Environmental Sensor Market by Type (Temperature, Humidity, Air Quality, Water Quality, Integrated, UV, Soil Moisture), Location (Indoor, Outdoor, Portable), Application, Vertical, Region (2021-2027)

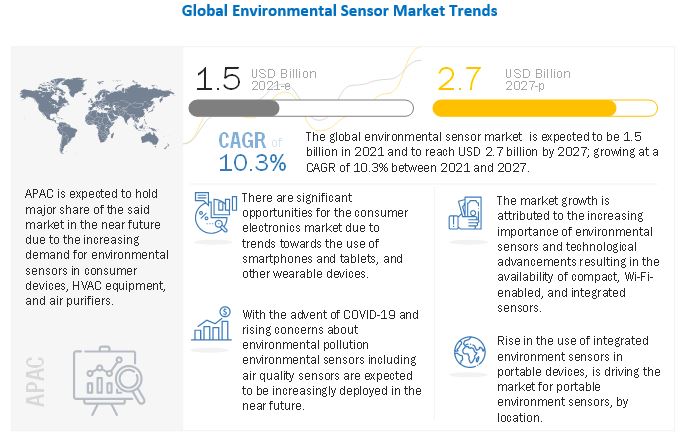

[231 Pages Report] The global environmental sensor market is estimated to grow from USD 1.5 billion in 2021 to USD 2.7 billion by 2027, at a CAGR of 10.3%.

Stringent environmental regulations to reduce air pollution is one of the major drivers for the environmental sensor market. The technological advancements in IOT and cloud-based services and growing adoption of environmental sensors in products such as consumer devices, HVAC, and air purifiers are driving the growth of market. Moreover, growing adoption of environmental sensors in consumer electronics and government and public utility verticals will drive the demand for this technology in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increase in air quality monitoring system act as major driver for the market

Initially, air monitoring was done manually by noting down the reading recorded by different analog systems. Automatic or Continuous Ambient Air Quality Monitoring Stations (CAAQMS) can monitor pollutants using different analyzers; thereby reducing the chances of manual error, generate data at regular time intervals, and efficiently transmit the data. The generated data are disseminated online through a digital display board to the public. These systems are now used in cities. Some countries use mathematical interpolation of the readings to estimate concentrations in surrounding areas. Indian cities are gradually improving their monitoring capacity and several metro cities, including state capitals, have begun to set up CAAQMS.Thus, due to the rise in air quality monitoring stations, it would upsurge the use of environmental sensors.

Restraint: Long-term monitoring of environmental data may lead to short life span of sensors

A key part of monitoring, and a key challenge, is measuring variables over an extended period of time. Continuous monitoring is important because data gaps reduce the ability to assess the full scope of variability in environmental resources.Also infrequent but significant events are often crucial to the status of environmental resources. Hence long term monitoring becomes a crucial part. But this continuous monitoring and operating of sensors can reduce the efficiency and performance thereby shortening their life span.

Opportunity: Devlopemnt of nanotechnology based environmental monitoring product is growing opportunity in the market

Historically, environmental sensors were used to detect gases, monitor humidity, and barometric pressure. Nowadays, due to the increasing need for sensor information, there is a growing demand for nanotechnology-based environmental monitoring products. By combining traditional environmental sensors with integrated sensors that are used in various consumer applications such as building automation and HVAC, designers can develop smart systems that enable machines to interact with each other and the world around them and can provide actionable environment data. Information from various types of sensors is combined to measure the environmental parameters surrounding these devices. For example, sensor-on-chip plays a significant role in wearables, wherein several sensors are combined to measure various environmental parameters on a single device.

Challenge: Stringent performance requirements of advanced sensor applications

Specifications of environmental sensors change with applications and technology being used. For instance, consumer electronics applications have stringent requirements regarding the size and power consumption of environmental sensors. In such cases, integrating several types of sensors with consumer applications, such as smartphones, becomes very difficult. Also, with the change in the industry or vertical, the specification of the sensor varies accordingly. For instance, gas sensing parameters in the automotive industry differ from those in the oil & gas industry; therefore, the performance requirements of gas sensors become critical in advanced applications.

Indoor environment sensors to have the largest market size in location segement of the market

Indoor environment quality is represented by pollutant concentration and thermal (temperature and relative humidity) conditions that affect the health and well-being of the occupants. At times it is observed that indoor air is more contaminated than outdoor air. While pollutant levels from individual sources may not pose a significant health risk, as most homes have more than one source contributing to indoor air pollution, there can be serious risks from the cumulative effects of these sources. Due to advancements in technology, wireless networks, such as Bluetooth, Wi-Fi, and ZigBee, have started to gain importance to monitor indoor environment quality. Also, cloud-based storage and big data analytics solutions help in viewing, storing, and analyzing the overall data. Indoor sensors are used to monitor environmental factors such as temperature, humidity, pressure, and air quality.

Smart city to have significant market size in terms of application of environmental sensor market

The environmental sensor market for the smart city application is mainly driven by environmental monitoring and control systems used to measure temperature, air, humidity, smoke, ultraviolet radiations, water quality, and others. The sensors provide the environmental monitoring of five significant factors CO2, noise, light, temperature, and humidity, and ensure that effective controls are in place to quickly make changes to alter the output. The systems can be used individually or can be integrated into smart application systems used for various other applications in maintaining sustainability in the city.

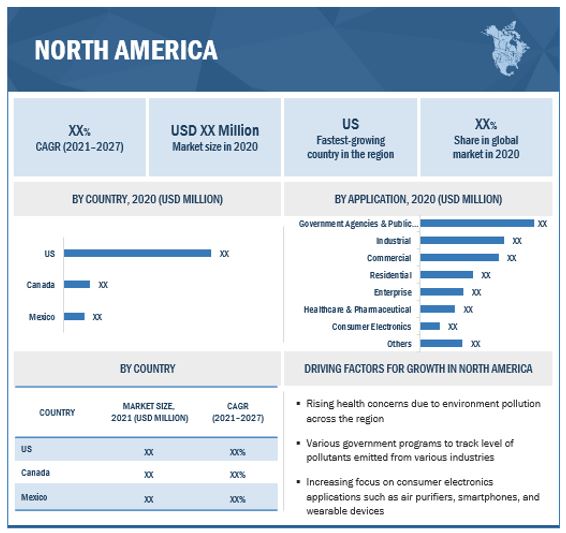

US to lead the environmental sensor market in North America during forecast period

The market for environmental sensors in the US is large as there is a major demand for environmental sensors in HVAC and commercial applications. The US Environmental Protection Agency (EPA) is among the leading agencies in standardizing and setting rules and regulations with regard to environmental monitoring across the world. The regulations set by EPA are stringent and have precise guidelines with regard to the implementation of environmental sensors in various industries. The environmental awareness among US citizens is comparatively higher than the citizens of other countries. The rules and regulations of the US government are expected to boost the adoption of environmental sensors industry in the country.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

The environmental sensor companies such as Bosch Sensortec (Germany), Sensirion (Switzerland), ams AG (Austria), Honeywell International (US), Siemens (Germany), Omron (Japan), Raritan (US), Texas Instruments (US), Schneider Electric (France), Amphenol (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Environmental Sensor Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2027 |

|

CAGR |

10.3% |

|

Segments covered |

By Type, By Location, By Application, By Vertical |

|

Geographies covered |

North America, Europe, APAC, Rest of the World |

|

Companies covered |

Bosch Sensortec (Germany), Sensirion (Switzerland), ams AG ( Austria), OMRON (Japan), Honeywell (US), Raritan (US), Siemens (Germany), Texas Instruments (US), Schneider Electric (France), Amphenol (US), STMicroelectronics (Switzerland), Aeroqual (New Zealand), Alphasense (England), AVTECH (US), Analog Devices (US), Apogee Instruments (US), Breeze Technologies (Germany). Develco Products (Denmark), Elichens (France), Figaro Engineering (Japan), NuWave Sensor Technology (Ireland), Renesas (Japan), RioT Technology (Canada), TE Connectivity (Switzerland) are the key players in the environmental sensor market. (Total 25 companies) |

The study categorizes the environmental sensor market based on value, by type, by location, by application and vertical at the regional and global levels.

Environmental Sensor Market By Type

- Introduction

- Temperature

- Humidity

- Air Quality

- Ultraviolet

- Integrated

- Soil Moisture

- Water Quality

Environmental Sensor Market By Location

- Indoor

- Outdoor

- Portable

Environmental Sensor Market By Application

- Smart Home Automation

- Smart Office Automation

- Smart City

- Others

Environmental Sensor Market By Vertical

- Commercial

- Enterprise

- Consumer Electronics

- Residential

- Healthcare and Pharmaceutical

- Government Agencies and Public Utilities

- Industrial

Environmental Sensor Market By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments

- In April 2021, Siemens announced Sitrans SCM IQ, a new industrial internet of things (IIOT) solution for smart condition monitoring, the anomaly detection of the Sitrans SCM IQ system is based on machine learning. It constantly monitors and analyzes all sensor values and detects deviations from the normal operating state in advance.

- In February 2021, Bosch Sensortec announced the launch of BMP384, a robust barometric pressure sensor that delivers accuracy in a compact package. This robust and compact package design offers a high level of protection against the ingression of water and other contaminants.

Frequently Asked Questions (FAQ):

What is the size of the global environmental sensor market?

The global environmental sensor market was valued to be USD 1.3 billion in 2020 and projected to reach USD 2.7 billion by 2027, at a CAGR of 10.3%.

What are the major driving factors and opportunities in the environmental sensor market?

Increasing health related concerns due to rising environmental pollution, growing adoption of environmental sensors in government and public utility and residential verticals, and growing adoption of new technological innovations in consumer electronics in APAC and other regions are the key drivers for the market.

Who are the star players in the global environmental sensor market?

Companies such Bosch Sensortec(Germany), Sensirion (Switzerland), ams AG(Austria), Honeywell(US) and Siemens(Germany) fall under the star category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have effective supply chain strategies. Such advantages give these companies an edge over other companies in the market.

What are the major strategies adopted by the key players?

Product launches and deals such as acquisitions, partnerships and agreements are the major strategies adopted by the key players of environmental sensor market.

Which region contributes to the largest market share in environmental sensor market during the forecast period?

APAC contributes the largest market share in environmental sensor market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ENVIRONMENTAL SENSOR MARKET

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 ENVIRONMENTAL SENSOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 ENVIRONMENTAL SENSOR MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis (demand side)

FIGURE 4 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 5 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 SUPPLY SIDE

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 SUPPLY SIDE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 9 TEMPERATURE SENSORS TO HOLD LARGEST SIZE OF ENVIRONMENTAL SENSOR MARKET DURING 2021–2027

FIGURE 10 PORTABLE MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 CONSUMER ELECTRONICS TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 12 MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ENVIRONMENTAL SENSOR MARKET, 2021–2027

FIGURE 13 GROWTH OPPORTUNITIES IN MARKET BETWEEN 2021 AND 2027

4.2 ENVIRONMENTAL SENSORS MARKET, BY TYPE

FIGURE 14 AIR /GAS QUALITY SENSOR MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN APAC, BY COUNTRY AND VERTICAL

FIGURE 15 GOVERNMENT AGENCIES & PUBLIC UTILITIES AND CHINA EXPECTED TO HOLD MAJOR SHARE OF MARKET IN APAC IN 2021

4.4 MARKET, GEOGRAPHIC SNAPSHOT

FIGURE 16 MARKET IN CHINA EXPECTED TO GROW AT HIGHEST CAGR DURING SFORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 IMPACT OF DRIVERS AND OPPORTUNITIES ON ENVIRONMENTAL SENSOR MARKET

FIGURE 18 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

FIGURE 19 STRINGENT ENVIRONMENT REGULATIONS TO UPSURGE USE OF ENVIRONMENTAL SENSORS

5.2.1 DRIVERS

5.2.1.1 Stringent environmental regulations to reduce air pollution

TABLE 2 REGULATIONS FOR STATIONARY SOURCES OF AIR POLLUTION

TABLE 3 ENVIRONMENTAL REGULATIONS/ACT FOR VARIOUS COUNTRIES

5.2.1.2 Health and safety concerns would upsurge demand for environmental monitoring systems

FIGURE 20 NUMBER OF ANNUAL PREMATURE DEATHS DUE TO POLLUTION (TOP 10 COUNTRIES) IN 2019

5.2.1.3 Increase in air quality monitoring stations

5.2.2 RESTRAINTS

5.2.2.1 Long-term monitoring of environmental data may lead to short life span of sensors

5.2.3 OPPORTUNITIES

5.2.3.1 Ongoing technological advancements in IoT and cloud-based services

5.2.3.2 Development of nanotechnology-based environmental monitoring products

5.2.3.3 Roles of remote sensing devices and GIS for real-time ambient air quality monitoring

5.2.3.4 Increasing adoption of environmental sensors for consumer products, HVAC, and air purifiers

5.2.4 CHALLENGES

5.2.4.1 Stringent performance requirements of advanced sensor applications

6 ENVIRONMENTAL SENSOR MARKET, BY TYPE (Page No. - 60)

6.1 INTRODUCTION

FIGURE 21 MARKET FOR AIR/GAS QUALITY SENSORS IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 4 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 5 MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 6 MARKET, BY TYPE, 2020–2027 (MILLION UNITS)

6.2 TEMPERATURE

6.2.1 COMMERCIAL AND RESIDENTIAL SEGMENTS TO DRIVE GROWTH FOR TEMPERATURE SENSORS

FIGURE 22 COMMERCIAL VERTICAL TO HOLD LARGEST SIZE OF TEMPERATURE SENSOR MARKET DURING FORECAST PERIOD

TABLE 7 TEMPERATURE SENSOR MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 8 TEMPERATURE SENSOR MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.3 HUMIDITY

6.3.1 RISING ADOPTION OF HUMIDITY SENSORS IN BUILDING AUTOMATION DRIVES GROWTH OF MARKET

TABLE 9 HUMIDITY SENSOR MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 10 HUMIDITY SENSOR MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.4 AIR QUALITY

6.4.1 RISING HEALTH RELATED CONCERNS DUE TO AIR POLLUTION IS SURGING THE DEMAND FOR AIR QUALITY SENSORS

TABLE 11 AIR QUALITY INDEX VALUES

FIGURE 23 CONSUMER ELECTRONICS VERTICAL TO GROW AT HIGHEST CAGR FOR AIR QUALITY SENSOR MARKET DURING FORECAST PERIOD

TABLE 12 AIR QUALITY SENSOR MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 13 AIR QUALITY SENSOR MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.5 ULTRAVIOLET

6.5.1 GROWING IMPORTANCE OF UV SENSORS IN POR TABLE DEVICES DRIVES GROWTH OF MARKET

TABLE 14 UV SENSOR MARKET, BY VERTICAL 2017–2020 (USD MILLION)

TABLE 15 UV SENSOR MARKET, BY VERTICAL 2021–2027 (USD MILLION)

6.6 INTEGRATED

6.6.1 PARADIGM SHIFT FROM STANDALONE SYSTEMS TO CLOUD BASED SERVICES AND ADVANCED TECHNOLOGICAL INNOVATIONS IS DRIVING THE MARKET OF INTEGRATED SENSORS

TABLE 16 COMPANIES OFFERING INTEGRATED ENVIRONMENTAL SENSORS

TABLE 17 INTEGRATED MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 18 INTEGRATED MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.7 SOIL MOISTURE

6.7.1 INCREASING ADOPTION OF SMART AGRICULTURE AND PRECISION FARMING METHODOLOGIES IS CONTRIBUTING TO GROWTH OF SOIL MOISTURE SENSORS

TABLE 19 SOIL MOISTURE SENSOR MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 20 SOIL MOISTURE SENSOR MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.8 WATER QUALITY

6.8.1 INCREASING TREND OF PO TABLE WATER USAGE THROUGH FILTERATION AND QUALITY DETECTION IS RISING DEMAND FOR WATER QUALITY SENSORS

TABLE 21 WATER QUALITY SENSOR MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 22 WATER QUALITY SENSOR MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

6.9 IMPACT OF COVID 19

7 ENVIRONMENTAL SENSOR MARKET, BY LOCATION (Page No. - 75)

7.1 INTRODUCTION

FIGURE 24 ENVIRONMENT SENSOR MARKET FOR PORTABLE SENSORS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 23 ENVIRONMENT SENSOR MARKET, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 24 ENVIRONMENT SENSOR MARKET, BY LOCATION, 2021–2027 (USD MILLION)

7.2 INDOOR

7.2.1 RISE IN POLLUTANT CONCENTRATION AND THERMAL CONDITIONS AT INDOOR LOCATIONS IS DRIVING MARKET FOR ENVIRONMENTAL SENSORS

TABLE 25 MAJOR SOURCES OF INDOOR POLLUTION

7.3 OUTDOOR

7.3.1 GROWING COMBUSTION PROCESSES DUE TO RISE IN INDUSTRIAL AND TRANSPORTATION ACTIVITIES FUEL NEED FOR ENVIRONMENTAL SENSORS AT OUTDOOR LOCATIONS

7.4 PORTABLE

7.4.1 INCREASING ADOPTION OF PORTABLE DEVICES HAS LED TO RISE IN DEMAND FOR ENVIRONMENTAL SENSORS

8 ENVIRONMENTAL SENSOR MARKET, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 25 MARKET FOR SMART HOME AUTOMATION APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 27 MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

8.2 SMART HOME AUTOMATION

8.2.1 INCREASING DEMAND IN HVAC SYSTEMS IS DRIVING GROWTH FOR ENVIRONMENTAL SENSORS IN SMART HOME AUTOMATION

8.3 SMART OFFICE AUTOMATION

8.3.1 INTEGRATION OF SENSORS IN OFFICE ECOSYSTEM TO BALANCE WORK AND HEALTH HAS LED TO INCREASED ADOPTION OF ENVIRONMENTAL SENSORS IN SAID APPLICATION

8.4 SMART CITY

8.4.1 ADOPTION OF SMART CITY PROJECTS AND SOLUTIONS OWING TO RISING HEALTH CONCERNS IS CONTRIBUTING TO GROWTH OF SAID MARKET

8.5 OTHERS

9 ENVIRONMENTAL SENSOR MARKET, BY VERTICAL (Page No. - 83)

9.1 INTRODUCTION

FIGURE 26 GOVERNMENT AGENCIES & PUBLIC UTILITIES VERTICAL TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 28 MARKET BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 29 MARKET BY VERTICAL, 2021–2027 (USD MILLION)

9.2 COMMERCIAL

9.2.1 COMMERCIAL VERTICAL TO HOLD LARGEST MARKET SHARE DUE TO INCREASING USE OF ENVIRONMENTAL SENSORS IN HVAC AND AIR QUALITY MONITORING APPLICATIONS

TABLE 30 MARKET FOR COMMERCIAL VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR COMMERCIAL VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

FIGURE 27 APAC TO DOMINATE MARKET FOR COMMERCIAL VERTICAL DURING FORECAST PERIOD

TABLE 32 MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 34 MARKET IN APAC FOR COMMERCIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 35 MARKET IN APAC FOR COMMERCIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 36 MARKET IN NORTH AMERICA FOR COMMERCIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 37 MARKET IN NORTH AMERICA FOR COMMERCIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 38 MARKET IN EUROPE FOR COMMERCIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 39 MARKET IN EUROPE FOR COMMERCIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 40 MARKET IN ROW FOR COMMERCIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 MARKET IN ROW FOR COMMERCIAL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.3 ENTERPRISE

9.3.1 INCREASING USE OF SENSORS IN OFFICE AUTOMATION FUEL GROWTH OF ENVIRONMENTAL SENSORS

TABLE 42 MARKET FOR ENTERPRISE VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR ENTERPRISE VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

FIGURE 28 APAC TO LEAD MARKET FOR ENTERPRISE VERTICAL DURING FORECAST PERIOD

TABLE 44 MARKET FOR ENTERPRISE VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 MARKET FOR ENTERPRISE VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 46 MARKET IN APAC FOR ENTERPRISE VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 47 MARKET IN APAC FOR ENTERPRISE VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 48 MARKET IN NORTH AMERICA FOR ENTERPRISE VERTICAL, BY COUNTRY, 2017–2020(USD MILLION)

TABLE 49 MARKET IN NORTH AMERICA FOR ENTERPRISE VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 50 MARKET IN EUROPE FOR ENTERPRISE VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 51 MARKET IN EUROPE FOR ENTERPRISE VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 52 MARKET IN ROW FOR ENTERPRISE VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MARKET IN ROW FOR ENTERPRISE VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.4 CONSUMER ELECTRONICS

9.4.1 APAC TO HOLD LARGEST SHARE OF ENVIRONMENTAL SENSORS MARKET FOR CONSUMER ELECTRONICS

9.4.2 SMARTPHONE AND TABLET

9.4.3 WEARABLE DEVICE

9.4.4 DIGITAL CLOCK

TABLE 54 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

TABLE 56 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 58 MARKET IN APAC FOR CONSUMER ELECTRONICS VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 59 MARKET IN APAC FOR CONSUMER ELECTRONICS VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 60 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 61 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 62 MARKET IN EUROPE FOR CONSUMER ELECTRONICS VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 63 MARKET IN EUROPE FOR CONSUMER ELECTRONICS VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 64 MARKET IN ROW FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET IN ROW FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.5 RESIDENTIAL

9.5.1 GROWING CONCERNS REGARDING INDOOR ENVIRONMENTAL POLLUTION IS DRIVING MARKET FOR RESIDENTIAL VERTICAL

TABLE 66 ENVIRONMENTAL SENSORS IN RESIDENTIAL VERTICAL

TABLE 67 MARKET FOR RESIDENTIAL VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR RESIDENTIAL VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

FIGURE 29 APAC TO DOMINATE MARKET FOR RESIDENTIAL VERTICAL DURING FORECAST PERIOD

TABLE 69 MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 71 MARKET IN APAC FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 72 MARKET IN APAC FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 73 MARKET IN NORTH AMERICA FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 74 MARKET IN NORTH AMERICA FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 75 MARKET IN EUROPE FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 76 MARKET IN EUROPE FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 77 MARKET IN ROW FOR RESIDENTIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN ROW FOR RESIDENTIAL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.6 HEALTHCARE AND PHARMACEUTICALS

9.6.1 HEALTHCARE

9.6.1.1 Need to monitor environmental parameters for patient wellbeing in healthcare facilities is driving market for environmental sensors

TABLE 79 ENVIRONMENTAL SENSORS IN HEALTHCARE

9.6.2 PHARMACEUTICALSz

9.6.2.1 Growing environmental pollution due to manufacturing and development of new therapeutic drugs fuels market growth

TABLE 80 MARKET FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 MARKET FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

FIGURE 30 NORTH AMERICA TO LEAD MARKET FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL DURING FORECAST PERIOD

TABLE 82 MARKET FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 84 MARKET IN APAC FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 85 MARKET IN APAC FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 86 MARKET IN NORTH AMERICA FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 88 MARKET IN EUROPE FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN EUROPE FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 90 MARKET IN ROW FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN ROW FOR HEALTHCARE AND PHARMACEUTICALS VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.7 GOVERNMENT AGENCIES AND PUBLIC UTILITIES

9.7.1 GOVERNMENT INVESTMENTS IN WEATHER MONITORING STATIONS AND SMART CITY PROJECTS ARE DRIVING MARKET

TABLE 92 MARKET FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 93 MARKET FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

FIGURE 31 MARKET IN APAC TO GROWTH AT HIGHEST CAGR FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL DURING FORECAST PERIOD

TABLE 94 MARKET FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 95 MARKET FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 96 MARKET IN APAC FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN APAC FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 100 MARKET IN EUROPE FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN EUROPE FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 102 MARKET IN ROW FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN ROW FOR GOVERNMENT AGENCIES AND PUBLIC UTILITIES, BY REGION, 2021–2027 (USD MILLION)

9.8 INDUSTRIAL

9.8.1 GROWING INDUSTRIALIZATION DUE TO RISE IN URBANIZATION CONTRIBUTES TO GROWING MARKET

TABLE 104 MARKET FOR INDUSTRIAL VERTICAL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 105 MARKET FOR INDUSTRIAL VERTICAL, BY TYPE, 2021–2027 (USD MILLION)

FIGURE 32 NORTH AMERICA TO DOMINATE MARKET, IN TERMS OF SIZE, FOR INDUSTRIAL VERTICAL DURING FORECAST PERIOD

TABLE 106 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 107 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 108 MARKET IN APAC FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 109 MARKET IN APAC FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 110 MARKET IN NORTH AMERICA FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN NORTH AMERICA FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 112 MARKET IN EUROPE FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN EUROPE FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 114 MARKET IN ROW FOR INDUSTRIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN ROW FOR INDUSTRIAL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.9 OTHERS

9.9.1 AGRICULTURE

9.9.1.1 SMART FARMING AND PRECISION FARMING METHODOLOGIES TO DRIVE DEMAND FOR ENVIRONMENTAL SENSORS

9.9.2 GREENHOUSE

9.9.2.1 INCREASING NEED FOR GREENHOUSES WILL CONTRIBUTE TO GROWTH OF ENVIRONMENTAL SENSOR MARKET

TABLE 116 MARKET FOR OTHER VERTICALS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 MARKET FOR OTHER VERTICALS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 118 MARKET FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 119 MARKET FOR OTHER VERTICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 120 MARKET IN APAC FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 121 MARKET IN APAC FOR OTHER VERTICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 122 MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 124 MARKET IN EUROPE FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN EUROPE FOR OTHER VERTICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 126 MARKET IN ROW FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 MARKET IN ROW FOR OTHER VERTICALS, BY REGION, 2021–2027 (USD MILLION)

9.1 IMPACT OF COVID-19

10 GEOGRAPHICAL ANALYSIS (Page No. - 126)

10.1 INTRODUCTION

FIGURE 33 APAC TO DOMINATE ENVIRONMENTAL SENSOR MARKET DURING FORECAST PERIOD

TABLE 128 MARKET, BY REGION, 2017–2020(USD MILLION)

TABLE 129 MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 35 US TO LEAD MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 130 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 131 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

10.2.1 US

10.2.1.1 High demand from HVAC and commercial verticals to boost growth of market in US

FIGURE 36 MOST POLLUTED CITIES/PLACES IN US–2020

10.2.2 CANADA

10.2.2.1 Stringent government regulations for air quality monitoring to drive growth of market in Canada

FIGURE 37 MOST POLLUTED CITIES/PLACES IN CANADA–2020

10.2.3 MEXICO

10.2.3.1 Rising pollution due to mining and oil and gas export activities contribute to demand for environmental sensors in Mexico

FIGURE 38 MOST POLLUTED CITIES/PLACES IN MEXICO–2020

10.3 EUROPE

FIGURE 39 EUROPE: SNAPSHOT OF ENVIRONMENTAL SENSOR MARKET

FIGURE 40 GERMANY TO HOLD LARGEST SIZE OF MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 132 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 133 MARKET IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Growing automotive manufacturing and electrical industries to surge demand for environmental sensors in Germany

FIGURE 41 MOST POLLUTED CITIES/PLACES IN GERMANY–2020

10.3.2 UK

10.3.2.1 Promotion of environmental sector and stringent environment monitoring norms contribute to demand for environmental sensors in UK

FIGURE 42 MOST POLLUTED CITIES/PLACES IN UK– 020

10.3.3 FRANCE

10.3.3.1 Rising concerns regarding pollution and climatic changes drive market for environmental sensors in France

FIGURE 43 MOST POLLUTED CITIES/PLACES IN FRANCE–2020

10.3.4 ITALY

10.3.4.1 Increasing government initiatives to control air pollution fuel growth of market in Italy

FIGURE 44 MOST POLLUTED CITIES/PLACES IN ITALY–2020

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 45 APAC: SNAPSHOT OF ENVIRONMENTAL SENSOR MARKET

FIGURE 46 CHINA TO DOMINATE MARKET IN APAC DURING FORECAST PERIOD

TABLE 134 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 135 MARKET IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Rise in adaptive anti-pollution measures to fuel growth of market in China

FIGURE 47 MOST POLLUTED CITIES/PLACES IN CHINA–2020

10.4.2 JAPAN

10.4.2.1 Growing government initiatives and demand for robust safety systems to drive market in Japan

FIGURE 48 MOST POLLUTED CITIES/PLACES IN JAPAN–2020

10.4.3 INDIA

10.4.3.1 Stringent government regulations due to operations of power plants to drive market in India

FIGURE 49 MOST POLLUTED CITIES/PLACES IN INDIA–2020

10.4.4 SOUTH KOREA

10.4.4.1 Large-scale manufacturing in electronics industry to fuel growth of market in South Korea

10.4.5 REST OF APAC

10.5 ROW

FIGURE 50 SOUTH AMERICA TO HOLD LARGER SIZE OF MARKET IN ROW DURING FORECAST PERIOD

TABLE 136 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 137 MARKET IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Surging industrial development and mining processes to propel demand for environmental sensors in South America

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Middle East

10.5.2.1.1 Large-scale oil and gas plants along with petrochemical plants create demand for environmental sensors in Middle East

10.5.2.2 Africa

10.5.2.2.1 Rise in demand for environmental sensors in building automation sector due to growing industrialization in African regions

10.6 IMPACT OF COVID-19

11 COMPETITIVE LANDSCAPE (Page No. - 148)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 138 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ENVIRONMENTAL SENSOR MANUFACTURERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET RANKING ANALYSIS: ENVIRONMENTAL SENSOR MARKET, 2020

FIGURE 51 MARKET RANKING ANALYSIS, 2020

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 52 ENVIRONMENTAL SENSOR MARKET: COMPANY EVALUATION QUADRANT, 2020

11.4.5 COMPETITIVE BENCHMARKING

FIGURE 53 COMPANY PRODUCT FOOTPRINT

TABLE 139 FOOTPRINT OF COMPANIES FOR DIFFERENT PRODUCTS

TABLE 140 FOOTPRINT OF COMPANIES IN DIFFERENT VERTICALS

TABLE 141 FOOTPRINT OF COMPANIES IN DIFFERENT REGIONS

11.5 COMPETITIVE SCENARIO AND TRENDS

11.5.1 PRODUCT LAUNCHES

TABLE 142 PRODUCT LAUNCHES, 2020–2021

11.5.2 DEALS

TABLE 143 DEALS, 2020–2021

11.5.3 OTHERS

TABLE 144 OTHER STRATEGIES, 2020–2021.

12 COMPANY PROFILES (Page No. - 162)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 KEY PLAYERS

12.1.1 BOSCH SENSORTEC

TABLE 145 BOSCH SENSORTEC: BUSINESS OVERVIEW

TABLE 146 BOSCH SENSORTEC: PRODUCTS OFFERED

TABLE 147 BOSCH SENSORTEC: PRODUCT LAUNCHES

TABLE 148 BOSCH SENSORTEC: DEALS

TABLE 149 BOSCH SENSORTEC: OTHER DEVELOPMENTS

12.1.2 SENSIRION

TABLE 150 SENSIRION : BUSINESS OVERVIEW

FIGURE 54 SENSIRION: COMPANY SNAPSHOT

TABLE 151 SENSIRION: PRODUCTS OFFERED

TABLE 152 SENSIRION : PRODUCT LAUNCHES

TABLE 153 SENSIRION : DEALS

TABLE 154 SENSIRION : OTHER DEVELOPMENTS

12.1.3 AMS AG

TABLE 155 AMS AG: BUSINESS OVERVIEW

FIGURE 55 AMS AG: COMPANY SNAPSHOT

TABLE 156 AMS AG ; PRODUCTS OFFERED

TABLE 157 AMS AG : PRODUCT LAUNCHES

TABLE 158 AMS AG : DEALS

TABLE 159 AMS AG : OTHER DEVELOPMENTS

12.1.4 HONEYWELL

TABLE 160 HONEYWELL: BUSINESS OVERVIEW

FIGURE 56 HONEYWELL: COMPANY SNAPSHOT

TABLE 161 HONEYWELL: PRODUCTS OFFERED

TABLE 162 HONEYWELL: PRODUCT LAUNCHES

TABLE 163 HONEYWELL: DEALS

12.1.5 SIEMENS

TABLE 164 SIEMENS: BUSINESS OVERVIEW

FIGURE 57 SIEMENS: COMPANY SNAPSHOT

TABLE 165 SIEMENS: PRODUCTS OFFERED

TABLE 166 SIEMENS: PRODUCTS LAUNCHES

TABLE 167 SIEMENS: DEALS

12.1.6 OMRON

TABLE 168 OMRON: BUSINESS OVERVIEW

FIGURE 58 OMRON: COMPANY SNAPSHOT

TABLE 169 OMRON: PRODUCTS OFFERED

TABLE 170 OMRON: PRODUCT LAUNCHES

TABLE 171 OMRON: DEALS

TABLE 172 OMRON: OTHER DEVELOPMENTS

12.1.7 RARITAN

TABLE 173 RARITAN: BUSINESS OVERVIEW

TABLE 174 RARITAN: PRODUCTS OFFERED

TABLE 175 RARITAN: PRODUCT LAUNCHES

TABLE 176 RARITAN: DEALS

TABLE 177 RARITAN: OTHER DEVELOPMENTS

12.1.8 TEXAS INSTRUMENTS

TABLE 178 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 59 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

TABLE 179 TEXAS INSTRUMENTS: PRODUCTS OFFERED

TABLE 180 TEXAS INSTRUMENTS: PRODUCT LAUNCHES

12.1.9 SCHNEIDER ELECTRIC

TABLE 181 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 60 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 182 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 183 SCHNEIDER ELECTRIC: DEALS

TABLE 184 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

12.1.10 AMPHENOL

TABLE 185 AMPHENOL: BUSINESS OVERVIEW

FIGURE 61 AMPHENOL: COMPANY SNAPSHOT

TABLE 186 AMPHENOL: PRODUCTS OFFERED

TABLE 187 AMPHENOL: PRODUCT LAUNCHES

TABLE 188 AMPHENOL: DEALS

TABLE 189 AMPHENOL: OTHERS

12.2 OTHER KEY PLAYERS

12.2.1 AEROQUAL

12.2.2 ALPHASENSE

12.2.3 AVTECH

12.2.4 ANALOG DEVICES

12.2.5 APOGEE INSTRUMENTS

12.2.6 BREEZE TECHNOLOGIES

12.2.7 DEVELCO PRODUCTS

12.2.8 ELICHENS

12.2.9 FIGARO ENGINEERING

12.2.10 METER GROUP

12.2.11 NUWAVE SENSOR

12.2.12 RENESAS

12.2.13 RIOT TECHNOLOGY

12.2.14 STMICROELECTRONICS

12.2.15 TE CONNECTIVITY

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 225)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global environmental sensor market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include company websites, magazines, industry news, associations, and databases (OneSource, Factiva, and Bloomberg), American Institute of Chemical Engineers(AIChE), Canadian Council of Ministers of the Environment (CCME), European Environment Agency (EEA) and corporate filings (such as annual reports, investor presentations, and financial statements). Secondary data has been collected and analyzed to arrive at the overall market size, further validated by primary research.

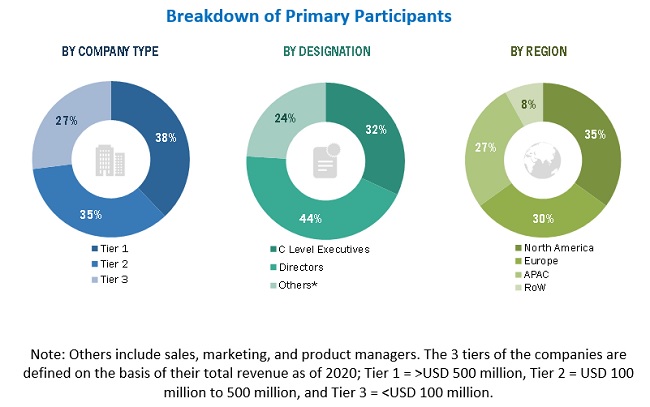

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the environmental sensor market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-and supply-side players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (the Middle East & Africa and South America). Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the overall size of the environmental sensor market. These methods have also been used extensively to estimate the size of various market subsegments.

The research methodology used to estimate the market size by top-down approach includes the following:

- Focusing, initially, on top-line investments and expenditures being made in the ecosystem of the environmental sensor market

- Calculating the market size considering revenues generated by major players through the sales of environmental sensor products

- Conducting multiple on-field discussion sessions with key opinion leaders across major companies involved in the development of environmental sensor products

- Estimating the geographic split using secondary sources based on various factors, such as the number of OEMs in a specific country and region, the role of major players in the market for the development of innovative products, and adoption and penetration rates in a particular country for various applications

The research methodology used to estimate the market size by bottom-up approach includes the following:

- Identifying key participants in the environmental sensor market that influence the entire market, along with the related component players.

- Analyzing major manufacturers of environmental sensors, studying their portfolios, and understanding different types and products. Analyzing developments undertaken by key players in the pre-COVID-19 period as well studying the measures/steps undertaken by them to deal with the COVID-19 pandemic.

- Analyzing the anticipated change in demand in the post-COVID-19 scenario.

- Analyzing trends pertaining to the use of environmental sensor technology components for different kinds of applications and verticals.

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product launches, collaborations, partnerships, and forecasting the market based on these developments and other critical parameters.

- Carrying out multiple discussions with key opinion leaders to understand different types of environmental sensor components and applications and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies.

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets.

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, for consumer electronics, commercial, enterprise, residential, government and public utility, healthcare and pharmaceuticals, industrial and others.

Report Objectives

- To describe and forecast the environmental sensor market, in terms of value, by type, by location, application and vertical.

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as product launches, contracts, agreements, and partnerships in the environmental sensor market.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Environmental Sensor Market