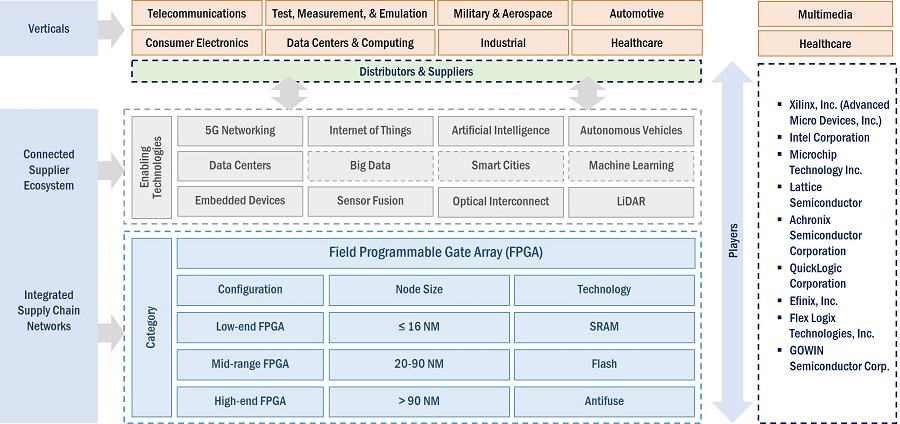

FPGA Market by Configuration (Low-end FPGA, Mid-range FPGA, High-end FPGA), Technology (SRAM, Flash, Antifuse), Node Size (=16 nm, 20-90 nm, >90 nm), Vertical (Telecommunications, Data Center & Computing, Automotive) and Region - Global Forecast to 2028

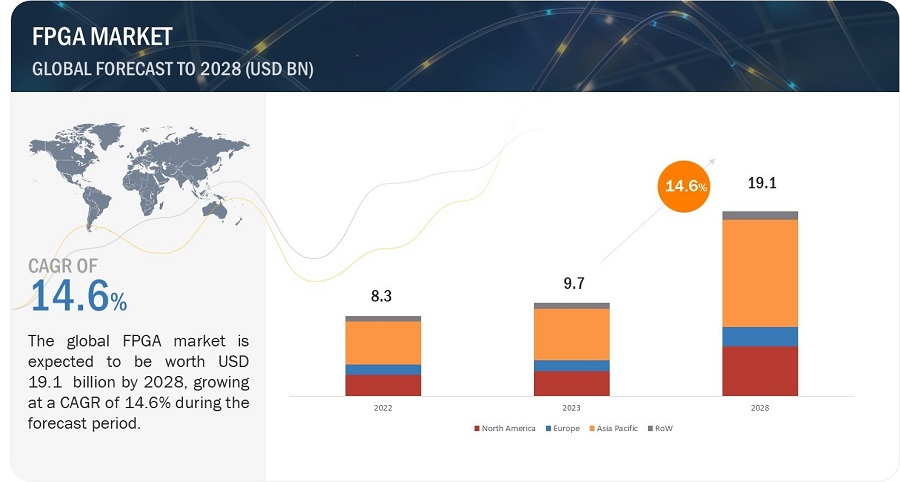

[323 Pages Report] The FPGA market is valued at USD 9.7 billion in 2023 and is projected to reach USD 19.1 billion by 2028, growing at a CAGR of 14.6% from 2023 to 2028. The increasing adoption of FPGA products in the advanced driver assistance systems, and proliferation of AI and IoT are among factors that contribute to the growth of the FPGA market.

FPGA Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

FPGA Market Dynamics

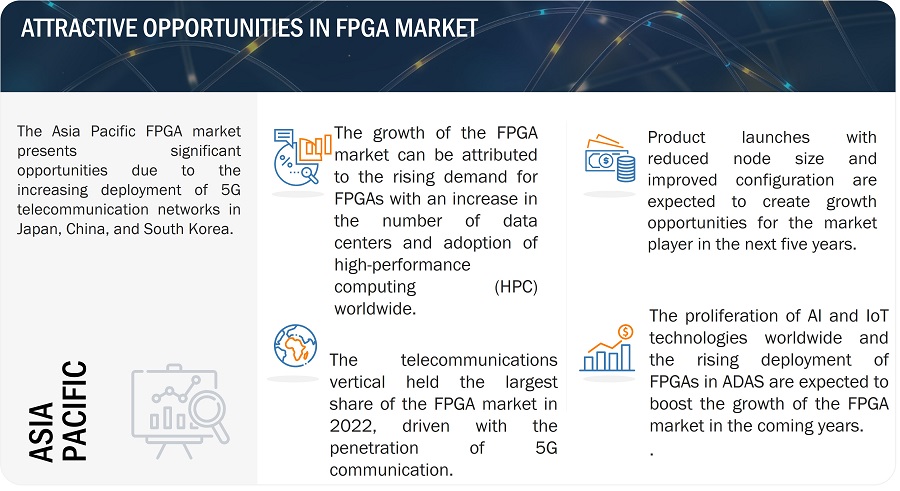

Drivers: Increasing number of data centers and high performance computing (HPC) facilities

The rising number of data centers and high-performance computing facilities worldwide is expected to drive the growth of the FPGA market. Data centers are essential for adopting IoT as they process data from millions of devices and sensors to carry out highly optimized autonomous operations. FPGAs are being integrated into data centers to offload and accelerate specific services. They improve the response time, throughput, and energy efficiency of high-performance computing, ADAS, IoT, and 5G devices by offloading computing workloads from the central processing units (CPU) of servers.

Restraint: Security concerns associated with FPGAs

Security vulnerabilities due to hidden bugs in FPGAs are restraining the market growth. FPGAs have a re-programmability feature, unlike traditional hardware chipsets and ICs. This feature helps developers to achieve desired functionality after manufacturing. However, the re-programmability feature makes FPGAs vulnerable to security attacks. Some of the FPGAs have hidden bugs in their hardware, which may lead hackers to steal critical data and get complete access control over the chipset.

Opportunity: Increasing penetration of eFPGAs into military and aerospace industry

The benefits associated with the use of eFPGAs in the aerospace industry include customizability, quick prototyping, real-time processing, space optimization, security, fault tolerance, legacy system integration, and flexibility to changing standards. With these benefits, eFPGA has become a useful technology for improving the performance, dependability, and flexibility of aerospace applications. The military sector uses eFPGAs for various purposes: customization, real-time processing, hardware acceleration, secure communication, fault tolerance, legacy system integration, SWaP optimization, and lifecycle management.

Challenge: Highly complex programming

FPGAs can be used to create reconfigurable accelerators with lower latency and better efficiency. However, while FPGAs offer increased efficiency, flexibility, and programmability, they can be challenging to program and manage. For instance, a large number of FPGAs must be integrated into the data center infrastructure. However, this large volume of FPGAs is expensive and difficult to program and deploy to the data center infrastructure. FPGAs are becoming more widely available as part of infrastructure-as-a-service offerings from leading companies. FPGA providers offer optimized FPGA libraries for integration into customers’ applications, such as cloud services and aerospace.

FPGA market Map:

The market for high-end FPGA segment to hold highest CAGR during the forecast period.

Devices with high-level integration architecture, known as high-end FPGAs, provide exceptional performance and high bandwidth. These FPGAs are equipped with next-generation hard processor systems and offer improved speed and functionality. With over 500,000 logic elements, 32+ transceiver counts, and 600+ input/output resources, these devices are top-of-the-line. The first 14 nm node size high-end FPGA, the Stratix 10 SoC, was introduced by Intel Corporation (US). Intel’s Stratix and Agilex families, Xilinx Inc.’s Virtex family, and Achronix Semiconductor Corporation’s Speedster7t FPGA family are all examples of high-end FPGAs that offer enhanced performance and power consumption.

20-90 nm segment in node size to hold highest market share of the FPGA market during forecast period

The 20–90 nm segment accounted for the largest share of the overall market, in terms of value, in 2022. Customers prefer FPGAs with node sizes ranging between 20–90 nm due to their high performance, programming flexibility, and low power consumption. These FPGAs have been available in the market for a considerable amount of time and are known for their industry-leading features, such as high bandwidth and reduced total system costs, which make them suitable for general-purpose and portable applications.

SRAM segment in technology to highest market share of the FPGA market during forecast period

FPGAs are commonly programmed using SRAM technology because they can easily reconfigure cells based on specific application needs. This allows for testing new FPGA designs against existing standards for FPGA-based devices. SRAM-based FPGAs enable logic implementation through look-up tables (LUT) and have gained popularity worldwide due to their ability to sort embedded RAM blocks and ease of controlling, routing, and configuring switches. They are highly flexible and ideal for designing finite state machines (FSM), computer programs, sequential logic circuits, and arithmetic circuits.

Data-center and computing segment to hold largest CAGR of the FPGA market during forecast period

The field of data storage technology is growing rapidly, allowing consolidation of existing IT functions with newly added capabilities. Large data centers now offer both traditional IT and new data analytics services, requiring performance and bandwidth storage systems and servers. FPGA are utilized in large-scale data centers to provide high-speed data processing through high bandwidth and low-latency connections to storage systems and networks, as well as data filtering, compression, and acceleration algorithms.

FPGA market in Asia Pacific estimated to grow at a higher CAGR during the forecast period

The Asia Pacific region is expected to experience significant growth in the FPGA market, mainly due to the telecommunications, industrial, automotive, consumer electronics, and computing sectors. China and Japan play a crucial role in the rapidly growing 5G market, with India following closely behind in rolling out 5G technology. This presents growth opportunities for telecom companies in India, thus driving the FPGA market. Industrial automation is also on the rise in Asia Pacific, increasing the demand for FPGAs.

FPGA Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the FPGA companies include Advanced Micro Devices (Xilinx, Inc.) (US), Intel Corporation (US), Microchip Technology Inc. (US), Lattice Semiconductor Corporation (US), and Achronix Semiconductor Corporation (US), Quicklogic Corporation (US), Efinix Inc. (US), Flexlogix(US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

Configuration, Node-Size, Technology, Market Size, Vertical, Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Advanced Micro Devices (Xilinx, Inc.) (US), Intel Corporation (US), Microchip Technology Inc. (US), Lattice Semiconductor Corporation (US), Achronix Semiconductor Corporation (US), Quicklogic Corporation(US), Efinix Inc.(US), Flexlogix(US), Gowin Semiconductor corporation(China), S2C(China), Renesas Electronics Corporation (Japan), AGM Micro(China), Shanghai Anlu Information Technology Co., Ltd. (China), Shenzhen Ziguang Tongchuang Electronics Co., Ltd. (China), Xi'an Zhiduojing Microelectronics Co., Ltd. (China), LeafLabs, LLC (US), Aldec, Inc. (US), Bytesnap Design(UK), Enclustra(Switzweland), Ensilica(UK), Gidel(US), Nuvation Engineering(US), Empuro Consulting Private Limited(India), Iwave Systems Technologies Pvt. Ltd. Mistral Solutions Pvt. Ltd.(India) |

FPGA Market Highlights

This research report categorizes the FPGA market based on configuration, node size, technology, market size, vertical, and region

|

Segment |

Subsegment |

|

Based on Configuration: |

|

|

Based on Node-size |

|

|

Based on Technology: |

|

|

Based on Market size: |

|

|

Based on Vertical: |

|

|

Based on Region: |

|

Recent Developments

- In February 2023, Lattice Semiconductor Corporation has announced its collaboration with Green Hills Software (US). This collaboration provided comprehensive safe and secure solutions for embedded industrial and automotive applications. Customers can use these collaborative solutions to create dependable, secure, and safe edge computing architectures with industry-leading power efficiency, performance, and code size.

- In November 2022, Xilinx, Inc. has recently introduced two new additions to their UltraScale+ series of electronics - the AU7P field-programmable gate array (FPGA) and ZU3T system-on-chip (SoC). These 16 nm FinFET-based devices are designed for low power consumption, high performance-per-watt, and compact form factor applications.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the FPGA market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies adopted by the key players to grow in the FPGA market.

Which region dominates the FPGA market?

The Asia Pacific region will dominate FPGA market.

What vertical dominates the FPGA market?

Telecommunication is expected to dominate the FPGA market.

Which technology type dominates the FPGA market?

SRAM segment is expected to have the largest market size during the forecast period.

Who are the major companies in the FPGA market?

Advanced Micro Devices (Xilinx, Inc.) (US), Intel Corporation (US), Microchip Technology Inc. (US), Lattice Semiconductor Corporation (US), and Achronix Semiconductor Corporation (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

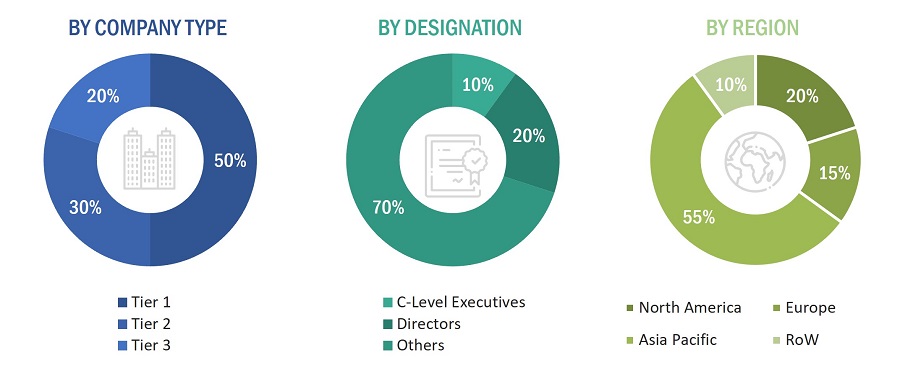

This section helps understand the methodology implemented during the development of the report on the FPGA market. Two basic sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the FPGA market. The secondary sources include company websites, magazines, industry news, associations, and databases (OneSource, Factiva, and Bloomberg). Primary sources comprise experts from the core and related industries, along with suppliers, manufacturers, distributors, end users, and technology developers, as well as alliances, standards, and certification organizations related to various parts of the supply chain of the FPGA market.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors have been referred to. Secondary research has been done to obtain key information about the market’s supply chain, the value chain, the pool of key market players, and market segmentation according to industry trends, regions, and developments from both market and technology perspectives.

In primary research, various sources from the supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side included experts such as C-level executives, directors, vice presidents, technical engineers, and related executives from multiple key companies and organizations operating in the FPGA market ecosystem.

Secondary sources used for this research study include company websites, corporate filings (such as annual reports, investor presentations, and financial statements), trade articles, white papers, industry news, and business and professional associations. The secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the FPGA market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The bottom-up approach has been employed to determine the FPGA market’s overall size. From the revenues of the key players (companies), the size of the FPGA market has been estimated at the first stage. The market has been further narrowed down to obtain splits for various verticals and regions. These splits have been validated through primary interviews with industry stakeholders and subject-matter experts.

FPGA Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A field programmable gate array (FPGA) is a semiconductor device comprising a configurable logic block (CLB) matrix interconnected by programmable interconnects. After manufacturing, this device can be reprogrammed to cater to specific application or feature requirements. Its re-programmability feature allows it to adapt to design changes or support new applications in an end-use product. The design engineer can modify a significant portion of the device’s electrical functionality during the printed circuit board (PCB) assembly process or even after the equipment has been distributed to end users.

Key Stakeholders

- FPGA component and material providers

- FPGA distributors, suppliers, and service providers

- Technology standards organizations, forums, alliances, and associations

- End users from various verticals

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startups

Report Objectives

- To define, describe, segment, and forecast the size of the field programmable gate array (FPGA) market in terms of value based on configuration, node size, technology, vertical, and region

- To define, describe, segment, and forecast the size of the FPGA market in terms of volume based on configuration

- To forecast the market size for various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the significant drivers, restraints, opportunities, and challenges influencing the growth of the FPGA market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

- To provide a detailed overview of the value chain of the FPGA ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To strategically profile key players, comprehensively analyze their market position in terms of ranking and core competencies2, and provide a competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, mergers, agreements, collaboration, and partnerships in the FPGA market

- To study the impact of the recession on the FPGA market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in FPGA Market