Wi-Fi Market by Component (Hardware, Solutions, and Services), Density (High-density Wi-Fi and Enterprise-class Wi-Fi), Location Type (Indoor and Outdoor), Organization Size, Vertical (Education, Retail and eCommerce) & Region - Global Forecast to 2027

Updated on : April 17, 2023

Wi-Fi Market Size, 2027

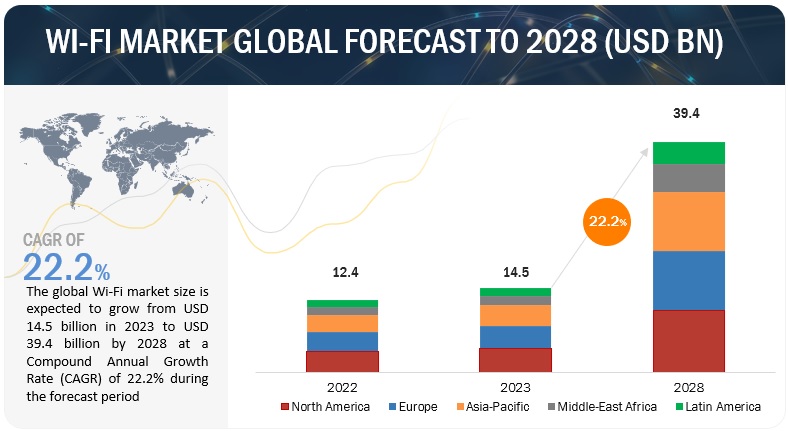

The global Wi-Fi market is expected to reach a market valuation of $31.3 billion by 2027, accelerating at a CAGR of 20.4% during the assessment year. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The widespread adoption of IoT devices is driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Wi-Fi Market Dynamics

Driver: Digital transformation initiatives in businesses, paving the way for Wi-Fi networks

In the current business environment, with rapid advancements in technologies, there is a rise in the use of digital solutions, connected devices, and IoT systems. This rapid rise in the adoption of digital solutions has paved the way for the growth of the Wi-Fi market. Organizations across the globe are eagerly implementing technologically advanced applications across their verticals to engage customers in innovative and captivating ways, raising the need for adequate-quality wireless network connectivity, such as Wi-Fi. Furthermore, to fulfill the needs of an organization to the fullest, these new applications must be deployed in an agile environment, leading to rapid and responsive development while keeping network performance and cost-effectiveness optimal. Wi-Fi network deployment helps enterprises rapidly build and connect business applications effectively. The Wi-Fi network also provides greater flexibility, scalability, reliability, and cost-effective benefits in connecting mission-critical business applications. Additionally, core industry sectors are keen on automating and digitalizing their business processes to streamline business operations and drive new business revenue opportunities. Wi-Fi networks support the digital transformation initiatives of enterprises with benefits, such as faster Time to Market (TTM), improved operational efficiency, and enhanced customer experience.

Restraint: Stringent government data regulations and guidelines

In order to protect data from unauthorized access, independent territories and countries in Europe, Latin America and the Caribbean, Asia, and Africa, have already adopted comprehensive data protection laws. The EU has had the GDPR in force since May 2018. As multiple businesses are operating across borders, international standardization in data protection laws and rights has become crucial for businesses and organizations as well as for individuals. GDPR, enforced by the EU, has placed a legal obligation on businesses, especially SMEs, to securely maintain the records of individuals consent to store and use their personal data. Furthermore, there is already an extensive federal privacy-related law that regulates the collection and use of personal data in the US, with some regulations particularly applicable for financial, health, and electronic communication information. Monitoring and securing the Wi-Fi network has become crucial for businesses especially SMEs, as they are likely to be targeted by cybercriminals, which in turn, may restrain the growth of the Wi-Fi market.

Opportunity: Government's initiatives for smart city projects

Smart city models have stimulated tremendous development drivers for various technology vendors and the associated service providers. With increasing government initiatives and focus on environmental campaigns, technology providers and consultants have aggressively started simulating innovative solutions based on conceptual modules for urban infrastructure design and development. The successful implementation of smart city projects depends heavily on technologies: data communications, cloud, mobility, and sensors, which all together form IoT. The technologies lay the foundation for smart city projects. Fast developments in technologies in recent years have enabled better connectivity of objects, resulting in the complete development of smarter ecosystems.

Wi-Fi connectivity is expected to offer huge support for smart city initiatives, as it will collect crucial consumer data whose access points will be installed in public spaces or city-authorized Wi-Fi zones. Wi-Fi connectivity will also be beneficial for maintaining law enforcement, as it would assist in tracking visitors in important public spaces, eventually providing enhanced security.

Challenge: Poor user experience in high-density environments

Due to substandard access point performance or inaccurate network planning, Various users face a poor Quality of Experience (QoE). Users, especially in large venues, such as stadiums, shopping malls, and midsized hotels, expect the Wi-Fi network to be reliable, scalable, and easily configurable. It becomes challenging for the network providrers to constantly deliver good and high-quality Wi-Fi services, as they face several issues. The most common issues include the poor range between Wi-Fi access points; interference in the network from external sources, such as weather stations and cell towers; and signal blockage by concrete walls.

Over the period of time, network planning solutions have also evolved. Modern access points allow over 30 users to access a Wi-Fi network simultaneously in an enterprise environment. However, under several conditions, users’ network experience is still weak. As the access points have built-in omnidirectional antennas, the cellular deployment of access points is advised under such circumstances,. Moreover, a high user concurrency rate presents another challenge in some interference-free Wi-Fi scenarios. However, not all users in high-density areas, such as stations, shopping malls, and stadiums, need to connect to the Internet simultaneously. They are a few key challenges in the global Wi-Fi market.

High-density Wi-Fi segment is projected to grow at the fastest rate during the forecast period

High-density wireless environments need the support of hundreds or even thousands of wireless clients in a given area. High-density Wi-Fi is a design strategy that provides pervasive connectivity to clients when a large number of clients are expected to connect to Access Points within a small space. If more than 30 clients are connecting to an AP, then a location can be classified as high-density

Large enterprises are set to account for the larger market share during the forecast period.

The deployment of Wi-Fi enables large enterprises to enhance customer engagement using cost-effective cloud-based solutions and services. The data of large enterprises is highly scattered across different departments. Using cloud-based Wi-Fi solutions, these enterprises can understand their real-time data flow and can access eLearning on both networks and the Internet.

The healthcare and life sciences vertical is pegged to emerge as the fastest-growing segment during the forecast period.

Wi-Fi offers centralized data management to healthcare and life sciences firms and thereby increases the scalability and reliability of the services offered. Cloud Wi-Fi services enable healthcare firms to easily and securely access the medical history and other critical information of patients from anywhere at any time, leading to higher adoption.

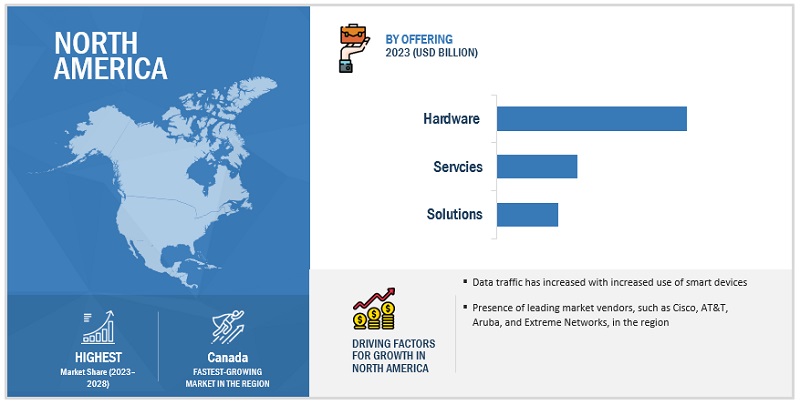

North America to account for the largest market share during the forecast period

North America is expected to account for a major share of the Wi-Fi market, and the trend is expected to continue during the forecast period. The startup culture in North America is growing at a fast pace as compared to the other regions. Additionally, the advent of SMEs and increasing R&D activities by large enterprises have aided the growth of the North American market. The growth in North America is mainly driven by the increasing adoption of integrated enterprise and business solutions. These solutions make the business processes and operations more flexible and agile. Due to the increasing wireless technology investments by major companies in the region, the demand for wireless hotspots and Wi-Fi solutions and services is expected to increase.

To know about the assumptions considered for the study, download the pdf brochure

Wi-Fi Market - Key Players

The Wi-Fi market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Wi-Fi market are Cisco (US), Juniper Networks (US), Huawei (China), Ericsson (Sweden), Extreme Networks (US), NETGEAR (US), Aruba (US), Panasonic (Japan), Alcatel-Lucent Enterprise (France), Fortinet (US), D-Link Systems (Taiwan), LEVER Technology Group (UK), Redway Networks (UK), Casa Systems (US), Broadcom (US), Ubiquiti Networks (US), Airtel (India), Orange Business Services (France), AT&T (US), Comcast Business (US), Vodafone (UK), iPass (US), Superloop (Australia), Telstra (Australia), Fujitsu (Japan), Cambium Networks (US), and Fon (Spain). The study includes an in-depth competitive analysis of these key players in the Wi-Fi market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 12.3 Billion |

|

Market size value for 2027 |

USD 31.3 Billion |

|

Growth rate |

20.4% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By component, density, location type, organization size, vertical, and region |

|

Wi-Fi Market Drivers |

|

|

Wi-Fi Market Opportunities |

|

|

Regions covered |

North America, Europe, Asia Pacific, the Middle East & Africa, Latin America |

|

Companies covered |

Cisco (US), Juniper Networks (US), NETGEAR (US), Aruba (US), Huawei (China), Panasonic (Japan), Alcatel-Lucent Enterprise (France), Ericsson (Sweden), Extreme Networks (US), Fortinet (US), D-Link Systems (Taiwan), LEVER Technology Group (UK), Redway Networks (UK), Casa Systems (US), Broadcom (US), Ubiquiti Networks (US), Airtel (India), Orange Business Services (France), AT&T (US), Comcast Business (US), Vodafone (UK), iPass (US), Superloop (Australia), Telstra (Australia), Fujitsu (Japan), Cambium Networks (US), and Fon (Spain) |

This research report categorizes the Wi-Fi market to forecast revenues and analyze trends in each of the following subsegments:

Wi-Fi Market By Component

-

Hardware

- Access points

- WLAN controllers

- Wireless hotspot gateways

- Other hardware (routers, switches, relays, antennas, and repeaters)

- Solutions

-

Services

-

Professional Services

- Network planning, design, and implementation

- Training, support, and maintenance

- Survey, analysis, and consulting

- Managed Services

-

Professional Services

Wi-Fi Market By Density

- Enterprise-Class Wi-Fi

- High-Density Wi-Fi

By Location Type

- Indoor

- Outdoor

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- Education

- Healthcare and Life Sciences

- Transportation and Logistics

- Retail and Ecommerce

- Government

- Manufacturing

- Hospitality

- Other Verticals (BFSI, oil and gas, utilities, IT and telecom, and sports and leisure)

By Region

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2022, Ericsson completed its acquisition of Vonage establishing Ericsson’s strategy to influence technology leaders to grow its mobile network business and expand into an enterprise.

- In February 2022, Juniper Networks acquired WiteSand, an innovator of cloud-native zero trust Network Access Control (NAC) solutions. This agreement brings a skilled engineering team and technology to Juniper, quickening the company’s attempts to deliver a next-generation NAC solution.

- In August 2021, Extreme Networks revealed its plans to acquire the software-defined wide area networking (SD-WAN) division of Infovista. The deal will help to expand its portfolio by offering cloud-managed SD-WAN and security solutions.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Wi-Fi market?

What is the estimated growth rate (CAGR) of the global Wi-Fi market for the next five years?

What does the current study of the Wi-Fi market consist of?

What are the major revenue pockets in the Wi-Fi market currently?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 WI-FI MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS & EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 3 WI-FI MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 WI-FI MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 3 FACTOR ANALYSIS: MARKET

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 10 LEADING SEGMENTS IN WI-FI MARKET IN 2022

FIGURE 11 MARKET: REGIONAL AND COUNTRY-WISE SHARE, 2022

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 MARKET: BRIEF OVERVIEW

FIGURE 12 DIGITAL TRANSFORMATION INITIATIVES AND WIDESPREAD ADOPTION OF IOT DEVICES TO DRIVE MARKET

4.2 MARKET, BY COMPONENT

FIGURE 13 HARDWARE SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

4.3 MARKET, BY DENSITY

FIGURE 14 ENTERPRISE-CLASS WI-FI SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

4.4 MARKET, BY LOCATION TYPE

FIGURE 15 INDOOR SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

4.5 MARKET, BY VERTICAL

FIGURE 16 EDUCATION SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

4.6 ASIA PACIFIC MARKET, BY COMPONENT AND VERTICAL

FIGURE 17 HARDWARE AND EDUCATION SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARES IN 2022

5 MARKET OVERVIEW (Page No. - 62)

5.1 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WI-FI MARKET

5.1.1 DRIVERS

5.1.1.1 Digital transformation initiatives by businesses

FIGURE 19 EMERGING TECHNOLOGICAL ADOPTION IN DIGITAL TRANSFORMATION, 2020

5.1.1.2 Global increase in number of internet users

FIGURE 20 INTERNET USERS AS PERCENTAGE OF REGIONAL POPULATION, 2018 VS. 2023

5.1.1.3 Increase in smartphone and wireless device adoption

5.1.1.4 Growth in adoption of BYOD and CYOD trend among organizations

5.1.1.5 Widespread adoption of IoT devices

FIGURE 21 GLOBAL NUMBER OF INTERNET OF THINGS CONNECTIONS (BILLION)

5.1.2 RESTRAINTS

5.1.2.1 Stringent government data regulations and guidelines

5.1.2.2 Contention loss and co-channel interference

5.1.3 OPPORTUNITIES

5.1.3.1 Government initiatives for smart city projects

5.1.3.2 Higher demand for carrier Wi-Fi

5.1.3.3 Continued upgrades in Wi-Fi standards

5.1.4 CHALLENGES

5.1.4.1 Poor user experience in high-density environments

5.1.4.2 Data security and privacy concerns

5.1.4.3 Disruption in supply chain of smart devices and connectivity hardware due to COVID-19 pandemic

5.2 INDUSTRY TRENDS

5.2.1 VALUE CHAIN ANALYSIS

FIGURE 22 WI-FI MARKET: VALUE CHAIN ANALYSIS

5.2.2 ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.2.3 PORTER’S FIVE FORCES MODEL

TABLE 5 MARKET: PORTER’S FIVE FORCES

5.2.3.1 Threat from new entrants

5.2.3.2 Threat from substitutes

5.2.3.3 Bargaining power of buyers

5.2.3.4 Bargaining power of suppliers

5.2.3.5 Degree of competition

5.2.4 AVERAGE SELLING PRICE TREND

TABLE 6 PRICING ANALYSIS

5.2.5 WI-FI MARKET: TECHNOLOGICAL LANDSCAPE

5.2.5.1 WiMAX

5.2.5.2 Cloud Services

5.2.5.3 LTE Network

5.2.5.4 MulteFire

5.2.5.5 5G Network

5.2.6 CASE STUDIES/USE CASES

5.2.6.1 The University of Cambridge used Aruba Wi-Fi and AirWave to create city-wide network access

5.2.6.2 Deployment of Telstra Air Public Wi-Fi service to improve community engagement in the City of Kingston

5.2.6.3 Cisco helped Tokio Marine & Nichido Fire Insurance revolutionize it with secure base infrastructures

5.2.6.4 Southstar Drug deployed Huawei Wi-Fi 6 solution for seamless wireless network experience

5.2.6.5 St. Jakob Park used Huawei’s Wi-Fi 6 for high user concurrency and secure connection

5.2.7 PATENT ANALYSIS

5.2.7.1 Methodology

5.2.7.2 Document Types

TABLE 7 PATENTS FILED, 2020–2022

5.2.7.3 Innovation and Patent Applications

FIGURE 23 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2022

5.2.7.3.1 Top applicants

FIGURE 24 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2022

TABLE 8 LIST OF FEW PATENTS IN WI-FI MARKET, 2020–2022

5.2.8 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MARKET

FIGURE 25 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3 KEY CONFERENCES AND EVENTS, 2022-2023

TABLE 9 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

5.4.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 11 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.5 REGULATORY LANDSCAPE

5.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.5.1.1 North America

5.5.1.1.1 United States

5.5.1.1.2 Canada

5.5.1.2 Europe

5.5.1.3 Asia Pacific

5.5.1.3.1 South Korea

5.5.1.3.2 China

5.5.1.3.3 India

5.5.1.4 Middle East & Africa

5.5.1.4.1 United Arab Emirates

5.5.1.4.2 Kingdom of Saudi Arabia

5.5.1.4.3 South Africa

5.5.1.5 Latin America

5.5.1.5.1 Brazil

5.5.1.5.2 Mexico

6 WI-FI MARKET, BY COMPONENT (Page No. - 89)

6.1 INTRODUCTION

FIGURE 28 WI-FI SERVICES TO GROW AT HIGHEST CAGR AMONG COMPONENTS

TABLE 16 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE: MARKET DRIVERS

FIGURE 29 ACCESS POINTS SEGMENT TO GROW AT HIGHEST CAGR

TABLE 18 WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 19 WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 20 WI-FI HARDWARE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 WI-FI HARDWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 ACCESS POINTS

6.2.2.1 Access points extend existing wireless network coverage

TABLE 22 WI-FI ACCESS POINTS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 WI-FI ACCESS POINTS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 WLAN CONTROLLERS

6.2.3.1 WLAN controllers manage wireless network access points

TABLE 24 WI-FI WLAN CONTROLLERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 WI-FI WLAN CONTROLLERS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 WIRELESS HOTSPOT GATEWAYS

6.2.4.1 Hotspot gateways help connect two wireless networks with different transmission protocols

TABLE 26 WIRELESS HOTSPOT GATEWAYS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 WIRELESS HOTSPOT GATEWAYS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 OTHER HARDWARE

TABLE 28 OTHER WI-FI HARDWARE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 OTHER WI-FI HARDWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOLUTIONS

6.3.1 NECESSITY FOR SEAMLESS WI-FI INTERNET ACCESS TO DRIVE SEGMENT

6.3.2 SOLUTIONS: WI-FI MARKET DRIVERS

TABLE 30 WI-FI SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 WI-FI SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES: MARKET DRIVERS

FIGURE 30 MANAGED WI-FI SERVICES TO GROW AT HIGHER CAGR

TABLE 32 WI-FI SERVICES MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 33 WI-FI SERVICES MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 34 WI-FI SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 35 WI-FI SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2 PROFESSIONAL SERVICES

FIGURE 31 TRAINING, SUPPORT, AND MAINTENANCE TO GROW AT HIGHEST CAGR

TABLE 36 PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 37 PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 38 PROFESSIONAL WI-FI SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 PROFESSIONAL WI-FI SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.1 Network Planning, Design, and Implementation

6.4.2.1.1 Services to help in strategic planning and implementation of Wi-Fi services

TABLE 40 WI-FI NETWORK PLANNING, DESIGN, AND IMPLEMENTATION SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 WI-FI NETWORK PLANNING, DESIGN, AND IMPLEMENTATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.2 Training, Support, and Maintenance

6.4.2.2.1 Support and maintenance services to help in designing, deployment, administration, and troubleshooting Wi-Fi services

TABLE 42 WI-FI TRAINING, SUPPORT, AND MAINTENANCE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 WI-FI TRAINING, SUPPORT, AND MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.3 Survey, Analysis, and Consulting

6.4.2.3.1 Services to simplify and optimize networks for enterprises

TABLE 44 WI-FI SURVEY, ANALYSIS, AND CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 WI-FI SURVEY, ANALYSIS, AND CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.3 MANAGED SERVICES

6.4.3.1 Optimum network performance through use of cloud-based managed Wi-Fi services

TABLE 46 MANAGED WI-FI SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 MANAGED WI-FI SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7 WI-FI MARKET, BY DENSITY (Page No. - 105)

7.1 INTRODUCTION

FIGURE 32 HIGH-DENSITY WI-FI SEGMENT TO GROW AT HIGHER CAGR

TABLE 48 MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 49 MARKET, BY DENSITY, 2022–2027 (USD MILLION)

7.2 ENTERPRISE-CLASS WI-FI

7.2.1 UNFAILING TECH SUPPORT TO PROVIDE QUICK FIXES TO CHALLENGES

7.2.2 ENTERPRISE-CLASS WI-FI: MARKET DRIVERS

TABLE 50 ENTERPRISE-CLASS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 ENTERPRISE-CLASS WI-FI: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 HIGH-DENSITY WI-FI

7.3.1 HIGH DEMAND FOR FLEXIBLE SOLUTIONS

7.3.2 HIGH-DENSITY WI-FI: MARKET DRIVERS

TABLE 52 HIGH-DENSITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 HIGH-DENSITY MARKET, BY REGION, 2022–2027 (USD MILLION)

8 WI-FI MARKET, BY LOCATION TYPE (Page No. - 109)

8.1 INTRODUCTION

FIGURE 33 OUTDOOR WI-FI TO GROW AT HIGHER CAGR

TABLE 54 MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 55 MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

8.2 INDOOR

8.2.1 HIGHER ACCURACY OF INDOOR TRACKING WITH ADDED WI-FI ACCESS POINTS

8.2.2 INDOOR: MARKET DRIVERS

TABLE 56 INDOOR MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 INDOOR MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 OUTDOOR

8.3.1 DEMAND FOR EFFECTIVE OUTDOOR COVERAGE RANGE AND PERFORMANCE

8.3.2 OUTDOOR: MARKET DRIVERS

TABLE 58 OUTDOOR MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 OUTDOOR MARKET, BY REGION, 2022–2027 (USD MILLION)

9 WI-FI MARKET, BY ORGANIZATION SIZE (Page No. - 113)

9.1 INTRODUCTION

FIGURE 34 SMES TO GROW AT HIGHER CAGR

TABLE 60 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 61 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 NEED TO UNDERSTAND REAL-TIME DATA FLOW ACROSS DIFFERENT DEPARTMENTS

9.2.2 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 62 LARGE ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 SMALL & MEDIUM-SIZED ENTERPRISES

9.3.1 WI-FI TO HELP ENSURE NETWORK SECURITY AND QUALITY OF SERVICES

9.3.2 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 64 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 65 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

10 WI-FI MARKET, BY VERTICAL (Page No. - 118)

10.1 INTRODUCTION

FIGURE 35 HEALTHCARE & LIFE SCIENCES TO GROW AT HIGHEST CAGR

TABLE 66 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 67 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 EDUCATION

10.2.1 WI-FI TO HELP ACCESS ELEARNING CONTENT AND CRUCIAL INFORMATION FROM REMOTE LOCATIONS

10.2.2 EDUCATION: MARKET DRIVERS

TABLE 68 EDUCATION VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 EDUCATION VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 HEALTHCARE & LIFE SCIENCES

10.3.1 WI-FI SOLUTIONS TO IMPROVE TREATMENT PATHS AND PATIENT RESULTS

10.3.2 HEALTHCARE & LIFE SCIENCES: MARKET DRIVERS

TABLE 70 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 71 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 TRANSPORTATION & LOGISTICS

10.4.1 WI-FI TO PROVIDE GREATER NETWORK INFRASTRUCTURE VISIBILITY

10.4.2 TRANSPORTATION & LOGISTICS: MARKET DRIVERS

TABLE 72 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 RETAIL & ECOMMERCE

10.5.1 CLOUD-BASED TECHNOLOGIES TO BOOST CUSTOMER EXPERIENCE

10.5.2 RETAIL & ECOMMERCE: MARKET DRIVERS

TABLE 74 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 GOVERNMENT

10.6.1 CLOUD-BASED TECHNOLOGIES ENABLE GOVERNMENT OFFICIALS TO ACCESS AND SHARE DATA ON VARIOUS DEVICES

10.6.2 GOVERNMENT: MARKET DRIVERS

TABLE 76 GOVERNMENT VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 77 GOVERNMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 MANUFACTURING

10.7.1 DEMAND TO BLOCK CONNECTIVITY PROBLEMS WITH LIMITED IT RESOURCES

10.7.2 MANUFACTURING: MARKET DRIVERS

TABLE 78 MANUFACTURING VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 79 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 HOSPITALITY

10.8.1 NEED FOR CENTRALLY MANAGED NETWORKING

10.8.2 HOSPITALITY: WI-FI MARKET DRIVERS

TABLE 80 HOSPITALITY VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 HOSPITALITY VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 OTHER VERTICALS

10.9.1 OTHER VERTICALS: MARKET DRIVERS

TABLE 82 OTHER VERTICALS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 83 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 WI-FI MARKET, BY REGION (Page No. - 130)

11.1 INTRODUCTION

FIGURE 36 MARKET: REGIONAL SNAPSHOT

TABLE 84 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: PESTLE ANALYSIS

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 86 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Advancements in communication technology

TABLE 104 US: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 105 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 106 US: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 107 US: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 108 US: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 109 US: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 US: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 111 US: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 US: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 113 US: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 114 US: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 115 US: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 116 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 117 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 118 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 119 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Rise in investments in wireless technologies

TABLE 120 CANADA: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 121 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 122 CANADA: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 123 CANADA: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 CANADA: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 125 CANADA: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 CANADA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 127 CANADA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 CANADA: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 129 CANADA: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 130 CANADA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 131 CANADA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 132 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 133 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 134 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 135 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: PESTLE ANALYSIS

TABLE 136 EUROPE: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 138 EUROPE: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 139 EUROPE: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 140 EUROPE: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 141 EUROPE: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 EUROPE: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 143 EUROPE: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 EUROPE: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 153 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Increase in adoption of cloud-based services

TABLE 154 UK: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 155 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 UK: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 157 UK: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 158 UK: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 159 UK: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 UK: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 161 UK: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 162 UK: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 163 UK: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 164 UK: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 165 UK: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 166 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 167 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 168 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 169 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Increase in smartphone users and tech-savvy customers

11.3.4 FRANCE

11.3.4.1 Government initiatives for growth of smart cities

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 170 ASIA PACIFIC: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 172 ASIA PACIFIC: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 173 ASIA PACIFIC: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 177 ASIA PACIFIC: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Growth opportunities for Wi-Fi vendors

TABLE 188 CHINA: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 189 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 190 CHINA: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 191 CHINA: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 192 CHINA: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 193 CHINA: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 CHINA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 195 CHINA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 196 CHINA: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 197 CHINA: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 198 CHINA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 199 CHINA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 200 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 201 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 202 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 203 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Adoption of Wi-Fi in booming retail industry

11.4.4 INDIA

11.4.4.1 Rise in number of Wi-Fi-enabled devices

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

TABLE 204 MIDDLE EAST & AFRICA: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Demand to boost wireless connectivity

TABLE 222 MIDDLE EAST: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 223 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 224 MIDDLE EAST: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 225 MIDDLE EAST: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 226 MIDDLE EAST: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 227 MIDDLE EAST: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 228 MIDDLE EAST: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 229 MIDDLE EAST: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 230 MIDDLE EAST: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 231 MIDDLE EAST: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 232 MIDDLE EAST: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 233 MIDDLE EAST: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 234 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 235 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 236 MIDDLE EAST: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 237 MIDDLE EAST: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.3 AFRICA

11.5.3.1 Higher requirement for mobility by enterprises to fuel adoption of Wi-Fi

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: PESTLE ANALYSIS

TABLE 238 LATIN AMERICA: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 240 LATIN AMERICA: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 241 LATIN AMERICA: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 242 LATIN AMERICA: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 243 LATIN AMERICA: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 244 LATIN AMERICA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 245 LATIN AMERICA: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 246 LATIN AMERICA: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 249 LATIN AMERICA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 251 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 252 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 253 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 254 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 255 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Businesses to adopt Wi-Fi solutions for uninterrupted connectivity

TABLE 256 BRAZIL: WI-FI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 257 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 258 BRAZIL: WI-FI HARDWARE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 259 BRAZIL: WI-FI HARDWARE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 260 BRAZIL: WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 261 BRAZIL: WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 262 BRAZIL: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 263 BRAZIL: PROFESSIONAL WI-FI SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 264 BRAZIL: WI-FI MARKET, BY DENSITY, 2016–2021 (USD MILLION)

TABLE 265 BRAZIL: MARKET, BY DENSITY, 2022–2027 (USD MILLION)

TABLE 266 BRAZIL: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 267 BRAZIL: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 268 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 269 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 270 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 271 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Developing social media landscape and adoption of wireless internet connectivity

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 191)

12.1 INTRODUCTION

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 272 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN WI-FI MARKET

12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 273 MARKET: DEGREE OF COMPETITION

12.4 HISTORICAL REVENUE ANALYSIS

FIGURE 39 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

12.5 COMPETITIVE BENCHMARKING

TABLE 274 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 275 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 276 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 40 KEY WI-FI MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 41 STARTUP/SME MARKET EVALUATION MATRIX, 2022

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 277 PRODUCT LAUNCHES, 2019–2022

12.8.2 DEALS

TABLE 278 DEALS, 2020–2022

12.8.3 OTHERS

TABLE 279 OTHERS, 2019

13 COMPANY PROFILES (Page No. - 201)

13.1 MAJOR PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 CISCO

TABLE 280 CISCO: BUSINESS OVERVIEW

FIGURE 42 CISCO: COMPANY SNAPSHOT

TABLE 281 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 282 CISCO: PRODUCT LAUNCHES

TABLE 283 CISCO: DEALS

13.1.2 ERICSSON

TABLE 284 ERICSSON: BUSINESS OVERVIEW

FIGURE 43 ERICSSON: COMPANY SNAPSHOT

TABLE 285 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 286 ERICSSON: PRODUCT LAUNCHES

TABLE 287 ERICSSON: DEALS

TABLE 288 ERICSSON: OTHERS

13.1.3 EXTREME NETWORKS

TABLE 289 EXTREME NETWORKS: BUSINESS OVERVIEW

FIGURE 44 EXTREME NETWORKS: COMPANY SNAPSHOT

TABLE 290 EXTREME NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 291 EXTREME NETWORKS: PRODUCT LAUNCHES

TABLE 292 EXTREME NETWORKS: DEALS

13.1.4 HUAWEI

TABLE 293 HUAWEI: BUSINESS OVERVIEW

FIGURE 45 HUAWEI: COMPANY SNAPSHOT

TABLE 294 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 295 HUAWEI: PRODUCT LAUNCHES

13.1.5 JUNIPER NETWORKS

TABLE 296 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 46 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 297 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 298 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 299 JUNIPER NETWORKS: DEALS

13.1.6 PANASONIC

TABLE 300 PANASONIC: BUSINESS OVERVIEW

FIGURE 47 PANASONIC: COMPANY SNAPSHOT

TABLE 301 PANASONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 302 PANASONIC: PRODUCT LAUNCHES

TABLE 303 PANASONIC: DEALS

13.1.7 FORTINET

TABLE 304 FORTINET: BUSINESS OVERVIEW

FIGURE 48 FORTINET: COMPANY SNAPSHOT

TABLE 305 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 306 FORTINET: PRODUCT LAUNCHES

TABLE 307 FORTINET: DEALS

13.1.8 ARUBA

TABLE 308 ARUBA: BUSINESS OVERVIEW

TABLE 309 ARUBA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 310 ARUBA: PRODUCT LAUNCHES

TABLE 311 ARUBA: DEALS

13.1.9 ALCATEL-LUCENT ENTERPRISE

TABLE 312 ALCATEL-LUCENT ENTERPRISE: BUSINESS OVERVIEW

TABLE 313 ALCATEL-LUCENT ENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 314 ALCATEL-LUCENT ENTERPRISE: PRODUCT LAUNCHES

TABLE 315 ALCATEL-LUCENT ENTERPRISE: DEALS

13.1.10 NETGEAR

TABLE 316 NETGEAR: BUSINESS OVERVIEW

FIGURE 49 NETGEAR: COMPANY SNAPSHOT

TABLE 317 NETGEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 318 NETGEAR PRODUCT LAUNCHES

TABLE 319 NETGEAR: DEALS

13.1.11 BROADCOM

13.1.12 AIRTEL

13.1.13 ORANGE BUSINESS SERVICES

13.1.14 COMCAST BUSINESS

13.1.15 VODAFONE

13.1.16 TELSTRA

13.1.17 FUJITSU

13.1.18 AT&T

13.1.19 UBIQUITI NETWORKS

13.2 STARTUPS/SMES

13.2.1 LEVER TECHNOLOGY GROUP

13.2.2 REDWAY NETWORKS

13.2.3 IPASS

13.2.4 SUPERLOOP

13.2.5 CAMBIUM NETWORKS

13.2.6 CASA SYSTEMS

13.2.7 FON

13.2.8 D-LINK

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 256)

14.1 INTRODUCTION

14.2 WI-FI AS A SERVICE MARKET

14.2.1 WI-FI AS A SERVICE MARKET: MARKET DEFINITION

14.2.2 WI-FI AS A SERVICE MARKET OVERVIEW

14.2.3 WI-FI AS A SERVICE MARKET, BY SOLUTION

TABLE 320 WI-FI AS A SERVICE MARKET, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 321 WI-FI AS A SERVICE MARKET, BY SOLUTIONS, 2021–2026 (USD MILLION)

14.2.4 WI-FI AS A SERVICE MARKET, BY SERVICE

TABLE 322 WI-FI AS A SERVICE MARKET, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 323 WI-FI AS A SERVICE MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 324 PROFESSIONAL SERVICES: WI-FI AS A SERVICE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 325 PROFESSIONAL SERVICES: WI-FI AS A SERVICE MARKET, BY TYPE, 2021–2026 (USD MILLION)

14.2.5 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE

TABLE 326 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2017–2020 (USD MILLION)

TABLE 327 WI-FI AS A SERVICE MARKET, BY LOCATION TYPE, 2021–2026 (USD MILLION)

14.2.6 WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE

TABLE 328 WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 329 WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

14.2.7 WI-FI AS A SERVICE MARKET, BY VERTICAL

TABLE 330 WI-FI AS A SERVICE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 331 WI-FI AS A SERVICE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

14.2.8 WI-FI AS A SERVICE MARKET, BY REGION

TABLE 332 WI-FI AS A SERVICE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 333 WI-FI AS A SERVICE MARKET, BY REGION, 2021–2026 (USD MILLION)

14.3 WI-FI 6 MARKET

14.3.1 WI-FI 6 MARKET: DEFINITION

14.3.2 WI-FI 6 MARKET OVERVIEW

14.3.3 WI-FI 6 MARKET, BY OFFERING

TABLE 334 WI-FI 6 MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 335 WI-FI 6 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 336 OFFERING: WI-FI 6 MARKET, BY HARDWARE, 2017–2021 (USD MILLION)

TABLE 337 OFFERING: WI-FI 6 MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 338 SERVICES: WI-FI 6 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 339 SERVICES: WI-FI 6 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

14.3.4 WI-FI 6 MARKET, BY LOCATION TYPE

TABLE 340 WI-FI 6 MARKET, BY LOCATION TYPE, 2017–2021 (USD MILLION)

TABLE 341 WI-FI 6 MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

14.3.5 WI-FI 6 MARKET, BY ORGANIZATION SIZE

TABLE 342 WI-FI 6 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 343 WI-FI 6 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

14.3.6 WI-FI 6 MARKET, BY VERTICAL

TABLE 344 WI-FI 6 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 345 WI-FI 6 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

14.3.7 WI-FI 6 MARKET, BY REGION

TABLE 346 WI-FI 6 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 347 WI-FI 6 MARKET, BY REGION, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 266)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

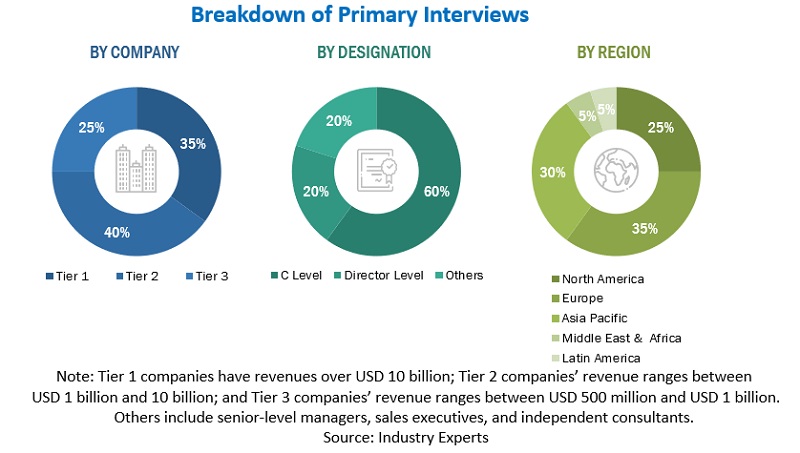

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Wi-Fi market. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred to, such as the National Telecommunications and Information Administration, the US Department of Commerce, Canadian Radio-television and Telecommunications Commission, the UK Government Digital Service, EU WiFi4EU Initiative, European Wireless Infrastructure Association, Asia Internet Coalition (AIC), Internet and Mobile Association of India (IAMAI), Internet Association Japan, and the Australian Broadcasting Authority (ABA). Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Wi-Fi solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Wi-Fi solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Wi-Fi solutions, which is expected to affect the overall Wi-Fi market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the Wi-Fi market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the Wi-Fi market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Wi-Fi Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the Wi-Fi market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Report Objectives

- To determine, segment, and forecast the global Wi-Fi market by component, density, location type, organization size, vertical, and region, in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Wi-Fi market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and research and development (R&D) activities

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wi-Fi Market