Environment, Health, and Safety Market by Component (Software and Services (Project Deployment and Implementation Services, Audit, Assessment and Regulatory Compliance)), Deployment Mode (Cloud, On-premises), Vertical & Region - Global Forecast to 2027

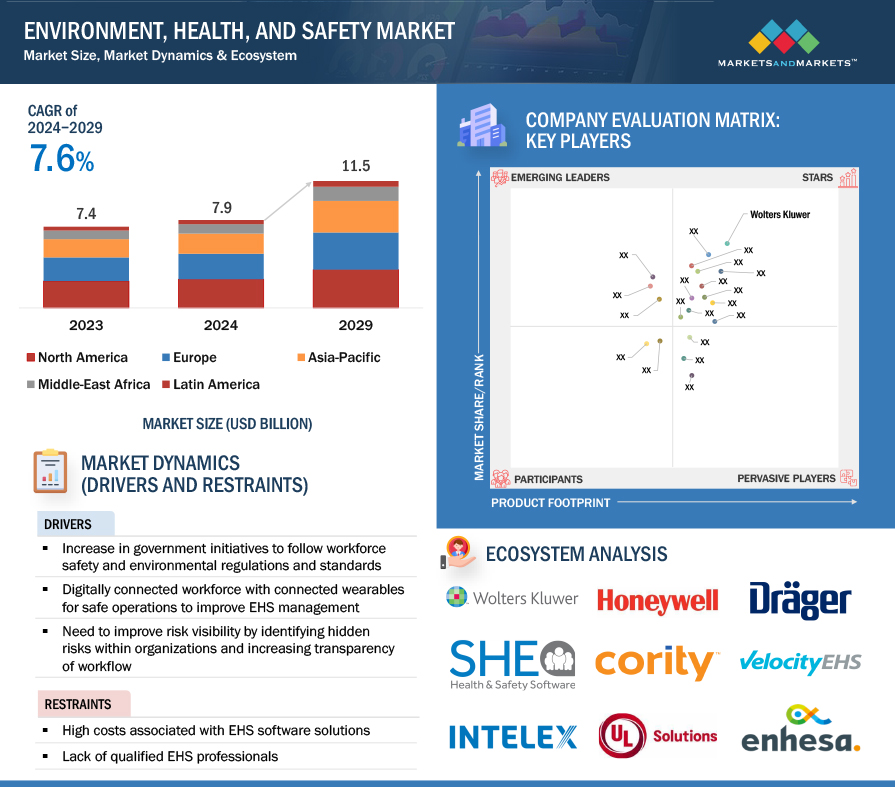

[237 Pages Report] The global environment, health, and safety market size is projected to grow from USD 6.7 billion in 2022 to USD 9.4 billion by 2027, at a CAGR of 7.0% during the forecast period. Technological innovations helping various industries to achieve worker engagement and adopt environment, health, safety, and quality programs are driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing government initiatives to ensure workforce safety and follow certain environmental regulations and standards

EHS solutions help organizations safeguard the health and safety of their workers and the environment. Government authorities such as the Occupational Health and Safety Administration (OSHA), the Environmental Protection Agency (EPA), the Department of Justice (DOJ), and state agencies require organizations to follow certain workforce safety and environmental regulations and standards.

Regulatory authorities exert economic pressure on organizations for optimizing their business processes and making them environment friendly. Due to high scrutiny and stringent regulations, the management teams are forced to deploy environment, health, and safety software solutions in the workplace to reduce the occurrence of incidents at workplace. Enterprises need to adhere to the major industry standards, such as Environmental Compliance Certificate (ECC), Occupational Safety and Health Administration (OSHA), and Food and Drug Administration (FDA). Regulatory compliances play a major role in encouraging companies to maintain industry standards and mandates for all business processes. Every organization or workplace is associated with some or the other form of risks, where the nature and intensity of the harm caused due to the accidents vary according to the nature of the industry. The implementation of EHS software across verticals is being proactively mandated by the governing bodies and regional federal agencies to adhere to environmental and occupational safety standards.

Restraint: High cost associated with EHS software solutions

Businesses in low-income countries have limited adoption of EHS software solutions. The high software implementation and installation costs are expected to hinder the market growth. It becomes difficult for low-income countries to purchase solutions from another country and get installed in their organizations. The installation and subscription fees have become excessively high for these solutions. Air quality monitoring, carbon footprint management, and air and water pollution monitoring are a few applications where implementing cutting-edge technologies, such as AI, IoT sensors, and analytics, require high maintenance costs. Air quality monitoring software is used for analysis and testing of air quality parameters. The software uses advanced cutting technologies, such as gas sensors, RFID, and PCR-based biosensors for detecting the chemical and biological components from the air and the cost of these technologies is high. Hence, verticals of different regions end up following traditional EHS management systems as they cannot afford the heavy initial cost of the EHS software solution. Even developed regions, such as North America and Europe, face difficulties in replacing their legacy infrastructure or in-house EHS management with environment, health, and safety software solutions.

Opportunity: Increase in government initiatives for low carbon emission policies

As per the Grantham Research Institute on Climate Change and the Environment, and the Sabin Center on Climate Change Law, there are more than 1,200 low-carbon policies existing across 164 countries, which account for 95% of global GHG emissions. The number of climate laws continues to grow rapidly. In 1997, there were just 60 laws, with the figure rising 20-fold to reach 1,260 in 2019. During that time, climate laws' stock doubled every four or five years. Most countries now have at least the outlines of their climate policies. Since the Paris Agreement was sealed in December 2015, 47 more climate laws have been passed. Governments worldwide are constantly making efforts to control GHG emissions by different

Challenge: Weak regulatory frameworks in developing countries

Poor regulatory framework is one of the major challenges faced by developing and underdeveloped countries. Other factors affecting the maintenance of a safe and healthy work environment include poor OSH management, organizational features of work and employment, and economic position. In the last few years, the awareness of EHS software solutions and services has grown significantly. However, a vast population base is still dependent on traditional methods as it is unaware of the availability of EHS software solutions. This factor could be obstructing the market from attaining its true potential. Stringent government regulations and guidelines have boosted the recognition of environment, health, and safety software solutions and services among organizations and have highlighted the significance of protecting the environment and employees.

Furthermore, organizations are expected to adhere to several regulations in the environment, health, and safety market; however, there are several complexities in selecting these standards. These laws and regulations are developed and administered by national, state, and local government agencies globally. To determine which of these legal and other requirements apply to an organizations operations is a critical task. Moreover, an organization failing to comply with these requirements may lead to substantial fines or other penalties.

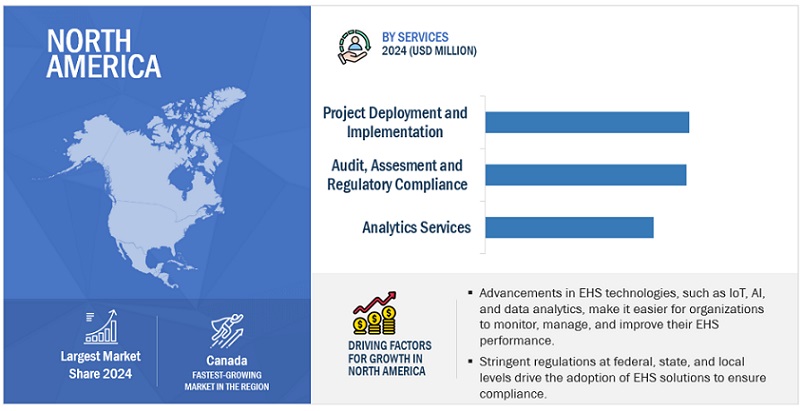

Services segment is projected to grow at the fastest rate during the forecast period.

Based on services, the environment, health, and safety market has been segmented into analytics services; project deployment and implementation services; business consulting and advisory services; audit, assessment, and regulatory compliance services; certification services; and training and support services. The need to manage emergencies safely and effectively has increased the importance of following all the emergency procedures and training all employees. It also enables safety coordinators and emergency service providers to handle a situation and determine the best way to bring it under control.

Energy and utilities vertical is set to account for the largest market share during the forecast period

The energy and utilities vertical has observed the significant adoption of environment, health, and safety software solutions due to the rising awareness regarding the EHS laws, regulations, and standards. In the past, occupational health risks were calculated in terms of immediate accident, especially fatality rates. Today, the emphasis has increased on delayed effects of exposure to cancer-inducing substances and radiation leading to higher adoption in energy and utilities.

North America to account for the largest market share during the forecast period

North America comprises the US and Canada. The US and Canada have sustainable and well-established economies, which empower them to invest strongly in R&D activities, contributing to developing new technologies. The major reason behind the strong development of the EHS market can be attributed to the stringent rules and regulations followed by the US and Canada governments. The EHS department of the US is responsible for the development and implementation of safety programs intended to protect the safety and well-being of federal, state, and local occupational safety and health and environmental regulations. The EHS department manages chemical safety, occupational safety, biosafety, industrial hygiene, hazardous waste, asbestos, radon, and indoor air quality programs.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The environment, health, and safety market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global EHS market are VelocityEHS (US), Wolters Kluwer (Netherlands), Intelex Technologies (Canada), Cority Software Inc. (Canada), Benchmark ESG (India), Sphera (India), Intertek (UK), Quentic GmbH (Germany), UL Solutions (US), Alcumus (UK), Evotix (UK), VisiumKMS (US), Ideagen (UK), EcoOnline AS (Norway), Diligent Corporation (US), ETQ (US), Dakota Software Corporation (US), ProcessMAP (US), SafetyCulture (Australia), ProntoForms (Canada), 3E (US), Enhesa (US), SHEQX (Australia), IsoMetrix (US), SAP (Germany), Pro-Sapien (UK), SafetySite (Denmark), CMO Software (UK), ComplianceQuest (US), Indus Environmental Services (India), Inicia (Japan), ASK-EHS Engineering (India), Al Sahraa Group (UAE), SHE Group (South Africa), EHS Brazil (Brazil), and IVEMSA (Mexico). The study includes an in-depth competitive analysis of these key players in the EHS market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

20172027 |

|

Base year considered |

2021 |

|

Forecast period |

20222027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By component, deployment mode, vertical, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

VelocityEHS (US), Wolters Kluwer (Netherlands), Intelex Technologies (Canada), Cority Software Inc. (Canada), Benchmark ESG (India), Sphera (India), Intertek (UK), Quentic GmbH (Germany), UL Solutions (US), Alcumus (UK), Evotix (UK), VisiumKMS (US), Ideagen (UK), EcoOnline AS (Norway), Diligent Corporation (US), ETQ (US), Dakota Software Corporation (US), ProcessMAP (US), SafetyCulture (Australia), ProntoForms (Canada), 3E (US), Enhesa (US), SHEQX (Australia), IsoMetrix (US), SAP (Germany), Pro-Sapien (UK), SafetySite (Denmark), CMO Software (UK), ComplianceQuest (US), Indus Environmental Services (India), Inicia (Japan), ASK-EHS Engineering (India), Al Sahraa Group (UAE), SHE Group (South Africa), EHS Brazil (Brazil), and IVEMSA (Mexico). |

This research report categorizes the EHS market to forecast revenues and analyze trends in each of the following subsegments:

By Component

- Software

- Services

- Analytics

- Project deployment and implementation

- Business consultancy and advisory

- Audit, assessment, and regulatory compliance

- Certification

- Training and support

By Deployment Mode

- Cloud

- On-premises

By Vertical

- Energy and utilities

- Chemicals and materials

- Healthcare

- Construction and engineering

- Food and beverage

- Government and defense

- Manufacturing

- Others (Telecom, IT and ITeS, Automotive, and Retail)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

- Asia Pacific

- China

- India

- South Korea

- Japan

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

- Middle East and Africa

- Middle East

- UAE

- KSA

- Rest of Middle East

- Middle East

- Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2022, Partners Group acquired a significant minority stake in VelocityEHS. This will drive the growth at VelocityEHS and cement its position as a leading player in the global EHS and ESG software market.

- In September 2022, Cority declared the acquisition of Reporting 21, a prominent sustainability-centered SaaS platform and consultancy. The acquisition will help Cority empower organizations to operate responsibly and make better decisions.

- In April 2021, Intelex and Industrial Scientific partnered to announce the availability of Intelex HazardIQ for iNet. This integrated solution provides users with features such as identifying high-risk areas, triggering workflows for determining root cause, initiating evacuation activities, and creating prevention actions.

Frequently Asked Questions (FAQ):

What is EHS?

As defined by ComplianceQuest, EHS management is an all-in-one term that focuses on improving the EHS performance of a business. EHS management refers to the implementation of procedures focused on ensuring and improving the safety of workers and their surroundings. These processes play a significant role in achieving and maintaining the overall environmental goals of the organization. EHS Management is a crucial aspect of an enterprises operations. It not only helps minimize the impact on the environment and improve worker safety and well-being but also can improve employee retention, productivity, and enhance the brand image of the company spurring customer and corporate growth.

Which countries are considered in Europe?

The report includes an analysis of the UK, France, and Germany in Europe.

Which are the key drivers supporting the growth of the EHS market?

The key driver supporting the growth of the EHS market includes an increase in government initiatives to follow certain workforce safety and environmental regulations and standards, a digitally connected workforce with connected wearables for safe operations to improve EHS management, increasing the number of internet users around the world, the need to improve risk visibility by identifying hidden risks within organizations and increase the transparency of workflow, and proliferation of the software-as-a-service deployment model.

Who are the key vendors in the EHS market?

The key vendors operating in the EHS market include VelocityEHS (US), Wolters Kluwer (Netherlands), Intelex Technologies (Canada), Cority Software Inc. (Canada), Benchmark ESG (India), Sphera (India), Intertek (UK), Quentic GmbH (Germany), UL Solutions (US), Alcumus (UK), Evotix (UK), VisiumKMS (US), Ideagen (UK), EcoOnline AS (Norway), IHS Markit (UK), Diligent Corporation (US), ETQ (US), Dakota Software Corporation (US), ProcessMAP (US), SafetyCulture (Australia), ProntoForms (Canada), 3E (US), Enhesa (US), SHEQX (Australia), IsoMetrix (US), SAP (Germany), Pro-Sapien (UK), SafetySite (Denmark), CMO Software (UK), ComplianceQuest (US), Indus Environmental Services (India), Inicia (Japan), ASK-EHS Engineering (India), Al Sahraa Group (UAE), SHE Group (South Africa), EHS Brazil (Brazil), and IVEMSA (Mexico). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

FIGURE 1 ENVIRONMENT, HEALTH, AND SAFETY MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS & EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 20192021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 ENVIRONMENT, HEALTH, AND SAFETY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 7 TOP-DOWN APPROACH

2.2.3 ENVIRONMENT, HEALTH, AND SAFETY MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 GROWTH FORECAST ASSUMPTIONS

FIGURE 10 MARKET GROWTH ASSUMPTIONS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 11 ENVIRONMENT, HEALTH, AND SAFETY MARKET, REGIONAL SHARE, 2022

FIGURE 12 MARKET: GROWTH TREND

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 BRIEF OVERVIEW OF ENVIRONMENT, HEALTH, AND SAFETY MARKET

FIGURE 13 INCREASE IN GOVERNMENT INITIATIVES TO FOLLOW WORKFORCE SAFETY AND ENVIRONMENTAL REGULATIONS TO DRIVE MARKET GROWTH

FIGURE 14 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.2 NORTH AMERICAN MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 15 SOFTWARE AND CLOUD SEGMENTS TO ACCOUNT FOR LARGER MARKET SHARES IN NORTH AMERICA IN 2022

4.3 EUROPEAN MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 16 SOFTWARE AND CLOUD SEGMENTS TO ACCOUNT FOR LARGER MARKET SHARES IN EUROPE IN 2022

4.4 ASIA PACIFIC MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 17 SOFTWARE AND CLOUD SEGMENTS TO ACCOUNT FOR LARGER MARKET SHARES IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENVIRONMENT, HEALTH, AND SAFETY MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in government initiatives to follow workforce safety and environmental regulations and standards

TABLE 2 ENVIRONMENTAL REGULATIONS, ACTS, AND LAWS

5.2.1.2 Digitally connected workforce with connected wearables for safe operations to improve EHS management

5.2.1.3 Need to improve risk visibility by identifying hidden risks within organizations and increasing transparency of workflow

5.2.1.4 Proliferation of software-as-a-service deployment model

5.2.2 RESTRAINTS

5.2.2.1 High cost associated with EHS software solutions

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in government initiatives for low carbon emission policies

FIGURE 19 TOTAL CLIMATE CHANGE LAWS

5.2.3.2 Technological innovations to help various industries achieve worker engagement and adopt quality programs

5.2.3.3 Modernization of industry infrastructure for low carbon emissions

5.2.4 CHALLENGES

5.2.4.1 Poor regulatory frameworks in emerging economies

5.2.4.2 Lack of skills and end-to-end solutions

5.3 VALUE CHAIN

FIGURE 20 ENVIRONMENT, HEALTH, AND SAFETY MARKET: VALUE CHAIN ANALYSIS

5.4 CASE STUDIES

5.4.1 HARLEY DAVIDSON USED PROCESSMAP EHS SOLUTION FOR WORKER SAFETY

5.4.2 AGNICO EAGLE MINES LTD ADOPTED INTELEX HEALTH & SAFETY MANAGEMENT SUITE FOR RISK ASSESSMENT

5.4.3 OWENS GROUP USED EVOTIX SOLUTION TO MANAGE EMPLOYEE HEALTH AND SAFETY INFORMATION

5.4.4 ENVIROSERV ADOPTED ISOMETRIX SOLUTION TO MANAGE GENERAL SAFETY, HEALTH, ENVIRONMENT, AND QUALITY PROCESSES

5.4.5 AMERICAN MULTINATIONAL CONGLOMERATE COMPANY ADOPTED BENCHMARK ESG TO MANAGE SAFETY AND COMPLIANCE

5.4.6 FRAZER USED VELOCITYEHS SOLUTION TO MANAGE SAFETY PROGRAM-RELATED INFORMATION

5.4.7 AMERICAS STYRENICS USED DAKOTA SOFTWARE FOR COMPLIANCE-RELATED DOCUMENTATION

5.4.8 INEOS STYROLUTION USED VISIUMKMS MODULE FOR ANALYTICS AND REPORTING

5.5 ECOSYSTEM/MAPPING

TABLE 3 ENVIRONMENT, HEALTH, AND SAFETY MARKET: ECOSYSTEM

5.6 PORTERS FIVE FORCES MODEL

TABLE 4 IMPACT OF EACH FORCE ON MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 DEGREE OF COMPETITION

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPES

TABLE 5 PATENTS FILED, 20202022

5.7.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 21 NUMBER OF PATENTS GRANTED ANNUALLY, 20202022

5.7.3.1 Top applicants

FIGURE 22 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 20202022

TABLE 6 LIST OF FEW PATENTS IN ENVIRONMENT, HEALTH, AND SAFETY MARKET, 20202022

5.8 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MARKET

FIGURE 23 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS

TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS

5.9.2 AVERAGE SELLING PRICE TREND

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

5.10.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 9 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.11 TECHNOLOGY ANALYSIS

5.11.1 ARTIFICIAL INTELLIGENCE

5.11.2 INDUSTRIAL INTERNET OF THINGS AND BIG DATA

5.12 REGULATORY LANDSCAPE

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.1 NORTH AMERICA

5.12.2 EUROPE

5.12.2.1 France

5.12.2.2 UK

5.12.3 ASIA PACIFIC

5.12.3.1 China

5.12.3.2 South Korea

5.12.3.3 Japan

5.12.4 MIDDLE EAST & AFRICA

5.12.4.1 UAE

5.12.4.2 Saudi Arabia

5.12.5 LATIN AMERICA

5.12.5.1 Brazil

5.12.5.2 Mexico

5.13 KEY CONFERENCES & EVENTS IN 20222023

TABLE 14 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY SOFTWARE FEATURE (Page No. - 80)

6.1 HEALTH AND SAFETY MANAGEMENT

6.2 ENVIRONMENTAL AND SUSTAINABILITY MANAGEMENT

6.3 WASTE MANAGEMENT

6.4 ENERGY AND WATER MANAGEMENT

6.5 AIR QUALITY AND COMPLIANCE MANAGEMENT

6.6 INCIDENT AND RISK MANAGEMENT

6.7 INDUSTRIAL HYGIENE MANAGEMENT

7 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT (Page No. - 82)

7.1 INTRODUCTION

7.1.1 COMPONENT: MARKET DRIVERS

FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 16 FETY MARKET, BY COMPONENT, 20222027 (USD MILLION)

7.2 SOFTWARE

7.2.1 HELPS MANAGE INCIDENTS AND MAINTAIN COMPLIANCE ACROSS OPERATIONAL PROCESSES

TABLE 17 SOFTWARE: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 18 SOFTWARE: MARKET, BY REGION, 20222027 (USD MILLION)

7.3 SERVICES

TABLE 19 SERVICES: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 20 SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

FIGURE 27 PROJECT DEPLOYMENT AND IMPLEMENTATION SEGMENT TO GROW AT LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 21 SERVICES: MARKET, BY TYPE, 20172021 (USD MILLION)

TABLE 22 SERVICES: MARKET, BY TYPE, 20222027 (USD MILLION)

7.3.1 ANALYTICS

7.3.1.1 Aggregates and analyzes data from multiple resources to increase profits

TABLE 23 ANALYTICS: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 24 ANALYTICS: MARKET, BY REGION, 20222027 (USD MILLION)

7.3.2 PROJECT DEPLOYMENT AND IMPLEMENTATION

7.3.2.1 Services provided during deployment and implementation of EHS solutions

TABLE 25 PROJECT DEPLOYMENT AND IMPLEMENTATION: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 26 PROJECT DEPLOYMENT AND IMPLEMENTATION: MARKET, BY REGION, 20222027 (USD MILLION)

7.3.3 BUSINESS CONSULTING AND ADVISORY

7.3.3.1 Promotes digital transformation and evolution of business processes through EHS

TABLE 27 BUSINESS CONSULTING AND ADVISORY: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 28 BUSINESS CONSULTING AND ADVISORY: ETY MARKET, BY REGION, 20222027 (USD MILLION)

7.3.4 AUDIT, ASSESSMENT, AND REGULATORY COMPLIANCE

7.3.4.1 Identifies waste minimization and recycling opportunities

TABLE 29 AUDIT, ASSESSMENT, AND REGULATORY COMPLIANCE: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 30 AUDIT, ASSESSMENT, AND REGULATORY COMPLIANCE: ENMARKET, BY REGION, 20222027 (USD MILLION)

7.3.5 CERTIFICATION

7.3.5.1 Offers competitive advantage and enhanced processes

TABLE 31 CERTIFICATION: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 32 CERTIFICATION: MARKET, BY REGION, 20222027 (USD MILLION)

7.3.6 TRAINING AND SUPPORT

7.3.6.1 Addresses and analyzes data retrieved from EHS solution

TABLE 33 TRAINING AND SUPPORT: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 34 TRAINING AND SUPPORT: MARKET, BY REGION, 20222027 (USD MILLION)

8 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY DEPLOYMENT MODE (Page No. - 94)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 28 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 35 MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 36 MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

8.2 CLOUD

8.2.1 RISING DEMAND FOR ENVIRONMENT, HEALTH, AND SAFETY TO ENHANCE SECURITY AND PRIVACY

TABLE 37 CLOUD: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 38 CLOUD: MARKET, BY REGION, 20222027 (USD MILLION)

8.3 ON-PREMISES

8.3.1 INCREASED NEED FOR QUICK AND FAST ACCESS

TABLE 39 ON-PREMISES: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 40 ON-PREMISES: MARKET, BY REGION, 20222027 (USD MILLION)

9 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY VERTICAL (Page No. - 99)

9.1 INTRODUCTION

FIGURE 29 ENERGY AND UTILITIES VERTICAL TO GROW AT LARGEST MARKET SIZE DURING FORECAST PERIOD

9.1.1 VERTICAL: MARKET DRIVERS

TABLE 41 MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 42 MARKET, BY VERTICAL, 20222027 (USD MILLION)

9.2 ENERGY AND UTILITIES

9.2.1 ADVANCING LAWS, REGULATIONS, AND STANDARDS TO DRIVE MARKET

TABLE 43 ENERGY AND UTILITIES: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 44 ENERGY AND UTILITIES: MARKET, BY REGION, 20222027 (USD MILLION)

9.3 CHEMICALS AND MATERIALS

9.3.1 USED TO MANAGE WORKFORCE AND GUARANTEE WORKPLACE SAFETY

TABLE 45 CHEMICALS AND MATERIALS: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 46 CHEMICALS AND MATERIALS: MARKET, BY REGION, 20222027 (USD MILLION)

9.4 HEALTHCARE

9.4.1 USED TO ENHANCE SAFETY, RISK AVOIDANCE, AND ENVIRONMENTAL MANAGEMENT

TABLE 47 HEALTHCARE: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 48 HEALTHCARE: MARKET, BY REGION, 20222027 (USD MILLION)

9.5 CONSTRUCTION AND ENGINEERING

9.5.1 USED TO LESSEN DAMAGE IMPACT ON ENVIRONMENT

TABLE 49 CONSTRUCTION AND ENGINEERING: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 50 CONSTRUCTION AND ENGINEERING: MARKET, BY REGION, 20222027 (USD MILLION)

9.6 FOOD AND BEVERAGE

9.6.1 ADOPTION OF EHS SOFTWARE TO TAKE CARE OF ENVIRONMENTAL MANAGEMENT

TABLE 51 FOOD AND BEVERAGE: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 52 FOOD AND BEVERAGE: MARKET, BY REGION, 20222027 (USD MILLION)

9.7 GOVERNMENT AND DEFENSE

9.7.1 USED TO REPORT INCIDENTS AND TRACK TASKS

TABLE 53 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 54 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 20222027 (USD MILLION)

9.8 OTHER VERTICALS

TABLE 55 OTHER VERTICALS: MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 56 OTHER VERTICALS: MARKET, BY REGION, 20222027 (USD MILLION)

10 ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY REGION (Page No. - 109)

10.1 INTRODUCTION

TABLE 57 MARKET, BY REGION, 20172021 (USD MILLION)

TABLE 58 MARKET, BY REGION, 20222027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: PESTLE ANALYSIS

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.2.2 US

10.2.2.1 Government initiatives and plans to drive demand for EHS solutions

TABLE 69 US: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 70 US: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 71 US: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 72 US: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 73 US: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 74 US: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 75 US: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 76 US: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Increasing efforts for workplace safety with regulations to drive EHS market

TABLE 77 CANADA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 78 CANADA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 79 CANADA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 80 CANADA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 81 CANADA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 82 CANADA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 83 CANADA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 84 CANADA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: PESTLE ANALYSIS

TABLE 85 EUROPE: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.3.2 UK

10.3.2.1 Growth in major verticals to offer opportunities for EHS solutions

TABLE 95 UK: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 96 UK: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 97 UK: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 98 UK: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 99 UK: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 100 UK: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 101 UK: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 102 UK: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Government initiatives for workplace safety to promote adoption of EHS solutions

TABLE 103 GERMANY: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Occupational health and safety policies to drive EHS market

10.3.5 ITALY

10.3.5.1 Regulations for water and air pollution to drive market

10.3.6 SPAIN

10.3.6.1 Occupational risk prevention laws in Spain to boost market

10.3.7 NORDICS

10.3.7.1 Health and safety initiatives in Nordics to boost adoption of EHS solutions

10.3.8 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 111 ASIA PACIFIC: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Shift toward IoT and AI technologies to drive EHS market

TABLE 121 CHINA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 122 CHINA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 123 CHINA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 124 CHINA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 125 CHINA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 126 CHINA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 127 CHINA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 128 CHINA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 EHS regulatory and policy trends in India to drive market

TABLE 129 INDIA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 130 INDIA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 131 INDIA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 132 INDIA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 133 INDIA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 134 INDIA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 135 INDIA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 136 INDIA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Stringent laws and regulations in Japan to drive EHS market

TABLE 137 JAPAN: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 138 JAPAN: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 141 JAPAN: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

10.4.5.1 Stringent regulations to promote secure environment for workers

TABLE 145 AUSTRALIA AND NEW ZEALAND: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 146 AUSTRALIA AND NEW ZEALAND: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 147 AUSTRALIA AND NEW ZEALAND: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 148 AUSTRALIA AND NEW ZEALAND: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 149 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 150 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 151 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 152 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.4.6 SOUTH KOREA

10.4.6.1 New amendments in law to drive EHS market

10.4.7 SOUTHEAST ASIA

10.4.7.1 Association of Southeast Asian nations to boost occupational, safety, and health performance

10.4.8 REST OF ASIA PACIFIC

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

TABLE 153 MIDDLE EAST & AFRICA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Rapid development and digital transformation to drive need for EHS solutions

TABLE 163 MIDDLE EAST: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 164 MIDDLE EAST: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.5.2.2 UAE

TABLE 165 UAE: MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 166 UAE: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 167 UAE: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 168 UAE: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 169 UAE: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 170 UAE: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 171 UAE: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 172 UAE: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.5.2.3 KSA

TABLE 173 KSA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 174 KSA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 175 KSA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 176 KSA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 177 KSA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 178 KSA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 179 KSA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 180 KSA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.5.2.4 Rest of Middle East

10.5.3 AFRICA

10.5.3.1 Water and air pollution laws to drive market

TABLE 181 AFRICA: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 182 AFRICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.5.3.2 South Africa

10.5.3.3 Egypt

10.5.3.4 Nigeria

10.5.3.5 Rest of Africa

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: PESTLE ANALYSIS

TABLE 183 LATIN AMERICA: MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY VERTICAL, 20222027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY COUNTRY, 20172021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

10.6.2 BRAZIL

10.6.2.1 Growth in various verticals to encourage adoption of workplace safety solutions

TABLE 193 BRAZIL: ENVIRONMENT, HEALTH, AND SAFETY MARKET, BY COMPONENT, 20172021 (USD MILLION)

TABLE 194 BRAZIL: MARKET, BY COMPONENT, 20222027 (USD MILLION)

TABLE 195 BRAZIL: MARKET, BY SERVICE, 20172021 (USD MILLION)

TABLE 196 BRAZIL: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 197 BRAZIL: MARKET, BY DEPLOYMENT MODE, 20172021 (USD MILLION)

TABLE 198 BRAZIL: MARKET, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 199 BRAZIL: MARKET, BY VERTICAL, 20172021 (USD MILLION)

TABLE 200 BRAZIL: MARKET, BY VERTICAL, 20222027 (USD MILLION)

10.6.3 MEXICO

10.6.3.1 Climate policies in Mexico to drive EHS market

10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 174)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 201 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN ENVIRONMENT, HEALTH, AND SAFETY MARKET

11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 202 MARKET: DEGREE OF COMPETITION

11.4 HISTORICAL REVENUE ANALYSIS

FIGURE 32 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 20192021 (USD MILLION)

11.5 COMPETITIVE BENCHMARKING

TABLE 203 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 204 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 205 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 33 KEY ENVIRONMENT, HEALTH, AND SAFETY MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 34 STARTUP/SME MARKET EVALUATION MATRIX, 2022

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 206 PRODUCT LAUNCHES, 20192021

11.8.2 DEALS

TABLE 207 DEALS, 20212022

12 COMPANY PROFILES (Page No. - 185)

12.1 MAJOR PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

12.1.1 WOLTERS KLUWER

TABLE 208 WOLTERS KLUWER: BUSINESS OVERVIEW

FIGURE 35 WOLTERS KLUWER: COMPANY SNAPSHOT

TABLE 209 WOLTERS KLUWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 210 WOLTERS KLUWER: PRODUCT LAUNCHES

TABLE 211 WOLTERS KLUWER: DEALS

12.1.2 VELOCITYEHS

TABLE 212 VELOCITYEHS: BUSINESS OVERVIEW

TABLE 213 VELOCITYEHS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 214 VELOCITYEHS: PRODUCT LAUNCHES

TABLE 215 VELOCITYEHS: DEALS

12.1.3 INTELEX

TABLE 216 INTELEX: BUSINESS OVERVIEW

TABLE 217 INTELEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 218 INTELEX: PRODUCT LAUNCHES

TABLE 219 INTELEX: DEALS

12.1.4 BENCHMARK ESG

TABLE 220 BENCHMARK ESG: BUSINESS OVERVIEW

TABLE 221 BENCHMARK ESG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 222 BENCHMARK ESG: PRODUCT LAUNCHES

TABLE 223 BENCHMARK ESG: DEALS

12.1.5 CORITY

TABLE 224 CORITY: BUSINESS OVERVIEW

TABLE 225 CORITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 226 CORITY: PRODUCT LAUNCHES

TABLE 227 CORITY: DEALS

12.1.6 SPHERA

TABLE 228 SPHERA: BUSINESS OVERVIEW

TABLE 229 SPHERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 230 SPHERA: PRODUCT LAUNCHES

TABLE 231 SPHERA: DEALS

12.1.7 INTERTEK

TABLE 232 INTERTEK: BUSINESS OVERVIEW

FIGURE 36 INTERTEK: COMPANY SNAPSHOT

TABLE 233 INTERTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 234 INTERTEK: PRODUCT LAUNCHES

TABLE 235 INTERTEK: DEALS

12.1.8 QUENTIC

TABLE 236 QUENTIC: BUSINESS OVERVIEW

TABLE 237 QUENTIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 238 QUENTIC: PRODUCT LAUNCHES

TABLE 239 QUENTIC: DEALS

12.1.9 UL

TABLE 240 UL: BUSINESS OVERVIEW

TABLE 241 UL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 UL: DEALS

12.1.10 PROCESSMAP

TABLE 243 PROCESSMAP: BUSINESS OVERVIEW

TABLE 244 PROCESSMAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 PROCESSMAP: PRODUCT LAUNCHES

TABLE 246 PROCESSMAP: DEALS

12.1.11 SAP

12.1.12 IBM

12.1.13 ALCUMUS

12.1.14 EVOTIX

12.1.15 ECOONLINE

12.1.16 DILIGENT CORPORATION

12.1.17 IDEAGEN

12.1.18 ETQ

12.1.19 3E

12.1.20 DAKOTA SOFTWARE

12.1.21 ISOMETRIX

12.1.22 ENHESA

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 STARTUP/SMES

12.2.1 VISIUMKMS

12.2.2 SAFETYCULTURE

12.2.3 PRONTOFORMS

12.2.4 COMPLIANCEQUEST

12.2.5 SAFETYSITE

12.2.6 PRO-SAPIEN

12.2.7 SHEQX

12.2.8 CMO SOFTWARE

12.2.9 INDUS ENVIRONMENTAL SERVICES

12.2.10 INICIA

12.2.11 ASK-EHS ENGINEERING

12.2.12 AI SAHRAA GROUP

12.2.13 SHE GROUP

12.2.14 EHS BRAZIL

12.2.15 IVEMSA

13 ADJACENT/RELATED MARKETS (Page No. - 231)

13.1 INTRODUCTION

13.2 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COMPONENT

TABLE 247 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COMPONENT, 20162019 (USD MILLION)

TABLE 248 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COMPONENT, 20192025 (USD MILLION)

TABLE 249 SOLUTION: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 250 SOLUTION: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION, 20192025 (USD MILLION)

TABLE 251 GREEN TECHNOLOGY AND SUSTAINABILITY, BY SERVICE, 20162019 (USD MILLION)

TABLE 252 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY SERVICE, 20192025 (USD MILLION)

TABLE 253 SERVICES: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 254 SERVICES: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION, 20192025 (USD MILLION)

13.2.4 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY TECHNOLOGY

TABLE 255 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 256 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY TECHNOLOGY, 20192025 (USD MILLION)

13.2.5 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY APPLICATION

TABLE 257 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 258 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY APPLICATION, 20192025 (USD MILLION)

13.2.6 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION

TABLE 259 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 260 GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY REGION, 20192025 (USD MILLION)

TABLE 261 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COMPONENT, 20162019 (USD MILLION)

TABLE 262 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COMPONENT, 20192025 (USD MILLION)

TABLE 263 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY SERVICE, 20162019 (USD MILLION)

TABLE 264 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY SERVICE, 20192025 (USD MILLION)

TABLE 265 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY TECHNOLOGY, 20162019 (USD MILLION)

TABLE 266 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 267 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 268 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY APPLICATION, 20192025 (USD MILLION)

TABLE 269 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 270 NORTH AMERICA: GREEN TECHNOLOGY AND SUSTAINABILITY MARKET, BY COUNTRY, 20192025 (USD MILLION)

13.3 CARBON FOOTPRINT MANAGEMENT MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT

TABLE 271 COMPONENT: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 272 SOLUTION: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 273 SERVICES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 274 CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 20182025 (USD MILLION)

TABLE 275 CONSULTING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 276 INTEGRATION AND DEPLOYMENT MANAGEMENT: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 277 SUPPORT AND MAINTENANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

13.3.4 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE

TABLE 278 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 279 CLOUD: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 280 ON-PREMISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

13.3.5 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 281 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

13.3.6 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL

TABLE 282 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 20182025 (USD MILLION)

13.3.7 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION

TABLE 283 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 284 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 20182025 (USD MILLION)

TABLE 285 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 20182025 (USD MILLION)

TABLE 286 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 287 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 288 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 20182025 (USD MILLION)

TABLE 289 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING TYPE, 20182025 (USD MILLION)

TABLE 290 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 20182025 (USD MILLION)

14 APPENDIX (Page No. - 249)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

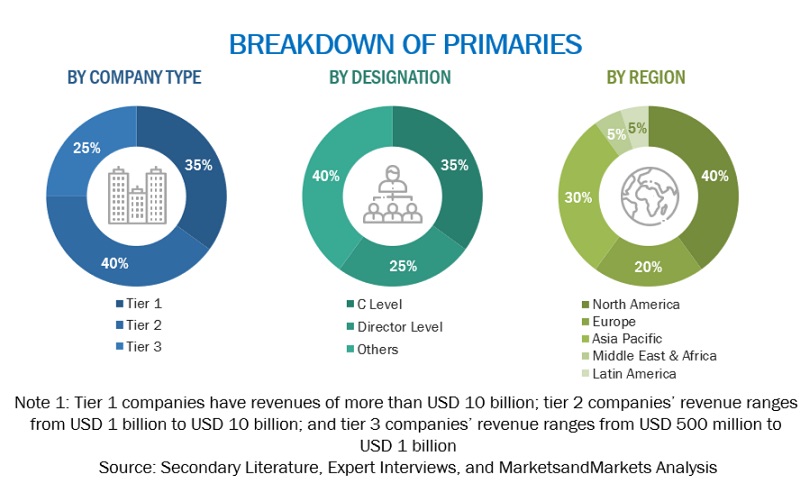

The research methodology used for the EHS market report involved the use of extensive secondary sources and directories, and several reputed open-source databases to identify and collect information useful for this technical-and market-oriented study. The primary sources were industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industrys value chain. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering EHS software solutions and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the markets prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports, best practices, international organization websites and resources (UN-Habitat, Zero Waste Europe, Global Carbon Project, Emissions Database for Global Atmospheric Research (EDGAR), International Energy Agency (IEA), United Nations Framework Convention on Climate Change (UNFCC), Union of Concerned Scientists, U.S. Green Building Council, and Environmental Protection Agency), press releases and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industrys value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing environment, health, and safety software solutions. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers, at public and investor-owned utilities.

In the market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information. Primary research was further conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the environment, health, and safety market. The first approach involves estimating the market size by summating companies revenue generated through the sales of solutions and services.

EHS Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the EHS market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Report Objectives

- To determine, segment, and forecast the global environment, health, and safety market by component, deployment mode, vertical, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East and Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the EHS market

- To study the complete value chain and related industry segments and perform a value chain analysis of the EHS market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total EHS market

- To analyze industry trends, pricing data, and patents and innovations related to the EHS market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the EHS market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research and Development (R&D) activities

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

- Further breakdown of the France environment, health, and safety market

- Further breakdown of South Korean EHS market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Environment, Health, and Safety Market

Interested in HSE market in UAE

Interested in industry overview and market analysis in SHEQ for global and South African Market

Interested in market eatimation of EHS for US market.

Interested in market segmentation of EHS solution.