Specialty Chemicals Market by Type (Plasticizers, Water-Based, Coagulants and Flocculants, Scale Inhibitors), Application (Paper and Packaging, Automotive, Consumer Goods, Construction), and Region - Global Forecast to 2028

Specialty Chemicals Market

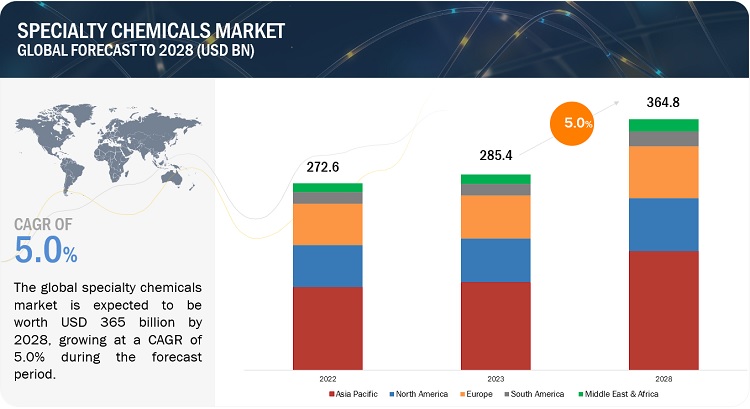

The global specialty chemicals market was valued at USD 272.6 billion in 2022 and is projected to reach USD 364.8 billion by 2028, growing at a cagr 5.0% from 2023 to 2028. Specialty chemicals is a whole ecosystem consisting of multiple chemicals within the category. In this report we have considered different specialty chemicals such as plastic additives, rubber additives, adhesives, cosmetic ingredients, lubricating oil additives, specialty oilfield chemicals, water treatment chemicals, electronic chemicals, textile chemicals, and advanced ceramic chemicals. Packaging industry is one of the major consumer of specialty chemicals, especially for food and cosmetic packaging application. This growth is driven by the emergence of e-commerce platforms.

To know about the assumptions considered for the study, Request for Free Sample Report

Specialty Chemicals Market Dynamics

Driver: Increasing demand from end-use industries

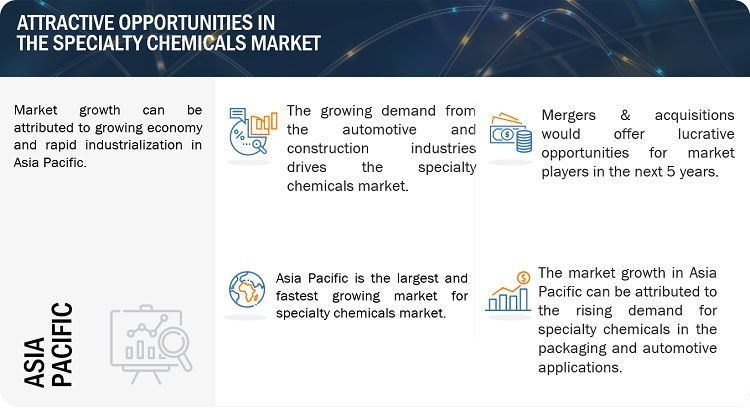

Due to the expansion of different end-use industries, including automotive, electronics, construction, medical, and packaging, the demand for specialty chemicals has been rising recently. One of the biggest consumers of specialty chemicals is the automotive industry. Specialty chemicals are used in the manufacturing of a few automobile parts, including tires, coatings, and adhesives inorder to enhance their performance and durability. The demand for specialty chemicals is expected to grow further as these sectors develop and innovate, presenting potential for producers in the specialty chemicals market.

Restraints: Government and environmental regulations

The regulatory framework in which the specialty chemicals industry operates frequently puts strict rules on the companies. To protect workers, customers, and the environment, these rules are implemented by government organizations and environmental authorities. Although these laws are essential for safeguarding the public's health and reducing their negative effects on the environment, they can be difficult for the companies to comply with. To satisfy the required standards, they must spend a lot of money on testing, research and development, and documentation.

Opportunities: Green & sustainable specialty chemicals

Specialty chemicals that provide eco-friendly and sustainable solutions now have a lot of opportunities because of rising environmental concerns and standards around sustainability. The need for specialty chemicals that support these initiatives is rising as the companies work to minimize their environmental impact and implement more eco-friendly practices. These specialty chemicals are essential for lowering emissions, increasing energy effectiveness, and promoting sustainability in a variety of industries, including consumer goods, construction, and the automobile industry.

Challenges: Volatility in raw material prices

The specialty chemicals manufacturing process includes the use of various raw materials. Specialty chemicals often depend on specific raw materials, and any changes in their prices can have a major impact on manufacturing costs and profit margins. The cost of producing specialty chemicals can be directly impacted by changes in the price of these raw ingredients. If the prices of key raw materials increase significantly, it can result in higher production costs for plastic additive, rubber additives, adhesives and other specialty chemicals manufacturer. When the cost of raw materials used in specialty chemicals rises, manufacturers may face challenges in maintaining competitive pricing. Specialty chemicals may be more expensive and less appealing to consumers if they are unable to bear the extra costs.

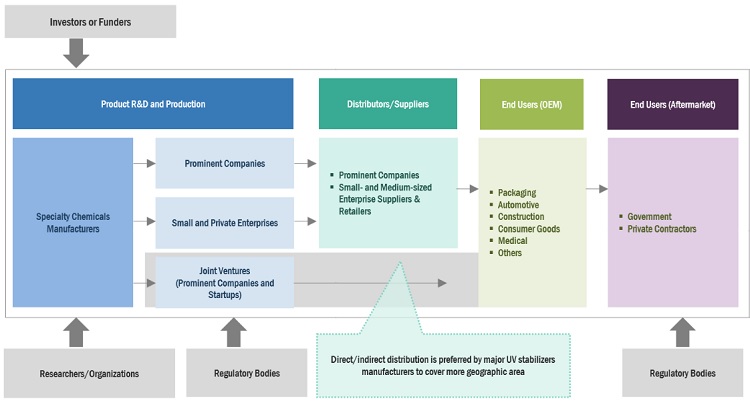

Specialty Chemicals Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of specialty chemicals. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include BASF SE (Germany), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Evonik Industries AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), and Arkema (France).

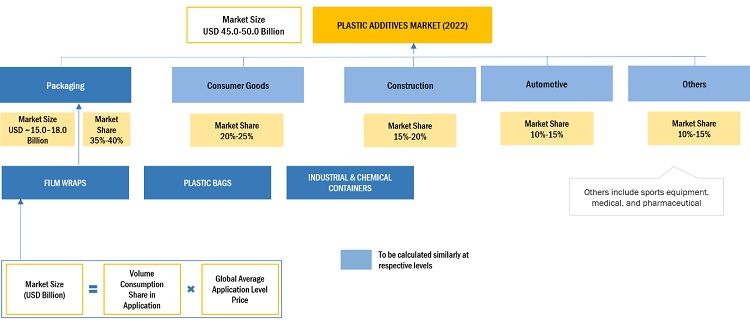

Based on type, plasticizers was the largest segment for plastic additives market, in terms of value, in 2022.

The development of new plasticizer formulations and manufacturing processes has expanded the range of applications for plasticizers. This includes the development of bio-based and non-phthalate plasticizers, which have gained popularity because of their safe and non-toxic attributes. Also the growing construction industries fuels the demand for plasticizers as they are used in the manufacturing of PVC-based pipes, cables, and other construction materials.

Based on application, consumer goods was the second-largest segment for plastic additives market, in terms of value, in 2022.

The consumer goods segment accounted for the second-largest market share in the plastic additives market in terms of value, in 2022. There is a significant demand for plastic additives in the consumer goods application to protect goods from the damaging by UV rays while being stored and transported, improve durability, and enhance performance . Overall, the need for product protection, consumer expectations, regulatory requirements, and technological developments in plastic additives formulations are all projected to drive up demand for plastic additives in consumer goods application.

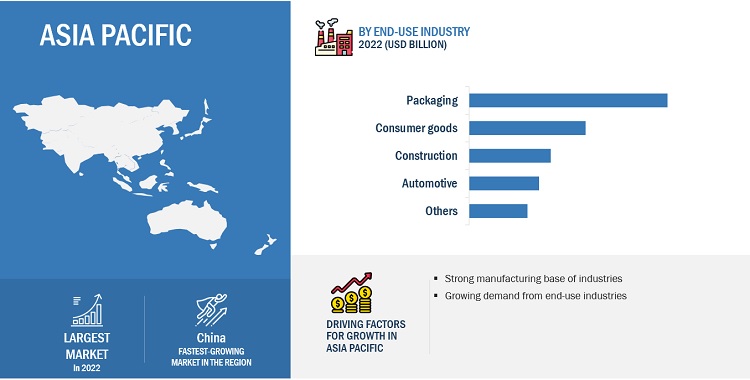

“Asia Pacific accounted for the largest market share for plastic additives market, in terms of value, in 2022”

Asia Pacific is home to some of the fastest-growing economies, such as China, India, and Southeast Asian countries. The economic growth in these countries leads to the growth of construction activities, infrastructure development, and urbanization, which drives the demand for specialty chemicals. Specialty chemicals are used in finished products as ingerdients to enhance their performance, durability, and protect from damaging. Also the rising disposable income in this region contributes to an increased infrastructure and construction activities. Asia Pacific countries such as India and China have low cost labor which attract major automotive manufacturers to set up their operational plant in these countries. All these factors are driving the market for specialty chemicals in Asia Pacific region majorly in automotive, construction, medical, packaging, and consumer goods applications.

Note: For illustration, largest type, application, region is provided for plastic additives similar information is provided for all the ten chemicals in the report.

To know about the assumptions considered for the study, download the pdf brochure

Specialty Chemicals Market Players

The players profiled in the report include BASF SE (Germany), Evonik Industries AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), and Arkema (France). Unitechem Group (China), and Everlight Chemical Industrial Corporation (Taiwan) among others, these are the key manufacturers that secured major market share in the last few years.

Specialty Chemicals Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 272.6 billion |

|

Revenue Forecast in 2028 |

USD 364.8 billion |

|

CAGR |

5.0% |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Million/Billion) |

|

Segments covered |

Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include BASF SE (Germany), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Evonik Industries AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), Arkema (France) among others. |

This report categorizes the global specialty chemicals market based on type, application, and region.

On the basis of type, the specialty chemicals market has been segmented as follows:

-

Adhesives

- Water-based

- Solvent-based

- Hot-Melt

- Reactive & Others

-

Water Treatment Chemical

- Coagulants & Flocculants

- Scale Inhibitors

- Corrosion Inhibitors

- Biocides & Disinfectants

- Chelating Agents

- Others

-

Electronic Chemicals

- Silicon Wafers

- PCB Laminates

- Specialty Gases

- Conductive Polymers

- Photoresist & Photoresist Ancillaries

- Others

-

Rubber Additives

- Antidegradants

- Accelerators

- Others

-

Lubricating Oil Additives

- Viscosity Index Improvers

- Dispersants

- Detergents

- Antioxidants

- Extreme Pressure Additives

- Others

-

Cosmetic Ingredients

- Emollients

- Surfactants

- Conditioning Polymers

- Rheology Modifiers

- Emulsifiers

- Others

-

Advanced Ceramic Materials

- Alumina Ceramics

- Silicon Carbide Ceramics

- Titanate Ceramics

- Zirconia Ceramics

- Others

-

Plastic Additives

- Plasticizers

- Flame Retardants

- Stabilizers

- Impact Modifiers

- Nucleating Agent

- Others

-

Specialty Oilfield Chemicals

- Demulsifers

- Inhibitors & Scavengers

- Rheology Modifiers

- Friction Modifiers

- Specialty Biocides

- Others

-

Textile Chemicals

- Coating & Sizing Agents

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Desizing Agents

- Others

On the basis of application, the specialty chemicals market has been segmented as follows:

-

Adhesives

- Paper & Packaging

- Building & Construction

- Medical

- Automotive & Transportation

- Electronic

- Others

-

Water Treatment Chemical

- Residential

- Commercial

- Industrial

-

Electronic Chemicals

- Semiconductor

- Others

-

Rubber Additives

- Tire

- Non-Tire

-

Lubricating Oil Additives

- Automotive

- Industrial

-

Cosmetic Ingredients

- Skin Care

- Hair Care

- Oral Care

- Make-Up

- Others

-

Advanced Ceramic Materials

- Electronics & Electricals

- Transportation

- Medical

- Environmental

- Chemical

- Others

-

Plastic Additives

- Packaging

- Consumer Goods

- Construction

- Automotive

- Others

-

Specialty Oilfield Chemicals

- Production

- Well Stimulation

- Drilling Fluids

- Enhanced Oil Recovery

- Cementing

- Others

-

Textile Chemicals

- Apparel

- Home Textile

- Technical Textile

- Others

On the basis of region, the Specialty chemicals market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In June 2021, BASF SE introduced VALERAS to its plastic additives’ portfolio with high sustainability value. This new product portfolio allows its customers gain access to a range of innovative solutions that empower them to effectively pursue their sustainability objectives..

- In December 2022, Dow has introduced the SILASTIC SA 994X Liquid Silicone Rubber (LSR) series, demonstrating the company's ongoing commitment to developing intelligent, secure, and environmentally friendly technologies for the mobility and transportation sector. The SILASTIC SA 994X LSR series comprises a collection of primerless, self-adhesive, general-purpose, and self-lubricating LSRs with a one-to-one mix ratio.

- In February 2021, Dow introduced DOWSIL IE-8749, a new generation durable water repellent finish for fabrics based on the silicone chemistry. Studies conducted on a variety of textiles substrates based on DOWSIL IE-8749 Emulsion treatment demonstrated improved fabric retention in comparison to standard silicone finishes..

- In June 2022, Nouryon launched Expancel HP92 microspheres, revolutionizing the use of thermoplastic microsphere fillers in high-pressure manufacturing applications for the automotive industry. With the growing emphasis on lightweight materials to comply with stringent emission standards and meet consumer demands for fuel-efficient vehicles without compromising performance or passenger comfort, the introduction of Expancel HP92 microspheres marks a significant advancement.

- In August 2022, Nouryon entered into an exclusive partnership with Brenntag Specialties, appointing them as the sole distributor of Nouryon's innovative LumaTreat® tagged polymers in the United States and Canada. This agreement covers a diverse range of Nouryon's specialty polymers and aims to provide professionals in the water treatment industry with enhanced availability of essential ingredients for industrial and commercial cooling and heating systems.

Frequently Asked Questions (FAQ):

Which are the major players in specialty chemicals market?

The key players profiled in the report include BASF SE (Germany), DOW Inc. (US), Nouryon (The Netherlands), LANXESS AG (Germany), Evonik Industries AG (Germany), Huntsman Corporation (US), Covestro AG (Germany), Clariant AG (Switzerland), Solvay S.A. (Belgium), and Arkema (France).

What are the drivers for the specialty chemicals market?

The increasing demand from end-use industries are the major drives for specialty chemicals market. Also, advancement in technology and innovation is expected to create new opportunities for the market.

What are the various strategies key players are focusing within specialty chemicals market?

New product launches, expansion and partnership are some of the strategies atoped by key players to expand their global presence.

What are the opportunities for specialty chemicals market during the forecast period?

Green & sustainable specialty chemicals and growing influence of specialty chemicals in personal care and cosmetic industries is expected to create new opportunities during the forecast period.

What are the major factors restraining specialty chemicals market growth during the forecast period?

Government & environmental regulations is expected to restrict the market demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

6 Industry Trends

The study involved four major activities in estimating the market size for specialty chemicals. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments. We have provided research methodology for plastic additives market. Similar approach has been used for other specialty chemicals mentioned in the report.

Secondary Research

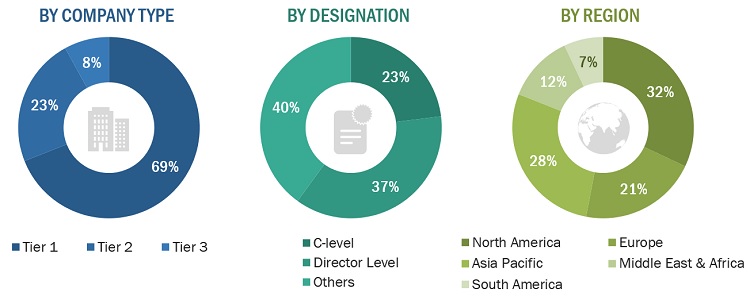

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Specialty chemicals market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the packaging, medical, construction, automotive, consumer goods and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Arkema |

Director of Marketing |

|

BASF SE |

Manager- Sales & Marketing |

|

Evonik Industries AG |

Sales Manager |

|

Clariant AG |

Production Manager |

|

Solvay S.A. |

Operation Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the specialty chemicals industry. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Specialty chemicals Market: Bottom-Up Approach (Plastic Additives)

To know about the assumptions considered for the study, Request for Free Sample Report

Specialty chemicals Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Specialty chemicals industry.

Market Definition

Specialty chemicals are ingredients that are used to enhance the performance, shelf life, durability, and stability of plastics, polymers, rubber and other products. There are various specialty chemicals, in this report we have considered some major specialty chemicals including plastic additives, rubber additives, adhesives, cosmetic ingredients, lubricating oil additives, specialty oilfield chemicals, water treatment chemicals, electronic chemicals, textile chemicals, and advanced ceramic chemicals.

Key Stakeholders

- Specialty chemicals manufacturers

- Specialty chemicals suppliers

- Raw material suppliers

- Service providers

- End users, such as automotive, construction, and other companies

- Government bodies

Report Objectives

- To analyze and forecast the specialty chemicals industry including plastic additives, rubber additives, adhesives, advanced ceramics, electronic chemicals, cosmetic ingredients, textile chemicals, lubricating oil additives, water treatment chemicals, and specialty oilfield chemicals in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, application, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Specialty Chemicals Market

Specialty chemical market

General information on market size on water repellent coating market

Interested in specialty additives encompassing food and personal care end-use markets

Need knowledge of trends and forecasts, markets for Surfactants, food additives, polymer, personal care products .

Report title not mentioned

Interested in speciality additives

Speciality chemicals industry overview.

Interested in the list of customers and suppliers of Specialty Chemicals

Key players their product offerings and major strategies adopted present in the market