Gas Sensors Market by Gas Type (Oxygen, Carbon Monoxide, Carbon Dioxide, Nitrogen Oxide, Volatile Organic Compounds, Hydrocarbons), Technology, Output Type, Product Type, Application and Region - Global Forecast to 2027

Updated on : March 23, 2023

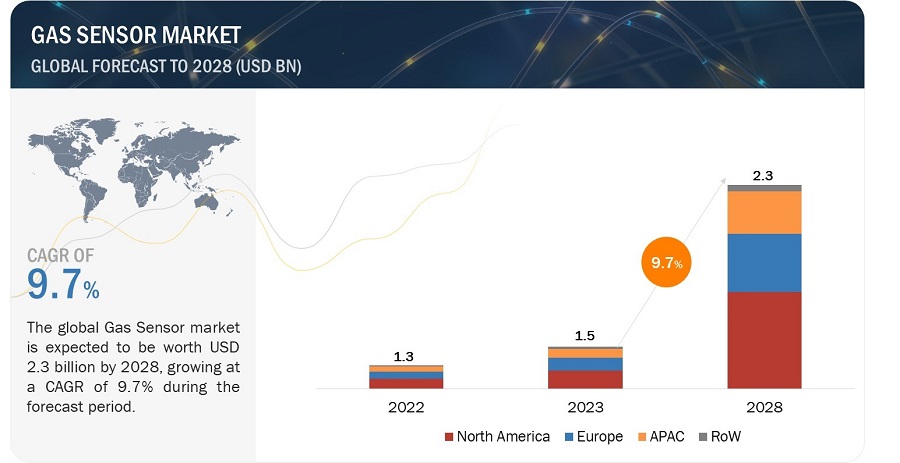

The gas sensors market is projected to reach USD 2.1 Billion by 2027, growing at a CAGR of 8.9% during the forecast period.

The formulation and implementation of various health and safety regulations across the world, increased adoption of gas sensors in HVAC systems and air quality monitors, rise in demand for gas sensors in critical industries, increased air pollution level, and the need to monitor air quality in smart cities are the factors driving the growth of the gas sensors industry.

Networking of gas sensors through the internet of things (IoT), cloud computing, and big data; the rising adoption of gas sensors in consumer electronic devices; growing involvement of several private and public organizations to create awareness among masses for air quality monitoring, and the increasing demand for miniaturized wireless gas sensors across the world are expected to present growth opportunities for the market players. Operational issues faced by electrochemical sensors act as a challenge to the growth of the gas sensor market.

The objective of the report is to define, describe, and forecast the gas sensor market based on product, gas type, technology, connectivity, output type, application, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Gas Sensors Market Dynamics

Drivers: Rising demand for gas sensors in critical industries

The market for gas sensors is growing due to an increase in demand in essential industries. A large number of gases such as carbon monoxide, carbon dioxide, ammonia, hydrogen sulfide, and hydrocarbons are released into the air by these critical industries.

Excess emissions of these gases in the air can adversely affect human health. Several regulatory bodies are implementing various regulations to secure the ecosystem from harmful gases. The US, the UK, Germany, China, and France have laid various regulations to prevent the emission of harmful gases into the air. The gases produced in the chemical industry are used at low flashpoints with lower explosive limits (LEL) and a wide flammable/explosive range.

However, the chances of accidents caused by these gases can be reduced with the continuous use of gas monitors and detectors equipped with gas sensors. Furthermore, power industry also releases flue gas into the atmosphere that is generated from the combustion of fossil fuels. It also contains mercury, traces of other metals, and fly ash if it is released from coal-fired plants. This leads to the need for detecting and monitoring these gases as well as taking corrective measures so that a limited amount of such gases is released directly into the atmosphere.

Restraints: Intense pricing pressure resulting in decline in average selling prices

While the widespread applications of gas sensors in automobiles, HVAC systems, air quality monitoring systems, and consumer devices lead to increased shipments of these sensors, the sales growth is significantly restrained by price erosion.

This is partially a result of the intense competition among the rising number of sensor manufacturers. Several companies are channeling their research and development activities toward providing cost-effective gas sensor solutions that use MEMS technology and developing IoT-compatible sensors. This results in pricing pressure, especially for applications where gas sensors are used in high volume. Consequently, manufacturers are compelled to decrease the potential price of gas sensors.

While the reduction in ASP is beneficial for consumers, it results in shrinking profit margins for suppliers. Thus, intense pricing pressure results in a fall in the average selling price (ASP), which hampers revenue growth in the highly competitive gas sensor market.

Opportunities: Rising deployment of IoT, cloud computing, and big data in gas sensors

IoT plays a key role in the information technology sector. It refers to a network of sensors formed by the integration of various information-sensing devices with the internet.

Moreover, IoT creates a huge demand for advanced connected devices enabling M2M and interoperation with other devices according to the requirement of the connected environment. For instance, Renesas’ 32-bit RX130 MCU is connected to the sensor network by a smart Wi-Fi module to feed the data to a suitable gateway and then connects to the cloud, which detects flammable gases present in the environment. The increasing use of mobile devices and the growing demand for IoT, coupled with advancements in cloud computing and big data analytics, have led to the need for gas sensors with new and advanced gas sensing capabilities.

Further, various start-ups are investing to develop a network of sensors capable of providing pollution data using gas sensors. For instance, Aclima, a US-based company specializing in the design and deployment of environmental sensor networks, uses the Google Cloud platform to analyze data to measure, map, and understand the air quality across various cities in the US. It collects environmental data from 2 billion data points daily. Such uses serve as an opportunity for the market.

Challenges: Technical issues such as high energy consumption

The gas sensor market is expanding at a significant pace owing to COVID-19. However, certain technical issues might limit the growth of the market. High energy consumption, sensitivity to environmental conditions, high cost, and difficulty in fabrication are a few of the major problems associated with gas sensors.

Gas sensors require proper and timely maintenance and replacement to avoid problems related to accuracy, and sensitivity. The cost of gas sensors is also high due to the complexity involved in the manufacturing process. The development and commercialization of new gas sensors are highly challenging and time-consuming, which also increases the cost.

Thus, the development cycle of new and innovative gas sensors is lengthy and must meet stringent regulations as well as performance requirements, which can prove to be a challenge in this situation.

Gas Sensors Market Segment Overview

Gas Detector to witness significant share in the gas sensor market

Gas detectors hold a significant share in the gas sensor product type segment. Gas detectors are important devices required for the overall safety of premises, especially in industries producing potentially dangerous chemicals and gases during the manufacturing process.

The major application areas of these gas detectors are in the automotive, metal & chemical, oil & gas, food & beverage, mining, medical, and power station industries. Further, the surging adoption of gas detection products and growing product & development strategies from major market players are driving the market growth.

For instance, in 2021, Honeywell launched two new Bluetooth-connected gas detectors that can deliver continuous monitoring for dangerous gases even in fog, rain, snow, and other inclement weather conditions, helping facilities keep their oil and gas, petrochemical, chemical, and other workers and industrial sites safe.

Smart cities & building automation to create lucrative growth opportunities for gas sensors during the forecast period

Air quality monitoring is required for both indoor and outdoor environments and can be accomplished using a number of gas sensor units distributed over the required area to measure the levels of various critical gases, including CO, hydrogen sulfide (H2S), and nitrogen dioxide (NO2).

In smart cities, gas sensors can be used for various environmental monitoring applications for monitoring air quality, which includes weather stations and monitoring of the environment at public places. The HVAC system is used for building applications to monitor and regulate environmental conditions in all types of buildings. Ventilation units are used to control the concentrations of gaseous compositions of indoor air, which is based on measurements conducted using gas sensors.

The most common gas sensors used in HVAC systems are CO2, NOx, CO, O2, and VOC. The rising environmental pollution levels and increasingly degrading indoor air quality have created a significant demand for gas sensors for HVAC applications.

Smart cities & building automation to create lucrative growth opportunities for gas sensor during the forecast period

Oxygen sensors are mainly used to monitor the air quality and combustion of gases in automobile and industrial applications. The concentration of oxygen can be measured in the air or dissolved water in parts per million (ppm).

Gas sensors are used to detect the level of oxygen in a wide range of end-use applications such as automobiles, smart cities & building automation, the food & beverage industry, the medical industry, the oil & gas industry, and water treatment plants. Major companies that provide oxygen sensors are City Technology (UK), MEMBRAPOR (Germany), Alphasense (UK), Figaro Engineering (Japan), and Dynament (UK), among others.

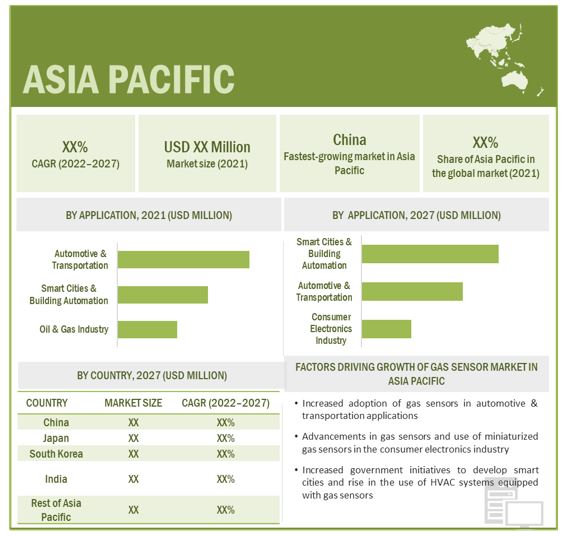

Gas sensors market to witness highest demand in APAC region

According to GSMA (Groupe Speciale Mobile Association) Intelligence, Asia Pacific has the largest number of smartphone users in the world, and advancements in gas sensing technology are expected to lead to the integration of gas sensors with smartphones, smart bands, and tablets.

This, in turn, is expected to fuel the growth of the gas sensors market in the region. Growing awareness among people regarding the impact of air pollution on human health is also fuelling the demand for smart air quality monitors, smart bands, air purifiers, and air cleaners equipped with gas sensors. China plays a significant role in the gas sensor market as it is one of the leading automobile manufacturers in the world.

According to the International Trade Organization, automobile production in China is the largest in the world, and the country has a significant number of smart city projects. The automotive and smart cities & building automation sectors are expected to significantly contribute to the growth of the gas sensor market in the country. Several other industries, such as mining, chemical, and energy, as well as oil refineries of the country also use gas sensors.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Gas Sensors Industry

Major gas sensors companies are include Honeywell Analytics (UK), Amphenol (US), Figaro Engineering (Japan), Alphasense Ltd. (UK), Sensirion AG (Switzerland), Dynament Ltd. (UK), ams AG (Austria), MEMBRAPOR AG (Switzerland), and Senseair AB (Sweden), among others.

Gas Sensors Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.4 Billion |

|

Market Size Value in 2027 |

USD 2.1 Billion |

|

Growth Rate |

CAGR of 8.9% |

|

Market Size Available for Years |

2018-2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022-2027 |

|

Units |

Value (USD Million/Billion), Volume (Million Units) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

|

| Largest Growing Region | APAC |

| Largest Market Share Segment | Gas Detector |

| Largest Growth Segment | Smart Cities & Building Automation |

| Key Market Drivers | Rising demand for gas sensors in critical industries |

| Key Market Opportunity | Rising deployment of IoT, cloud computing, and big data |

This report categorizes the gas sensor market based on product, gas type, technology, connectivity, output type, application, region.

Gas Sensors Market, by Product:

- Gas Analyzers & Monitors

- Gas Detectors

- Air Quality Monitors

- Air Purifiers/Air Cleaners

- HVAC Systems

- Medical Equipment

- Consumer Devices

Market, by Gas Type:

- Oxygen (O2)

- Carbon Monoxide (CO)

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Chlorine (Cl)

- Hydrogen Sulfide (H2S)

- Nitrogen Oxide (NOx)

- Volatile Organic Compounds

- Sulfur Dioxide (SO2)

- Methane (CH4)

- Hydrocarbons

- Hydrogen

Market, by Technology:

- Electrochemical

- Photoionization Detection (PID)

- Solid-State/Metal-Oxide-Semiconductors (MOS)

- Catalytic

- Infrared

- Laser

- Zirconia

- Holographic

- Others (Paramagnetic, Flame Ionization Detection (FID), Chemiluminescence, Carbon Nanotubes, Polymers, and Ultraviolet)

Market, by Connectivity:

- Wired

- Wireless

Market, by Output Type:

- Analog

- Digital

Market, by Output Type:

- Automotive & Transportation

- Smart Cities & Building Automation

- Oil & Gas Industry

- Water & Wastewater Treatment

- Food & Beverage Industry

- Power Stations

- Medical Industry

- Metal & Chemical Industry

- Mining Industry

- Consumer Electronics Industry

Gas Sensors Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- Finland

- Italy

- UK

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of APAC

-

RoW

- Middle East

- South America

Recent Developments in Gas Sensors Industry

- In April 2022, MSA Safety, Incorporated launched its latest industry game-changer – the ALTAIR io 4 Gas Detection Wearable devices. the ALTAIR io 4 device represents the hardware portion of a cloud-ready suite of technology that MSA calls the Connected Work Platform.

- In April 2022, Sensirion presented its SEN50 and SEN55 environmental sensing solutions for measuring relevant environmental parameters. The SEN50 environmental node is a part of the SEN5x series and represents a straightforward sensor solution platform for the accurate measurement of particulate matter.

- In February 2021, Sensirion AG completed the acquisition of Qmicro B.V., an innovative OEM supplier of miniaturized gas-analysis technologies. With this acquisition, Sensirion expanded its gas sensing portfolio from components and modules to stand-alone micro gas analyzers for industrial applications.

- In April 2021, Amphenol Corporation completed its acquisition of MTS Systems Corporation. Amphenol expects MTS Sensors business to add ~ USD 350 million in sales in the first twelve months after closing. As previously disclosed, MTS Sensors is expected to be increased by USD 0.05 to Amphenol’s earnings per share in the first twelve months after closing, which excludes acquisition-related expenses and reflects the company’s recent 2-for-1 stock split.

Frequently Asked Questions (FAQs):

How big gas sensors market?

The gas sensors market is projected to grow from USD 1.4 Billion in 2022 to USD 2.1 Billion by 2027; it is expected to grow at a CAGR of 8.9% during the forecast period.

Which is the potential market for oxygen gas sensor in terms of the application?

Consumer electronics is the region with high growth opportunities owing to advancements in wearable devices and IoT technology. Major companies that provide oxygen sensors are City Technology (UK), MEMBRAPOR (Germany), Alphasense (UK), Figaro Engineering (Japan), and Dynament (UK), among others.

What are the opportunities for new market entrants?

Factors such as rising deployment of IoT, cloud computing, and big data in gas sensors, growing adoption of gas sensors in consumer electronics, and increasing demand for miniaturized wireless gas sensor are creating opportunities for the players in the market.

Which applications are expected to drive the growth of the market in the next six years?

Smart cities & building automation is expected to remain the major application driving significant demand for gas sensors. In smart cities, gas sensors can be used for various environmental monitoring applications for monitoring air quality, which includes weather stations and monitoring of the environment at public places. Major gases that are monitored include CO, CO2, SO2, NO, NO2, and VOCs. Earlier, gas detectors were used to detect a single gas; however, modern units detect several toxic or combustible gases or even a combination of both. Further, several companies have shifted their focus toward the high-growth segments such as smart cities and building automation applications through more aggressive marketing of gas sensor models appropriate for respective OEMs. Companies such as AlphaSense (UK), Membrapor AG (Germany), and Figaro Engineering (Japan) have revised their strategies to capture maximum share in the high-growth markets and are driving market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

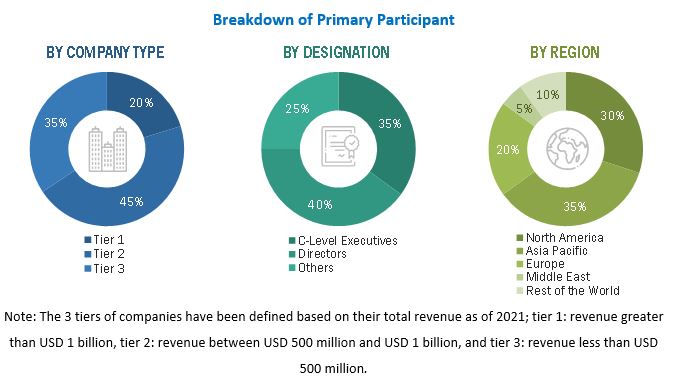

This section of the report helps in understanding the methodology implemented for developing the gas sensor market report. This research study involves extensive use of secondary sources, directories, and databases (such as annual reports or presentations of companies, industry association publications, directories, technical handbooks, World Economic Outlook (WEO), trade websites, Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the gas sensor market. Primary sources mainly comprise several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, system providers, technology developers, alliances, and standards and certification organizations related to the various phases of this industry’s value chain.

In-depth interviews have been conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess prospects. The following figure shows the market research methodology applied in making this report on the gas sensor market.

Secondary Research

The secondary sources referred to for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers and certified publications, directories, and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottommost level, geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative information and quantitative data for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the gas sensor market.

Extensive primary research has been conducted after acquiring knowledge about the gas sensor market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand (end-user industries) and supply (gas sensor manufacturers and distributors) sides across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% and 75% of the primary interviews have been conducted with the demand and supply sides, respectively. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and validate the size of the gas sensor market and its subsegments listed in this report. The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of the annual and financial reports of the top market players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Gas sensor Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the gas sensor market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To define and forecast the size of the gas sensor market based on product, gas type, technology, connectivity, output type, application, and region in terms of value and volume

- To describe and forecast the size of gas detector and air quality monitors used in the gas sensor market

- To describe and forecast the size of the gas sensor market in five key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the gas sensor market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, and partnerships, in the gas sensor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gas Sensors Market

We need information regarding Gas sensors specifically in the medical industry. In Europe, Ireland and UK are the target markets, this is required for university research project.

AerNos will change the world

HVAC comprises a number of gas sensors uses to monitor the indoor air and control the ventilation. Do you have gas sensor data for HVAC applications in APAC?

Does the report include price and necessary measurement rages for low cost MOX sensors? Can you provide any comparison of these sensors with Electrochemical sensors?

Could I get a sample report? I want to get a sense of what type of data I would get if we buy this report

The government mandates is one of the major factor influencing the growth of gas sensor market. What would be impact of government mandates in long term like after 3 years and 5 years?

I need to know some additional coverage details on this report, specifically if the gas type is expanded beyond the description. BTEX, bio-aerosols, microorganism's, and other carbon/biologic compounds are of specific interest.

The VOC sensor is widely used these days in smart cities and building applications. How do you look towards the use of VOCs in consumer electronics applications? Do you have VOC market estimations for various applications?

There has been a huge research in the use of miniaturized and wireless gas sensors. How do you look towards the use of miniaturized gas sensors used in portable sensors? Do you have MEMS gas sensor forecasts for next 5 years?

We are building an application that uses sensors and provides critical alarms for threshold violations. This report will help us to gauge the market and align our product accordingly. Can you share the report brochure or sample?

Good evening, I'm an Italian student and for study purposes, I'm interested in the market forecasts for MOS-type gas sensors only. Aware I'm asking a lot, do you think I could have some information in that field only?

I am a graduate student researching gas sensor use cases and market sizing in smart cities. Specifically I am interested in optical and metal oxide detectors.

We are looking for market sizes of Gas sensors for gases like ammonia, CO, hydrocarbons. Further, we are more interested in Electrochemical type gas sensors.

We’d mainly like to know the below points. As you may guess, we are working on an investigation into specifically CO2 sensor companies market analysis and opportunity. 1. Market size transition (actual to forecast) of CO2 Sensors market by below segments and factors. A) For building use B) For smart house use C) For automotive use D) For IoT use 2. Competitor intelligence (incl. strategy, SWOT analysis) A) Sense Air - Sweden B) Amphenol – U.S. C) Cubic - China D) Figaro Engineering - Japan E) Others

Automotive and transportation sector is the most important application of gas sensors. Do you have market estimations for oxygen and NOx gas sensors used for the monitoring of in-cabin air quality monitoring?

I am a doctoral student with specialization in gas sensor field. I want to learn more from the report brochure so that I could better understand industry dynamics in this field. Can you please share the brochure with me?

Does the report provide insights on MEMS-based gas sensors and their market potential in general and especially in consumer electronics, environmental and building automation applications?