Green Hydrogen Market by Technology (Alkaline and PEM), Renewable Source (Wind, Solar, Geothermal, Hydropower, and Hybrid of Wind & Solar), End-Use Industry (Mobility, Power, Chemical, Industrial, Grid Injection), and Region - Global Forecast to 2027

Green Hydrogen Market

The global green hydrogen market was valued at USD 676 million in 2022 and is projected to reach USD 7,314 million by 2027, growing at a cagr 61.0% from 2022 to 2027. The market's growth is attributed to the lowering cost of producing renewable energy by all sources, development of electrolysis technologies and high demand from FCEVs and power industry. However, high initial production costs and an Under-developed market are some of the challenges that restrict the market's growth. The mobility industry accounted for a share of 58% in terms of value in the Green Hydrogen Market in 2022 and is projected to reach USD 4,550 million by 2027 at a CAGR of 63.4%. The power sector is projected to witness the second-highest CAGR of 63.0%, growing from USD 88.5 million in 2022 to USD 1018 million by 2027.

Global Green Hydrogen Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Green Hydrogen Market Dynamics

Driver: Low variable electricity costs

The major cost of green hydrogen production is associated with the energy input. In the past decade, the cost of producing renewable energy from all sources has been reduced drastically. The biggest decline was shown by solar energy, which is nearly 25% of what it was previously. This is due to technical advancement, raw material cost, production advancement, and higher product efficiency.

With the development of new composites, solar and wind energy costs are continuously declining. The cost associated with renewable energy mainly consists of a fixed cost of installation and marginal maintenance. Therefore, the cost of producing green hydrogen will also decrease with continuous operations.

Restraint: Sustainability management and High initial cost

It must be ensured that energy utilized in the production comes from renewable sources to produce green hydrogen. This is easily achieved by plants that produce their electricity, but for the plants that utilize grid power for green hydrogen production, energy tracking becomes difficult. The grid power may constitute some part that utilizes fossil fuels; hence emissions associated with electricity production must be considered while calculating the emissions for green hydrogen. This creates problems as plants relying completely on renewable energy have fluctuating output and hence higher costs of production. In contrast, those relying on grid power have indirect greenhouse gas emissions associated with them.

Opportunity: Decreasing costs of electrolyzers

The cost of electrolyzers dropped to nearly half its value five years ago. This fall is expected to continue in the current decade. Another factor affecting the final cost is reducing the cost of renewable energy sources. The major reason for this fall in cost is the investments put in research and development of the technology to make it more efficient. The recent development of solid oxide electrolyzers that can give 100% efficiency at a high-temperature range shows the potential of the technology.

Challenge: Under-developed market

Hydrogen as a fuel source has not gained widespread acceptance. The technologies required to use hydrogen efficiently are still in the developing phase or are working models. The demand for green hydrogen currently is limited to the developed and developing countries that are a part of the net-zero emissions pact. Even amongst these countries, the majority lack the technology required for efficient use. Most of the technologies are developed but are not yet available commercially. The market will show comparatively sluggish growth until the technologies are commercially available

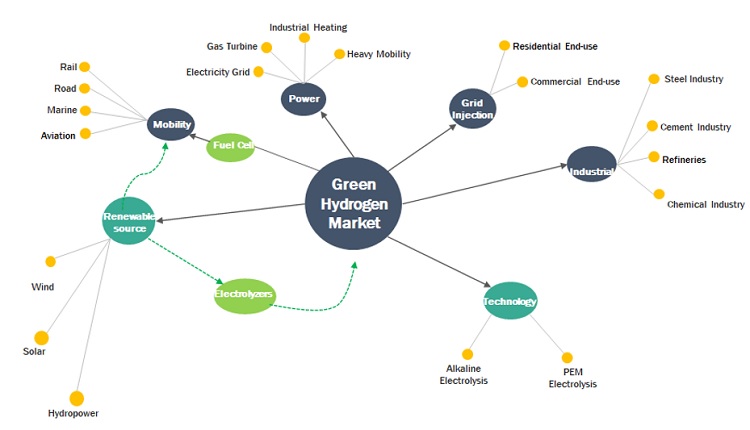

Green Hydrogen Market Ecosystem

High demand in mobility industry for green hydrogen

High demand in mobility industry for green hydrogen due to its practical applications. The only emission from a fuel cell vehicle using hydrogen is water steam. Hydrogen is thus a clean fuel for cars without emissions of pollutants and greenhouse gases that contribute to climate change. Hydrogen charging stations are quite similar to the traditional filling stations. As hydrogen vehicles don’t need to be plugged in to charge unlike battery powered electric cars the process of refuelling is quick. The prospects for the hydrogen economy are good. It could play a major role in the energy transition since it has a high energy efficiency, emits no pollutants locally and can contribute to massively reducing greenhouse gas emissions.

Power industry holds the second highest share in the green hydrogen market both in terms of value and volume.

Based end-use industry, the green hydrogen market has been segmented into mobility, chemical, power, grid injection, industrial and others. Power segment is expected to grow with the second highest CAGR during the forecast period both in terms of value and volume. The green hydrogen market in the power segment includes projects that supply electricity to the electricity grid with a gas turbine or fuel cell. Renewable energy is replacing conventional fossil fuels-based power plants worldwide, but the major problem faced by them is the ability to react to fluctuations in load conditions. Green hydrogen proves to be a sustainable option to store the excess energy generated by sources such as solar and wind, then utilized when needed. Hydrogen can be used in gas turbines to cope up with load fluctuations. Some industries are energy-intensive and hence face problems switching to renewable sources such as refining, steel, cement, heavy mobility, and industrial heating. Green hydrogen can be used directly or in the form of ammonia to cope with the high-power demands of such industries.

To know about the assumptions considered for the study, download the pdf brochure

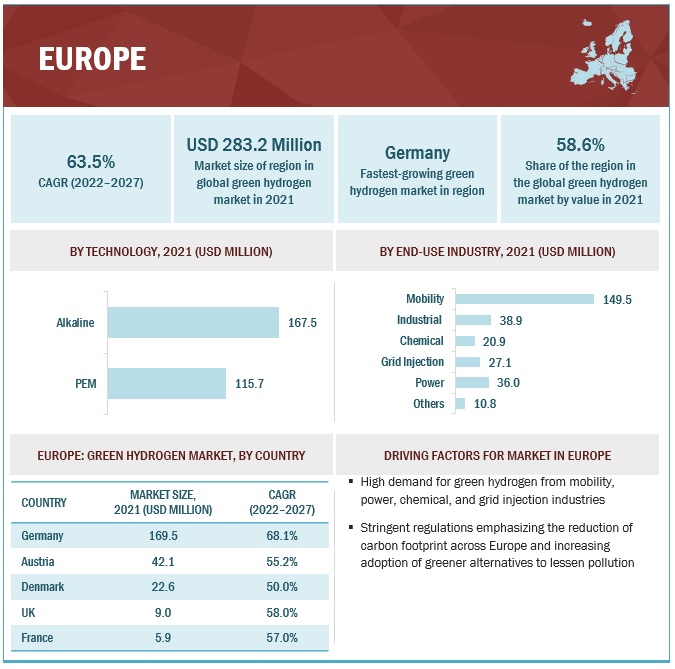

Europe held the largest market share in the activated carbon fiber market

Europe is the largest market for green hydrogen in 2021. It has a significant number of manufacturers that are actively participating in development activities, especially in expansions and new product launches. The region has the presence of major green hydrogen manufacturers, such as Siemens Energy AG (Germany), Nel ASA (Norway), Linde plc (Ireland), H&R Ölwerke Schindler GmbH (Germany), Wind to Gas Energy GmbH & Co. KG (Germany), Air Liquide S.A. (France). Europe is an attractive market for the green hydrogen. The expanding manufacturing facilities in Europe promise a high potential for market growth in the coming years.

Green Hydrogen Market Players

Some of the key players in the global green hydrogen market are Siemens Energy AG (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Nel ASA (Norway), Linde plc (Ireland), Cummins Inc. (US), H&R Ölwerke Schindler GmbH (Germany), Wind to Gas Energy GmbH & Co. KG (Germany), Guangdong Nation-Synergy Hydrogen Power Technology Co., Ltd. (China), Air Liquide S.A. (France), and Air Products and Chemicals, Inc. (US).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the green hydrogen market. The study includes an in-depth competitive analysis of these key players in the green hydrogen market, with their company profiles, recent developments, and key market strategies.

Green Hydrogen Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 676 million |

|

Revenue Forecast in 2027 |

USD 7,314 million |

|

CAGR |

61.0% |

|

Years considered for the study |

2018-2021 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD million), Volume (Tons) |

|

Segments |

Technology, Renewable Source, End-Use Industry and Region |

|

Regions |

Europe, North America, Asia Pacific, Latin America, Middle East and Africa, Rest of the world |

|

Companies |

Siemens Energy AG (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Nel ASA (Norway), Linde plc (Ireland), Cummins Inc. (US), H&R Ölwerke Schindler GmbH (Germany), Wind to Gas Energy GmbH & Co. KG (Germany), Guangdong Nation-Synergy Hydrogen Power Technology Co., Ltd. (China), Air Liquide S.A. (France), and Air Products and Chemicals, Inc. (US), Uniper SE (Germany), Engie SA (France), Orsted AS(Denmark), Lhyfe (France). |

This research report categorizes the green hydrogen market based on technology, renewable source, end-use industry and region.

By Technology:

- Alkaline Electrolysis

- PEM Electrolysis

By Renewable source:

- Wind Energy

- Solar Energy

- Others (geothermal, hydropower, and hybrid of wind & solar)

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments

- In June 2022, Air Liquide S.A. and Siemens Energy have formed a joint venture in Europe to produce industrial scale renewable hydrogen electrolyzers in series. This Franco-German collaboration will enable the emergence of a sustainable hydrogen economy in Europe and foster a European ecosystem for electrolysis and hydrogen technology by combining the expertise of two of the world's leading companies in their respective fields. Production is expected to begin in the second half of 2023, with a capacity of three gigatons per year by 2025.

- In May 2022, Air Liquide S.A., CaetanoBus, and Toyota Motor Europe have agreed to collaborate on the development of integrated hydrogen solutions. This will include infrastructure development as well as vehicle fleets to accelerate the spread of hydrogen mobility for both light- and heavy-duty vehicles.

- In April 2022, Lhyfe and WPD collaborated for the large-scale production of renewable green hydrogen at Storgrundet offshore wind farm, Soderhamn municipality (Sweden) facility.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the green hydrogen market?

High demand from mobility due to superior performance with low zero carbon emission of green hydrogen has driven the market.

Which is the fastest-growing region-level market for green hydrogen?

Europe is the fastest-growing green hydrogen market due to the presence of major green hydrogen manufacturers.

What are the factors contributing to the final price of green hydrogen?

Energy costs plays a vital role in the costs along with manufacturing technology.

What are the challenges in the green hydrogen market?

High initial costs and underdeveloped market are the major challenges.

Which energy based green hydrogen holds the largest market share?

Wind energy based green hydrogen, in terms of value and volume hold the largest share due to lower energy cost.

How is the green hydrogen market aligned?

The market is relatively new and growing at a very fast pace. It is a potential market and many manufactures are planning business strategies to expand their business or reduce their carbon footprint.

Who are the major manufacturers?

Siemens Energy AG (Germany), Linde (Ireland), Toshiba Energy Systems & Solutions Corporation (Japan), Air Liquide (France) and Nel ASA (Norway)

What are the major end use industry for green hydrogen?

The major end-use industry of green hydrogen includes mobility, chemical, power, industrial, grid injection.

What is the biggest restraint in the green hydrogen market?

High initial investment is the biggest restraint.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.4.4 CURRENCY CONSIDERED

1.4.5 UNIT CONSIDERED

1.4.6 LIMITATIONS

1.4.7 STAKEHOLDERS

1.4.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH APPROACH

FIGURE 1 GREEN HYDROGEN MARKET: RESEARCH DESIGN

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH 1

2.2.2 SUPPLY-SIDE APPROACH 2

2.2.3 SUPPLY-SIDE APPROACH 3

2.2.4 DEMAND-SIDE APPROACH

2.3 FORECAST NUMBER CALCULATION

2.4 RESEARCH DATA

2.4.1 SECONDARY DATA

2.4.1.1 Key data from secondary sources

2.4.2 PRIMARY DATA

2.4.2.1 Key data from primary sources

2.4.2.2 Primary interviews – Top green hydrogen manufacturers

2.4.2.3 Breakdown of primary interviews

2.4.2.4 Key industry insights

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 2 GREEN HYDROGEN MARKET: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 3 GREEN HYDROGEN MARKET: TOP-DOWN APPROACH

2.6 DATA TRIANGULATION

FIGURE 4 GREEN HYDROGEN MARKET: DATA TRIANGULATION

2.7 RESEARCH ASSUMPTIONS

2.8 RESEARCH LIMITATIONS AND RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 5 WIND ENERGY-BASED GREEN HYDROGEN MARKET IN 2021

FIGURE 6 ALKALINE ELECTROLYSIS LED GREEN HYDROGEN MARKET IN 2021

FIGURE 7 MOBILITY END-USE INDUSTRY TO REGISTER HIGHEST CAGR IN GREEN HYDROGEN MARKET DURING FORECAST PERIOD

FIGURE 8 EUROPE DOMINATED GREEN HYDROGEN MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN GREEN HYDROGEN MARKET

FIGURE 9 SIGNIFICANT GROWTH EXPECTED IN GREEN HYDROGEN MARKET BETWEEN 2022 AND 2027

4.2 GREEN HYDROGEN MARKET, BY TECHNOLOGY

FIGURE 10 ALKALINE ELECTROLYSIS ACCOUNTED FOR LARGER MARKET SHARE IN 2021

4.3 GREEN HYDROGEN MARKET, BY RENEWABLE SOURCE

FIGURE 11 WIND ENERGY WAS LARGEST RENEWABLE SOURCE USED FOR GREEN HYDROGEN PRODUCTION IN 2021

4.4 GREEN HYDROGEN MARKET, BY END-USE INDUSTRY

FIGURE 12 MOBILITY WAS LARGEST END-USE INDUSTRY SEGMENT IN 2021

4.5 GREEN HYDROGEN MARKET, BY KEY COUNTRY

FIGURE 13 GERMANY TO BE FASTEST-GROWING GREEN HYDROGEN MARKET DURING 2022–2027

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREEN HYDROGEN MARKET

5.2.1 DRIVERS

5.2.1.1 Low variable electricity costs

5.2.1.2 Technological advancements

5.2.1.3 Global plans for net-zero emissions by 2050

5.2.1.4 High demand from FCEVs and power industry

5.2.2 RESTRAINTS

5.2.2.1 High cost of green hydrogen

5.2.2.2 Lack of transportation infrastructure

5.2.2.3 Energy loss in value chain

5.2.2.4 Sustainability management

5.2.3 OPPORTUNITIES

5.2.3.1 Decreasing cost of electrolyzers

5.2.3.2 Increasing government investments

5.2.3.3 Announcement of large-capacity green hydrogen projects

5.2.3.4 Favorable policies for green hydrogen

5.2.4 CHALLENGES

5.2.4.1 High initial investments

5.2.4.2 Under-developed market

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 GREEN HYDROGEN MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 GREEN HYDROGEN MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 16 GREEN HYDROGEN MARKET: SUPPLY CHAIN ANALYSIS

TABLE 2 GREEN HYDROGEN MARKET: SUPPLY CHAIN

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF KEY PLAYER OFFERINGS, BY END-USE INDUSTRY

FIGURE 17 AVERAGE SELLING PRICE OF KEY PLAYER OFFERINGS FOR TOP 3 END-USE INDUSTRIES (USD/TON)

5.6 AVERAGE SELLING PRICE, BY REGION

TABLE 3 GREEN HYDROGEN AVERAGE SELLING PRICE, BY REGION

FIGURE 18 GREEN HYDROGEN AVERAGE SELLING PRICE, BY TECHNOLOGY

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

5.7.2 BUYING CRITERIA

FIGURE 20 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

TABLE 5 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

5.8 TECHNOLOGY ANALYSIS

5.8.1 GREEN HYDROGEN TECHNOLOGIES

5.8.1.1 Polymer electrolyte membrane electrolyzers

5.8.1.2 Alkaline electrolyzers

5.8.1.3 Solid oxide electrolyzer cells

5.8.1.4 Anion exchange membrane water electrolysis

5.8.2 COMMERCIALIZATION OF GREEN HYDROGEN TECHNOLOGIES

5.8.3 RECENT DEVELOPMENTS RELATED TO SOLID OXIDE ELECTROLYZERS AND ALKALINE EXCHANGE MEMBRANE WATER ELECTROLYSIS

5.8.4 FACTORS SUPPORTING GROWTH OF EMERGING ELECTROLYSIS TECHNOLOGIES IN GREEN HYDROGEN MARKET

5.8.5 GLOBAL ELECTROLYZER CAPACITY ADDITION PER ANNUM

FIGURE 21 NEW ELECTROLYZER CAPACITY INSTALLATION (2019–2027)

5.9 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 6 GREEN HYDROGEN MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.10 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON GREEN HYDROGEN MARKET

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 TARIFF AND REGULATORY LANDSCAPE

TABLE 11 CURRENT STANDARD CODES FOR GREEN HYDROGEN

5.12 ECOSYSTEM: GREEN HYDROGEN MARKET

FIGURE 22 GREEN HYDROGEN MARKET: ECOSYSTEM

5.13 VALUE CHAIN ANALYSIS: GREEN HYDROGEN MARKET

FIGURE 23 GREEN HYDROGEN MARKET: VALUE CHAIN ANALYSIS

5.13.1 RAW MATERIAL SELECTION

5.14 KEY MARKETS FOR IMPORT/EXPORT

5.14.1 CHINA

5.14.2 CANADA

5.14.3 GERMANY

5.14.4 SAUDI ARABIA

5.14.5 NORWAY

5.14.6 NETHERLANDS

5.14.7 CHILE

5.14.8 AUSTRALIA

5.14.9 SOUTH KOREA

5.14.10 JAPAN

5.15 GREEN HYDROGEN GLOBAL PROJECTS

TABLE 12 UPCOMING PROJECTS FOR GREEN HYDROGEN

5.16 CASE STUDY ANALYSIS

5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.18 PATENT ANALYSIS

5.18.1 INTRODUCTION

5.18.2 METHODOLOGY

5.18.3 DOCUMENT TYPE

TABLE 13 GREEN HYDROGEN MARKET: GLOBAL PATENTS

FIGURE 24 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 25 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

5.18.4 INSIGHTS

5.18.5 LEGAL STATUS OF PATENTS

FIGURE 26 GREEN HYDROGEN MARKET: LEGAL STATUS OF PATENTS

5.18.6 JURISDICTION ANALYSIS

FIGURE 27 GLOBAL JURISDICTION ANALYSIS

5.18.7 TOP APPLICANTS’ ANALYSIS

FIGURE 28 ZHEJIANG UNIVERSITY: HIGHEST NUMBER OF PATENTS

5.18.8 LIST OF PATENTS BY ZHEJIANG UNIVERSITY

5.18.9 LIST OF PATENTS BY JINAN UNIVERSITY

5.18.10 LIST OF PATENTS BY EAST CHINA NORMAL UNIVERSITY

5.18.11 LIST OF PATENTS BY ACRE COKING & REFRACTORY ENGINEERING CONSULTING CORPORATION

5.18.12 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

6 GREEN HYDROGEN MARKET, BY TECHNOLOGY (Page No. - 99)

6.1 INTRODUCTION

FIGURE 29 ALKALINE ELECTROLYSIS TECHNOLOGY TO DOMINATE GREEN HYDROGEN MARKET DURING FORECAST PERIOD

TABLE 14 GREEN HYDROGEN MARKET SIZE, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 15 GREEN HYDROGEN MARKET SIZE, BY TECHNOLOGY, 2019–2021 (KILOTON)

TABLE 16 GREEN HYDROGEN MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 17 GREEN HYDROGEN MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

6.2 ALKALINE ELECTROLYSIS

6.2.1 ALKALINE ELECTROLYSIS TO LEAD GREEN HYDROGEN MARKET IN TECHNOLOGY SEGMENT

FIGURE 30 EUROPE TO BE LARGEST MARKET FOR ALKALINE ELECTROLYSIS TECHNOLOGY

TABLE 18 ALKALINE ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 19 ALKALINE ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 20 ALKALINE ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 21 ALKALINE ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3 PEM ELECTROLYSIS

6.3.1 EUROPE TO DOMINATE MARKET FOR PEM ELECTROLYSIS SEGMENT

FIGURE 31 EUROPE TO REMAIN LARGEST GREEN HYDROGEN MARKET FOR PEM ELECTROLYSIS TECHNOLOGY

TABLE 22 PEM ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 23 PEM ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 24 PEM ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 PEM ELECTROLYSIS: GREEN HYDROGEN MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7 GREEN HYDROGEN MARKET, BY RENEWABLE SOURCE (Page No. - 107)

7.1 INTRODUCTION

TABLE 26 GREEN HYDROGEN MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (USD MILLION)

TABLE 27 GREEN HYDROGEN MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (KILOTON)

TABLE 28 GREEN HYDROGEN MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (USD MILLION)

TABLE 29 GREEN HYDROGEN MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (KILOTON)

7.2 WIND ENERGY

7.2.1 RISING DEMAND FOR WIND ENERGY AS CLEAN ENERGY SOURCE

TABLE 30 GREEN HYDROGEN FROM WIND ENERGY MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 GREEN HYDROGEN FROM WIND ENERGY MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 32 GREEN HYDROGEN FROM WIND ENERGY MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 GREEN HYDROGEN FROM WIND ENERGY MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7.3 SOLAR ENERGY

7.3.1 CONTINUOUS ADVANCEMENTS IN PV TECHNOLOGIES

TABLE 34 GREEN HYDROGEN FROM SOLAR ENERGY MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 GREEN HYDROGEN FROM SOLAR ENERGY MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 36 GREEN HYDROGEN FROM SOLAR ENERGY MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 GREEN HYDROGEN FROM SOLAR ENERGY MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7.4 OTHER RENEWABLE ENERGY SOURCES

FIGURE 35 EUROPE TO BE LARGEST GREEN HYDROGEN MARKET FOR OTHER RENEWABLE ENERGY SOURCES

TABLE 38 GREEN HYDROGEN FROM OTHER SOURCES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 GREEN HYDROGEN FROM OTHER SOURCES MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 40 GREEN HYDROGEN FROM OTHER SOURCES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 GREEN HYDROGEN FROM OTHER SOURCES MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

8 GREEN HYDROGEN MARKET, BY END-USE INDUSTRY (Page No. - 116)

8.1 INTRODUCTION

FIGURE 36 MOBILITY END-USE INDUSTRY TO WITNESS RAPID GROWTH DURING FORECAST PERIOD

TABLE 42 GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 43 GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 44 GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 45 GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

TABLE 46 ENERGY DENSITY OF VARIOUS FUELS

8.2 MOBILITY

8.2.1 MOBILITY TO BE LARGEST END-USE INDUSTRY

FIGURE 37 EUROPE TO DOMINATE GREEN HYDROGEN MARKET IN MOBILITY INDUSTRY

TABLE 47 GREEN HYDROGEN MARKET SIZE IN MOBILITY INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

TABLE 48 GREEN HYDROGEN MARKET SIZE IN MOBILITY INDUSTRY, BY REGION, 2019–2021 (KILOTON)

TABLE 49 GREEN HYDROGEN MARKET SIZE IN MOBILITY INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 GREEN HYDROGEN MARKET SIZE IN MOBILITY INDUSTRY, BY REGION, 2022–2027 (KILOTON)

8.3 CHEMICAL

8.3.1 GROWING DEMAND FOR CLEAN ENERGY SOURCES IN CHEMICAL INDUSTRY

FIGURE 38 ASIA PACIFIC TO BE SECOND-LARGEST GREEN HYDROGEN MARKET IN CHEMICAL INDUSTRY

TABLE 51 GREEN HYDROGEN MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 GREEN HYDROGEN MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2019–2021 (KILOTON)

TABLE 53 GREEN HYDROGEN MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 GREEN HYDROGEN MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2022–2027 (KILOTON)

8.4 POWER

8.4.1 USE OF EFFICIENT GREEN ENERGY DRIVING POWER SECTOR

FIGURE 39 EUROPE TO REMAIN LARGEST GREEN HYDROGEN MARKET IN POWER INDUSTRY

TABLE 55 GREEN HYDROGEN MARKET SIZE IN POWER INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 GREEN HYDROGEN MARKET SIZE IN POWER INDUSTRY, BY REGION, 2019–2021 (KILOTON)

TABLE 57 GREEN HYDROGEN MARKET SIZE IN POWER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 GREEN HYDROGEN MARKET SIZE IN POWER INDUSTRY, BY REGION, 2022–2027 (KILOTON)

8.5 GRID INJECTION

8.5.1 INCREASED PENETRATION OF RENEWABLES IN ENERGY SYSTEM

FIGURE 40 ASIA PACIFIC TO BE SECOND FASTEST-GROWING GREEN HYDROGEN MARKET IN GRID INJECTION INDUSTRY

TABLE 59 GREEN HYDROGEN MARKET SIZE IN GRID INJECTION INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

TABLE 60 GREEN HYDROGEN MARKET SIZE IN GRID INJECTION INDUSTRY, BY REGION, 2019–2021 (KILOTON)

TABLE 61 GREEN HYDROGEN MARKET SIZE IN GRID INJECTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 GREEN HYDROGEN MARKET SIZE IN GRID INJECTION INDUSTRY, BY REGION, 2022–2027 (KILOTON)

8.6 INDUSTRIAL

8.6.1 GROWING DEMAND FOR CLEAN ENERGY

FIGURE 41 EUROPE TO BE FASTEST-GROWING GREEN HYDROGEN MARKET IN INDUSTRIAL SECTOR

TABLE 63 GREEN HYDROGEN MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2019–2021 (USD MILLION)

TABLE 64 GREEN HYDROGEN MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2019–2021 (KILOTON)

TABLE 65 GREEN HYDROGEN MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 GREEN HYDROGEN MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2022–2027 (KILOTON)

8.7 OTHERS

FIGURE 42 EUROPE TO ACCOUNT FOR LARGEST SHARE OF GREEN HYDROGEN MARKET FOR OTHER INDUSTRIES SEGMENT

TABLE 67 GREEN HYDROGEN MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2021 (USD MILLION)

TABLE 68 GREEN HYDROGEN MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2021 (KILOTON)

TABLE 69 GREEN HYDROGEN MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 GREEN HYDROGEN MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (KILOTON)

9 GREEN HYDROGEN MARKET, BY REGION (Page No. - 132)

9.1 INTRODUCTION

FIGURE 43 GERMANY TO WITNESS HIGHEST CAGR IN GREEN HYDROGEN MARKET

9.1.1 GREEN HYDROGEN MARKET SIZE, BY REGION

TABLE 71 GREEN HYDROGEN MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 72 GREEN HYDROGEN MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 73 GREEN HYDROGEN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 GREEN HYDROGEN MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

9.2 NORTH AMERICA

FIGURE 44 NORTH AMERICA: GREEN HYDROGEN MARKET SNAPSHOT

9.2.1 GREEN HYDROGEN MARKET SIZE IN NORTH AMERICA, BY TECHNOLOGY

TABLE 75 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (KILOTON)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

9.2.2 GREEN HYDROGEN MARKET SIZE IN NORTH AMERICA, BY RENEWABLE SOURCE

TABLE 79 NORTH AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (KILOTON)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (KILOTON)

9.2.3 GREEN HYDROGEN MARKET SIZE IN NORTH AMERICA, BY END-USE INDUSTRY

TABLE 83 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY 2019–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY 2022–2027 (KILOTON)

9.2.4 GREEN HYDROGEN MARKET SIZE IN NORTH AMERICA, BY COUNTRY

TABLE 87 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.2.4.1 US

9.2.4.1.1 Most promising global market

9.2.4.1.2 Green hydrogen market in US, by end-use industry

TABLE 91 US: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 92 US: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 93 US: MARKET SIZE, BY END-USE INDUSTRY 2022–2027 (USD MILLION)

TABLE 94 US: MARKET SIZE, BY END-USE INDUSTRY 2022–2027 (KILOTON)

9.2.4.2 Canada

9.2.4.2.1 Growth in mobility and power sectors

9.2.4.2.2 Green hydrogen market in Canada, by end-use industry

TABLE 95 CANADA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 97 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)s

9.3 EUROPE

FIGURE 45 EUROPE: GREEN HYDROGEN MARKET SNAPSHOT

9.3.1 GREEN HYDROGEN MARKET SIZE IN EUROPE, BY TECHNOLOGY

TABLE 99 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (KILOTON)

TABLE 101 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

9.3.2 GREEN HYDROGEN MARKET SIZE IN EUROPE, BY RENEWABLE SOURCE

TABLE 103 EUROPE: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (KILOTON)

TABLE 105 EUROPE: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (KILOTON)

9.3.3 GREEN HYDROGEN MARKET SIZE IN EUROPE, BY END-USE INDUSTRY

TABLE 107 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 109 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.3.4 GREEN HYDROGEN MARKET SIZE IN EUROPE, BY COUNTRY

TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 113 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.3.4.1 Germany

9.3.4.1.1 World leader in green hydrogen

9.3.4.1.2 Green hydrogen market in Germany, by end-use industry

TABLE 115 GERMANY: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 116 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 117 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 118 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.3.4.2 Austria

9.3.4.2.1 High focus on developing green hydrogen economy

9.3.4.2.2 Green hydrogen market in Austria, by end-use industry

TABLE 119 AUSTRIA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 120 AUSTRIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 121 AUSTRIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 122 AUSTRIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.3.4.3 Denmark

9.3.4.3.1 Demand in mobility sector to drive market

9.3.4.3.2 Green hydrogen market in Denmark, by end-use industry

TABLE 123 DENMARK: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 124 DENMARK: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 125 DENMARK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 126 DENMARK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.3.4.4 UK

9.3.4.4.1 Diversified industrial base to increase demand

9.3.4.4.2 Green hydrogen market in UK, by end-use industry

TABLE 127 UK: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 128 UK: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 129 UK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 130 UK: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.3.4.5 France

9.3.4.5.1 Energy and power industries to support market growth

9.3.4.5.2 Green hydrogen market in France, by end-use industry

TABLE 131 FRANCE: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 132 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 133 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 134 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.3.4.6 Rest of Europe

9.3.4.6.1 Green hydrogen market in Rest of Europe, by end-use industry

TABLE 135 REST OF EUROPE: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 137 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.4 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: GREEN HYDROGEN MARKET SNAPSHOT

9.4.1 GREEN HYDROGEN MARKET SIZE IN ASIA PACIFIC, BY TECHNOLOGY

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (KILOTON)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

9.4.2 GREEN HYDROGEN MARKET SIZE IN ASIA PACIFIC, BY RENEWABLE SOURCE

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (KILOTON)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (KILOTON)

9.4.3 GREEN HYDROGEN MARKET SIZE IN ASIA PACIFIC, BY END-USE INDUSTRY

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY 2019–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.4.4 GREEN HYDROGEN MARKET SIZE IN ASIA PACIFIC, BY COUNTRY

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.4.4.1 China

9.4.4.1.1 Mobility to drive market growth

9.4.4.1.2 Green hydrogen market in China, by end-use industry

TABLE 155 CHINA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 156 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 157 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 158 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.4.4.2 Japan

9.4.4.2.1 Potential to become green hydrogen leader in world

9.4.4.2.2 Green hydrogen market in Japan, by end-use industry

TABLE 159 JAPAN: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 160 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 161 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 162 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.4.4.3 Australia

9.4.4.3.1 Most promising market due to vast natural resources

9.4.4.3.2 Green hydrogen market in Australia, by end-use industry

TABLE 163 AUSTRALIA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 164 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 165 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 166 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.4.4.4 Rest of Asia pacific

9.4.4.4.1 Green hydrogen market in Rest of Asia Pacific, by end-use industry

TABLE 167 REST OF ASIA PACIFIC: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 169 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.5 MIDDLE EAST & AFRICA

9.5.1 GREEN HYDROGEN MARKET SIZE IN MIDDLE EAST & AFRICA, BY TECHNOLOGY

TABLE 171 MIDDLE EAST & AFRICA: GREEN HYDROGEN MARKET SIZE, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (KILOTON)

TABLE 173 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

9.5.2 GREEN HYDROGEN MARKET SIZE IN MIDDLE EAST & AFRICA, BY RENEWABLE SOURCE

TABLE 175 MIDDLE EAST & AFRICA: GREEN HYDROGEN MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (KILOTON)

TABLE 177 MIDDLE EAST & AFRICA: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (KILOTON)

9.5.3 GREEN HYDROGEN MARKET SIZE IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY

TABLE 179 MIDDLE EAST & AFRICA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.5.4 GREEN HYDROGEN MARKET SIZE IN MIDDLE EAST & AFRICA, BY COUNTRY

TABLE 183 MIDDLE EAST & AFRICA: GREEN HYDROGEN MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.5.4.1 UAE

9.5.4.1.1 Increasing green hydrogen production plants to meet demand

9.5.4.1.2 Green hydrogen market in UAE, by end-use industry

TABLE 187 UAE: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 188 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 189 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 190 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.5.4.2 Saudi Arabia

9.5.4.2.1 Demand for green hydrogen in mobility applications

9.5.4.2.2 Green hydrogen market in Saudi Arabia, by end-use industry

TABLE 191 SAUDI ARABIA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 192 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 193 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 194 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.5.4.3 Rest of Middle East & Africa

9.5.4.3.1 Green hydrogen market in Rest of Middle East & Africa, by end-use industry

TABLE 195 REST OF MIDDLE EAST & AFRICA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 196 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 197 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.6 LATIN AMERICA

9.6.1 GREEN HYDROGEN MARKET SIZE IN LATIN AMERICA, BY TECHNOLOGY

TABLE 199 LATIN AMERICA: GREEN HYDROGEN MARKET SIZE, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2021 (KILOTON)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (KILOTON)

9.6.2 GREEN HYDROGEN MARKET SIZE IN LATIN AMERICA, BY RENEWABLE SOURCE

TABLE 203 LATIN AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2019–2021 (KILOTON)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY RENEWABLE SOURCE, 2022–2027 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, RENEWABLE SOURCE, 2022–2027 (KILOTON)

9.6.3 GREEN HYDROGEN MARKET SIZE IN LATIN AMERICA, BY END-USE INDUSTRY

TABLE 207 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.6.4 GREEN HYDROGEN MARKET SIZE IN LATIN AMERICA, BY COUNTRY

TABLE 211 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.6.4.1 Brazil

9.6.4.1.1 Largest market for green hydrogen in Latin America

9.6.4.1.2 Green hydrogen market in Brazil, by end-use industry

TABLE 215 BRAZIL: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 216 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 217 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 218 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.6.4.2 Mexico

9.6.4.2.1 Rising demand from mobility and power industries

9.6.4.2.2 Green hydrogen market in Mexico, by end-use industry

TABLE 219 MEXICO: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 220 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 221 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 222 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.6.4.3 Argentina

9.6.4.3.1 Growing economic status and spending on green hydrogen projects

9.6.4.3.2 Green hydrogen market in Argentina, by end-use industry

TABLE 223 ARGENTINA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 224 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 225 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 226 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

9.6.4.4 Rest of Latin America

9.6.4.4.1 Green Hydrogen market in Rest of Latin America, by end-use industry

TABLE 227 REST OF LATIN AMERICA: GREEN HYDROGEN MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

TABLE 228 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

TABLE 229 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 230 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 203)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

FIGURE 47 MARKET SHARE OF TOP COMPANIES IN GREEN HYDROGEN MARKET

TABLE 231 DEGREE OF COMPETITION: GREEN HYDROGEN MARKET

10.3 MARKET RANKING

FIGURE 48 RANKING OF TOP 5 PLAYERS IN GREEN HYDROGEN MARKET

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

10.5 COMPANY EVALUATION MATRIX

TABLE 232 COMPANY PRODUCT FOOTPRINT

TABLE 233 COMPANY INDUSTRY FOOTPRINT

TABLE 234 COMPANY APPLICATION FOOTPRINT

TABLE 235 COMPANY REGION FOOTPRINT

10.5.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GREEN HYDROGEN MARKET

10.5.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 50 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GREEN HYDROGEN MARKET

10.6 COMPANY EVALUATION QUADRANT (TIER 1)

10.6.1 STARS

10.6.2 PERVASIVE PLAYERS

10.6.3 PARTICIPANTS

10.6.4 EMERGING LEADERS

FIGURE 51 GREEN HYDROGEN: COMPETITIVE LEADERSHIP MAPPING, 2021

10.7 MARKET EVALUATION FRAMEWORK

TABLE 236 GREEN HYDROGEN MARKET: DEALS, 2017–2022

TABLE 237 GREEN HYDROGEN: OTHERS, 2017–2022

TABLE 238 GREEN HYDROGEN MARKET: NEW PRODUCT LAUNCH/DEVELOPMENT, 2017–2022

10.7.1 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 239 GREEN HYDROGEN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 240 GREEN HYDROGEN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES EVALUATION MATRIX

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 DYNAMIC COMPANIES

10.8.4 STARTING BLOCKS

FIGURE 52 GREEN HYDROGEN: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

11 COMPANY PROFILES (Page No. - 236)

11.1 KEY COMPANIES

(Business overview, Deals, Products offered, Recent Developments, MNM view)*

11.1.1 AIR LIQUIDE S.A.

TABLE 241 AIR LIQUIDE S.A.: COMPANY OVERVIEW

FIGURE 53 AIR LIQUIDE S.A.: COMPANY SNAPSHOT

11.1.2 AIR PRODUCTS AND CHEMICALS, INC.

TABLE 242 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

FIGURE 54 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

11.1.3 ENGIE SA

TABLE 243 ENGIE SA: COMPANY OVERVIEW

FIGURE 55 ENGIE SA: COMPANY SNAPSHOT

11.1.4 UNIPER SE

TABLE 244 UNIPER SE: COMPANY OVERVIEW

FIGURE 56 UNIPER SE: COMPANY SNAPSHOT

11.1.5 SIEMENS ENERGY AG

TABLE 245 SIEMENS ENERGY AG: COMPANY OVERVIEW

FIGURE 57 SIEMENS ENERGY AG: COMPANY SNAPSHOT

11.1.6 LHYFE

TABLE 246 LHYFE: COMPANY OVERVIEW

11.1.7 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

TABLE 247 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

FIGURE 58 TOSHIBA CORPORATION (PARENT COMPANY): COMPANY SNAPSHOT

11.1.8 NEL ASA

TABLE 248 NEL ASA: COMPANY OVERVIEW

FIGURE 59 NEL ASA: COMPANY SNAPSHOT

11.1.9 ØRSTED A/S

TABLE 249 ØRSTED A/S: COMPANY OVERVIEW

FIGURE 60 ØRSTED A/S: COMPANY SNAPSHOT

11.1.10 LINDE PLC

TABLE 250 LINDE PLC: COMPANY OVERVIEW

FIGURE 61 LINDE PLC: COMPANY SNAPSHOT

11.1.11 CUMMINS INC.

TABLE 251 CUMMINS INC.: COMPANY OVERVIEW

FIGURE 62 CUMMINS INC.: COMPANY SNAPSHOT

11.1.12 H&R ÖLWERKE SCHINDLER GMBH

TABLE 252 H&R ÖLWERKE SCHINDLER GMBH: COMPANY OVERVIEW

FIGURE 63 H&R ÖLWERKE SCHINDLER GMBH: COMPANY SNAPSHOT

11.1.13 WIND TO GAS ENERGY GMBH & CO. KG

TABLE 253 WIND TO GAS ENERGY GMBH & CO. KG: COMPANY OVERVIEW

11.1.14 GUANGDONG SINO-SYNERGY HYDROGEN ENERGY TECHNOLOGY CO., LTD.

TABLE 254 SINO-SYNERGY HYDROGEN ENERGY TECHNOLOGY (JIAXING) CO., LTD.: COMPANY OVERVIEW

11.2 OTHER KEY PLAYERS

11.2.1 IBERDROLA, S.A.

11.2.2 ENEL GREEN POWER S.P.A.

11.2.3 ENVISION DIGITAL

11.2.4 HYNAMICS (EDF)

11.2.5 ACWA POWER

11.2.6 GREEN HYDROGEN SYSTEMS

11.2.7 THE STATE ATOMIC ENERGY CORPORATION ROSATOM

11.2.8 ENEGIX RENEWABLE ENERGIES LTD.

11.2.9 ACME SOLAR HOLDINGS PVT. LTD.

11.2.10 GEOPURA, LTD.

11.2.11 IWATANI CORPORATION

11.2.12 XEBEC ADSORPTION, INC.

11.2.13 AQUAHYDREX, INC.

11.2.14 ENAPTER S.R.L.

11.2.15 STARFIRE ENERGY

11.2.16 HIRINGA ENERGY LIMITED

11.2.17 PLUG POWER, INC.

11.2.18 ATAWEY

11.2.19 ITM POWER PLC

11.2.20 BEIJING CEI TECHNOLOGY CO., LTD.

11.2.21 TIANJIN MAINLAND HYDROGEN EQUIPMENT CO., LTD.

11.2.22 THYSSENKRUPP AG

*Details on Business overview, Deals, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 318)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

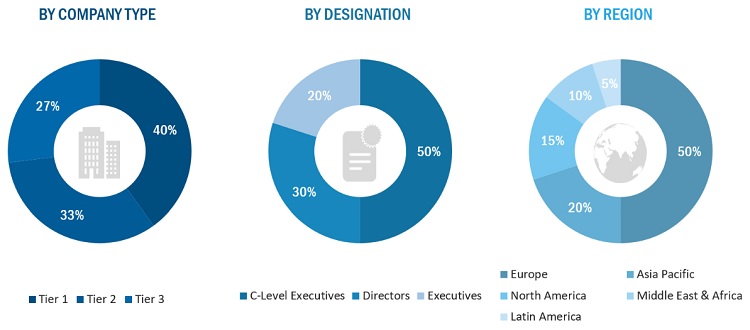

The study involves two major activities in estimating the current market size for green hydrogen market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Green Hydrogen Market Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study. Also, Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Green Hydrogen Market Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the activated carbon fiber market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Green Hydrogen Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total green hydrogen market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Green Hydrogen Market Data Triangulation

After arriving at the overall green hydrogen market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in, mobility, power, chemical, industrial, grid injection and other end-use industries.

Green Hydrogen Market Report Objectives

- To analyze and forecast the global market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market.

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Green Hydrogen Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Green Hydrogen Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Green Hydrogen Market Regional Analysis

- Further breakdown of Rest of Asia Pacific activated carbon fiber market

- Further breakdown of Rest of European activated carbon fiber market

- Further breakdown of Rest of Middle East & Africa activated carbon fiber market

- Further breakdown of Rest of Latin American activated carbon fiber market

Green Hydrogen Market Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Clean Hydrogen Market Overview

Clean Hydrogen Market Trends

Top Companies in Clean Hydrogen Market

Clean Hydrogen Market Impact on Different Industries

Speak to our Analyst today to know more about Clean Hydrogen Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Green Hydrogen Market