROWTH

TABLE 33 EMS MARKET FOR SOFTWARE, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 34 EMS MARKET FOR SOFTWARE, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

8.4 SERVICES

8.4.1 MARKET FOR PEMS SERVICES TO GROW AT HIGHER CAGR FROM 2021 TO 2027

8.4.1.1 Installation

8.4.1.2 Training

8.4.1.3 Maintenance

TABLE 35 EMS MARKET FOR SERVICES, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 36 EMS MARKET FOR SERVICES, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

9 EMS MARKET, BY INDUSTRY (Page No. - 87)

9.1 INTRODUCTION

FIGURE 34 EMS MARKET, BY INDUSTRY

FIGURE 35 POWER GENERATION INDUSTRY TO LEAD EMS MARKET THROUGHOUT FORECAST PERIOD

TABLE 37 EMS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 38 EMS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.1.1 POWER GENERATION

9.1.1.1 Power generation industry holds largest share in EMS market

TABLE 39 EMS MARKET FOR POWER GENERATION, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 40 EMS MARKET FOR POWER GENERATION, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 41 EMS MARKET FOR POWER GENERATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 EMS MARKET FOR POWER GENERATION, BY REGION, 2022–2027 (USD MILLION)

9.1.2 OIL & GAS

9.1.2.1 Exploration activities in oil & gas industry to create demand for EMS

TABLE 43 EMS MARKET FOR OIL & GAS, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 44 EMS MARKET FOR OIL & GAS, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 45 EMS MARKET FOR OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 EMS MARKET FOR OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

9.1.3 CHEMICALS, PETROCHEMICALS, REFINERIES, AND FERTILIZERS

9.1.3.1 Growing concerns regarding emissions of greenhouse gases driving adoption of EMS in chemical, petrochemical, refineries, and fertilizers industry

TABLE 47 EMS MARKET FOR CHEMICALS, PETROCHEMICALS, REFINERIES, AND FERTILIZERS, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 48 EMS MARKET FOR CHEMICALS, PETROCHEMICALS, REFINERIES, AND FERTILIZERS, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 49 EMS MARKET FOR CHEMICALS, PETROCHEMICALS, REFINERIES, AND FERTILIZERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 EMS MARKET FOR CHEMICALS, PETROCHEMICALS, REFINERIES, AND FERTILIZERS, BY REGION, 2022–2027 (USD MILLION)

9.1.4 BUILDING MATERIALS

9.1.4.1 CEMS to hold largest size of building materials industry during forecast period

TABLE 51 EMS MARKET FOR BUILDING MATERIALS, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 52 EMS MARKET FOR BUILDING MATERIALS, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 53 EMS MARKET FOR BUILDING MATERIALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 EMS MARKET FOR BUILDING MATERIALS, BY REGION, 2022–2027 (USD MILLION)

9.1.5 PULP & PAPER

9.1.5.1 PEMS market for pulp & paper industry to grow at higher CAGR during forecast period

TABLE 55 EMS MARKET FOR PULP & PAPER, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 56 EMS MARKET FOR PULP & PAPER, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 57 EMS MARKET FOR PULP & PAPER, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 EMS MARKET FOR PULP & PAPER, BY REGION, 2022–2027 (USD MILLION)

9.1.6 PHARMACEUTICALS

9.1.6.1 Technological advancements in pharmaceuticals driving demand for EMS

TABLE 59 EMS MARKET FOR PHARMACEUTICALS, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 60 EMS MARKET FOR PHARMACEUTICALS, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 61 EMS MARKET FOR PHARMACEUTICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 EMS MARKET FOR PHARMACEUTICALS, BY REGION, 2022–2027 (USD MILLION)

9.1.7 METALS

9.1.7.1 EMS help metal companies to monitor emission levels in real time

TABLE 63 EMS MARKET FOR METALS, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 64 EMS MARKET FOR METALS, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 65 EMS MARKET FOR METALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 EMS MARKET FOR METALS, BY REGION, 2022–2027 (USD MILLION)

9.1.8 MINING

9.1.8.1 CEMS to hold larger market size for mining industry from 2022 to 2027

TABLE 67 EMS MARKET FOR MINING, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 68 EMS MARKET FOR MINING, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 69 EMS MARKET FOR MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 EMS MARKET FOR MINING, BY REGION, 2022–2027 (USD MILLION)

9.1.9 MARINE & SHIPPING

9.1.9.1 EMS ensures smooth operations of companies in marine and shipping industry

TABLE 71 EMS MARKET FOR MARINE & SHIPPING, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 72 EMS MARKET FOR MARINE & SHIPPING, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 73 EMS MARKET FOR MARINE & SHIPPING, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 EMS MARKET FOR MARINE & SHIPPING, BY REGION, 2022–2027 (USD MILLION)

9.1.10 WASTE INCINERATION

9.1.10.1 PEMS to exhibit highest CAGR for waste incineration industry during forecast period

TABLE 75 EMS MARKET FOR WASTE INCINERATION, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 76 EMS MARKET FOR WASTE INCINERATION, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 77 EMS MARKET FOR WASTE INCINERATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 EMS MARKET FOR WASTE INCINERATION, BY REGION, 2022–2027 (USD MILLION)

10 EMS MARKET, GEOGRAPHIC ANALYSIS (Page No. - 106)

10.1 INTRODUCTION

FIGURE 36 EMS MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 79 EMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 EMS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 SNAPSHOT: EMS MARKET IN NORTH AMERICA

TABLE 81 EMS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 EMS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 EMS MARKET IN NORTH AMERICA, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 84 EMS MARKET IN NORTH AMERICA, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 85 EMS MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 86 EMS MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Prominent presence of various end-user industries in country to drive market growth in US

10.2.2 CANADA

10.2.2.1 Significant demand from power generation and chemicals industries to drive EMS market growth in Canada

10.2.3 MEXICO

10.2.3.1 Upcoming investments in coal-fired power plants to propel EMS market growth in Mexico

10.3 EUROPE

FIGURE 38 SNAPSHOT: EMS MARKET IN EUROPE

TABLE 87 EMS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 EMS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 EMS MARKET IN EUROPE, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 90 EMS MARKET IN EUROPE, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 91 EMS MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 EMS MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Growing cement industry to foster growth of EMS market in UK

10.3.2 GERMANY

10.3.2.1 Germany is fastest-growing market for EMS in Europe

10.3.3 FRANCE

10.3.3.1 Rising demand for chemicals to spur EMS market growth in France

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 39 SNAPSHOT: EMS MARKET IN APAC

TABLE 93 EMS MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 EMS MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 EMS MARKET IN APAC, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 96 EMS MARKET IN APAC, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 97 EMS MARKET IN APAC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 EMS MARKET IN APAC, BY INDUSTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China is largest market for emission monitoring systems

10.4.2 JAPAN

10.4.2.1 Prominent presence of players to accelerate EMS market growth in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Stringent emission norms in country to create increased demand for emission monitoring systems

10.4.4 INDIA

10.4.4.1 Growing steel production to surge demand for emission monitoring systems

10.4.5 REST OF APAC

10.5 REST OF THE WORLD

TABLE 99 EMS MARKET IN ROW, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 EMS MARKET IN ROW, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 EMS MARKET IN ROW, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 102 EMS MARKET IN ROW, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 103 EMS MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 104 EMS MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Industrialization and urbanization in Middle East to propel EMS market growth

TABLE 105 MIDDLE EAST EMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 MIDDLE EAST EMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Development in mining industry to fuel adoption of emission monitoring systems

10.5.3 AFRICA

10.5.3.1 Oil & gas activities driving demand for emission monitoring systems in Africa

11 COMPETITIVE LANDSCAPE (Page No. - 126)

11.1 OVERVIEW

11.2 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 40 EMS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 107 OVERVIEW OF STRATEGIES ADOPTED BY VENDORS OF EMS

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 108 EMS MARKET SHARE ANALYSIS (2021)

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 41 EMS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2021

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 42 EMS MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

11.7 EMS MARKET: COMPANY FOOTPRINT

TABLE 109 COMPANY FOOTPRINT

TABLE 110 PRODUCT FOOTPRINT OF COMPANIES

TABLE 111 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 112 REGIONAL FOOTPRINT OF COMPANIES

11.8 START-UP EVALUATION MATRIX

TABLE 113 EMS: DETAIL LIST OF KEY START-UP/SMES

TABLE 114 EMS: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES

11.9 COMPETITIVE SITUATIONS AND TRENDS

11.9.1 PRODUCT LAUNCHES

TABLE 115 EMS MARKET: PRODUCT LAUNCHES, 2019-2021

12 COMPANY PROFILES (Page No. - 140)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 ABB LTD.

TABLE 116 ABB LTD.: BUSINESS OVERVIEW

FIGURE 43 ABB LTD.: COMPANY SNAPSHOT

TABLE 117 ABB LTD.: PRODUCTS OFFERED

12.1.2 AMETEK, INC.

TABLE 118 AMETEK, INC.: BUSINESS OVERVIEW

FIGURE 44 AMETEK, INC.: COMPANY SNAPSHOT

TABLE 119 AMETEK, INC.: PRODUCT OFFERED

12.1.3 EMERSON ELECTRIC COMPANY

TABLE 120 EMERSON ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 45 EMERSON ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 121 EMERSON ELECTRIC COMPANY: PRODUCT OFFERED

12.1.4 BAKER HUGHES COMPANY

TABLE 122 BAKER HUGHES COMPANY: BUSINESS OVERVIEW

FIGURE 46 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

TABLE 123 BAKER HUGHES COMPANY: PRODUCT OFFERED

12.1.5 SIEMENS AG

TABLE 124 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 47 SIEMENS AG: COMPANY SNAPSHOT

TABLE 125 SIEMENS AG: PRODUCT OFFERED

12.1.6 PARKER-HANNIFIN CORP.

TABLE 126 PARKER-HANNIFIN CORP.: BUSINESS OVERVIEW

FIGURE 48 PARKER-HANNIFIN CORP.: COMPANY SNAPSHOT

TABLE 127 PARKER-HANNIFIN CORP.: PRODUCTS OFFERED

12.1.7 ROCKWELL AUTOMATION, INC.

TABLE 128 ROCKWELL AUTOMATION, INC.: BUSINESS OVERVIEW

FIGURE 49 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

TABLE 129 ROCKWELL AUTOMATION, INC.: PRODUCTS OFFERED

12.1.8 SICK

TABLE 130 SICK: BUSINESS OVERVIEW

FIGURE 50 SICK: COMPANY SNAPSHOT

TABLE 131 SICK: PRODUCTS OFFERED

12.1.9 TELEDYNE TECHNOLOGIES, INC.

TABLE 132 TELEDYNE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 51 TELEDYNE TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 133 TELEDYNE TECHNOLOGIES, INC.: PRODUCTS OFFERED

12.1.10 THERMO FISHER SCIENTIFIC INC.

TABLE 134 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 52 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

TABLE 135 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERED

12.1.11 CMC SOLUTIONS, LLC

TABLE 136 CMC SOLUTIONS, LLC: BUSINESS OVERVIEW

TABLE 137 CMC SOLUTIONS, LLC.: PRODUCT OFFERED

12.1.12 ENVEA (ENVIRONMENTAL S.A.)

TABLE 138 ENVEA (ENVIRONMENTAL S.A.): BUSINESS OVERVIEW

TABLE 139 ENVEA (ENVIRONMENTAL S.A.): PRODUCT OFFERED

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ENVIRO TECHNOLOGY SERVICES PLC.

TABLE 140 ENVIRO TECHNOLOGY SERVICES PLC.: BUSINESS OVERVIEW

12.2.2 FUJI ELECTRIC CO., LTD.

TABLE 141 FUJI ELECTRIC CO., LTD.: BUSINESS OVERVIEW

12.2.3 PROTEA LTD.

TABLE 142 PROTEA LTD.: BUSINESS OVERVIEW

12.2.4 HORIBA LTD.

TABLE 143 HORIBA LTD.: BUSINESS OVERVIEW

12.2.5 OPSIS AB.

TABLE 144 OPSIS AB.: BUSINESS OVERVIEW

12.2.6 ECOTECH

TABLE 145 ECOTECH: BUSINESS OVERVIEW

12.2.7 DURAG GROUP

TABLE 146 DURAG GROUP: BUSINESS OVERVIEW

12.2.8 CHEMTROLS INDUSTRIES PRIVATE LIMITED

TABLE 147 CHEMTROLS INDUSTRIES PRIVATE LIMITED: BUSINESS OVERVIEW

12.2.9 GASMET TECHNOLOGIES

TABLE 148 GASMET TECHNOLOGIES: BUSINESS OVERVIEW

12.2.10 HANGZHOU ZETIAN TECHNOLOGY CO., LTD.

TABLE 149 HANGZHOU ZETIAN TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

12.2.11 CISCO

TABLE 150 CISCO.: BUSINESS OVERVIEW

12.2.12 TECHNOVA

TABLE 151 TECHNOVA: BUSINESS OVERVIEW

12.2.13 TRACE

TABLE 152 TRACE: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKETS (Page No. - 178)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 GAS SENSORS MARKET, BY PRODUCT TYPE

TABLE 153 GAS SENSOR MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 154 GAS SENSOR MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

13.3.1 GAS ANALYZERS & MONITORS

13.3.1.1 Vital role of gas analyzers in increasing safety level at workplaces to boost demand for gas sensors

13.3.2 GAS DETECTORS

13.3.2.1 Gas detectors segment held largest share of gas sensor market in 2020

13.3.3 AIR QUALITY MONITORS

13.3.3.1 Growing awareness regarding air quality monitoring to boost demand for gas sensors

13.3.4 AIR PURIFIERS/AIR CLEANERS

13.3.4.1 Growing use of air purifiers to detect VOC pollutants to propel demand for gas sensors

13.3.5 HVAC

13.3.5.1 Increasing demand for HVAC systems to boost growth of gas sensor market

13.3.6 MEDICAL EQUIPMENT

13.3.6.1 Growing demand for ventilators during COVID-19 pandemic has increased adoption of oxygen sensors in medical devices

13.3.7 CONSUMER DEVICES

13.3.7.1 Growing adoption of wearable devices to propel growth of gas sensor market for consumer devices

14 APPENDIX (Page No. - 183)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

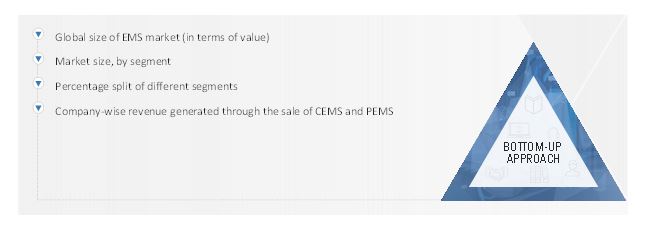

The study involved four major activities in estimating the size of the emission monitoring system (EMS) market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the EMS market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the EMS industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the EMS market based on system type, offering, industry, and region. It also includes information about the key developments undertaken from both markets- and technology-oriented perspectives.

Primary Research

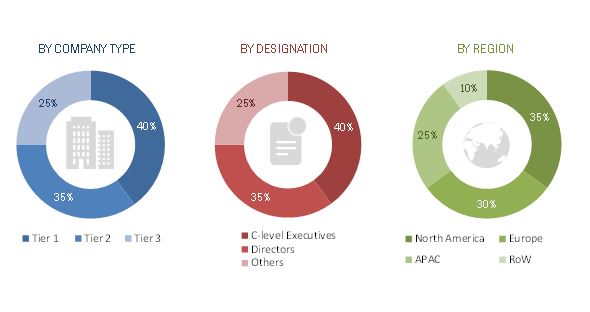

Extensive primary research has been conducted after understanding and analyzing the current scenario of the EMS market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the EMS market.

- First, companies offering emission monitoring systems have been identified, and their product mapping with respect to different parameters such as system type, offering, and industry has been carried out.

- The size of the EMS market has been estimated based on the demand for CEMS and PEMS from different industries. The revenues of the companies operating in the emission monitoring system ecosystem and the anticipated change in the demand for emission monitoring systems offered by them in the post-COVID-19 scenario have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the EMS market to validate the global size of the market. The discussions included the impact of COVID-19 on the ecosystem of the EMS market.

- Then, the size of the EMS market has been validated through secondary sources, which include the Source Testing Association and the Air Quality and Emission Show.

- The CAGR of the EMS market has been calculated considering the historical and future market trends and the impact of COVID-19 by understanding the industry penetration rate of emission monitoring systems and their demand and supply in different applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases were also studied.

The top-down approach has been used to estimate and validate the total size of the EMS market.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the EMS market.

Report Objectives

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

- Information related to revenues obtained from key manufacturers and providers of emission monitoring systems has been studied and analyzed to estimate the global size of the EMS market.

- Revenues, geographic presence, and key verticals and different types of offerings of all identified players in the emission monitoring system market have been studied to estimate and arrive at the percentage split of the different market segments.

- All major players in each segment (system type and offering) of the EMS market have been identified through secondary research and duly verified through brief discussions with industry experts.

- Multiple discussions with key opinion leaders of all major companies involved in developing emission monitoring systems have been conducted to validate the market split based on system type, offering, industry, and region.

- Geographic splits have been estimated using secondary sources, based on factors such as the number of players offering emission monitoring systems in a specific country or region and the system type of emission monitoring systems provided by these players.

- The impact of COVID-19 on the steps mentioned above has also been considered.

-

To define and forecast the size of the emission monitoring system (EMS) market segmented

by system type, offering, industry, and geography, in terms of value - To describe and forecast the size of the market for four key regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their key countries

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the EMS ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of their ranking and core competencies2, along with a detailed competitive landscape for market leaders

- To analyze key growth strategies such as product launches and acquisitions adopted by the key market players to enhance their position in the market

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Emission Monitoring System (EMS) Market

Wish to know more about PEMS.

I am looking for the market potential of (satellite-based) (CO2, NH3, NOx, and SO2) emission monitoring systems, both in the Netherlands and globally.

I am interested in this market report. Please send me a free sample. Thank you best Regards Fabian Bong

The use of emission monitoring systems has been regulated and mandated because of the increasing regulations for environmental pollution control. Does this report cover all the legal and environmental regulations pertaining to the emission monitoring system market?

Cement, oil & gas, and power plants and combustion industries, among others, emit tons of hazardous gases that impact the environment and human health. Governments of many European countries are undertaking environmental regulation policies and initiating environment protection acts to protect the environment and sustain human life and natural resources. I am looking for emission monitoring systems market in major European countries and the impact of government policies on the market growth.

Rapid industrialization and rising concerns related to the air quality are the major factors impacting the adoption of emission monitoring systems in the APAC region. Can you provide the emission monitoring market growth and development in APAC with countries having the major share?

The emission monitoring ecosystem has witnessed a lot of product innovations. Companies such as Emerson, ABB, and AMETEK have launched new products. Can you provide growth opportunities for manufacturers in the emission monitoring system market ?

The emission monitoring systems market is highly fragmented with a large number of big, medium-sized and small players. Can you provide the competitive landscape for players across the regions ?