Furfural Market by Raw Material (Sugarcane Bagasse, Corncob, Rice Husk and Others), Application (Derivatives (Furfural Alcohol and Other Derivatives), solvent) and Region (Asia-Pacific, Americas, Europe,Middle East and Africa) - Global Forecast to 2024

Updated on : March 12, 2023

Furfural Market Size

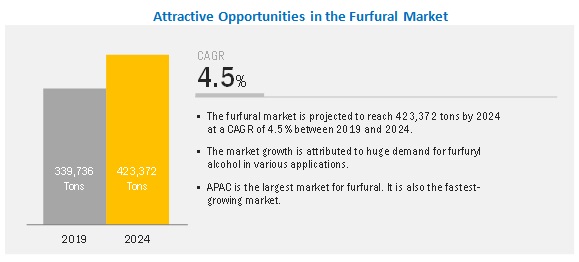

The global furfural market size was valued at USD 551 million in 2019 and is projected to reach USD 700 million by 2024, growing at a cagr 4.9% from 2019 to 2024. Additionally, the market is projected to reach 423,372 tons by 2024, at a cagr 4.5% during the forecast period. Furfural is an organic intermediate obtained using renewable sources. It finds use in various applications such as derivatives and solvents as it is a green chemical and has no adverse effect on the environment during its consumption and production.

Furfural is an organic intermediate derived from agricultural residues, such as corncob, rice husk, and sugarcane bagasse (SCB) or wood residues. It is used for manufacturing furan-based biochemicals and biofuels. The furfural market is segmented in the report based on raw material, application, and region. Corncob is the most widely used raw material as it has the highest hemicellulose content (30.0-35.0%), which provides excellent yield and economic value, and derivatives manufacturing is the major application of furfural. Furfural is used as the starting material for the production of several furan derivatives, such as furfural alcohol, tetrahydrofuran (THF), maleic anhydride (MA), 2 methyl tetrahydrofuran (MTHF), and 1, 5-pentanediol.

By raw material, corncob to account for the largest market share of the furfural market during the forecast period

Corncob is the middle part of the maize on which the kernels are grown. Corncob and SCB are the two primary raw materials used to produce furfural. Corncob is generally the desired product because it has the highest hemicellulose content (30.0%-35.0%) among all the proven raw materials for furfural. It provides higher economic value as it gives greater yield when compared to other products. Corncob accounted for the largest share of the furfural market, by raw material, in 2018 and is expected to dominate the raw materials segment during the forecast period.

By application, derivatives to drive the furfural market growth during the forecast period

Furfural is used as the starting material for the manufacturing of several furan derivatives, such as furfuryl alcohol, tetrahydrofuran (THF), maleic anhydride (MA), 2-methyl tetrahydrofuran (MTHF), and 1, 5-pentanediol.

Furfuryl alcohol manufacturing dominates the global furfural market. Furfuryl alcohol is majorly used for the production of furan resin that is used as a foundry sand binder. According to the IKB Deutsche Industriebank, the foundry industry is expected to grow in the coming years, majorly driven by the emerging markets. The growth of the foundry industry is expected to increase the demand for foundry resins. This, in turn, is likely to drive the demand for furfuryl alcohol, globally. Also, with the increasing focus on biochemicals and biofuels, the demand for other furfural-based derivatives is increasing, thereby driving the demand for furfural.

APAC projected to register the highest CAGR during the forecast period

APAC is expected to lead the furfural market during the forecast period as the production and consumption of furfural is majorly concentrated in China. In 2018, the region accounted for the highest share in terms of the value of the overall market. The derivatives segment is the largest application of furfural in APAC.

Market Dynamics

Driver: Growing demand for furfuryl alcohol

Furfuryl alcohol is a chemical, which is derived from furfural. Furfuryl alcohol plays a vital role in the production of foundry sand binders due to its high reactivity. This alcohol has been extensively used for producing cores and mold for metal for many decades. It is also used in the production of tetrahydrofurfuryl alcohol (THFA), which is widely used in the pharmaceutical industry. According to the World Foundry Organization, the foundry industry is expected to grow by 13.0-14.0% until 2025 in India, which is expected to be the second-largest foundry market in the world, after China. Therefore, the growing foundry industry is leading to the demand for furfuryl alcohol, thereby boosting the market for furfural.

Restraint: Availability of crude oil-based alternatives

The availability of crude oil-based alternative products, which are relatively cheaper, is restraining the market for furfural. Furan resin is used in the foundry industry for preparing binders. However, phenolic resin, which is obtained from crude oil, is cheaper than furan resin, according to various primary respondents. Also, butanediol (BDO) is used in polytetramethylene ether glycol (PTMEG) for the production of spandex, which is used in the textile industry. THF, which is a derivative of furfural, can be used for the production of spandex, but its higher cost due to the processing of furfural makes it less preferable than BDO.

Opportunity: Emerging demand for furfural derivatives (apart from furfuryl alcohol) in various applications

An increase in the demand for spandex from the textile & apparel industry is being witnessed due to its high strength and elastic properties. The changing textile industry and increasing awareness about health have helped the growth of the spandex fibers market in recent years. This is likely to drive the market for PTMEG, which is an application of THF. THF is one of the furan derivatives manufactured with the use of furfural. Polyurethane (PU) is another chemical, which is produced from PTMEG. PU is widely used in various industries, such as apparel, appliances, automotive, construction, flooring, furnishing, marine, and medical. PU foam is highly preferred for automotive interiors and also for thermal insulation in buildings due to its energy efficiency properties. China is the major consumer and producer of PU in the world, and hence a favorable market scenario in APAC is expected to drive the demand for PU during the forecast period, in turn creating opportunities for the furfural manufacturers.

Challenge: Low yield of furfural from traditional technology

Furfural is a chemical, which is obtained from biomass and is transformed into various chemical compounds and fuels using the most known method, the Quaker Oats method. Many technologies have been developed to valorize agricultural feedstocks or wood residues to manufacture furfural. One of them is the Supra Yield technology, which provided a yield of about 70.0% in pilot-scale studies. However, the commercial implementation of this technology could not deliver the returns obtained in pilot studies. Besides, several research studies have been made focusing on understanding the reaction mechanisms for furfural manufacturing from agricultural/wood residues. The current focus is on scaling up these studies to improve the yield of furfural on a commercial scale.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD, thousand), Volume (tons) |

|

Segments covered |

By Application and By Raw Materials |

|

Geographies covered |

Americas, Europe, APAC, Middles East & Africa |

|

Companies covered |

Transfuran Chemicals (Belgium), Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa), Hongye Holding Group Corporation (China), KRBL(India), Lenzing (Austria), Tanin (Slovenia), and Shandong Crownchem Industries (China) |

This research report categorizes the global furfural market based on application, raw material, and region.

Based on application:

- Derivatives

- Solvent

- Others (pharmaceutical, agriculture and food & beverage)

Based on raw material:

- Sugarcane Bagasse

- Corncob

- Rice Husk

- Others (wood chips, oat hulls, and cotton husks)

Based on region:

- Americas

- Europe

- APAC

- Middle East & Africa

Key Market Players

Transfuran Chemicals (Belgium), Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa)

Key Questions Answered

- What was the market size of furfural in 2018?

- What are the global trends in demand for furfural?

- Will the market witness an increase or a decline in demand in the near future?

- What were the revenue pockets for furfural in 2018?

Frequently Asked Questions (FAQ):

What are the major drivers leading the growth of furfural market?

As the chemical industry is looking to reduce the carbon footprints alternatives for fossil resources are gaining importance. Apart from this the demand for furfural alcohol is also increasing from the growing foundry industry to be used as binders especially in China and India.

Who are the major players in the furfural market?

Major players in the market are Central Romana Corporation (Dominican Republic), Pennakem (US), Illovo Sugar Africa (South Africa), Lenzing (Austria) and Transfurans Chemicals (Belgium).

Are there any issues faced by the furfural manufacturers in the market?

The availability of fossil fuel based products that relatively cheaper than the furfural based products is hampering the growth of the market. For instance, furan resin is used for the binders in foundry industry but most of the time phenolic resin, which is obtained from crude oil, is used due to its lower cost.

What are the factors that determine the price of furfural?

Price of furfural differs according to the raw materials used in the production. Manufacturers in different region use different raw materials depending upon the availability of agriculture residues. Apart from this processing and transportation cost of raw material is also included in the final price.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.3 Market Size Estimation

2.1.3.1 Market Size Estimation: Top-Down Approach

2.1.3.2 Market Size Estimation: Bottom-Up Approach

2.2 Data Triangulation

2.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Furfural Market

4.2 APAC Furfural Market, By Country and Application, 2018

4.3 Furfural Market, By Key Countries

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Furfuryl Alcohol

5.2.1.2 Shift Toward Renewable Chemicals

5.2.2 Restraints

5.2.2.1 Availability of Crude Oil-Based Alternatives

5.2.3 Opportunities

5.2.3.1 Emerging Demand for Furfural Derivatives (Apart From Furfuryl Alcohol) in Various Applications

5.2.4 Challenges

5.2.4.1 Low Yield of Furfural From Traditional Technology

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Furfural Patent Analysis

5.4.1 Insights

6 Furfural Market, By RaW Material (Page No. - 37)

6.1 Introduction

6.2 Sugarcane Bagasse (Scb)

6.2.1 A Sustainable Sugar Industry By-Product, Scb is Available in Abundance in All Regions

6.3 Corncob

6.3.1 Corncob Consists of the Highest Hemicellulose Content of All the RaW Materials for Furfural

6.4 Rice Husk

6.4.1 Rice Husk Has the Lowest Content of Hemicellulose

6.5 Others

7 Furfural Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Derivatives

7.2.1 Huge Demand for Furfural in the Manufacturing of Furfuryl Alcohol is Driving the Market in This Segment

7.3 Solvent

7.3.1 The Non-Toxicity of Furfural Makes It A Suitable Alternative to Phenols for the Refining of Lubricant Oils Through Solvent Extraction

7.4 Others

8 Furfural Market, By Region (Page No. - 50)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Backed By A Strong Pharmaceuticals Market, China is the Largest Producer of Furfural in the World

8.2.2 Thailand

8.2.2.1 The Furfural Market in Thailand is Expected to Be Driven By the Rising Sportswear Industry During the Forecast Period

8.2.3 India

8.2.3.1 The Pharmaceutical Industry is One of the Major Drivers for the Market in the Country

8.2.4 Rest of APAC

8.3 Europe

8.3.1 Belgium

8.3.1.1 The Presence of the World’s Largest Furfuryl Alcohol Plant Makes the Country A Major Market

8.3.2 Netherlands

8.3.2.1 Imports and Exports of Furfural are Driving the Market in the Country

8.3.3 Germany

8.3.3.1 The Growing Foundry Industry is Boosting the Demand for Furfural

8.3.4 Rest of Europe

8.4 Middle East & Africa

8.4.1 South Africa

8.4.1.1 A Significant Amount of Furfural Manufactured in the Country is Exported to APAC and European Countries

8.4.2 Algeria

8.4.2.1 As the Largest Importer of Furfural in Africa, Algeria Holds Growth Potential for the Market

8.4.3 Rest of Middle East & Africa

8.5 Americas

8.5.1 US

8.5.1.1 The Growing Sportswear Market is Expected to Drive the Market in the Country

8.5.2 Rest of Americas

9 Company Profiles (Page No. - 80)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis)*

9.1 Central Romana Corporation

9.2 Pennakem

9.3 Illovo Sugar Africa

9.4 Lenzing

9.5 Transfurans Chemicals

9.6 Silvateam

9.7 Hongye Holding Group Corporation

9.8 KRBL

9.9 Tanin

9.10 Shandong Crownchem Industries Limited

9.11 Additional Players

9.11.1 Laxmi Furals Private Limited

9.11.2 Xingtai Chunlei Furfuryl Alcohol

9.11.3 Shanghai Ruizheng Technology

9.11.4 Hefei Tnj Chemical Industry

9.11.5 Zhucheng Taisheng Chemical

9.11.6 NC Nature Chemicals

9.11.7 Furnova Polymers

9.11.8 TCI Chemicals

9.11.9 Beijing Lys Chemicals

9.11.10 Aurus Specialty Chemicals

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis)*

10 Appendix (Page No. - 96)

10.1 Discussion Guide

10.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.3 Available Customizations

10.4 Related Reports

10.5 Author Details

List of Tables (112 Tables)

Table 1 Top 30 Chemicals That Can Be Obtained From Biomass

Table 2 Furfural Yield From Different Types of RaW Materials

Table 3 Furfural Market Size, By RaW Material, 2017–2024 (Ton)

Table 4 Furfural Market Size, By RaW Material, 2017–2024 (USD Thousand)

Table 5 Sugarcane Bagasse: Furfural Market Size, 2017–2024 (Ton)

Table 6 Sugarcane Bagasse: Furfural Market Size, 2017–2024 (USD Thousand)

Table 7 Corncob: Furfural Market Size, 2017–2024 (Ton)

Table 8 Corncob: Furfural Market Size, 2017–2024 (USD Thousand)

Table 9 Rice Husk: Furfural Market Size, 2017–2024 (Ton)

Table 10 Rice Husk: Furfural Market Size, 2017–2024 (USD Thousand)

Table 11 Other RaW Materials: Furfural Market Size, 2017–2024 (Ton)

Table 12 Other RaW Materials: Furfural Market Size, 2017–2024 (USD Thousand)

Table 13 Furfural Market Size, By Application, 2017–2024 (Ton)

Table 14 Furfural Market Size, By Application, 2017–2024 (USD Thousand)

Table 15 Furfural Market Size, By Derivatives, 2017–2024 (Ton)

Table 16 Furfural Market Size, By Derivatives, 2017–2024 (USD Thousand)

Table 17 Furfural Market Size in Derivatives Application, By Region, 2017–2024 (Ton)

Table 18 Furfural Market Size in Derivatives Application, By Region, 2017–2024 (USD Thousand)

Table 19 Furfural Market Size in Furfuryl Alcohol Manufacturing Application, By Region, 2017–2024 (Ton)

Table 20 Furfural Market Size in Furfuryl Alcohol Manufacturing Application, By Region, 2017–2024 (USD Thousand)

Table 21 Furfural Market Size in Other Derivatives, By Region, 2017–2024 (Ton)

Table 22 Furfural Market Size in Other Derivatives, By Region, 2017–2024 (USD Thousand)

Table 23 Furfural Market Size in Solvent Application, By Region, 2017–2024 (Ton)

Table 24 Furfural Market Size in Solvent Application, By Region, 2017–2024 (USD Thousand)

Table 25 Furfural Market Size in Other Applications, By Region, 2017–2024 (Ton)

Table 26 Furfural Market Size in Other Applications, By Region, 2017–2024 (USD Thousand)

Table 27 Furfural Market Size, By Region, 2017–2024 (Ton)

Table 28 Furfural Market Size, By Region, 2017–2024 (USD Thousand)

Table 29 APAC: Furfural Market Size, By Country, 2017–2024 (Ton)

Table 30 APAC: Market Size, By Country, 2017–2024 (USD Thousand)

Table 31 APAC: Market Size, By RaW Material, 2017–2024 (Ton)

Table 32 APAC: Market Size, By RaW Material, 2017–2024 (USD Thousand)

Table 33 APAC: Market Size, By Application, 2017–2024 (Ton)

Table 34 APAC: Market Size, By Application, 2017–2024 (USD Thousand)

Table 35 APAC: Market Size, By Derivative, 2017–2024 (Ton)

Table 36 APAC: Market Size, By Derivative, 2017–2024 (USD Million)

Table 37 China: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 38 China: Market Size, By Application, 2017–2024 (USD Thousand)

Table 39 China: Market Size, By Derivative, 2017–2024 (Ton)

Table 40 China: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 41 Thailand: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 42 Thailand: Market Size, By Application, 2017–2024 (USD Thousand)

Table 43 Thailand: Market Size, By Derivative, 2017–2024 (Ton)

Table 44 Thailand: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 45 India: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 46 India: Market Size, By Application, 2017–2024 (USD Thousand)

Table 47 India: Market Size, By Derivative, 2017–2024 (Ton)

Table 48 India: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 49 Rest of APAC: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 50 Rest of APAC: Market Size, By Application, 2017–2024 (USD Thousand)

Table 51 Rest of APAC: Market Size, By Derivative, 2017–2024 (Ton)

Table 52 Rest of APAC: Market Size, By Derivative, 2017–2024 (USD Million)

Table 53 Europe: Furfural Market Size, By Country, 2017–2024 (Ton)

Table 54 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 55 Europe: Market Size, By RaW Material, 2017–2024 (Ton)

Table 56 Europe: Market Size, By RaW Material, 2017–2024 (USD Thousand)

Table 57 Europe: Market Size, By Application, 2017–2024 (Ton)

Table 58 Europe: Market Size, By Application, 2017–2024 (USD Thousand)

Table 59 Europe: Market Size, By Derivative, 2017–2024 (Ton)

Table 60 Europe: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 61 Belgium: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 62 Belgium: Market Size, By Application, 2017–2024 (USD Thousand)

Table 63 Belgium: Market Size, By Derivative, 2017–2024 (Ton)

Table 64 Belgium: and Its Derivatives Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 65 Netherlands: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 66 Netherlands: Market Size, By Application, 2017–2024 (USD Thousand)

Table 67 Netherlands: Market Size, By Derivative, 2017–2024 (Ton)

Table 68 Netherlands: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 69 Germany: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 70 Germany: Market Size, By Application, 2017–2024 (USD Thousand)

Table 71 Germany: Market Size, By Derivative, 2017–2024 (Ton)

Table 72 Germany: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 73 Rest of Europe: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 74 Rest of Europe: Market Size, By Application, 2017–2024 (USD Thousand)

Table 75 Rest of Europe: Market Size, By Derivative, 2017–2024 (Ton)

Table 76 Rest of Europe: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 77 Middle East & Africa: Furfural Market Size, By Country, 2017–2024 (Ton)

Table 78 Middle East & Africa: Market Size, By Country, 2017–2024 (USD Thousand)

Table 79 Middle East & Africa: Market Size, By RaW Material, 2017–2024 (Ton)

Table 80 Middle East & Africa: Market Size, By RaW Material, 2017–2024 (USD Thousand)

Table 81 Middle East & Africa: Market Size, By Application, 2017–2024 (Ton)

Table 82 Middle East & Africa: Market Size, By Application, 2017–2024 (USD Thousand)

Table 83 Middle East & Africa: Market Size, By Derivative, 2017–2024 (Ton)

Table 84 Middle East & Africa: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 85 South Africa: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 86 South Africa: Market Size, By Application, 2017–2024 (USD Thousand)

Table 87 South Africa: Market Size, By Derivatives, 2017–2024 (Ton)

Table 88 South Africa: Market Size, By Derivatives, 2017–2024 (USD Thousand)

Table 89 Algeria: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 90 Algeria: Market Size, By Application, 2017–2024 (USD Thousand)

Table 91 Algeria: Market Size, By Derivative, 2017–2024 (Ton)

Table 92 Algeria: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 93 Rest of Middle East & Africa: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 94 Rest of Middle East & Africa: Market Size, By Application, 2017–2024 (USD Thousand)

Table 95 Rest of Middle East & Africa: Market Size, By Derivative, 2017–2024 (Ton)

Table 96 Rest of Middle East & Africa: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 97 Americas: Furfural Market Size, By Country, 2017–2024 (Ton)

Table 98 Americas: Market Size, By Country, 2017–2024 (USD Thousand)

Table 99 Americas: Market Size, By RaW Material, 2017–2024 (Ton)

Table 100 Americas: Market Size, By RaW Material, 2017–2024 (USD Thousand)

Table 101 Americas: Market Size, By Application, 2017–2024 (Ton)

Table 102 Americas: Market Size, By Application, 2017–2024 (USD Thousand)

Table 103 Americas: Market Size, By Derivative, 2017–2024 (Ton)

Table 104 Americas: Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 105 US: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 106 US: Market Size, By Application, 2017–2024 (USD Thousand)

Table 107 US: Market Size, By Derivative, 2017–2024 (Ton)

Table 108 US: and Its Derivatives Market Size, By Derivative, 2017–2024 (USD Thousand)

Table 109 Rest of Americas: Furfural Market Size, By Application, 2017–2024 (Ton)

Table 110 Rest of America: Market Size, By Application, 2017–2024 (USD Thousand)

Table 111 Americas: Furfural Market Size, By Derivative, 2017–2024 (Ton)

Table 112 Americas: Market Size, By Derivative, 2017–2024 (USD Thousand)

List of Figures (26 Figures)

Figure 1 Furfural Market: Research Design

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Data Triangulation: Furfural Market

Figure 5 Derivatives Application Accounted for the Largest Market Share in 2018

Figure 6 Corncob Was the Largest RaW Material Segment of the Market in 2018

Figure 7 APAC to Be the Fastest-Growing Market for Furfural

Figure 8 Increasing Demand From APAC to Drive the Furfural Market

Figure 9 China and Derivatives Segment Accounted for the Largest Shares in the APAC Furfural Market

Figure 10 China to Grow at the Highest Rate

Figure 11 Drivers, Restraints, Opportunities, and Challenges in the Furfural Market

Figure 12 Furfural Market: Porter’s Five Forces Analysis

Figure 13 Publication Trends - Last 4 Years

Figure 14 Trend Analysis and Graphical Representation

Figure 15 Top Assignees

Figure 16 Corncob Segment Dominated the Furfural Market, By RaW Material in 2018

Figure 17 Derivatives Segment Was the Dominating Application of Furfural in 2018

Figure 18 APAC: Furfural Market Snapshot

Figure 19 Europe: Furfural Market Snapshot

Figure 20 Americas: Furfural Market Snapshot

Figure 21 Central Romana Corporation: SWOT Analysis

Figure 22 Pennakem: SWOT Analysis

Figure 23 Illovo Sugar Africa: SWOT Analysis

Figure 24 Lenzing: Company Snapshot

Figure 25 Lenzing: SWOT Analysis

Figure 26 KRBL: Company Snapshot

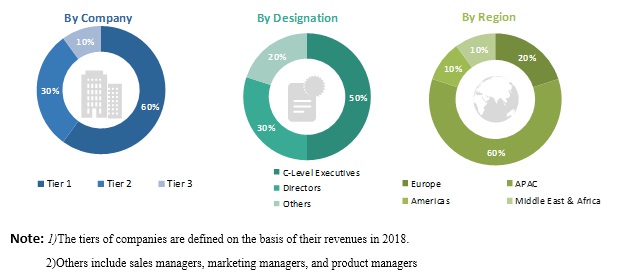

The study involves four major activities in estimating the current market size of furfural. Exhaustive secondary research was done to collect information related to the furfural market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The furfural market comprises several stakeholders, such as raw material suppliers, technology developers, derivatives manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of application usage. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global furfural market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size included the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable. To complete the overall market estimation process and arrive at the exact statistics for all segments and sub-segments. Data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches

Report Objectives

- To define, describe, and forecast the market size of furfural, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market size on the basis of application and raw material

- To forecast the market size of different segments with respect to four regions, namely, APAC, Europe, the Americas, and the Middle East and Africa.

- To forecast the market size of different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of a region with respect to a particular country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Growth opportunities and latent adjacency in Furfural Market