Encoder Market by Encoder Type (Linear and Rotary), Signal Type (Incremental, Absolute), Technology (Optical, Magnetic, Inductive), Application (Automotive, Consumer Electronics, Industrial, Power) and Region - Global Forecast to 2027

Encoder Market

Encoder Market And Top Companies

DYNAPAR

Dynapar Corporation is a subsidiary of Fortive—an electrical and electronics manufacturing group. The parent company offers its products through three business segments, namely, Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions, wherein Dynapar Corporation is a part of the precision technologies business segment. Dynapar offers a wide range of products and solutions, such as rotary encoders, resolvers, encoder accessories, condition monitoring, and condition monitoring applications. It offers various encoders through brands such as Dynapar, NorthStar, Harowe, and Hengstler. The company is associated with some of the Brand Standard Associations—ANSI, ASME, CSA Group, ISO, and others; Brand Communication Protocols—BiSS Interface, DeviceNet, Inetrbus, and Profibus; and Band Recognized Distributor Partners—AHTD, Fortive, DDC, Marathon, and Technosoft.

SENSATA TECHNOLOGIES

Sensata Technologies is a global industrial technology company and a pioneer in mission-critical sensors and controls. The company has a diverse product portfolio and has been catering to a wide range of verticals, such as aerospace & defense, energy, industrial, material handling, medical, motors, and professional food equipment. In 2018, Sensata manufactured and provided more than 47,000 products to its customers. The company operates through two major business segments—Performance Sensing and Sensing Solutions, wherein the encoders are part of the Sensing Solutions segment. The position sensors and encoders are marketed through brands such as Kavlico, BEI Sensors, and Newall. The rotary and linear encoders prove to have high quality, durability, accuracy, repeatability, reliability in tough environments, and competitive pricing. The company has a large presence across the globe, with business centers and manufacturing and sales sites located in 13 countries.

HEIDENHAIN

HEIDENHAIN is a pioneer in measurement control and drive system technologies. Major offerings of the company include linear encoders, angle encoders, rotary encoders, CNC controls, and digital readouts. These products are mainly used in high-precision machine tools as well as electric component manufacturing and distribution plants. Further, the company’s expertise in encoders has enabled it to automate production machines and systems and attain a prime position in the market. HEIDENHAIN provides its diverse product portfolio under the brands AMO, ETEL, IMT, LTN, NUMERIK JENA, RENCO, and RSF to most of the industries and applications, such as machine tools, automation, semiconductors, electronics, metrology, robotics, drive systems, medical technology, elevators, printing machines, structural health monitoring, and telescopes. The company has its sales agencies, service agencies, subsidiaries, as well as a distribution network. It has a cumulative of 30 subsidiaries and 40 distributors located across the globe. Additionally, its high emphasis on research and development has aided the company to focus mainly on innovation and development of advanced technologies.

Encoder Market and Top Applications

Consumer Electronics

Consumer electronics is one of the fastest-growing markets for encoders. In this industry, encoders are widely used in office equipment such as PC-based scanning equipment, printers, copiers, answering machines, and scanners. For instance, many industrial inkjet printing systems are equipped with a rotary encoder to track the motion of the object to be printed. This enables the print head to apply the image to a precisely controlled location on the object. Furthermore, an evident surge has been noticed in the use of encoders in APAC and North America for consumer electronics applications owing to the rapid adoption of new technologies and the presence of many consumer electronics giants, such as Apple (US), Samsung Electronics (South Korea), Huawei (China), Sony Corporation (Japan), HP Inc. (US)

Healthcare

Healthcare applications require high precision, where encoders play a vital role by accurate positioning. Applications such as robotic surgery, oncological radiation treatment, and laboratory analysis are all benefiting due to the advancements in encoder technology. Surgery robots that are surgeon-assist-based are being more widely accepted in the healthcare sector. Some surgery robots are required to have redundancy for motion control components, while others can drill and measure distances at the same time, making accuracy especially important. Besides, some of the other applications of encoders in the healthcare sector are ophthalmic laser treatment, dialysis, artificial respiration, physical therapy, and orthopedic rehab. Encoders play a vital role in laboratory analysis due to the presence of multiple machines that perform critical tasks where precise and accurate measurements of the position, speed, and motion are important.

Encoder Market By Top Encoder Type

Rotary Encoder

The increasing demand for automated industrial machines and robotics is driving the growth of the rotary encoders market. Rotary encoders are electromechanical devices used to measure the number of rotations, rotational angle, and rotational position of equipment. They are used for position sensing across various applications, for example, on motors paired with drives and automated machinery in consumer electronics, elevators, conveyor speed monitors, industrial machines, and robotics. They track the turning of motor shafts to generate a digital position and motion information. Whether incremental or absolute, magnetic, or optical, rotary encoders track motor shaft rotation to generate a digital position and motion information. Rotary encoders are used in a wide range of applications that require monitoring or control, or both, of mechanical systems, including industrial controls, robotics, photographic lenses, computer input devices, and rotating radar platforms.

[215 Pages Report] The encoder market is projected to grow from USD 2.7 billion in 2022 to USD 4.3 billion by 2027; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.7% from 2022 to 2027.

The market growth is driven by factors including rising need for high-end automation across industries and rising expansion of automotive markets driving the encoder demand. Additionally, increasing demand for machine learning and artificial intelligence-based systems is expected to create growth opportunities during the forecast period. However, accuracy related errors and mechanical failures in harsh environment are challenging the market growth.

Encoder Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Encoders Market Dynamics

DRIVERS: Rising need for high-end automation across industries.

As the adoption of automation is booming in all industry, the usage of encoders is also increasing for various applications. For instance, the encoders are used in linear measurement, web tensioning, registration mark timing, backstop gauging, filling, conveying, etc. Similarly, in industry half of the electricity is used to power the electric motors, therefore majority of these electric motors use encoders to monitor or control the functions of the motors. Furthermore, encoders are also used in robotics, whether it’s an articulating arm used in a manufacturing plant or in a guided robot, all these use encoders. These automated systems need effective speed and positioning feedback systems to function the operation with limited human assistance. Therefore, the encoder industry is used in various applications where force sensing and adjustment is very important to precisely control the robotic system.

RESTRAINT: Accuracy-related errors.

Encoders are at the heart of any closed-loop servo system and provide feedback to the controller, which uses this information to determine if the motor has reached the commanded position or velocity and encoder feedback is essential for the performance of many automation applications. Hence, encoder accuracy is essential for the proper operation of a closed-loop system. Accuracy is the difference between the true position (or speed) of the device being measured and the position (or speed) reported by the encoder. Several interacting parameters affect encoder accuracy. These include the width and spacing of lines on the encoder disk or units which might introduce a small error in the timing of the pulses generated by the encoder. Once an encoder is manufactured, the addition of more lines or patterns to the code disk is not possible. Inconsistent width and/or spacing lead to errors in the timing of the pulses. For absolute encoders, accuracy is influenced by the precision with which the pattern is placed on the code disk.

OPPORTUNITIES: Increasing demand for machine learning and artificial intelligence-based systems.

Across the world, traditional systems are shifting toward Industry 4.0, also known as the Fourth Industrial Revolution. Using machine learning and artificial intelligence, Industry 4.0 will allow physical equipment or machines to communicate with control systems and act autonomously. For instance, customers return a defective product with a scratch or a food item past its expiration date. Defects can hurt a brand or retailer’s credibility in an era when maintaining consumer trust is critical. Therefore, many organizations have embraced artificial intelligence (AI) and automation to speed up supply chains, increase inventory and order accuracy, and improve quality control.

CHALLENGES: Mechanical failures in harsh environments.

Encoders are commonly used in harsh or challenging environments, such as food/beverage processing, heavy equipment industry, specialty vehicle manufacturing, energy generation, medical device manufacturing, and wastewater treatment facilities. In harsh environments, encoder failure is caused by solid particulate or liquid contamination, mechanical bearing overload, and signal output failure. As a result of any of these, the encoder ceases to operate, or the system operates erratically. Similarly, encoders are mostly come in contact with particulates such as sand, salt, small wood chips, or dust particles. These particulates enter the encoders and block the optical processing which results in failure of the device. Even industrial encoders with high IP rating will not withstand in such contamination for long. Therefore, use of encoder in harsh environment such as meeting moisture, extreme temperature, salt spray, chemical and vibration above limit results in encoder failure.

Absolute Encoder segment is expected to register highest CAGR during the forecast period

Absolute rotary encoders measure the actual position of the device/product by generating a stream of unique digital codes (instead of pulses) that represent the encoder’s actual position. They provide unique position values as soon as they are switched on by scanning the position of a coded element. Simialry, absolute linear encoders produce a digital output that signifies the unit’s actual position. These encoders assign a unique digital value to each position, which allows them to maintain precise position information, even in case of a power cut. Renishaw plc (UK), Fortive (Dynapar Corporation) (US), FRABA B.V. (The Netherlands), Sensata Technologies Holding plc (US), are some of the key players offer and develop absolute encoder.

Industrial application is expected to hold largest market share during the forecast period

Encoders in industrial applications are used for linear measurement, registration of mark timing, web tensioning, backstop gauging, conveying, and filling. The most common application is providing feedback in motion control of electric motors. In the industrial sector, nearly half of the electricity consumed is used to power electric motors; the majority of these motors are equipped with encoders. For instance, encoders are used specifically in robotics for determining motion position, controlling joint position, measuring linear extension, and providing gripper & finger feedback and force feedback. Typical applications of robots in industries include welding, painting, assembly, picking and placing for printed circuit boards, packaging and labeling, palletizing, product inspection, and testing of high endurance, speed, and precision. Furthermore, these encoders are used in heavy duty to light duty applications. In the heavy-duty applications, the encoder has to operate in high temperature with particulates, moisture, contaminants and under shock of vibration whereas in light duty application, the encoder is used in consumer facing applications where conditions are under controlled like temperature, vibration, moisture, etc. Therefore, the encoder offers excellent speed and positioning performance with temperature resistance and reliable shock resistance. Thus, the increase in the adoption of robotics and factory automation is expected to fuel the demand for encoders in the industrial application segment.

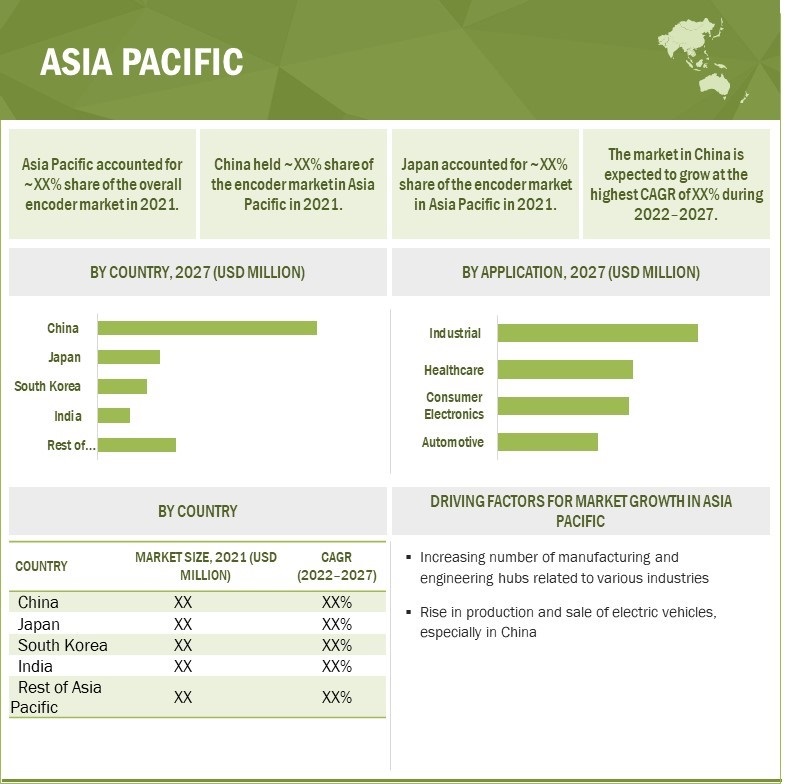

Asia Pacific to grow at the highest CAGR during the forecast period

The increase in manufacturing and engineering hubs related to various industries attributed to the growth of the encoder market in theAsia pacific region. Countries Like, China has witnessed tremendous industrial growth for the past two decades and has overtaken the US to become the world’s largest producer of manufactured goods. The country is a hub for electronics & semiconductor components and the largest manufacturer of commercial vehicles. Furthermore, rapid economic growth and the emergence of numerous small- and medium-scale enterprises are contributing to the increasing demand for low-end MFPs in China, leading to the growth of the encoder market. South Korean robotic shipment ranked third globally, and the country has the highest density of industrial robots in the world. The automakers in Korea have adopted many robots, which help manufacture electric and hybrid vehicle batteries. The adoption of robotics and automation in the manufacturing industry boosting the demand of encoder in the country

Encoder Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Encoder Companies are dominated by players such as Renishaw plc (UK), HEIDENHAIN (Germany), FRABA B.V. (The Netherlands), Sensata Technologies Holding plc (US), ifm electronics gmbh (Germany), Mitutoyo Corporation (Japan), Pepperl+Fuchs SE (Germany), Fortive (US), maxon motor ag (switzerland), Balluff Inc. (Germany). Pilz GmbH & Co. KG (Germany), Tamagawa Seiki Co., Ltd. (Japan), FAULHABER Group (Germany), Baumer Group (Switzerland), Koyo Electronics Industries Co., Ltd. (Japan), Schneider Electric SE (France), Omron Corporation (Japan), Rockwell Automation, Inc. (US), SICK AG (Germany), Hengstler GmbH (Germany), Kubler Group (Germany), Elap srl (Italy), SIKO GmbH (Germany), Nemicon Corporation (Japan), and Gurley Precision Instruments (Japan).

Encoders Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 2.7 Billion |

| Revenue Forecast in 2027 | USD 4.3 Billion |

| Growth Rate | 9.7% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

|

|

Regions Covered |

North America, Europe, Asia Pacific and RoW |

|

Companies Covered |

|

Encoder Market Highlights

This research report categorizes the encoder market by frequency type, type, industry, and region.

|

Aspect |

Details |

|

By Encoder Type: |

|

|

By Signal Type: |

|

|

By Technology: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Encoders Industry

- In May 2022, Pepperl+Fuchs launched the hollow shaft ENI90 series incremental rotary encoder. These rotary encoders are compact and robust bring maximum precision to any standard or heavy-duty application and withstand with rotational speed of up to 6,000 rpm.

- In November 2021, Baumer launched new bearingless encoder EB200E which is designed in a way that it can be integrated on any axis without complex adaptation if the mechanics. The encoder is first in class smart incremental encoder with IO-Link which provides speed monitoring function and replaces additional hardware components.

- In July 2021, Balluff Inc has launched rotary encoders used wherever speed/rotary movements or angular velocity, length and positions need to be recorded. These encoders convert the mechanical movements into digital electrical signals.

- In June 2021, Balluff Inc. launched the BML SF2 magnetic safety encoder system for applications like in special machine building for cutting and forming machines.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the encoder market during 2022-2027?

The global encoder market is expected to record a CAGR of 9.7% from 2022–2027.

What are the driving factors for the encoder market?

need for high-end automation across industries, growth in adoption of Industry 4.0 and expansion of automotive market driving the encoder demand.

Which applications are expected to drive the growth of the market in the next six years?

Industrial, Consumer Electronics, Healthcare and Automotive are those industry with the highest opportunities for encoder market

Which region will lead the encoder market in the future?

Asia Pacific is expected to lead the encoder market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ENCODER MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 ENCODER MARKET: REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 ENCODER MARKET: RESEARCH DESIGN

2.2 SECONDARY & PRIMARY RESEARCH

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary interviews with experts

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN ENCODER MARKET

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach to arrive at market share by bottom-up analysis (demand side)

FIGURE 5 ENCODER MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach to arrive at market share by top-down analysis (supply side)

FIGURE 6 ENCODER MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 INDUSTRIAL APPLICATIONS TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 9 ROTARY ENCODER SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

FIGURE 10 MAGNETIC TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN ENCODER MARKET

FIGURE 12 INCREASING MANUFACTURING & ENGINEERING HUBS WORLDWIDE TO DRIVE MARKET

4.2 ENCODER MARKET, BY ENCODER TYPE

FIGURE 13 ROTARY ENCODER SEGMENT TO REGISTER HIGHER CAGR BETWEEN 2022 AND 2027

4.3 ENCODER MARKET, BY SIGNAL TYPE

FIGURE 14 INCREMENTAL ENCODER TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

4.4 ENCODER MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

FIGURE 15 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC REGION DURING FORECAST PERIOD

4.5 ENCODER MARKET, BY COUNTRY

FIGURE 16 CHINA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 ENCODER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising need for high-end automation across industries

5.2.1.2 Growing adoption of Industry 4.0

FIGURE 18 ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS

5.2.1.3 Growing expansion of automotive markets worldwide

FIGURE 19 ENCODER MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Accuracy-related errors

5.2.2.2 Variations in international regulations

FIGURE 20 ENCODERS MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Rising government initiatives to boost industrial automation

TABLE 1 INVESTMENTS IN INDUSTRIAL AUTOMATION PROVIDED THROUGH GOVERNMENT INITIATIVES

5.2.3.2 Increasing demand for machine learning and artificial intelligence-based systems

5.2.3.3 Innovative technologies in automotive and UAV industries

FIGURE 21 ENCODER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Mechanical failure in harsh environments

FIGURE 22 ENCODER MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 ENCODER MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 24 ENCODER MARKET: ECOSYSTEM ANALYSIS

TABLE 2 ENCODER MARKET ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 3 INDICATIVE PRICES OF ENCODERS

5.5.1 AVERAGE SELLING PRICE OF ENCODER TYPES OFFERED BY KEY PLAYERS

FIGURE 25 AVERAGE SELLING PRICE OF ENCODER TYPES OFFERED BY KEY PLAYERS

TABLE 4 AVERAGE SELLING PRICE OF SIGNAL TYPE ENCODERS OFFERED BY KEY PLAYERS (USD)

TABLE 5 AVERAGE SELLING PRICE OF ENCODER TYPES OFFERED BY KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN ENCODERS MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 IMPACT OF IIOT ON ENCODER INDUSTRIES

5.7.2 RISE OF COLLABORATIVE & AGV ROBOTS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 ENCODER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 ENCODER MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 7 ENCODER MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

5.9.2 BUYING CRITERIA

FIGURE 28 ENCODER MARKET: KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.10 CASE STUDIES

TABLE 9 SAM-JEONG AUTOMATION INCORPORATED RENISHAW’S INCREMENTAL ENCODER TO ACHIEVE ACCURACY

TABLE 10 PAL ROBOTICS INTEGRATED ENCODERS INTO ROBOTIC TECHNOLOGY

TABLE 11 SCODIX ULTRA CHOSE RENISHAW’S TONIC INCREMENTAL ENCODER SYSTEM TO ACHIEVE HIGH-QUALITY PRINTING

5.11 TRADE ANALYSIS

FIGURE 29 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 30 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 12 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 13 ENCODER MARKET: KEY PATENTS, 2020–2021

5.13 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 14 ENCODER MARKET: KEY CONFERENCES & EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 STANDARDS

TABLE 19 STANDARDS FOR ENCODER MARKET

6 ENCODER MARKET, BY ENCODER TYPE (Page No. - 76)

6.1 INTRODUCTION

FIGURE 33 ROTARY ENCODER SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

TABLE 20 ENCODER MARKET, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 21 ENCODER MARKET, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 22 ENCODER MARKET, BY ENCODER TYPE, 2018–2021 (MILLION UNITS)

TABLE 23 ENCODER MARKET, BY ENCODER TYPE, 2022–2027 (MILLION UNITS)

6.2 ROTARY ENCODER

6.2.1 CONVERTS ANGULAR POSITIONING OF A ROTATING SHAFT INTO ANALOG/DIGITAL SIGNALS

TABLE 24 ROTARY ENCODER MARKET, BY SIGNAL TYPE, 2018–2021 (USD MILLION)

TABLE 25 ROTARY ENCODER MARKET, BY SIGNAL TYPE, 2022–2027 (USD MILLION)

TABLE 26 ROTARY ENCODER MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 27 ROTARY ENCODER MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 28 ROTARY ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 29 ROTARY ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.3 LINEAR ENCODER

6.3.1 MEASURES POSITION BY SENDING FEEDBACK TO CONTROL SYSTEM

TABLE 30 LINEAR ENCODER MARKET, BY SIGNAL TYPE, 2018–2021 (USD MILLION)

TABLE 31 LINEAR ENCODER MARKET, BY SIGNAL TYPE, 2022–2027 (USD MILLION)

TABLE 32 LINEAR ENCODER MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 33 LINEAR ENCODER MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 34 LINEAR ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 35 LINEAR ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7 ENCODER MARKET, BY SIGNAL TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 34 INCREMENTAL ENCODER SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

TABLE 36 ENCODER MARKET, BY SIGNAL TYPE, 2018–2021 (USD MILLION)

TABLE 37 ENCODER MARKET, BY SIGNAL TYPE, 2022–2027 (USD MILLION)

TABLE 38 ENCODER MARKET, BY SIGNAL TYPE, 2018–2021 (MILLION UNITS)

TABLE 39 ENCODER MARKET, BY SIGNAL TYPE, 2022–2027 (MILLION UNITS)

7.2 INCREMENTAL ENCODER

7.2.1 SIMPLIFIED HARDWARE AND FLEXIBLE FUNCTIONALITY TO DRIVE MARKET

TABLE 40 INCREMENTAL ENCODER MARKET, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 41 INCREMENTAL ENCODER MARKET, BY ENCODER TYPE, 2022–2027 (USD MILLION)

7.3 ABSOLUTE ENCODER

7.3.1 RELIABLE MEASUREMENT PERFORMANCE TO DRIVE MARKET

TABLE 42 ABSOLUTE ENCODER MARKET, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 43 ABSOLUTE ENCODER MARKET, BY ENCODER TYPE, 2022–2027 (USD MILLION)

8 ENCODER MARKET, BY TECHNOLOGY (Page No. - 89)

8.1 INTRODUCTION

FIGURE 35 MAGNETIC TECHNOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 44 ENCODER MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 45 ENCODER MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 46 ENCODER MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 47 ENCODER MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

8.2 MAGNETIC ENCODER

8.2.1 RELIABLE DIGITAL FEEDBACK IN HARSH ENVIRONMENTS TO DRIVE MARKET

TABLE 48 MAGNETIC TECHNOLOGY, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 49 MAGNETIC TECHNOLOGY, BY ENCODER TYPE, 2022–2027 (USD MILLION)

8.3 OPTICAL ENCODER

8.3.1 ABILITY TO MONITOR AND CONTROL MECHANICAL SYSTEMS TO DRIVE UPTAKE

TABLE 50 OPTICAL TECHNOLOGY, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 51 OPTICAL TECHNOLOGY, BY ENCODER TYPE, 2022–2027 (USD MILLION)

8.4 INDUCTIVE ENCODER

8.4.1 COMPACT DESIGN WITH HIGH ACCURACY TO DRIVE DEMAND

TABLE 52 INDUCTIVE TECHNOLOGY, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 53 INDUCTIVE TECHNOLOGY, BY ENCODER TYPE, 2022–2027 (USD MILLION)

8.5 OTHER TECHNOLOGIES

TABLE 54 OTHER TECHNOLOGIES, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 55 OTHER TECHNOLOGIES, BY ENCODER TYPE, 2022–2027 (USD MILLION)

9 ENCODER MARKET, BY APPLICATION (Page No. - 96)

9.1 INTRODUCTION

FIGURE 36 INDUSTRIAL APPLICATION SEGMENT TO DOMINATE ENCODER MARKET DURING FORECAST PERIOD

TABLE 56 ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 57 ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 58 ENCODER MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 59 ENCODER MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

9.2 INDUSTRIAL

9.2.1 INCREASING UTILIZATION OF ENCODERS IN ROBOTICS AND FACTORY AUTOMATION

TABLE 60 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 61 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 62 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.3 HEALTHCARE

9.3.1 UTILIZATION OF SURGICAL ROBOTS IN HEALTHCARE APPLICATIONS TO DRIVE MARKET

TABLE 64 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 65 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 66 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.4 CONSUMER ELECTRONICS

9.4.1 SURGE OF LINEAR MOTOR ENCODERS IN ELECTRICAL APPLIANCES TO DRIVE MARKET

TABLE 68 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 69 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 70 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.5 AUTOMOTIVE

9.5.1 RISING INTEGRATION OF AUTOMATION IN AUTOMOBILES TO PROPEL GROWTH

TABLE 72 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 73 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 74 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.6 POWER

9.6.1 INCREASING COMPLEXITIES IN SOLAR & WIND ENERGY APPLICATIONS TO DRIVE MARKET

TABLE 76 ENCODER MARKET FOR POWER APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 77 ENCODER MARKET FOR POWER APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 78 ENCODER MARKET FOR POWER APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 ENCODER MARKET FOR POWER APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.7 FOOD & BEVERAGE

9.7.1 INTEGRATION OF IO-LINK TECHNOLOGY INTO ENCODERS TO DRIVE MARKET

TABLE 80 ENCODER MARKET FOR FOOD & BEVERAGE APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 81 ENCODER MARKET FOR FOOD & BEVERAGE APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 82 ENCODER MARKET FOR FOOD & BEVERAGE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 ENCODER MARKET FOR FOOD & BEVERAGE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.8 AEROSPACE

9.8.1 PRECISION CONTROL TECHNOLOGY OF ENCODERS IN AIRBORNE PLANES TO PROPEL GROWTH

TABLE 84 ENCODER MARKET FOR AEROSPACE APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 85 ENCODER MARKET FOR AEROSPACE APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 86 ENCODER MARKET FOR AEROSPACE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 ENCODER MARKET FOR AEROSPACE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.9 PRINTING

9.9.1 USE OF ROTARY ENCODERS IN PRINTING APPLICATIONS AND OFFICE EQUIPMENT TO DRIVE MARKET

TABLE 88 ENCODER MARKET FOR PRINTING APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 89 ENCODER MARKET FOR PRINTING APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 90 ENCODER MARKET FOR PRINTING APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 ENCODER MARKET FOR PRINTING APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.10 TEXTILE

9.10.1 GROWING UTILIZATION OF ENCODERS IN WEAVING & KNITTING PROCESSES TO DRIVE MARKET

TABLE 92 ENCODER MARKET FOR TEXTILE APPLICATION, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 93 ENCODER MARKET FOR TEXTILE APPLICATION, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 94 ENCODER MARKET FOR TEXTILE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 ENCODER MARKET FOR TEXTILE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHER APPLICATIONS

TABLE 96 ENCODER MARKET FOR OTHER APPLICATIONS, BY ENCODER TYPE, 2018–2021 (USD MILLION)

TABLE 97 ENCODER MARKET FOR OTHER APPLICATIONS, BY ENCODER TYPE, 2022–2027 (USD MILLION)

TABLE 98 ENCODER MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 ENCODER MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

10 ENCODER MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 37 GEOGRAPHIC SNAPSHOT: ASIA PACIFIC MARKET TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 100 ENCODER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 ENCODER MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 102 ENCODER MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 103 ENCODER MARKET, BY REGION, 2022–2027 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: ENCODER MARKET SNAPSHOT

TABLE 104 NORTH AMERICA: ENCODER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: ENCODER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 107 NORTH AMERICA: ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Large industrial base for consumer electronics and automotive manufacturing to drive market

10.2.2 CANADA

10.2.2.1 Rising adoption of advanced technologies in aerospace industry to drive market

10.2.3 MEXICO

10.2.3.1 Expanding consumer electronics industry to support market growth

10.3 EUROPE

FIGURE 39 EUROPE: ENCODER MARKET SNAPSHOT

TABLE 108 EUROPE: ENCODER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 EUROPE: ENCODER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 EUROPE: ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Expanding manufacturing sector to drive uptake of encoders

10.3.2 GERMANY

10.3.2.1 Growing use of robotics in automobiles to drive market

10.3.3 FRANCE

10.3.3.1 Growing manufacturing & textile industries to drive demand for encoders

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: ENCODER MARKET SNAPSHOT

TABLE 112 ASIA PACIFIC: ENCODER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: ENCODER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Rising expansion of manufacturing & mining industries to drive market

10.4.2 JAPAN

10.4.2.1 Rising demand for electric & hybrid vehicles in automotive industry to drive market

10.4.3 SOUTH KOREA

10.4.3.1 Increasing technological advancements in consumer electronics to drive demand for encoders

10.4.4 INDIA

10.4.4.1 Rising textile industry to drive market

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD

TABLE 116 REST OF THE WORLD: ENCODER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 117 REST OF THE WORLD: ENCODER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 REST OF THE WORLD: ENCODER MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 REST OF THE WORLD: ENCODER MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Growing mining industry to fuel market growth

10.5.2 MIDDLE EAST

10.5.2.1 Surge in automation to drive demand for encoders

10.5.3 AFRICA

10.5.3.1 Rising manufacturing hub for automotive vehicles to drive market

11 COMPETITIVE LANDSCAPE (Page No. - 138)

11.1 INTRODUCTION

11.2 COMPANY REVENUE ANALYSIS

FIGURE 41 ENCODER MARKET: REVENUE ANALYSIS OF TOP THREE PLAYERS, 2017–2021

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 120 ENCODER MARKET: MARKET SHARE OF TOP FIVE PLAYERS, 2021

11.4 COMPETITIVE EVALUATION QUADRANT, 2021

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 42 ENCODER MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2021

11.4.5 ENCODER MARKET: COMPANY FOOTPRINT

TABLE 121 COMPANY TYPE FOOTPRINT

TABLE 122 COMPANY APPLICATION FOOTPRINT

TABLE 123 COMPANY REGION FOOTPRINT

TABLE 124 COMPANY FOOTPRINT

11.5 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION MATRIX, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 43 ENCODER MARKET: SME EVALUATION QUADRANT, 2021

11.5.5 STARTUPS/SMES EVALUATION MATRIX

TABLE 125 ENCODER MARKET: KEY STARTUPS/SMES

TABLE 126 ENCODER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 127 ENCODER MARKET: PRODUCT LAUNCHES & DEVELOPMENTS (MAY 2019–MAY 2022)

11.6.2 DEALS

TABLE 128 ENCODER MARKET: DEALS

11.6.3 OTHER DEVELOPMENTS

TABLE 129 ENCODER MARKET: OTHER DEVELOPMENTS (APRIL 2019–JULY 2022)

12 COMPANY PROFILES (Page No. - 158)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 SENSATA TECHNOLOGIES INC.

TABLE 130 SENSATA TECHNOLOGIES INC: COMPANY OVERVIEW

FIGURE 44 SENSATA TECHNOLOGIES INC: COMPANY SNAPSHOT

TABLE 131 SENSATA TECHNOLOGIES INC: PRODUCTS OFFERED

TABLE 132 SENSATA TECHNOLOGIES INC: PRODUCT LAUNCHES

TABLE 133 SENSATA TECHNOLOGIES INC: OTHER DEVELOPMENTS

12.1.2 HEIDENHAIN

TABLE 134 HEIDENHAIN: COMPANY OVERVIEW

TABLE 135 HEIDENHAIN: PRODUCTS OFFERED

TABLE 136 HEIDENHAIN: PRODUCTS LAUNCHES

TABLE 137 HEIDENHAIN: OTHER DEVELOPMENTS

12.1.3 FORTIVE (DYNAPAR CORPORATION)

TABLE 138 FORTIVE (DYNAPAR CORPORATION): COMPANY OVERVIEW

FIGURE 45 FORTIVE (DYNAPAR CORPORATION): COMPANY SNAPSHOT

TABLE 139 FORTIVE (DYNAPAR CORPORATION): PRODUCTS OFFERED

TABLE 140 FORTIVE (DYNAPAR CORPORATION): PRODUCT LAUNCHES

12.1.4 RENISHAW PLC

TABLE 141 RENISHAW PLC: COMPANY OVERVIEW

FIGURE 46 RENISHAW PLC: COMPANY SNAPSHOT

TABLE 142 RENISHAW PLC: PRODUCTS OFFERED

TABLE 143 RENISHAW PLC: PRODUCTS LAUNCHES

12.1.5 MITUTOYO CORPORATION

TABLE 144 MITUTOYO CORPORATION: COMPANY OVERVIEW

TABLE 145 MITUTOYO CORPORATION: PRODUCTS OFFERED

TABLE 146 MITUTOYO CORPORATION: OTHER DEVELOPMENTS

12.1.6 FRABA B.V. (POSITAL FRABA)

TABLE 147 FRABA B.V. (POSITAL FRABA): COMPANY OVERVIEW

TABLE 148 FRABA B.V.: PRODUCTS OFFERED

TABLE 149 FRABA B.V.: PRODUCT LAUNCHES

TABLE 150 FRABA B.V.: DEALS

TABLE 151 FRABA B.V.: OTHER DEVELOPMENTS

12.1.7 IFM ELECTRONIC GMBH

TABLE 152 IFM ELECTRONIC GMBH: COMPANY OVERVIEW

TABLE 153 IFM ELECTRONIC GMBH: PRODUCTS OFFERED

TABLE 154 IFM ELECTRONIC GMBH: OTHER DEVELOPMENTS

12.1.8 PEPPERL+FUCHS SE

TABLE 155 PEPPERL+FUCHS SE: COMPANY OVERVIEW

TABLE 156 PEPPERL+FUCHS SE: PRODUCTS OFFERED

TABLE 157 PEPPERL+FUCHS SE: PRODUCT LAUNCHES

12.1.9 MAXON MOTOR AG

TABLE 158 MAXON MOTOR AG: BUSINESS OVERVIEW

TABLE 159 MAXON MOTOR AG: PRODUCTS OFFERED

TABLE 160 MAXON MOTOR AG: PRODUCT LAUNCHES

TABLE 161 MAXON MOTOR AG: OTHER DEVELOPMENTS

12.1.10 BALLUFF INC.

TABLE 162 BALLUFF INC: COMPANY OVERVIEW

TABLE 163 BALLUFF INC: PRODUCT OFFERED

TABLE 164 BALLUFF INC: PRODUCT LAUNCHES

TABLE 165 BALLUFF INC: OTHER DEVELOPMENTS

12.1.11 PILZ GMBH & CO. KG

TABLE 166 PILZ GMBH & CO. KG: COMPANY OVERVIEW

TABLE 167 PILZ GMBH & CO. KG: PRODUCTS OFFERED

12.1.12 TAMAGAWA SEIKI CO., LTD.

TABLE 168 TAMAGAWA SEIKI CO., LTD.: COMPANY OVERVIEW

TABLE 169 TAMAGAWA SEIKI CO., LTD.: PRODUCTS OFFERED

12.1.13 FAULHABER GROUP

TABLE 170 FAULHABER GROUP: COMPANY OVERVIEW

TABLE 171 FAULHABER GROUP: PRODUCTS OFFERED

TABLE 172 FAULHABER GROUP: PRODUCT LAUNCHES

TABLE 173 FAULHABER GROUP: OTHER DEVELOPMENTS

12.1.14 BAUMER GROUP

TABLE 174 BAUMER GROUP: COMPANY OVERVIEW

TABLE 175 BAUMER GROUP: PRODUCTS OFFERED

TABLE 176 BAUMER GROUP: PRODUCT LAUNCHES

TABLE 177 BAUMER GROUP: OTHER DEVELOPMENTS

12.1.15 KOYO ELECTRONICS INDUSTRIES CO., LTD.

TABLE 178 KOYO ELECTRONICS INDUSTRIES CO., LTD: COMPANY OVERVIEW

TABLE 179 KOYO ELECTRONICS INDUSTRIES CO., LTD: PRODUCTS OFFERED

TABLE 180 KOYO ELECTRONICS INDUSTRIES CO., LTD: PRODUCT LAUNCHES

TABLE 181 KOYO ELECTRONICS INDUSTRIES CO., LTD: OTHER DEVELOPMENTS

12.2 OTHER KEY PLAYERS

12.2.1 SCHNEIDER ELECTRIC SE

12.2.2 OMRON CORPORATION

12.2.3 ROCKWELL AUTOMATION, INC.

12.2.4 SICK AG

12.2.5 HENGSTLER GMBH

12.2.6 KÜBLER GROUP

12.2.7 ELAP SRL

12.2.8 SIKO GMBH

12.2.9 NEMICON CORPORATION

12.2.10 GURLEY PRECISION INSTRUMENTS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 201)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 POSITION SENSOR MARKET, BY APPLICATION

13.3.1 INTRODUCTION

TABLE 182 POSITION SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 183 POSITION SENSOR MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.2 MACHINE TOOLS

13.3.2.1 Use of position sensors in machine tools enables a higher degree of automation and versatility

TABLE 184 POSITION SENSOR MARKET FOR MACHINE TOOLS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 185 POSITION SENSOR MARKET FOR MACHINE TOOLS, BY TYPE, 2020–2025 (USD MILLION)

13.3.3 ROBOTICS

13.3.3.1 Position sensors provide meaningful information to controllers via electronic signals enabling robots to perform tasks efficiently

TABLE 186 POSITION SENSOR MARKET FOR ROBOTICS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 187 POSITION SENSOR MARKET FOR ROBOTICS, BY TYPE, 2020–2025 (USD MILLION)

13.3.4 MOTION SYSTEMS

13.3.4.1 Position sensors are used in motion systems to measure absolute or incremental displacement

TABLE 188 POSITION SENSOR MARKET FOR MOTION SYSTEMS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 189 POSITION SENSOR MARKET FOR MOTION SYSTEMS, BY TYPE, 2020–2025 (USD MILLION)

13.3.5 MATERIAL HANDLING

13.3.5.1 Material handling applications require position sensors to ensure safe and controlled operations

TABLE 190 POSITION SENSOR MARKET FOR MATERIAL HANDLING, BY TYPE, 2016–2019 (USD MILLION)

TABLE 191 POSITION SENSOR MARKET FOR MATERIAL HANDLING, BY TYPE, 2020–2025 (USD MILLION)

13.3.6 TEST EQUIPMENT

13.3.6.1 Automotive, aerospace, industrial, and medical sectors use position sensors to test equipment and ensure high accuracy & precision

TABLE 192 POSITION SENSOR MARKET FOR TEST EQUIPMENT, BY TYPE, 2016–2019 (USD MILLION)

TABLE 193 POSITION SENSOR MARKET FOR TEST EQUIPMENT, BY TYPE, 2020–2025 (USD MILLION)

13.3.7 OTHERS

TABLE 194 POSITION SENSOR MARKET FOR OTHER APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 195 POSITION SENSOR MARKET FOR OTHER APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

13.3.8 IMPACT OF COVID-19 ON POSITION SENSOR MARKET FOR DIFFERENT APPLICATIONS

14 APPENDIX (Page No. - 209)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

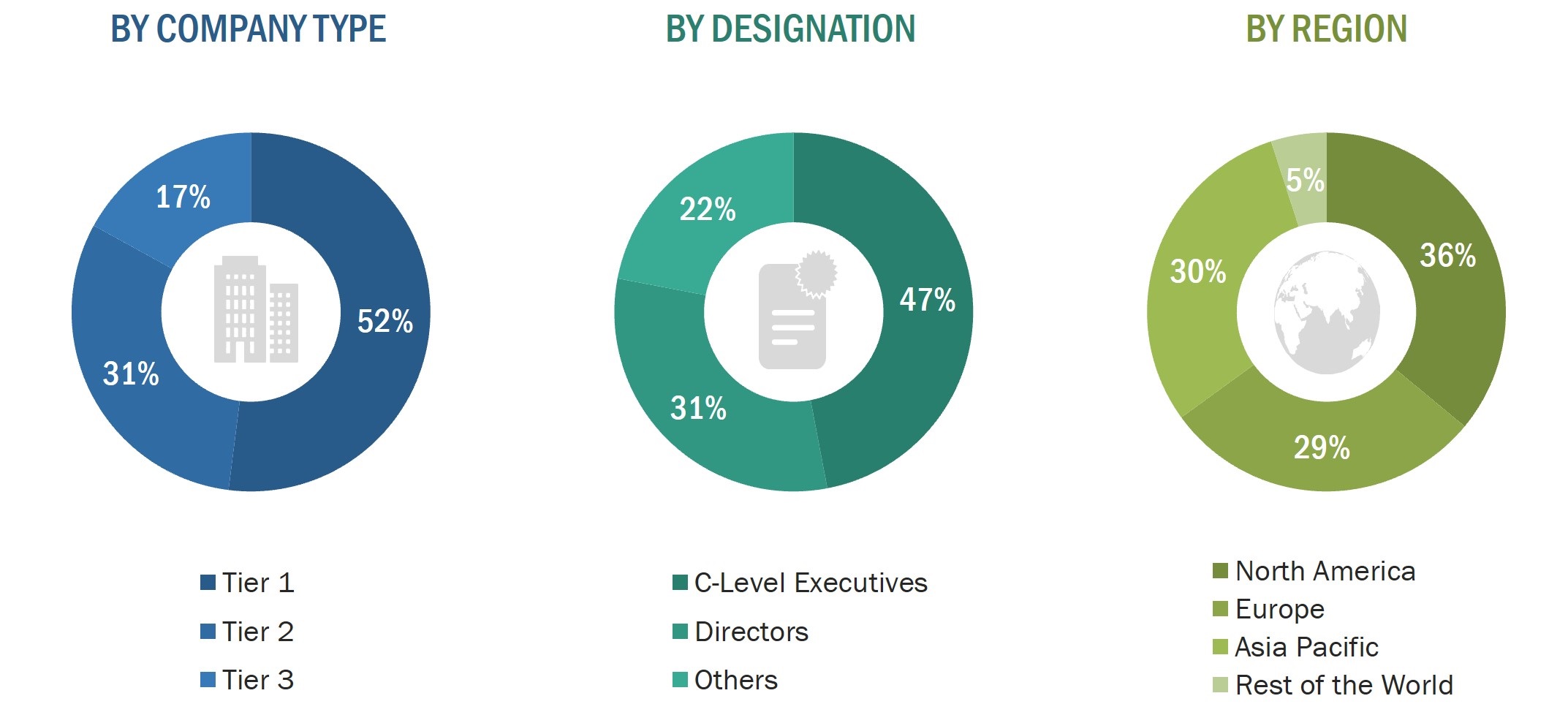

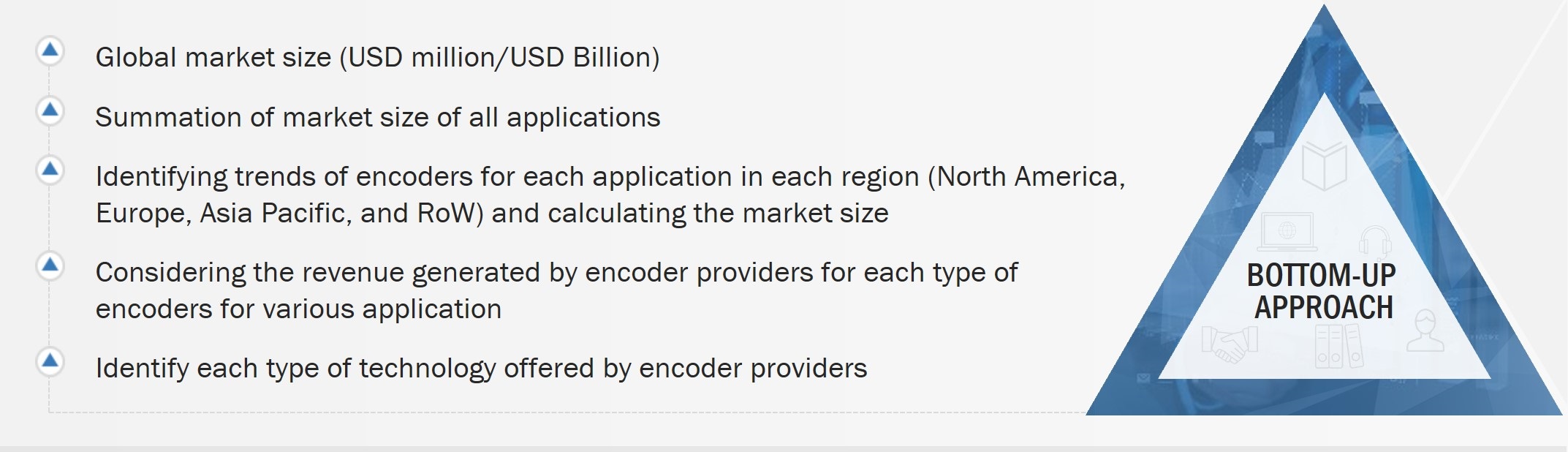

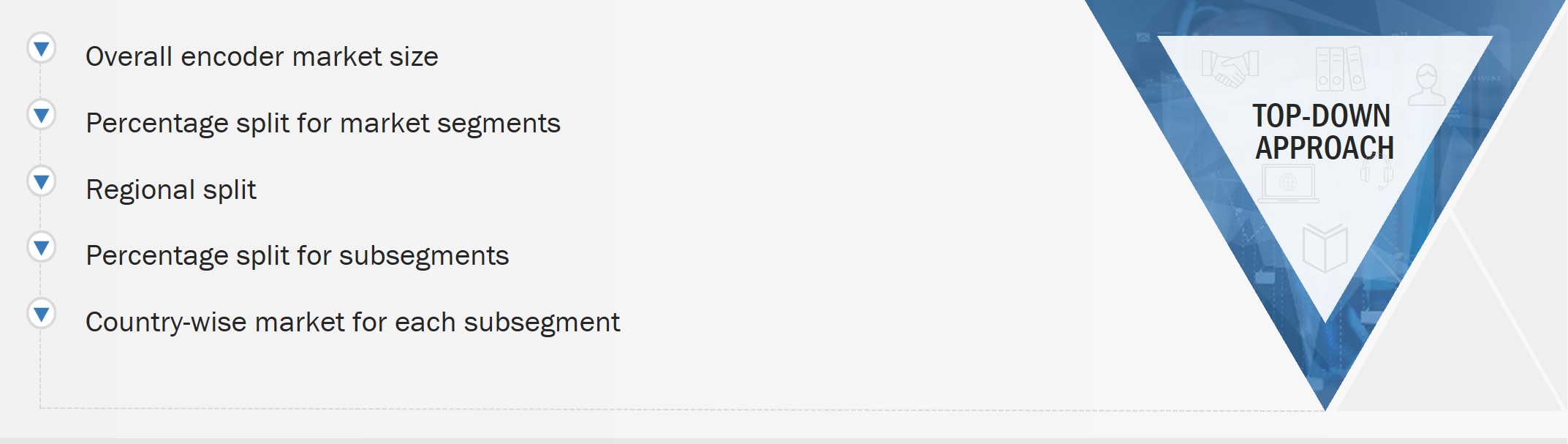

The study involved four major activities in estimating the size of the encoder market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press releases); trade, business, and professional associations; white papers, encoder-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the encoder market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast, and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the encoder market.

Major players in the encoder market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. The entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Encoder Market : Bottom-Up Approach

- Identifying entities in the encoder market that influence the entire market, along with related automation players

- Analyzing major providers of encoders and studying their portfolios, and understanding different types of encoders

- Analyzing trends pertaining to the use of different types of encoders for different applications

- Tracking the ongoing and upcoming developments in the market, such as investments made, R&D activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand different types of encoders, applications, and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing revenues of companies generated and then combining the same to get the market estimate

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimates at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

Encoder Market : Top-Down Approach

- Focusing on top-line investments and expenditure made in the encoder ecosystem

- Building and developing information related to the revenue generated by offering key types of encoders

- Conducting multiple on-field discussions with key opinion leaders from the major companies involved in development of encoders

- Calculating the market size considering revenues generated by major players through the sale of encoders

- Further segmenting the market on the basis of R&D activities and key developments in major market areas

- Further segmenting the market by mapping the use of encoder for different applications

- Estimating the geographic split using secondary sources based on various factors, such as the number of encoder providers, role of automation companies, and adoption of automation solutions in a specific country and region; role of major players in the market for the development of innovative products; and adoption and penetration rates in a particular country for various applications

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global encoder market based on encoder type, signal type, technology type, application, and geography.

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the encoder market

- To analyze opportunities for stakeholders in the encoder market by identifying the high-growth segments

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 along with detailing the competitive leadership and analyzing growth strategies, such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships, of the leading players.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Encoder Market