Actuators Market Size, Share & Industry Growth Analysis Report by Actuation (Electrical, Pneumatic, Hydraulic), Type (Linear, Rotary), Application (Industrial Automation, Robotics, Vehicles & Equipment), Vertical (Automotive, Electronics, Healthcare), Geography- Global Growth Driver and Industry Forecast to 2027

Updated on : May 12, 2023

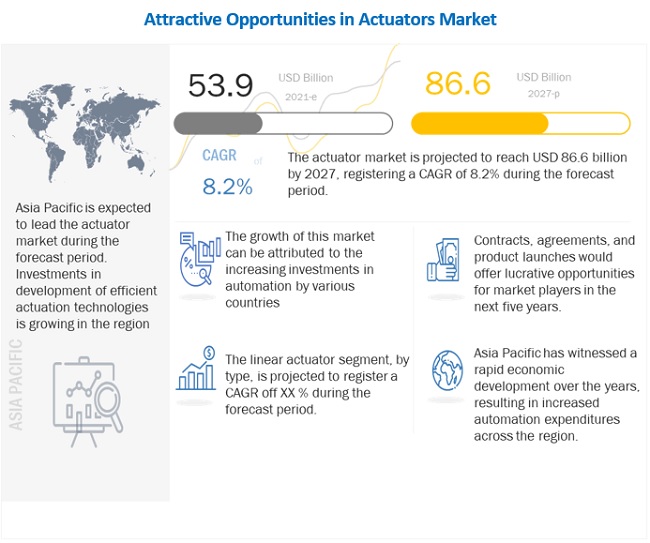

[341 Pages Report] The Actuators Market is projected to grow from USD 53.9 billion in 2021 to USD 86.6 billion by 2027, at a CAGR of 8.2% between 2021 and 2027. Increased demand for new and advanced actuators in different verticals and the development of smart cities across the globe are some of the growth opportunities for the Actuators Industry.

Actuators are devices that convert energy into motion and are majorly used in moving or controlling mechanisms and systems. Actuators are operated by an external source of energy, typically electric current, hydraulic fluid pressure, or pneumatic pressure, which is then converted to motion. Actuators perform two basic motions—linear and rotary motion. They are available in varying types, sizes, and power configurations, depending on the applications they are to be used in.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Actuators Market

The COVID-19 outbreak has triggered disruptions to global supply chains and business processes. While the pandemic did not impact the 2019 demand for valve actuators, the market projections do consider industry trends and how the COVID-19 pandemic will influence the valve actuators market in various vertical industries. Most industries utilizing actuators like agriculture, healthcare, automotive, aerospace and defense, and food and beverages were crushed negatively by the current COVID-19 pandemic outbreak. Apart from the healthcare sector, nearly all industrial sectors witnessed a downfall. Also, imposition of lockdowns and quarantine regulations internationally in India, Canada, and European nations have disturbed the normal flow of business, demand for sale or new projects, and revenue in major industries like aviation, automotive, and oil & gas. These industries normally are the prime business prospects for the actuators market.

Actuators Market Dynamics:

Driver: Rising Demand of Actuators in Healthcare

The healthcare industry is designing and producing innovative machines that need actuators. They find usage in medical devices such as wheelchairs, lifts for patients, treatment chairs, dental chairs, beds used for medical purposes, and CT, MRI, and PT scanning instruments. The global healthcare actuators market growth is mainly credited to factors such as expanding healthcare facilities and rising elderly population. The number of hospitals is increasing in various nations like the US, India, and China. In recent times, cancer has become one of the deadliest diseases globally. The most common in 2020 in terms of new cases of cancer were breast cancer (2.26 million cases) and lung cancer (2.21 million cases). Also, the outburst of the COVID-19 pandemic in early 2020 led to huge traffic of patients into hospitals all around the world. These factors positively impact the actuators market because actuators are widely used for various purposes in healthcare. One common example is the usage of voice coil actuators and control valves in ventilators that facilitate the delivery of air to patients who cannot breathe on their own due to lung disease, surgery, or other serious illness or accidents. Also, the RT-PCR testing, which is highly effective in detecting the SARS-CoV-2 virus, employs linear actuators (simply act as a conveyer belt) for its linear motion systems and to carry out a huge volume of RT-PCR tests required during emergencies like COVID-19. The linear actuators help in loading, unloading, and movement of the samples and liquid handling process needed at key stages of the test. The linear actuators help in the process of labeling and barcoding the samples, and they can perform quicker and longer than human beings. A leading company called MecVel utilizes actuators for various applications such as linear automation systems incorporated into incubators for newborn babies and electric linear actuators used for X-ray machines etc.

Opportunity: Wide Array of Applications Employing the Use of Linear Actuators

Actuators have wide usage in various industries, namely, agriculture, household and entertainment, construction, electronics and electrical, marine, aerospace and defense, chemicals, paper and plastics, oil & gas, food and beverages, and healthcare. Linear actuators are an important part of day-to-day life. They are specifically used for applications such as material handling, robotics, food and beverages, window automation, cutting equipment, agricultural machinery, solar panel and valve operations, and non-industrial applications. A linear actuator modifies the rotational motion of a motor into a straight movement. Typical electric motors move in a circle, while linear actuators move back and forth. The push and pull function allow the machine to slide, tip, and lift objects with the push of a switch. Linear actuators are accountable for shifting loads from one point to another. The electromechanical version has the additional ability to stop the progress mid-stroke. Linear actuators facilitate reliable, secure, and precise mobility, primarily when operators use them in combination with sensors or other smart machinery. The combination permits workers to accomplish previously monotonous tasks with negligible manual involvement. Linear actuators make motion possible in robotics-related machinery. They allow robots to collaborate with their surroundings through wheels, clamps, arms, and legs.

Challenge: Issues of Leakage in Pneumatic and Hydraulic Actuators

Pneumatic actuators transform energy generated from compressed air into mechanical movement. The installation of pneumatic actuators is considerably tiresome work, and the maintenance cost of these actuators is high. Pneumatic actuators are a combination of various systems that include compressors, air filters, lube tubes, dryers, and regulators. The negligence or lack of maintenance of these systems can lead to problems like excessive noise and air leaks.

In the case of hydraulic actuators, the hydraulic fluid is pumped by employing a reservoir, which transforms energy into mechanical motion. Hydraulic actuators have several advantages over pneumatic actuators in the generation of force and control of processes. However, the probability of fluid leakages, risk of fire, and spoiling of actuation systems due to erosion caused by fluid leakages pose as a major threat. Thus, leakage issues, coupled with the high noise caused by operating pneumatic and hydraulic actuators, are expected to hinder the market growth prospects during the forecast period.

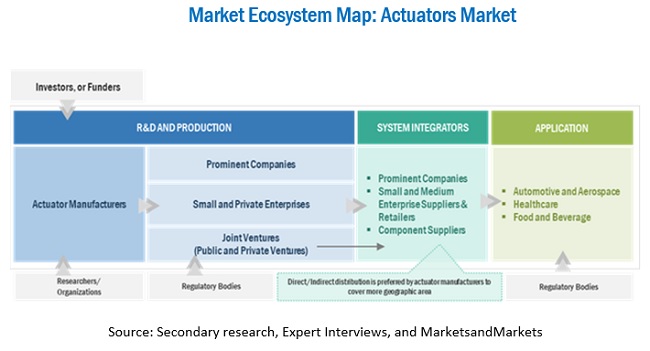

Actuators Market Ecosystem

Prominent companies providing actuators, private and small enterprises, distributors/suppliers/retailers, and end customers are the key stakeholders in the actuators market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries also serve as major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

Based on Type, the Linear Actuator Segment Accounts for the Largest Market Size During the Forecast Period

The growth of this segment can be attributed to their increased use in packaging machines, medical equipment, production machinery, transportation, and aerospace & defense industries.

Based on the Vertical, the Automotive Segment is Projected to Lead the Market During the Forecast Period

Actuators are not only used in major functional systems of an automobile but also in the bodywork and the interior of an automobile. Thus driving the demand for actuators in the automotive vertical.

Based on the Actuation, the Electrical Segment is Projected to Lead the Market During the Forecast Period

Electrical actuators provide increased control and acceleration at high speeds. The force for applying thrust can be programmed without the requirement for compressed air and the related infrastructure, and the total energy consumption in these actuators is low.

Based on Application, the Vehicles and Equipment Segment Accounts for the Largest Market Size During the Forecast Period

The vehicles and equipment segment covers actuators used in automotive, aircraft, ships, and defense vehicles for motion control. These can be hydraulic, pneumatic, electrical, or mechanical actuators. Actuators are widely used in various functional systems of an automobile, aircraft, ships as well as in defense vehicles.

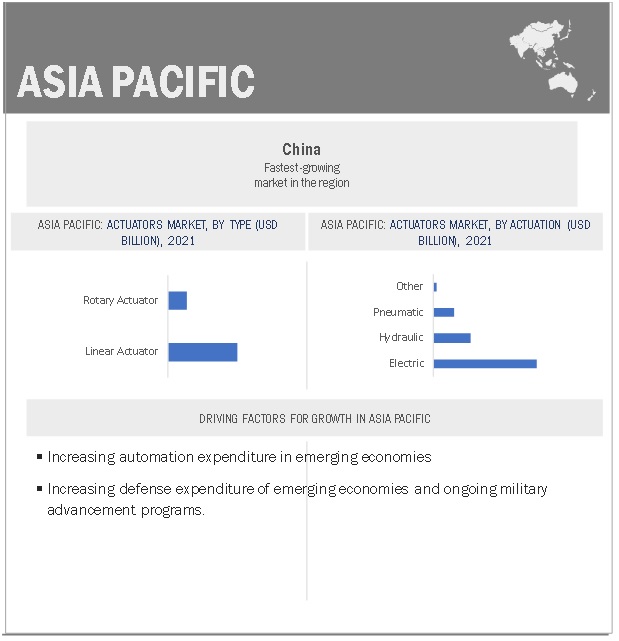

“Asia Pacific is Projected to Grow at the Highest CAGR During the Forecast Period.”

The Asia Pacific region is estimated to account for a share of 48.2% of the actuators market in 2021. The actuators market in this region has been studied for Japan, China, India, South Korea, Taiwan, and the Rest of Asia Pacific. Industries in the Asia Pacific region are continuously upgrading their capabilities and as such, require machinery equipped with new and advanced actuators. Countries such as China and Japan are primarily investing in robotics and automation to gain a tactical edge in the field of robotics and process automation. This provides an excellent growth opportunity for the manufacturers of actuators in the Asia Pacific region.

Actuators Industry Companies: Top Key Market Players

The Actuators Companies are dominated by globally established players such as ABB (Switzerland), Rockwell Automation (US), Altra Industrial Motion (US), Moog (US), SMC (Japan), Curtis Wright (Exlar) (US), and MISUMI (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Market Size |

USD 53.9 billion in 2021 |

|

Projected Market Size |

USD 86.6 billion by 2027 |

|

Growth Rate |

8.2% |

|

Forecast Period |

2021 - 2027 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver |

Rising Demand of Actuators in Healthcare |

| Key Market Opportunity |

Wide Array of Applications Employing the Use of Linear Actuators |

| Largest Growing Region |

Asia Pacific |

| Largest Market Share Segment |

Automotive Segment |

| Highest CAGR Segment |

Electrical Segment |

| Largest Application Market Share |

Vehicles and Equipment Segment |

This research report categorizes the Actuators Market based on industry, forecasting type, purpose, organization size, and region.

Actuators Market, By Actuation

- Electrical

- Pneumatic

- Hydraulic

- Others

Actuators Market, By Application

- Industrial automation

- Robotics

- Vehicles and Equipment

Actuators Market, By Type

- Linear Actuator

- Rotary Actuator

Actuators Market, By Vertical

- Food & Beverages

- Oil & Gas;

- Metals, Mining, and Machinery

- Power Generation

- Chemicals, Paper, and Plastics

- Pharmaceutical & Healthcare

- Automotive

- Aerospace & Defense

- Marine

- Electronics & Electrical

- Construction

- Agriculture

- Utilities

- Household & Entertainment.

Actuators Market, By Region

- North America

- Europe

- Asia Pacific

- RoW (Latin America, Africa, and Middle East)

Recent Developments

- In February 2020, Emerson introduced the ASCO Series 158 Gas Valve and Series 159 Motorized Actuator. Designed specifically for burner-boiler applications, the new products offer OEMs, distributors, contractors, and end-users a new combustion safety shut-off valve option that increases safety and reliability and enhances both, flow and control.

- In October 2019, Parker Hannifin Corporation completed its acquisition of LORD Corporation – a leading manufacturer of advanced adhesives and coatings as well as vibration and motion control technologies – for approximately USD 3.675 billion in cash.

Frequently Asked Questions (FAQ):

What is the Current Size of the Actuators Market?

The actuators market size is projected to grow from an estimated USD 53.9 billion in 2021 to USD 86.6 billion by 2027, at a CAGR of 8.2% during the forecast period.

Who Are the Winners in the Actuators Market?

ABB (Switzerland), Rockwell Automation (US), Altra Industrial Motion (US), Moog (US), SMC (Japan), Curtis Wright (Exlar) (US), and MISUMI (Japan) are some of the winners in the actuators market.

What is the COVID-19 Impact on the Actuators Market?

The COVID-19 outbreak has triggered disruptions to global supply chains and business processes. While the pandemic did not impact the 2019 demand for valve actuators, the market projections do consider industry trends and how the COVID-19 pandemic will influence the valve actuators market in various vertical industries.

What Are Some of the Technological Advancements in the Market?

Smart Actuators, The foundation of smart actuation begins with the incorporation of onboard electronics components. This facilitates improved control functions that were previously directed from an external source into the actuator. The main functions comprise switching, position feedback, and system diagnostics.

What Are the Factors Driving the Growth of the Market?

Rising demand for actuators in the automotive, rapid growth of industrialization and utilization of robotics, the revival of space travel, and rising demand for actuators in healthcare. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

FIGURE 1 ACTUATORS MARKET SEGMENTATION

1.2.2 REGIONAL SCOPE

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.3.1 USD EXCHANGE RATES

1.4 LIMITATIONS

1.5 INCLUSIONS & EXCLUSIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH INDUSTRY FLOW

FIGURE 3 ACTUATORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary insights

2.1.2.3 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand from healthcare industry

2.2.2.2 Rising demand in robotics

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Advancements in actuators

2.3 MARKET SIZE ESTIMATION

2.4 MARKET DEFINITION & SCOPE

2.4.1 SEGMENTS AND SUBSEGMENTS

2.4.2 SEGMENT DEFINITIONS

2.4.2.1 Actuators market, by actuation

2.4.2.2 Actuators market, by type

2.4.2.3 Actuators market, by application

2.4.2.4 Actuators market, by vertical

2.5 RESEARCH APPROACH & METHODOLOGY

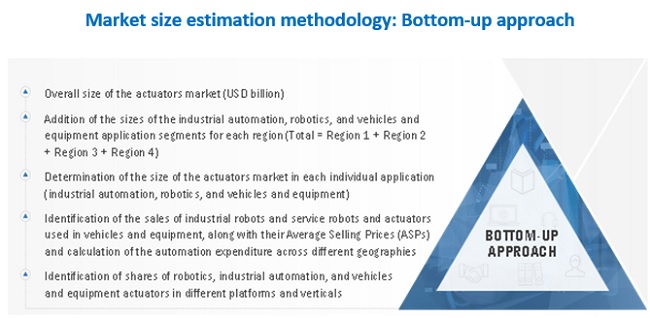

2.5.1 BOTTOM-UP APPROACH

2.5.2 REGIONAL ACTUATORS MARKET

2.5.3 GENERAL APPROACH FOR ACTUATORS MARKET

2.5.4 ACTUATORS MARKET, BY ACTUATION

2.5.5 ACTUATORS MARKET, BY TYPE

2.5.6 ACTUATORS, BY APPLICATION

2.5.7 ACTUATORS, BY VERTICAL

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.8 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.6 DATA TRIANGULATION & VALIDATION

2.6.1 DATA TRIANGULATION THROUGH SECONDARY RESEARCH

2.6.2 DATA TRIANGULATION THROUGH PRIMARIES

FIGURE 7 DATA TRIANGULATION

2.7 RESEARCH ASSUMPTIONS

2.7.1 MARKET SIZING

2.7.2 MARKET GROWTH FORECASTING

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 RISKS

2.9 OTHERS

2.9.1 LIMITATIONS/GRAY AREAS

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 9 ELECTRONICS AND ELECTRICAL SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR

FIGURE 10 LINEAR SEGMENT PROJECTED TO LEAD ACTUATORS MARKET DURING FORECAST PERIOD

FIGURE 11 ELECTRIC SEGMENT PROJECTED TO LEAD ACTUATORS DURING THE FORECAST PERIOD

FIGURE 12 ASIA PACIFIC REGION EXPECTED TO LEAD ACTUATORS IN 2021

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES IN ACTUATORS MARKET

FIGURE 13 INCREASED GLOBAL DEMAND FOR ELECTRIC ACTUATORS IS EXPECTED TO DRIVE THE MARKET

4.2 ACTUATORS, BY ACTUATION

FIGURE 14 ELECTRIC SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2027

4.3 ACTUATORS, BY TYPE

FIGURE 15 LINEAR ACTUATOR SEGMENT PROJECTED TO LEAD ACTUATORS MARKET FROM 2021 TO 2027

4.4 ACTUATORS, BY REGION

FIGURE 16 ASIA PACIFIC ACTUATORS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand from automotive industry

5.2.1.2 Rapid industrialization and utilization of robotics

FIGURE 18 GROWTH EXPECTATION IN ROBOTICS AND AUTOMATION ACROSS INDUSTRIES

5.2.1.3 Rising demand from healthcare

5.2.1.4 Revival of space travel

5.2.2 RESTRAINTS

5.2.2.1 Low oil prices and economic slowdown

FIGURE 19 PRICE OF OIL & GAS, 2011–2018 (USD/BARREL)

5.2.3 OPPORTUNITIES

5.2.3.1 Wide array of applications employing linear actuators

5.2.3.2 Growth of luxury, electric, and driverless cars

5.2.3.3 Increased spending on renewable sources of energy for power generation

5.2.4 CHALLENGES

5.2.4.1 Issues of leakage in pneumatic and hydraulic actuators

5.2.4.2 Pandemic and its effect on actuators

5.3 IMPACT OF COVID-19 ON ACTUATORS

FIGURE 20 IMPACT OF COVID-19 ON ACTUATORS

5.4 OPERATIONAL DATA

TABLE 1 NEW COMMERCIAL AIRPLANES DELIVERIES, BY REGION, 2019-2038

TABLE 2 ORDERS AS PER SHIPBUILDER’S ASSOCIATION OF JAPAN, MARCH 2021

TABLE 3 TABLE COMPLETION OF ORDERS AS PER SHIPBUILDER’S ASSOCIATION OF JAPAN, MARCH 2021

5.5 RANGES AND SCENARIOS

FIGURE 21 IMPACT OF COVID-19 ON ACTUATORS: 3 GLOBAL SCENARIOS

5.6 MARKET ECOSYSTEM FOR ACTUATORS

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 APPLICATIONS

FIGURE 22 MARKET ECOSYSTEM MAP: ACTUATOR

5.7 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS

5.8 AVERAGE SELLING PRICE OF ACTUATORS

TABLE 4 AVERAGE SELLING PRICE OF ACTUATORS AND ITS COMPONENTS FOR THE YEAR 2020-2021

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.9.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ACTUATOR MANUFACTURERS

FIGURE 24 REVENUE IMPACT IN ACTUATORS

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 ACTUATORS: PORTER’S FIVE FORCES

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWERS OF SUPPLIERS

5.10.4 BARGAINING POWERS OF BUYERS

5.10.5 DEGREE OF COMPETITION

5.11 USE CASE ANALYSIS: ACTUATORS

5.11.1 LIFT ASSIST TECHNOLOGY TO ELIMINATE WORKPLACE RELATED INJURIES

5.11.2 USAGE OF ACTUATORS IN HOME DÉCOR APPLICATIONS

5.12 TRADE ANALYSIS

TABLE 6 COUNTRY-WISE EXPORTS, HYDRAULIC POWER ENGINES AND MOTORS (A TYPE OF ACTUATOR) LINEAR ACTING “CYLINDERS, " 2019-2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE IMPORTS, HYDRAULIC POWER ENGINES AND MOTORS (A TYPE OF ACTUATOR) LINEAR ACTING “CYLINDERS, " 2019-2020 (USD THOUSAND)

5.13 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS (Page No. - 85)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 SMART ACTUATORS

6.2.2 HYBRID ACTUATORS

6.2.3 MEMS-ELECTROTHERMAL ACTUATORS

6.2.4 AMPLIFIED PIEZOELECTRIC ACTUATOR

6.3 TECHNOLOGY ANALYSIS

6.3.1 ARTIFICIAL MUSCLE ACTUATOR

6.3.2 SMART ACTUATORS FOR INDUSTRY 4.0

6.4 IMPACT OF MEGATRENDS

6.4.1 AUTOMATIC DOOR ACTUATOR

6.4.2 ACTUATORS IN UNMANNED SYSTEMS, AIRCRAFT, AND SPACECRAFT

6.5 INNOVATIONS & PATENT REGISTRATIONS

TABLE 8 INNOVATIONS & PATENT REGISTRATIONS, 2014–2019

7 ACTUATORS MARKET, BY ACTUATION (Page No. - 91)

7.1 INTRODUCTION

FIGURE 25 ELECTRIC SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 9 ACTUATORS MARKET, BY ACTUATION, 2017–2020 (USD BILLION)

TABLE 10 ACTUATORS, BY ACTUATION, 2021–2027 (USD BILLION)

7.2 ELECTRIC

7.2.1 INCREASED USE OF ELECTRICAL ACTUATORS IN DIFFERENT INDUSTRIES TO DRIVE DEMAND

TABLE 11 ELECTRIC ACTUATORS MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 12 ELECTRIC ACTUATORS, BY REGION, 2021–2027 (USD BILLION)

7.3 HYDRAULIC

7.3.1 USE IN HIGH-FORCE APPLICATIONS TO DRIVE DEMAND

TABLE 13 HYDRAULIC ACTUATORS MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 14 HYDRAULIC ACTUATORS, BY REGION, 2021–2027 (USD BILLION)

7.4 PNEUMATIC

7.4.1 USE IN F&B AND OIL & GAS INDUSTRIES TO DRIVE DEMAND

TABLE 15 PNEUMATIC ACTUATORS MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 16 PNEUMATIC ACTUATORS, BY REGION, 2021–2027 (USD BILLION)

7.5 OTHERS

7.5.1 RECENT DEVELOPMENTS IN THERMAL, PIEZOELECTRIC, AND HYBRID ACTUATORS TO DRIVE DEMAND

TABLE 17 OTHERS ACTUATORS MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 18 OTHERS ACTUATORS, BY REGION, 2021–2027 (USD BILLION)

8 ACTUATORS MARKET, BY APPLICATION (Page No. - 98)

8.1 INTRODUCTION

FIGURE 26 ACTUATORS MARKET, BY APPLICATION, 2021 & 2027 (USD BILLION)

TABLE 19 ACTUATORS, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 20 ACTUATORS, BY APPLICATION, 2021–2027 (USD BILLION)

8.2 INDUSTRIAL AUTOMATION

TABLE 21 ACTUATORS MARKET IN INDUSTRIAL AUTOMATION, BY REGION, 2017–2020 (USD BILLION)

TABLE 22 ACTUATORS IN INDUSTRIAL AUTOMATION, BY REGION, 2021–2027 (USD BILLION)

TABLE 23 ACTUATORS IN INDUSTRIAL AUTOMATION, BY VERTICAL, 2017–2020(USD MILLION)

TABLE 24 ACTUATORS IN INDUSTRIAL AUTOMATION, BY VERTICAL, 2021–2027 (USD BILLION)

8.3 ROBOTICS

TABLE 25 ACTUATORS MARKET IN ROBOTICS, BY REGION, 2017–2020 (USD BILLION)

TABLE 26 ACTUATORS IN ROBOTICS, BY REGION, 2021–2027 (USD BILLION)

TABLE 27 ACTUATORS IN ROBOTICS, BY VERTICAL, 2017–2020(USD BILLION)

TABLE 28 ACTUATORS IN ROBOTICS, BY VERTICAL, 2021–2027 (USD BILLION)

TABLE 29 ACTUATORS IN ROBOTICS, BY ROBOT TYPE, 2017–2020 (USD BILLION)

TABLE 30 ACTUATORS IN ROBOTICS, BY ROBOT TYPE, 2021–2027 (USD BILLION)

8.3.1 INDUSTRIAL ROBOTS

TABLE 31 ROBOTICS ACTUATORS MARKET IN INDUSTRIAL ROBOTS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 32 ROBOTICS ACTUATORS IN INDUSTRIAL ROBOTS, BY VERTICAL, 2021–2027 (USD MILLION)

8.3.2 SERVICE ROBOTS

TABLE 33 ROBOTICS ACTUATORS MARKET IN SERVICE ROBOTS, BY VERTICAL, 2017–2020 (USD BILLION)

TABLE 34 ROBOTICS ACTUATORS IN SERVICE ROBOTS, BY VERTICAL, 2021–2027 (USD BILLION)

8.4 VEHICLES AND EQUIPMENT

TABLE 35 ACTUATORS MARKET IN VEHICLES AND EQUIPMENT, BY REGION, 2017–2020 (USD BILLION)

TABLE 36 ACTUATORS IN VEHICLES AND EQUIPMENT, BY REGION, 2021–2027 (USD BILLION)

TABLE 37 ACTUATORS IN VEHICLES AND EQUIPMENT, BY VERTICAL, 2017–2020 (USD BILLION)

TABLE 38 ACTUATORS IN VEHICLES AND EQUIPMENT, BY VERTICAL, 2021–2027 (USD BILLION)

9 ACTUATORS MARKET, BY TYPE (Page No. - 109)

9.1 INTRODUCTION

FIGURE 27 ACTUATORS MARKET, BY TYPE, 2021 & 2027 (USD BILLION)

TABLE 39 ACTUATORS, BY TYPE, 2017–2020 (USD BILLION)

TABLE 40 ACTUATORS, BY TYPE, 2021–2027 (USD BILLION)

9.2 LINEAR ACTUATORS

9.2.1 ROD TYPE

9.2.1.1 Increasing use of rod-less type linear actuators in aircraft structures to drive demand

9.2.2 SCREW TYPE

9.2.2.1 Growing use with servomotors in drive and control hardware to fuel demand

9.2.3 BELT TYPE

9.2.3.1 Rising usage to increase operational efficiency of process automation to drive demand

TABLE 41 LINEAR ACTUATORS MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 42 LINEAR ACTUATORS, BY REGION, 2021–2027 (USD BILLION)

TABLE 43 LINEAR ACTUATORS, BY TYPE, 2017–2020 (USD BILLION)

TABLE 44 LINEAR ACTUATORS, BY TYPE, 2021–2027 (USD BILLION)

9.3 ROTARY ACTUATORS

9.3.1 MOTORS

9.3.1.1 Surging sales of industrial robots to drive demand

9.3.2 BLADDER & VANE

9.3.2.1 Increasing use in gates and valves in process industry to drive demand

9.3.3 PISTON TYPE

9.3.3.1 Growing use for precision control applications in electronics industry to drive demand

TABLE 45 ROTARY ACTUATORS MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 46 ROTARY ACTUATORS, BY REGION, 2021–2027 (USD BILLION)

TABLE 47 ROTARY ACTUATORS, BY TYPE, 2017–2020 (USD BILLION)

TABLE 48 ROTARY ACTUATORS, BY TYPE, 2021–2027 (USD BILLION)

10 ACTUATORS MARKET, BY VERTICAL (Page No. - 116)

10.1 INTRODUCTION

10.1.1 IMPACT OF COVID-19 ON VERTICALS

10.1.1.1 Most impacted vertical

10.1.1.2 Least impacted vertical

FIGURE 28 ACTUATORS MARKET, BY VERTICAL, 2021 & 2027 (USD BILLION)

TABLE 49 ACTUATORS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 50 ACTUATORS, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 51 ACTUATORS VOLUME, BY VERTICAL, 2017–2020 (MILLION)

TABLE 52 ACTUATORS VOLUME, BY VERTICAL, 2021–2027 (MILLION)

10.2 FOOD & BEVERAGES

10.2.1 REQUIREMENT FOR INCREASED AUTOMATION AND CAPACITY ENHANCEMENT TO DRIVE THE SEGMENT

TABLE 53 ACTUATORS MARKET FOR FOOD & BEVERAGES, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 ACTUATORS FOR FOOD & BEVERAGES, BY REGION, 2021–2027 (USD MILLION)

TABLE 55 ACTUATORS FOR FOOD & BEVERAGES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 56 ACTUATORS FOR FOOD & BEVERAGES, BY APPLICATION, 2021–2027 (USD MILLION)

10.3 OIL & GAS

10.3.1 INCREASE IN OIL & GAS EXPLORATION ACTIVITIES IN ASIA PACIFIC TO DRIVE THE SEGMENT

TABLE 57 ACTUATORS MARKET OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 ACTUATORS FOR OIL & GAS, BY REGION, 2021–2027 (USD MILLION)

TABLE 59 ACTUATORS FOR OIL & GAS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 ACTUATORS FOR OIL & GAS, BY APPLICATION, 2021–2027 (USD MILLION)

10.4 METALS, MINING, AND MACHINERY

10.4.1 REQUIREMENT FOR ROBUST ACTUATORS IN MINING INDUSTRY TO DRIVE THE SEGMENT

TABLE 61 ACTUATORS MARKET METALS, MINING, AND MACHINERY, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 ACTUATORS FOR METALS, MINING, AND MACHINERY, BY REGION, 2021–2027 (USD MILLION)

TABLE 63 ACTUATORS FOR METALS, MINING, AND MACHINERY, BY APPLICATION, 2017–2020(USD MILLION)

TABLE 64 ACTUATORS FOR METALS, MINING, AND MACHINERY, BY APPLICATION, 2021–2027 (USD MILLION)

10.5 POWER GENERATION

10.5.1 INCREASED SPENDING ON RENEWABLE SOURCES TO DRIVE THE SEGMENT

TABLE 65 ACTUATORS MARKET FOR POWER GENERATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 ACTUATORS FOR POWER GENERATION, BY REGION, 2021–2027 (USD MILLION)

TABLE 67 ACTUATORS FOR POWER GENERATION, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 68 ACTUATORS FOR POWER GENERATION, BY APPLICATION, 2021–2027 (USD MILLION)

10.6 CHEMICALS, PAPER, AND PLASTICS

10.6.1 RAPID INDUSTRIALIZATION AND STRINGENT IMPLEMENTATION OF ENVIRONMENTAL REGULATIONS TO DRIVE THE SEGMENT

TABLE 69 ACTUATORS MARKET FOR CHEMICALS, PAPER, AND PLASTICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 ACTUATORS FOR CHEMICALS, PAPER, AND PLASTICS, BY REGION, 2021–2027 (USD MILLION)

TABLE 71 ACTUATORS FOR CHEMICALS, PAPER, AND PLASTICS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 72 ACTUATORS FOR CHEMICALS, PAPER, AND PLASTICS, BY APPLICATION, 2021–2027 (USD MILLION)

10.7 PHARMACEUTICAL & HEALTHCARE

10.7.1 STRINGENT REGULATIONS FOR HYGIENE AND INCREASED DEMAND FOR SURGICAL ROBOTS TO DRIVE THE SEGMENT

TABLE 73 ACTUATORS MARKET FOR PHARMACEUTICAL & HEALTHCARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 ACTUATORS MARKET FOR PHARMACEUTICAL & HEALTHCARE, BY REGION, 2021–2027 (USD MILLION)

TABLE 75 ACTUATORS FOR PHARMACEUTICAL & HEALTHCARE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 76 ACTUATORS FOR PHARMACEUTICAL & HEALTHCARE, BY APPLICATION, 2021–2027 (USD MILLION)

10.8 AUTOMOTIVE

10.8.1 INCREASED DEMAND FOR INDUSTRIAL ROBOTS IN AUTOMOTIVE TO DRIVE THE SEGMENT

TABLE 77 ACTUATORS MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD BILLION)

TABLE 78 ACTUATORS FOR AUTOMOTIVE, BY REGION, 2021–2027 (USD BILLION)

TABLE 79 ACTUATORS FOR AUTOMOTIVE, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 80 ACTUATORS FOR AUTOMOTIVE, BY APPLICATION, 2021–2027 (USD BILLION)

10.9 AEROSPACE & DEFENSE

10.9.1 RISE IN DEFENSE EXPENDITURES, COMMERCIAL AVIATION, AND MILITARY MODERNIZATION PROGRAMS TO DRIVE THE SEGMENT

TABLE 81 ACTUATORS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 ACTUATORS FOR AEROSPACE & DEFENSE, BY REGION, 2021–2027 (USD MILLION)

TABLE 83 ACTUATORS FOR AEROSPACE & DEFENSE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 84 ACTUATORS FOR AEROSPACE & DEFENSE, BY APPLICATION, 2021–2027 (USD MILLION)

10.10 MARINE

10.10.1 INCREASED USAGE IN COMMERCIAL SHIPBUILDING TO DRIVE THE SEGMENT

TABLE 85 ACTUATORS MARKET FOR MARINE, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 ACTUATORS FOR MARINE, BY REGION, 2021–2027 (USD MILLION)

TABLE 87 ACTUATORS FOR MARINE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 88 ACTUATORS FOR MARINE, BY APPLICATION, 2021–2027 (USD MILLION)

10.11 ELECTRONICS & ELECTRICAL

10.11.1 GROWING DEMAND FOR BATTERIES, CHIPS, AND DISPLAYS TO DRIVE THE SEGMENT

TABLE 89 ACTUATORS MARKET FOR ELECTRONICS & ELECTRICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 ACTUATORS FOR ELECTRONICS & ELECTRICAL, BY REGION, 2021–2027 (USD MILLION)

TABLE 91 ACTUATORS FOR ELECTRONICS & ELECTRICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 92 ACTUATORS FOR ELECTRONICS & ELECTRICAL, BY APPLICATION, 2021–2027 (USD MILLION)

10.12 CONSTRUCTION

10.12.1 INCREASED DEMAND FOR ELECTRICAL LINEAR ACTUATORS IN LIFTING AND MATERIAL HANDLING APPLICATIONS TO DRIVE THE SEGMENT

TABLE 93 ACTUATORS MARKET FOR CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 94 ACTUATORS FOR CONSTRUCTION, BY REGION, 2021–2027 (USD MILLION)

TABLE 95 ACTUATORS FOR CONSTRUCTION, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 ACTUATORS FOR CONSTRUCTION, BY APPLICATION, 2021–2027 (USD MILLION)

10.13 UTILITIES

10.13.1 INCREASED DEMAND FOR LOGISTICS, AGRICULTURE, AND FIELD ROBOTS TO DRIVE THE SEGMENT

TABLE 97 ACTUATORS MARKET FOR UTILITIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 98 ACTUATORS FOR UTILITIES, BY REGION, 2021–2027 (USD MILLION)

TABLE 99 ACTUATORS FOR UTILITIES, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 100 ACTUATORS FOR UTILITIES, BY APPLICATION, 2021–2027 (USD MILLION)

10.14 HOUSEHOLD & ENTERTAINMENT

10.14.1 INCREASED DEMAND FOR SERVICE ROBOTS IN DOMESTIC APPLICATIONS TO DRIVE THE DEMAND

TABLE 101 ACTUATORS MARKET FOR HOUSEHOLD & ENTERTAINMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 ACTUATORS FOR HOUSEHOLD & ENTERTAINMENT, BY REGION, 2021–2027 (USD MILLION)

TABLE 103 ACTUATORS FOR HOUSEHOLD & ENTERTAINMENT, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 104 ACTUATORS FOR HOUSEHOLD & ENTERTAINMENT, BY APPLICATION, 2021–2027 (USD MILLION)

10.15 AGRICULTURE

10.15.1 GROWING ADOPTION OF MECHANIZATION AND INCREASING GOVERNMENT SUPPORT TO DRIVE THE SEGMENT

TABLE 105 ACTUATORS MARKET FOR AGRICULTURE, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 ACTUATORS FOR AGRICULTURE, BY REGION, 2021–2027 (USD MILLION)

11 REGIONAL ANALYSIS (Page No. - 140)

11.1 INTRODUCTION

11.2 GLOBAL SCENARIOS OF ACTUATORS MARKET

FIGURE 29 GLOBAL SCENARIOS OF ACTUATORS

FIGURE 30 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF ACTUATORS MARKET IN 2021

TABLE 107 ACTUATORS, BY REGION, 2017–2020 (USD BILLION)

TABLE 108 ACTUATORS, BY REGION, 2017–2027 (USD BILLION)

11.3 NORTH AMERICA

11.3.1 COVID-19 RESTRICTIONS IN NORTH AMERICA

11.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA ACTUATORS MARKET SNAPSHOT

TABLE 109 NORTH AMERICA ACTUATORS, BY TYPE, 2017–2020 (USD BILLION)

TABLE 110 NORTH AMERICA ACTUATORS, BY TYPE, 2021–2027 (USD BILLION)

TABLE 111 NORTH AMERICA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 112 NORTH AMERICA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 113 NORTH AMERICA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 NORTH AMERICA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 115 NORTH AMERICA ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2017–2020 (USD MILLION)

TABLE 116 NORTH AMERICA ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2021–2027 (USD MILLION)

TABLE 117 NORTH AMERICA ACTUATORS, BY APPLICATION, BY ROBOTICS, 2017–2020 (USD MILLION)

TABLE 118 NORTH AMERICA ACTUATORS, BY APPLICATION, BY ROBOTICS, 2021–2027 (USD MILLION)

TABLE 119 NORTH AMERICA ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2017–2020 (USD MILLION)

TABLE 120 NORTH AMERICA ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2021–2027 (USD MILLION)

TABLE 121 NORTH AMERICA ACTUATORS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 122 NORTH AMERICA ACTUATORS, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 123 NORTH AMERICA ACTUATORS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 124 NORTH AMERICA ACTUATORS, BY COUNTRY, 2021–2027 (USD MILLION)

11.3.3 US

11.3.3.1 Increase adoption of Industry 4.0 to drive the market

TABLE 125 US ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 126 US ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 127 US ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 128 US ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 129 US ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 130 US ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.3.4 CANADA

11.3.4.1 Increasing demand for linear actuators to drive the market

TABLE 131 CANADA ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 132 CANADA ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 133 CANADA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 134 CANADA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 135 CANADA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 136 CANADA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.3.5 MEXICO

11.3.5.1 Increasing demand from oil and gas industry to drive the market

TABLE 137 MEXICO ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 138 MEXICO ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 139 MEXICO ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 140 MEXICO ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 141 MEXICO ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 142 MEXICO ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.4 EUROPE

11.4.1 COVID-19 RESTRICTONS IN EUROPE

11.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE ACTUATORS MARKET SNAPSHOT

TABLE 143 EUROPE ACTUATORS, BY TYPE, 2017–2020 (USD BILLION)

TABLE 144 EUROPE ACTUATORS, BY TYPE, 2021–2027 (USD BILLION)

TABLE 145 EUROPE ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 146 EUROPE ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 147 EUROPE ACTUATORS, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 148 EUROPE ACTUATORS, BY APPLICATION, 2021–2027 (USD BILLION)

TABLE 149 EUROPE ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2017–2020 (USD MILLION)

TABLE 150 EUROPE ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2021–2027 (USD MILLION)

TABLE 151 EUROPE ACTUATORS, BY APPLICATION, BY ROBOTICS, 2017–2020 (USD MILLION)

TABLE 152 EUROPE ACTUATORS, BY APPLICATION, BY ROBOTICS, 2021–2027 (USD MILLION)

TABLE 153 EUROPE ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2017–2020 (USD MILLION)

TABLE 154 EUROPE ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2021–2027 (USD MILLION)

TABLE 155 EUROPE ACTUATORS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 156 EUROPE ACTUATORS, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 157 EUROPE ACTUATORS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 158 EUROPE ACTUATORS, BY COUNTRY, 2021–2027 (USD MILLION)

11.4.3 GERMANY

11.4.3.1 Presence of thriving automobile and manufacturing industries to drive the market

TABLE 159 GERMANY ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 160 GERMANY ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 161 GERMANY ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 162 GERMANY ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 163 GERMANY ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 164 GERMANY ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.4.4 FRANCE

11.4.4.1 Presence of major aerospace and defense manufacturers to drive the market

TABLE 165 FRANCE ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 166 FRANCE ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 167 FRANCE ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 168 FRANCE ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 169 FRANCE ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 170 FRANCE ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.4.5 UK

11.4.5.1 Increasing demand from oil & gas industry to drive the market

TABLE 171 UK ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 172 UK ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 173 UK ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 174 UK ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 175 UK ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 176 UK ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.4.6 ITALY

11.4.6.1 Presence of major automobile and food & beverages manufacturers to drive the market

TABLE 177 ITALY ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 178 ITALY ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 179 ITALY ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 180 ITALY ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 181 ITALY ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 182 ITALY ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.4.7 SWITZERLAND

11.4.7.1 Increasing demand from pharma industry to drive the market

TABLE 183 SWITZERLAND ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 184 SWITZERLAND ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 185 SWITZERLAND ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 186 SWITZERLAND ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 187 SWITZERLAND ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 188 SWITZERLAND ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 189 REST OF EUROPE ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 190 REST OF EUROPE ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 191 REST OF EUROPE ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 192 REST OF EUROPE ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 193 REST OF EUROPE ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 194 REST OF EUROPE ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.5 ASIA PACIFIC

11.5.1 COVID-19 RESTRICTONS IN ASIA PACIFIC

11.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC ACTUATORS MARKET SNAPSHOT

TABLE 195 ASIA PACIFIC ACTUATORS, BY TYPE, 2017–2020 (USD BILLION)

TABLE 196 ASIA PACIFIC ACTUATORS, BY TYPE, 2021–2027(USD BILLION)

TABLE 197 ASIA PACIFIC ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 198 ASIA PACIFIC ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 199 ASIA PACIFIC ACTUATORS, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 200 ASIA PACIFIC ACTUATORS, BY APPLICATION, 2021–2027 (USD BILLION)

TABLE 201 ASIA PACIFIC ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2017–2020 (USD MILLION)

TABLE 202 ASIA PACIFIC ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2021–2027 (USD MILLION)

TABLE 203 ASIA PACIFIC ACTUATORS, BY APPLICATION, BY ROBOTICS, 2017–2020 (USD MILLION)

TABLE 204 ASIA PACIFIC ACTUATORS, BY APPLICATION, BY ROBOTICS, 2021–2027 (USD MILLION)

TABLE 205 ASIA PACIFIC ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2017–2020 (USD MILLION)

TABLE 206 ASIA PACIFIC ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2021–2027 (USD MILLION)

TABLE 207 ASIA PACIFIC ACTUATORS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 208 ASIA PACIFIC ACTUATORS, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 209 ASIA PACIFIC ACTUATORS, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 210 ASIA PACIFIC ACTUATORS, BY COUNTRY, 2021–2027(USD BILLION)

11.5.3 CHINA

11.5.3.1 Presence of all major industries to drive the market

TABLE 211 CHINA ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 212 CHINA ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 213 CHINA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 214 CHINA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 215 CHINA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 216 CHINA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.5.4 JAPAN

11.5.4.1 Increasing demand across major industries to drive the market

TABLE 217 JAPAN ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 218 JAPAN ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 219 JAPAN ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 220 JAPAN ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 221 JAPAN ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 222 JAPAN ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.5.5 INDIA

11.5.5.1 Presence of flourishing steel and textile industries to drive the market

TABLE 223 INDIA ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 224 INDIA ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 225 INDIA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 226 INDIA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 227 INDIA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 228 INDIA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.5.6 SOUTH KOREA

11.5.6.1 Presence of major automotive and electronics manufacturers to drive the market

TABLE 229 SOUTH KOREA ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 230 SOUTH KOREA ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 231 SOUTH KOREA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 232 SOUTH KOREA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 233 SOUTH KOREA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 234 SOUTH KOREA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.5.7 TAIWAN

11.5.7.1 Presence of major semiconductor and electronics manufacturers to drive the market

TABLE 235 TAIWAN ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 236 TAIWAN ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 237 TAIWAN ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 238 TAIWAN ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 239 TAIWAN ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 240 TAIWAN ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.5.8 REST OF ASIA PACIFIC

TABLE 241 REST OF ASIA PACIFIC ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 242 REST OF ASIA PACIFIC ACTUATORS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 243 REST OF ASIA PACIFIC ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 244 REST OF ASIA PACIFIC ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 245 REST OF ASIA PACIFIC ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 246 REST OF ASIA PACIFIC ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

FIGURE 34 ROW ACTUATORS MARKET SNAPSHOT

TABLE 247 ROW ACTUATORS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 248 ROW ACTUATORS, BY TYPE, 2021–2027(USD MILLION)

TABLE 249 ROW ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 250 ROW ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 251 ROW ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 252 ROW ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 253 ROW ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2017–2020 (USD MILLION)

TABLE 254 ROW ACTUATORS, BY APPLICATION, BY INDUSTRIAL AUTOMATION, 2021–2027 (USD MILLION)

TABLE 255 ROW ACTUATORS, BY APPLICATION, BY ROBOTICS, 2017–2020 (USD MILLION)

TABLE 256 ROW ACTUATORS, BY APPLICATION, BY ROBOTICS, 2021–2027 (USD MILLION)

TABLE 257 ROW ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2017–2020 (USD MILLION)

TABLE 258 ROW ACTUATORS, BY APPLICATION, BY VEHICLES AND EQUIPMENT, 2021–2027 (USD MILLION)

TABLE 259 ROW ACTUATORS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 260 ROW ACTUATORS, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 261 ROW ACTUATORS, BY REGION, 2017–2020 (USD MILLION)

TABLE 262 ROW ACTUATORS, BY REGION, 2021–2027 (USD MILLION)

11.6.1 MIDDLE EAST

TABLE 263 MIDDLE EAST ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 264 MIDDLE EAST ACTUATORS, BY TYPE, 2021–2027(USD MILLION)

TABLE 265 MIDDLE EAST ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 266 MIDDLE EAST ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 267 MIDDLE EAST ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 268 MIDDLE EAST ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.6.2 LATIN AMERICA

TABLE 269 LATIN AMERICA ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 270 LATIN AMERICA ACTUATORS, BY TYPE, 2021–2027(USD MILLION)

TABLE 271 LATIN AMERICA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 272 LATIN AMERICA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 273 LATIN AMERICA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 274 LATIN AMERICA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

11.6.3 AFRICA

TABLE 275 AFRICA ACTUATORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 276 AFRICA ACTUATORS, BY TYPE, 2021–2027(USD MILLION)

TABLE 277 AFRICA ACTUATORS, BY ACTUATION, 2017–2020 (USD MILLION)

TABLE 278 AFRICA ACTUATORS, BY ACTUATION, 2021–2027 (USD MILLION)

TABLE 279 AFRICA ACTUATORS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 280 AFRICA ACTUATORS, BY APPLICATION, 2021–2027 (USD MILLION)

12 CUSTOMER ANALYSIS (Page No. - 204)

12.1 OBJECTIVES

12.2 INTRODUCTION

12.2.1 FOURTH INDUSTRIAL REVOLUTION (INDUSTRY 4.0)

12.2.2 CONSUMER BUYING PROCESS

12.2.3 PROMINENT COMPANIES

12.2.4 SMALL AND MEDIUM ENTERPRISES

FIGURE 35 SUPPLY CHAIN: DIRECT DISTRIBUTION BY PROMINENT FIRMS IS PREVALENT IN ACTUATORS MARKET

12.3 CUSTOMER ACTUATOR SELECTION CRITERIA

12.4 TESTING

12.4.1 SELECTION CRITERIA

12.4.2 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN TESTING INDUSTRY

12.4.3 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN TESTING INDUSTRY

12.4.4 MAJOR ACTUATOR SUPPLIERS FOR TESTING INDUSTRY

12.5 FOOD & BEVERAGE INDUSTRY

12.5.1 SELECTION CRITERIA

12.5.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN F&B INDUSTRY

12.5.3 APPLICATION AREAS OF ACTUATORS BEING USED IN F&B INDUSTRY

12.5.4 FACTORS THAT WILL AFFECT DEMAND FOR ACTUATORS DURING THE NEXT 3 TO 5 YEARS

12.5.5 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN F&B INDUSTRY

12.5.6 MAJOR ACTUATOR SUPPLIERS FOR F&B INDUSTRY

12.6 CHEMICAL INDUSTRY

12.6.1 SELECTION CRITERIA

12.6.2 APPLICATION AREAS WHEREIN ACTUATORS ARE BEING USED IN CHEMICAL INDUSTRY

12.6.3 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN CHEMICAL INDUSTRY

12.6.4 FACTORS THAT WILL AFFECT THE DEMAND FOR ACTUATORS DURING THE NEXT 3 TO 5 YEARS

12.6.5 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN CHEMICAL INDUSTRY

12.6.6 MAJOR ACTUATOR SUPPLIERS FOR THIS INDUSTRY

12.7 METALS AND MINING INDUSTRY

12.7.1 SELECTION CRITERIA

12.7.2 APPLICATION AREAS WHERE ACTUATORS ARE BEING USED IN METALS & MINING INDUSTRY

12.7.3 FACTORS THAT WILL AFFECT DEMAND FOR ACTUATORS DURING NEXT 3 TO 5 YEARS

12.7.4 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN METALS & MINING INDUSTRY

12.7.5 MAJOR ACTUATOR SUPPLIERS FOR METALS AND MINING INDUSTRY

12.8 MANUFACTURING & CONSTRUCTION INDUSTRY

12.8.1 SELECTION CRITERIA

12.8.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN MANUFACTURING & CONSTRUCTION INDUSTRY

12.8.3 APPLICATION AREAS WHEREIN ACTUATORS ARE BEING USED IN MANUFACTURING & CONSTRUCTION INDUSTRY

12.8.4 FACTORS THAT WILL AFFECT DEMAND FOR ACTUATORS DURING NEXT 3 TO 5 YEARS

12.8.5 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN MANUFACTURING & CONSTRUCTION INDUSTRY

12.8.6 MAJOR ACTUATOR SUPPLIERS FOR MANUFACTURING & CONSTRUCTION INDUSTRY

12.9 PHARMACEUTICAL AND HEALTH CARE

12.9.1 SELECTION CRITERIA

12.9.2 ACTUATOR/ACTUATION SYSTEM ISSUES FACED BY CUSTOMERS IN PHARMACEUTICAL & HEALTHCARE

12.9.3 APPLICATION AREAS WHEREIN ACTUATORS ARE BEING USED IN PHARMACEUTICALS INDUSTRY

12.9.4 FACTORS THAT WILL AFFECT DEMAND FOR ACTUATORS DURING THE NEXT 3 TO 5 YEARS

12.9.5 MAJOR ACTUATOR/SYSTEM BUYERS IN PHARMACEUTICALS INDUSTRY

12.9.6 MAJOR ACTUATOR SUPPLIERS FOR PHARMACEUTICALS INDUSTRY

12.1 PULP AND PAPER INDUSTRY

12.10.1 SELECTION CRITERIA

12.10.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN PULP & PAPER INDUSTRY

12.10.3 DIFFERENT APPLICATION AREAS WHERE ACTUATORS ARE BEING USED IN PULP & PAPER INDUSTRY

12.10.4 FACTORS THAT WILL AFFECT DEMAND FOR ACTUATORS DURING NEXT 3 TO 5 YEARS

12.10.5 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN PULP & PAPER INDUSTRY

12.10.6 MAJOR ACTUATOR SUPPLIERS FOR PULP & PAPER INDUSTRY

12.11 WATER TREATMENT

12.11.1 SELECTION CRITERIA

12.11.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS WATER TREATMENT INDUSTRY

12.11.3 APPLICATIONS WHEREIN ACTUATORS ARE USED IN WATER TREATMENT INDUSTRY

12.11.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN THIS INDUSTRY IN NEXT 3 TO 5 YEARS

12.11.5 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN WATER TREATMENT INDUSTRY

12.11.6 MAJOR ACTUATOR SUPPLIERS FOR WATER TREATMENT INDUSTRY

12.12 OIL & GAS

12.12.1 SELECTION CRITERIA

12.12.2 APPLICATION AREAS FOR ACTUATORS IN THE OIL & GAS INDUSTRY

12.12.3 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN OIL & GAS INDUSTRY

12.12.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN INDUSTRY IN NEXT 3 TO 5 YEARS

12.12.5 MAJOR CERTIFICATIONS REQUIRED FOR ACTUATORS FOR OIL & GAS INDUSTRY

12.12.6 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN OIL & GAS INDUSTRY

12.12.7 MAJOR ACTUATOR SUPPLIERS FOR OIL & GAS INDUSTRY

12.13 AEROSPACE

12.13.1 SELECTION CRITERIA

12.13.2 MAJOR PROBLEMS RELATED TO ACTUATOR/ACTUATION SYSTEMS FACED BY CUSTOMERS IN AEROSPACE INDUSTRY

12.13.3 APPLICATION AREAS WHERE ACTUATORS ARE BEING USED IN AEROSPACE INDUSTRY

12.13.4 DIFFERENT APPLICATION AREAS WITHIN FLIGHT CONTROLS WHERE ACTUATORS ARE USED

12.13.5 APPLICATION AREAS WITHIN FLIGHT CONTROLS WHERE LINEAR ACTUATORS ARE USED

12.13.6 CHANGING ACTUATOR REQUIREMENTS IN FUTURE

12.13.7 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN AEROSPACE INDUSTRY

12.13.8 MAJOR ACTUATOR SUPPLIERS IN AEROSPACE INDUSTRY

12.14 DEFENSE

12.14.1 SELECTION CRITERIA

12.14.2 ADVANTAGES OF ACTUATORS IN DEFENSE

12.14.3 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN DEFENSE INDUSTRY

12.14.4 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN POWER GENERATION INDUSTRY

12.14.5 MAJOR ACTUATOR SUPPLIERS IN DEFENSE INDUSTRY

12.15 POWER GENERATION

12.15.1 SELECTION CRITERIA

12.15.2 APPLICATIONS FOR WHICH ACTUATORS ARE USED

12.15.3 APPLICATION AREAS FOR ACTUATORS IN POWER GENERATION INDUSTRY

12.15.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN INDUSTRY IN NEXT 3 TO 5 YEARS

12.15.5 CUSTOMER EXPECTATIONS FOR ACTUATORS AND RELATED SYSTEMS SUPPLIERS REGARDING MAINTENANCE AND SUPPORT

12.15.6 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN POWER GENERATION INDUSTRY

12.15.7 MAJOR ACTUATOR SUPPLIERS IN POWER GENERATION INDUSTRY

12.16 AUTOMOTIVE INDUSTRY

12.16.1 SELECTION CRITERIA

12.16.2 APPLICATION AREAS FOR ACTUATORS IN AUTOMOTIVE INDUSTRY

12.16.3 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN THIS INDUSTRY

12.16.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN INDUSTRY IN NEXT 3 TO 5 YEARS

12.16.5 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN AUTOMOTIVE INDUSTRY

12.16.6 MAJOR ACTUATOR SUPPLIERS IN AUTOMOTIVE INDUSTRY

13 COMPETITIVE LANDSCAPE (Page No. - 249)

13.1 INTRODUCTION

13.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 36 MARKET RANKING OF LEADING PLAYERS IN THE ACTUATORS, 2020

13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

FIGURE 37 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN THE ACTUATORS, 2020

13.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2019

FIGURE 38 REVENUE ANALYSIS OF LEADING PLAYERS IN THE ACTUATORS, 2020

13.5 COMPETITIVE OVERVIEW

TABLE 281 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE ACTUATORS MARKET BETWEEN 2018 AND 2020

13.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 282 COMPANY PRODUCT FOOTPRINT

TABLE 283 COMPANY APPLICATION FOOTPRINT

TABLE 284 COMPANY INDUSTRY FOOTPRINT

TABLE 285 COMPANY REGION FOOTPRINT

13.6.1 COMPANY EVALUATION QUADRANT

13.6.1.1 Star

13.6.1.2 Emerging leader

13.6.1.3 Pervasive

13.6.1.4 Participant

FIGURE 39 ACTUATORS MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

13.6.2 ACTUATORS COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

13.6.2.1 Progressive companies

13.6.2.2 Responsive companies

13.6.2.3 Dynamic companies

13.6.2.4 Starting blocks

FIGURE 40 ACTUATORS MARKET (START-UPS) COMPETITIVE LEADERSHIP MAPPING, 2020

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES

TABLE 286 ACTUATORS MARKET: PRODUCT LAUNCHES, JANUARY 2018- JANUARY 2021

13.7.2 DEALS

TABLE 287 ACTUATORS MARKET: DEALS, FEBRUARY 2018– DECEMBER 2020

13.7.3 OTHERS

TABLE 288 ACTUATORS: EXPANSIONS, JANUARY 2018- OCTOBER 2018

14 COMPANY PROFILES (Page No. - 268)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 EMERSON ELECTRIC

TABLE 289 EMERSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 41 EMERSON ELECTRIC: COMPANY SNAPSHOT

TABLE 290 ACTUATORS MARKET: PRODUCT LAUNCH, FEBRUARY 2019

TABLE 291 ACTUATORS: OTHERS, JANUARY 2018

14.2.2 ROCKWELL AUTOMATION

TABLE 292 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 42 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 293 ACTUATORS MARKET: PRODUCT LAUNCH, NOVEMBER 2018

TABLE 294 ACTUATORS: DEALS, NOVEMBER 2017 –AUGUST 2018

14.2.3 PARKER HANNIFIN CORPORATION

TABLE 295 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 43 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

TABLE 296 ACTUATORS MARKET: PRODUCT LAUNCH, JUNE 2018-MAY 2019

TABLE 297 ACTUATORS: DEALS, OCTOBER 2019

14.2.4 ABB

TABLE 298 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT

TABLE 299 ACTUATORS MARKET: DEALS, AUGUST 2018-NOVEMBER 2018

TABLE 300 ACTUATORS: OTHERS, OCTOBER 2018

14.2.5 SMC

TABLE 301 SMC: BUSINESS OVERVIEW

FIGURE 45 SMC: COMPANY SNAPSHOT

TABLE 302 ACTUATORS MARKET: PRODUCT LAUNCH, MAY 2018- DECEMBER 2018

TABLE 303 ACTUATORS: OTHERS, OCTOBER 2018

14.3 OTHER PLAYERS

14.3.1 MOOG

TABLE 304 MOOG: BUSINESS OVERVIEW

FIGURE 46 MOOG: COMPANY SNAPSHOT

TABLE 305 ACTUATORS MARKET: DEALS, FEBRUARY 2017-FEBRUARY 2018

14.3.2 CURTISS-WRIGHT CORPORATION

TABLE 306 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

FIGURE 47 CURTISS-WRIGHT: COMPANY SNAPSHOT

TABLE 307 ACTUATORS MARKET: PRODUCT LAUNCH, FEBRUARY 2018- JANUARY 2021

TABLE 308 ACTUATORS: DEALS, DECEMBER 2020

14.3.3 ALTRA INDUSTRIAL MOTION

TABLE 309 ALTRA INDUSTRIAL MOTION: BUSINESS OVERVIEW

FIGURE 48 ALTRA INDUSTRIAL MOTION: COMPANY SNAPSHOT

TABLE 310 ACTUATORS: PRODUCT LAUNCH, MARCH 2017- MARCH 2018

14.3.4 TOLOMATIC

TABLE 311 TOLOMATIC: BUSINESS OVERVIEW

TABLE 312 ACTUATORS MARKET: PRODUCT LAUNCH, SEPTEMBER 2020

14.3.5 VENTURE MFG. CO.

TABLE 313 VENTURE MFG. CO.: BUSINESS OVERVIEW

14.3.6 IAI

TABLE 314 IAI: BUSINESS OVERVIEW

TABLE 315 ACTUATORS: PRODUCT LAUNCH, FEBRUARY 2019- JANUARY 2021

14.3.7 SKF

TABLE 316 SKF: BUSINESS OVERVIEW

FIGURE 49 SKF: COMPANY SNAPSHOT

TABLE 317 ACTUATORS MARKET: DEALS, JULY 2018

14.3.8 HARMONIC DRIVE LLC

TABLE 318 HARMONIC DRIVE LLC: BUSINESS OVERVIEW

TABLE 319 ACTUATORS: PRODUCT LAUNCH, SEPTEMBER 2018

14.3.9 NOOK INDUSTRIES, INC.

TABLE 320 NOOK INDUSTRIES, INC.: BUSINESS OVERVIEW

14.3.10 KOLLMORGEN

TABLE 321 KOLLMORGEN: BUSINESS OVERVIEW

14.3.11 MISUMI GROUP INC.

TABLE 322 MISUMI GROUP INC.: BUSINESS OVERVIEW

FIGURE 50 MISUMI GROUP INC.: COMPANY SNAPSHOT

TABLE 323 ACTUATORS MARKET: OTHERS, NOVEMBER 2017

14.3.12 DVG AUTOMATION

TABLE 324 DVG AUTOMATION: BUSINESS OVERVIEW

14.3.13 MACRON DYNAMICS

TABLE 325 MACRON DYNAMICS: BUSINESS OVERVIEW

TABLE 326 ACTUATORS: PRODUCT LAUNCH, FEBRUARY 2018

14.3.14 ROTOMATION

TABLE 327 ROTOMATION: BUSINESS OVERVIEW

14.3.15 CEDRAT TECHNOLOGIES

TABLE 328 CEDRAT TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 329 ACTUATORS MARKET: PRODUCT LAUNCH, JULY 2017

14.3.16 KINITICS AUTOMATION

TABLE 330 KINITICS AUTOMATION: BUSINESS OVERVIEW

TABLE 331 ACTUATORS: PRODUCT LAUNCH, JANUARY 2018

14.3.17 FESTO

TABLE 332 FESTO: BUSINESS OVERVIEW

TABLE 333 ACTUATORS: PRODUCT LAUNCH, OCTOBER 2019

TABLE 334 ACTUATORS: DEALS

TABLE 335 ACTUATORS: OTHERS, APRIL 2018-OCTOBER 2018

14.3.18 IMI PLC

TABLE 336 IMI PLC: BUSINESS OVERVIEW

FIGURE 51 IMI PLC: COMPANY SNAPSHOT

TABLE 337 ACTUATORS: DEALS, NOVEMBER 2018

14.3.19 EATON CORPORATION

TABLE 338 EATON CORPORATION: BUSINESS OVERVIEW

FIGURE 52 EATON CORPORATION: COMPANY SNAPSHOT

14.3.20 WITTENSTEIN SE

TABLE 339 WITTENSTEIN SE: COMPANY OVERVIEW

14.3.21 PROGRESSIVE AUTOMATIONS

TABLE 340 PROGRESSIVE AUTOMATIONS: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 335)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

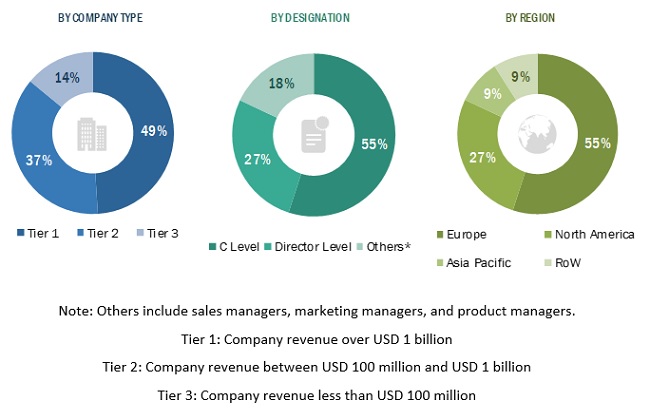

The research study conducted on the actuators market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the actuators market. The primary sources considered included industry experts from the actuators market as well as sub-component manufacturers, actuator system service providers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the actuators market as well as to assess the growth prospects of the market.

Secondary Research

Secondary sources that were referred to for this research study on the actuators market included financial statements of companies offering actuators and information from various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the actuators market that was validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the actuators market. The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with industry experts with knowledge of actuators.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the segments and subsegments of the actuators market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the actuators market based on type, actuation, application, vertical, and region

- To forecast the size of various segments of the actuators market across North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the actuators market across the globe

- To analyze technological advancements undertaken and new products launched in the market

- To identify the financial position, key products, and key developments undertaken by leading companies in the market

- To analyze micromarkets with respect to their growth trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market, along with the market share analysis of leading players

- To provide a comprehensive analysis of business and corporate strategies adopted by key players to strengthen their position in the actuators market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Actuators Market

I am interested in this report as a demonstration to the Department of Defense that fluid power actuators continue to be a very viable solution within industry despite the proliferation of electric actuators.

I am researching the market potential of shape memory alloy actuators in the global actuator market and the aerospace market.

We are interested in the worldwide growth and absolute revenue of electric alternatives instead of pneumatic actuators.

We developed an actuator product and we are doing a market research to sell this product. We need information for faster sales response and further development. I hope you will help me with market information related to actuators or market information related to sales. Thank you.