Head Mounted Display (HMD) Market by Type, Technology (AR, VR), Application (Consumer, Commercial, Enterprise & Industry, Aerospace & Defense), Product Type, Component, Connectivity, and Geography - Global Forecast to 2026

Updated on : April 24, 2023

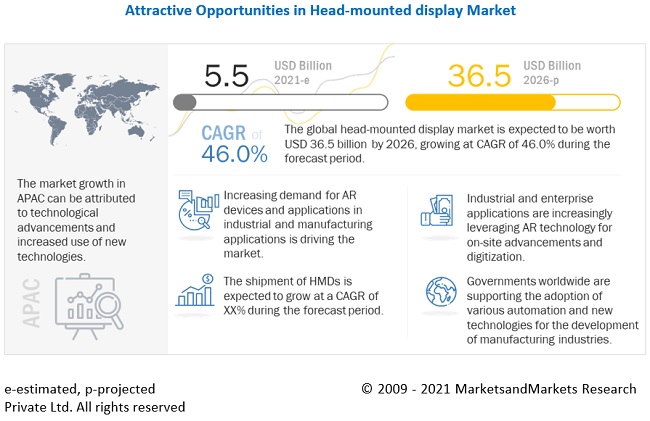

The Head-mounted Display (HMD) Market size is projected to reach USD 36.5 billion by 2026, at a CAGR of 46.0% during the forecast period.

Surge in investments by major players in development of HMDs, increased adoption of AR and VR technologies due to COVID-19, availability of low-cost HMDs, and technological advancements and growing digitalization—are the key factors driving the head-mounted display industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of Head-mounted display

Driver: Surge in investments by major players in development of HMDs

There has been a significant increase in the investments toward the development of HMDs, and in the use of such devices in various applications worldwide. The investments in the HMD market have been huge, and investors have been keen to invest in companies that have proved the worth of their technologies and products in the last few years.

Companies such as Facebook Corporation, Intel Corporation, Qualcomm, Inc., Alphabet, Inc., Comcast Ventures, and Samsung Group are investing heavily in the HMD market. Also, several research institutes are carrying out research in the AR application market for various products and applications. Research institutes are being funded by private firms and venture capitalists or governments. Industries such as consumer electronics, aerospace & defense, healthcare, retail, and advertising are embracing AR due to its benefits.

Boeing announced a new setup named HorizonX in 2017. It would be investing in some companies to start with, including Upskill, a major company in enterprise software for industrial AR devices, and Zunum Aero. In April 2019, Magic Leap raised USD 280 million from NTT DoCoMo, the Japan-based cellphone service provider. The objective of the partnership is to combine NTT’s 5G infrastructure with Magic Leap’s AR platform. In January 2019, Niantic raised USD 245 million from a venture capital company named IVP. The funding’s objective is to support the company behind Pokémon Go to innovate and develop innovative AR solutions and expand its gaming offerings.

Restraint: Lack of standardization for HMD design

Many manufacturers of HMDs and eyeglasses are focusing on enhancing the user experience and making products more informative. The lack of standardization causes compatibility issues between products from different sellers, as different products have different specifications and quality, which affects user experience. To enable widespread enterprise and consumer adoption of HMDs, VR and AR HMDs require similar universal standards that allow developers to make applications that are open and interoperable across different headsets.

For mobile virtual reality, where different smartphones from different manufacturers are used, it becomes more complicated, as users have different operating systems, screen standards, and other parameters. As a result, it becomes difficult for developers to create VR apps, which limits the growth of the market. Therefore, the lack of standardization restrains the growth of the market.

Opportunity: Growing use of HMDs for video games

HMDs have a high penetration rate in video games, as they enhance the gaming experience. PlayStation (PS) PlayStation has made HMDs more popular. HMDs project digital images, allowing a 3D view to enhance the user experience by projecting images and game screens like real-world images, which increases the quality of gaming. The spending on the video game industry has witnessed a huge surge due to the COVID-19 pandemic. Top-tier gaming companies are launching many AR and VR games. The gaming industry has undergone a technological evolution with the emergence of VR and 3D technologies. Therefore, the growing gaming sector would drive the market for HMDs.

Challenge: Adverse impact of lockdowns due to COVID-19 on commercial trade

The imposition of lockdowns and social distancing measures has severely affected the manufacturing sector, as a large chunk of consumer spending is discretionary. Hence, it is being postponed or canceled due to quarantine and social distancing. Some companies had to completely halt their manufacturing operations, which disrupted their supply chains. For instance, key automobile companies such as Volkswagen, Ford, and General Motors had shut down all their production units worldwide during the first wave of COVID-19 in the first half of 2020. The second wave in 2021 has also caused partial lockdowns in various countries and hampered the HMD market again. The third and fourth quarters of 2021 are expected to drive the growth of the HMD market, as COVID-19 cases are expected to reduce with the vaccinations being done on a large scale. All these factors, along with the potential third wave of COVID-19, are expected to significantly impact the growth of the HMD market until mid-2022.

Displays to account for the largest share of components in the head-mounted display market

Display is one of the basic components in HMDs, and its decreasing cost is expected to boost the market for HMDs. Displays are used in many AR devices, owing to which a high growth in the demand for displays in the HMD market can be witnessed. Most AR displays are still in the R&D phase, and companies are trying to make them more compact and add many features.

Wired connectivity held the largest share of head-mounted display market

On the basis of connectivity, market has been segmented as wired and wireless. Wired connectivity headsets are also called tethered headsets. Tethered headsets are connected to PCs or gaming consoles using cables. Some of the wired headsets that are physically connected to PCs are Oculus Rift, HTC Vive, and PlayStation VR. Tethered headsets are large and expensive. They also often work in combination with external cameras to track the user’s head with better accuracy.

Eyewear products to account for the largest share in the head-mounted display market

On the basis of product type, the HMD market has been segmented into head-mounted and eyewear. The market for eyewear products is expected to grow at a higher CAGR owing to the increasing demand for AR applications. Increasing use of eyewear in various applications, such as industry and enterprise, healthcare, and research and design, is expected to increase the market for eyewear HMDs. Eyewear products are also expected to be used in the consumer application with the growing adoption of advanced technologies. Such products give information about the surroundings without disturbing the wearer’s normal field of view and allow the wearer to get driving directions, e-mails, and other notifications.

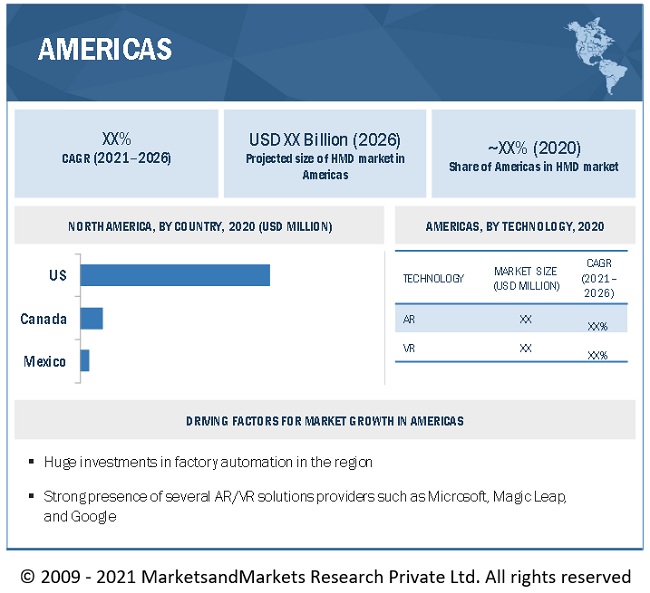

Americas is leading the market for head-mounted display

In the Americas, North America is the leading region for HMDs. Investments made by the major players in the US have led the market growth in this region. Adoption of new technologies and presence of major companies are also among the drivers for the North American market’s growth. In North America, many companies are investing in HMDs. The spread of COVID-19 in the Americas has led to fatalities and loss of lives and livelihood. Countries in the region faced serious disruptions in automotive, transportation, retail, agriculture, and construction sectors, leading to a complete or partial shutdown of manufacturing units, except for essential commodities. The HMD market in North America has also been affected by the pandemic, resulting in a significant loss for the HMD market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players in the head-mounted display companies include Sony (Japan), Oculus VR (Facebook) (US), Microsoft (US), HTC (Taiwan), Google (US), and so on.

Head-mounted Display Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 5.5 Billion |

| Projected Market Size | USD 36.5 Billion |

| Growth Rate | CAGR of 46.0% |

|

Market size available for years |

2021–2026 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Surge in Investments by Major Players in Development of HMDs |

| Largest Growing Region | North America |

| Largest Market Share Segment | Wired Connectivity Segment |

| Highest CAGR Segment | Eyewear Segment |

In this research report, the head-mounted display market has been segmented on the basis of technology, offering, device type, application, and geography.

Based on Type, the Head Mounted Display Market been Segmented as follows:

- Slide-on HMD

- Integrated HMD

- Discrete HMD

Based on Technology, the Head Mounted Display Market been Segmented as follows:

- AR Technology

- VR Technology

Based on Component, the Head Mounted Display Market been Segmented as follows:

- Processors and Memory

- Displays

- Lenses

- Sensors

- Controllers

- Cameras

- Cases and Connectors

- Others

Based on Product Type, the Head Mounted Display Market been Segmented as follows:

- Head-mounted

- Eyewear

Based on Connectivity, the Head Mounted Display Market been Segmented as follows:

- Wired

- Wireless

Based on Application, the Head Mounted Display Market been Segmented as follows:

- Consumer

- Commercial

- Enterprise & Industry

- Engineering & Design

- Healthcare

- Aerospace & Defense

- Education

- Others

Based on Geographic Analysis, the Head Mounted Display Market been Segmented as follows:

- Americas

- Europe

- APAC

- RoW

Recent Developments

- In April 2021, Microsoft has won a USD 22 billion contract for manufacturing Augmented Reality Gear from the US Army. It would start manufacturing Integrated Augmentation Systems under the contract, which is for over a timeline of 10 years.

- In March 2021, Sony has unveiled its new VR controllers that would be different from the ball-on-a-stick controllers used in PS4. Sony has also stated that the controllers will come with adaptive triggers, haptic feedback, and finger touch detection features, among others.

- In January 2021, Magic Leap has entered into a multi-phased, multi-year strategic partnership agreement with Google (US) for Google Cloud to deliver spatial computing solutions to businesses and Google Cloud customers.

Frequently Asked Questions (FAQ):

What is the current size of the global head-mounted display market?

The head-mounted display market is expected to grow from USD 5.5 billion in 2021 to USD 36.5 billion by 2026, at a CAGR of 46.0%

Who are the winners in the global head-mounted display market?

Some of the key companies operating in the head-mounted display market are Sony (Japan), Google (US), Microsoft (US), Oculus (US), HTC (Taiwan), Seiko Epson (Japan), Samsung (South Korea), Lenovo (China), Magic Leap (US), and Vuzix (US) and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/contracts/ collaborations/acquisitions to expand their global presence and increase their share in the global head-mounted display market.

What are the major drivers for the head-mounted display market?

Surge in investments by major players in development of HMDs, increased adoption of AR and VR technologies due to COVID-19, availability of low-cost HMDs, and technological advancements and growing digitalization—are the key factors driving the head-mounted display market.

What are the growing application verticals in the head-mounted display market?

The head-mounted display market is led by the consumer application. Gaming has been the most important sector in which mobile AR has been used. Pokémon Go has led the market and contributed significantly to the market growth. The demand for VR HMDs is high in consumer applications because of their use in gaming and sports & entertainment. The use of HMDs as smart glasses in sports (such as ski driving and fighting games) is increasing.

What are the impact of COVID-19 on the global head-mounted display market?

Due to COVID-19, the manufacturing units of major players are highly hampered due to worldwide lockdown and limited availability of labor and raw material. A number of scheduled product launches and related developments have been postponed due to the pandemic. However, the impact of COVID-19 is expected to reduce during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 HMD MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 HMD MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 HMD MARKET: RESEARCH METHODOLOGY

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up analysis (demand side)

FIGURE 6 HMD MARKET: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE CALCULATION BY BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size by top-down analysis (supply side)

FIGURE 8 HMD MARKET: TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE CALCULATION BY TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 11 ASSUMPTIONS FOR THE RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 12 HEAD-MOUNTED DISPLAY MARKET, 2017–2026 (USD MILLION)

FIGURE 13 VIRTUAL REALITY TO HOLD LARGER SHARE OF HMD MARKET IN 2021

FIGURE 14 CONSUMER APPLICATION TO LEAD HMD MARKET FROM 2021 TO 2026

FIGURE 15 HMD MARKET, BY GEOGRAPHY, 2021

3.1 IMPACT OF COVID-19 ON HEAD-MOUNTED DISPLAY MARKET

FIGURE 16 IMPACT OF COVID-19 ON HEAD-MOUNTED DISPLAY MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 HEAD-MOUNTED DISPLAY MARKET IS LIKELY TO WITNESS SIGNIFICANT GROWTH ACROSS REGIONS

FIGURE 17 GROWING DEMAND FOR HMDS IN HEALTHCARE AND ENTERPRISE APPLICATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 HMD MARKET IN APAC, BY APPLICATION AND COUNTRY

FIGURE 18 ENTERPRISE & INDUSTRY APPLICATION AND CHINA TO HOLD LARGEST SHARE OF HMD MARKET IN APAC BY 2026

4.3 HMD MARKET: DEVELOPED VS. DEVELOPING MARKETS, 2021 AND 2026 (USD MILLION)

FIGURE 19 US TO LEAD HMD MARKET BY 2026

4.4 HMD MARKET, BY COUNTRY

FIGURE 20 HMD MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 INVESTMENTS BY MAJOR PLAYERS AND ADOPTION OF AR AND VR TECHNOLOGIES DURING COVID-19 TO DRIVE HMD MARKET

5.2.1 DRIVERS

5.2.1.1 Surge in investments by major players in development of HMDs

5.2.1.2 Increased adoption of AR and VR technologies due to COVID-19

5.2.1.3 Availability of low-cost HMDs

5.2.1.4 Technological advancements and growing digitalization

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardization for HMD design

5.2.2.2 Display latency and energy consumption affect overall performance of VR devices

5.2.2.3 Health concerns related to low resolution and lack of movement

5.2.2.4 Trade restrictions between US and China

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of HMDs for video games

5.2.3.2 Increasing patents portfolio

5.2.3.3 Surging demand for lightweight HMDs and portable devices

5.2.4 CHALLENGES

5.2.4.1 Low awareness about HMDs

5.2.4.2 Adverse impact of lockdowns due to COVID-19 on commercial trade

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 HMD SUPPLY CHAIN ANALYSIS (2020): MAJOR VALUE IS ADDED DURING RESEARCH & PRODUCT DEVELOPMENT AND MANUFACTURING STAGES

5.4 REGULATORY LANDSCAPE

5.5 ECOSYSTEM ANALYSIS

FIGURE 23 DISPLAY MARKET: ECOSYSTEM ANALYSIS

FIGURE 24 AR & VR ECOSYSTEM AND TECHNOLOGIES USED IN HMDS

TABLE 1 COMPANIES AND THEIR ROLE IN ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 HEAD-MOUNTED DISPLAY MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 HEAD-MOUNTED DISPLAY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

FIGURE 26 HIGHLY COMPETITIVE MARKET OWING TO PRESENCE OF SEVERAL WELL-ESTABLISHED PLAYERS

5.6.2 THREAT OF SUBSTITUTES

FIGURE 27 THREAT OF SUBSTITUTES HAD LOW IMPACT ON HEAD-MOUNTED DISPLAY MARKET OWING TO ABSENCE OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

FIGURE 28 BARGAINING POWER OF BUYERS WAS MODERATE OWING TO INCREASED DEMAND FROM DIFFERENT APPLICATIONS

5.6.4 BARGAINING POWER OF SUPPLIERS

FIGURE 29 BARGAINING POWER OF SUPPLIERS WAS HIGH DUE TO INCREASED BRAND VALUE

5.6.5 THREAT OF NEW ENTRANTS

FIGURE 30 THREAT OF NEW ENTRANTS HAD LOW IMPACT OWING TO REQUIREMENT OF HIGH CAPITAL INVESTMENTS

5.7 TECHNOLOGY ANALYSIS

5.7.1 VIRTUAL REALITY MICRODISPLAYS

5.7.1.1 LOMID project

5.7.1.2 VR HMD microdisplay by Kopin

5.7.2 MONITOR-BASED AR TECHNOLOGY

5.7.3 NEAR-EYE-BASED TECHNOLOGY

5.8 TRENDS IMPACTING BUSINESSES OF CUSTOMERS

FIGURE 31 AI IS EXPECTED TO MAKE SIGNIFICANT CONTRIBUTION ACROSS INDUSTRIES

5.9 CASE STUDIES

5.9.1 VIRTUAL REALITY-BASED TRAINING FOR EMPLOYEES

5.9.2 VIRTUAL REALITY-BASED SURGICAL TRAINING EXPERIENCE

5.9.3 ELECTRIC SAFETY RECERTIFICATION USING HTC VIVE TO IMPART BETTER TRAINING AND ENHANCE STAFF MOTIVATION

5.10 AVERAGE SELLING PRICES (ASP) TREND

TABLE 3 AVERAGE PRICES OF AR AND VR HMDS

TABLE 4 HOURLY RATES OF DEVELOPERS IN DIFFERENT REGIONS

TABLE 5 COMPARISON OF SDK PRICING

5.11 PATENTS ANALYSIS

FIGURE 32 NUMBER OF PATENTS RELATED TO AR AND VR PUBLISHED FROM 2012 TO 2020

FIGURE 33 SHARE OF TOP 10 COMPANIES IN PATENT APPLICATIONS FROM 2012 TO 2020

TABLE 6 KEY PATENTS IN 2019 AND 2020

5.12 TRADE ANALYSIS

FIGURE 34 IMPORTS DATA, BY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 35 EXPORTS DATA, BY COUNTRY, 2016–2019 (USD THOUSAND)

6 HEAD-MOUNTED DISPLAY MARKET, BY TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 36 DISCRETE HMDS TO BECOME DOMINANT HMD TYPE BY 2026

TABLE 7 HMD MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 8 HMD MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 SLIDE-ON HEAD-MOUNTED DISPLAYS

6.2.1 SLIDE-ON HMDS COMPRISE A SMARTPHONE HOLDER, LENSES, AND OTHER BASIC INPUTS

6.3 DISCRETE HEAD-MOUNTED DISPLAYS

6.3.1 DISCRETE HMDS ARE EXPECTED TO LEAD HMD MARKET BY 2026

6.4 INTEGRATED HEAD-MOUNTED DISPLAYS

6.4.1 INTEGRATED HMDS ARE INDEPENDENT COMPUTING DEVICES

7 HEAD-MOUNTED DISPLAY MARKET, BY COMPONENT (Page No. - 79)

7.1 INTRODUCTION

FIGURE 37 DISPLAYS SEGMENT IS EXPECTED TO DOMINATE HMD MARKET DURING FORECAST PERIOD

TABLE 9 HMD MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 10 HMD MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

7.2 PROCESSORS AND MEMORY

7.2.1 PROCESSORS AND MEMORY ARE VITAL COMPONENTS OF CONTROL UNITS

7.3 CONTROLLERS

7.3.1 CONTROLLER UNITS ARE RESPONSIBLE FOR COMPLEX CALCULATIONS AND OTHER DECISION-MAKING PROCESSES

7.4 SENSORS

7.4.1 INCREASED USE OF SENSORS IN HEAD-MOUNTED DISPLAYS FOR DETECTING MOTION DRIVES THIS SEGMENT

7.4.2 MAGNETOMETERS

7.4.3 ACCELEROMETERS

7.4.4 GYROSCOPES

7.4.5 PROXIMITY SENSORS

7.5 CAMERAS

7.5.1 CAMERAS FORM CRUCIAL COMPONENTS TO MEASURE DEPTH AND AMPLITUDE OF OBJECTS

7.6 DISPLAYS

7.6.1 DISPLAYS HOLD A MAJOR SHARE OF HEAD-MOUNTED DISPLAY DEVICES

7.7 LENSES

7.7.1 LENSES ARE USED IN HMDS FOR MAPPING OF UP-CLOSE DISPLAY TO WIDER FIELD OF VIEW

7.8 CASES AND CONNECTORS

7.8.1 CASING HELPS ACCOMMODATE ALL ELECTRICAL AND MECHANICAL COMPONENTS

7.9 OTHERS

7.9.1 QUARTZ, TOUCHPADS, AND PANELS ARE AMONG OTHER COMPONENTS USED IN HMDS

7.9.2 IMPACT OF COVID-19 ON COMPONENT MARKET

8 HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY (Page No. - 85)

8.1 INTRODUCTION

FIGURE 38 HMD MARKET FOR AUGMENTED REALITY EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 11 HMD MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 12 HMD MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 39 VR SEGMENT EXPECTED TO DOMINATE HMD MARKET IN TERMS OF VOLUME DURING FORECAST PERIOD

TABLE 13 HMD MARKET, BY TECHNOLOGY, 2017–2020 (MILLION UNITS)

TABLE 14 HMD MARKET, BY TECHNOLOGY, 2021–2026 (MILLION UNITS)

8.2 AUGMENTED REALITY

8.2.1 AR-ENABLED DEVICES ARE EXPECTED TO BE USED IN ENTERPRISE AND INDUSTRY APPLICATION

TABLE 15 HMD MARKET FOR AUGMENTED REALITY IN TERMS OF VALUE AND VOLUME, 2017–2020

TABLE 16 HMD MARKET FOR AUGMENTED REALITY IN TERMS OF VALUE AND VOLUME, 2021–2026

TABLE 17 AR HMD MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 HMD MARKET FOR AR, BY REGION, 2021–2026 (USD MILLION)

FIGURE 40 AMERICAS EXPECTED TO DOMINATE HMD MARKET FOR AR FOR ENTERPRISE AND INDUSTRY APPLICATION BY 2026

TABLE 19 HMD MARKET FOR AR FOR ENTERPRISE AND INDUSTRY APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 HMD MARKET FOR AR FOR ENTERPRISE AND INDUSTRY APPLICATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 41 HMD MARKET FOR AR FOR COMMERCIAL APPLICATION IN APAC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 HMD MARKET FOR AR FOR COMMERCIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 HMD MARKET FOR AR FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 42 APAC EXPECTED TO LEAD HMD MARKET FOR AR FOR ENGINEERING AND DESIGN APPLICATION BY 2026

TABLE 23 HMD MARKET FOR AR FOR ENGINEERING AND DESIGN APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 HMD MARKET FOR AR FOR ENGINEERING AND DESIGN APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 HMD MARKET FOR AR FOR AEROSPACE AND DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 HMD MARKET FOR AR FOR AEROSPACE AND DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 27 HMD MARKET FOR AR FOR HEALTHCARE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 HMD MARKET FOR AR FOR HEALTHCARE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 HMD MARKET FOR AR FOR CONSUMER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 HMD MARKET FOR AR FOR CONSUMER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 31 HMD MARKET FOR AR FOR EDUCATION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 HMD MARKET FOR AR FOR EDUCATION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 HMD MARKET FOR AR FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 HMD IN AR MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.3 VIRTUAL REALITY

8.3.1 INCREASED DEMAND FOR VR HMDS IN CONSUMER APPLICATIONS EXPECTED TO DRIVE THIS SEGMENT

TABLE 35 HMD MARKET FOR VR IN TERMS OF VALUE AND VOLUME, 2017–2020

TABLE 36 HMD MARKET FOR VR IN TERMS OF VALUE AND VOLUME, 2021–2026

FIGURE 43 APAC EXPECTED TO DOMINATE HMD MARKET FOR VR BY 2026

TABLE 37 VR HMD MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 VR HMD MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 44 HMD MARKET IN AR FOR CONSUMER APPLICATION IN APAC ANTICIPATED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 HMD MARKET FOR VR FOR CONSUMER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 HMD MARKET FOR VR FOR CONSUMER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 45 VR HMD MARKET FOR COMMERCIAL APPLICATION IN APAC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 41 HMD MARKET FOR VR FOR COMMERCIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 HMD MARKET FOR VR FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 43 HMD MARKET FOR VR FOR ENTERPRISE AND INDUSTRY APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 HMD MARKET FOR VR FOR ENTERPRISE AND INDUSTRY APPLICATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 46 APAC TO LEAD VR HMD MARKET FOR ENGINEERING AND DESIGN APPLICATION BY 2026

TABLE 45 HMD MARKET FOR VR FOR ENGINEERING AND DESIGN APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 HMD MARKET FOR VR FOR ENGINEERING AND DESIGN APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 HMD MARKET FOR VR FOR AEROSPACE AND DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 HMD MARKET FOR VR FOR AEROSPACE AND DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 47 HMD MARKET FOR VR FOR HEALTHCARE APPLICATION IN APAC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 HMD MARKET FOR VR FOR HEALTHCARE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 HMD MARKET FOR VR FOR HEALTHCARE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 HMD MARKET FOR VR FOR EDUCATION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 HMD MARKET FOR VR FOR EDUCATION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 53 HMD MARKET FOR VR FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 HMD MARKET FOR VR FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

9 HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION (Page No. - 108)

9.1 INTRODUCTION

FIGURE 48 ENTERPRISE & INDUSTRY APPLICATION TO ACCOUNT FOR LARGEST SIZE OF HMD MARKET BY 2026

TABLE 55 HMD MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 56 HMD MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 49 ENTERPRISE AND INDUSTRY APPLICATION TO HOLD LARGEST SIZE OF AUGMENTED REALITY-BASED HMD MARKET DURING FORECAST PERIOD

TABLE 57 HMD MARKET FOR AR, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 58 HMD MARKET FOR AR, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 50 CONSUMER APPLICATION TO ACCOUNT FOR LARGEST SIZE OF VIRTUAL REALITY-BASED HMD MARKET DURING FORECAST PERIOD

TABLE 59 HMD MARKET FOR VR, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 HMD MARKET FOR VR, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 CONSUMER

9.2.1 GAMING

9.2.1.1 Gaming is a major driver for HMD market growth

9.2.2 SPORTS & ENTERTAINMENT

9.2.2.1 Use of AR and VR HMDs enhances viewing experience in sports & entertainment applications

9.2.3 OTHERS

9.2.3.1 Other uses include navigation and notifications

TABLE 61 HMD MARKET FOR CONSUMER APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 62 HMD MARKET FOR CONSUMER APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 51 APAC EXPECTED TO LEAD HMD MARKET FOR CONSUMER APPLICATION DURING FORECAST PERIOD

TABLE 63 HMD MARKET FOR CONSUMER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 HMD MARKET FOR CONSUMER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.3 COMMERCIAL

9.3.1 ADVERTISING, MARKETING, AND BRANDING

9.3.1.1 Advertising and branding would be key growth drivers for HMD market for commercial

9.3.2 RETAIL

9.3.2.1 Try before you buy will play a crucial role in driving HMD market in retail

9.3.3 TOURISM

9.3.3.1 Interaction with virtual objects in various tourist location is key driver for use of HMDs

9.3.3.2 Use cases of HMD in commercial application

TABLE 65 HMD MARKET FOR COMMERCIAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 66 HMD MARKET FOR COMMERCIAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 52 HMD MARKET FOR COMMERCIAL APPLICATION EXPECTED TO GROW AT HIGHEST CAGR IN APAC DURING FORECAST PERIOD

TABLE 67 HMD MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 HMD MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.4 ENTERPRISE AND INDUSTRY

9.4.1 VIRTUAL INTERVIEWS

9.4.1.1 HR staff can use VR to conduct face-to-face interviews with candidates in virtual conference rooms

9.4.2 VIRTUAL MEETINGS

9.4.2.1 Virtual meetings would be crucial driver for market growth

9.4.3 WAREHOUSES

9.4.3.1 Order picking would drive use of HMDs in warehouses

9.4.4 EMERGENCY RESPONSE

9.4.4.1 HMDs help emergency response professionals conduct critical tasks smoothly and safely

9.4.5 OPERATION AND ASSEMBLY

9.4.5.1 Enhanced efficiency of operations and reduced requirement of manual training can be achieved using HMDs

9.4.6 MAINTENANCE AND INSPECTION SERVICES

9.4.6.1 Important information in visual fields and interaction with this information to drive use of HMDs

9.4.7 FIELD REPAIR SERVICES

9.4.7.1 Collaboration at remote workplaces and expert assistance for field services and repairs to play crucial role

9.4.8 FREIGHT LOADING AND TRANSPORTATION

9.4.8.1 Freight transportation by air, water, and road requires digital data and planning software

9.4.8.2 Use cases of HMDs in enterprise and industry

TABLE 69 HMD MARKET FOR ENTERPRISE AND INDUSTRY APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 70 HMD MARKET FOR ENTERPRISE AND INDUSTRY APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 53 AMERICAS EXPECTED TO HOLD LARGEST SIZE OF HMD MARKET FOR ENTERPRISE AND INDUSTRY APPLICATION DURING FORECAST PERIOD

TABLE 71 HMD MARKET FOR ENTERPRISE AND INDUSTRY APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 HMD MARKET FOR ENTERPRISE AND INDUSTRY APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.5 ENGINEERING & DESIGN

9.5.1 DESIGN

9.5.1.1 Replicating real world and displaying information using HMDs would drive HMD market in engineering & design segment

9.5.2 ARCHITECTURE

9.5.2.1 Architects can create walls, doors, and furniture around them in 3D space using HMDs

TABLE 73 HMD MARKET FOR ENGINEERING & DESIGN APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 74 HMD MARKET FOR ENGINEERING & DESIGN APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 54 HMD MARKET FOR ENGINEERING AND DESIGN APPLICATION TO GROW AT HIGHEST CAGR IN APAC DURING FORECAST PERIOD

TABLE 75 HMD MARKET FOR ENGINEERING AND DESIGN APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 HMD MARKET FOR ENGINEERING AND DESIGN APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.6 AEROSPACE & DEFENSE

9.6.1 SIMULATION TRAINING TO BE KEY FACTOR FOR ADOPTION OF HMDS IN AEROSPACE AND DEFENSE APPLICATIONS

TABLE 77 HMD MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 78 HMD MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 79 HMD MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 HMD MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.7 HEALTHCARE

9.7.1 TRAINING

9.7.1.1 HMDs can help provide training to healthcare students or trainee doctors for surgeries

9.7.2 TREATMENT AND SURGERY

9.7.2.1 Increased interactivity using HMDs with holographic visualization boosts adoption of HMDs for treatments and surgeries

9.7.3 PATIENT CARE MANAGEMENT

9.7.3.1 Patient care and healing using HMD will act as a major driver

TABLE 81 HMD MARKET FOR HEALTHCARE APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 82 HMD MARKET FOR HEALTHCARE APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 55 AMERICAS TO HOLD LARGEST SIZE OF HMD MARKET FOR HEALTHCARE APPLICATION BY 2026

TABLE 83 HMD MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 HMD MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.8 EDUCATION

9.8.1 HMDS CAN HELP CREATE AN INTERESTING AND INTERACTIVE LEARNING ATMOSPHERE IN ACADEMIC INSTITUTES

9.8.2 VIDEO GUIDE

9.8.3 STREAMING LESSONS

9.8.4 REMOTE TEACHING

9.8.5 VIRTUAL CLASSROOMS

TABLE 85 HMD MARKET FOR EDUCATION APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 86 HMD MARKET FOR EDUCATION APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 56 APAC TO BECOME LARGEST HMD MARKET FOR EDUCATION APPLICATION BY 2026

TABLE 87 HMD MARKET FOR EDUCATION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 HMD MARKET FOR EDUCATION APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHERS

9.9.1 SPACE

9.9.1.1 Space applications have been critical in the HMD market

9.9.2 JOURNALISM

9.9.2.1 Mobile content to play a crucial role

TABLE 89 HMD MARKET FOR OTHER APPLICATIONS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 90 HMD MARKET FOR OTHER APPLICATIONS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 91 HMD MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 HMD MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

10 HEAD-MOUNTED DISPLAY MARKET, BY PRODUCT TYPE (Page No. - 137)

10.1 INTRODUCTION

FIGURE 57 HMD MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 93 HMD MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 94 HMD MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.2 HEAD-MOUNTED

10.2.1 HEAD-MOUNTED PRODUCTS PLAY A MAJOR ROLE IN VARIOUS APPLICATIONS, SUCH AS CONSUMER AND COMMERCIAL

10.3 EYEWEAR

10.3.1 MARKET FOR EYEWEAR PRODUCTS IS EXPECTED TO GROW AT A HIGHER CAGR OWING TO THE INCREASING DEMAND FOR AR APPLICATIONS

11 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY (Page No. - 141)

11.1 INTRODUCTION

TABLE 95 HMD MARKET SIZE IN TERMS OF VALUE AND VOLUME, 2017–2020

TABLE 96 HMD MARKET SIZE IN TERMS OF VALUE AND VOLUME, 2021–2026

FIGURE 58 WIRELESS HMD MARKET EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 97 HMD MARKET, BY CONNECTIVITY, 2017–2020 (USD MILLION)

TABLE 98 HMD MARKET, BY CONNECTIVITY, 2021–2026 (USD MILLION)

11.2 WIRED

11.2.1 WIRED HEADSETS OFTEN WORK IN COMBINATION WITH EXTERNAL CAMERAS TO TRACK USER’S HEAD WITH BETTER ACCURACY

11.3 WIRELESS

11.3.1 WIRELESS HMDS GENERALLY USE SMARTPHONES FOR DISPLAY AND PROCESSING

12 GEOGRAPHIC ANALYSIS (Page No. - 145)

12.1 INTRODUCTION

FIGURE 59 GEOGRAPHIC SNAPSHOT: HMD MARKET IN APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 60 US TO HOLD LARGEST SIZE OF HMD MARKET FROM 2021 TO 2026

TABLE 99 HMD MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 100 HMD MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 AMERICAS

FIGURE 61 AMERICAS: SNAPSHOT OF HMD MARKET

TABLE 101 HMD MARKET IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 HMD MARKET IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 103 HMD MARKET IN AMERICAS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 104 HMD MARKET IN AMERICAS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 105 HMD MARKET IN AMERICAS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 106 HMD MARKET IN AMERICAS, BY APPLICATION, 2021–2026 (USD MILLION)

12.2.1 IMPACT OF COVID-19 ON HMD MARKET IN AMERICAS

12.2.2 NORTH AMERICA

TABLE 107 HMD MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 108 HMD MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 109 HMD MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 110 HMD MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.2.1 US

12.2.2.1.1 Increased use of HMDs for defense applications to contribute to market growth in US

12.2.2.2 Canada

12.2.2.2.1 Increasing investments in cutting-edge technologies to fuel market growth in Canada

12.2.2.3 Mexico

12.2.2.3.1 Promising growth potential for HMD market in Mexico

12.2.3 SOUTH AMERICA

12.2.3.1 Growing consumer market to drive market growth

TABLE 111 HMD MARKET IN SOUTH AMERICA, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 112 HMD MARKET IN SOUTH AMERICA, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.3 EUROPE

FIGURE 62 EUROPE: SNAPSHOT OF HMD MARKET

TABLE 113 HMD MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 HMD MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 115 HMD MARKET IN EUROPE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 116 HMD MARKET IN EUROPE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 117 HMD MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 118 HMD MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

12.3.1 IMPACT OF COVID-19 ON HMD MARKET IN EUROPE

12.3.2 UK

12.3.2.1 Increasing focus on digitization in UK to drive market growth

12.3.3 GERMANY

12.3.3.1 Surging adoption of new technologies in manufacturing sector to contribute to market growth in Germany

12.3.4 FRANCE

12.3.4.1 Surging adoption of HMDs in retail sector to enhance market growth in France

12.3.5 ITALY

12.3.5.1 Continuous focus on digitalization likely to drive market growth

12.3.6 REST OF EUROPE

12.3.6.1 Inflow of products and technologies from UK, Germany, and France to propel market growth

12.4 ASIA PACIFIC

FIGURE 63 ASIA PACIFIC: SNAPSHOT OF HMD MARKET

TABLE 119 HMD MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 120 HMD MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 121 HMD MARKET IN APAC, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 122 HMD MARKET IN APAC, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 123 HMD MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 124 HMD MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.1 IMPACT OF COVID-19 ON HMD MARKET IN APAC

12.4.2 CHINA

12.4.2.1 High number of local players producing HMDs to drive market growth

12.4.3 JAPAN

12.4.3.1 High growth of healthcare sector to fuel market growth

12.4.4 INDIA

12.4.4.1 Increasing awareness about advanced technologies to play a crucial role in market growth

12.4.5 AUSTRALIA

12.4.5.1 Increased demand in entertainment applications to fuel HMD market growth

12.4.6 SOUTH KOREA

12.4.6.1 Digital revolution in enterprise and industrial applications to drive market growth

12.4.7 REST OF APAC

12.4.7.1 High consumer spending to boost HMD market in Rest of APAC countries

12.5 ROW

TABLE 125 HMD MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 126 HMD MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 127 HMD MARKET IN ROW, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 128 HMD MARKET IN ROW, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 129 HMD MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 130 HMD MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.1 IMPACT OF COVID-19 ON HMD MARKET IN ROW

12.5.2 MIDDLE EAST

12.5.2.1 Oil & gas and mining industries to fuel demand for HMDs

12.5.3 AFRICA

12.5.3.1 Focus on technological advancements to fuel growth of HMD market

13 COMPETITIVE LANDSCAPE (Page No. - 175)

13.1 INTRODUCTION

FIGURE 64 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS, CONTRACTS, PARTNERSHIPS, AGREEMENTS, AND ACQUISITIONS AS KEY GROWTH STRATEGIES FROM 2018 TO 2021

13.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 65 TOP PLAYERS IN HEAD-MOUNTED DISPLAY MARKET, 2015–2019

13.3 MARKET SHARE ANALYSIS OF KEY PLAYERS IN HEAD-MOUNTED DISPLAY MARKET IN 2020

TABLE 131 HEAD-MOUNTED DISPLAY MARKET: DEGREE OF COMPETITION

TABLE 132 HEAD-MOUNTED DISPLAY MARKET RANKING ANALYSIS

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STAR

13.4.2 EMERGING LEADER

13.4.3 PERVASIVE

13.4.4 PARTICIPANT

FIGURE 66 HEAD-MOUNTED DISPLAY MARKET: COMPANY EVALUATION QUADRANT, 2020

13.5 COMPANY EVALUATION QUADRANT – PRODUCT FOOTPRINT

13.5.1 COMPANY FOOTPRINT, BY TECHNOLOGY (20 COMPANIES)

13.5.2 COMPANY FOOTPRINT, BY APPLICATION (20 COMPANIES)

13.5.3 COMPANY FOOTPRINT, BY REGION (20 COMPANIES)

13.5.4 COMPANY FOOTPRINT

13.6 STARTUP/SME EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 67 HEAD-MOUNTED DISPLAY MARKET (GLOBAL) STARTUP/SME EVALUATION QUADRANT, 2020

13.7 COMPETITIVE SITUATIONS AND TRENDS

13.7.1 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 133 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2021

13.7.2 DEALS

TABLE 134 DEALS, 2019–2021

14 COMPANY PROFILES (Page No. - 188)

14.1 INTRODUCTION

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

14.2 KEY PLAYERS

14.2.1 SONY

TABLE 135 SONY: BUSINESS OVERVIEW

FIGURE 68 SONY: COMPANY SNAPSHOT

14.2.2 GOOGLE

TABLE 136 GOOGLE: BUSINESS OVERVIEW

FIGURE 69 GOOGLE: COMPANY SNAPSHOT

14.2.3 MICROSOFT

TABLE 137 MICROSOFT: BUSINESS OVERVIEW

FIGURE 70 MICROSOFT: COMPANY SNAPSHOT

14.2.4 OCULUS VR (FACEBOOK)

TABLE 138 OCULUS VR (FACEBOOK): BUSINESS OVERVIEW

14.2.5 HTC

TABLE 139 HTC: BUSINESS OVERVIEW

FIGURE 71 HTC: COMPANY SNAPSHOT

14.2.6 SEIKO EPSON

FIGURE 72 SEIKO EPSON: COMPANY SNAPSHOT

14.2.7 SAMSUNG ELECTRONICS

TABLE 140 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 73 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

14.2.8 LENOVO

TABLE 141 LENOVO: BUSINESS OVERVIEW

FIGURE 74 LENOVO: COMPANY SNAPSHOT

14.2.9 MAGIC LEAP, INC.

TABLE 142 MAGIC LEAP: BUSINESS OVERVIEW

14.2.10 VUZIX

TABLE 143 VUZIX: BUSINESS OVERVIEW

FIGURE 75 VUZIX: COMPANY SNAPSHOT

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14.3 OTHER PLAYERS

14.3.1 PANASONIC CORPORATION

14.3.2 XIAOMI CORPORATION

14.3.3 BAE SYSTEMS

14.3.4 META COMPANY

14.3.5 THALES

14.3.6 ULTRALEAP

14.3.7 REALWEAR

14.3.8 MERGE LABS

14.3.9 DYNABOOK AMERICAS

14.3.10 OPTINVENT

14.4 STARTUP ECOSYSTEM

14.4.1 SOLOS

14.4.2 LYNX

14.4.3 BEYEONICS SURGICAL LTD.

14.4.4 NIMO PLANET

14.4.5 EVERYSIGHT

15 APPENDIX (Page No. - 227)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

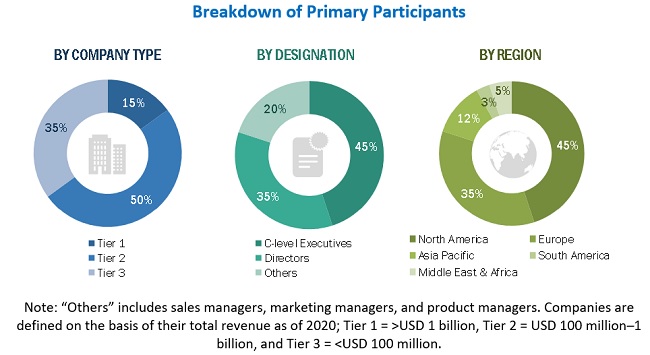

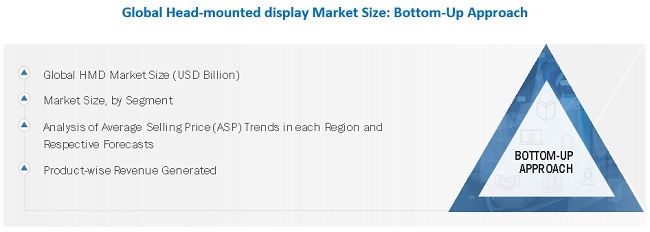

The study involved four major activities in estimating the size of the head-mounted display market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Consumer Technology Association (CTA), Integrated Systems Europe, Camera & Imaging Products Association (CIPA), the Society for Information Display (SID), and Touch Taiwan; white papers, AR- and VR-related marketing journals, certified publications, and articles from recognized authors; gold and silver standard websites; directories; and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the head-mounted display market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (consumer, commercial, healthcare) and supply-side (OEM/ODM, system integrators, solution providers) players across four major regions, namely, Americas, Europe, APAC, and Rest of the World (Middle East, Africa). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the head-mounted display market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the head-mounted display (HMD) market, in terms of value, on the basis of type, technology, product type, component, connectivity, application, and region

- To define, describe, and forecast the HMD market, in terms of volume, on the basis of technology

- To define and describe the HMD market on the basis of type

- To forecast the market size for various segments with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the market

- To study the evolution and timeline of the HMD market using the value chain analysis and market roadmaps

- To analyze competitive developments such as funding, acquisitions, new product developments, and research and development (R&D) in the HMD market

- To strategically profile key players, comprehensively analyze their core competencies2, and describe the competitive landscape of the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Head Mounted Display (HMD) Market

We are trying to better understand the HMD market in terms of applications breakdown versus technologies, and more specifically the aspects of electro-optics

I am doing market research to determine which companies are in the HMD space, as well as other spaces related to VR/MoCap/AR. I am running an study as part of an innovation award to determine best fit with our applications. Any help will be appreciated.

Please send me some market insights or key findings that I can use to get a client to buy the full report OR come back with a custom request.

I am an Industrial student at the University and working on a project on virtual reality industry and different variety of HMDs. I was wondering if you had a student discount rate for your site?

I want to get forecast not only HMD device, but also service and solution revenue forecast by using HMD. I want to know categorized service and solution revenue forecast by using HMD are included in this report or not.

Can you provide data about systems integrated in the helmet for the firefighting? Thanks in advance for your support.

I would like to know more details regarding research methodology and validation sources. Also, looking for customized research in this area.

Interested to more about Eyewear Segment Expected to Grow at the highest CAGR during forecast period.

Please provide the global data and some validate statistics for head mounted devices for Indian market.