Extruded Polystyrene Market by Application (Foundation (Basement & Below Ground), Roof, Wall, Floor & Ceiling), End Use (Residential, Commercial), Region (Europe, North America, APAC, Middle East & Africa, South America) - Global Forecast to 2024

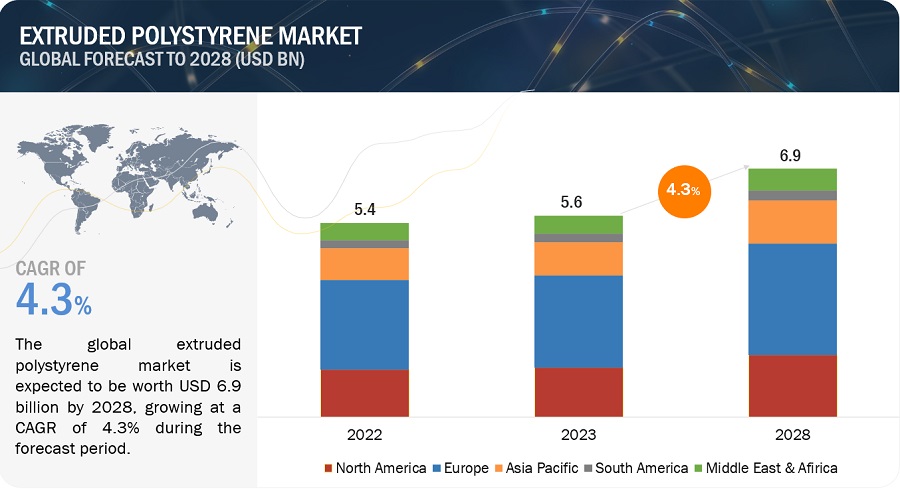

[138 Pages Report] The global extruded polystyrene (XPS) market size is estimated to be USD 5.5 billion in 2019 and projected to reach USD 6.7 billion by 2024, at a CAGR of 4.0%, during the same period. Increasing construction activities around the globe are driving the demand for XPS, as it is primarily used for improving the insulation of buildings. The use of XPS in emerging countries is likely to act as a growth opportunity for the market in the future.

To know about the assumptions considered for the study, Request for Free Sample Report

Foundation accounts for the largest share of the Extruded Polystyrene Market.

Based on application, the XPS industry has been segmented into foundation, wall, roof, floor & ceiling, and others. The foundation segment is expected to grow at the highest CAGR, in terms of value. The energy lost through buildings foundation accounts for a huge percentage when compared with the other parts of the building such as walls or roofs. Thus, foundation requires heavy insulation in order to prevent energy losses and to keep the moisture from penetrating into the foundation. The XPS not only saves energy used for heating/cooling but it also strengthens the overall infrastructure owing to its various properties such as high compressive strength and moisture resistance.

Residential end use is expected to grow faster than commercial end use due to the huge demand for residential infrastructure in developed as well as developing countries

Based on end use, the XPS industry has been segmented into residential, commercial, and others. The residential segment accounts for the highest share, in terms of value and volume, during the forecast period, owing to an increase in demand for residential infrastructure development in the emerging countries.

To know about the assumptions considered for the study, download the pdf brochure

APAC is expected to account for the largest Extruded Polystyrene Market share during the forecast period.

The XPS industry in the APAC region is expected to grow at the highest CAGR during the forecast period. Rapid urbanization is fueling the growth of the Extruded Polystyrene Market in the region. Increasing government and private sector investments in infrastructure development can boost the construction market, and countries such as India and China are expected to lead the demand for XPS in the APAC region during the forecast period. Thus, the construction industry has huge potential for the demand for XPS.

Key Market Players

The key players operating in the Extruded Polystyrene Market include BASF SE (Germany), Synthos S.A. (Poland), DuPont de Nemours Inc. (US), Saint-Gobain Isover SA (France), Knauf group (Insulation) (Germany), Owens corning Inc. (US), TechnoNicol Corporation (Russia), Austrotherm GmbH (Austria), Ursa Insulation SA (Spain), Penoplex SPB LLC (Russia), Ravago Group (Luxembourg), and Loyal Group (China).

Ravago (Luxembourg) has become the leading company in the manufacturing of XPS insulation products. It has a diversified product portfolio with several investments in acquisitions. The company continuously focuses on its organic as well as inorganic growth to expand its market share in Europe. As of now, the company has been aggressively expanding in the European market, which is considered to be the largest market for XPS due to the huge demand. For instance, in January 2019, the Ravago Group purchased XPS business from DuPont Europe. This acquisition has bolstered the XPS capacity of Ravago in Europe, and it has made the company one of the biggest XPS manufacturers in the world. Ravago also acquired Knauf Insulation's XPS business in the UK and France to improve its geographic footprint in the European market. These aggressive inorganic strategies have enabled the Ravago Group to rapidly increase its XPS manufacturing capacity in a short time span.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Billion) and Volume (Thousand Cubic Meter) |

|

Segments |

Application, End use, and Region |

|

Regions |

Asia Pacific (APAC), the Middle East & Africa, Europe, North America, and South America |

|

Companies |

BASF SE (Germany), Synthos S.A. (Poland, DuPont de Nemours Inc. (US), Saint-Gobain Isover SA (France), Knauf Group (Insulation) (Germany), Owens corning Inc. (US), TechnoNicol Corporation (Russia), Austrotherm GmbH (Austria), Ursa Insulation SA (Spain), Penoplex SPB LLC (Russia), Ravago Group (Luxembourg), Loyal Group (China) |

This research report categorizes the Extruded Polystyrene Market based on application, end use, and region.

Based on Application:

- Foundation

- Wall

- Roof

- Floor & ceiling

- Others (Pipes, Marine Insulation, and Utility Lines)

Based on End use:

- Residential

- Commercial

- Others (Roads, Highways, Railways, and Runways)

Based on Region:

- APAC

- Middle East & Africa

- Europe

- North America

- South America

The market is further analyzed for key countries in each of these regions.

Recent Developments

- In May 2019, TechnoNicol Corporation launched a new XPS plant in, Ossipowitschi, Belarus. The plants location is ideal for distribution in Europe, which is expected to reduce the companys transportation expenditure and serve a bigger part of the European market.

- In January 2019, Ravago purchased Dow's European XPS insulation business. The agreement covers the purchase of Dowss XPS operations at Lavrion-Greece, Dilovasi-Turkey, Kings Lynn-UK, Norrkoeping-Sweden, Drusenheim-France, Rheinmuenster and Schkopau-Germany, and sales and marketing activities based in Europe.

- Synthos is expanding its XPS capacity at its production plant in Owiκcim, Poland. The increased capacity will allow the company to supply its products across Central Europe. Also, with capacity expansion, Synthos expected to increase its XPS share in the European market.

- In April 2018, Austrotherm launched a new XPS insulation board that can be used for external insulation (perimeter) within the soil and for efficient drainage as the XPS has moisture-resistant properties.

Key questions addressed by the report

- What are the major developments impacting the Extruded Polystyrene Market ?

- What are the latest innovations and key events in the industry?

- What will be the major factors impacting market growth during the forecast period?

- What are the driving factors, opportunities, restraints, and challenges that affect the growth of the market?

- What are the strategic growth opportunities for the existing and new players in the market?

Frequently Asked Questions (FAQ):

Why extruded polystyrene is gaining market share?

Development of green buildings, reduction in energy consumption and its related cost, and presence of stringent building energy codes are the driving factors in the XPS market.

What is the biggest restraint for extruded polystyrene (XPS)?

Availability of High-Performance Substitutes isthe major restraints in the extruded polystyrene (XPS) market.

What are the factors Influencing the growth of extruded polystyrene (XPS)?

Increasing construction activities around the globe are driving the demand for XPS, as it is primarily used for improving the insulation of buildings. The use of XPS in emerging countries is likely to act as a growth opportunity for the market in the future.

Which end-use industry is estimated to register the highest share in the XPS market?

The residential segment accounts for the highest share, in terms of value and volume, during the forecast period, owing to an increase in demand for residential infrastructure development in the emerging countries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Key Industry Insights

2.1.4 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities for Players in the Extruded Polystyrene Market

4.2 Extruded Polystyrene Market Size, By End Use

4.3 Extruded Polystyrene Market Size, Developed vs.Developing Countries

4.4 APAC: Extruded Polystyrene Market

4.5 Extruded Polystyrene Market Attractiveness

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Regulations to Reduce Greenhouse Gas Emission

5.2.1.2 Development of Green Buildings

5.2.1.3 Reduction in Energy Consumption and Its Related Cost

5.2.1.4 Presence of Stringent Building Energy Codes

5.2.1.5 Rebates and Tax Credits

5.2.2 Restraints

5.2.2.1 Availability of High-Performance Substitutes

5.2.2.2 Volatility in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Easy Recyclability of Polystyrene Products

5.2.3.2 High Energy Requirements

5.2.4 Challenges

5.2.4.1 Rising Stringent Government Regulations

5.2.4.2 Lack of Awareness

5.3 Policy & Regulations

5.4 Porters Five Forces Analysis

5.4.1 Threat of Substitutes

5.4.2 Bargaining Power of Buyers

5.4.3 Threat of New Entrants

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

6 Extruded Polystyrene Market, By End Use (Page No. - 47)

6.1 Introduction

6.2 Residential

6.2.1 Increasing Population and Growing Urbanization to Drive the Demand for XPS in the Residential Segment

6.3 Commercial

6.3.1 Growing Demand for Commercial Construction Projects is Driving the Extruded Polystyrene Market

6.4 Others (Roadways, Highways, Railways, Runways)

6.4.1 Growth and Development in the Infrastructure Sector to Drive the XPS Consumption in This Segment

7 Extruded Polystyrene Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Foundation

7.2.1 Energy Loss Through Basement Or Foundation is A Critical Issue for the Building Sector

7.3 Roof

7.3.1 XPS in Roof Eliminates the Chance of Water Condensation Within Building Assemblies

7.4 Wall

7.4.1 XPS Helps in Protecting the Overall Integrity of the Wall System

7.5 Floor & Ceiling

7.5.1 XPS in Floor & Ceiling Prevents Energy Loss By Hvac Systems

7.6 Others

7.6.1 Potential Opportunities for XPS in Pipes, Marine Insulation, and Utility Lines Insulation

8 Extruded Polystyrene Market, By Region (Page No. - 63)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Energy Conservation Law in China to Reduce Energy Losses in Buildings is Driving the Extruded Polystyrene Market

8.2.2 South Korea

8.2.2.1 Low Domestic Construction Activities Have Resulted in A Drop in XPS Demand in the Country

8.2.3 India

8.2.3.1 Growing Middle-Class Population and Urbanization Play A Crucial Role in Driving the Construction Industry

8.2.4 Japan

8.2.4.1 Stringent Energy Conservation Goals are Expected to Provide A Boost to the Building Insulation Sector in Japan

8.2.5 Thailand

8.2.5.1 New Residential Constructions are Expected to Have Thermal Insulation Due to Residential Building Standards

8.2.6 Indonesia

8.2.6.1 Manufacturers in the Country are Aggressively Adopting Sustainable Practices to Reduce Co2 Emission and Decrease Waste

8.2.7 Malaysia

8.2.7.1 The Country is Focusing More on Rural Projects and Manufacturing Sector, Thus Boosting the XPS Demand

8.2.8 Rest of APAC

8.3 Europe

8.3.1 Germany

8.3.1.1 Increasing Focus on the Construction Industry to Drive the Extruded Polystyrene Market in the Country

8.3.2 Poland

8.3.2.1 Polish Infrastructure Industry to Grow at the Highest Cagr

8.3.3 Russia

8.3.3.1 Demand for Thermal Insulation, Water-Resistant XPS Board, and Other Construction Materials to Drive the Russian Extruded Polystyrene Market

8.3.4 Italy

8.3.4.1 New Construction Projects to Drive the Demand for Extruded Polystyrene Market in the Country

8.3.5 Turkey

8.3.5.1 Growth in the Domestic Construction Sector to Boost the Demand for XPS in the Country

8.3.6 France

8.3.6.1 Eu Energy Conservation and Emission Reduction Goals are A Major Factor for the Growth of the Extruded Polystyrene Market in the Country

8.3.7 Spain

8.3.7.1 The Construction Sector is Primarily Driven By the Residential Sector and the Growing Demand for Houses in Urban Areas

8.3.8 UK

8.3.8.1 New Residential and Commercial Infrastructure is Expected to Drive the Extruded Polystyrene Market

8.3.9 Rest of Europe

8.4 North America

8.4.1 US

8.4.1.1 Growth of the Residential Housing Sector to Drive the Extruded Polystyrene Market in the Country

8.4.2 Canada

8.4.2.1 Growth of the Economy and Construction Industry to Drive the Extruded Polystyrene Market in the Country

8.4.3 Mexico

8.4.3.1 The Boost From the Government for Green Buildings is Expected to Increase the Demand for Sustainable Construction Materials in the Country

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Saudi Arabia is Promoting Foreign and Private Investments in the Country, Giving A Boost to the Construction Industry

8.5.2 Qatar

8.5.2.1 Robust Growth in the Construction Sector is Expected to Generate Demand for XPS in the Country

8.5.3 UAE

8.5.3.1 Large Scope for New Infrastructural Development to Drive the Extruded Polystyrene Market

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Investment Partnership Program has Promoted the Private Sector Participation in Infrastructure Development

8.6.2 Argentina

8.6.2.1 Favorable Construction Outlook to Drive the Countrys Extruded Polystyrene Market

8.6.3 Colombia

8.6.3.1 Demand for High-Performance, Cost-Effective, and Environmentally Advanced Building Products to Drive the Extruded Polystyrene Market

8.6.4 Rest of South America

9 Competitive Landscape (Page No. - 105)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Scenario

9.3.1 Product Launch

9.3.2 Expansion

9.3.3 Acquisition & Technology Development

10 Company Profiles (Page No. - 110)

(Business Overview, Products Offered, Recent Developments, MnM View)*

10.1 BASF SE

10.2 Synthos SA

10.3 Kingspan Group PLC

10.4 Dupont De Nemours, Inc.

10.5 Owens Corning

10.6 Saint-Gobain Isover SA

10.7 The Ravago Group

10.8 Versalis S.P.A.

10.9 Knauf Group (Insulation)

10.1 Technonicol Corporation

10.11 Austrotherm GmbH

10.12 Ursa Insulation, SA

10.13 Penoplex SPB LLC

10.14 Loyal Group

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 131)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (114 Tables)

Table 1 Extruded Polystyrene Market Snapshot (2019 vs. 2024)

Table 2 Region-Wise Regulations to Reduce Ghg Emissions

Table 3 Global Regulations

Table 4 Extruded Polystyrene Market Size, By End Use, 20172024 (USD Million)

Table 5 Extruded Polystyrene Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 6 Residential Extruded Polystyrene Market Size, By Region, 20172024 (USD Million)

Table 7 Residential Extruded Polystyrene Market Size, By Region, 20172024 (Thousand Cubic Meter)

Table 8 Commercial Extruded Polystyrene Market Size, By Region, 20172024 (USD Million)

Table 9 Commercial Extruded Polystyrene Market Size, By Region, 20172024 (Thousand Cubic Meter)

Table 10 Others Extruded Polystyrene Market Size, By Region, 20172024 (USD Million)

Table 11 Others Extruded Polystyrene Market Size, By Region, 20172024 (Thousand Cubic Meter)

Table 12 Extruded Polystyrene Market Size, By Application, 20172024 (USD Million)

Table 13 Extruded Polystyrene Market Size, By Application, 20172024 (Thousand Cubic Meter)

Table 14 Extruded Polystyrene Market Size in Foundation Application, By Region, 20172024 (USD Million)

Table 15 Extruded Polystyrene Market Size in Foundation Application, By Region, 20172024 (Thousand Cubic Meter)

Table 16 Extruded Polystyrene Market Size in Roof Application, By Region, 20172024 (USD Million)

Table 17 Extruded Polystyrene Market Size in Roof Application, By Region, 20172024 (Thousand Cubic Meter)

Table 18 Extruded Polystyrene Market Size in Wall Application, By Region, 20172024 (USD Million)

Table 19 Extruded Polystyrene Market Size in Wall Application, By Region, 20172024 (Thousand Cubic Meter)

Table 20 Extruded Polystyrene Market Size in Floor & Ceiling Application, By Region, 20172024 (USD Million)

Table 21 Extruded Polystyrene Market Size in Floor & Ceiling Application, By Region, 20172024 (Thousand Cubic Meter)

Table 22 Extruded Polystyrene Market Size in Other Applications, By Region, 20172024 (USD Million)

Table 23 Extruded Polystyrene Market Size in Other Applications, By Region, 20172024 (Thousand Cubic Meter)

Table 24 Extruded Polystyrene Market Size, By Region, 20172024 (USD Million)

Table 25 Extruded Polystyrene Market Size, By Region, 20172024 (Thousand Cubic Meter)

Table 26 APAC: XPS Market Size, By Country, 20172024 (USD Million)

Table 27 APAC: XPS Market Size, By Country, 20172024 (Thousand Cubic Meter)

Table 28 APAC: XPS Market Size, By End Use, 20172024 (USD Million)

Table 29 APAC: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 30 APAC: XPS Market Size, By Application, 20172024 (USD Million)

Table 31 APAC: XPS Market Size, By Application, 20172024 (Thousand Cubic Meter)

Table 32 China: XPS Market Size, By End Use, 20172024 (USD Million)

Table 33 China: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 34 South Korea: XPS Market Size, By End Use, 20172024 (USD Million)

Table 35 South Korea: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 36 India: XPS Market Size, By End Use, 20172024 (USD Million)

Table 37 India: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 38 Japan: XPS Market Size, By End Use, 20172024 (USD Million)

Table 39 Japan: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 40 Thailand: XPS Market Size, By End Use, 20172024 (USD Million)

Table 41 Thailand: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 42 Indonesia: XPS Market Size, By End Use, 20172024 (USD Million)

Table 43 Indonesia: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 44 Malaysia: XPS Market Size, By End Use, 20172024 (USD Million)

Table 45 Malaysia: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 46 Rest of APAC: XPS Market Size, By End Use, 20172024 (USD Million)

Table 47 Rest of APAC: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 48 Europe: XPS Market Size, By Country, 20172024 (USD Million)

Table 49 Europe: XPS Market Size, By Country, 20172024 (Thousand Cubic Meter)

Table 50 Europe: XPS Market Size, By End Use, 20172024 (USD Million)

Table 51 Europe: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 52 Europe: XPS Market Size, By Application, 20172024 (USD Million)

Table 53 Europe: XPS Market Size, By Application, 20172024 (Thousand Cubic Meter)

Table 54 Germany: XPS Market Size, By End Use, 20172024 (USD Million)

Table 55 Germany: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 56 Poland: XPS Market Size, By End Use, 20172024 (USD Million)

Table 57 Poland: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 58 Russia: XPS Market Size, By End Use, 20172024 (USD Million)

Table 59 Russia: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 60 Italy: XPS Market Size, By End Use, 20172024 (USD Million)

Table 61 Italy: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 62 Turkey: XPS Market Size, By End Use, 20172024 (USD Million)

Table 63 Turkey: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 64 France: XPS Market Size, By End Use, 20172024 (USD Million)

Table 65 France: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 66 Spain: XPS Market Size, By End Use, 20172024 (USD Million)

Table 67 Spain: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 68 UK: XPS Market Size, By End Use, 20172024 (USD Million)

Table 69 UK: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 70 Rest of Europe: XPS Market Size, By End Use, 20172024 (USD Million)

Table 71 Rest of Europe: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 72 North America: XPS Market Size, By Country, 20172024 (USD Million)

Table 73 North America: XPS Market Size, By Country, 20172024 (Thousand Cubic Meter)

Table 74 North America: XPS Market Size, By End Use, 20172024 (USD Million)

Table 75 North America: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 76 North America: XPS Market Size, By Application, 20172024 (USD Million)

Table 77 North America: XPS Market Size, By Application, 20172024 (Thousand Cubic Meter)

Table 78 US: XPS Market Size, By End Use, 20172024 (USD Million)

Table 79 US: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 80 Canada: XPS Market Size, By End Use, 20172024 (USD Million)

Table 81 Canada: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 82 Mexico: XPS Market Size, By End Use, 20172024 (USD Million)

Table 83 Mexico: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 84 Middle East & Africa: XPS Market Size, By Country, 20172024 (USD Million)

Table 85 Middle East & Africa: XPS Market Size, By Country, 20172024 (Thousand Cubic Meter)

Table 86 Middle East & Africa: XPS Market Size, By End Use, 20172024 (USD Million)

Table 87 Middle East & Africa: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 88 Middle East & Africa: XPS Market Size, By Application, 20172024 (USD Million)

Table 89 Middle East & Africa: XPS Market Size, By Application, 20172024 (Thousand Cubic Meter)

Table 90 Saudi Arabia: XPS Market Size, By End Use, 20172024 (USD Million)

Table 91 Saudi Arabia: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 92 Qatar: XPS Market Size, By End Use, 20172024 (USD Million)

Table 93 Qatar: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 94 UAE: XPS Market Size, By End Use, 20172024 (USD Million)

Table 95 UAE: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 96 Rest of Middle East & Africa: XPS Market Size, By End Use, 20172024 (USD Million)

Table 97 Rest of Middle East & Africa: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 98 South America: XPS Market Size, By Country, 20172024 (USD Million)

Table 99 South America: XPS Market Size, By Country, 20172024 (Thousand Cubic Meter)

Table 100 South America: XPS Market Size, By End Use, 20172024 (USD Million)

Table 101 South America: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 102 South America: XPS Market Size, By Application, 20172024 (USD Million)

Table 103 South America: XPS Market Size, By Application, 20172024 (Thousand Cubic Meter)

Table 104 Brazil: XPS Market Size, By End Use, 20172024 (USD Million)

Table 105 Brazil: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 106 Argentina: XPS Market Size, By End Use, 20172024 (USD Million)

Table 107 Argentina: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 108 Colombia: XPS Market Size, By End Use, 20172024 (USD Million)

Table 109 Colombia: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 110 Rest of South America: XPS Market Size, By End Use, 20172024 (USD Million)

Table 111 Rest of South America: XPS Market Size, By End Use, 20172024 (Thousand Cubic Meter)

Table 112 Product Launch, 20162019*

Table 113 Expansion, 20162019*

Table 114 Acquisition & Technology Development, 20162019*

List of Figures (42 Figures)

Figure 1 XPS Market Segmentation

Figure 2 XPS Market: Research Design

Figure 3 XPS Market Size Estimation

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 XPS: Data Triangulation

Figure 7 Residential Segment to Dominate the Market Between 2019 and 2024

Figure 8 Foundation to Be Fastest-Growing & Largest Application Between 2019 and 2024

Figure 9 Europe to Dominate the XPS Market Between 2019 and 2024

Figure 10 Emerging as Well as Developed Economies to Offer Lucrative Growth Opportunities for Market Players

Figure 11 Residential Segment to Grow at A Moderate Cagr Between 2019 and 2024

Figure 12 XPS Market to Grow at A Faster Rate in the Emerging Countries

Figure 13 China to Register High Growth Due to Adoption of XPS Insulation in the Building & Construction Industry

Figure 14 China to Register the Highest Cagr Between 2019 and 2024

Figure 15 Drivers, Restraints, Opportunities, and Challenges for the XPS Market

Figure 16 US: National Spending on Green Construction

Figure 17 Construction and Demolition Waste Generation in Germany

Figure 18 Residential End Use to Dominate the Global XPS Market

Figure 19 Europe Dominated the Global XPS Market By End Use in 2019

Figure 20 Building Floor Space Distribution in Europe, By Region

Figure 21 High Growth in Major Applications to Drive the XPS Market

Figure 22 Foundation Segment to Account for the Highest Share of the XPS Market

Figure 23 Qatar to Be the Fastest-Growing XPS Market

Figure 24 APAC: China is the Largest as Well as Projected to Be the Fastest-Growing Market for XPS in the Region

Figure 25 Europe: Extruded Polystyrene Market Snapshot

Figure 26 North America: Extruded Polystyrene Market Snapshot

Figure 27 Saudi Arabia is the Largest Market for XPS in the Region

Figure 28 Brazil to Hold the Largest Share Due to the Rise in Building & Construction Activities in the Country

Figure 29 Expansions and Product Launch Were the Most Adopted Strategies By the Leading Players of the Extruded Polystyrene Market Between 2016 and 2019

Figure 30 Key Market Players in 2018

Figure 31 BASF SE: Company Snapshot

Figure 32 BASF SE: SWOT Analysis

Figure 33 Synthos SA: Company Snapshot

Figure 34 Synthos SA: SWOT Analysis

Figure 35 Kingspan Group PLC: Company Snapshot

Figure 36 Kingspan Group PLC: SWOT Analysis

Figure 37 Dupont De Nemours, Inc.: Company Snapshot

Figure 38 Dupont De Nemours, Inc.: SWOT Analysis

Figure 39 Owens Corning: Company Snapshot

Figure 40 Owens Corning: SWOT Analysis

Figure 41 Saint-Gobain Isover SA: Company Snapshot

Figure 42 Saint-Gobain Isover SA: SWOT Analysis

The study involved four major activities in estimating the current size of the extruded polystyrene (XPS) market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involved the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the XPS market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The XPS market comprises several stakeholders, such as manufacturers of XPS; raw material dealers & suppliers; end-use sectors of XPS such as residential, non-residential, and infrastructure; traders, distributors, and suppliers of XPS; regional manufacturers associations and general XPS associations and agencies & research organizations. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various leading companies and organizations operating in the XPS market.

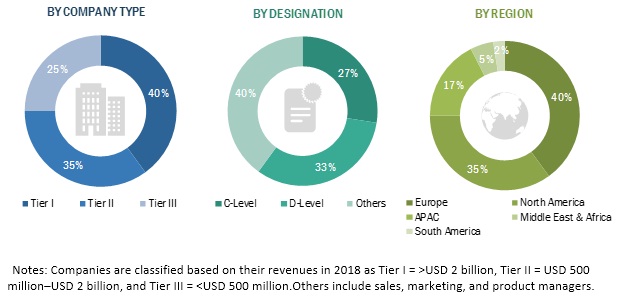

Following is the breakdown of primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the XPS market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall XPS market size-using the estimation processes explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the global extruded polystyrene market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market by application and end use

- To forecast the market size with respect to five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as expansions, product launches, and acquisitions & technology development in the XPS market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the XPS market, by country

Company Information:

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Extruded Polystyrene Market