Gas Separation Membranes Market by Material Type (Polyimide & Polyaramide, PS, CA), Application (N2 Generation & O2 Enrichment, HR, CO2 removal, Vapor/Gas Separation, Vapor/Vapor Separation, AD), Module (SW, HF) and Region - Global Forecast to 2026

Gas Separation Membranes Market

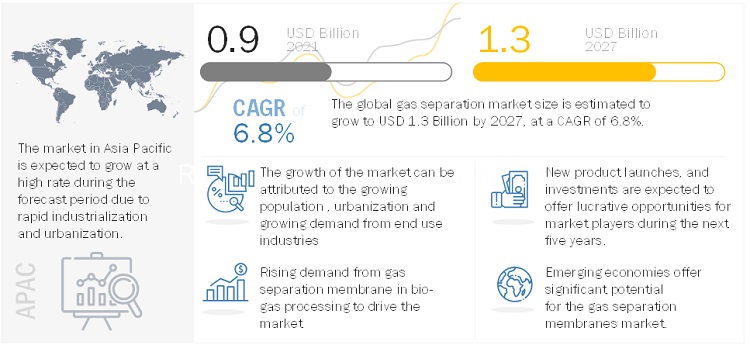

The gas separation membranes market was valued at USD 0.9 billion in 2021 and is projected to reach USD 1.3 billion by 2027, growing at a cagr 6.8% from 2022 to 2027. Gas separation membranes are used for degassing and separating gases from gas mixtures. Gas separation membranes are cost-effective due to low energy consumption and lower operation and maintenance cost. The gas separation membranes market is projected to register positive growth during the forecast period due to the increasing demand for biogas, shift from coal energy to natural gas, and increasing consumption of natural gas in developing economies. Various regulations regarding the plasticization of polymeric membranes have been issued, which is hampering the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Gas Separation Membranes Market Dynamics

Driver: Increasing demand for membranes in carbon dioxide separation processes

The separation of carbon dioxide from gas streams is one of the most important applications of gas separation membranes in various industries. It is used in gas sweetening (also known as purification of natural gas), enhanced oil recovery, and purification of biogas. Removal of carbon dioxide from natural gas is the largest application for gas separation membranes, followed by enhanced oil recovery. Carbon dioxide falls under the category of acid gases and is found in high levels in natural gas. It becomes highly corrosive when combined with water and corrodes pipelines and equipment. It also reduces the heating value of natural gas and pipeline capacity. In liquefied natural gas (LNG) plants, carbon dioxide must be removed to prevent freezing in low-temperature chillers. Thus, the removal of carbon dioxide is an important separation process for better transmission and processing of natural gas. A wide variety of gas removal technologies are available, such as the Benfield process, amine guard process, cryogenic process, pressure swing adsorption, thermal swing adsorption, and membranes. Each technology has its own advantages and disadvantages. However, membrane technology is increasingly used as it is economical and enables a significant amount of transmission of natural gas. These factors are expected to drive the gas separation membranes market in carbon dioxide removal application

Restraint: Technical disadvantages over other gas separation technologies

Currently, gas separation membranes are used only for moderate volume gas streams owing to flux and selectivity issues related to membranes. For large volume gas streams, membrane gas separation technology cannot compete with amine absorption technology, which is majorly used for carbon dioxide removal in natural gas, biogas, and others. Pressure swing adsorption technology is preferred for nitrogen generation & oxygen enrichment application over membrane separation technology owing to its higher efficiency. Pressure swing adsorption technology is less sensitive than the latter and is more reliable in harsh environments. High purity of 99.5%–99.9% is obtained by pressure swing adsorption technology, whereas membranes are restricted to around 95% purity levels. Additionally, the lifespan of pressure swing adsorption technology is much higher than that of membrane separation technology. These technical disadvantages are restricting the growth of the gas separation membranes market.

Opportunity: Development of mixed matrix membranes

End users prefer durable membrane materials having higher selectivity and permeability at lower costs owing to the economic competitiveness and challenges pertaining to extreme environments under which gas separating membranes function. R&D activities in inorganic membranes (ceramic, silica glass, and zeolites) have been trending in recent years. However, the costs involved in processing these membranes are three times more than that of polymeric membranes. In view of this, mixed matrix membranes are being developed to provide an alternative cost-effective membrane that combines homogeneously interpenetrating polymeric matrices for ease of processability and inorganic particle for high permeability and selectivity. These membranes are developed by mixing polymeric materials with zeolites or other molecular sieving media. These hybrid materials also offer the advantage of low cost and enhanced mechanical properties in comparison to typical inorganic membranes.

Challenge: Upscaling and commercializing new membranes

Most of the gas separation membranes developed by researchers are tested only in laboratories. Upscaling of new membranes technology will ensure reliability and durability. Upscaling also ensures the safe designing and operation of the membrane in real operating conditions through stress analysis in the field. However, testing the new membranes in the pilot plant and analyzing their performance is highly time-consuming and involves high installation cost. Therefore, most of the membranes developed in recent years are yet to be tested under real-time conditions, thus delaying their commercialization. The high cost and time consumption involved with upscaling and commercializing new products is a major challenge for the players in the market.

Polysulfone to register second-largest segment in the gas separation membranes market during the forecast period

Polysulfone is an organic polymer widely used due to the chemical and thermal stability provided to the membrane for gas separation. It is highly resistant to mineral acids, alkali, electrolytes, and oxidizing agents. Mechanically, it has high compaction resistance and is used under high pressures. Polysulfone membranes have reproducible properties and controllable size of pores, which can be reduced up to 0.04 microns. These membranes are majorly used in the automotive and electronic industries. Filter cartridges made from polysulfone membranes offer extremely high flow rates at very low differential pressures compared to nylon or polypropylene. Polysulfone is mainly used in gas separation applications due to its cost-effectiveness and properties, such as high rigidity, high strength, good creep resistance, and high heat deflection temperature.

Air dehydration is projected to grow at moderate rate in the gas separation membranes market in 2021

Air dehydration refers to the removal of moisture from humid air and is one of the largest membrane-based separation applications. Compressed air is passed through the membrane module, where water vapor molecules permeate through the membrane wall, leaving oxygen and nitrogen molecules to exit the unit as dry air. Membrane dehydration is commonly used in industries for the removal of moisture from pressurized air. Membranes for air dehydration are used in various applications, such as pneumatic controls, compression systems, power plants, aircraft carriers, point-of-use systems, dental tools, and spray-painting systems. The membrane system for air dehydration is widely used owing to its durability, cost-effectiveness, flexibility, ease of operation, and efficiency. Increasing demand from industries, such as electronics, packaging, and manufacturing, is driving the market in air dehydration application.

North America to register second-largest region in the gas separation membranes market during the forecast period

North America is the world's second-largest gas separation membranes market and accounted for a share of 25% in 2021, in terms of value. The US accounts for the major share of the North American gas separation membranes market due to the presence of a large number of manufacturers that have a wide geographical presence. Gas separation membranes are in high demand in this region due to the increasing demand for shale gas in the region. As compared to Canada and Mexico, the awareness and use of gas separation membranes began much earlier in the US. The carbon dioxide removal segment leads the North American gas separations membranes market, by application, due to the increasing demand for carbon dioxide removal in shale gas transmission in pipelines and to maintain methane/carbon dioxide ratio in biogas for vehicle and residential energy requirement purposes, especially in the US.

To know about the assumptions considered for the study, download the pdf brochure

Gas Separation Membranes Market Players

The key players in this market include Air Products and Chemicals, Inc. (US), Air Liquide Advanced Separations (France), Ube Industries Ltd. (Japan), Honeywell UOP (US), Fujifilm Manufacturing Europe B.V. (Netherlands), Schlumberger Ltd. (US), DIC Corporation (Japan), Parker Hannifin Corporation (US), Membrane Technology and Research, Inc. (US), and Generon, Inc. (US).

Recent Developments

- In November 2021, Honeywell announced collaboration with SK Innovation and Energy, a Korea-based energy refining company, for a feasibility study to retrofit SK's hydrogen plant with carbon capture. SK Innovation and Energy is expected to explore capturing and sequestering 400,000 tons of carbon dioxide (CO2) from existing hydrogen production facilities. Honeywell UOP has multiple technology offerings such as solvents, membranes, cryogenics, and pressure swing adsorption (PSA) systems that can be optimized to meet the project requirements.

- In June 2021, Air Products announced a new brand identity for its membrane business units, which will now all operate around the world as Air Products Membrane Solutions

- In July 2021, Air Liquide delivered the largest helium purification plant in Canada. The plant is expected to support North America Helium's site in southwest Saskatchewan, Canada. It is the largest helium production plant in Canada.

Frequently Asked Questions (FAQ):

Are there any regulations for gas separation membranes?

Several countries in Europe and North America have introduced regulations for this market. For e.g., In the US, Occupational Safety and Health Administration (OSHA) mandates industrial manufacturers to provide a secure working atmosphere for employees. The OSHA 29 CFR 1910.146 sets standards and procedures for restricted spaces that could contain higher than normal concentrations of nitrogen gas.

Who are the winners in the global gas separation membranes market?

Companies such as Air Products and Chemicals, Inc. (US), Air Liquide Advanced Separations (France), Ube Industries, Ltd. (Japan), Honeywell UOP (US), Fujifilm Manufacturing Europe B.V. (Netherlands), Schlumberger Limited (US), DIC Corporation (Japan), Parker-Hannifin Corporation (US), Membrane Technology and Research, Inc. (US), and Generon, Inc. (US) come under the winner’s category. They have the potential to broaden their product portfolio and compete with other players. Such advantages give these companies an edge over other companies.

What are some of the drivers in the market?

The increasing requirement of gas separation membranes in emerging economies due to rapid industrialization and superior properties compared to conventional counterparts are the major driving factors for the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 GAS SEPARATION MEMBRANES MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

FIGURE 1 GAS SEPARATION MEMBRANES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 2 GAS SEPARATION MEMBRANES MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis

FIGURE 3 GAS SEPARATION MEMBRANES MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 GAS SEPARATION MEMBRANES MARKET: DATA TRIANGULATION

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 30)

FIGURE 5 POLYIMIDE & POLYARAMIDE TO BE THE LARGEST SEGMENT

FIGURE 6 CARBON DIOXIDE REMOVAL TO BE LARGEST SEGMENT

FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING GAS SEPARATION MEMBRANES MARKET

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 ATTRACTIVE OPPORTUNITIES IN GAS SEPARATION MEMBRANES MARKET

FIGURE 8 GROWING DEMAND FOR GAS SEPARATION MEMBRANES IN EMERGING ECONOMIES TO DRIVE THE MARKET

4.2 GAS SEPARATION MEMBRANES MARKET, BY MATERIAL TYPE

FIGURE 9 POLYIMIDE & POLYARAMIDE TO BE LARGEST SEGMENT OF THE MARKET

4.3 GAS SEPARATION MEMBRANES MARKET, BY APPLICATION

FIGURE 10 CARBON DIOXIDE REMOVAL TO BE LARGEST APPLICATION OF GAS SEPARATION MEMBRANES

4.4 GAS SEPARATION MEMBRANES MARKET, BY MAJOR COUNTRIES

FIGURE 11 INDIA TO RECORD HIGHEST CAGR DURING THE FORECAST PERIOD

4.5 ASIA PACIFIC GAS SEPARATION MEMBRANES MARKET, BY APPLICATION AND COUNTRY, 2020

FIGURE 12 CHINA ACCOUNTED FOR LARGEST SHARE OF THE MARKET IN ASIA PACIFIC

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GAS SEPARATION MEMBRANES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for membranes in carbon dioxide separation processes

5.2.1.2 Growing demand in nitrogen generation and syngas cleaning

5.2.1.3 Increasing demand for biogas

5.2.2 RESTRAINTS

5.2.2.1 Technical disadvantages over other gas separation technologies

5.2.2.2 Plasticization of polymeric membranes in high-temperature applications

5.2.3 OPPORTUNITIES

5.2.3.1 Development of mixed matrix membranes

5.2.4 CHALLENGES

5.2.4.1 Upscaling and commercializing new membranes

5.3 PORTER’S FIVE FORCE ANALYSIS

FIGURE 14 GAS SEPARATION MEMBRANES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 TRENDS AND FORECAST OF GDP

TABLE 1 GDP OF KEY COUNTRIES, USD BILLION (2017-2020)

5.4.2 AUTOMOTIVE INDUSTRY

TABLE 2 PRODUCTION VOLUMES OF AUTOMOBILES (UNITS)

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 15 GAS SEPARATION MEMBRANES MARKET: SUPPLY CHAIN ANALYSIS

5.5.1 RAW MATERIAL SUPPLIERS

5.5.2 MANUFACTURERS

5.5.3 DISTRIBUTORS

5.5.4 END-USE INDUSTRIES

5.6 ECOSYSTEM MAPPING

FIGURE 16 GAS SEPARATION MEMBRANES MARKET: ECOSYSTEM

5.7 TRADE ANALYSIS

5.7.1 IMPORT-EXPORT SCENARIO OF GAS SEPARATION MEMBRANES MARKET

TABLE 3 EXPORT TRADE DATA FOR CENTRIFUGES, INCLUDING CENTRIFUGAL DRYERS, FILTERING OR PURIFYING MACHINERY AND APPARATUS, FOR LIQUIDS OR GASES

TABLE 4 IMPORT TRADE DATA FOR CENTRIFUGES, INCLUDING CENTRIFUGAL DRYERS, FILTERING OR PURIFYING MACHINERY AND APPARATUS, FOR LIQUIDS OR GASES

5.8 TECHNOLOGY ANALYSIS

5.8.1 PRESSURE SWING ADSORPTION (PSA) TECHNOLOGY

5.8.2 BIG DATA, MACHINE LEARNING & ARTIFICIAL INTELLIGENCE TECHNOLOGIES USED IN DESIGNING & OPTIMIZATION OF GAS SEPARATION MEMBRANES

5.8.3 MEMBRANE CONDENSER TECHNOLOGY

5.9 REGULATORY LANDSCAPE

TABLE 5 REGULATORY LANDSCAPE REGION-WISE/COUNTRY-WISE

5.10 IMPACT OF COVID-19 ON GAS SEPARATION MEMBRANES MARKET

5.10.1 COVID-19

5.10.2 COVID-19 ECONOMIC ASSESSMENT

5.10.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 17 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.10.4 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 18 PACE OF GLOBAL PROPAGATION OF COVID-19 UNPRECEDENTED

5.10.5 IMPACT ON GAS SEPARATION MEMBRANES MARKET

5.11 AVERAGE SELLING PRICING TREND

TABLE 6 GLOBAL AVERAGE PRICES OF GAS SEPARATION MEMBRANES, BY APPLICATION (USD/METER SQUARE)

5.12 GAS SEPARATION MEMBRANES MARKET: PATENT ANALYSIS

5.12.1 INTRODUCTION

5.12.2 METHODOLOGY

5.12.3 DOCUMENT TYPE

TABLE 7 PATENTS SCENARIO

FIGURE 19 PUBLICATION TRENDS (2010-2020)

5.12.4 INSIGHT

5.12.5 LEGAL STATUS OF PATENTS

FIGURE 20 GAS SEPARATION MEMBRANE PATENTS: LEGAL STATUS

FIGURE 21 JURISDICTION ANALYSIS

5.12.6 TOP COMPANIES/APPLICANTS

FIGURE 22 TOP COMPANIES WITH HIGHEST NUMBER OF PATENTS

TABLE 8 LIST OF PATENTS BY FUJIFILM CORP

TABLE 9 LIST OF PATENTS BY SUMITOMO CHEMICAL CO.

TABLE 10 LIST OF PATENTS BY UBE INDUSTRIES

TABLE 11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 GAS SEPARATION MEMBRANES MARKET, BY MODULE (Page No. - 58)

6.1 INTRODUCTION

6.2 HOLLOW FIBER

6.2.1 HIGH PACKING DENSITY AND COST-EFFECTIVENESS DRIVING DEMAND

6.3 SPIRAL WOUND

6.3.1 SPIRAL WOUND MEMBRANES HAVE LOW CAPITAL AND OPERATING COSTS

6.4 PLATE AND FRAME

6.4.1 CAPABILITY TO HANDLE HIGH SOLID CONCENTRATIONS DRIVING DEMAND

6.5 OTHERS

7 GAS SEPARATION MEMBRANES MARKET, BY MATERIAL TYPE (Page No. - 60)

7.1 INTRODUCTION

FIGURE 23 POLYIMIDE & POLYARAMIDE TO BE LARGEST MATERIAL TYPE DURING THE FORECAST PERIOD

TABLE 12 GAS SEPARATION MEMBRANES MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (USD MILLION)

TABLE 13 GAS SEPARATION MEMBRANES MARKET SIZE, BY MATERIAL TYPE, 2019–2026 (MILLION METERS SQUARE)

7.2 POLYIMIDE & POLYARAMIDE

7.2.1 HIGH CHEMICAL AND THERMAL STABILITY DRIVING THE DEMAND

7.3 POLYSULFONE

7.3.1 HIGH CHEMICAL RESISTANCE AND HIGH-PRESSURE OPERATIONS TO DRIVE THE MARKET

7.4 CELLULOSE ACETATE

7.4.1 CELLULOSE ACETATE MEMBRANES OFFER INCREASED SELECTIVITY

7.5 OTHERS

8 GAS SEPARATION MEMBRANES MARKET, BY APPLICATION (Page No. - 64)

8.1 INTRODUCTION

FIGURE 24 CARBON DIOXIDE REMOVAL TO BE LARGEST APPLICATION DURING FORECAST PERIOD (USD MILLION)

TABLE 14 GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 15 GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

8.2 NITROGEN GENERATION & OXYGEN ENRICHMENT

8.2.1 ONE OF THE MAJOR APPLICATIONS OF GAS SEPARATION MEMBRANES

8.2.2 PACKAGING AND STORAGE

8.2.3 METAL MANUFACTURING AND FABRICATION

8.2.4 ELECTRONICS

8.2.5 OIL & GAS

8.2.6 OTHERS

8.3 HYDROGEN RECOVERY

8.3.1 INCREASING USE OF HYDROGEN AT INDUSTRIAL SCALE DRIVING MARKET

8.3.2 HYDROGEN PURIFICATION IN REFINERIES

8.3.3 SYNGAS PROCESSES

8.3.4 HYDROGEN RECOVERY FROM PURGE GAS

8.4 CARBON DIOXIDE REMOVAL

8.4.1 MEMBRANES PROVIDE ENERGY-EFFICIENT, COMPACT, AND ECONOMICAL REMOVAL OF CARBON DIOXIDE

8.4.2 NATURAL GAS

8.4.3 BIOGAS

8.5 VAPOR/GAS SEPARATION

8.5.1 INCREASING DEMAND IN PETROCHEMICAL INDUSTRY DRIVING THE MARKET

8.6 VAPOR/VAPOR SEPARATION

8.6.1 VAPOR/VAPOR SEPARATION IS FASTEST-GROWING APPLICATION

8.7 AIR DEHYDRATION

8.7.1 INCREASED DEMAND FOR MEMBRANE-BASED DEHYDRATION IN INDUSTRIAL APPLICATIONS DRIVING GROWTH

8.8 OTHERS

9 GAS SEPARATION MEMBRANES MARKET, BY REGION (Page No. - 71)

9.1 INTRODUCTION

FIGURE 25 INDIAN GAS SEPARATION MEMBRANES MARKET TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 16 GAS SEPARATION MEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 GAS SEPARATION MEMBRANES MARKET SIZE, BY REGION, 2019-2026 (MILLION METERS SQUARE)

9.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: GAS SEPARATION MEMBRANES MARKET SNAPSHOT

TABLE 18 NORTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 19 NORTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METERS SQUARE)

TABLE 20 NORTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 21 NORTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.2.1 US

9.2.1.1 Recovering industrial activities to drive demand

TABLE 22 US: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 23 US: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.2.2 CANADA

9.2.2.1 Growing natural gas production likely to boost demand for gas separation membranes

TABLE 24 CANADA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 25 CANADA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.2.3 MEXICO

9.2.3.1 Growing demand for renewable energy to fuel the market

TABLE 26 MEXICO: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 27 MEXICO: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3 EUROPE

TABLE 28 EUROPE: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 EUROPE: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METERS SQUARE)

TABLE 30 EUROPE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 31 EUROPE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.1 GERMANY

9.3.1.1 Growing demand for renewable energy sources driving the market

TABLE 32 GERMANY: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 33 GERMANY: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.2 NETHERLANDS

9.3.2.1 Presence of large natural gas reserves contributing to market growth

TABLE 34 NETHERLANDS: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 35 NETHERLANDS: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.3 FRANCE

9.3.3.1 Growth in demand for renewable energy to drive market

TABLE 36 FRANCE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 37 FRANCE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.4 ITALY

9.3.4.1 Growing packaging industry and renewable energy sector generating positive impact

TABLE 38 ITALY: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 39 ITALY: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.5 SPAIN

9.3.5.1 Increasing demand for natural gas in residential, industrial, and fuel sectors driving the market

TABLE 40 SPAIN: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 41 SPAIN: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.6 RUSSIA

9.3.6.1 Oil & gas exports to drive market in Russia

TABLE 42 RUSSIA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 43 RUSSIA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.3.7 REST OF EUROPE

TABLE 44 REST OF EUROPE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 45 REST OF EUROPE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SNAPSHOT

TABLE 46 ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METERS SQUARE)

TABLE 48 ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 49 ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.4.1 CHINA

9.4.1.1 Changing consumer food preferences and growing energy sector to drive demand

TABLE 50 CHINA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 51 CHINA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.4.2 JAPAN

9.4.2.1 Sustainable packaging demand and growing natural gas demand to drive the market

TABLE 52 JAPAN: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 53 JAPAN: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.4.3 SOUTH KOREA

9.4.3.1 Increase in demand for hydrogen to drive the market

TABLE 54 SOUTH KOREA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 55 SOUTH KOREA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.4.4 INDIA

9.4.4.1 India is fastest-growing gas separation membranes market in the region

TABLE 56 INDIA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 57 INDIA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.4.5 REST OF ASIA PACIFIC

TABLE 58 REST OF ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 REST OF ASIA PACIFIC: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.5 SOUTH AMERICA

TABLE 60 SOUTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 61 SOUTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METERS SQUARE)

TABLE 62 SOUTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 63 SOUTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.5.1 BRAZIL

9.5.1.1 Improved renewable energy consumption to drive the market

TABLE 64 BRAZIL: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 BRAZIL: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.5.2 ARGENTINA

9.5.2.1 Growing natural gas and food packaging markets to drive growth

TABLE 66 ARGENTINA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 ARGENTINA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.5.3 REST OF SOUTH AMERICA

TABLE 68 REST OF SOUTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 69 REST OF SOUTH AMERICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.6 MIDDLE EAST & AFRICA

TABLE 70 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METERS SQUARE)

TABLE 72 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.6.1 SAUDI ARABIA

9.6.1.1 Saudi Arabia leads gas separation membranes market in the region

TABLE 74 SAUDI ARABIA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 75 SAUDI ARABIA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.6.2 UAE

9.6.2.1 Processed food products to drive gas separation membranes demand

TABLE 76 UAE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 UAE: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

9.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 78 REST OF MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 REST OF MIDDLE EAST & AFRICA: GAS SEPARATION MEMBRANES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METERS SQUARE)

10 COMPETITIVE LANDSCAPE (Page No. - 110)

10.1 INTRODUCTION

10.1.1 GAS SEPARATION MEMBRANES MARKET, KEY DEVELOPMENTS

TABLE 80 OVERVIEW OF STRATEGIES ADOPTED BY SOME KEY MARKET PLAYERS

10.2 MARKET SHARE ANALYSIS

FIGURE 28 MARKET SHARE OF KEY PLAYERS, 2020

10.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 29 MARKET RANKING OF KEY PLAYERS, 2020

10.3.1 AIR LIQUIDE ADVANCED SEPARATIONS

10.3.2 AIR PRODUCTS AND CHEMICALS

10.3.3 HONEYWELL UOP

10.3.4 UBE INDUSTRIES

10.3.5 FUJIFILM MANUFACTURING EUROPE B.V.

10.4 COMPETITIVE EVALUATION QUADRANT (TIER 1)

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

FIGURE 30 GAS SEPARATION MEMBRANES MARKET (GLOBAL) COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2020

10.4.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GAS SEPARATION MEMBRANES MARKET

10.4.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 32 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GAS SEPARATION MEMBRANES MARKET

10.5 COMPETITIVE EVALUATION QUADRANT (OTHER KEY PLAYERS)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

FIGURE 33 GAS SEPARATION MEMBRANES MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR OTHER KEY PLAYERS, 2020

10.5.4 STRENGTH OF PRODUCT PORTFOLIO (OTHER KEY PLAYERS)

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF OTHER KEY PLAYERS IN GAS SEPARATION MEMBRANES MARKET

10.5.5 BUSINESS STRATEGY EXCELLENCE (OTHER KEY PLAYERS)

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF OTHER KEY PLAYERS IN GAS SEPARATION MEMBRANES MARKET

10.6 COMPETITIVE SITUATION & TRENDS

10.6.1 PRODUCT LAUNCHES

TABLE 81 GAS SEPARATION MEMBRANES MARKET: PRODUCT LAUNCHES, 2018-2021

10.6.2 DEALS

TABLE 82 GAS SEPARATION MEMBRANES MARKET: DEALS, 2018-2021

10.6.3 OTHERS

TABLE 83 GAS SEPARATION MEMBRANES MARKET: OTHERS, 2018-2021

11 COMPANY PROFILES (Page No. - 123)

11.1 AIR LIQUIDE

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View)*

11.1.1 BUSINESS OVERVIEW

TABLE 84 AIR LIQUIDE: COMPANY OVERVIEW

FIGURE 36 AIR LIQUIDE: COMPANY SNAPSHOT

TABLE 85 AIR LIQUIDE: PRODUCT OFFERINGS

TABLE 86 AIR LIQUIDE: DEALS

TABLE 87 AIR LIQUIDE: OTHER DEVELOPMENTS

11.2 AIR PRODUCTS AND CHEMICALS, INC.

TABLE 88 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

FIGURE 37 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

TABLE 89 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCT OFFERINGS

TABLE 90 AIR PRODUCTS AND CHEMICALS, INC.: NEW PRODUCT LAUNCH

TABLE 91 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

TABLE 92 AIR PRODUCTS AND CHEMICALS, INC.: OTHER DEVELOPMENTS

11.3 HONEYWELL UOP

TABLE 93 HONEYWELL UOP: COMPANY OVERVIEW

FIGURE 38 HONEYWELL UOP: COMPANY SNAPSHOT

TABLE 94 HONEYWELL UOP: PRODUCT OFFERINGS

TABLE 95 HONEYWELL UOP: DEALS

TABLE 96 HONEYWELL UOP: OTHER DEVELOPMENTS

11.4 UBE INDUSTRIES

TABLE 97 UBE INDUSTRIES: COMPANY OVERVIEW

FIGURE 39 UBE INDUSTRIES: COMPANY SNAPSHOT

TABLE 98 UBE INDUSTRIES: PRODUCT OFFERINGS

11.5 FUJIFILM MANUFACTURING EUROPE B.V.

11.5.1 BUSINESS OVERVIEW

TABLE 99 FUJIFILM MANUFACTURING EUROPE B.V.: COMPANY OVERVIEW

11.5.2 PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 100 FUJIFILM MANUFACTURING EUROPE B.V.: PRODUCT OFFERINGS

11.6 DIC CORPORATION

TABLE 101 DIC CORPORATION: COMPANY OVERVIEW

FIGURE 40 DIC CORPORATION: COMPANY SNAPSHOT

TABLE 102 DIC CORPORATION: PRODUCT OFFERINGS

11.7 GENERON

TABLE 103 GENERON: COMPANY OVERVIEW

TABLE 104 GENERON: PRODUCT OFFERINGS

TABLE 105 GENERON: NEW PRODUCT LAUNCH

11.8 MEMBRANE TECHNOLOGY AND RESEARCH, INC. (MTR)

TABLE 106 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: COMPANY OVERVIEW

TABLE 107 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: PRODUCT OFFERINGS

TABLE 108 MEMBRANE TECHNOLOGY AND RESEARCH, INC.: OTHER DEVELOPMENTS

11.9 PARKER HANNIFIN CORPORATION

TABLE 109 PARKER HANNIFIN CORPORATION: COMPANY OVERVIEW

FIGURE 41 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

TABLE 110 PARKER HANNIFIN CORPORATION: PRODUCT OFFERINGS

11.10 SCHLUMBERGER LIMITED

TABLE 111 SCHLUMBERGER: COMPANY OVERVIEW

FIGURE 42 SCHLUMBERGER: COMPANY SNAPSHOT

TABLE 112 SCHLUMBERGER: PRODUCT OFFERINGS

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.11 OTHER KEY COMPANIES

11.11.1 AIRRANE

11.11.2 ATLAS COPCO

11.11.3 BORSIG GROUP

11.11.4 COBETTER FILTRATION EQUIPMENT CO., LTD.

11.11.5 EVONIK INDUSTRIES AG

11.11.6 GENRICH MEMBRANES PVT. LTD.

11.11.7 GRASYS JSC

11.11.8 GULF COAST ENVIRONMENTAL SYSTEMS (GCES)

11.11.9 MEGAVISION MEMBRANE

11.11.10 NOVAMEM LTD.

11.11.11 PERMSELECT

11.11.12 PERVATECH BV

11.11.13 SEPRATEK INC.

11.11.14 THEWAY MEMBRANES

11.11.15 TIANBANG NATIONAL ENGINEERING RESEARCH CENTER OF MEMBRANE TECHNOLOGY CO., LTD. (TBM)

12 APPENDIX (Page No. - 154)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Overview of Degassing System Market

Degassing systems are used to remove dissolved gases, such as oxygen, nitrogen, and carbon dioxide, from liquids. They are widely used in various industries, including food and beverage, pharmaceuticals, and water treatment. The global degassing system market is expected to grow significantly in the coming years due to increasing demand for high-quality products and stringent regulations regarding water and wastewater treatment.

Gas separation membranes are used to separate gases, including carbon dioxide, nitrogen, and oxygen, from a gas mixture. They are widely used in various industries, including petrochemicals, natural gas, and biogas. Some degassing systems also use gas separation membranes as a component.

The growth of the degassing system market is expected to have a positive impact on the gas separation membranes market. As the demand for degassing systems increases, the demand for gas separation membranes, which are used in some degassing systems, is also likely to increase.

Futuristic Growth Use-Cases of Degassing System Market

Some of the potential use-cases for degassing systems in the future include:

1. Water Treatment: Degassing systems can be used to remove dissolved gases from water, making it suitable for various applications, including drinking water, industrial water, and wastewater treatment.

2. Food and Beverage: Degassing systems can be used to remove dissolved gases from food and beverage products, including beer, wine, and juice, to improve their quality and shelf life.

3. Pharmaceutical: Degassing systems can be used to remove dissolved gases from pharmaceutical products, such as injectables and infusions, to improve their stability and shelf life.

Top Players in Degassing System Market

Some of the top players in the degassing system market include Sulzer Ltd., Evoqua Water Technologies LLC, Armstrong International Inc., Veolia Water Technologies, Hitachi Zosen Corporation, 3M Company, Parker Hannifin Corporation, Kadant Inc., H2O GmbH, Degremont SAS

Other Industries Impacted by Degassing System Market

The degassing system market is expected to have a significant impact on various industries in the future, including:

1. Petrochemicals: The petrochemical industry is expected to see increased use of degassing systems in various applications, including refining and chemical processing, to improve product quality and reduce environmental impact.

2. Oil and Gas: The oil and gas industry is expected to benefit from the use of degassing systems in various applications, including crude oil refining and natural gas processing, to improve product quality and reduce emissions.

3. Electronics: The electronics industry is expected to see increased use of degassing systems in various applications, including semiconductor manufacturing and LCD display production, to improve product quality and reduce defects.

4. Medical Devices: The medical device industry is expected to benefit from the use of degassing systems in various applications, including the production of medical tubing and catheters

Speak to our Analyst today to know more about Degassing System Market!

The study involved four major activities in estimating the current market size for gas separation membranes. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Gas Separation Membranes Market Secondary Research

In the secondary research process, extensive use of secondary sources, directories, and databases, such as Bloomberg, World Bank, Statista, American Chemistry Council (ACC), BP Statistics, International Organization of Motor Vehicle Manufacturers (OICA) sources, International Energy Agency (ITA), Trademap, Zauba, other government & private websites, associations related to the gas separation membranes industry. The study also involves analyzing regulations and regional government websites to identify and collect information useful for this technical, market-oriented, and commercial gas separation membranes market study.

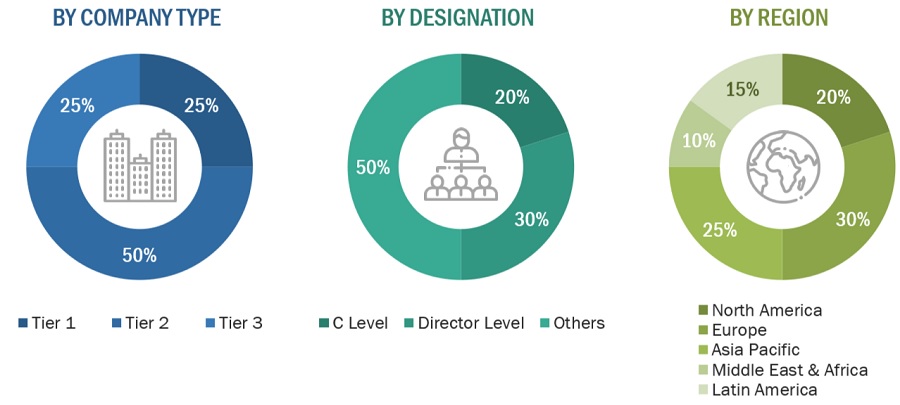

Gas Separation Membranes Market Primary Research

The gas separation membranes market comprises several stakeholders such as raw material suppliers, distributors, manufacturers, end-users, and regulatory organizations in the supply chain. Primary sources include experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major market players, and industry consultants, have been conducted to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Gas Separation Membranes Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the gas separation membranes market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, material types, and applications in various industries and markets were identified through extensive secondary research.

- The industry’s value chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Gas Separation Membranes Market Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of gas separation membranes and their applications.

Gas Separation Membranes Market Report Objectives of the Study

- To analyze and forecast the gas separation membranes market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market by material type and application

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with the key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments such as new product launch, merger & acquisition, agreement & collaboration, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Notes: 1. Micro markets are defined as sub segments of the gas separation membranes market included in the report.

2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Gas Separation Membranes Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Gas Separation Membranes Market Regional Analysis:

- Country-level analysis of the gas separation membranes market

Gas Separation Membranes Market Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gas Separation Membranes Market

Research required on utilization of contaminated natural gas sources by using energy-consumed membrane technology

Gas separation membranes for nitrogen generation of the London and oxygen and oxygen generation.