Fire Protection System Market by Product (Fire Suppression, Fire Detection, Fire Sprinkler, Fire Analysis, Fire Response), Services (Engineering, Installation and Design, Managed, Maintenance) and Region - Global Forecast to 2027

Updated on : April 04, 2023

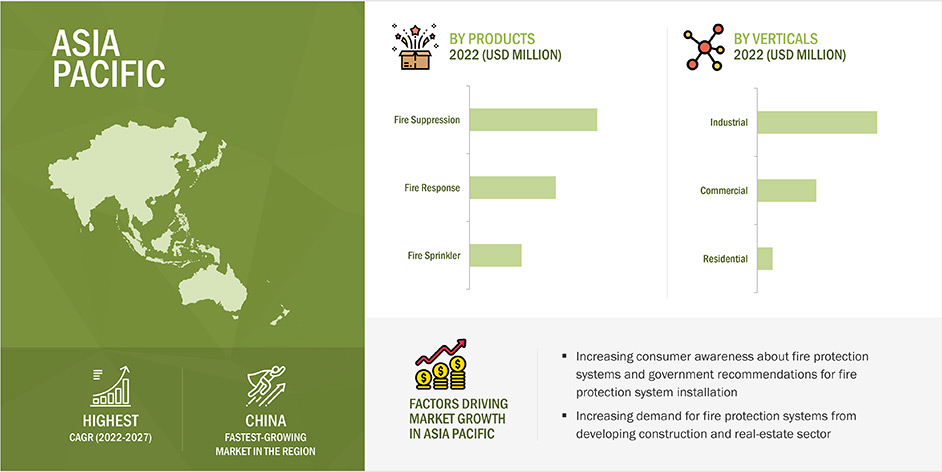

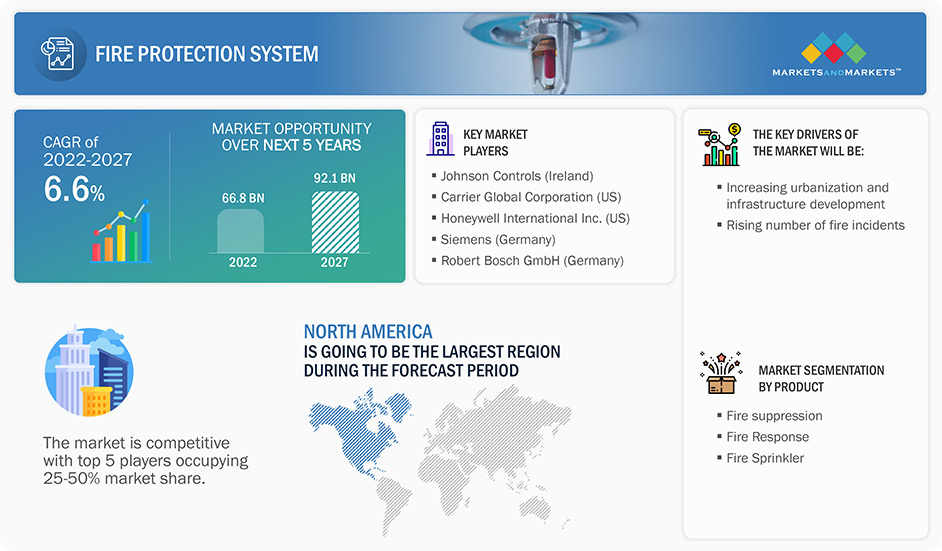

According to the latest market research report, the global fire protection system market is expected to reach USD 92.1 billion by 2027 from an estimated USD 66.8 billion in 2022, growing at a CAGR of 6.6% during the forecast period from 2022 to 2027. One of the fastest-growing countries in this industry is China, which is also the most populous nation and the largest economy in the Asia Pacific region. The country has a significant number of fire protection and safety firms, including local and multinational companies offering a wide range of fire safety products and services. China's government is anticipated to establish strict laws and regulations mandating the installation of fire protection systems in buildings, contributing to the growth of the fire protection system market in the Asia Pacific region.

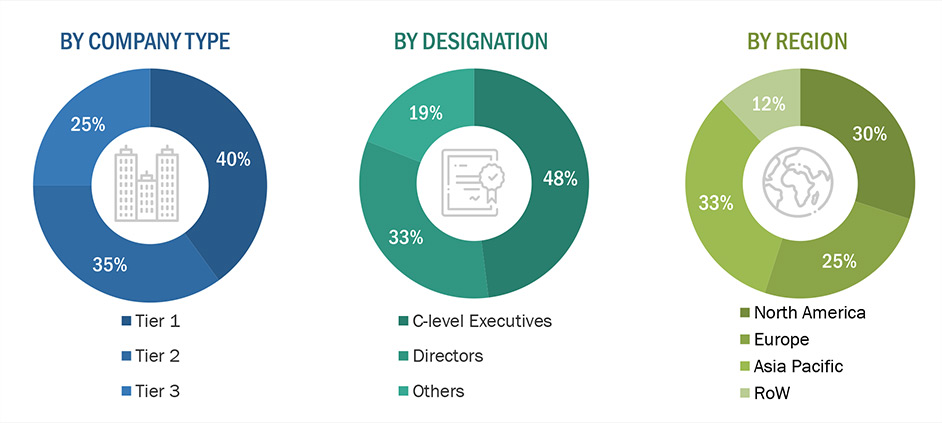

Fire Protection System Market Breakdown of the profiles of primary participants

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 33%, and RoW - 12%

Fire Protection System Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Fire Protection System Market Dynamics

DRIVERS: Strict government regulations pertaining to fire safety

Fire protection involves the combined efforts of federal custodians, tenants, private sector building owners, and local fire service agencies. Policies and regulations differ from region to region and are meant to safeguard human life and property. An example of this is the Australian Building Codes Board (ABCB) oversees issues related to safety, health, amenity, accessibility, and sustainability in buildings. ABCB is working with Fire and Rescue New South Wales (FRNSW), the Australasian Fire and Emergency Services Authorities Council (AFAC), and the Fire Protection Association of Australia (FPAA) to extend the current deemed-to-satisfy (DTS) provisions for sprinkler protection to medium-rise multistorey residential buildings.

Similarly, the Korean Fire Protection Association was established in 2011 as an outcome of the fire prevention law, the Act on the Indemnification for Fire-caused Loss and the Purchase of Insurance Policies. This association provides fire safety inspection and consulting services to specific buildings, such as manufacturing facilities, educational institutions, schools, and public properties. The governments of most developed economies provide monetary support for the installation and maintenance of fire protection systems, e.g., smoke detectors in homes and commercial buildings.

RESTRAINTS: Issues of false alarms and detection failures

A false alarm is an issue with smoke detectors and other fire detection systems. For instance, a smoke detector located in or near a kitchen may raise a nuisance alarm during the normal operations of kitchen appliances. Heat detectors do not sense the combustion particles and are designed to ring when the heat on their sensors increases at a stipulated rate or reaches a determined level. Due to such factors, fire alarm systems may fail to alert people.

OPPORTUNITIES: Growing adoption of water mist systems

The foam-based fire protection system is an aggregate of air-filled bubbles formed from aqueous solutions. It has a lower density than other flammable liquids. This foam-based system is mainly used to design a coherent floating blanket on flammable and combustible liquids to prevent fires by excluding air and cooling the fuel. This system also helps to prevent re-ignition by suppressing the formation of flammable vapors. Further, it sticks to the surfaces by providing protection from adjacent fires.

The foam-based fire detection system can be used as a fire control, prevention, or extinguishing agent for processing industrial areas, such as refineries, oil & gas, and commercial area. Foam-based fire detection systems are efficient and effective when used correctly and do not harm the environment.

The foaming agent in this system is readily biodegradable in natural environments and sewage treatment facilities. Foam-based fire suppression systems can cover larger areas, filling a huge warehouse in seconds. These systems are ideal when there is a need for an extinguishing agent to cover a huge area quickly. Foam-based suppression systems are more cost-effective from installation and maintenance points of view. Hence, their demand is growing so rapidly in the market.

CHALLENGES: Lack of integration and configuration in fire protection solutions

A key challenge for the fire protection system industry is the integration of user interfaces when multiple solutions are being used in a control mechanism. Fire protection systems can be efficient and cost-efficient if integrated directly into a centralized building control system so that the information can be obtained from a central point, and corresponding follow-up regulatory measures can proceed automatically in an emergency. By integrating these systems, a user can monitor the status of multiple systems from one location or access features, such as remote notification, trending, or maintenance management, which may not be available directly through a fire protection system.

Threats regarding security and fire protection to industries and commerce in the modern era, with more demanding compliance codes and standards, raise the need for more comprehensive and integrated solutions. However, owing to the complexity of the system and the increasing number of components included, the integration and configuration of the entire system become complicated. This factor poses a challenge for the market.

The fire response segment accounts for a significant Market share.

Fire response systems are activated simultaneously with fire suppression systems to prevent the spread of fire. These systems alert occupants in a building by triggering alarms and siren systems; setting off warnings and alerts; and sending emergency messages to the police, freighting troops, and ambulances. Both active and passive fire response systems are included in this section.

The combination of active and passive systems can provide the best fire protection to occupants and help prevent the spread of fire, consequently maintaining the structural integrity of the infrastructure where these systems are deployed. Some active fire response systems considered in this study include emergency lighting systems, public alert systems, secure communication systems, and fire alarm devices.

The market for academia & institutional vertical is expected to grow at the highest CAGR in commercial vertical

Educational or academic buildings are a major application area for the fire protection systems market. The academic and institutional segment include schools and colleges, libraries, and lecture halls, which require protection against fire hazards. These buildings are occupied by masses for a very long duration every day; therefore, fire protection systems are installed to ensure the safety of their lives and minimize the risk of any fire hazard. Water-based fire sprinkler systems are mainly used in this space. Fire suppression, detection, and sprinkler systems immensely contribute to overall fire protection in educational institutions.

Fire Protection System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The Fire Protection System Market in Asia Pacific is projected to grow at a significant CAGR.

Asia Pacific market is expected to grow at the highest rate during the forecast period. Growing urbanization has increased construction activities, contributing significantly to the growth of this region's fire protection system market. The Japanese government is focusing on creating more public awareness related to fire safety. Many fire safety-related initiatives have been undertaken in the country, for instance, the deployment of ample human resources in firefighting and public awareness initiatives in schools through radio, TV, and other media channels.

The use of fire extinguishers and sprinklers is high in Japan, and schools and workplaces provide training on using fire extinguishers. The market for fire extinguishers, sprinklers, and fire alarms is well-developed in Japan, and the growth trend is expected to continue in the coming years.

Key Market Players

Few top players in the fire protection system companies are Carrier Global Corporation (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany).

Fire Protection System Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 66.8 Billion |

| Projected Market Size | USD 92.1 Billion |

| Growth Rate | CAGR of 6.6% |

|

Forecast Period |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Market Leaders |

Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany) |

|

Top Companies in North America |

Global Corporation (US), Honeywell International Inc. (US) |

|

Key Market Driver |

Strict Government Regulations Pertaining to Fire Safety |

|

Key Market Opportunity |

Growing Adoption of Water Mist Systems |

|

Largest Growing Region |

Asia Specific |

|

Largest Market Share Segment |

Fire Response Segment |

|

Highest CAGR Segment |

Academia & Institutional Vertical |

Fire Protection System Market Highlights

This research report categorizes the fire protection system market by type, product, service, vertical and region.

|

Aspect |

Details |

|

Fire Protection System Market, By Type |

|

|

By Product |

|

|

By Service |

|

|

By Vertical |

|

|

Fire Protection System Market, By Region |

|

Recent Developments

- In June 2022, Kidde HomeSafe integrated smart detection system was launched. This system, provides complete home-detection solution which includes detection of carbon monoxide, smoke, water leaks and frozen pipes.

- In June 2022, Siemens Korea Smart Infrastructure launched the SRF 2.0 intelligent fire detection system, which has the auto self-diagnosis feature and provides high reliability & stable performance.

- In October 2020, Honeywell International Inc. launched the first tools from its new suite of Connected Life Safety Services (CLSS)— its first all-in-one cloud platform for fire safety systems.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the fire protection system market during 2022-2027?

The global fire protection system market is expected to record a CAGR of 6.6% from 2022–2027.

What are the driving factors for the fire protection system market?

Strict government regulations pertaining to fire safety is the key driving factor for this fire protection system market.

Which are the significant players operating in the fire protection system market?

Carrier Global Corporation (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany) are among a few top players in the fire protection system market.

Which region will grow at a fast rate in the future?

The fire protection system market in Asia pacific is expected to grow at the highest CAGR during the forecast period.

How big is the Fire Protection System Market?

6.6% growth rate is expected and estimated to reach USD 92.1 billion by 2027.

What are the Challenges in Fire Protection System Market?

key challenge for the fire protection system market is the integration of user interfaces when multiple solutions are being used in a control mechanism.

What are the Restraint in Fire Protection System Market?

False alarm is an issue with smoke detectors and other fire detection systems.

What Company Leading the Noth America Fire Protection System Market?

Carrier Global Corporation (US), Honeywell International Inc. (US) are leading players.

What are Opportunities in Fire Protection System Market?

Growing adoption of water mist systems.

Which Region is largest share of Market in Asia Specific?

China is expected to account for the largest share of the fire protection system market analysis in the Asia Pacific region during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 FIRE PROTECTION SYSTEM MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH APPROACH

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 PRIMARY AND SECONDARY RESEARCH

FIGURE 3 MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to derive market size using top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

TABLE 1 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 FIRE PROTECTION SYSTEM MARKET FORECAST, 2018–2027 (USD BILLION)

FIGURE 10 FIRE SUPPRESSION SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

FIGURE 11 MAINTENANCE SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

FIGURE 12 OIL, GAS, & MINING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL SEGMENT DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 14 GROWING CONSTRUCTION INDUSTRY AND ADOPTION OF WIRELESS TECHNOLOGY TO DRIVE MARKET GROWTH

4.2 MARKET, BY PRODUCT

FIGURE 15 FIRE SUPPRESSION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2027

4.3 MARKET, BY SERVICE

FIGURE 16 MAINTENANCE SERVICES SEGMENT TO REGISTER HIGHER CAGR FROM 2022 TO 2027

4.4 MARKET, BY VERTICAL

FIGURE 17 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2027

4.5 NORTH AMERICA: FIRE PROTECTION SYSTEM MARKET ANALYSIS, BY VERTICAL AND COUNTRY

FIGURE 18 INDUSTRIAL SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE

4.6 MARKET, BY COUNTRY

FIGURE 19 CHINA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing urbanization and infrastructure development

5.2.1.2 Rising number of fire incidents

FIGURE 21 HOME STRUCTURE FIRES IN US (2011–2020)

5.2.1.3 Strict government regulations pertaining to fire safety

5.2.1.4 Growing adoption of wireless technology in fire detection systems

FIGURE 22 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High installation and maintenance costs

5.2.2.2 Issues of false alarms and detection failures

5.2.2.3 High cost of smart detectors

FIGURE 23 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of water mist systems

5.2.3.2 Development of IoT-integrated smoke detectors

5.2.3.3 Periodic revision of regulatory compliances to increase fire safety

FIGURE 24 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Lack of integration and configuration in fire protection solutions

FIGURE 25 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 27 MARKET: ECOSYSTEM ANALYSIS

TABLE 2 FIRE PROTECTION SYSTEM MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 FLAME DETECTORS

5.5.1.1 Flame detectors: Average selling price, by type (key players)

FIGURE 28 FLAME DETECTORS: AVERAGE SELLING PRICES FOR KEY PLAYERS, BY TYPE (USD)

TABLE 3 FLAME DETECTORS: AVERAGE SELLING PRICES FOR KEY PLAYERS, BY TYPE (USD)

5.5.2 SMOKE DETECTORS

5.5.2.1 Smoke detectors: Average selling price, by type (key players)

FIGURE 29 SMOKE DETECTORS: AVERAGE SELLING PRICES FOR KEY PLAYERS, BY TYPE (USD)

TABLE 4 SMOKE DETECTORS: AVERAGE SELLING PRICES FOR KEY PLAYERS, BY TYPE (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTERNET OF THINGS (IOT)

5.7.2 CLOUD-BASED SOLUTIONS

5.7.3 VIDEO IMAGE SMOKE AND FLAME DETECTION SYSTEMS

5.7.4 ARTIFICIAL INTELLIGENCE

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

5.9.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

5.10 CASE STUDY ANALYSIS

TABLE 8 SARACEN FIRE PROTECTION LIMITED PROVIDED FIRE ALARMS FOR FOOD PROCESSING PLANTS IN ENGLAND

TABLE 9 FIRE PROTECTION SYSTEM INSTALLED BY EATON COLLEGE IN ITS OLD BUILDING

TABLE 10 MOUKA LIMITED INSTALLED VIDEO-BASED FIRE DETECTION DEVICE FOR FIRE DETECTION

TABLE 11 ROYAL PAPWORTH HOSPITAL APPOINTED STATIC SYSTEMS FOR FIRE ALARM SYSTEM REQUIREMENTS

5.11 TRADE ANALYSIS

FIGURE 33 IMPORT OF BURGLAR OR FIRE ALARMS AND SIMILAR APPARATUS, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 34 EXPORT OF BURGLAR OR FIRE ALARMS AND SIMILAR APPARATUS, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 12 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 36 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2021

TABLE 13 MARKET: LIST OF PATENTS, 2020–2021

5.13 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 14 FIRE PROTECTION SYSTEM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 CODES AND STANDARDS RELATED TO FIRE DETECTION

TABLE 20 CODES AND STANDARDS RELATED TO FIRE SUPPRESSION

6 FIRE PROTECTION SYSTEM MARKET, BY TYPE (Page No. - 86)

6.1 INTRODUCTION

FIGURE 37 MARKET, BY TYPE

6.2 ACTIVE FIRE PROTECTION SYSTEMS

6.2.1 ACTIVE SYSTEMS ARE WIDELY USED TO CONTROL AND SUPPRESS FIRE

6.3 PASSIVE FIRE PROTECTION SYSTEMS

6.3.1 PASSIVE SYSTEMS ACT AS FIRST LINE OF DEFENSE

6.3.2 PASSIVE FIRE PROTECTION AREAS

7 FIRE PROTECTION SYSTEM MARKET, BY PRODUCT (Page No. - 89)

7.1 INTRODUCTION

FIGURE 38 FIRE PROTECTION SYSTEM INDUSTRY: BY PRODUCT

FIGURE 39 FIRE SUPPRESSION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

TABLE 21 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.2 FIRE SUPPRESSION

7.2.1 DIFFERENT FIRE SUPPRESSOR MATERIALS USED BASED ON FIRE TYPE

7.2.2 FIRE SUPPRESSION REAGENTS

7.2.2.1 Chemical fire suppression systems

7.2.2.1.1 Dry chemical systems

7.2.2.1.2 Wet chemical systems

7.2.2.2 Gaseous

7.2.2.2.1 Clean agent fire suppression systems

7.2.2.2.2 Carbon dioxide (CO2) clean agent fire suppression systems

7.2.2.2.3 FM-200 clean agent fire suppression systems

7.2.2.2.4 Other clean agent fire suppression systems

7.2.2.3 Water

7.2.2.4 Foam

TABLE 23 FIRE SUPPRESSION MARKET, BY SUPPRESSION REAGENT, 2018–2021 (USD MILLION)

TABLE 24 FIRE SUPPRESSION MARKET, BY SUPPRESSION REAGENT, 2022–2027 (USD MILLION)

TABLE 25 FIRE SUPPRESSION MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 26 FIRE SUPPRESSION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 27 FIRE SUPPRESSION MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 29 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 FIRE SPRINKLER

7.3.1 WET FIRE SPRINKLERS

7.3.1.1 Highly reliable wet sprinkler systems mainly used in fire protection

TABLE 31 ADVANTAGES AND DISADVANTAGES OF WET FIRE SPRINKLER SYSTEMS

7.3.2 DRY FIRE SPRINKLERS

7.3.2.1 Dry fire sprinklers widely used in freezing conditions

7.3.3 PRE-ACTION FIRE SPRINKLERS

7.3.3.1 Pre-action fire sprinkler systems reduce accidental discharge

7.3.4 DELUGE FIRE SPRINKLERS

7.3.4.1 Deluge fire sprinkler systems widely used in hazardous environments

7.3.5 OTHER FIRE SPRINKLERS

TABLE 32 FIRE SPRINKLER MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 FIRE SPRINKLER MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 34 FIRE SPRINKLER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 35 FIRE SPRINKLER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 36 FIRE SPRINKLER MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 37 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 38 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 FIRE DETECTION

7.4.1 FIRE DETECTORS

7.4.1.1 Conventional systems

7.4.1.2 Addressable systems

TABLE 40 FIRE DETECTION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 FIRE DETECTION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 FIRE DETECTION MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 43 FIRE DETECTION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 44 FIRE DETECTION MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 45 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 46 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4.2 FLAME DETECTORS

7.4.2.1 Single IR

7.4.2.1.1 Single IR detectors detect flames containing hydrocarbons

7.4.2.2 Single UV

7.4.2.2.1 High-performance detection instrument

7.4.2.3 Dual UV/IR

7.4.2.3.1 Increased immunity compared to UV detectors

7.4.2.4 Triple IR (IR3)

7.4.2.4.1 Widely used in process industries

7.4.2.5 Multi IR

7.4.2.5.1 Suited for locations where combustion produces smoky fires

TABLE 48 FLAME DETECTORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 49 FLAME DETECTORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.4.3 VISUAL FLAME DETECTION TECHNOLOGY

7.4.3.1 Assesses potential risks and reduces unwanted shutdowns

7.4.3.2 Thermal imaging cameras

7.4.3.3 CCTV

7.4.3.4 Software

7.4.4 SMOKE DETECTORS

7.4.4.1 Photoelectric smoke detectors

7.4.4.1.1 Fatal fires to boost photoelectric smoke detectors market

7.4.4.2 Ionization smoke detectors

7.4.4.2.1 Detection of visible and invisible products of combustion through ionization smoke detectors

7.4.4.3 Dual-sensor smoke detectors

7.4.4.3.1 Dual-sensor smoke detectors combine advantages of photoelectric and ionization detectors

7.4.4.4 Beam smoke detectors

7.4.4.4.1 Growing adoption of beam smoke detectors in open space

7.4.4.5 Other smoke detectors

TABLE 50 SMOKE DETECTORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 51 SMOKE DETECTORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.4.5 HEAT DETECTORS

7.4.5.1 Beneficial in small and confined places

7.5 FIRE ANALYSIS

7.5.1 FIRE ANALYSIS SOLUTIONS ARE USED FOR SPATIAL REPRESENTATION OF DATA

TABLE 52 FIRE ANALYSIS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 53 FIRE ANALYSIS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 54 FIRE ANALYSIS MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 55 FIRE ANALYSIS MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 56 FIRE ANALYSIS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 FIRE ANALYSIS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 FIRE RESPONSE

7.6.1 EMERGENCY LIGHTING SYSTEMS

7.6.1.1 Emergency lighting allows safe evacuation during emergencies

7.6.2 VOICE EVACUATION AND PUBLIC ALERT SYSTEMS

7.6.2.1 Voice evacuation systems help in disseminating crucial information during fire emergencies

7.6.3 SECURE COMMUNICATION SYSTEMS

7.6.3.1 Secure communication systems mainly used by police, fire, and emergency response teams

7.6.4 FIRE ALARM DEVICES

7.6.4.1 Fire alarms remain most basic fire safety devices

TABLE 58 FIRE RESPONSE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 59 FIRE RESPONSE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 60 FIRE RESPONSE MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 61 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 62 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 MARKET, BY REGION, 2022–2027 (USD MILLION)

8 FIRE PROTECTION SYSTEM MARKET, BY SERVICE (Page No. - 118)

8.1 INTRODUCTION

FIGURE 40 FIRE PROTECTION SYSTEM INDUSTRY: BY SERVICE

FIGURE 41 MAINTENANCE SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2022

TABLE 64 FIRE PROTECTION SERVICES MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 65 FIRE PROTECTION SERVICES MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 66 FIRE PROTECTION SERVICES MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 67 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 68 MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 69 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 70 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 ENGINEERING SERVICES

8.2.1 ENGINEERING SERVICES HELP IN UNDERSTANDING CUSTOMER NEEDS FOR FIRE PROTECTION

8.3 INSTALLATION AND DESIGN SERVICES

8.3.1 COORDINATION BETWEEN DESIGNERS AND INSTALLATION PROFESSIONALS CRUCIAL FOR EFFECTIVE FIRE PROTECTION

8.4 MAINTENANCE SERVICES

8.4.1 NEED FOR TIMELY SERVICING AND AUDITING OF FIRE PROTECTION SYSTEMS

8.5 MANAGED SERVICES

8.5.1 RELIABLE MANAGED SERVICES FACILITATE SMOOTH BUSINESS OPERATIONS

8.6 OTHER SERVICES

9 FIRE PROTECTION SYSTEM MARKET, BY VERTICAL (Page No. - 124)

9.1 INTRODUCTION

FIGURE 42 MARKET: BY VERTICAL

FIGURE 43 INDUSTRIAL VERTICAL TO ACCOUNT FOR LARGEST SHARE IN 2022

TABLE 72 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 73 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 RESIDENTIAL

9.2.1 FIRE PROTECTION SYSTEMS PROTECT RESIDENTIAL BUILDINGS FROM FIRE HAZARDS

TABLE 74 RESIDENTIAL: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 75 RESIDENTIAL: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

TABLE 76 RESIDENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 RESIDENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 COMMERCIAL

TABLE 78 MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 79 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 80 COMMERCIAL: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 81 COMMERCIAL: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

TABLE 82 COMMERCIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 COMMERCIAL: FIRE PROTECTION SYSTEM MARKET ANALYSIS, BY REGION, 2022–2027 (USD MILLION)

9.3.1 ACADEMIA & INSTITUTIONAL

9.3.1.1 Water-based fire sprinkler systems widely used in academia

TABLE 84 ACADEMIA & INSTITUTIONAL: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 85 ACADEMIA & INSTITUTIONAL: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.3.2 RETAIL

9.3.2.1 Growing urbanization

TABLE 86 RETAIL: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 87 RETAIL: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.3.3 HEALTHCARE

9.3.3.1 Growing need for enhanced safety of patients

TABLE 88 HEALTHCARE: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 89 HEALTHCARE: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.3.4 HOSPITALITY

9.3.4.1 Growing use of water-based fire protection systems in hotels and lodgings

TABLE 90 HOSPITALITY: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 91 HOSPITALITY: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.3.5 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

9.3.5.1 Strict fire safety regulations by government

TABLE 92 BFSI: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 93 BFSI: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.4 INDUSTRIAL

TABLE 94 MARKET, BY INDUSTRIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 95 MARKET, BY INDUSTRIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 96 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4.1 ENERGY & POWER

9.4.1.1 High demand for fire protection systems to ensure safety of workforce and property

TABLE 98 ENERGY & POWER: FIRE PROTECTION SYSTEM MARKET ANALYSIS, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 99 ENERGY & POWER: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.4.2 GOVERNMENT

9.4.2.1 Gaseous and water mist sprinklers widely used in public facilities

TABLE 100 GOVERNMENT: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 101 GOVERNMENT: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.4.3 MANUFACTURING

9.4.3.1 Growing need to protect large and critical manufacturing structures

TABLE 102 MANUFACTURING: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 103 MANUFACTURING: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.4.4 OIL, GAS, & MINING

9.4.4.1 High use of gas-based suppression systems and sprinkler systems

TABLE 104 OIL, GAS, & MINING: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 105 OIL, GAS, & MINING: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.4.5 TRANSPORTATION & LOGISTICS

9.4.5.1 Increasing demand for swift and competent response to fire incidents

TABLE 106 TRANSPORTATION & LOGISTICS: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 107 TRANSPORTATION & LOGISTICS: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

9.4.6 OTHER INDUSTRIES

TABLE 108 OTHER INDUSTRIES: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 109 OTHER INDUSTRIES: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

10 FIRE PROTECTION SYSTEM MARKET GROWTH, BY REGION (Page No. - 147)

10.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION

FIGURE 45 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 110 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 111 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 46 US TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 112 NORTH AMERICA: FIRE PROTECTION SYSTEM MARKET TRENDS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising awareness about benefits of fire protection systems

10.2.2 CANADA

10.2.2.1 Growing adoption of advanced fire protection systems in new constructions

10.2.3 MEXICO

10.2.3.1 Investments in warehouse infrastructure development

10.3 EUROPE

FIGURE 48 UK TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 49 EUROPE: FIRE PROTECTION SYSTEM MARKET SNAPSHOT

TABLE 118 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Need to enhance wireless fire detection systems

10.3.2 GERMANY

10.3.2.1 Stringent fire safety rules and regulations

10.3.3 FRANCE

10.3.3.1 Government mandate to install fire sprinklers

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 50 CHINA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

FIGURE 51 ASIA PACIFIC: FIRE PROTECTION SYSTEM MARKET SNAPSHOT

TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Growing role of government to ensure mandatory installation of fire protection systems

10.4.2 JAPAN

10.4.2.1 Initiatives to increase public awareness regarding fire safety

10.4.3 SOUTH KOREA

10.4.3.1 Government initiatives to minimize fire-related damages

10.4.4 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 52 MIDDLE EAST TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

TABLE 130 ROW: FIRE PROTECTION SYSTEM MARKET, BY SUBREGION, 2018–2021 (USD MILLION)

TABLE 131 ROW: MARKET, BY SUBREGION, 2022–2027 (USD MILLION)

TABLE 132 ROW: MARKET, BY PRODUCT AND SERVICE, 2018–2021 (USD MILLION)

TABLE 133 ROW: MARKET, BY PRODUCT AND SERVICE, 2022–2027 (USD MILLION)

TABLE 134 ROW: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 135 ROW: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 High demand for fire protection systems in oil & gas sector

TABLE 136 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 137 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 AFRICA

10.5.2.1 Growing urbanization and improved standard of living

10.5.3 SOUTH AMERICA

10.5.3.1 Growing focus on public safety

11 COMPETITIVE LANDSCAPE (Page No. - 170)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 138 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

11.3 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 53 MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2017–2021

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 139 MARKET: MARKET SHARE ANALYSIS (2021)

11.5 COMPANY EVALUATION QUADRANT, 2021

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 54 MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 55 MARKET, SME EVALUATION QUADRANT, 2021

11.7 FIRE PROTECTION SYSTEM MARKET: COMPANY FOOTPRINT

TABLE 140 COMPANY FOOTPRINT

TABLE 141 VERTICAL: COMPANY FOOTPRINT

TABLE 142 REGIONAL: COMPANY FOOTPRINT

11.8 COMPETITIVE BENCHMARKING

TABLE 143 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 144 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.9 COMPETITIVE SITUATIONS AND TRENDS

11.9.1 MARKET: PRODUCT LAUNCHES

11.9.2 FIRE PROTECTION SYSTEM MARKET: DEALS

12 COMPANY PROFILES (Page No. - 189)

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

12.1 KEY PLAYERS

12.1.1 CARRIER GLOBAL CORPORATION

TABLE 145 CARRIER GLOBAL CORPORATION: BUSINESS OVERVIEW

FIGURE 56 CARRIER GLOBAL CORPORATION: COMPANY SNAPSHOT

TABLE 146 CARRIER GLOBAL CORPORATION: PRODUCT SOLUTIONS/SERVICES OFFERED

TABLE 147 CARRIER GLOBAL CORPORATION: PRODUCT LAUNCHES

TABLE 148 CARRIER GLOBAL CORPORATION: DEALS

12.1.2 HONEYWELL INTERNATIONAL INC.

TABLE 149 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 150 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 151 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

TABLE 152 HONEYWELL INTERNATIONAL INC.: DEALS

12.1.3 JOHNSON CONTROLS

TABLE 153 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 58 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 154 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 155 JOHNSON CONTROLS: PRODUCT LAUNCHES

12.1.4 ROBERT BOSCH GMBH

TABLE 156 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 59 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 157 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 158 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

TABLE 159 ROBERT BOSCH GMBH: DEALS

12.1.5 SIEMENS

TABLE 160 SIEMENS: BUSINESS OVERVIEW

FIGURE 60 SIEMENS: COMPANY SNAPSHOT

TABLE 161 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 162 SIEMENS: PRODUCT LAUNCHES

12.1.6 EATON CORPORATION PLC

TABLE 163 EATON CORPORATION PLC: BUSINESS OVERVIEW

FIGURE 61 EATON CORPORATION PLC: COMPANY SNAPSHOT

TABLE 164 EATON CORPORATION PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.7 GENTEX CORPORATION

TABLE 165 GENTEX CORPORATION: BUSINESS OVERVIEW

FIGURE 62 GENTEX CORPORATION: COMPANY SNAPSHOT

TABLE 166 GENTEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.8 HALMA PLC

TABLE 167 HALMA PLC: BUSINESS OVERVIEW

FIGURE 63 HALMA PLC: COMPANY SNAPSHOT

TABLE 168 HALMA PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 169 HALMA PLC: DEALS

12.1.9 HOCHIKI CO., LTD.

TABLE 170 HOCHIKI CO., LTD.: BUSINESS OVERVIEW

FIGURE 64 HOCHIKI CO., LTD.: COMPANY SNAPSHOT

TABLE 171 HOCHIKI CO., LTD.: PRODUCT OFFERINGS

TABLE 172 HOCHIKI CO., LTD.: PRODUCT LAUNCHES

12.1.10 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 173 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

FIGURE 65 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

TABLE 174 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 175 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

12.2 OTHER PLAYERS

12.2.1 API GROUP

12.2.2 ARGUS FIRE PROTECTION COMPANY LTD.

12.2.3 BAKERRISK

12.2.4 CIQURIX

12.2.5 DNV AS GROUP COMMUNICATIONS

12.2.6 ENCORE FIRE PROTECTION

12.2.7 FIKE CORPORATION

12.2.8 FIRE & GAS DETECTION TECHNOLOGIES, INC.

12.2.9 FIRELINE CORPORATION

12.2.10 FIRETROL PROTECTION SYSTEMS, INC.

12.2.11 GEXCON

12.2.12 IAMTECH

12.2.13 INSIGHT NUMERICS, LLC

12.2.14 MINIMAX VIKING GMBH

12.2.15 MSA SAFETY INCORPORATED

12.2.16 NAPCO SECURITY TECHNOLOGIES, INC.

12.2.17 ORR PROTECTION

12.2.18 SCHRACK SECONET AG

12.2.19 SECURITON AG

12.2.20 S&S SPRINKLER CO. LLC

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 255)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY REGION

TABLE 176 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 177 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 NORTH AMERICA

TABLE 178 NORTH AMERICA: PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 179 NORTH AMERICA: PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.4.1 US

13.4.1.1 Increasing adoption of automated solutions in oil & gas, pharmaceuticals, and food & beverages industries

13.4.2 CANADA

13.4.2.1 Growing support offered by Canadian government to small-scale food processing industries to adopt advanced technologies

13.4.3 MEXICO

13.4.3.1 Rising adoption of Industry 4.0 to provide growth opportunities for process automation and instrumentation

14 APPENDIX (Page No. - 260)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the fire protection system market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the fire protection system market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred fire protection system providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from fire protection system providers, such as Carrier Global Corporation (US), Honeywell International Inc. (US), Johnson Controls (Ireland), Robert Bosch GmbH (Germany), and Siemens (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the fire protection system market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the fire protection system market based on type, product, and services

- To define, describe, and forecast the fire protection system market based on vertical

- To describe and forecast the size of the fire protection system market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the fire protection system market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fire Protection System Market

New technological innovations such as cloud-based technology and 5G technology are creating huge opportunities for the fire protection device manufacturers. Do you have insights on how 5G technology has a positive impact on the growth of fire protection devices in the report?

With the increase in adoption of AR and VR technologies in various industrial applications, firefighters are also adopting VR training, which helps them to see outcomes and develop critical thinking skills. Could you provide more clarification on such type of training information in the report?

Nowadays, drones and UAVs are among of the fastest-growing markets and are used by fire departments as fire alarm resources. Is it possible to get few market trends and size of UAV-based fire protection systems from the report?

Does this analysis also include more specialized systems such as condensed aerosol fire suppression?

A fire in mines, forests, and other industries is a critical issue. Vehicle suppression systems are mostly used to inhibit the fire in heavy equipment used in such industries. I would like to have more information on vehicle suppression systems for APAC and Middle East regions, where these systems has penetrating with a high demand in the market.

Mobile ultrasound fire protection devices are more versatile than fixed monitors. These can be used for fast deployment in a wide range of scenarios and are creating huge opportunities for the growth of the fire protection system market. Could you provide more information on the vendors offering ultrasound fire protection monitors?