Glass Substrate Market by Type (Borosilicate, Silicon, Ceramic, and Fused Silica/Quartz-Based Glass Substrates), End-Use Industry (Electronics, Automotive, Medical, Aerospace & Defense, Solar), and Region - Global Forecast to 2022

[126 Pages Report] Glass Substrate Market size was valued at USD 1.42 Billion in 2016 and is projected to reach USD 1.97 Billion by 2022, at a CAGR of 5.7% between 2017 and 2022. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

The objectives of the study are as follows:

- To define, describe, and forecast the glass substrate market on the basis of type, end-use industry, and region

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the market size, in terms of value, with respect to 5 main regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and R&D activities in the glass substrate market

Research Methodology

Top-down approach has been used to estimate and validate the size of the glass substrate market as well as estimate the sizes of various other dependent submarkets. The research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the glass substrate market.

To know about the assumptions considered for the study, download the pdf brochure

The supply chain of the glass substrate market starts with sourcing of raw materials, followed by manufacturing of glass substrates, processing of glass substrates, and supplying of finished glass substrate products. The finished products are used in various end-use applications. Key players in the glass substrate market are AGC (Japan), SCHOTT (Germany), Corning Inc. (US), Nippon Sheet Glass (Japan), Plan Optik (Germany), HOYA Corporation (Japan), LG Chem (South Korea), OHARA Inc. (Japan), IRICO Group New Energy Company Limited (China), and The Tunghsu Group (China).

Key Target Audience:

- Glass Substrate Manufacturing Companies

- Traders, Distributors, and Retailers

- Raw Material Suppliers

- Commercial R&D Institutes

- Research Institutes, Trade Associations, and Government Agencies

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This research report categorizes the glass substrate market on the basis of type, end-use industry, and region.

On the basis of Type:

- Borosilicate-based Glass Substrates

- Silicon-based Glass Substrates

- Ceramic-based Glass Substrates

- Fused Silica/Quartz-based Glass Substrates

- Others (Soda-lime and Aluminosilicate-based Glass Substrates)

On the basis of End-use Industry:

- Electronics

- Automotive

- Medical

- Aerospace & Defense

- Solar

On the basis of Region:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

The market has been further analyzed for key countries in each of these regions.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Country Information:

- Glass substrate market analysis for additional countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis:

- Detailed pricing analysis for each type of glass substrate products

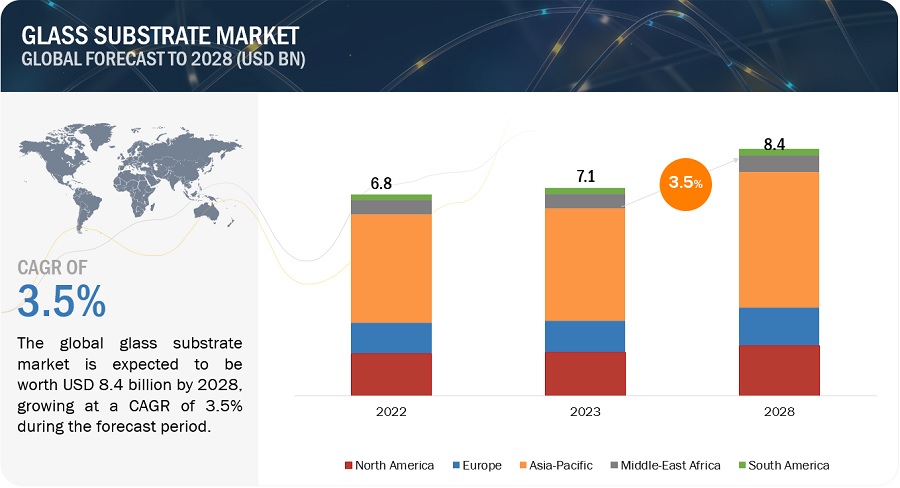

The glass substrate market is estimated to be USD 1.49 Billion in 2017 and is projected to reach USD 1.97 Billion by 2022, at a CAGR of 5.7% between 2017 and 2022. The increasing use of LCDs in consumer durables, smart handheld devices, and automotive applications is one of the most significant factors projected to drive the growth of the glass substrate market. In addition, the growth of the semiconductor and electronics industries is further projected to drive the increased demand for glass substrates.

Based on type, the glass substrate market has been segmented into borosilicate-based glass substrates, silicon-based glass substrates, ceramic-based glass substrates, fused silica/quartz-based glass substrates, and others. Borosilicate-based glass substrates type is the most widely used type of glass substrates, owing to their superior properties, such as low coefficient of thermal expansion, high chemical resistivity, and high surface strength.

Based on end-use industry, the glass substrate market has been classified into electronics, automotive, medical, aerospace & defense, and solar. The electronics industry is the largest end-use industry segment of the glass substrate market. An increase in manufacturing of display devices, electronic components, semiconductors, MEMS devices, and information, computing & telecommunication devices is expected to drive the growth of the glass substrate market in the electronics industry.

Asia Pacific is estimated to be the largest market for glass substrates. The glass substrate market in the Asia Pacific region is projected to grow at the highest CAGR during the forecast period, owing to the presence of numerous electronics manufacturers in this region. China is expected to account for the largest share of the glass substrate market in the Asia Pacific region in 2022. This market in China is projected to grow at the highest CAGR during the forecast period. Major producers of glass substrates such as AGC (Japan), Nippon Sheet Glass (Japan), HOYA Corporation (Japan), LG Chem (South Korea), OHARA Inc. (Japan), IRICO Group New Energy Company Limited (China), and The Tunghsu Group (China) are located in the Asia Pacific region.

The high manufacturing cost of glass substrates acts as a restraint to the growth of the market. However, manufacturers of glass substrates are focused on managing their yields through process control with the aim of optimizing production costs.

Companies operating in the glass substrate market have adopted the expansions strategy to increase their market share and cater to the increasing demand for glass substrate products. For example, in August 2017, Asahi Glass Co. (AGC) started the construction of the 11th generation TFT glass substrate manufacturing kilns in China. This development strategy enabled the company to increase its production capacity and address the growing demand for glass substrates in China.

Companies such as AGC (Japan), SCHOTT (Germany), Corning Inc. (US), Nippon Sheet Glass (Japan), and The Tunghsu Group (China) adopted the strategy of expansions, new product developments, and agreements to enhance their share in the glass substrate market between 2014 and 2017.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Significant Opportunities in the Glass Substrate Market

4.2 Glass Substrate Market in APAC, By Type and Country

4.3 Glass Substrate Market Size, By Developed and Developing Countries

4.4 Glass Substrate Market, By Type

4.5 Glass Substrate Market, By End-Use Industry

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Use of Lcds in Consumer Durables, Smart Handheld Devices, and Automotive Applications

5.2.1.2 Growth of the Semiconductor Industry

5.2.1.3 Growing Need of Larger-Generation Glass From the Electronics Industry

5.2.2 Restraints

5.2.2.1 High Cost of Technology Development and Manufacturing Process of Glass Substrates

5.2.3 Opportunities

5.2.3.1 Innovations in Display Technologies

5.2.3.2 Growing Use of Glass Substrates in the Automotive Industry

5.2.4 Challenges

5.2.4.1 LCD Glass to Meet Strict Quality Requirements

5.3 Macro-Economic Indicators

5.3.1 GDP Growth Rate Forecast of Major Economies

5.3.2 Electronics Industry Outlook

5.3.3 Semiconductor Industry Outlook

5.3.4 Medical Device Industry Outlook

6 Glass Substrate Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Borosilicate-Based Glass Substrates

6.3 Silicon-Based Glass Substrates

6.4 Ceramic-Based Glass Substrates

6.5 Fused Silica-/Quartz-Based Glass Substrates

6.6 Others

7 Glass Substrate Market, By End-Use Industry (Page No. - 46)

7.1 Introduction

7.2 Electronics

7.3 Automotive

7.4 Medical

7.5 Aerospace & Defense

7.6 Solar Power

8 Glass Substrate Market, By Region (Page No. - 54)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 South America

8.3.1 Brazil

8.3.2 Argentina

8.3.3 Rest of South America

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 UK

8.4.4 Italy

8.4.5 Russia

8.4.6 Rest of Europe

8.5 APAC

8.5.1 China

8.5.2 Japan

8.5.3 India

8.5.4 South Korea

8.5.5 Taiwan

8.5.6 Rest of APAC

8.6 Middle East & Africa

8.6.1 South Africa

8.6.2 Saudi Arabia

8.6.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 88)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 New Product Developments

9.3.3 Agreements

10 Company Profiles (Page No. - 93)

10.1 Asahi Glass Co., Ltd. (AGC)

10.2 Schott AG

10.3 Corning Inc.

10.4 Nippon Sheet Glass Co, Ltd.

10.5 Plan Optik AG

10.6 Hoya Corporation

10.7 LG Chem, Ltd.

10.8 Ohara Inc.

10.9 IRICO Group New Energy Company Limited

10.10 The Tunghsu Group

10.11 Other Key Market Players

10.12 Glass Substrates Processors

11 Appendix (Page No. - 119)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (75 Tables)

Table 1 Trends and Forecast of GDP Growth Rates, 2016–2022

Table 2 Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 3 Borosilicate-Based Glass Substrate Market Size, By Region, 2015–2022 (USD Million)

Table 4 Silicon-Based Glass Substrate Market Size, By Region, 2015–2022 (USD Million)

Table 5 Ceramic-Based Glass Substrate Market Size, By Region, 2015–2022 (USD Million)

Table 6 Fused Silica-/Quartz-Based Glass Substrate Market Size, By Region, 2015–2022 (USD Million)

Table 7 Other Glass Substrate Market Size, By Region, 2015–2022 (USD Million)

Table 8 Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 9 Glass Substrate Market Size in Electronics End-Use Industry, By Region, 2015–2022 (USD Million)

Table 10 Glass Substrate Market Size in Automotive End-Use Industry, By Region, 2015–2022 (USD Million)

Table 11 Glass Substrate Market Size in Medical End-Use Industry, By Region, 2015–2022 (USD Million)

Table 12 Glass Substrate Market Size in Aerospace & Defense End-Use Industry, By Region, 2015–2022 (USD Million)

Table 13 Glass Substrate Market Size in Solar Power End-Use Industry By Region, 2015–2022 (USD Million)

Table 14 Glass Substrate Market Size, By Region, 2015–2022 (USD Million)

Table 15 North America: Glass Substrate Market Size, By Country, 2015–2022 (USD Million)

Table 16 North America: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 17 North America: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 18 US: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 19 US: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 20 Canada: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 21 Canada: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 22 Mexico: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 23 Mexico: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 24 South America: Glass Substrate Market Size, By Country, 2015–2022 (USD Million)

Table 25 South America: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 26 South America: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 27 Brazil: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 28 Brazil: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 29 Argentina: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 30 Argentina: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 31 Rest of South America: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 32 Rest of South America: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 33 Europe: By Market Size, By Country, 2015–2022 (USD Million)

Table 34 Europe: By Market Size, By Type, 2015–2022 (USD Million)

Table 35 Europe: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 36 Germany: By Market Size, By Type, 2015–2022 (USD Million)

Table 37 Germany: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 38 France: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 39 France: Glass Substrate Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 40 UK: By Market Size, By Type, 2015–2022 (USD Million)

Table 41 UK: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 42 Italy: By Market Size, By Type, 2015–2022 (USD Million)

Table 43 Italy: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 44 Russia: By Market Size, By Type, 2015–2022 (USD Million)

Table 45 Russia: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 46 Rest of Europe: By Market Size, By Type, 2015–2022 (USD Million)

Table 47 Rest of Europe: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 48 APAC: Glass Substrate Market Size, By Country, 2015–2022 (USD Million)

Table 49 APAC: By Market Size, By Type, 2015–2022 (USD Million)

Table 50 APAC: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 51 China: By Market Size, By Type, 2015–2022 (USD Million)

Table 52 China: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 53 Japan: By Market Size, By Type, 2015–2022 (USD Million)

Table 54 Japan: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 55 India: By Market Size, By Type, 2015–2022 (USD Million)

Table 56 India: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 57 South Korea: By Market Size, By Type, 2015–2022 (USD Million)

Table 58 South Korea: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 59 Taiwan: By Market Size, By Type, 2015–2022 (USD Million)

Table 60 Taiwan: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 61 Rest of APAC: By Market Size, By Type, 2015–2022 (USD Million)

Table 62 Rest of APAC: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 63 Middle East & Africa: By Market Size, By Country, 2015–2022 (USD Million)

Table 64 Middle East & Africa: By Market Size, By Type, 2015–2022 (USD Million)

Table 65 Middle East & Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 66 South Africa: Glass Substrate Market Size, By Type, 2015–2022 (USD Million)

Table 67 South Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 68 Saudi Arabia: By Market Size, By Type, 2015–2022 (USD Million)

Table 69 South Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 70 Rest of Middle East & Africa: By Market Size, By Type, 2015–2022 (USD Million)

Table 71 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 72 Ranking of Major Glass Substrate Manufacturers, 2016

Table 73 Expansions, 2014–1017

Table 74 New Product Developments, 2014–2017

Table 75 Agreements, 2014–2017

List of Figures (46 Figures)

Figure 1 Global Glass Substrate Market: Research Design

Figure 2 Global Glass Substrate Market: Data Triangulation

Figure 3 Borosilicate to Be the Largest Glass Substrate Type Between 2017 and 2022

Figure 4 Electronics to Be the Dominant End-Use Industry of Glass Substrate Between 2017 and 2022

Figure 5 APAC Was the Largest Glass Substrate Market in 2016

Figure 6 Increasing Demand From Electronics and Semiconductors Industry to Drive Glass Substrate Market

Figure 7 China Led the APAC Glass Substrate Market in 2016

Figure 8 India to Be the Fastest-Growing Market Between 2017 and 2022

Figure 9 Borosilicate to Be the Fastest-Growing Glass Substrate TypeBetween 2017 and 2022

Figure 10 Electronics to Be the Dominant End-Use Industry Between 2017 and 2022

Figure 11 Factors Governing the Glass Substrate Market

Figure 12 Production of Global Electronics and It Industries, 2014-2017

Figure 13 Leading Countries in Electronics Industry, 2015

Figure 14 Global Semiconductor Sales, 2015-2018

Figure 15 Global Medical Devices Market, 2016-2020

Figure 16 Borosilicate-Based Glass Substrates Led the Glass SubstrateMarket in 2016 (USD Million)

Figure 17 APAC to Be the Fastest-Growing Market for Borosilicate-Based Glass Substrates Between 2017 and 2022

Figure 18 APAC to Be the Largest Market for Silicon-Based Glass Substrates Between 2017 and 2022

Figure 19 APAC to Be the Fastest-Growing Market for Ceramic-Based Glass Substrates Between 2017 and 2022

Figure 20 APAC to Be the Largest Market for Fused Silica-/Quartz-Based Glass Substrates Between 2017 and 2022

Figure 21 APAC to Be the Largest Market for Other Glass Substrates, Between 2017 and 2022

Figure 22 Electronics End-Use Industry Accounted for Largest Share in 2016

Figure 23 APAC to Be the Fastest-Growing Glass Substrate Market in the Electronics Segment Between 2017 and 2022

Figure 24 APAC to Be the Largest Glass Substrate Market in the Automotive Segment Between 2017 and 2022

Figure 25 APAC to Be the Fastest-Growing Glass Substrate Market in the Medical Segment Between 2017 and 2022

Figure 26 APAC to Be the Largest Glass Substrate Market in the Aerospace & Defense Segment Between 2017 and 2022

Figure 27 APAC to Be the Largest Glass Substrate Market in the Solar Power Segment Between 2017 and 2022

Figure 28 Regional Snapshot: Rapidly Growing Markets are Emerging as New Strategic Locations

Figure 29 US Market Snapshot, 2017 vs. 2022

Figure 30 European Glass Substrate Market Snapshot: Germany to Be the Largest Market Between 2017 and 2022

Figure 31 APAC Glass Substrate Market Snapshot: China to Be the Largest Market Between 2017 and 2022

Figure 32 Companies Adopted Expansions as the Key Growth Strategy Between 2014 and 2017

Figure 33 Asahi Glass Co., Ltd.: Company Snapshot

Figure 34 Asahi Glass Co., Ltd.: SWOT Analysis

Figure 35 Schott AG: Company Snapshot

Figure 36 Schott AG: SWOT Analysis

Figure 37 Corning Inc.: Company Snapshot

Figure 38 Corning Inc.: SWOT Analysis

Figure 39 Nippon Sheet Glass Co., Ltd.: Company Snapshot

Figure 40 Nippon Sheet Glass Co., Ltd.: SWOT Analysis

Figure 41 Plan Optik AG: Company Snapshot

Figure 42 Plan Optik AG: SWOT Analysis

Figure 43 Hoya Corporation: Company Snapshot

Figure 44 LG Chem, Ltd.: Company Snapshot

Figure 45 Ohara Inc.: Company Snapshot

Figure 46 IRICO Group New Energy Company Limited: Company Snapshot

Growth opportunities and latent adjacency in Glass Substrate Market