EV Cables Market by Type (BEV, HEV, PHEV), By Voltage (Low, High), EV Application (Engine & Powertrain, Battery & Charging Management), High Voltage Application, Insulation, Shielding Type (Copper, Aluminium), Component and Region - Global Forecast to 2026

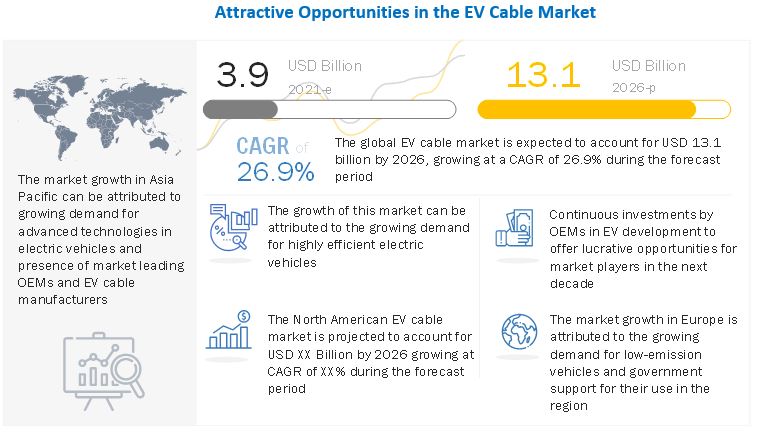

[210 Pages Report] The global EV Cables Market is projected to grow at a CAGR of 26.9% during the forecast period, to reach USD 13.1 billion by 2026 from an estimated USD 3.9 billion in 2021. EV cables perform different functions in electric vehicles as they aid in signal transmission and powering up of different electronic and electrical devices. They are also used to set up electrical circuits in electric vehicles, and are designed to operate in extreme conditions effectively.

The COVID-19 pandemic has become a major concern for EV stakeholders. Suspension of vehicle production and supply disruptions have brought the electric vehicle industry to a halt. Lower EV sales post the pandemic will be a major concern for automotive OEMs for the next few quarters. The electric vehicle cables market, however, is expected to witness a significant boost in 2022 owing to the carbon emission norms by different countries. Before that, lower vehicle sales and abrupt stoppage in the development of new automotive technologies will result in sluggish growth of the EV cables market in 2021.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Electric Vehicle Cable Market

The outbreak of the COVID-19 pandemic is not expected to affect the extraction of materials such as steel, copper, and aluminmm. With trade restrictions in place during the first six months of 2020, raw material extraction was continued by major extractors in China. However, the prices of raw materials such as copper will continue to rise, with copper price hitting USD 10,000 per ton for the first time in 10 years in May 2021.

The COVID-19 pandemic has had a severe impact on the global automotive industry. This is witnessed in terms of the supply chain disruptions of part exports from China, large-scale manufacturing interruptions across Europe, and closure of assembly plants in the US and other major countries, such as India and Brazil, where the automotive sector highly contributes to the GDP

Market Dynamics:

Driver: Increasing growth of electric vehicles

The market for EV cable is expected to grow with the increase in sales of electric vehicles. EV sales have surged with growth in all three top auto markets: China, the US, and Europe. Factors such as growing demand for low emission commuting and governments supporting long-range, zero-emission vehicles through subsidies and tax rebates have compelled manufacturers to provide electric vehicles around the world. Electric passenger car is the fastest-growing segment in the EV market and is expected to witness significant growth during the forecast period. This has led to a growing demand for EV cables in the market. Leading markets for electric vehicles such as China, the US, and Germany are investing significantly in electric vehicles. Countries across North America and Europe, along with many Asian countries, have adopted measures to reduce emissions in the coming decades and replace their vehicle fleets for lower emissions by varying amounts by 2050. This will increase the demand for electric vehicles and EV cables.

Restraint: High initial cost of electric vehicles

The high manufacturing costs of EVs have been a major concern in their widespread adoption. The expected reduction in battery prices and reduced R&D costs are expected to lead to a reduction in the overall cost of purchasing electric hatchbacks, crossovers, or SUVs to reach the levels of ICE vehicles, leading to the rising demand for EVs. The cost of EVs is significantly higher than ICE vehicles due to the high price of rechargeable lithium-ion batteries required for these vehicles. Hence, it restrains the market growth for EV cables. The price of cathode affects the price of the batteries to a large extent. This is because materials such as cobalt, nickel, lithium, and magnesium used in these batteries are high-priced. The cost of production of EVs is also significantly higher than ICE vehicles due to the expensive process involved in developing these vehicles. It affects the growth of electric vehicles, thus affecting the market for EV cables.

Opportunity: Government initiatives pertaining to EV charging infrastructure

The rising demand for EVs in various parts of the world is expected to increase the demand for charging stations. As a result, various governments are funding the development of charging station infrastructure, as well as subsidizing EV charging infrastructure. This move by governments is a must, as it will boost the sales of electric vehicles, which will benefit the market for EV cables. In addition to subsidies, governments are also introducing favorable policies for the installation of EV charging infrastructure. Several governments are providing various kinds of incentives such as low or zero registration fees and exemptions from import tax, purchase tax, and road tax. Proper charging infrastructure will ensure increased sales of electric vehicles, thus increasing the market for EV cables. Targets for EV charging provision vary from one place to another, given the levels of vehicle ownership and projected transport electrification trends. They will also vary over time as EV penetration increases.

Challenges: Lack of EV charging infrastructure in developing economies

To facilitate the widespread acceptance of EVs, an adequately developed infrastructure of charging stations is required. Barring a few countries such as the US, Germany, the UK, France, and Japan, the development of this infrastructure is in the initial stage across the world. This affects the market for electric vehicles, thus hampering the market for EV cables. Governments of various countries are offering subsidies and tax exemptions on infrastructure development to reduce the setup cost and promote sales of EVs, which will increase the market for EV cables. For instance, the Japanese government started investing in development of charging stations across the country in association with electric vehicle manufacturers such as Nissan, Mitsubishi, and Honda. Due to this partnership, Japan today has more charging stations (40,000) than fuel stations (34,000).

By EV type: BEV segment is estimated to hold the largest share of the overall EV cables market

Due to increasing concerns over emission reduction by countries around the world, BEVs are growing in demand. Earlier, due to less availability of charging stations and the high cost of EV batteries, BEVs were less in demand. However, due to decreasing cost of EV batteries at a fast and steady rate coupled with increasing EV range and a growing number of EV charging networks around the world, BEV demand has been growing drastically, increasing the market for EV cables. While BEVs are emission-free, several advancements in technology have also helped improve the sales of BEVs. Modern electric vehicles require automotive wiring and cables that can carry extreme voltages and these cables need to integrate seamlessly into the automotive assembly line for safety, low weight impact, and neatness. Hence, the market for EV cables is expected to grow in the future. Rising integration of electronic devices in BEVs has positively affected demand for EV cables.

By Voltage: High voltage segment is expected to dominate the EV cable market

High-voltage cables in electric vehicles move power to and from the battery and various systems throughout the electric vehicle. High-voltage EV cables are used for connecting the charging port and the battery, battery inter wiring, and the engine and other electrical components to carry the electric current power. As the automotive industry is moving toward electric and hybrid vehicles, the use of high-voltage batteries is also increasing proportionally. High-voltage cables are mostly used for battery applications in electric vehicles. Thus, with the increase in use of batteries for electric vehicles, the high-voltage EV cables market will also grow.

By EV application: Battery & Battery management is estimated to be the largest market during the forecast period

In electric, hybrid, fuel cell, and plug-in electric vehicles, batteries are used as a power source for electric motors. The external power source and ICE are used to charge batteries. In hybrid vehicles, manufacturers are shifting toward 48V batteries as they offer better vehicle stability and reduced fluctuations in vehicle voltage. Automotive OEMs are using high-voltage batteries to overcome the fuel economy standards set by governments. Modern electric vehicles require automotive wiring and cables that can carry extreme voltages and these cables need to integrate seamlessly into the battery line for safety, low weight impact, and neatness. Thus, with the growth of the battery market for electric vehicles, the EV cables market will grow proportionally.

Asia Pacific is expected to account for the largest market size during the forecast period

China, Japan, South Korea, and India are considered under Asia Pacific for market analysis. Increasing demand for electric vehicles in South Korea is also expected to drive the market for EV cables in the region. The region is home to some of the fastest developing economies of the world such as China and India. The governments of these emerging economies have recognized the growth potential of the electric vehicle market and, hence, have taken different initiatives to attract major OEMs to manufacture electric vehicles in domestic markets, thereby driving the demand for EV cables. The concept of reducing carbon emission by electrifying transportation has caught the attention of local and national governments. Hence, the use of electric vehicles has become popular in the region. In September 2020, the Indian government announced plans to offer incentives worth USD 4.6 billion to companies establishing advanced battery manufacturing facilities as part of its plans to reduce oil imports while switching to EVs. Hence the market for EV cables is expected to rise in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major EV Cables Market players include Leoni AG (Germany), Huber +Suhner (Switzerland), Sumitomo Electric Industries., Ltd (Japan), Aptiv (Ireland), Nexans (France)

These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements. Some instances are provided below.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20212026 |

|

Base year considered |

2020 |

|

Forecast period |

20212026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

BY EV type, by insulation material, by shielding type, by components, by Voltage, by high Voltage, by EV application |

|

Geographies covered |

Asia Pacific, Europe and North America |

|

Companies covered |

Leoni AG (Germany), Huber + Suhner (Switzerland), Sumitomo Electric Industries., Ltd (Japan), Aptiv (Ireland) and Nexans (France) |

This research report categorizes the market based on EV type, insulation material, shielding type, components, Voltage, high Voltage, EV application

Based on EV Type:

- BEV

- HEV

- PHEV

- FCEV

Based on Insulation Material:

- Silicon Rubber Jacket

- Fluoropolymers

- Thermoplastics

- Others

Based on Shielding Type:

- Copper

- Aluminum

- Others

Based on Components:

- Wires

- Connectors/Terminals

- Fuses

- Others

Based on Voltage:

- Low

- Medium

- High

- Very high

Based on High Voltage Type:

- Engine & Powertrain

- Battery & Battery Management

- Charging Management

- Power Electronics

- Others

Based on EV Application:

- Engine & Powertrain

- Battery & Battery Management

- Charging Management

- Power Electronics

- Others

Based on Region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Norway

- Spain

- UK

- North America

- US

- Canada

Recent Developments

- In July 2021, Nexans announced a cable manufacturing facility in Tianjin, China. The new plant covers a 3,000-meter square to produce a large range of cable products and solutions.

- In November 2020, Huber + Suhner launched its new flexible and robust Radox Screened Flex high voltage battery cable range for electric vehicles by combining Radox technology with a new type of semiconductor.

- In August 2019, Leoni AGs Wire & Cable Solutions Division (WCS) announced an expansion of its facility in Cuauhtιmoc, Mexico, by 7,000 square meters with the option for a further 3,000 square meters. The purpose is to increase the Hivocar high voltage cables for vehicles with alternative drive.

- In October-2018, Leoni AG showcased innovative technologies for electro mobility at the International Suppliers Fair (IZB), Wolfsburg. It illustrated a wide variety of internationally approved cables & solutions, fast charging technology, power supply with high-voltage cables, and LEONiQ digital cable technology.

Frequently Asked Questions (FAQ):

Does this report cover various applications of EV cable?

Yes, EV cable applications such as engine & powertrain, battery & battery management, charging management, power electronics and others as a segment is provided in the report.

Which countries are considered in the Asian region?

The report includes Asia Pacific countries such as:

- China

- India

- Japan

- South Korea

We are interested in regional EV cable market for electric vehicle types? Does this report cover electric vehicle types?

Yes, EV cable market for electric vehicle type are covered at global and regional level.

Does this report include impact of COVID-19 on EV cables?

Yes, the market includes qualitative insights for COVID-19 impact on the EV cables

Does this report provide insights on EV vehicle type?

Yes, EV Vehicle type is covered for BEV, PHEV, FCEV and HEV .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN THE EV CABLES MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

TABLE 2 CURRENCY EXCHANGE VALUE

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 ELECTRIC VEHICLE CABLES MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 ELECTRIC VEHICLE CABLES MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 ELECTRIC VEHICLE CABLES MARKET: TOP-DOWN APPROACH

FIGURE 8 ELECTRIC VEHICLE CABLES MARKET: RESEARCH DESIGN AND METHODOLOGY

FIGURE 9 RESEARCH APPROACH: EV CABLES MARKET

2.3.3 DEMAND-SIDE APPROACH

FIGURE 10 TOP-DOWN RESEARCH METHODOLOGY APPROACH: COMPANY BASED REVENUE APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.6 ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 12 OEMS ANNOUNCEMENT TO SHIFT TOWARD EVS

FIGURE 13 EV CABLES MARKET: MARKET OVERVIEW

FIGURE 14 EV CABLES MARKET, BY REGION, 20212026 (USD MILLION)

FIGURE 15 FCEV SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD (20212026)

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRIC VEHICLE CABLES MARKET

FIGURE 16 INCREASING DEMAND FOR ELECTRIC VEHICLES TO DRIVE THE MARKET

4.2 ELECTRIC VEHICLE CABLES MARKET, BY EV TYPE

FIGURE 17 BEV WOULD HAVE LARGEST MARKET DURING FORECAST PERIOD (20212026)

4.3 ELECTRIC VEHICLE CABLES MARKET, BY INSULATION MATERIAL

FIGURE 18 THERMOPLASTIC ESTIMATED TO HOLD MAJORITY OF THE MARKET (20212026)

4.4 ELECTRIC VEHICLE CABLES MARKET, BY SHIELDING TYPE

FIGURE 19 COPPER SEGMENT WOULD HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD (20212026)

4.5 ELECTRIC VEHICLE CABLES MARKET, BY COMPONENT

FIGURE 20 WIRE SEGMENT EXPECTED TO LEAD THE MARKET DURING FORECAST PERIOD (20212026)

4.6 ELECTRIC VEHICLE CABLES MARKET, BY VOLTAGE

FIGURE 21 HIGH VOLTAGE SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (20212026)

4.7 ELECTRIC VEHICLE CABLES MARKET, BY HIGH VOLTAGE TYPE

FIGURE 22 BATTERY & BATTERY MANAGEMENT SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (20212026)

4.8 ELECTRIC VEHICLE CABLES MARKET, BY EV APPLICATION

FIGURE 23 CHARGING MANAGEMENT WILL BE THE FASTEST GROWING SEGMENT (20212026)

4.9 ELECTRIC VEHICLE CABLES MARKET, BY REGION

FIGURE 24 ASIA PACIFIC PROJECTED TO BE THE LARGEST MARKET

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

TABLE 3 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 25 EV CABLES MARKET: DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing growth of electric vehicles

FIGURE 26 GLOBAL SALES OF ELECTRIC PASSENGER CARS, 20172020, (THOUSAND UNITS)

5.2.1.2 Increase in fuel prices

TABLE 4 AVERAGE PETROL PRICES IN US (2016-2020)

FIGURE 27 OIL CONSUMPTION AROUND THE WORLD IN PAST 10 YEARS

5.2.1.3 Rising focus of automakers on emission-free vehicles

TABLE 5 OEMS TARGET TO SHIFT TOWARDS EV

5.2.2 RESTRAINTS

5.2.2.1 High initial cost of electric vehicles

TABLE 6 AVERAGE VEHICLE COST, BY PROPULSION, 2021

5.2.2.2 Limited subsidies by governments and financial organizations

TABLE 7 SUBSIDIES OFFERED FOR ELECTRIC VEHICLES IN CHINA, (2019-2020)

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives pertaining to EV charging infrastructure

TABLE 8 GOVERNMENT PROGRAMS FOR PROMOTION OF ELECTRIC VEHICLE SALES

5.2.3.2 Rising popularity of hybrid electric vehicles

FIGURE 28 GLOBAL PHEV SALES, BY VOLUME (THOUSAND UNITS)

5.2.4 CHALLENGES

5.2.4.1 Lack of EV charging infrastructure in developing economies

TABLE 9 COUNTRY-WISE COMPARISON OF EV CHARGER DENSITY

FIGURE 29 EV CHARGING DEMAND, 2020-2030

5.2.4.2 Longer charging time than other fuels

FIGURE 30 AVERAGE INITIAL INVESTMENT COMPARISON FOR DIFFERENT TYPES OF FUEL STATIONS

5.3 PORTERS FIVE FORCES

FIGURE 31 PORTERS FIVE FORCES: ELECTRIC VEHICLE CABLES MARKET

TABLE 10 EV CABLES MARKET: IMPACT OF PORTERS FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 RIVALRY AMONG EXISTING COMPETITORS

5.4 ELECTRIC VEHICLE CABLES MARKET ECOSYSTEM

FIGURE 32 EV CABLES MARKET: ECOSYSTEM ANALYSIS

5.4.1 EV CABLE PROVIDERS

5.4.2 TIER-I SUPPLIERS

5.4.3 OEMS

5.4.4 END USERS

TABLE 11 ELECTRIC VEHICLE CABLES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 33 VALUE CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.6.1 SELECTIVE METAL COATING TECHNOLOGY

5.6.2 ILLUMINATED EV CHARGING CABLE

5.6.3 V2X TECHNOLOGY

5.7 PATENT ANALYSIS

5.8 TRENDS AND DISRUPTIONS IN ELECTRIC VEHICLE CABLES MARKET

FIGURE 34 TRENDS AND DISRUPTIONS IN EV CABLES MARKET

5.9 CASE STUDY

5.9.1 CASE STUDY ON ELECTRICAL CONNECTION FOR ALUMINIUM CONDUCTORS IN AUTOMOTIVE APPLICATIONS

5.10 REGULATORY FRAMEWORK

5.10.1 NETHERLANDS

TABLE 12 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

5.10.2 GERMANY

TABLE 13 GERMANY: ELECTRIC VEHICLE INCENTIVES

5.10.3 FRANCE

TABLE 14 FRANCE: ELECTRIC VEHICLE INCENTIVES

5.10.4 UK

TABLE 15 UK: ELECTRIC VEHICLE INCENTIVES

5.10.5 CHINA

TABLE 16 CHINA: ELECTRIC VEHICLE INCENTIVES

5.10.6 US

TABLE 17 US: ELECTRIC VEHICLE INCENTIVES

5.11 ELECTRIC VEHICLE CABLES MARKET: COVID-19 IMPACT

5.11.1 IMPACT ON RAW MATERIAL SUPPLY

5.11.2 COVID-19 IMPACT ON AUTOMOTIVE INDUSTRY

5.11.3 ANNOUNCEMENTS

TABLE 18 ANNOUNCEMENTS

5.11.4 IMPACT ON AUTOMOTIVE PRODUCTION

5.12 ELECTRIC VEHICLE CABLES MARKET SCENARIO ANALYSIS

FIGURE 35 EV CABLES MARKET FUTURE TRENDS & SCENARIO, 20212026 (USD MILLION)

5.12.1 MOST LIKELY SCENARIO

TABLE 19 EV CABLES MARKET (MOST LIKELY SCENARIO), BY REGION, 20212026 (USD MILLION)

5.12.2 OPTIMISTIC SCENARIO

TABLE 20 EV CABLES MARKET (OPTIMISTIC), BY REGION, 20212026 (USD MILLION)

5.12.3 PESSIMISTIC SCENARIO

TABLE 21 EV CABLES MARKET (PESSIMISTIC), BY REGION, 20212026 (USD MILLION)

6 ELECTRIC VEHICLE CABLE MARKET, BY EV TYPE (Page No. - 80)

6.1 INTRODUCTION

FIGURE 36 FCEV SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (20212026)

TABLE 22 ELECTRIC VEHICLE CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

6.2 OPERATIONAL DATA

TABLE 23 EV CABLE MANUFACTURERS, BY VEHICLE TYPE

6.2.1 ASSUMPTIONS

TABLE 24 ASSUMPTIONS: BY EV TYPE

6.3 RESEARCH METHODOLOGY

6.4 BATTERY ELECTRIC VEHICLE (BEV)

6.4.1 INCREASE IN ADOPTION OF INTEGRATED COMPONENTS TO DRIVE THE SEGMENT

TABLE 25 BEV: EV CABLES MARKET, BY REGION, 20182026 (USD MILLION)

6.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

6.5.1 EXTENDED DRIVING RANGE DUE TO LIQUID FUEL TANK & ICE TO DRIVE THE SEGMENT

TABLE 26 PHEV: EV CABLES MARKET, BY REGION, 20182026 (USD MILLION)

6.6 FUEL CELL ELECTRIC VEHICLE (FCEV)

6.6.1 ADVANCEMENTS IN FUEL CELL TECHNOLOGY TO DRIVE THE SEGMENT

TABLE 27 FCEV: EV CABLES MARKET, BY REGION, 20182026 (USD MILLION)

6.7 HYBRID ELECTRIC VEHICLE (HEV)

6.7.1 IMPROVED PERFORMANCE & PRESENCE OF ICE TO DRIVE THE SEGMENT

TABLE 28 HEV: EV CABLES MARKET, BY REGION, 20182026 (USD MILLION)

6.8 KEY INDUSTRY INSIGHTS

7 ELECTRIC VEHICLE CABLE MARKET, BY VOLTAGE (Page No. - 89)

7.1 INTRODUCTION

FIGURE 37 HIGH-VOLTAGE CABLE EXPECTED TO DOMINATE THE MARKET, 20212026 (USD MILLION)

TABLE 29 ELECTRIC VEHICLE CABLES MARKET, BY VOLTAGE, 20182026 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 30 EV CABLE PROVIDERS, BY VOLTAGE TYPE

7.2.1 ASSUMPTIONS

TABLE 31 ASSUMPTIONS: BY VOLTAGE

7.3 RESEARCH METHODOLOGY

7.4 LOW VOLTAGE (UP TO 100 V)

7.4.1 INSTALLATION OF LOW VOLTAGE CABLES FOR APPLICATIONS SUCH AS POWER ELECTRONICS TO DRIVE THE SEGMENT

TABLE 32 LOW VOLTAGE: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

7.5 MEDIUM VOLTAGE (100 V -300 V)

7.5.1 RISING ADOPTION OF NEW EV TECHNOLOGIES TO DRIVE THE SEGMENT

TABLE 33 MEDIUM VOLTAGE: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

7.6 HIGH VOLTAGE (300 V 1000 V)

7.6.1 INCREASE IN CHARGING MANAGEMENT MARKET FOR ELECTRIC VEHICLES TO DRIVE THE SEGMENT

TABLE 34 HIGH VOLTAGE: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

7.7 VERY HIGH VOLTAGE (ABOVE 1000 V)

7.7.1 SHIFT TOWARD VERY HIGH VOLTAGE ARCHITECTURE TO DRIVE THE SEGMENT

TABLE 35 VERY HIGH: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

7.8 KEY INDUSTRY INSIGHTS

8 ELECTRIC VEHICLE CABLE MARKET, BY EV APPLICATION (Page No. - 97)

8.1 INTRODUCTION

FIGURE 38 EV BATTERY SEGMENT EXPECTED TO DOMINATE THE MARKET, 20212026 (USD MILLION)

TABLE 36 EV CABLE MARKET, BY EV APPLICATION, 20182026 (USD MILLION)

8.2 OPERATIONAL DATA

TABLE 37 EV CABLE PROVIDERS APPLICATION

8.2.1 ASSUMPTIONS

TABLE 38 ASSUMPTIONS: BY EV APPLICATION

8.3 RESEARCH METHODOLOGY

8.4 ENGINE & POWERTRAIN

8.4.1 DEMAND FOR HIGH-VOLTAGE CABLES TO DRIVE THE SEGMENT

TABLE 39 ENGINE & POWERTRAIN: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

8.5 BATTERY & BATTERY MANAGEMENT

8.5.1 RISE IN DEMAND FOR HYBRID ELECTRIC VEHICLES TO DRIVE THE SEGMENT

TABLE 40 BATTERY & BATTERY MANAGEMENT: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

8.6 CHARGING MANAGEMENT

8.6.1 GROWING CHARGING INFRASTRUCTURE TO DRIVE THE SEGMENT

TABLE 41 CHARGING MANAGEMENT: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

8.7 POWER ELECTRONICS

8.7.1 GROWING PREFERENCE OF CUSTOMERS FOR ADVANCED TECHNOLOGIES TO DRIVE THE SEGMENT

TABLE 42 POWER ELECTRONICS: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

8.8 OTHERS (MOTOR, INVERTER & OTHERS)

8.8.1 RISING DEMAND FOR INTEGRATED MOTORS TO DRIVE THE SEGMENT

TABLE 43 OTHERS (MOTOR, INVERTER & OTHERS): EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

8.9 KEY INDUSTRY INSIGHTS

9 ELECTRIC VEHICLE CABLE MARKET, BY HIGH-VOLTAGE CABLE APPLICATION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 39 BATTERY & BATTERY MANAGEMENT SEGMENT EXPECTED TO DOMINATE THE MARKET, 20212026 (USD MILLION)

TABLE 44 EV CABLES MARKET, BY HIGH VOLTAGE TYPE, 20182026 (USD MILLION)

9.2 OPERATIONAL DATA

TABLE 45 EV CABLE PROVIDERS, BY HIGH VOLTAGE TYPE, BY APPLICATION

9.2.1 ASSUMPTIONS

TABLE 46 ASSUMPTIONS: BY HIGH VOLTAGE, BY APPLICATION

9.3 RESEARCH METHODOLOGY

9.4 ENGINE & POWERTRAIN

9.4.1 GROWING SALES OF ELECTRIC VEHICLES TO DRIVE THE SEGMENT

TABLE 47 ENGINE & POWERTRAIN: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

9.5 BATTERY & BATTERY MANAGEMENT

9.5.1 ADOPTION OF ADVANCED INTEGRATED TECHNOLOGIES TO DRIVE THE SEGMENT

TABLE 48 BATTERY AND BATTERY MANAGEMENT APPLICATION: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

9.6 CHARGING MANAGEMENT

9.6.1 GROWING ELECTRIFICATION TREND TO DRIVE THE SEGMENT

TABLE 49 CHARGING MANAGEMENT APPLICATION: EV CABLES MARKET, BY REGION, 20182026 (USD MILLION)

9.7 POWER ELECTRONICS

9.7.1 SHIFT TOWARD HIGH VOLTAGE ARCHITECTURE TO DRIVE THE SEGMENT

TABLE 50 POWER ELECTRONICS APPLICATION: EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

9.8 OTHERS (MOTOR, INVERTER & OTHERS)

9.8.1 INCREASING FOCUS ON ECO-FRIENDLY VEHICLES TO DRIVE THE SEGMENT

TABLE 51 OTHERS (MOTOR, INVERTER AND OTHER): EV CABLE MARKET, BY REGION, 20182026 (USD MILLION)

9.9 KEY INDUSTRY INSIGHTS

10 EV CABLES MARKET, BY INSULATION MATERIAL (Page No. - 115)

10.1 INTRODUCTION

FIGURE 40 THERMOPLASTIC SEGMENT IS EXPECTED TO BE THE LARGEST DURING THE FORECAST PERIOD (20212026)

TABLE 52 ELECTRIC VEHICLE CABLES MARKET, BY INSULATION MATERIAL, 20182026 (USD MILLION)

10.2 OPERATIONAL DATA

TABLE 53 CHARACTERISTICS & BENEFITS OF CABLE JACKET

TABLE 54 COMPARISON OF CABLE JACKET MATERIALS

10.2.1 ASSUMPTIONS

TABLE 55 ASSUMPTIONS: BY INSULATION COVER MATERIAL

10.3 RESEARCH METHODOLOGY

10.4 SILICONE RUBBER INSULATION

10.4.1 HIGHLY BENEFICIAL PROPERTIES TO DRIVE THE SEGMENT

TABLE 56 SILICON RUBBER: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

10.5 THERMOPLASTIC ELASTOMER

10.5.1 EV DEMAND IN MODERATELY LOW-TEMPERATURE REGIONS TO DRIVE THE SEGMENT

TABLE 57 THERMOPLASTIC ELASTOMER: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

10.6 FLUORO-POLYMERS

10.6.1 GROWING DEMAND FOR HIGHLY ADAPTABLE EV CABLES TO DRIVE THE SEGMENT

TABLE 58 FLUORO-POLYMERS: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

10.7 OTHERS

10.7.1 DEMAND FOR FIBER-BASED INSULATION TO DRIVE THE SEGMENT

TABLE 59 OTHERS: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

10.8 KEY PRIMARY INSIGHTS

11 EV CABLES MARKET, BY SHIELDING TYPE (Page No. - 123)

11.1 INTRODUCTION

FIGURE 41 COPPER IS EXPECTED TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD (20212026)

TABLE 60 EV CABLE MARKET, BY SHIELDING TYPE, 20182026 (USD MILLION)

11.2 OPERATIONAL DATA

TABLE 61 COMPARISON OF COPPER AND ALUMINUM SHIELDING

11.2.1 ASSUMPTIONS

TABLE 62 ASSUMPTIONS: BY SHIELDING TYPE

11.3 RESEARCH METHODOLOGY

11.4 COPPER

11.4.1 GROWING DEMAND FOR LONG-LASTING EV CABLES TO DRIVE THE SEGMENT

TABLE 63 COPPER: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

TABLE 64 COPPER REQUIRED IN EVS (LBS)

11.5 ALUMINUM

11.5.1 GROWING DEMAND FOR HIGHLY EFFICIENT EV CABLES TO DRIVE THE SEGMENT

TABLE 65 ALUMINUM: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

TABLE 66 COMPARISON OF PROPERTIES ALUMINUM VS COPPER

11.6 OTHERS

11.6.1 DEVELOPMENT OF NEW MATERIALS TO DRIVE THE SEGMENT

TABLE 67 OTHERS: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

11.7 KEY PRIMARY INSIGHTS

12 EV CABLES MARKET, BY COMPONENT (Page No. - 130)

12.1 INTRODUCTION

FIGURE 42 WIRE SEGMENT IS EXPECTED TO BE LARGEST DURING THE FORECAST PERIOD (20212026)

TABLE 68 ELECTRIC VEHICLE CABLES MARKET, BY COMPONENT, 20182026 (USD MILLION)

12.2 OPERATIONAL DATA

TABLE 69 COMPONENT SUPPLIERS FOR EV CABLES

12.2.1 ASSUMPTIONS

TABLE 70 ASSUMPTIONS: BY COMPONENT

12.3 RESEARCH METHODOLOGY

12.4 WIRES

12.4.1 GROWING DEMAND FOR EVS TO DRIVE THE SEGMENT

TABLE 71 WIRES: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

12.5 CONNECTORS/TERMINALS

12.5.1 GROWING DEMAND FOR ELECTRIC DRIVETRAINS TO DRIVE SEGMENT

TABLE 72 CONNECTORS/TERMINALS: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

12.6 FUSES

12.6.1 DEMAND FOR SAFETY OF EV DRIVETRAIN COMPONENTS TO DRIVE THE SEGMENT

TABLE 73 FUSE: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

12.7 OTHERS

12.7.1 DEMAND FOR EV POWER TRANSMISSION COMPONENTS TO DRIVE THE SEGMENT

TABLE 74 OTHERS: ELECTRIC VEHICLE CABLES MARKET, BY REGION, 20182026 (USD MILLION)

12.8 KEY PRIMARY INSIGHTS

13 ELECTRIC VEHICLE CABLES MARKET, BY REGION (Page No. - 137)

13.1 INTRODUCTION

FIGURE 43 ASIA PACIFIC EXPECTED TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 75 EV CABLES MARKET, BY REGION, 20182026 (USD MILLION)

13.2 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: EV CHARGING CABLES MARKET SNAPSHOT

TABLE 76 ASIA PACIFIC: ELECTRIC VEHICLE CABLES MARKET, BY COUNTRY, 20182026 (USD MILLION)

13.2.1 CHINA

13.2.1.1 Consistently increasing sales of EVs to drive the market

TABLE 77 CHINA EV SALES DATA (THOUSAND UNITS)

TABLE 78 CHINA: EV CABLE MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.2.2 INDIA

13.2.2.1 Active participation of OEMs to drive the market

TABLE 79 INDIA EV SALES DATA (THOUSAND UNITS)

TABLE 80 INDIA: ELECTRIC VEHICLE CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.2.3 JAPAN

13.2.3.1 EV charging management facilities to drive the market

TABLE 81 JAPAN EV SALES DATA (THOUSAND UNITS)

TABLE 82 JAPAN: ELECTRIC VEHICLE CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.2.4 SOUTH KOREA

13.2.4.1 Adoption of advanced technologies to drive the market

TABLE 83 SOUTH KOREA EV SALES DATA (THOUSAND UNITS)

TABLE 84 SOUTH KOREA: ELECTRIC VEHICLE CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.3 EUROPE

TABLE 85 EUROPE: EV CABLES MARKET, BY COUNTRY, 20182026 (USD MILLION)

13.3.1 FRANCE

13.3.1.1 Government incentives for EV adoption to drive the market

TABLE 86 FRANCE EV SALES DATA (THOUSAND UNITS)

TABLE 87 FRANCE: EV CHARGING CABLES MARKET, BY APPLICATION, 20182026 (USD MILLION)

13.3.2 GERMANY

13.3.2.1 Presence of leading EV cable manufacturers to drive the market

TABLE 88 GERMANY EV SALES DATA (THOUSAND UNITS)

TABLE 89 GERMANY: EV CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.3.3 NORWAY

13.3.3.1 Rising popularity of PHEVs to drive the market

TABLE 90 NORWAY EV SALES DATA (THOUSAND UNITS)

TABLE 91 NORWAY: EV CABLES MARKET, BY EV TYPE, 20182026(USD MILLION)

13.3.4 SPAIN

13.3.4.1 Scrappage policy by the government to drive the market

TABLE 92 SPAIN EV SALES DATA (THOUSAND UNITS)

TABLE 93 SPAIN: EV CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.3.5 UK

13.3.5.1 Growing EV battery ecosystem to drive the market

TABLE 94 UK EV SALES DATA (THOUSAND UNITS)

TABLE 95 UK: EV CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.4 NORTH AMERICA

FIGURE 45 NORTH AMERICA: EV CABLES MARKET SNAPSHOT

TABLE 96 NORTH AMERICA: EV CABLES MARKET, BY COUNTRY, 20182026 (USD MILLION)

13.4.1 US

13.4.1.1 Presence of leading electric vehicle manufacturers to drive the market

TABLE 97 US EV SALES DATA (THOUSAND UNITS)

TABLE 98 US: EV CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

13.4.2 CANADA

13.4.2.1 Growth of FCEVs to drive the market

TABLE 99 CANADA EV SALES DATA (THOUSAND UNITS)

TABLE 100 CANADA: EV CABLES MARKET, BY EV TYPE, 20182026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 156)

14.1 OVERVIEW

14.2 EV CABLES: MARKET RANKING ANALYSIS

TABLE 101 MARKET RANKING ANALYSIS, 2020

FIGURE 46 MARKET RANKING ANALYSIS, 2020

14.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 47 TOP PUBLIC/LISTED PLAYERS THAT DOMINATED ELECTRIC VEHICLE CABLES MARKET IN LAST FIVE YEARS

14.4 COMPETITIVE SCENARIO

14.4.1 NEW PRODUCT LAUNCHES

14.4.2 DEALS

TABLE 102 DEALS, 20182021

14.4.3 OTHERS

TABLE 103 OTHERS, 2018-2021

14.5 COMPANY EVALUATION QUADRANT

14.5.1 STARS

14.5.2 EMERGING LEADERS

14.5.3 PERVASIVE

14.5.4 PARTICIPANTS

FIGURE 48 EV CABLES MARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 104 EV CABLES MARKET: COMPANY FOOTPRINT, 2021

TABLE 105 EV CABLES MARKET: PRODUCT FOOTPRINT, 2021

14.5.5 EV CABLES MARKET: REGIONAL FOOTPRINT, 2021

14.6 START-UP/SME EVALUATION QUADRANT

14.6.1 PROGRESSIVE COMPANIES

14.6.2 RESPONSIVE COMPANIES

14.6.3 DYNAMIC COMPANIES

14.6.4 STARTING BLOCKS

FIGURE 49 EV CABLES MARKET: START-UP/SME EVALUATION QUADRANT, 2021

14.7 RIGHT TO WIN, 2018-2021

TABLE 106 WINNERS VS TAIL-ENDERS

15 COMPANY PROFILES (Page No. - 167)

15.1 KEY PLAYERS

(Business overview, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

15.1.1 LEONI AG

TABLE 107 LEONI AG: BUSINESS OVERVIEW

FIGURE 50 LEONI AG: COMPANY SNAPSHOT

TABLE 108 LEONI AG: PRODUCTS OFFERED

TABLE 109 LEONI AG: NEW PRODUCT DEVELOPMENTS

TABLE 110 LEONI AG: DEALS

TABLE 111 LEONI AG: OTHERS

15.1.2 HUBER+SUHNER

TABLE 112 HUBER+SUHNER: BUSINESS OVERVIEW

FIGURE 51 HUBER+SUHNER: COMPANY SNAPSHOT

TABLE 113 HUBER+SUHNER: PRODUCTS OFFERED

TABLE 114 HUBER+SUHNER: NEW PRODUCT DEVELOPMENTS

15.1.3 SUMITOMO ELECTRIC INDUSTRIES, LTD.

TABLE 115 SUMITOMO ELECTRIC INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 52 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 116 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS OFFERED

15.1.4 APTIV

TABLE 117 APTIV: BUSINESS OVERVIEW

FIGURE 53 APTIV: COMPANY SNAPSHOT

TABLE 118 APTIV: PRODUCTS OFFERED

TABLE 119 APTIV: DEALS

15.1.5 NEXANS

TABLE 120 NEXANS: BUSINESS OVERVIEW

FIGURE 54 NEXANS: COMPANY SNAPSHOT

TABLE 121 NEXANS: PRODUCTS OFFERED

TABLE 122 NEXANS: OTHERS

15.1.6 TE CONNECTIVITY

TABLE 123 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 55 TE CONNECTIVITY: COMPANY SNAPSHOT

TABLE 124 TE CONNECTIVITY: PRODUCTS OFFERED

15.1.7 ELAND CABLES

TABLE 125 ELAND CABLES: BUSINESS OVERVIEW

FIGURE 56 ELAND CABLES: COMPANY SNAPSHOT

TABLE 126 ELAND CABLES: PRODUCTS OFFERED

15.1.8 ACOME

TABLE 127 ACOME: BUSINESS OVERVIEW

FIGURE 57 ACOME: COMPANY SNAPSHOT

TABLE 128 ACOME: PRODUCTS OFFERED

TABLE 129 ACOME: NEW PRODUCT DEVELOPMENTS

TABLE 130 ACOME: OTHERS

15.1.9 ELKEM

TABLE 131 ELKEM: BUSINESS OVERVIEW

FIGURE 58 ELKEM: COMPANY SNAPSHOT

TABLE 132 ELKEM: PRODUCTS OFFERED

TABLE 133 ELKEM: OTHERS

15.1.10 COROPLAST

TABLE 134 COROPLAST: BUSINESS OVERVIEW

TABLE 135 COROPLAST: PRODUCTS OFFERED

TABLE 136 COROPLAST: NEW PRODUCT DEVELOPMENTS

TABLE 137 COROPLAST: DEALS

15.1.11 CHAMPLAIN CABLE CORPORATION

TABLE 138 CHAMPLAIN CABLE CORPORATION: BUSINESS OVERVIEW

TABLE 139 CHAMPLAIN CABLE CORPORATION: PRODUCTS OFFERED

TABLE 140 CHAMPLAIN CABLE CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 141 CHAMPLAIN CABLE CORPORATION: DEALS

15.1.12 SINBON ELECTRONICS

TABLE 142 SINBON ELECTRONICS: BUSINESS OVERVIEW

TABLE 143 SINBON ELECTRONICS: PRODUCTS OFFERED

TABLE 144 SINBON ELECTRONICS: OTHERS

15.1.13 PHILATRON WIRE & CABLE

TABLE 145 PHILATRON WIRE & CABLE: BUSINESS OVERVIEW

TABLE 146 PHILATRON WIRE & CABLE: PRODUCTS OFFERED

TABLE 147 PHILATRON WIRE & CABLE: NEW PRODUCT DEVELOPMENTS

15.2 OTHER KEY PLAYERS

15.2.1 FURUKAWA ELECTRIC CO., LTD

15.2.2 HENGFEI CABLE CO., LTD

15.2.3 DYDEN CORPORATION

15.2.4 RIYING ELECTRONICS CO., LTD

15.2.5 THB GROUP

15.2.6 YURA CORPORATION

15.2.7 YAZAKI CORPORATION

15.2.8 FUJIKURA LTD

15.2.9 OMG EV CABLE

15.2.10 DRAXLMAIER GROUP

15.2.11 BESEN INTERNATIONAL GROUP

15.2.12 GENERAL CABLE (PRYSMIAN GROUP)

*Details on Business overview, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats not be captured in case of unlisted companies.

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 206)

16.1 ASIA PACIFIC IS KEY FOCUS MARKET FOR EV CABLES

16.2 ADOPTION OF HIGH VOLTAGE CABLES IS ON RISE

16.3 CONCLUSION

17 APPENDIX (Page No. - 207)

17.1 KEY INSIGHTS OF INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

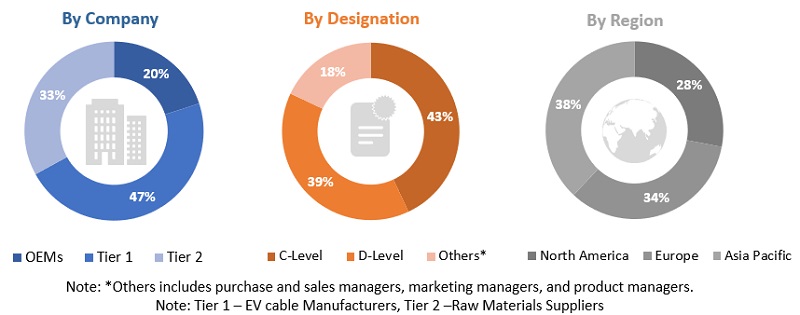

The study involved 4 major activities in estimating the market size for EV cables. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global market. Secondary sources include company annual reports/presentations, press releases, industry association publications, India Electronics & Semiconductor Association, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association Of Automoblie Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (Marklines and Factiva).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across 3 major regions, namely, Asia Pacific, Europe and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To analyze and forecast the EV cables market, in terms of value (USD million), from 2021 to 2026

- To provide detailed information regarding the major factors influencing the growth of the EV cable market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall EV cable market

- To segment and forecast the EV cables market, by value, based on region (Asia Pacific, Europe and North America)

- To segment and forecast the EV cables market size, by value, based on EV type (BEV, PHEV, FCEV, and HEV)

- To segment the market for EV cable and forecast the market size, by value, based on insulation materials (thermoplastics, fluropolymers, silicon rubber jacket, and others)

- To segment the market for EV cable and forecast the market size, by value, based on shielding type (copper, aluminium, and others)

- To segment the market for EV cable and forecast the market size, by value, based on components (wires, connectors/ terminals, fuses, and others)

- To segment the market for EV cable and forecast the market size, by value, based on Voltage (low, medium, high, and very high)

- To segment and forecast the EV cable market size, by value, based on high Voltage, by application type (engine & powertrain, battery & battery management, charging management, power electronics, and others)

- To segment and forecast the EV cable market size, by value, based on EV application (engine & powertrain, battery & battery management, charging management, power electronics, and others)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities undertaken by the key industry participants

Available Customizations

Detailed analysis of EV cables market, by type

Detailed analysis of EV cables market, by vehicle type

- Buses

- Trucks

Company Information

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in EV Cables Market