Feed Additives Market by Livestock, Type (Phosphates, Amino Acids, Vitamins, Acidifiers, Carotenoids, Enzymes, Flavors & Sweeteners, Mycotoxin Detoxifiers, Minerals, and Antioxidants), Form, Source, and Region - Forecast to 2026

Feed Additives Market Analysis & Report Summary, Global Size

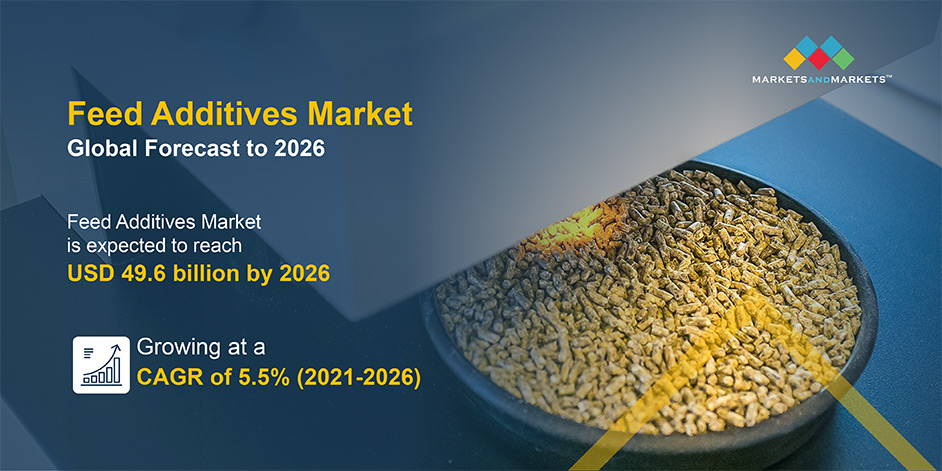

The feed additives market, valued at $38.1 billion in 2021, is projected to grow to $49.6 billion by 2026, with a 5.5% annual growth rate during 2021 and 2026. The growth of this market is propelled by a convergence of factors, including the surging demand for animal-based protein, expanding global population, heightened consciousness about the advantages of feed additives for animal well-being and development, innovative breakthroughs in feed additive production, surging adoption of precision livestock farming, and governmental backing for feed additive utilization. The Asia Pacific region is poised to dominate the market due to its massive livestock population and growth rate, along with a rising number of feed mills and feed production, especially in India and Japan.

To know about the assumptions considered for the study, Request for Free Sample Report

The feed additives market is distinguished by several crucial characteristics, including:

Elevated Awareness of Animal Health: As people become more informed about the significance of animal health and well-being, the use of feed additives is rising. These additives promote overall animal health, which is beneficial for farmers and consumers alike.

Soaring Demand for Animal-based Protein: The growing appetite for animal-based protein like meat and dairy products is fueling the growth of the feed additives market. This is because feed additives help improve animal health and growth, leading to higher yields of animal-based protein.

Rigid Regulations: The feed additives sector is subject to strict regulations, which may vary by country or region. These regulations are put in place to ensure the safety and effectiveness of feed additives and can impact the development and commercialization of new products.

Technological Innovations: Technological advancements are leading to the creation of new, more effective feed additives.

Precision Farming Adoption: The adoption of precision farming practices, such as precision feeding, is on the rise. Precision feeding involves providing animals with the precise nutritional needs they require at various stages of their life cycle through feed additives.

Several drivers such as increase in the demand and consumption of livestock-based products, growth in the feed production, rise in awareness about feed quality, rise in the global demand for naturally produced feed and feed additives, standardization of meat products owing to disease outbreaks and implementation of innovative animal husbandry practices to improve meat quality will drive the feed additives market.

An increase in health awareness has resulted in the demand for quality meat. Recent disease outbreaks in livestock have led to the use of feed additives to improve quality. Government monitoring agencies such as the US Food and Drug Administration and European Food Safety Authority have imposed rules regarding the quality of food to be delivered to consumers. Innovative animal husbandry practices such as the use of antibacterial feed additives enhance the quality of livestock products, which in turn will increase the consumption of feed additives.

Feed Additives Market Dynamics

Drivers: Increase in demand and consumption of livestock-based products

An increase in demand and consumption of livestock-based products such as dairy & dairy-based products, meat, and eggs is expected to drive the usage of feed additives in feed for the growth and development of farm animals. Poultry meat is the primary driver for the growth of the overall meat production, owing to its high demand, low production cost, and lower product prices, both in developed and developing countries. Furthermore, owing to the increasing awareness about the role and dynamics of food nutrients, especially protein, on overall physical and mental growth and development, there is a growing trend toward animal-sourced protein in the form of either meat, eggs, or milk. This drives the usage of feed additives in feed as it increases its nutritional quality.

Restraints: Ban on antibiotics in different nations

An increase in raw material prices is a major challenge faced by feed manufacturers worldwide. Feed acids, antioxidants, and vitamins are extracted from natural sources such as seeds, tree barks, and plant leaves. The rising cost of extraction from these sources, coupled with stringent regulations for waste biomaterials and wastewater treatment, restrains the feed additives market growth. Availability of feed has become a critical issue for the industry. With the growing global population and the consequent rise in demand for food, the industry faces severe pressure in procuring raw feed such as corn, wheat, and barley.

Opportunities: Shifting towards natural growth promoters

Antimicrobial compounds are commonly included in poultry diets for promoting growth and controlling diseases. The European Union banned feed-grade antibiotic growth promoters, owing to cross-resistance and also due to the risk posed to the EU’s food safety and public health. Due to this, feed manufacturers are adopting new forms of natural feed additives apart from antibiotics with the help of modern science. This new generation of growth enhancers includes botanical additives such as appropriate blends of herbs or plant extracts. Herbs and plant extracts used as feed additives include different bio-active ingredients such as alkaloids, bitters, flavonoids, glycosides, mucilage, saponins, and tannins. Therefore, there are various effects expected from herbs and plant extracts—they act on the appetite and intestinal microflora, thereby stimulating pancreatic secretions to increase endogenous enzyme activity and immune system. Many plant products and their constituents have broad antimicrobial activity and antioxidant & sedative properties.

Challenges: Sustainability of feed and livestock chain

The global feed additives market industry is focusing on improving feed efficiency by improving the feed conversion rates for all major livestock and farmed fish species. The feed and livestock industries can achieve sustainability by developing a harmonized environmental footprint methodology, based on life cycle analysis, involving the entire chain. The development of common metrics can also help to calculate a broader range of resource efficiency indicators. Efficient usage of feed ingredients can support the reduction of the environmental impact of livestock farming through resource-efficient feed production. The use of co-products from other processing industries can reduce the pressure on land-grown crops.

Based on type, the preservatives segment is projected to grow with the highest CAGR in the global market during the forecast period

The feed preservatives are expected to grow at the highest CAGR over the forecast period. The demand for feed preservatives has increased due to the rising focus of the feed manufacturer on extending the shelf life of the feed. In the last 60 years, significant dietary changes have occurred in livestock breeding, which has resulted in the increased need and usage of feed preservatives such as mold inhibitors and anticaking agents.

Based on livestock, the poultry segment is projected to grow with the highest CAGR in the global market during the forecast period

Based on livestock, the poultry segment is projected to be the largest and fastest-growing segment in the feed additives market. Growing concerns about animal health and consumer preferences for a specific color of yolk and meat has led to increasing demand for poultry feed additives.

Based on form, dry segment is projected to account for a larger share in the global market during the forecast period

By form, this market is segmented into dry and liquid. The dry form has a higher demand among livestock producers, as they are easy to mix with feed and are easy to store and handle. Its availability in pellet and mash forms further allows consumers to have options in terms of mixing techniques, which should support the growth of this segment.

Based on source, synthetic segment is projected to grow fastest in the feed additives market during the forecast period

By source, the synthetic segment is anticipated to grow fastest over the forecast period. Easier availability of raw materials and lower production costs are the major factors driving the demand for the synthetic feed additives. Stronger market penetration than the natural segment will also ensure a higher growth rate for synthetic feed additives.

To know about the assumptions considered for the study, download the pdf brochure

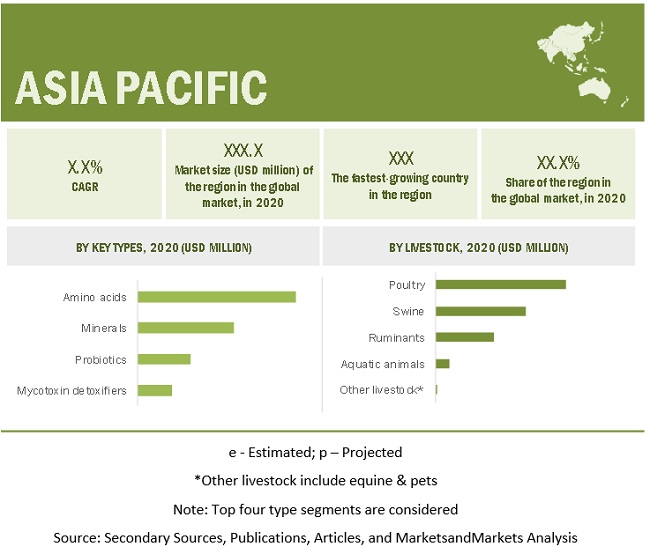

The Asia Pacific region accounted for the largest share in the global market, in terms of value. The market in the region is driven by the presence of a large livestock population and their growth rate. Furthermore, the region has witnessed an increase in the number of feed mills and feed production, particularly in countries such as India and Japan. This increase in the number of feed mills in the region reflects the growth in feed production. The largest feed producer, China, contributes significantly to the region’s leading position, with Thailand and Indonesia being the emerging feed-producing countries, while India and Japan demonstrate constant growth in feed production.

Top Feed Additives Companies:

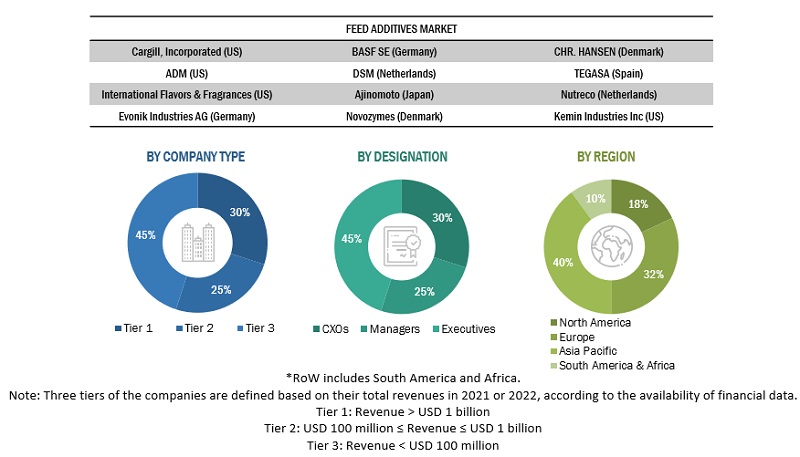

Key players in this market include Cargill (US), ADM (US), Dupont (US), Evonik (Germany), BASF (Germany), DSM (Netherlands), Ajinomoto (Japan), Novozymes (Denmark), Chr Hansen (Denmark), TEGASA (Spain), Nutreco (Netherlands), Kemin Industries Inc. (US), Adisseo (France), Alltech (US), Palital Feed Additives B.V. (Netherlands), Global Nutrition International (France), Centafarm SRL (Italy), Bentoli (US), NUQO Feed Additives (France), and Novus International Inc. (US).

Feed Additives Market Report Scope

|

Report Metric |

Details |

|

Market size value in 2021 |

USD 38.1 billion |

|

Revenue forecast in 2026 |

USD 49.6 billion |

|

Growth rate |

CAGR of 5.5% from 2021-2026 |

|

Historical data |

2017-2026 |

|

Base year for estimation |

2020 |

|

Forecast period |

2021-2026 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Livestock, Region, Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

Cargill (US), ADM (US), Dupont (US), Evonik (Germany), BASF (Germany), DSM (Netherlands), Ajinomoto (Japan), Novozymes (Denmark), Chr Hansen (Denmark), TEGASA (Spain), Nutreco (Netherlands), Kemin Industries Inc. (US), Adisseo (France), Alltech (US), Palital Feed Additives B.V. (Netherlands) |

|

Major Regional Submarkets |

China is Projected to be the Fastest-Growing Market for Feed Additives in the Forecast Period |

Target Audience:

- Animal husbandry companies

- Large-scale ranches and poultries

- Government and research organizations

- Feed additive manufacturers

- Feed additive distributors

- Marketing directors

- Key executives from various key companies and organizations in the feed additives market

Report Scope (Revenue, USD Billion, 2021- 2026)

This research report categorizes the feed additives market based on type, livestock, form, source, and region.

Based on Type

- Amino acids

- Phosphates

- Vitamins

- Acidifiers

- Carotenoids

- Enzymes

- Mycotoxin detoxifiers

- Flavors & sweeteners

- Antibiotics

- Minerals

- Antioxidants

- Non-protein nitrogen

- Phytogenics

- Preservatives

- Probiotics

Based on Livestock

- Poultry

- Ruminants

- Swine

- Aquatic animals

- Other livestock (equine and pet food)

Based on Form

- Dry

- Liquid

Based on Source

- Synthetic

- Natural

Based on Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- In February 2021, Kemin Industries launched a new product named KemTRACE Chromium-OR, an organic compliant chromium propionate feed ingredient for swine, cattle, broiler, and horse diets.

- In July 2020, ADM launched NutriPass L, an encapsulated lysine supplement that is rumen-stable and intestinally available to cows. Through effective encapsulation, NutriPass supplies a consistent and stable supply of metabolizable lysine for lactating cows and growing cattle.

- In February 2021, Alltech and DLG Group came together to focus on delivering profitability and efficiency to livestock producers in Scandinavia. Both the companies are finalizing the purchase of the Finnish company, Kärki-Agri.

- In November 2020, Evonik expanded its customer service offering for its animal nutrition customers by introducing a new digital portal called ‘myAMINO.’ Through this portal, the company has brought together its digital customer activities and services and added two web stores. It would help the company to strengthen its animal nutrition business.

Frequently Asked Questions (FAQ):

What is the expected market size for the global feed additives market in the coming years?

From 2021 to 2026, the global feed additives market is reaching a market size of $49.6 billion in 2026, up from $38.1 billion in 2021.

What is the estimated growth rate (CAGR) of the global feed additives market for the next five years?

The global feed additives market is set for significant growth, with a projected surge at a CAGR of 5.5%.

What are the major revenue pockets in the feed additives market currently?

In terms of value, the Asia Pacific region held the greatest share of the global market. The existence of a high cattle population and their rate of growth drive the market in the region. Furthermore, the number of feed mills and feed production in the region has increased, particularly in countries such as India and Japan. The increased number of feed mills in the region reflects the region's increased feed production. China, the region's largest feed producer, contributes greatly to the region's leadership position, with Thailand and Indonesia emerging as feed-producing countries, and India and Japan demonstrating consistent development in feed output.

What are some of the drivers fuelling the growth of feed additive market?

An increase in demand and consumption of livestock-based products such as dairy & dairy-based products, meat, and eggs is expected to drive the usage of feed additives in feed for the growth and development of farm animals. Poultry meat is the primary driver for the growth of the overall meat production, owing to its high demand, low production cost, and lower product prices, both in developed and developing countries. Furthermore, owing to the increasing awareness about the role and dynamics of food nutrients, especially protein, on overall physical and mental growth and development, there is a growing trend toward animal-sourced protein in the form of either meat, eggs, or milk. This drives the usage of feed additives in feed as it increases its nutritional quality.

-

Growth in feed production

The global feed production has increased consistently in the recent past, driven primarily by the demand-side factors, including an increase in livestock production and consumption and the resultant population. Other factors that impact the volume of feed production include the increasing commercialization of livestock rearing practices, particularly in developing economies.

What is the outlook for the feed additives market?

The feed additives market is expected to grow significantly during the forecast period, driven by the increasing demand for animal-based protein, the growing awareness of the benefits of feed additives among farmers, and the increasing adoption of precision farming.

What kind of information is provided in the competitive landscape section?

For the list of below mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market include ADM (US), Cargill (US), DSM (Netherlands), DuPont (US), Evonik (Germany), BASF (Germany), and Ajinomoto (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 STUDY SCOPE FOR SUBTYPES

1.4 REGIONS COVERED

1.4.1 INCLUSIONS AND EXCLUSIONS

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 FEED ADDITIVE MARKET SIZE ESTIMATION: DEMAND SIDE

2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON TYPES AND SUBTYPES, BY REGION)

FIGURE 4 FEED ADDITIVE MARKET SIZE ESTIMATION: APPROACH ONE

2.2.2 APPROACH TWO: TOP-DOWN (BASED ON THE GLOBAL MARKET)

FIGURE 5 FEED ADDITIVE MARKET SIZE ESTIMATION: APPROACH TWO

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT (GDP) FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF GLOBAL ECONOMY RECOVERY

3 EXECUTIVE SUMMARY (Page No. - 64)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 12 IMPACT OF COVID-19 ON THE FEED ADDITIVES MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD BILLION)

FIGURE 13 MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2021 VS. 2026 (USD BILLION)

FIGURE 15 MARKET SIZE FOR FEED ADDITIVES, BY FORM, 2021 VS. 2026 (USD BILLION)

FIGURE 16 MARKET SIZE FOR FEED ADDITIVES, BY SOURCE, 2021 VS. 2026 (USD BILLION)

FIGURE 17 FEED ADDITIVE MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 18 INCREASE IN DEMAND AND CONSUMPTION OF LIVESTOCK-BASED PRODUCTS TO PROPEL THE MARKET

4.2 MAJOR REGIONAL SUBMARKETS

FIGURE 19 CHINA PROJECTED TO BE THE FASTEST-GROWING MARKET FOR FEED ADDITIVES IN THE FORECAST PERIOD

4.3 ASIA PACIFIC: FEED ADDITIVES MARKET, BY KEY TYPE & COUNTRY

FIGURE 20 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2020

4.4 MARKET FOR FEED ADDITIVES, BY TYPE

FIGURE 21 AMINO ACIDS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET FOR FEED ADDITIVES, BY LIVESTOCK & REGION

FIGURE 22 ASIA PACIFIC IS PROJECTED TO DOMINATE THE MARKET FOR FEED ADDITIVES DURING THE FORECAST PERIOD

4.6 MARKET FOR FEED ADDITIVES, BY FORM

FIGURE 23 THE DRY FORM IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.7 MARKET FOR FEED ADDITIVES, BY SOURCE

FIGURE 24 ASIA PACIFIC DOMINATED BOTH SOURCES OF FEED ADDITIVES IN 2020

FIGURE 25 COVID-19 IMPACT ON THE GLOBAL MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 77)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand and consumption of livestock-based products

FIGURE 27 MAJOR MEAT PRODUCING REGIONS/COUNTRIES, 2017–2019 (THOUSAND TONNES)

FIGURE 28 MAJOR BOVINE MEAT PRODUCING REGIONS/COUNTRIES, 2017–2019 (THOUSAND TONNES)

FIGURE 29 MAJOR SWINE MEAT PRODUCING REGIONS/COUNTRIES, 2017–2019 (THOUSAND TONNES)

FIGURE 30 MAJOR POULTRY MEAT PRODUCING REGIONS/COUNTRIES, 2017–2019 (THOUSAND TONNES)

FIGURE 31 ANIMAL-BASED PRODUCT CONSUMPTION, BY COMMODITY, 1967–2030 (MILLION TONS)

5.2.1.2 Growth in feed production

FIGURE 32 FEED PRODUCTION TREND, 2015–2019 (MILLION TONS)

FIGURE 33 REGIONAL FEED PRODUCTION SNAPSHOT, 2017 (MILLION TONS)

FIGURE 34 LEADING FEED PRODUCING COUNTRIES, 2017 (MILLION TONS)

5.2.1.3 Rise in awareness about feed quality

5.2.1.4 Rise in the global demand for naturally produced feed and feed additives

5.2.1.5 Standardization of meat products owing to disease outbreaks

5.2.1.6 Implementation of innovative animal husbandry practices to improve meat quality

5.2.2 RESTRAINTS

5.2.2.1 Ban on antibiotics in different nations

5.2.2.2 Volatile raw material prices for natural feed additives

5.2.2.2.1 Increase in cost of feed ingredients

5.2.2.3 Stringent regulatory framework

5.2.3 OPPORTUNITIES

5.2.3.1 Shift toward natural growth promoters

5.2.3.2 Increase in demand for nutritional supplements for monogastric animals

5.2.3.3 Developing countries emerge as a strong consumer of feed additives

5.2.4 CHALLENGES

5.2.4.1 Quality control of genetic feed additive products manufactured by Asian companies

5.2.4.2 Sustainability of feed and livestock chain

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4 EFFECT ON GLOBAL MEAT CONSUMPTION

5.5 EFFECTS ON ANIMAL HEALTH

5.6 EFFECT ON FEED CONSUMPTION

6 INDUSTRY TRENDS (Page No. - 90)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING AND MANUFACTURING

6.2.3 ASSEMBLY

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 35 VALUE CHAIN ANALYSIS OF THE FEED ADDITIVES MARKET: RAW MATERIAL SOURCING AND MANUFACTURING KEY CONTRIBUTORS

6.3 TECHNOLOGY ANALYSIS

6.3.1 AGGLOMERATION (PELLETIZING)

6.3.2 DOSING SYSTEMS

6.4 PRICING ANALYSIS

TABLE 3 FEED ADDITIVE AVERAGE SELLING PRICES (ASP), BY REGION, 2017–2020 (USD/TON)

TABLE 4 FEED ADDITIVE AVERAGE SELLING PRICES (ASP), BY KEY TYPE, 2017–2020 (USD/TON)

6.5 MARKET MAP AND ECOSYSTEM FEED ADDITIVES MARKET

6.5.1 DEMAND SIDE

6.5.2 SUPPLY SIDE

6.5.3 FEED & ANIMAL NUTRITION: ECOSYSTEM VIEW

6.5.4 FEED ADDITIVES: MARKET MAP

TABLE 5 MARKET FOR FEED ADDITIVES: SUPPLY CHAIN (ECOSYSTEM)

6.6 YC-YCC SHIFT

FIGURE 36 REVENUE SHIFT FOR THE GLOBAL MARKET

6.7 PATENT ANALYSIS

FIGURE 37 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 38 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 39 TOP 10 APPLICANTS WITH HIGHEST NUMBER. OF PATENT DOCUMENTS

TABLE 6 SOME OF THE PATENTS PERTAINING TO FEED ADDITIVES, 2019–2020

6.8 TRADE ANALYSIS

TABLE 7 EXPORT DATA OF FEED ADDITIVES FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

TABLE 8 RE-EXPORT DATA OF FOOD COLORS FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

TABLE 9 IMPORT DATA OF FEED ADDITIVES FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET FOR FEED ADDITIVES: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

TABLE 11 GROWING INNOVATION IN ANIMAL DIET

TABLE 12 INCREASE IN CONCERN TO IMPROVE LIVESTOCK HEALTH IN ASIA PACIFIC

7 REGULATORY FRAMEWORK (Page No. - 109)

7.1 REGULATIONS

7.1.1 FEED ADDITIVES REGULATORY APPROVAL FROM THE EUROPEAN UNION

7.1.2 TIME DURATION FOR A FEED ADDITIVE IN THE REGISTER

7.1.3 REGISTRATION OF FEED ADDITIVES

7.1.4 PACKAGING OF FEED ADDITIVES

7.1.5 LABELING OF FEED ADDITIVES

7.1.6 MANUFACTURE AND SALE OF FEED ADDITIVES

7.1.7 IMPORT OF FEED ADDITIVES

7.1.8 REEVALUATION OF FEED ADDITIVES

7.2 REGULATORY FRAMEWORK, COUNTRY-WISE

7.2.1 US

7.2.1.1 Labeling

7.2.1.2 Association of American Feed Control Officials (AAFCO)

7.2.2 CANADA

7.2.2.1 Legal authorities

7.2.3 BRAZIL

7.2.4 CHINA

7.2.5 THE EUROPEAN UNION

7.2.6 JAPAN

7.2.7 SOUTH AFRICA

8 FEED ADDITIVES MARKET, BY TYPE (Page No. - 115)

8.1 INTRODUCTION

FIGURE 40 FEED ADDITIVES MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 13 MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 14 MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 15 MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2017–2020 (KT)

TABLE 16 MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2021–2026 (KT)

8.1.1 COVID-19 IMPACT ON THE FEED ADDITIVES MARKET, BY TYPE

8.1.1.1 Optimistic scenario

TABLE 17 OPTIMISTIC SCENARIO: FEED ADDITIVES MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.2 Realistic scenario

TABLE 18 REALISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic scenario

TABLE 19 PESSIMISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2018–2021 (USD MILLION)

8.2 AMINO ACIDS

8.2.1 LYSINE

8.2.1.1 Relatively high value and digestibility of lysine is projected to drive the market

8.2.2 METHIONINE

8.2.2.1 Essential amino acid for all livestock

8.2.3 THREONINE

8.2.3.1 Enhances the protein synthesis and promote the growth of the livestock

8.2.4 TRYPTOPHAN

8.2.4.1 Monitors the appetite, sleep, and synthesis of serotonin, besides protein synthesis

TABLE 20 FEED AMINO ACIDS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 21 FEED AMINO ACIDS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 22 FEED AMINO ACIDS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 FEED AMINO ACIDS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 PHOSPHATES

8.3.1 MONOCALCIUM PHOSPHATE

8.3.1.1 Prevents the abnormal development of bones in livestock

8.3.2 DICALCIUM PHOSPHATE

8.3.2.1 High bioavailability of phosphate such as dicalcium phosphate with low cost of production

8.3.3 MON0-DICALCIUM PHOSPHATE

8.3.3.1 Widely used for young livestock as it enhances the taste of feed and helps in improving feed intake

8.3.4 DEFLUORINATED PHOSPHATE

8.3.4.1 Good source of calcium, phosphorus, and sodium

8.3.5 TRICALCIUM PHOSPHATE

8.3.5.1 Essential for growth and development of livestock

8.3.6 OTHER PHOSPHATES

TABLE 24 FEED PHOSPHATES MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 25 FEED PHOSPHATES MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 26 FEED PHOSPHATES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 FEED PHOSPHATES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 VITAMINS

8.4.1 FAT-SOLUBLE VITAMINS

8.4.1.1 Rise in importance of vitamins as a key constituent for metabolic functions of livestock

8.4.2 WATER-SOLUBLE VITAMINS

8.4.2.1 Help in the optimum growth and development of the livestock

TABLE 28 FEED VITAMINS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 29 FEED VITAMINS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 30 FEED VITAMINS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 FEED VITAMINS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 ACIDIFIERS

8.5.1 PROPIONIC ACID

8.5.1.1 Improves silage production and provides aerobic stability in silages

8.5.2 FORMIC ACID

8.5.2.1 Helps in feed preservation

8.5.3 CITRIC ACID

8.5.3.1 Helps enhance immunity against Newcastle disease in vaccinated broilers

8.5.4 LACTIC ACID

8.5.4.1 Used to improve animal health and productivity

8.5.5 SORBIC ACID

8.5.5.1 Helps preserve the feed from microbial agents

8.5.6 MALIC ACID

8.5.6.1 Widely used as a preservative and acidity regulator for pet food

8.5.7 ACETIC ACID

8.5.7.1 Controls mold and reduces bacterial growth in feed

8.5.8 OTHER ACIDIFIERS

TABLE 32 FEED ACIDIFIERS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 33 FEED ACIDIFIERS MARKET SIZE, BY SUBTYPE 2021–2026 (USD MILLION)

TABLE 34 FEED ACIDIFIERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 FEED ACIDIFIERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 CAROTENOIDS

8.6.1 ASTAXANTHIN

8.6.1.1 Health benefits of astaxanthin are projected to drive the growth

8.6.2 CANTHAXANTHIN

8.6.2.1 Improves the consistency of the color of poultry egg and chicken meat

8.6.3 LUTEIN

8.6.3.1 Preferred as a naturally occurring carotenoid

8.6.4 BETA-CAROTENE

8.6.4.1 Improves the reproductive performance of ruminants and protects against oxidative stress

TABLE 36 FEED CAROTENOIDS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 37 FEED CAROTENOIDS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 FEED CAROTENOIDS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 FEED CAROTENOIDS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.7 ENZYMES

8.7.1 PHYTASES

8.7.1.1 Low cost and increasing nutritional benefits

8.7.2 CARBOHYDRASES

8.7.2.1 Xylanase and amylase—major types of carbohydrase used in feed enzymes

8.7.3 PROTEASES

8.7.3.1 Help in reducing the dietary protein levels of livestock

8.7.4 OTHER ENZYMES

TABLE 40 FEED ENZYMES MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 41 FEED ENZYMES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 FEED ENZYMES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 FEED ENZYMES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.8 MYCOTOXIN DETOXIFIERS

8.8.1 BINDERS

8.8.1.1 Helps extend shelf life and easily available

8.8.2 MODIFIERS

8.8.2.1 Helps in converting mycotoxins into less toxic compounds

TABLE 44 FEED MYCOTOXIN DETOXIFIERS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 45 FEED MYCOTOXIN DETOXIFIERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 FEED MYCOTOXIN DETOXIFIERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 FEED MYCOTOXIN DETOXIFIERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.9 FLAVORS & SWEETENERS

8.9.1 FLAVORS

8.9.1.1 Growth in focus on increasing the feed palatability

8.9.2 SWEETENERS

8.9.2.1 Used to mask the undesired taste of feed

TABLE 48 FEED FLAVORS & SWEETENERS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 49 FEED FLAVORS & SWEETENERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 FEED FLAVORS & SWEETENERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 FEED FLAVORS & SWEETENERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.10 ANTIBIOTICS

8.10.1 TETRACYCLINE

8.10.1.1 Used to cure several bacterial infections

8.10.2 PENICILLIN

8.10.2.1 Helps to improve egg production and egg hatchability

8.10.3 OTHER ANTIBIOTICS

TABLE 52 FEED ANTIBIOTICS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 53 FEED ANTIBIOTICS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 54 FEED ANTIBIOTICS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 FEED ANTIBIOTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.11 MINERALS

8.11.1 POTASSIUM

8.11.1.1 Helps regulate the metabolism of protein and carbohydrates

8.11.2 CALCIUM

8.11.2.1 Helps in strengthening bones and improves eggshell quality

8.11.3 PHOSPHORUS

8.11.3.1 Plays an important role in the high rate of egg production

8.11.4 MAGNESIUM

8.11.4.1 Helps ruminants maintain optimum pH in the rumen

8.11.5 SODIUM

8.11.5.1 Lack of sodium results in muscle cramps, harsh coat, and reduced appetite in livestock

8.11.6 IRON

8.11.6.1 Deficiency can lead to reduced feed intake, impaired immune system, and low fertility in livestock

8.11.7 ZINC

8.11.7.1 Helps in the growth of hair, skin cells, and hoof health

8.11.8 COPPER

8.11.8.1 Added to swine and poultry feed to enhance health and growth

8.11.9 MANGANESE

8.11.9.1 Vital for the development of eggshell formation in poultry

8.11.10 OTHER MINERALS

TABLE 56 FEED MINERALS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 57 FEED MINERALS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 58 FEED MINERALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 FEED MINERALS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.12 ANTIOXIDANTS

8.12.1 SYNTHETIC

8.12.1.1 BHT protects the fat-soluble vitamins against oxidative degradation and loss of active ingredients in feed

8.12.2 NATURAL

8.12.2.1 Fewer side effects than synthetic antioxidants

TABLE 60 FEED ANTIOXIDANTS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 61 FEED ANTIOXIDANTS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 62 FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.13 NON-PROTEIN NITROGEN

8.13.1 UREA

8.13.1.1 Increase in demand for cattle feed as it is inexpensive and easily available

8.13.2 AMMONIA

8.13.2.1 Helps digestibility and increases feed intake

8.13.3 OTHER NON-PROTEIN NITROGEN ADDITIVES

TABLE 64 FEED NON-PROTEIN NITROGEN MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 65 FEED NON-PROTEIN NITROGEN MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 66 FEED NON-PROTEIN NITROGEN MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 FEED NON-PROTEIN NITROGEN MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.14 PRESERVATIVES

8.14.1 MOLD INHIBITORS

8.14.1.1 Extend the shelf-life of the feed

8.14.2 ANTICAKING AGENTS

8.14.2.1 Prevent the accumulation of feed nutrients

TABLE 68 FEED PRESERVATIVES MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 69 FEED PRESERVATIVES MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 70 FEED PRESERVATIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 FEED PRESERVATIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.15 PHYTOGENICS

8.15.1 ESSENTIAL OILS

8.15.1.1 Improve the gut health and aid in healthy digestion in poultry

8.15.2 FLAVONOIDS

8.15.2.1 Flavonoids help in improving the gut health and control heart stress of livestock

8.15.3 SAPONINS

8.15.3.1 Saponins improve animal performance by suppressing intestinal and ruminal ammonia production

8.15.4 OLEORESINS

8.15.4.1 Consumption is growing rapidly as they impart color, flavor, and aroma to livestock feed

8.15.5 OTHER PHYTOGENICS

TABLE 72 FEED PHYOTOGENICS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 73 FEED PHYTOGENICS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 74 FEED PHYTOGENICS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 FEED PHYTOGENICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.16 PROBIOTICS

8.16.1 LACTOBACILLI

8.16.1.1 Potential to replace antibiotic growth promoters

8.16.2 BIFIDOBACTERIA

8.16.2.1 Primary groups of bacteria found in adult livestock

8.16.3 STREPTOCOCCUS THERMOPHILUS

8.16.3.1 Low usage in the feed industry

8.16.4 YEAST

8.16.4.1 Helps in increased production of milk in dairy cattle

TABLE 76 FEED PROBIOTICS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 77 FEED PROBIOTICS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 78 FEED PROBIOTICS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 FEED PROBIOTICS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

9 FEED ADDITIVES MARKET, BY LIVESTOCK (Page No. - 159)

9.1 INTRODUCTION

FIGURE 41 FEED ADDITIVES MARKET SHARE (VALUE), BY LIVESTOCK, 2021 VS. 2026

TABLE 80 MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 81 MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2021–2026 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE FEED ADDITIVE MARKET, BY LIVESTOCK

9.1.1.1 Optimistic scenario

TABLE 82 OPTIMISTIC SCENARIO: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2018–2021 (USD MILLION)

9.1.1.2 Realistic scenario

TABLE 83 REALISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 84 PESSIMISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2018–2021 (USD MILLION)

9.2 POULTRY

9.2.1 INCREASING CONSUMPTION OF CHICKEN AND EGGS TO ENCOURAGE POULTRY FARMING

9.2.2 BROILERS

9.2.3 LAYERS

9.2.4 BREEDERS

TABLE 85 POULTRY FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 86 POULTRY FEED ADDITIVE MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 87 POULTRY FEED ADDITIVE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 POULTRY FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 RUMINANTS

9.3.1 RISE IN DEMAND FOR DAIRY PRODUCTS AND BEEF TO INCREASE THE USE OF ADDITIVES IN RUMINANT FEED

9.3.2 CALVES

9.3.3 DAIRY CATTLE

9.3.4 BEEF CATTLE

9.3.5 OTHER RUMINANTS

TABLE 89 RUMINANT FEED ADDITIVES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 90 RUMINANT FEED ADDITIVE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 91 RUMINANT FEED ADDITIVE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 RUMINANT FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 SWINE

9.4.1 RISE IN CONSUMPTION OF PORK TO DRIVE THE SWINE FEED ADDITIVES MARKET

9.4.2 STARTERS

9.4.3 GROWERS

9.4.4 SOWS

TABLE 93 SWINE FEED ADDITIVES MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 94 SWINE FEED ADDITIVE MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 95 SWINE FEED ADDITIVE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 SWINE FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 AQUATIC ANIMALS

9.5.1 GROWTH IN CONSUMPTION OF SEAFOOD DRIVES THE MARKET FOR AQUATIC FEED ADDITIVES

TABLE 97 AQUAFEED ADDITIVE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 98 AQUAFEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 OTHER LIVESTOCK

TABLE 99 OTHER LIVESTOCK FEED ADDITIVES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 100 OTHER LIVESTOCK FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 FEED ADDITIVES MARKET, BY FORM (Page No. - 172)

10.1 INTRODUCTION

FIGURE 42 FEED ADDITIVES MARKET SHARE (VALUE), BY FORM, 2021 VS. 2026

TABLE 101 FEED ADDITIVE MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 102 FEED ADDITIVE MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE FEED ADDITIVE MARKET, BY FORM

10.1.1.1 Optimistic scenario

TABLE 103 OPTIMISTIC SCENARIO: FEED ADDITIVES MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

10.1.1.2 Realistic scenario

TABLE 104 REALISTIC SCENARIO: FEED ADDITIVE MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 105 PESSIMISTIC SCENARIO: FEED ADDITIVE MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

10.2 DRY

10.2.1 EASE OF MIXING, STORAGE, AND HANDLING TO DRIVE THE MARKET FOR DRY FORM OF FEED ADDITIVES

TABLE 106 DRY FEED ADDITIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 107 DRY FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 LIQUID

10.3.1 UNIFORMITY AND MORE ACCURATE DOSING OF LIQUID FEED ADDITIVES LIKELY TO PROPEL THE MARKET

TABLE 108 LIQUID FEED ADDITIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 LIQUID FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 FEED ADDITIVES MARKET, BY SOURCE (Page No. - 177)

11.1 INTRODUCTION

FIGURE 43 FEED ADDITIVES MARKET SHARE (VALUE), BY SOURCE, 2021 VS. 2026

TABLE 110 MARKET SIZE FOR FEED ADDITIVES, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 111 MARKET SIZE FOR FEED ADDITIVES, BY SOURCE, 2021–2026 (USD MILLION)

11.1.1 COVID-19 IMPACT ON THE FEED ADDITIVES MARKET, BY SOURCE

11.1.1.1 Optimistic scenario

TABLE 112 OPTIMISTIC SCENARIO: FEED ADDITIVES MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

11.1.1.2 Realistic scenario

TABLE 113 REALISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY SOURCE, 2018–2021 (USD MILLION)

11.1.1.3 Pessimistic scenario

TABLE 114 PESSIMISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY SOURCE, 2018–2021 (USD MILLION)

11.2 SYNTHETIC

11.2.1 LOW COST OF PRODUCTION AND HIGH STABILITY IS PROJECTED TO PROPEL THE GROWTH OF SYNTHETIC FEED ADDITIVES

TABLE 115 SYNTHETIC FEED ADDITIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 116 SYNTHETIC FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 NATURAL

11.3.1 INCREASE IN DEMAND FOR NATURAL FEED IS LIKELY TO ENHANCE THE MARKET FOR NATURAL FEED ADDITIVES

TABLE 117 NATURAL FEED ADDITIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 118 NATURAL FEED ADDITIVE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 FEED ADDITIVES MARKET, BY REGION (Page No. - 183)

12.1 INTRODUCTION

FIGURE 44 FEED ADDITIVES MARKET SHARE (VALUE), BY KEY COUNTRY, 2020

TABLE 119 MARKET SIZE FOR FEED ADDITIVES, BY REGION, 2017–2020 (USD MILLION)

TABLE 120 MARKET SIZE FOR FEED ADDITIVES, BY REGION, 2021–2026 (USD MILLION)

TABLE 121 MARKET SIZE FOR FEED ADDITIVES, BY REGION, 2017–2020 (KT)

TABLE 122 MARKET SIZE FOR FEED ADDITIVES, BY REGION, 2021–2026 (KT)

12.1.1 COVID-19 IMPACT ON THE FEED ADDITIVES MARKET, BY REGION

12.1.1.1 Optimistic Scenario

TABLE 123 OPTIMISTIC SCENARIO: FEED ADDITIVES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.2 Realistic Scenario

TABLE 124 REALISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY REGION, 2018–2021 (USD MILLION)

12.1.1.3 Pessimistic Scenario

TABLE 125 PESSIMISTIC SCENARIO: MARKET SIZE FOR FEED ADDITIVES, BY REGION, 2018–2021 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: FEED ADDITIVES MARKET SNAPSHOT, 2020

TABLE 126 NORTH AMERICA: MARKET SIZE FOR FEED ADDITIVES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET SIZE FOR FEED ADDITIVES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE FOR FEED ADDITIVES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 132 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Largest share in the North American market in 2020

TABLE 138 US: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 139 US: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Increase in demand for meat and the lenient regulations pertaining to the use of growth promoters in the country

TABLE 140 CANADA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 141 CANADA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Support from government programs and rise in livestock production to drive feed additive consumption in Mexico

TABLE 142 MEXICO: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 143 MEXICO: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3 EUROPE

TABLE 144 EUROPE: FEED ADDITIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 149 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 150 EUROPE: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 155 EUROPE: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

12.3.1 SPAIN

12.3.1.1 Increased production efficiencies in dairy to boost the demand for livestock feed additives

TABLE 156 SPAIN: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 157 SPAIN: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3.2 RUSSIA

12.3.2.1 The Russian meat industry has witnessed significant growth in recent years

TABLE 158 RUSSIA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 159 RUSSIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Modernization of the livestock industry resulted in the use of scientific methods for livestock production

TABLE 160 GERMANY: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 161 GERMANY: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Domestic demand for meat products plays an important role in the rising demand for essential additives in livestock feed

TABLE 162 FRANCE: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 163 FRANCE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Italy accounted for the fifth-largest share for feed additives in the region

TABLE 164 ITALY: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 165 ITALY: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3.6 UK

12.3.6.1 Production expansion by dairy co-operatives is expected to support the demand for animal feed additives in the forecast period

TABLE 166 UK: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 167 UK: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 168 REST OF EUROPE: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: FEED ADDITIVES MARKET SNAPSHOT

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 171 ASIA PACIFIC:MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Advancements in the feed industry of the country are expected to create a demand for superior-quality feed

TABLE 182 CHINA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 183 CHINA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.4.2 INDIA

12.4.2.1 Availability of raw materials and a major destination for foreign companies

TABLE 184 INDIA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 185 INDIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Stabilization in feed prices to drive the adoption of feed additives

TABLE 186 JAPAN: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 187 JAPAN: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.4.4 THAILAND

12.4.4.1 Opportunities in the poultry industry

TABLE 188 THAILAND: MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2016–2020 (USD MILLION)

TABLE 189 THAILAND: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.4.5 INDONESIA

12.4.5.1 Increase in feed production to have a proportional impact on the consumption of feed additives

TABLE 190 INDONESIA: MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 191 INDONESIA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 192 REST OF ASIA PACIFIC: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 194 SOUTH AMERICA: FEED ADDITIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 195 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 196 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 197 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 198 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 199 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 200 SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 201 SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 202 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 203 SOUTH AMERICA: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 204 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 205 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Animal husbandry is one of the main industries in Brazilian agriculture

TABLE 206 BRAZIL: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 207 BRAZIL: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Increase in the modernization of the meat processing and dairy industries

TABLE 208 ARGENTINA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 209 ARGENTINA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.5.3 REST OF SOUTH AMERICA

TABLE 210 REST OF SOUTH AMERICA: MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 211 REST OF SOUTH AMERICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

TABLE 212 ROW: FEED ADDITIVES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 213 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 214 ROW: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 215 ROW: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 216 ROW: MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 217 ROW: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 218 ROW: MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 219 ROW: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 220 ROW: MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 221 ROW: MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

TABLE 222 ROW: MARKET SIZE, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 223 ROW: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

12.6.1 MIDDLE EAST

12.6.1.1 Increase in meat consumption and production and rise in livestock disease outbreaks

TABLE 224 MIDDLE EAST: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 225 MIDDLE EAST: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Presence of a substantial livestock population

TABLE 226 AFRICA: MARKET SIZE FOR FEED ADDITIVES, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 227 AFRICA: MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 245)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2020

TABLE 228 FEED ADDITIVES MARKET: DEGREE OF COMPETITION

13.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 47 OVERALL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

13.4 COVID-19- SPECIFIC COMPANY RESPONSE

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 48 FEED ADDITIVES MARKET, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

13.5.5 PRODUCT FOOTPRINT

TABLE 229 COMPANY FOOTPRINT, BY TYPE

TABLE 230 COMPANY FOOTPRINT, BY LIVESTOCK

TABLE 231 COMPANY FOOTPRINT, BY SOURCE

TABLE 232 COMPANY FOOTPRINT, BY FORM

TABLE 233 COMPANY FOOTPRINT, BY REGION

TABLE 234 OVERALL COMPANY FOOTPRINT

13.6 FEED ADDITIVES MARKET, START-UP/SME EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 49 FEED ADDITIVE MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SMES)

13.7 NEW PRODUCT LAUNCHES AND DEALS

13.7.1 NEW PRODUCT LAUNCHES

TABLE 235 FEED ADDITIVE MARKET: NEW PRODUCT LAUNCHES, JUNE 2020–FEBRUARY 2021

13.7.2 DEALS

TABLE 236 FEED ADDITIVE MARKET: DEALS, MARCH 2020–FEBRUARY 2021

13.7.3 OTHER DEVELOPMENTS

TABLE 237 FEED ADDITIVE MARKET: OTHERS, JUNE 2019–NOVEMBER 2020

14 COMPANY PROFILES (Page No. - 257)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 KEY PLAYERS

14.1.1 CARGILL

TABLE 238 CARGILL: BUSINESS OVERVIEW

FIGURE 50 CARGILL: COMPANY SNAPSHOT

TABLE 239 CARGILL: PRODUCTS OFFERED

TABLE 240 CARGILL: NEW PRODUCT LAUNCHES

TABLE 241 CARGILL: DEALS

TABLE 242 CARGILL: OTHER DEVELOPMENTS

14.1.2 ADM

TABLE 243 ADM: BUSINESS OVERVIEW

FIGURE 51 ADM: COMPANY SNAPSHOT

TABLE 244 ADM: PRODUCTS OFFERED

TABLE 245 ADM: NEW PRODUCT LAUNCHES

TABLE 246 ADM: DEALS

TABLE 247 ADM: OTHERS

14.1.3 DUPONT

TABLE 248 DUPONT: BUSINESS OVERVIEW

FIGURE 52 DUPONT: COMPANY SNAPSHOT

TABLE 249 DUPONT: PRODUCTS OFFERED

TABLE 250 DUPONT: NEW PRODUCT LAUNCHES

TABLE 251 DUPONT: DEALS

14.1.4 EVONIK

TABLE 252 EVONIK: BUSINESS OVERVIEW

FIGURE 53 EVONIK: COMPANY SNAPSHOT

TABLE 253 EVONIK: PRODUCTS OFFERED

TABLE 254 EVONIK: NEW PRODUCT LAUNCHES

TABLE 255 EVONIK: DEALS

TABLE 256 EVONIK: OTHER DEVELOPMENTS

14.1.5 BASF

TABLE 257 BASF: BUSINESS OVERVIEW

FIGURE 54 BASF: COMPANY SNAPSHOT

TABLE 258 BASF: PRODUCTS OFFERED

TABLE 259 BASF: NEW PRODUCT LAUNCHES

14.1.6 DSM

TABLE 260 DSM: BUSINESS OVERVIEW

FIGURE 55 DSM: COMPANY SNAPSHOT

TABLE 261 DSM: PRODUCTS OFFERED

TABLE 262 DSM: NEW PRODUCT LAUNCHES

TABLE 263 DSM: DEALS

TABLE 264 DSM: OTHER DEVELOPMENT

14.1.7 AJINOMOTO

TABLE 265 AJINOMOTO: BUSINESS OVERVIEW

FIGURE 56 AJINOMOTO: COMPANY SNAPSHOT

TABLE 266 AJINOMOTO: PRODUCTS OFFERED

14.1.8 NOVOZYMES

TABLE 267 NOVOZYMES: BUSINESS OVERVIEW

FIGURE 57 NOVOZYMES: COMPANY SNAPSHOT

TABLE 268 NOVOZYMES: PRODUCTS OFFERED

TABLE 269 NOVOZYMES: DEALS

TABLE 270 NOVOZYMES: OTHER DEVELOPMENTS

14.1.9 CHR. HANSEN

TABLE 271 CHR. HANSEN: BUSINESS OVERVIEW

FIGURE 58 CHR. HANSEN: COMPANY SNAPSHOT

TABLE 272 CHR. HANSEN: PRODUCTS OFFERED

14.1.10 TEGASA

TABLE 273 TEGASA: BUSINESS OVERVIEW

TABLE 274 TEGASA: PRODUCTS OFFERED

14.2 START-UPS/SMES

TABLE 275 NUTRECO: BUSINESS OVERVIEW

TABLE 276 NUTRECO: PRODUCTS OFFERED

14.2.2 KEMIN INDUSTRIES INC.

TABLE 277 KEMIN INDUSTRIES INC.: BUSINESS OVERVIEW

TABLE 278 KEMIN INDUSTRIES INC.: PRODUCTS OFFERED

TABLE 279 KEMIN INDUSTRIES INC.: NEW PRODUCT LAUNCHES

TABLE 280 KEMIN INDUSTRIES INC.: DEALS

TABLE 281 KEMIN INDUSTRIES INC.: OTHER DEVELOPMENTS

14.2.3 ADISSEO

TABLE 282 ADISSEO OVERVIEW

TABLE 283 ADISSEO: PRODUCTS OFFERED

TABLE 284 ADISSEO: DEALS

TABLE 285 ADISSEO: OTHERS

14.2.4 ALLTECH

TABLE 286 ALLTECH: BUSINESS OVERVIEW

TABLE 287 ALLTECH: PRODUCTS OFFERED

TABLE 288 ALLTECH: NEW PRODUCT LAUNCHES

TABLE 289 ALLTECH: DEALS

TABLE 290 ALLTECH: OTHER DEVELOPMENTS

14.2.5 PALITAL FEED ADDITIVES B.V

14.2.6 GLOBAL NUTRITION INTERNATIONAL

14.2.7 CENTAFARM SRL

14.2.8 BENTOLI

14.2.9 NUQO FEED ADDITIVES

14.2.10 NOVUS INTERNATIONAL, INC.

14.3 LONG LIST OF COMPANIES

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 317)

15.1 INTRODUCTION

TABLE 291 ADJACENT MARKETS TO FEED ADDITIVES

15.2 LIMITATIONS

15.3 PHYTOGENIC FEED ADDITIVES

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 292 PHYTOGENIC FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2018–2025 (USD MILLION)

15.4 FEED ENZYMES MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 293 FEED ENZYMES MARKET SIZE, BY LIVESTOCK, 2018–2025 (USD MILLION)

16 APPENDIX (Page No. - 320)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the feed additives market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Feed Additives Market Report Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of global and regional animal husbandry companies, large-scale ranches and poultries, and government & research organizations. The supply side is characterized by the presence of feed additive manufacturers, feed additive distributors, marketing directors, research officers and quality control officers, and key executives from various key companies and organizations operating in the feed additive market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed additive market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the feed additives market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast the feed additive market, in terms of type, livestock, form, source, and region

- To describe and forecast the feed additive market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the feed additive market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the feed additive market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements, in the feed additive market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific feed additive market, by key country

- Further breakdown of the Rest of European feed additive market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Feed Additives Market

Looking for information regarding the functions of main actors involved in the valuechain for feed additives.

Interested in market share values of different feed additives in India.

Looking for a financials section for Kemin and know what ingredients are covered in the vitamin section.

Interested in market information for feed additives in Azerbaijan

I want to know about the market share, strongest regional presence, products, and pricing for the Feed Additives Market study.