Gunshot Detection Systems Market by Installation(Fixed Installation, Vehicle Mounted, Soldier Mounted System), End User, Solution (System, Subscription-based Gunshot Detection Services), Application and Region - Global Forecast to 2027

Updated on : March 03, 2023

[186 Pages Report] The Gunshot Detection Systems market size is projected to USD 7.8 Billion by 2027 from USD 4.9 Billion in 2022 growing at a CAGR of 9.7% from 2022 to 2027.

The increasing number of shootings in schools, universities, and hospitals is expected to fuel the growth of the gunshot detection systems industry. Aside from that, law enforcement organizations are increasingly utilizing the technology, notably in the North American region. Increased investment in border security is likely to drive market development in the coming years. These devices can help border security personnel identify and prevent smuggling, infiltration, and illegal immigration.

Gunshot Detection Systems Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Gunshot Detection Systems Market Dynamics

Driver:Minimizing enemy gunfire casualties in war zone

Gunshot detection plays an important role in determining the origin of gunfire and preparing soldiers for a counterattack. The US Army has purchased wearable sniper detector systems from QinetiQ Systems (UK) for soldiers stationed in Iraq and Afghanistan. These systems identify the distance and direction of shots fired within a tenth of a second. Raytheon’s Boomerang uses a fixed array of microphones mounted on a High Mobility Multipurpose Wheeled Vehicle (HMMWV) to locate the position of the shooter. The Boomerang automatically provides an immediate indication of hostile fire or sniper attack and localizes the shooter’s position, allowing for a rapid, informed, and coordinated response. Another system prominently used in the European region is Pilar by the ACOEM Group. This system can be vehicle-mounted for sniper localization.

Restraint: The expense of installation might lower the market's grade.

The cost of installing gunshot detection technology is considerable since it necessitates the installation of sensors and cameras across a vast region. Sensor and camera installation raises service and maintenance costs. High installation and maintenance expenses may limit the market for gunfire detection systems.

Opportunity: Smart cities require a gunshot detection system.

Future smart cities are projected to deploy cutting-edge technologies to enhance security. One of the technologies that can help cities improve citizen security is gunshot detection. These technologies give forensic evidence to law enforcement and security organizations during shooting investigations.

Challenge: Technological challenges in integration with command-and-control systems

An increase in casualties in combat situations is a significant concern for the armed forces. Gunshot detection systems are high-end technology systems designed to minimize human loss in conflict zones. The integration of these systems with command-and-control systems, such as C4ISR, is a complex process. The complexities involved in integration are acting as a challenge in the adoption of gunshot detection systems. The capability of threat detection will improve information sharing across multiple military units. This integration will help in improving the reaction time and threat detection by providing information on enemy sniper units and enemy gunfire positions. Futuristic soldier programs around the world are focusing on increasing the situational awareness of soldiers in war situations.

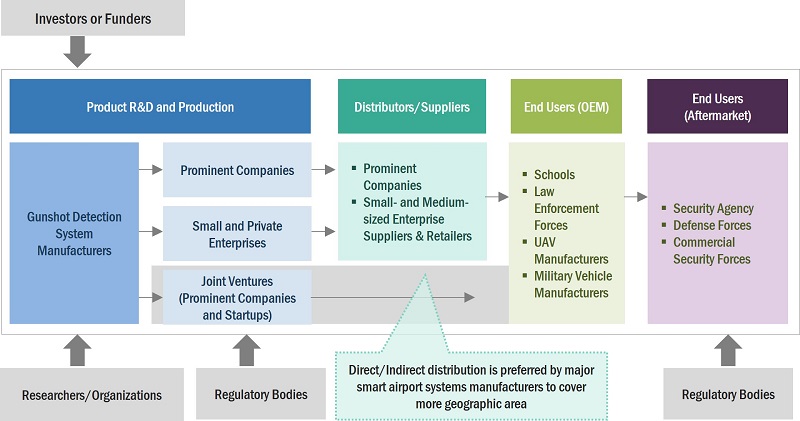

Gunshot Detection Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of aircraft hydraulic systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), among others.

Fixed Installation segment to dominate market share during the forecast period

Based on Installation, the Gunshot Detection Systems market has been segmented into fixed installation, vehicle installation and soldier mounted. The fixed installation segment is expected to increase significantly in the upcoming years. The increase in segment remuneration can be attributed to improvements in the safety systems of present school, university, and military infrastructures. Fixed gunshot detection systems track a gunshot occurrence using acoustic sensor node technology. These systems are put on walls, poles, or border crossings for military purposes.

Commercial segment to lead the market for Gunshot Detection Systems during the forecast period

Based on End User, the Gunshot Detection Systems market has been segmented into Commercial & Defense Segment. Increasing demand for public safety is the primary factor for the growth of the segment during the forecast period. Additionally, the rising instances of gunfire and shootouts in interior locations such as schools, malls, private and government buildings have led to an increase in demand for indoor gunshot detection systems, boosting industry instances.

System segment to witness higher demand during the forecast period

Based on Solution, the Gunshot Detection Systems market has been classified into System and Subscription based gunshot detection services. The system comprises all of the hardware needed to detect gunshots using sensors. Acoustic sensors and display systems, among others, are employed in gunshot detection systems. Increasing gunfire incidents across the globe are leading to the increased demand for the gunshot detection system.

Outdoor segment to acquire the largest market share during the forecast period

Based on Application, the Gunshot Detection Systems market has been classified into Indoor and outdoor segment. These systems are also used at international crossings, as well as on armoured vehicles and air platforms like UAVs and helicopter gunships. The outdoor category is expected to be the largest in 2022 and to maintain its dominance throughout the forecast period. The increased value is due to the greater coverage area and improved precision. The cross-border conflicts are the primary factor for the utilization of gunshot detection systems for outdoor applications.

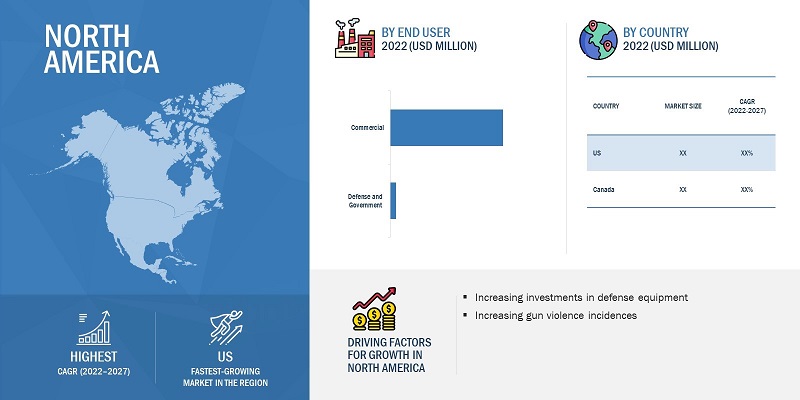

Nort America is projected to witness the highest market share during the forecast period

North Ameica leads the Gunshot Detection Systems market. Because of the high rates of shooting or gunshots near schools, colleges, and universities, as educational facilities within the area, North America dominates the Gunshot Detection Systems market. The rising rate of gun violence, combined with the growing need for sophisticated gunshot detection systems, will drive market growth in the next years. The United States has seen a rise in gun crime in recent years, prompting law enforcement to deploy gunshot detection devices.

Gunshot Detection Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Gunshot Detection Systems Companies - Key Market Players

The Gunshot Detection Systems Companies are dominated by globally established players such as Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), and among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Installation, By End User, By Solution, By Application, By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, Rest of the World |

|

Companies Covered |

Shot spotter, Inc., (US) Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), Acoem Group (France), THALES (France), Databuoy Corporation (US), and Elta Systems Ltd. (Israel), among others. |

Gunshot Detection Systems Market Highlights

This research report categorizes the Gunshot detection system Market based on Component, Type, End User, Platform, Application and Region.

|

Aspect |

Details |

|

By Application |

|

|

By Solution |

|

|

By End User |

|

|

By Installation |

|

|

By Region |

|

Recent Developments

- In September 2022, 3xLOGIC, Inc., a supplier of integrated, intelligent security systems, introduced a new variety of deployment choices for users seeking to secure smaller areas in active shooter scenarios with the new Single Sensor Gunshot Detection solution. The 3xLOGIC 8-sensor device is intended for bigger places, such as a gymnasium, cafeteria, library, or pole installed outside to cover wider regions.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Gunshot Detection Systems market?

The Gunshot Detection Systems market is being driven by the installation on the advanced Gunshot Detection Systems in the schools, colleges, theater, public areas to enhance the public safety. The Systems helps in sharing real-time information that increases the possibility of saving lives in the event of a shooting incident. Other establishments, such as banks and financial organizations, also have a significant demand for these systems, as do high-security prisons and defence installations. Additionally the growth of the market has been pushed by the rising need for advancement in border surveillance systems and perimeter security.

What are the key sustainability strategies adopted by leading players operating in the Gunshot Detection Systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Gunshot Detection Systems market. The major players include Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), and among others. These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Gunshot Detection Systems market?

Some of the major emerging technologies and use cases disrupting the market include the Utilization of Optical Detection Systems, Infrared Cameras, Laser Range Finders, and GPS with Gunshot Detection Systems.

Who are the key players and innovators in the ecosystem of the Gunshot Detection Systems market?

The key players in the Gunshot Detection Systems market include Shot spotter, Inc. (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel).

Which region is expected to hold the highest market share in the Gunshot Detection Systems market?

The Gunshot Detection Systems market in North America is projected to hold the highest market share during the forecast period due openfire arm incidents occuring in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

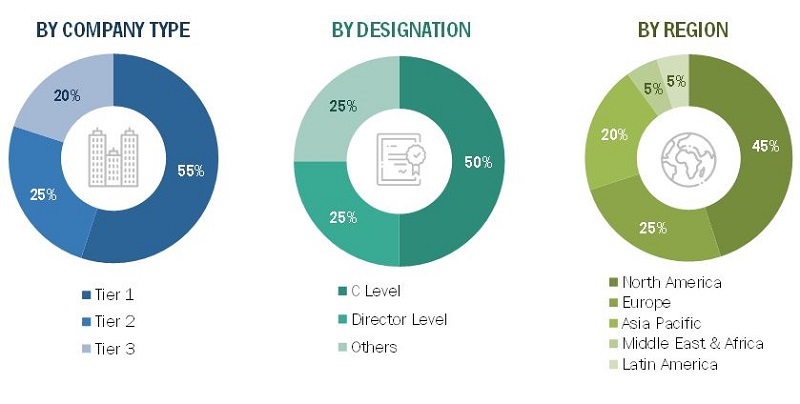

The study involved four major activities in estimating the current market size for the Gunshot detection system market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Gunshot detection system market comprises several stakeholders, such as raw material providers, Gunshot detection system manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Gunshot detection system market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

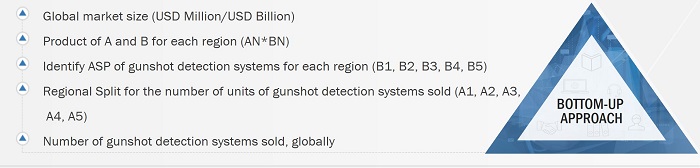

Market Size Estimation Methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the gunshot detection systems market from the demand for such systems and components by end users in each country, and the average cost of integration for both brownfield and greenfield. These calculations led to the estimation of the overall market size.

Market Size Estimation Methodology: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

he most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Gunshot detection system market.

Gunshot Detection Systems Market: The Rise of Gunfire Locator and Gunshot Location Technologies

The world we live in today is fraught with security risks, and gun violence is one of the most pressing. In recent years, there has been a significant rise in the use of firearms for criminal activities, resulting in a growing demand for technologies that can detect and locate gunshots. This has led to the development of gunshot detection systems, which are becoming increasingly popular in the security industry. In this blog, we will explore the gunshot detection systems market and the technologies used in these systems, including gunfire locator systems and gunshot location technologies.

Gunshot detection systems are designed to detect and locate the sound of gunshots. They are commonly used in urban areas, where the sound of gunshots can be difficult to pinpoint. These systems typically use a network of microphones or acoustic sensors placed throughout the area being monitored. When a gunshot is fired, the sound waves created by the shot are picked up by the sensors, and the system uses algorithms to triangulate the location of the shot.

Gunfire locator systems are a type of gunshot detection system that uses acoustic sensors to detect the sound of gunfire. These sensors are placed throughout an area and are designed to detect the unique acoustic signature of a gunshot. When a gunshot is detected, the system uses algorithms to determine the location of the shot and sends an alert to the appropriate authorities.

Gunshot location technologies are another type of gunshot detection system that uses a combination of acoustic sensors and video cameras to detect and locate gunshots. These systems use algorithms to analyze the sound waves and visual data captured by the sensors and cameras to determine the location of the shot. They are particularly effective in areas where there is a lot of background noise or where the sound of gunshots may be difficult to detect.

Key Challenges:

- Finding up-to-date and relevant statistics on the global gunshot detection systems market, as well as the specific market segments for gunfire locator systems and gunshot location technologies.

- Understanding and accurately explaining the technical workings of these systems and the algorithms used to detect and locate gunshots, while still making the content accessible to a general audience.

- Balancing the need to acknowledge the important role that gunshot detection systems play in enhancing security with the sensitive and controversial nature of gun violence and gun control.

North America is expected to be the largest market for gunshot detection systems, due to the high incidence of gun violence in the region. However, the market is also expected to grow in other regions, such as Europe, Asia Pacific, the Middle East, and Africa, as governments and private organizations invest in security measures to protect their citizens and assets.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Gunshot detection system market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 2)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gunshot Detection Systems Market

We are considering to invest in a new company that developed a gunshot detection solution. I would like to review the brochure first.