Flooring Market by Material (Resilient, Non-Resilient (Ceramic tiles, Wood, Laminate, Stone), Soft-floor covering), End-use Industry (Residential, Non-residential), & Region (North America, Europe , APAC, MEA, South America) - Global Forecast to 2028

Flooring Market Size

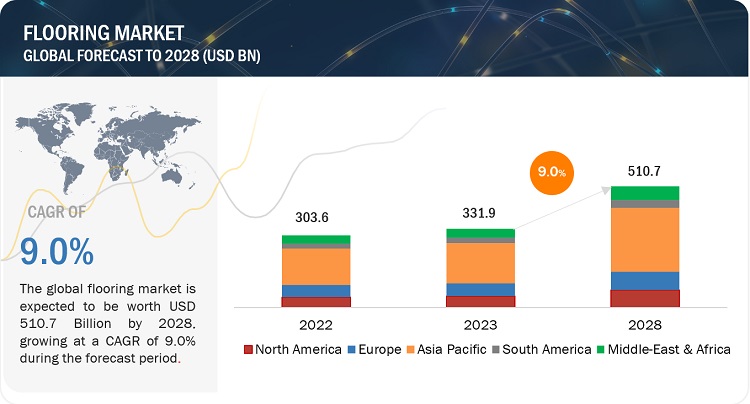

The global flooring market is valued at USD 331.9 billion in 2023 and is projected to reach USD 510.7 billion by 2028, growing at a cagr 9.0% from 2023 to 2028. The market growth is driven by construction and infrastructure development. The demand for flooring materials is closely tied to construction activities and infrastructure development. As new residential, commercial, and industrial buildings are constructed or renovated, there is a need for flooring solutions. Infrastructure projects such as transportation systems, airports, and public spaces also contribute to the demand for flooring materials.

Attractive Opportunities in the Flooring Market

To know about the assumptions considered for the study, Request for Free Sample Report

Flooring Market Dynamics

Driver: Rise in population & rapid urbanization and increase in investment in the construction industry are the major drivers of the flooring market.

As the population grows, the demand for housing also rises. This creates a need for flooring materials in residential construction projects. Whether it's new housing developments or renovations, the flooring market benefits from the increased demand for various types of flooring products. Urbanization leads to the construction of roads, bridges, airports, railway stations, and public spaces, all of which require flooring materials. The flooring market benefits from this increased construction activity in urban areas.

Restraint: Volatile raw material prices

Raw material price fluctuations can be a considerable restraint for the flooring industry, affecting the profitability and competitiveness of flooring companies. Fluctuations in raw material prices directly impact the cost of producing flooring products. If the prices of key raw materials, such as wood, vinyl, carpet fibers, ceramics, or resins, increase, manufacturers may face higher production costs. This can lead to increased prices for finished flooring products, affecting consumer demand and market competitiveness.

Opportunities: Rise in demand from emerging economies

Emerging economies present significant opportunities for the flooring industry due to rapid urbanization, a growing middle class, infrastructure development, renovation and modernization needs, rising consumer awareness, and the growing tourism and hospitality industry. These factors drive the demand for flooring materials and offer a favourable market environment for manufacturers and suppliers. By leveraging these opportunities, flooring businesses can establish a strong presence and drive growth in emerging markets.

Challenges: Disposal of waste

The flooring industry generates a significant volume of waste during installation, renovation, and demolition processes. This waste includes old flooring materials, scraps, packaging, adhesives, and other related items. Disposing of such large volumes of waste can be costly and time-consuming. Some flooring materials, such as certain adhesives, coatings, or underlays, may contain hazardous substances. Disposing of these materials requires adherence to specific regulations and guidelines to ensure proper handling, containment, and disposal to avoid environmental and health risks.

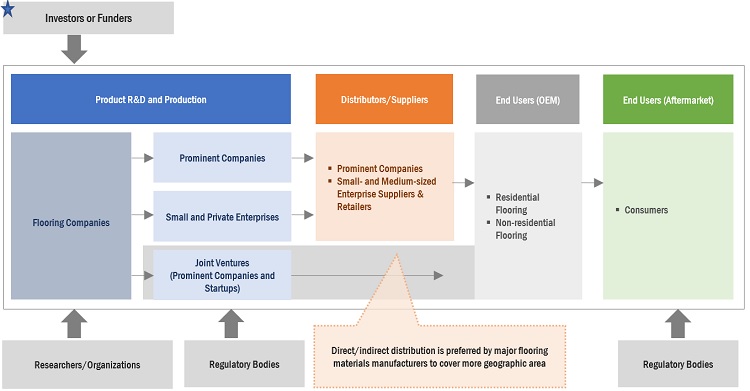

Flooring Market Ecosystem

By Material, Resilient flooring material accounted for the highest CAGR during the forecast period

Resilient flooring materials, such as vinyl, linoleum, and rubber, are known for their durability and long lifespan. They can withstand high foot traffic, resist scratches, stains, and dents, and maintain their appearance over time. This durability appeals to consumers looking for flooring options that offer longevity and require minimal maintenance or replacement, making resilient materials a popular choice.

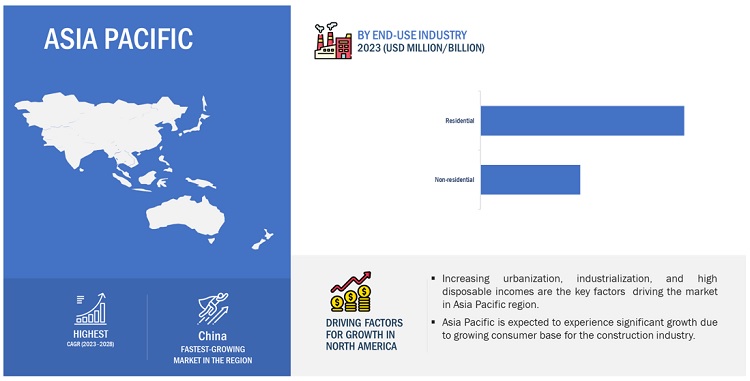

By End Use Industry, Non-residential accounted for the highest CAGR during the forecast period

The growth of non-residential flooring market is driven by rapid urbanization and industrialization. Construction of commercial buildings and infrastructure projects, such as offices, hotels, hospitals, airports, and public spaces, create a higher demand for durable and visually appealing flooring solutions. Government and private investments in infrastructure development further contribute to the expansion of the non-residential flooring market.

Asia Pacific is projected to account for the highest CAGR in the flooring market during the forecast period

The Asia Pacific region is undergoing rapid urbanization, with a significant rural-to-urban population shift. This has resulted in a surge in construction projects, encompassing residential, commercial, and industrial sectors. Therefore, there is a rising need for flooring solutions to accommodate the expanding urban areas. Countries like China, India, and Southeast Asian nations are experiencing robust economic growth, leading to increased consumer purchasing power and investments in infrastructure ventures. This economic progress has created a greater demand for high-quality flooring products and materials, driven by improved living standards and disposable income.

To know about the assumptions considered for the study, download the pdf brochure

Flooring Market Players

Flooring market comprises key manufacturers such as Mohawk Industries, Inc. (US), Tarkett (France), Forbo (Switzerland), Shaw Industries Group Inc. (Georgia), Interface, Inc. (US), and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the flooring market. Major focus was given to the new product development due to the changing requirements of consumers across the world.

Flooring Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 331.9 billion |

|

Revenue Forecast in 2028 |

USD 510.7 billion |

|

CAGR |

9.0% |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion), and Volume (Million Square Meters) |

|

Segments |

Material, End-use industry, and Region |

|

Regions |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies |

The major players are Mohawk Industries, Inc. (US), Tarkett (France), Forbo (Switzerland), Shaw Industries Group Inc. (Georgia), Interface, Inc. (US), and others are covered in the flooring market. |

This research report categorizes the global flooring market on the basis of Material, End-use industry, and Region.

Flooring Market, By Material

-

Resilient Flooring

- Vinyl

- Others

-

Non-Resilient Flooring

- Ceramic tiles

- Wood

- Laminate

- Stone

- Others

- Soft floor covering/ Carpets & Rugs

Flooring Market, By End-use industry

- Non-residential

- Residential

Flooring Market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In February 2023, Tarkett has collaborated with Dutch design research firm Studio RENS, to launch DESSO X RENS, a range of carpet tiles that can be recycled into a new raw material.

- In November 2022, Mohawk Industries, Inc. acquired Elizabeth Coatings (Brazil). With this acquisition, the company became the largest producer of ceramic tiles by revenue in Brazil.

- In November 2022, Tarkett has launched the carpet tile collection with the lowest circular carbon footprint.

- In July 2022, Mohawk Industries, Inc. acquired the Foss Manufacturing Company, LLC, a Georgia-based manufacturer known for its expertise in non-woven, needle-punch technology used in products ranging from peel-and-stick carpet tile to artificial turf.

- In June 2022, Forbo has launched a brand-new adhesive-free, Health, and Safety Executive (HSE) compliant safety flooring range: Surestep Fast Fit.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the flooring market?

The flooring market is expected to witness significant growth in the future due to rise in population & rapid urbanization, increase in investment in the construction industry, and rise in the number of renovation & remodelling activities.

What is the major challenge in the flooring market?

The major challenge in the flooring market is the disposal of waste.

What are the restraining factors in the flooring market?

The major restraining factor faced by the flooring market volatile raw material prices and rise in health and environmental concerns.

What is the key opportunity in the flooring market?

Growth of the organized retail sector is the key opportunity in the flooring market.

What are the end-use industries where flooring materials are used?

The flooring materials are majorly used in residential and non-residential floor construction. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

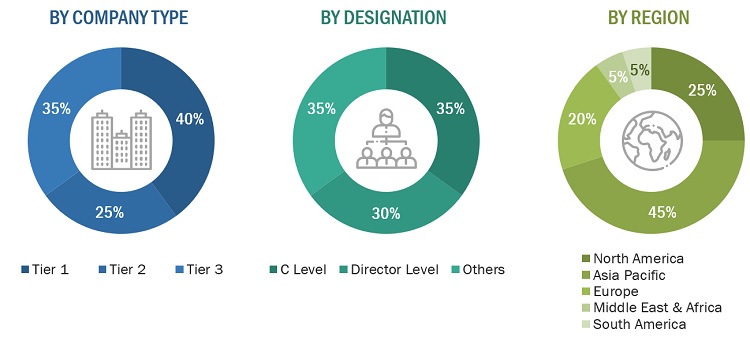

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the flooring market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The flooring market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the flooring market. Primary sources from the supply side include associations and institutions involved in the flooring industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global flooring industry. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

The Flooring industry refers to the industry that produces and supplies flooring materials and products. Flooring is the process of supplying structural support, covering the floor with any finishing materials, and establishing a livable area. Common resilient flooring materials include vinyl and rubber. The non-resilient flooring materials include wood, ceramic, and stone. Additionally, carpet and rugs are also a good flooring option.

Key Stakeholders

- Raw material suppliers

- Flooring material manufacturers

- Flooring associations

- Builders & contractors

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, describe, and forecast the global flooring market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on material, region, and end-use industry.

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the Asia Pacific flooring market

- Further breakdown of the Rest of Europe's flooring market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Flooring Market