Enterprise Asset Management Market by Application (Asset Life Cycle Management, Inventory Management, Predictive Maintenance), Component, Organization Size, Deployment Model, Vertical (Manufacturing, Energy & Utilities) and Region - Global Forecast to 2027

Updated on : April 06, 2023

Enterprise Asset Management Market Size, 2027

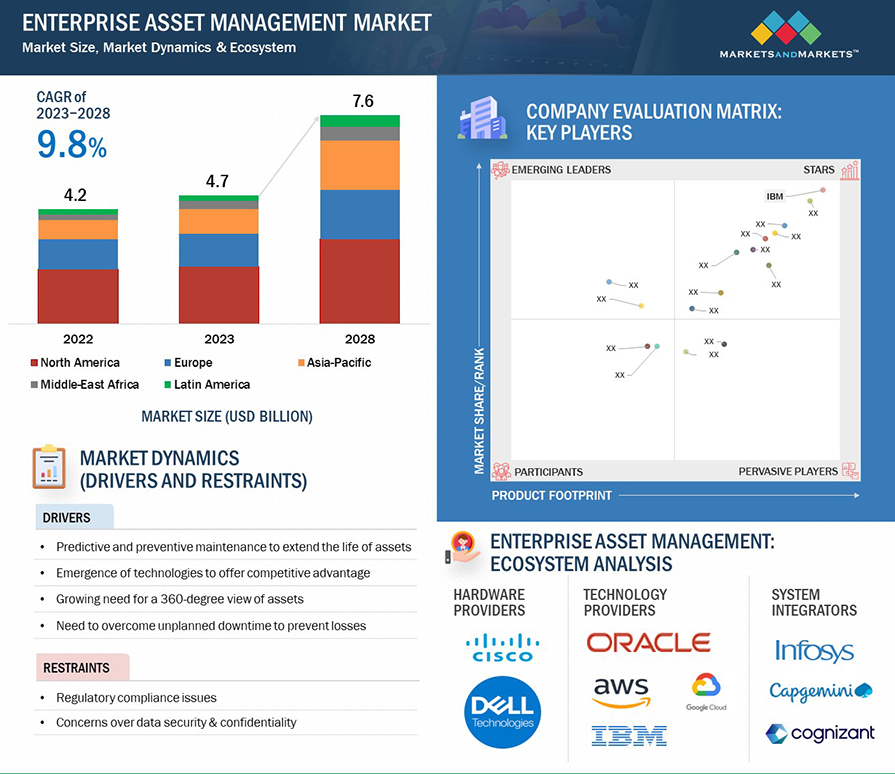

[242 Pages Report] The global Enterprise Asset Management Market in terms of revenue was estimated to be worth $4.2 billion in 2022 and is poised to reach $7.0 billion by 2027, growing at a CAGR of 10.5% from 2022 to 2027. The convergence of AI, IoT, and analytics and the growing need for gaining a 360-degree view of assets is expected to boost the adoption of EAM solutions during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Enterprise Asset Management Market Dynamics

Driver: Emergence of mobility in EAM solutions

The ubiquity of mobility and mobile devices, including smartphones, tablets, and phablets, drive a “mobile-first” mentality across businesses and industries. This increased use of mobile devices is expected to expand the reach of mobility in EAM solutions. The handheld smart devices have grown in capability alongside EAM and field service systems with technologies such as GPS, GIS, RFID, and embedded cameras.

With modern mobile devices and ruggedized versions of these devices, life can be easier and more productive for EAM users. Maintenance workers can access work order instructions, equipment hierarchies, part numbers, inventory data, and similar information at their fingertips. Hence, EAM and CMMS software providers have addressed this data duplication by creating mobile applications that can easily be integrated with the core system. Due to the integration with the central system, even remote employees could enter the data safely and quickly.

Restraint: Concerns over data security and confidentiality

With the growing digitization, cyber-attacks are also increasing drastically. Therefore, data security has become an important factor for the organizations to remain competitive in the global market. Organizations embracing new advanced digital technologies are making their data vulnerable to risks. There is a significant rise in cybersecurity concerns with the transfer of data from the field to the cloud platform, as malicious parties can attack servers, networks, and communication channels. As per Ultimo Enterprise Asset Management Trend Report 2022, over 80% organizations are using software-based solutions, such as cloud or on-premises EAM software, to manage their assets, cybersecurity does not appear to be a priority for the respondents. While most saw security features as somewhat important criteria in future asset management software, over 30% disregarded. The increasing level of connectivity and integration between devices and solutions can create new vulnerabilities that are challenging to address if staff don't know what to look out for.

Opportunity: Adoption of a digital asset management strategy to drive better return on assets

Digital asset management strategy forms an important part of businesses. Improving assets' reliability and performance are among organizations' top priorities. Implementing and deploying EAM solutions across organizations can be complex and involve many strategic and technical decisions. Businesses are focusing on controlling costs and maximizing value from their investments. The major challenge businesses face is that they have no digital asset management strategy. However, organizations have started recognizing the potential of the digital asset management strategy and made significant improvements in labor utilization and reduced equipment downtime and inventory needs. With multiple touchpoints, a well-formulated asset management strategy would help organizations make the best use of their assets.

Challenge: Integration of EAM with the third-party ERP systems

Asset management is essential for smooth operations across a wide range of industries. Asset-intensive organizations need Enterprise Resource Planning (ERP) and EAM systems. The effective integration of these systems enables organizations to put their asset management capabilities to greater use and improve their core business processes. Integrating EAM and ERP systems at times becomes quite challenging as many organizations have their legacy ERP systems in place. This could cause great difficulty for these organizations to upgrade to new ERP systems with built-in EAM components.

Enterprise asset management market ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on applications, predictive maintenance application segment to grow at higher CAGR during forecast period

Today, there is a growing market for digital technologies in asset management. For instance, mobile applications provide maintenance personnel with real-time information on the issues detected in the assets, which prevents unplanned downtime. "Predictive maintenance systems aim to improve maintenance schedules, costs, and identify problems within the organization’s fixed assets. It helps in improving productivity, increasing sales, and improving profit margins. EAM vendors offer predictive maintenance solutions to asset-centric organizations that help resolve system downtime issues and anomalies with AI and ML-based algorithms.

Based on deployment models, cloud deployment model to grow at higher CAGR during forecast period

Cloud-based EAM solutions offer a significant number of benefits over on-premises EAM solutions. These solutions save upfront installation and maintenance costs as the third part vendor governs it. The vendor takes care of the necessary upgrades and installation, resulting in low maintenance costs. Most cloud-based EAM solution providers offer advanced security tools and support GDPR compliance. Vendors have experts in place to overcome cyberattacks and provide 24/7 security monitoring.

Based on verticals, transportation & logistics vertical to grow at highest CAGR during forecast period

EAM solutions help businesses in the transportation and logistics industry minimize the costs of managing and maintaining transportation assets, such as bridges, roads, tunnels, and rails. The geotechnical monitoring of transportation assets enables organizations to perform maintenance operations whenever and wherever required. Following best practices help in making strategic decisions for asset performance, enhancing asset lifecycle, and maintaining public transit infrastructure for transportation and logistics authorities. EAM solutions also provide "fleet management capabilities, cost optimization, and improved return on assets (RoA).

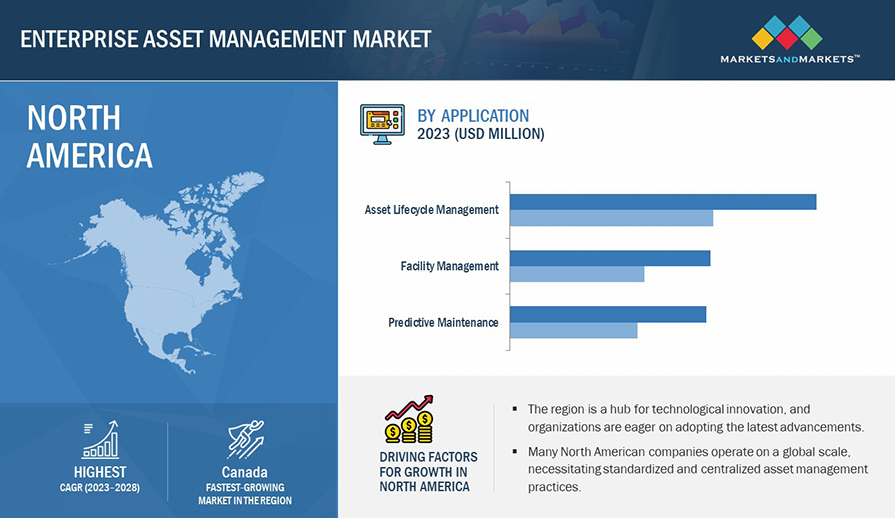

Asia Pacific to grow at highest CAGR during forecast period

Asia Pacific is one of the world's fastest-growing and most emerging economies. The region continuously focuses on innovation and digitalization to develop the IT infrastructure. Countries such as China, Japan, India, and Australia utilize advanced technologies such as AI, IoT, and cloud to innovate EAM offerings. Further, the region has many asset-intensive industries such as manufacturing, energy & utilities, and transportation, which is boosting the adoption of EAM solutions in the region. The growing usage of cloud-based applications is generating a huge amount of data, which leads to difficulty in managing data manually, which is acting as a major driver for the adoption of cloud-based EAM solutions and services in the region. Further, the presence of key players offering EAM solutions in the region is also expected to drive the demand during the forecast period.

Key Market Players

The enterprise asset management market is dominated by companies such as IBM (US), SAP (Germany), Oracle (US), Hexagon (Sweden), IFS (Sweden), Hitachi Energy (Switzerland), IFS Intelligent Process Solutions (Germany), Accruent (US), AVEVA (UK), Aptean (US), eMaint (US), CGI (Canada), UpKeep (US), RFgen Software (US), AssetWorks(US), and Ramco Systems (India). These vendors have a large customer base and a strong geographic presence with distribution channels globally to drive business revenue and growth.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Historical data | 2018–2027 |

| Base year for estimation | 2021 |

| Forecast period | 2022–2027 |

| Quantitative units | Value (USD Billion) |

| Segments covered | Enterprise asset management market by Application, Component, Organization Size, Deployment Model, Vertical (Energy & Utilities, Government & Public Sector, Manufacturing, Transportation & Logistics), and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Key companies profiled | IBM (US), SAP (Germany), Oracle (US), Hexagon (Sweden), IFS (Sweden), Hitachi Energy (Switzerland), IFS Intelligent Process Solutions (Germany), Accruent (US), AVEVA (UK), Aptean (US), eMaint (US), CGI (Canada), UpKeep (US), RFgen Software (US), AssetWorks (US), and Ramco Systems (India) |

This research report categorizes the enterprise asset management market to forecast revenue and analyze trends in each of the following submarkets:

Based on Application:

- Asset Lifecycle Management

- Inventory Management

- Work Order Management

- Labor Management

- Predictive Maintenance

- Facility Management

- Other Applications

Based on Component:

- Solutions

-

Services

- Professional Services

- Managed Services

Based on Deployment Model:

- On-premises

- Cloud

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Verticals:

- Manufacturing

- Energy & Utilities

- Healthcare & Life Sciences

- Transportation & Logistics

- IT & Telecom

- Government & Public Sector

- Education

- Other Verticals

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In September 2022, IBM announced the acquisition of Dialexa, a US digital product engineering company, to help enterprises achieve digital transformation and drive innovation.

- In February 2021, SAP launched SAP Learning Hub for its partners, who combine all the learning content required by their partners.

- In October 2022, Oracle introduced a new asset-based service solution for Oracle Fusion Cloud Applications Suite. It will help businesses predict and prevent asset downtime to reduce costs, optimize service efficiency, and enhance customer experience.

- In December 2022, Hexagon announced the release of HxGN EAM v12, the latest version of SaaS EAM. It offers further extended capabilities of APM with Root Cause Analysis (RCA) features, enables calculation and visualization of Asset Investment Planning (AIP), and increases the capability of HxGN EAM Digital

- In March 2021, SAP acquired Singavio, one of the leaders in the enterprise business process intelligence and process management space, to help companies quickly understand, improve, transform and manage their business processes at scale.

Frequently Asked Questions (FAQ):

What is the projected market value of the enterprise asset management market?

Why enterprise asset management market is growing?

- Increasing need for cost-effective asset management

- Emphasis on asset lifecycle management

- Rise of digitalization and IoT

- Shift towards cloud-based solutions

- Regulatory compliance

Which region has the highest market share in the enterprise asset management market?

Which application is expected to witness high adoption in the coming years?

Which are the major vendors in the enterprise asset management market?

What are some of the drivers in the enterprise asset management market?

- A surge in asset management workloads with the growth of asset-intensive industries.

- The increase in adoption of IoT, AI, and cloud offerings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

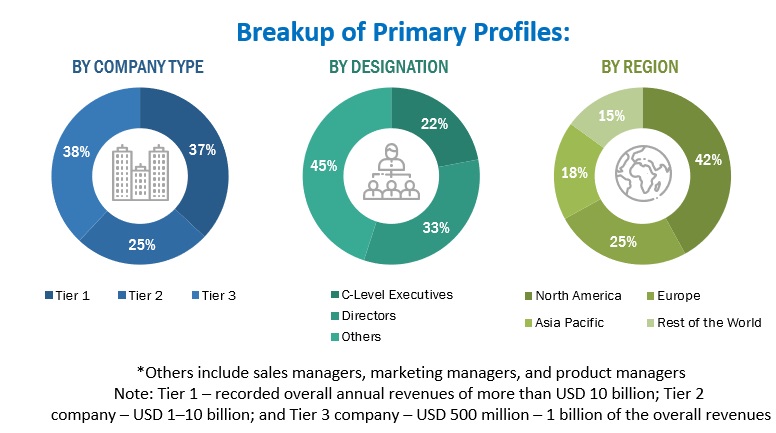

The study involved four major activities to estimate the current market size of the enterprise asset management market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting information useful for this technical, market-oriented, and commercial study of the enterprise asset management market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were utilized to estimate and validate the total enterprise asset management market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through paid and unpaid secondary resources.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides, in the enterprise asset management market.

Report Objectives

- To define, describe, and forecast the enterprise asset management market based on component, application, deployment model, organization size, industry vertical, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the impact of the recession on the global market

- To forecast the market size of main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs and on best effort basis for profiling additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Asset Management Market