Feminine Hygiene Products Market by Nature (Disposable, Reusable), Type (Sanitary Napkins, Panty Liners, Tampons, Menstrual Cups), Region (Asia Pacific, North America, Europe, Middle East and Africa, South America) - Global Forecast to 2025

Updated on : February 15, 2023

The global feminine hygiene products market was valued at USD 20.9 billion in 2020 and is projected to reach USD 27.7 billion by 2025, growing at a cagr 5.8% from 2020 to 2025. Increasing female awareness of menstrual health & hygiene, rising disposable income of females, and women empowerment are expected to accelerate the growth of the market across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Feminine hygiene products Market

COVID-19 is an infectious disease caused by the newly discovered coronavirus. The spread of this virus is impacting the growth of economies across the globe. The disease was unknown before its outbreak In Wuhan (China) in December 2019. The COVID-19 pandemic is expected to have a secondary impact on the feminine hygiene products market. According to a survey conducted by the Menstrual Health Alliance India, the COVID-19 pandemic has severely hit access to feminine hygiene products. As per the survey, over 82% of feminine hygiene product manufacturers had to pause operations in India due to social distancing norms and lockdown. However, a different trend was observed in the US. Just as the COVID-19 pandemic disrupted work, school, and social routines, so did hoarding interrupted the supply of feminine hygiene products Women relying on free feminine hygiene products from schools, social service centers, government health centers, and medical facilities also faced shortages due to the COVID-19 pandemic.

Market Dynamics

Driver: Rising female literacy and awareness of menstrual health & hygiene

The relationship between literacy and health has been the focus of much research and policy debates. It shows that feminine health and hygiene has improved with the growing literacy rate. Now-a-days females are giving more attention towards hygiene and menstrual health. Many government organizations are working to improve literacy rate of females in underdeveloped and developing countries. The rising literacy level among females is expected to have a positive impact on the overall feminine health management and thus is directly linked to the adoption of feminine hygiene products. As a result, rising female literacy is expected to drive the feminine hygiene products market.

Restraint: Social stigma associated with menstruation and feminine hygiene products

The common perception and stigma associated with menstruation acts as a major disadvantage for many women. Girls face stigma, harassment, and social exclusion during menstruation. This compels girls and women to adopt traditional feminine hygiene products or completely avoid using them. There are various wrong believes in rural areas related to feminine hygiene products such as these products could cause disease if it comes in contact with other garbage Women needs feminine hygiene products and an appropriate place for managing their menstruation. These needs are often overlooked in rural areas, making menstruation an impediment in community participation, education, and working life. Various other social stigma surrounding feminine menstruation acts as a significant restraint for the growth of the feminine hygiene products market.

Opportunity: Developing eco-friendly feminine hygiene products

There are companies such as Saathi, Carmesi, Heyday, Everteen, Purganic, and Aakar that are producing 100% bio-degradable sanitary napkins. Many alternatives are available in market such as fiber, jute fiber, and banana fiber, along with a cellulose-based hydrogel that can replace the synthetic superabsorbent polymer. Making use of natural absorbent material can also help to reduce the overall cost of sanitary napkin. Currently, the issue of the non-biodegradability of feminine hygiene products is a serious environmental concern. However, the development of eco-friendly products such as sanitary napkins from the natural fiber is a sustainable option to advance in this market.

Challenge: Impact of feminine hygiene products on the environment

Plastic disposable napkin has negative impact on the environment, it takes approximately 500-800 years to decompose completely. Thousands of tons of disposable sanitary napkin waste are generated every month all over the world, many of which end up in landfill or clogged in waterways. These products are responsible for soil infertility, groundwater pollution and other severe problems. The environmental issues act as one of the primary challenges for the growth of the feminine hygiene products market.

Based on nature, the disposable segment accounted for the largest market share in 2019

By nature, the disposable segment accounted for the largest market share in 2019. Feminine hygiene products such as sanitary napkins, tampons, and panty liners are considered under the disposable segment. These products are used to protect undergarments from light menstrual flow, spotting, or vaginal discharge and maintain cleanliness. Disposable feminine hygiene products are easily available compared to reusable feminine hygiene products.

Based on type, the Sanitary Napkins segment accounted for the largest market share in 2019

By type, the Sanitary Napkins segment accounted for the largest share of the feminine hygiene products market in 2019. A sanitary napkin is a type of feminine hygiene product that is worn externally, unlike tampons and menstrual cups, which are worn inside the vagina. The large share of the sanitary napkins segment can be attributed to increased awareness compared to other feminine hygiene products, along with easy availability.

Asia Pacific accounted for the largest share of the feminine hygiene products market in 2019

Asia Pacific accounted for the largest share of the feminine hygiene products market in 2019 The large share can be attributed to the high female population in countries such as India and China.Growing disposable income, rapid urbanization, and awareness about menstrual hygiene management are driving the feminine hygiene products market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Feminine Hygiene Products Market Players

Johnson & Johnson (US), Procter & Gamble (US), Kimberly-Clark (US), Essity Aktiebolag (publ) (Sweden), Kao Corporation (Japan), Daio Paper Corporation (Japan), Unicharm Corporation (Japan), Premier FMCG (South Africa), Ontex (Belgium), Hengan International Group Company Ltd. (China), Drylock Technologies (Belgium), Natracare LLC (US), First Quality Enterprises, Inc. (US), and Bingbing Paper Co., Ltd. (China) are some of the leading players operating in the feminine hygiene products market.

Feminine Hygiene Products Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 20.9 billion |

|

Revenue Forecast in 2025 |

USD 27.7 billion |

|

CAGR |

5.8% |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million), Volume (Million Units) |

|

Segments Covered |

Type, and Nature |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

Johnson & Johnson (US), Procter & Gamble (US), Kimberly-Clark (US), Essity Aktiebolag (publ) (Sweden), Kao Corporation (Japan), Daio Paper Corporation (Japan), Unicharm Corporation (Japan), Premier FMCG (South Africa), Ontex (Belgium), Hengan International Group Company Ltd. (China), Drylock Technologies (Belgium), Natracare LLC (US), First Quality Enterprises, Inc. (US), Bingbing Paper Co., Ltd. (China), TZMO SA (Poland), Quanzhou Hengxue Women Sanitary Products Co., Ltd. (China), Rael Inc (US), Redcliffe Hygiene Private Limited (India), The Keeper, Inc. (US), STERNE (India), MeLuna (Germany), Diva International Inc. (Canada), Tosama (Slovenia), Premier Care Industries (US), Lambi (Mexico), Hygienic Articles (Mexico), Alyk, Inc. (US), Cotton High Tech - Cohitech (South Africa), and Sirona Hygiene Pvt Ltd. (India), among others |

This research report categorizes the feminine hygiene products market based on nature, type and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on the Nature:

- Disposable

- Reusable

Based on the Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

Based on the Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2020, Ontex announced plans for new personal hygiene manufacturing plant in Rockingham County, North Carolina, US. The new facility is scheduled to start production from mid-2021.

- In October 2020, Kimberly-Clark Corporation acquired Softex Indonesia to accelerate growth in the personal care business segment across Southeast Asia.

- In February 2019, Procter & Gamble acquired This is L., a period care startup that manufactures organic pads and tampons.

- In 2019, Unicharm Corporation launched Sofy Chojukusui (ultra-sound sleep) Pant, which is a pant-type feminine napkin.

Frequently Asked Questions (FAQ):

What are feminine hygiene products?

Feminine hygiene products are personal care products used during menstruation or vaginal discharge. According to the US Food & Drug Administration (FDA), feminine hygiene products are tampons, menstrual pads, sanitary napkins, panty liners, menstrual sponges, and menstrual cups. By nature, the feminine hygiene products market is segmented into disposable and reusable. Sanitary napkins, tampons, and panty liners are disposable feminine hygiene products, while menstrual cups, cloth menstrual pads, period panties, and sponges are reusable feminine hygiene products.

What are the different types of feminine hygiene products?

Sanitary Napkins, Tampons, Panty Liners, and Menstrual Cups are the different types of feminine hygiene products.

Which are the key countries expected to fuel the growth of feminine hygiene products market?

The feminine hygiene products market is expected to grow the fastest in India, followed by Saudi Arabia, Indonesia, Thailand, among others.

What are the key driving factors for the feminine hygiene products market?

Increasing female population & rapid urbanization, rising female literacy and awareness of menstrual health & hygiene, rising disposable income of females and women empowerment are expected to drive the feminine hygiene products market.

What are the major challenges which may hinder the growth of the feminine hygiene products market?

Impact of feminine hygiene products on the environment, and lack of facilities for menstrual hygiene management are the major challenges that are expected to hinder the growth of the overall feminine hygiene products market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 FEMININE HYGIENE PRODUCTS MARKET, BY NATURE: INCLUSIONS & EXCLUSIONS

TABLE 2 FEMININE HYGIENE PRODUCT MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 3 FEMININE HYGIENE PRODUCT MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FEMININE HYGIENE PRODUCTS MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 FEMININE HYGIENE PRODUCTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION (DEMAND SIDE): FEMININE HYGIENE PRODUCTS MARKET

FIGURE 4 MARKET SIZE ESTIMATION (SUPPLY SIDE): FEMININE HYGIENE PRODUCTS MARKET

2.3 MARKET ENGINEERING PROCESS

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

TABLE 4 FEMININE HYGIENE PRODUCTS MARKET SNAPSHOT, 2020 & 2025

FIGURE 7 SANITARY PADS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF FEMININE HYGIENE PRODUCT MARKET IN 2019

FIGURE 8 DISPOSABLE SEGMENT ACCOUNTED FOR A LARGER SHARE OF FEMININE HYGIENE PRODUCTS MARKET IN 2019

FIGURE 9 ASIA PACIFIC EXPECTED TO LEAD THE FEMININE HYGIENE PRODUCT MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 OVERVIEW OF THE FEMININE HYGIENE PRODUCTS MARKET

FIGURE 10 RISING AWARENESS ABOUT MENSTRUAL HYGIENE IS A MAJOR FACTOR DRIVING THE FEMININE HYGIENE PRODUCTS MARKET

4.2 FEMININE HYGIENE PRODUCT MARKET, BY REGION

FIGURE 11 FEMININE HYGIENE PRODUCTS MARKET IN ASIA PACIFIC PROJECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC FEMININE HYGIENE PRODUCT MARKET, BY TYPE AND COUNTRY

FIGURE 12 SANITARY PADS SEGMENT AND CHINA ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET IN ASIA PACIFIC IN 2020

4.4 FEMININE HYGIENE PRODUCTS MARKET, BY MAJOR COUNTRIES

FIGURE 13 FEMININE HYGIENE PRODUCT MARKET IN INDIA PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

FIGURE 14 FEMININE HYGIENE PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increasing female population & rapid urbanization

FIGURE 15 GLOBAL POPULATION, 2010-2020

FIGURE 16 GLOBAL FEMALE POPULATION, 2019

5.1.1.2 Rising female literacy and awareness of menstrual health & hygiene

FIGURE 17 GLOBAL FEMALE LITERACY RATE, 2010-2018

5.1.1.3 Rising disposable income of females and women empowerment

5.1.2 RESTRAINTS

5.1.2.1 Social stigma associated with menstruation and feminine hygiene products

5.1.3 OPPORTUNITIES

5.1.3.1 Developing eco-friendly feminine hygiene products

5.1.3.2 Growth opportunities in emerging countries

5.1.4 CHALLENGES

5.1.4.1 Impact of feminine hygiene products on the environment

5.1.4.2 Lack of facilities for menstrual hygiene management

5.1.4.3 Supply chain, trade, and economic disruptions due to the COVID-19 pandemic

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: FEMININE HYGIENE PRODUCTS MARKET

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF RIVALRY

6 INDUSTRY TRENDS (Page No. - 50)

6.1 MACROECONOMIC INDICATORS

6.1.1 FEMALE LITERACY RATE

TABLE 5 FEMALE LITERACY RATE, BY COUNTRY, 2015-2019

6.1.2 HUMAN DEVELOPMENT INDEX (HDI)

TABLE 6 HUMAN DEVELOPMENT INDEX, 2019

6.1.3 URBANIZATION

TABLE 7 URBAN POPULATION, 2019

6.1.4 PER CAPITA INCOME

TABLE 8 PER CAPITA INCOME, 2019

6.2 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING THE RAW MATERIAL SUPPLIERS PHASE

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.3 RAW MATERIAL ANALYSIS

6.3.1 SUPERABSORBENT POLYMER (SAP)

6.3.2 POLYPROPYLENE (PP)

6.3.3 POLYETHYLENE (PE)

6.3.4 MEDICAL GRADE SILICONE

6.4 AVERAGE SELLING PRICE TREND ANALYSIS

TABLE 10 AVERAGE PRICES OF FEMININE HYGIENE PRODUCTS, BY REGION (USD)

6.5 REGULATORY LANDSCAPE

TABLE 11 FEMININE HYGIENE PRODUCT STANDARDS & REGULATIONS, BY COUNTRY

6.6 COVID-19 IMPACT

6.6.1 INTRODUCTION

6.6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COUNTRY-WISE SPREAD OF COVID-19

6.6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.6.3.1 COVID-19 Impact on the Economy-Scenario Assessment

FIGURE 22 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 23 SCENARIOS OF COVID-19 IMPACT

6.7 IMPACT OF COVID-19 ON FEMININE HYGIENE PRODUCTS MARKET

TABLE 12 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO COVID-19

7 FEMININE HYGIENE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 65)

7.1 INTRODUCTION

7.2 SUPERMARKET & HYPERMARKET

7.2.1 COVID-19 IMPACT ON SUPERMARKET & HYPERMARKET

7.3 E-COMMERCE

7.3.1 COVID-19 IMPACT ON E-COMMERCE

7.4 DEPARTMENT STORE

7.5 CONVENIENCE STORE

7.6 RETAIL PHARMACIES

8 FEMININE HYGIENE PRODUCTS MARKET, BY NATURE (Page No. - 67)

8.1 INTRODUCTION

FIGURE 24 FEMININE HYGIENE PRODUCTS MARKET, BY NATURE, 2020 & 2025 (USD MILLION)

TABLE 13 FEMININE HYGIENE PRODUCT MARKET SIZE, BY NATURE, 2018-2025 (USD MILLION)

8.1.1 DISPOSABLE

8.1.2 REUSABLE

9 FEMININE HYGIENE PRODUCTS MARKET, BY TYPE (Page No. - 70)

9.1 INTRODUCTION

FIGURE 25 FEMININE HYGIENE PRODUCTS MARKET, BY TYPE, 2020 & 2025 (USD MILLION)

TABLE 14 FEMININE HYGIENE PRODUCT MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 15 FEMININE HYGIENE PRODUCT MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

9.2 SANITARY NAPKINS

TABLE 16 SANITARY NAPKINS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 17 SANITARY NAPKINS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

9.3 TAMPONS

TABLE 18 TAMPONS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 19 TAMPONS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

9.4 PANTY LINERS

TABLE 20 PANTY LINERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 21 PANTY LINERS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

9.5 MENSTRUAL CUPS

TABLE 22 MENSTRUAL CUPS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 23 MENSTRUAL CUPS MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

10 FEMININE HYGIENE PRODUCTS MARKET, BY REGION (Page No. - 77)

10.1 INTRODUCTION

FIGURE 26 FEMININE HYGIENE PRODUCTS MARKET, BY KEY COUNTRIES, 2020-2025

TABLE 24 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 25 MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

10.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: FEMININE HYGIENE PRODUCTS MARKET SNAPSHOT

TABLE 26 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 27 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 28 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 29 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.2.1 CHINA

10.2.1.1 China is the largest market for feminine hygiene products in Asia Pacific

TABLE 30 CHINA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 31 CHINA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 32 CHINA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.2.2 INDIA

10.2.2.1 Fastest-growing market for feminine hygiene products in Asia Pacific

TABLE 33 INDIA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 34 INDIA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 35 INDIA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.2.3 JAPAN

10.2.3.1 Increased female population and literacy fuel the demand for feminine hygiene products

TABLE 36 JAPAN: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 37 JAPAN: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 38 JAPAN: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.2.4 INDONESIA

10.2.4.1 Different initiatives by key players to spread awareness about menstrual hygiene is expected to spur the demand for feminine hygiene products

TABLE 39 INDONESIA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 40 INDONESIA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 41 INDONESIA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.2.5 MALAYSIA

10.2.5.1 Government initiatives toward period poverty propel the market in this country

TABLE 42 MALAYSIA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 43 MALAYSIA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 44 MALAYSIA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.2.6 THAILAND

10.2.6.1 Increase in female population to spur the feminine hygiene products market

TABLE 45 THAILAND: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 46 THAILAND: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 47 THAILAND: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: FEMININE HYGIENE PRODUCTS MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.3.1 US

10.3.1.1 The US is estimated to be the largest market in North America

TABLE 52 US: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 53 US: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 54 US: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.3.2 CANADA

10.3.2.1 Government initiatives toward menstrual hygiene management are expected to drive the market

TABLE 55 CANADA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 56 CANADA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 CANADA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.3.3 MEXICO

10.3.3.1 Increase in female population to spur the demand for feminine hygiene products

TABLE 58 MEXICO: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 59 MEXICO: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 60 MEXICO: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4 EUROPE

FIGURE 29 EUROPE: FEMININE HYGIENE PRODUCTS MARKET SNAPSHOT

TABLE 61 EUROPE: MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 63 EUROPE: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4.1 GERMANY

10.4.1.1 Germany is the largest market for feminine hygiene products in Europe

TABLE 65 GERMANY: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 66 GERMANY: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 67 GERMANY: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4.2 FRANCE

10.4.2.1 France accounted for the second-largest share in the European feminine hygiene products market

TABLE 68 FRANCE: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCT MARKET

TABLE 69 FRANCE: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 70 FRANCE: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4.3 ITALY

10.4.3.1 Government initiatives toward menstrual hygiene management are expected to drive the market in Italy

TABLE 71 ITALY: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 72 ITALY: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 73 ITALY: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4.4 UK

10.4.4.1 The UK expected to be the fastest-growing market in Europe

TABLE 74 UK: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 75 UK: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 76 UK: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4.5 POLAND

10.4.5.1 Female literacy is a major factor driving the European feminine hygiene products market

TABLE 77 POLAND: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCT MARKET

TABLE 78 POLAND: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 79 POLAND: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.4.6 NORWAY

10.4.6.1 Increase in the female population is expected to spur the demand for feminine hygiene products in Norway

TABLE 80 NORWAY: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 81 NORWAY: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 82 NORWAY: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.5 SOUTH AMERICA

TABLE 83 SOUTH AMERICA: FEMININE HYGIENE PRODUCTS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 84 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 85 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.5.1 BRAZIL

10.5.1.1 Brazil was the largest market in South America in 2019

TABLE 87 BRAZIL: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 88 BRAZIL: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 89 BRAZIL: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.5.2 ARGENTINA

10.5.2.1 Increase in awareness about menstrual hygiene will drive the market

TABLE 90 ARGENTINA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 91 ARGENTINA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 92 ARGENTINA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.5.3 CHILE

10.5.3.1 Increased female population is expected to drive the demand for feminine hygiene products

TABLE 93 CHILE: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 94 CHILE: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 95 CHILE: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.6 MIDDLE EAST & AFRICA

TABLE 96 MIDDLE EAST & AFRICA: FEMININE HYGIENE PRODUCTS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNITS)

TABLE 98 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.6.1 SOUTH AFRICA

10.6.1.1 Government initiatives towards menstrual hygiene management to fuel the market

TABLE 100 SOUTH AFRICA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 101 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 102 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.6.2 SAUDI ARABIA

10.6.2.1 Saudi Arabia is the fastest-growing market for feminine hygiene products

TABLE 103 SAUDI ARABIA: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 104 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 105 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

10.6.3 UAE

10.6.3.1 Higher per capita income is expected to spur the demand for feminine hygiene products

TABLE 106 UAE: MACROINDICATORS FOR THE FEMININE HYGIENE PRODUCTS MARKET

TABLE 107 UAE: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 108 UAE: MARKET SIZE, BY TYPE, 2018-2025 (MILLION UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 119)

11.1 OVERVIEW

FIGURE 30 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND OCTOBER 2020

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 31 MARKET EVALUATION FRAMEWORK: 2020 SAW CAPACITY EXPANSIONS AND ACQUISITIONS LEADING THIS SPACE

11.3 MARKET SHARE ANALYSIS

11.3.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN FEMININE HYGIENE PRODUCTS MARKET

11.3.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS IN FEMININE HYGIENE PRODUCT MARKET

11.4 KEY MARKET DEVELOPMENTS

TABLE 109 EXPANSIONS, 2017-2020

TABLE 110 PRODUCT LAUNCHES, 2017-2020

TABLE 111 PARTNERSHIPS, 2017-2020

TABLE 112 ACQUISITIONS, 2017-2020

TABLE 113 COLLABORATIONS, 2017-2020

12 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 125)

12.1 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

12.1.1 STAR

12.1.2 EMERGING LEADERS

12.1.3 PERVASIVE

12.1.4 PARTICIPANTS

FIGURE 32 FEMININE HYGIENE PRODUCTS MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

12.2 COMPETITIVE BENCHMARKING

12.2.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN FEMININE HYGIENE PRODUCTS MARKET

12.2.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN FEMININE HYGIENE PRODUCT MARKET

12.3 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.3.1 PROCTER & GAMBLE

FIGURE 35 PROCTER & GAMBLE: COMPANY SNAPSHOT

12.3.2 KIMBERLY-CLARK CORPORATION

FIGURE 36 KIMBERLY-CLARK CORPORATION: COMPANY SNAPSHOT

12.3.3 JOHNSON & JOHNSON

FIGURE 37 JOHNSON & JOHNSON: COMPANY SNAPSHOT

12.3.4 UNICHARM CORPORATION

FIGURE 38 UNICHARM CORPORATION: COMPANY SNAPSHOT

12.3.5 ESSITY AKTIEBOLAG (PUBL)

FIGURE 39 ESSITY AKTIEBOLAG (PUBL): COMPANY SNAPSHOT

12.3.6 KAO CORPORATION

FIGURE 40 KAO CORPORATION: COMPANY SNAPSHOT

12.3.7 DAIO PAPER CORPORATION

FIGURE 41 DAIO PAPER CORPORATION: COMPANY SNAPSHOT

12.3.8 ONTEX

FIGURE 42 ONTEX: COMPANY SNAPSHOT

12.3.9 HENGAN INTERNATIONAL GROUP COMPANY LTD.

FIGURE 43 HENGAN INTERNATIONAL GROUP COMPANY LTD.: COMPANY SNAPSHOT

12.3.10 PREMIER FMCG

12.3.11 DRYLOCK TECHNOLOGIES

12.3.12 NATRACARE LLC

12.3.13 FIRST QUALITY ENTERPRISES, INC.

12.3.14 BINGBING PAPER CO., LTD.

12.4 SME MATRIX, 2019

12.4.1 STAR

12.4.2 EMERGING COMPANIES

12.4.3 PERVASIVE

12.4.4 EMERGING LEADERS

FIGURE 44 FEMININE HYGIENE PRODUCTS MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2019

12.5 SME PROFILES

12.5.1 DIVA INTERNATIONAL INC.

12.5.2 PREMIER CARE INDUSTRIES

12.5.3 LAMBI

12.5.4 HYGIENIC ARTICLES

12.5.5 TZMO SA

12.5.6 TOSAMA

12.5.7 REDCLIFFE HYGIENE PRIVATE LIMITED

12.5.8 THE KEEPER, INC.

12.5.9 ALYK, INC

12.5.10 QUANZHOU HENGXUE WOMEN SANITARY PRODUCTS CO., LTD.

12.5.11 COTTON HIGH TECH, S.L. (COHITECH)

12.5.12 RAEL INC

12.5.13 SIRONA HYGIENE PVT LTD.

12.5.14 STERNE

12.5.15 MELUNA

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 170)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the feminine hygiene products market. Exhaustive secondary research was undertaken to collect information on the feminine hygiene products market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the feminine hygiene products value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the market. After that, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the feminine hygiene products market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the feminine hygiene products market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

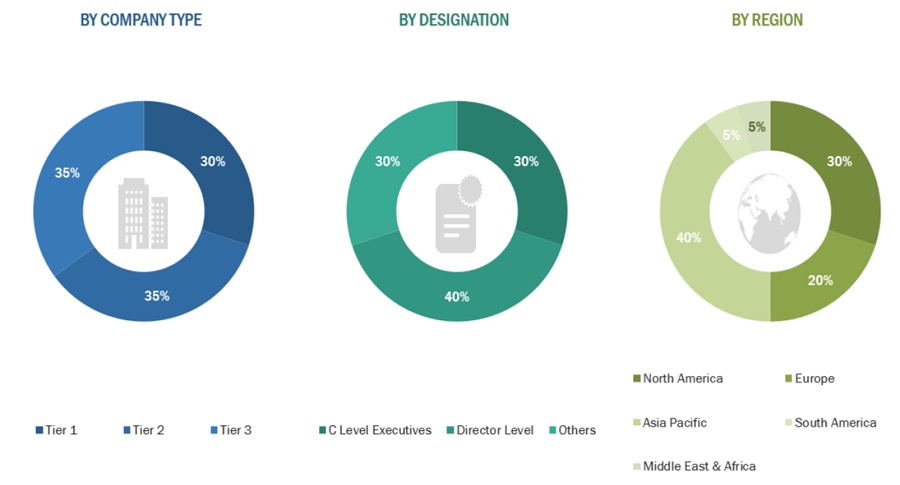

Primary Research

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the feminine hygiene products market. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the feminine hygiene products market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the feminine hygiene products market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the feminine hygiene products market based on type, nature, and region

- To forecast the size of the market and its segments with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as expansions, product launches, acquisitions, partnerships, and collaborations in the feminine hygiene products market

Available Customizations

The following customization options are available for the report:

- Further breakdown of the North America, Asia Pacific and Europe feminine hygiene products markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Growth opportunities and latent adjacency in Feminine Hygiene Products Market