Head-up Display Market Size, Share and Industry Growth Analysis Report by Type (Conventional Head-up Display and Augmented Reality (AR) Based Head-up Display), Application, Components (Video Generators, Projectors/Projection Units, Display Units, Software) and Region - Global Growth Driver and Industry Forecast to 2027

Updated on : April 24, 2023

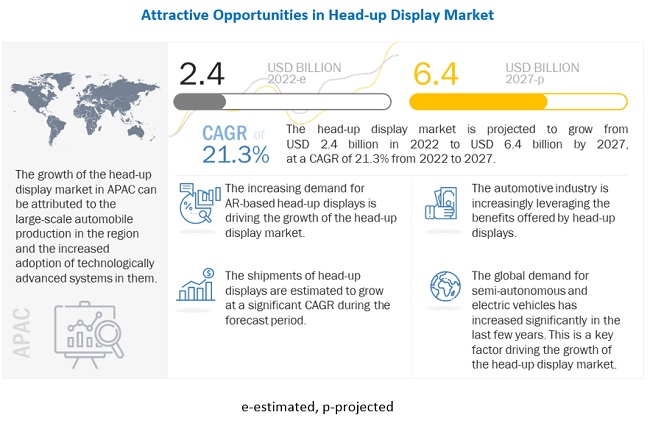

The global head-up display market in terms of revenue was estimated to be worth USD 2.4 billion in 2022 and is poised to reach USD 6.4 billion by 2027, growing at a CAGR of 21.3% from 2021 to 2026. The new research study consists of an industry trend analysis of the market.

Factors such increasing awareness about passenger and vehicle safety are driving the growth of the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global head-up display market

There has been a severe impact of the COVID-19 pandemic on the growth of the head-up display market. The supply of components used for the development of head-up displays has witnessed some disruptions as most of the research and development activities and new product launches related to head-up displays are expected to be postponed or dropped until the end of 2022.

The global semiconductor shortage is creating significant challenges for the global automotive industry. The production lines of many brands have been severely hit, which in turn has pushed the delivery timelines of vehicles. Almost every major automotive company has recognized the unprecedented challenge, which may pose a threat for at least another year, and is reworking on set plans. BMW in Germany, for instance, is reportedly planning to drop head-up displays from some of the additional package options it offers on its products. According to a report in the German auto website Bimmer Today, the head-up display option may be done away with from a package that also includes feature highlights such as laser lights, selective beam, and driving assistant. It is reported that while the entire package costs EUR 3,650, the plan is to price it at EUR 2,500 if HUDs are not included.

Head-up display Market Dynamics

Driver: Increasing awareness about passenger and vehicle safety

The safety of passengers and vehicles is of prime importance for vehicle buyers. Regulatory authorities across the world are focusing on improving the safety of vehicles. According to a global status report on road safety published in 2019, more than 1.35 million deaths caused by traffic on roads occur every year across the world. Studies suggest that road traffic injuries will become the fifth leading cause of death globally by 2030. Driver distraction is one of the key causes of these accidents. According to the National Center for Statistics and Analysis (NCSA), crashes killing ~9 people and injuring more than 1,000 a day in the US are reported to take place due to distracted drivers. Thus, accidents due to the distraction of drivers caused by monitoring in-vehicle displays can be reduced using head-up displays.

Road traffic crashes cost approximately 3% of the gross domestic product (GDP) of most countries globally. Approximately 93% of the road fatalities in the world occur in low- and middle-income countries, even though these countries have ~60% of the total vehicles of the world (Source: WHO).

In most cases, drivers take their eyes off the road to read an instrument cluster, which requires short distance vision adjustment. After reading the instrument clusters, the vision of drivers has to readjust to a large visual distance on the road. At least half a second is required by the eyes to focus on the road after reading the conventional instrument clusters. The frequent shift of focus leads to tiring of eyes and loss of concentration among drivers. In this regard, the critical information related to vehicle speed and navigation, among other factors, offered by head-up displays in the line of sight of drivers reduces their distraction. This has encouraged automobile manufacturers to deploy head-up displays in their vehicles. Thus, safety awareness across the world is expected to propel the demand for head-up displays in automobiles. Advanced AR-based head-up displays are expected to be installed in luxury cars, while conventional head-up displays would be preferred in passenger cars.

Restraint: Space constraint in automotive cockpit

Advanced head-up displays, such as AR-based head-up displays, make driving highly comfortable and safe by virtually displaying real-time traffic conditions for drivers. However, windshield-based head-up displays require large space in automotive cockpits. Thus, significant efforts are being made to re-design automotive cockpits owing to substantial space occupied by AR-based head-up displays on the dashboards of automobiles. Any decrease in the size of AR-based head-up displays is expected to result in reduced clarity of augmented images, causing them to be less legible to drivers. Moreover, iris recognition devices and gesture control devices are required to be installed with head-up displays in vehicles to make the projections available precisely in the field of view of drivers. The space constraints for embedding AR-based head-up displays in automotive cockpits are a key restraining factor for the growth of the head-up display market for automotive applications.

Opportunity: Growing demand for semi-autonomous and electric vehicles

The global demand for semi-autonomous and electric vehicles has increased significantly in the last few years. The increased adoption of these vehicles is accelerating the demand for head-up displays. Semi-autonomous vehicles can sense their environment and navigate to the destination with the partial interference of humans. They can be operated through voice commands. These vehicles are primarily used to provide enhanced safety and convenience to drivers. Semi-autonomous vehicles are equipped with advanced functions such as park assistance, forward collision avoidance, and advanced cruise control. The head-up displays deployed in semi-autonomous vehicles display these features on windshields in the line of sight of drivers.

Challenge: Availability of laser-based volumetric displays as alternatives to head-up displays

Laser-based volumetric displays are key substitutes for head-up displays. Volumetric head-up displays represent information in a volumetric aspect. With the help of lasers, images are projected on windshields to give the illusion of depth. During the night and harsh driving conditions such as fog, low-light vision, and heavy rains, laser-based volumetric displays ensure enhanced safety and traveling information to drivers. In the automotive industry, volumetric head-up displays use laser rays to display images on windshields. In the aviation sector, volumetric displays play an important role in air traffic control.

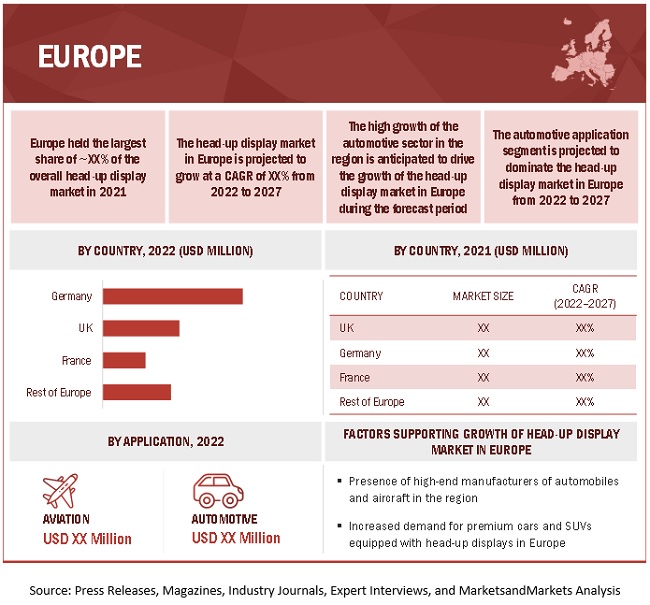

Europe held the largest market for the head-up display market in 2027 owing to increasing adoption of head-up displays in different automobiles being manufactured in the region

Europe is projected to account for the largest size of the head-up display market from 2022 to 2027. The market in this region has been studied for Germany, the UK, France, and the Rest of Europe. Globally, Europe is considered as the prominent luxury/premium car-manufacturing region. Leading high-end car OEMs, such as Audi AG (Germany), BMW AG (Germany), Mercedes-Benz (Germany), Bentley Motors Ltd. (UK), Maserati (Italy), Skoda Auto (Malda), Ferrari s.p.a (Italy), and Bugatti Automobiles S.A.S (France), have their headquarters in Europe. As head-up displays are among key safety features, most of the manufacturers of luxury/premium cars install head-up displays in their car models that are manufactured in Europe. The increasing demand for luxury or premium cars and SUVs equipped with head-up displays is expected to drive the growth of the market in Europe.

Europe is also one of the leading aircraft-manufacturing regions in the world. Key European airlines, such as Lufthansa AG (Germany), Air France (France), and Airbus (France), are the leading civil aviation aircraft manufacturers present in Europe. Gulfstream (Georgia), BAE Systems (UK), Dassault (France), Eurocopter (France), and AgustaWestland (UK) are among the key aircraft and helicopter manufacturers in the world that are based in Europe. The significant presence of automobile and aircraft manufacturers in the region is also driving the market growth of the head-up display industry in Europe.

Continental (Germany), BAE Systems (UK), Thales Group (France), Garmin (Switzerland), Bosch (Germany), and Saab AB (Sweden) are the leading players operating in the market in Europe. The main drivers for the growth of the market in the region include the surging demand for advanced technologies, rising requirements for a safe and secure driving experience, and the development of connected cars. In addition, the rising deployment of head-up displays in vehicles for improved visibility and efficiency is also fueling the growth of the head-up display market in Europe.

To know about the assumptions considered for the study, download the pdf brochure

Top Head-up Display (HUD) Companies - Key Market Players

The head-up display companies is dominated by a few globally established players such as Continental (Germany), Nippon Seiki (Japan), Visteon (US), Pioneer (Japan), BAE Systems (UK), Denso (Japan), Bosch (Germany), and Yazaki Corporation (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market Size Value in 2022 |

USD 2.4 Billion |

| Revenue Forecast in 2027 | USD 6.4 Billion |

| Growth Rate | 21.3% |

| Base Year Considered | 2021 |

| Historical Data Available for Years | 2018–2027 |

|

Forecast Period |

2022–2027 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top HUD Companies in North America |

|

| Key Market Driver | Increasing awareness about passenger and vehicle safety |

| Key Market Opportunity | Growing demand for semi-autonomous and electric vehicles |

| Largest Growing Region | Europe |

| Largest Market Share Segment | Projectors/ Projection Units Segment |

| Highest CAGR Segment | AR based HUD |

| Largest Application Market Share | Automotive Application |

The study categorizes the head-up display market based on component, type, application and region.

Head-up Display Market By Component:

- Video generators

- Projectors/Projection Units

- Display units

- Software

- Other Components (Relay optics, Magnifying glass and Control Panels)

Head-up Display Market By Type:

- Conventional head-up display

- Augmented Reality (AR)-based head-up display

Head-up Display Market By Application:

- Aviation

- Automotive

Head-up Display Market By Region:

- North America

- Europe

- APAC

- RoW

Recent Developments

- In January 2022, Panasonic unveiled the AR-HUD 2.0, the first product to include a new patented eye-tracking system (ETS), enhancing the AR experience. This HUD also includes AI-powered navigation software with 3D AR overlays, icons, and mappings.

- In January 2022, Visteon delivers a high-quality intelligent cockpit experience for conventional and electric vehicles. This includes artificial intelligence-based speech recognition and camera domain integration.

- In October 2021, BAE systems delivers 1.6-megapixel hawk eye sensor is a major development for targeting and surveillance applications optimally used for battery-powered soldier systems. It has high-performance imaging capabilities in all lighting conditions.

Frequently Asked Questions (FAQ):

What is the current size of the global head-up display market?

The head-up display market is projected to grow from USD 2.4 billion in 2022 to USD 6.4 billion by 2027; it is expected to grow at a CAGR of 21.3% from 2022 to 2027.

Why head-up displays are used?

Head-up displays (HUD) are used to enable car drivers or aircraft pilots to see the projected information related to their current speed and speed limit, the distance between vehicles, and fuel level, along with navigation directions, on windshields or attached reflector lenses.

What is the impact of covid-19 on the head-up display market?

Vehicle production has suffered in leading countries across the world owing to supply shortages and production suspensions caused by the spread of the COVID-19. The demand for new vehicles in pandemic-affected countries has dropped and is still not expected to pick up owing to the imposition of lockdowns to contain the spread of the virus. Global vehicle production fell by 20–25% in 2020 owing to the progression of COVID-19. This, in turn, has hampered the growth of the head-up display market worldwide. However, global automobile production is expected to increase from 2022 onward, but the demand side is expected to fully recover by 2027.

HUDs were making inroads in mass-market vehicles before the outbreak of the pandemic and the global shortage of semiconductors. However, currently, it is unclear what impact the current semiconductor shortage would have on their mass-market adoption. As a result, the global semiconductor shortage is expected to be a key challenge for the growth of the head-up display market.

What are the technological trends going in the head-up display market?

Head-up displays are being increasingly used in automotive and aviation applications. Augmented reality is an emerging trend in the field of head-up displays. AR-based head-up displays offer features similar to full-color advanced-driver assistance system (ADAS), including visual warning and lane-departure warning. The industry trends chapter covers the supply chain analysis of the head-up display market. It also includes regulations and standards concerning the deployment and the use of head-up displays.

Which are the major companies in the head-up display market?

Continental (Germany), Nippon Seiki (Japan), Visteon (US), Pioneer (Japan), BAE Systems (UK), Denso (Japan), Bosch (Germany), and Yazaki Corporation (Japan) are the players dominating the global head-up displaymarket. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 PACKAGE SIZE

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 HEAD-UP DISPLAY MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at the market size using bottom-up analysis (demand side)

FIGURE 5 HEAD-UP DISPLAY MARKET: BOTTOM-UP APPROACH

FIGURE 6 HEAD-UP DISPLAY MARKET SIZE CALCULATION USING BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 7 HEAD-UP DISPLAY MARKET: TOP-DOWN APPROACH

FIGURE 8 HEAD-UP DISPLAY MARKET SIZE CALCULATION USING TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

2.6 LIMITATION OF RESEARCH

TABLE 1 MARKET FORECASTING METHODOLOGY ADOPTED FROM 2020 TO 2027

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 11 HEAD-UP DISPLAY MARKET, 2018–2027 (USD MILLION)

FIGURE 12 PROJECTORS/PROJECTION UNITS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2027 IN TERMS OF VALUE

FIGURE 13 CONVENTIONAL HEAD-UP DISPLAYS SEGMENT TO HOLD LARGE SHARE OF MARKET IN 2022 IN TERMS OF VALUE

FIGURE 14 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGE SIZE OF MARKET FROM 2020 TO 2027 IN TERMS OF VALUE

FIGURE 15 EUROPE TO HOLD LARGEST SHARE OF MARKET IN 2022 IN TERMS OF VALUE

3.1 COVID-19 IMPACT ON HUD MARKET

FIGURE 16 COVID-19 IMPACT ON HUD MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN HEAD-UP DISPLAY MARKET

FIGURE 17 INCREASING GLOBAL DEMAND FOR SEMI-AUTONOMOUS AND ELECTRIC VEHICLES TO DRIVE GROWTH OF HEAD-UP DISPLAYS MARKET

4.2 HUD MARKET IN APAC, BY APPLICATION AND COUNTRY

FIGURE 18 AUTOMOTIVE SEGMENT TO HOLD LARGE SHARE OF HUD MARKET IN APAC IN 2027 (IN TERMS OF VALUE)

4.3 HUD MARKET: DEVELOPED AND DEVELOPING MARKETS, 2022 VS. 2027 (USD MILLION)

FIGURE 19 US IS ESTIMATED TO BE LARGEST MARKET FOR HEAD-UP DISPLAYS FROM 2022 TO 2027 (IN TERMS OF VALUE)

4.4 CONVENTIONAL HUD MARKET, BY TYPE

FIGURE 20 WINDSHIELD-BASED HEAD-UP DISPLAYS TO ACCOUNT FOR LARGER SHARE OF CONVENTIONAL HUD MARKET IN 2027 (IN TERMS OF VALUE)

4.5 HUD MARKET, BY REGION

FIGURE 21 HUD MARKET IN CANADA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027 (IN TERMS OF VALUE)

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 INCREASING AWARENESS ABOUT PASSENGER AND VEHICLE SAFETY TO SPUR DEMAND FOR HEAD-UP DISPLAYS

5.2.1 DRIVERS

5.2.1.1 Increasing awareness about passenger and vehicle safety

FIGURE 23 DISTRIBUTION OF DEATHS BY ROAD USER TYPE IN 2018

FIGURE 24 ROAD ACCIDENT DEATHS PER MILLION HABITANTS, BY COUNTRY, 1997–2017

5.2.1.2 Enhanced convenience offered by combination of satellite navigation technology and head-up displays

5.2.1.3 Growing demand for improvement of in-vehicle experience

FIGURE 25 BENEFITS OF HUD FOR END USERS

FIGURE 26 CATEGORIES OF HUD DESIGNS

TABLE 2 APPLICATIONS THAT BENEFIT FROM HUD

5.2.1.4 Growing demand for connected vehicles across the world

5.2.1.5 Increasing demand for technologically advanced head-up displays

5.2.1.6 Growing adoption of AR-based head-up displays

5.2.2 RESTRAINTS

5.2.2.1 Space constraints in automotive cockpits

5.2.2.2 High luminance, power, and brightness requirements of head-up displays

5.2.2.3 Incorrect interpretation of symbols used in head-up displays

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for semi-autonomous and electric vehicles

5.2.3.2 Emergence of screen-less displays

5.2.3.3 Enhanced driving experience offered by AR-based head-up displays

5.2.3.4 Introduction of portable HUDs at lower prices in low and middle car segments

5.2.4 CHALLENGES

5.2.4.1 Impact of COVID-19 on supply chains and global chip shortage

5.2.4.2 High costs of advanced head-up displays

5.2.4.3 Availability of laser-based volumetric displays as alternatives to head-up displays

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 IMPACT OF EACH FORCE ON HEAD-UP DISPLAY MARKET

5.4 PRICING ANALYSIS

FIGURE 27 AVERAGE SELLING PRICE OF HEAD-UP DISPLAYS FOR AUTOMOTIVE APPLICATIONS, 2018–2021

FIGURE 28 AVERAGE SELLING PRICE OF HEAD-UP DISPLAYS FOR AVIATION APPLICATIONS, 2018–2021

5.5 TRADE ANALYSIS

TABLE 4 IMPORT DATA FOR MONITORS AND PROJECTORS NOT INCORPORATING TELEVISION RECEPTION APPARATUSES, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 5 EXPORT DATA FOR MONITORS AND PROJECTORS NOT INCORPORATING TELEVISION RECEPTION APPARATUSES, BY COUNTRY, 2015–2020 (USD MILLION)

5.6 DISPLAY ECOSYSTEM

FIGURE 29 DISPLAY MARKET: ECOSYSTEM ANALYSIS

FIGURE 30 HEAD-UP DISPLAY ECOSYSTEM FOR COCKPITS

TABLE 6 HUD MARKET ECOSYSTEM

5.7 HUD MARKET: CASE STUDIES

TABLE 7 BOYD CORPORATION HELPED NAVDY TO DEVELOP THERMAL SOLUTION FOR ITS HEAD-UP DISPLAYS

TABLE 8 GX GROUP HELPED VISTEON TO DESIGN COMPACT HEAD-UP DISPLAY UNIT

TABLE 9 EVALUATION OF USABILITY OF HEAD-UP DISPLAYS BY MITSUBISHI ELECTRIC RESEARCH LABORATORIES

5.7.1 GARMIN COLLABORATED WITH FORD MOTORS TO INTEGRATE ITS NAVIGATION TECHNOLOGY

5.7.2 PIONEER PARTNERED WITH CONTINENTAL TO DEVELOP COCKPIT SOLUTIONS

5.8 PATENT ANALYSIS

FIGURE 31 ANNUAL NUMBER OF PATENTS GRANTED OVER THE LAST 10 YEARS

TABLE 10 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 11 IMPORTANT PATENT REGISTRATIONS, 2015–2020

5.9 REVENUE SHIFT IN HUD MARKET

5.10 REGULATORY STANDARDS

5.10.1 STANDARDS IN ITS/C-ITS

TABLE 12 BASE STANDARDS OF C-ITS

TABLE 13 STANDARDS: EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

TABLE 14 SECURITY AND PRIVACY STANDARDS DEVELOPED BY ETSI

TABLE 15 HUD MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022-2023)

6 INDUSTRY TRENDS (Page No. - 88)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 33 ASSEMBLY, MANUFACTURING, AND SOFTWARE DEVELOPMENT STAGES ADD MAJOR VALUE TO HEAD-UP DISPLAYS

6.3 FEATURES OF HEAD-UP DISPLAYS

6.3.1 FIELD OF VIEW

6.3.2 RESOLUTION

6.3.3 BRIGHTNESS

6.3.4 ACCURACY

6.3.5 COMBINER TRANSMITTANCE

6.4 TECHNOLOGY ANALYSIS

FIGURE 34 TECHNOLOGIES USED IN HEAD-UP DISPLAYS

6.4.1 CATHODE RAY TUBES

6.4.2 LIGHT-EMITTING DIODES

6.4.3 OPTICAL WAVEGUIDES

6.4.4 MICROELECTROMECHANICAL SYSTEMS

7 HEAD-UP DISPLAY MARKET, BY TYPE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 35 HEAD-UP DISPLAY MARKET, BY TYPE

FIGURE 36 AR-BASED HEAD-UP DISPLAYS SEGMENT TO REGISTER HIGHER GROWTH IN THE FORECAST PERIOD

TABLE 16 HUD MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 17 HUD MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 CONVENTIONAL HEAD-UP DISPLAYS

7.2.1 WINDSHIELD-BASED HEAD-UP DISPLAYS

7.2.1.1 Windshield-based head-up displays use projectors and a set of mirrors to relay information

7.2.2 COMBINER-BASED HEAD-UP DISPLAYS

7.2.2.1 Combiner-based head-up displays can be accommodated in less space in automotive cockpits

TABLE 18 CONVENTIONAL HUD MARKET, BY SUB-TYPE, 2018–2021 (USD MILLION)

TABLE 19 CONVENTIONAL HUD MARKET, BY SUB-TYPE, 2022–2027 (USD MILLION)

FIGURE 37 AUTOMOTIVE SEGMENT TO DOMINATE CONVENTIONAL HUD MARKET FROM 2022 TO 2027

TABLE 20 CONVENTIONAL HUD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 21 CONVENTIONAL HUD MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 22 CONVENTIONAL HUD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 CONVENTIONAL HUD MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 AR-BASED HEAD-UP DISPLAYS

7.3.1 INSTALLATION OF AR-BASED HEAD-UP DISPLAYS IN LUXURY CARS TO FUEL THEIR GLOBAL DEMAND

TABLE 24 AR-BASED HEAD-UP DISPLAY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 25 AR-BASED HEAD-UP DISPLAY, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 26 AR-BASED HUD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 AR-BASED HUD MARKET, BY REGION, 2022–2027 (USD MILLION)

8 HEAD-UP DISPLAY MARKET, BY COMPONENT (Page No. - 102)

8.1 INTRODUCTION

FIGURE 38 HEAD-UP DISPLAY MARKET, BY COMPONENT

FIGURE 39 PROJECTORS/PROJECTION UNITS SEGMENT TO HOLD LARGEST SIZE OF HUD MARKET IN 2022

TABLE 28 HUD MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 29 HUD MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

8.2 VIDEO GENERATORS

8.2.1 VIDEO GENERATORS ACT AS AN INTERFACE BETWEEN PROJECTION UNITS AND DATA TO BE DISPLAYED

TABLE 30 HUD MARKET FOR VIDEO GENERATORS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 31 HUD MARKET FOR VIDEO GENERATORS, BY TYPE, 2022–2027 (USD MILLION)

8.3 PROJECTORS/PROJECTION UNITS

8.3.1 INCREASED USE OF HIGH VERSION PICO PROJECTORS IN HEAD-UP DISPLAYS TO SUPPORT MARKET GROWTH

FIGURE 40 TYPES OF PROJECTOR TECHNOLOGIES

8.3.2 LIQUID CRYSTAL ON SILICON (LCOS) PROJECTORS

8.3.3 DIGITAL LIGHT PROCESSING (DLP) PROJECTORS

8.3.4 LASER BEAM STEERING (LBS) PROJECTORS

TABLE 32 HEAD-UP DISPLAYS FOR PROJECTORS/PROJECTION UNITS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 HUD MARKET FOR PROJECTORS/PROJECTION UNITS, BY TYPE, 2022–2027 (USD MILLION)

8.4 DISPLAY UNITS

8.4.1 DISPLAY UNITS PROCESS IMAGES TO DISPLAY THEM ON WINDSHIELDS OF VEHICLES OR COMBINERS

FIGURE 41 TYPES OF DISPLAY TECHNOLOGIES

8.4.2 DIGITAL MICROMIRROR DEVICE (DMD) TECHNOLOGY

8.4.3 LIQUID CRYSTAL DISPLAY (LCD) TECHNOLOGY

8.4.4 LIQUID CRYSTAL ON SILICON TECHNOLOGY

8.4.4.1 Nematic LCoS displays

8.4.4.2 Ferroelectric LCoS displays

TABLE 34 HUD MARKET FOR DISPLAY UNITS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 HEAD-UP DISPLAYS FOR DISPLAY UNITS, BY TYPE, 2022–2027 (USD MILLION)

8.5 SOFTWARE

8.5.1 SOFTWARE APPLICATIONS ARE INCORPORATED IN HEAD-UP DISPLAYS FOR NAVIGATIONAL PURPOSES

TABLE 36 HUD MARKET FOR SOFTWARE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 HUD MARKET FOR SOFTWARE, BY TYPE, 2022–2027 (USD MILLION)

8.6 OTHER COMPONENTS

TABLE 38 HUD MARKET FOR OTHER COMPONENTS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 HEAD-UP DISPLAYS FOR OTHER COMPONENTS, BY TYPE, 2022–2027 (USD MILLION)

9 HEAD-UP DISPLAY MARKET, BY APPLICATION (Page No. - 112)

9.1 INTRODUCTION

FIGURE 42 HEAD-UP DISPLAY MARKET, BY APPLICATION

FIGURE 43 AUTOMOTIVE SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 40 HUD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 HUD MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 HEAD-UP DISPLAYS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 43 HUD MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

9.2 AVIATION

9.2.1 CIVIL AVIATION

9.2.1.1 Civil aircraft

9.2.1.1.1 Use of head-up displays in commercial and civil aircraft to provide required information to pilots is increasing

9.2.1.2 Civil helicopters

9.2.1.2.1 Deployment of head-up displays in civil helicopters is increasing for providing information related to flight safety

9.2.2 MILITARY AVIATION

9.2.2.1 Aircraft

9.2.2.1.1 Military aircraft use head-up displays to provide cockpit information to pilots

9.2.2.2 Helicopters

9.2.2.2.1 Modern military helicopters use head-up displays during war missions

FIGURE 44 CIVIL AVIATION SEGMENT TO DOMINATE HUD MARKET FROM 2022 TO 2027

TABLE 44 HUD MARKET FOR AVIATION, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 45 HUD MARKET FOR AVIATION, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 46 MARKET FOR AVIATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR AVIATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 48 MARKET FOR AVIATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR AVIATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 CONVENTIONAL HUD MARKET FOR AVIATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 CONVENTIONAL MARKET FOR AVIATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 AR-BASED MARKET FOR AVIATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 AR-BASED MARKET FOR AVIATION, BY REGION, 2022–2027 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 PASSENGER CARS

9.3.1.1 Passenger cars segment projected to dominate head-up display market for automotive applications

9.3.2 COMMERCIAL VEHICLES

9.3.2.1 Formulation of mandates and regulations regarding vehicle safety to fuel adoption of advanced safety features in commercial vehicles

FIGURE 45 PASSENGER CARS SEGMENT TO DOMINATE HUD MARKET FOR AUTOMOTIVE APPLICATIONS

TABLE 54 MARKET FOR AUTOMOTIVE, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR AUTOMOTIVE, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 56 HEAD-UP DISPLAYS MARKET FOR AUTOMOTIVE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR AUTOMOTIVE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 HUD MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 HUD MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 CONVENTIONAL MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 CONVENTIONAL HUD MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 AR-BASED MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 AR-BASED MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 125)

10.1 INTRODUCTION

FIGURE 46 HEAD-UP DISPLAY MARKET, BY REGION

FIGURE 47 REGIONAL SNAPSHOT: HEAD-UP DISPLAYS MARKET

FIGURE 48 US TO HOLD LARGEST SIZE OF MARKET FROM 2022 TO 2027

TABLE 64 HUD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 49 MARKET IN NORTH AMERICA

FIGURE 50 SNAPSHOT OF HUD MARKET IN NORTH AMERICA

TABLE 66 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 69 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 70 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 HUD MARKET IN NORTH AMERICA FOR AVIATION APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 MARKET IN NORTH AMERICA FOR AVIATION APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 MARKET IN NORTH AMERICA FOR AUTOMOTIVE APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 MARKET IN NORTH AMERICA FOR AUTOMOTIVE APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing demand for advanced features in vehicles to drive market growth in the US

TABLE 76 HUD MARKET IN US, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 MARKET IN US, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing awareness about passenger and vehicle safety to propel market growth in Canada

TABLE 78 MARKET IN CANADA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 HUD MARKET IN CANADA, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Evolving automotive industry to drive the market growth in Mexico

TABLE 80 HEAD-UP DISPLAYS MARKET IN MEXICO, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 HEAD-UP DISPLAYS MARKET IN MEXICO, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 51 HUD MARKET IN EUROPE

FIGURE 52 SNAPSHOT OF MARKET IN EUROPE

TABLE 82 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 HEAD-UP DISPLAY MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 MARKET IN EUROPE FOR AVIATION APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 89 HUD MARKET IN EUROPE FOR AVIATION APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 90 HUD MARKET IN EUROPE FOR AUTOMOTIVE APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 MARKET IN EUROPE FOR AUTOMOTIVE APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Leading car manufacturers offering vehicles equipped with head-up displays to drive market growth in Germany

TABLE 92 HUD MARKET IN GERMANY, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 HEAD-UP DISPLAYS MARKET IN GERMANY, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Surging demand for luxury cars to drive market growth in UK

TABLE 94 MARKET IN UK, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN UK, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Manufacturing of high-end cars in France to drive market growth

TABLE 96 MARKET IN FRANCE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 MARKET IN FRANCE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 98 HEAD-UP DISPLAYS MARKET IN REST OF EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 HUD MARKET IN REST OF EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4 APAC

FIGURE 53 HUD MARKET IN APAC

FIGURE 54 SNAPSHOT OF MARKET IN APAC

TABLE 100 HUD MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 MARKET IN APAC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 MARKET IN APAC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 MARKET IN APAC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 105 MARKET IN APAC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 MARKET IN APAC FOR AVIATION APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 107 HUD MARKET IN APAC FOR AVIATION APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 MARKET IN APAC FOR AUTOMOTIVE APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 109 HEAD-UP DISPLAYS MARKET IN APAC FOR AUTOMOTIVE APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing vehicle production in China to propel market growth

TABLE 110 HUD MARKET IN CHINA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 HUD MARKET IN CHINA, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Ongoing mass production of automotive parts to result in low prices of head-up displays in Japan

TABLE 112 HUD MARKET IN JAPAN, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 113 MARKET IN JAPAN, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Increasing development of semi-autonomous and autonomous vehicles in South Korea to contribute to market growth

TABLE 114 MARKET IN SOUTH KOREA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 MARKET IN SOUTH KOREA, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Rising awareness about benefits of head-up displays to play crucial role in market growth in Australia

TABLE 116 HUD MARKET IN AUSTRALIA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 117 MARKET IN AUSTRALIA, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.5 REST OF APAC

TABLE 118 HEAD-UP DISPLAYS MARKET IN REST OF APAC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 HEAD-UP DISPLAYS MARKET IN REST OF APAC, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 ROW

FIGURE 55 HEAD-UP DISPLAYS MARKET IN ROW

10.5.1 MIDDLE EAST AND AFRICA

10.5.1.1 Surging demand for head-up display-equipped helicopters and increasing disposable income of people to propel market growth in MEA

10.5.2 SOUTH AMERICA

10.5.2.1 Rising number of automobile assembling plants to drive market growth in South America

TABLE 120 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 122 HEAD-UP DISPLAYS MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 123 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 \MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 125 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 MARKET IN ROW FOR AVIATION APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 127 MARKET IN ROW FOR AVIATION APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 MARKET IN ROW FOR AUTOMOTIVE APPLICATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 129 MARKET IN ROW FOR AUTOMOTIVE APPLICATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 130 MARKET IN MIDDLE EAST, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 131 MARKET IN MIDDLE EAST, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 132 MARKET IN AFRICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 133 MARKET IN AFRICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 HUD MARKET IN SOUTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 135 MARKET IN SOUTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 156)

11.1 INTRODUCTION

11.2 REVENUE ANALYSIS: TOP 3 COMPANIES

FIGURE 56 DOMINANCE OF TOP 3 PLAYERS IN HEAD-UP DISPLAY MARKET IN LAST 5 YEARS

11.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 136 OVERVIEW OF STRATEGIES ADOPTED BY HEAD-UP DISPLAY MARKET MANUFACTURERS

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 137 HEAD-UP DISPLAY MARKET: DEGREE OF COMPETITION

FIGURE 57 HEAD-UP DISPLAY MARKET SHARE, BY COMPANY (2020)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 EMERGING LEADER

11.5.4 PARTICIPANT

FIGURE 58 HEAD-UP DISPLAY MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

11.6 HEAD-UP DISPLAY MARKET: COMPANY FOOTPRINT

11.6.1 APPLICATION AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS

TABLE 138 APPLICATION AND REGIONAL FOOTPRINT OF COMPANIES

TABLE 139 APPLICATION FOOTPRINT OF COMPANIES

TABLE 140 REGIONAL FOOTPRINT OF COMPANIES

11.7 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2020

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCK

FIGURE 59 HEAD-UP DISPLAY MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

11.8 COMPETITIVE SITUATIONS & TRENDS

TABLE 141 HEAD-UP DISPLAY MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 142 HEAD-UP DISPLAY MARKET: DEALS

TABLE 143 HEAD-UP DISPLAY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 144 HEAD-UP DISPLAY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12 COMPANY PROFILES (Page No. - 167)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Product Launches, Deals, and MnM View)*

12.1.1 NIPPON SEIKI

TABLE 145 NIPPON SEIKI: BUSINESS OVERVIEW

FIGURE 60 NIPPON SEIKI: COMPANY SNAPSHOT

12.1.2 CONTINENTAL

TABLE 146 CONTINENTAL: BUSINESS OVERVIEW

FIGURE 61 CONTINENTAL: COMPANY SNAPSHOT

12.1.3 VISTEON CORPORATION

TABLE 147 VISTEON CORPORATION: BUSINESS OVERVIEW

FIGURE 62 VISTEON CORPORATION: COMPANY SNAPSHOT

12.1.4 DENSO CORPORATION

TABLE 148 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 63 DENSO CORPORATION: COMPANY SNAPSHOT

12.1.5 BOSCH

TABLE 149 BOSCH: BUSINESS OVERVIEW

FIGURE 64 BOSCH: COMPANY SNAPSHOT

12.1.6 PIONEER CORPORATION

TABLE 150 PIONEER CORPORATION: BUSINESS OVERVIEW

FIGURE 65 PIONEER CORPORATION: COMPANY SNAPSHOT

12.1.7 BAE SYSTEMS

TABLE 151 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 66 BAE SYSTEMS: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 YAZAKI CORPORATION

TABLE 152 YAZAKI CORPORATION: BUSINESS OVERVIEW

12.2.2 GARMIN

TABLE 153 GARMIN: BUSINESS OVERVIEW

FIGURE 67 GARMIN: COMPANY SNAPSHOT

12.2.3 PANASONIC

TABLE 154 PANASONIC: BUSINESS OVERVIEW

FIGURE 68 PANASONIC: COMPANY SNAPSHOT

12.2.4 HONEYWELL AEROSPACE

12.2.5 THALES GROUP

12.2.6 MICROVISION

12.2.7 RENESAS ELECTRONICS

12.2.8 COLLINS AEROSPACE

12.2.9 STMICROELECTRONICS

12.2.10 ALPS ALPINE

12.2.11 ELBIT SYSTEMS

12.2.12 SAAB AB

12.2.13 TRANSDIGM GROUP

12.3 KEY INNOVATORS

12.3.1 WAYRAY

12.3.2 HUDWAY

12.3.3 ENVISICS

12.3.4 I4DRIVE

12.3.5 TEXAS INSTRUMENTS

* Business Overview, Products Offered, Product Launches, Deals, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 215)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

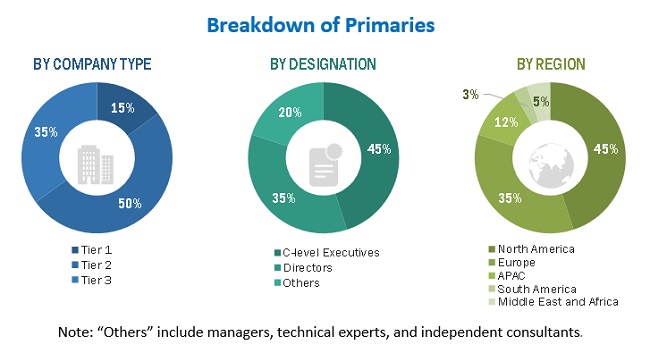

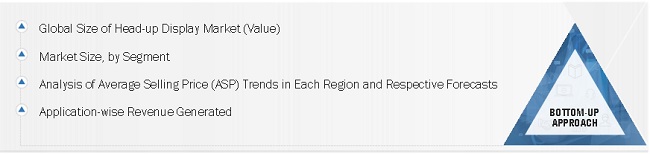

The study involved four major activities in estimating the size of the head-up display market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations (such as Consumer Technology Association (CTA), Integrated Systems Europe, the Organisation Internationale des Constructeurs d'Automobiles (OICA), the Society for Information Display (SID), and Touch Taiwan); white papers, AR- and VR-related marketing journals, certified publications, and articles by recognized authors; gold and silver standard websites; directories; and databases.f

Secondary research has been conducted to obtain key information about the supply chain of the display industry, monetary chain of the market, the total pool of key players, and market segmentation according to the industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the head-up display market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (consumers, industries) and supply-side (head-up display manufacturers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (the Middle East & Africa). Approximately 70% and 30% of primary interviews have been conducted from the supply and demand side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the head-up display market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various applications that use or are expected to use head-up displays

- Analyzing historical and current data pertaining to the size of the head-up display market, in terms of volume, for each application using their production statistics

- Analyzing the average selling prices of head-up displays based on different technologies

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases

- Identifying leading manufacturers of head-up displays, studying their portfolios, and understanding features of their displays and their underlying technologies, as well as the types of head-up displays offered

- Tracking ongoing and identifying upcoming developments in the market through investments, research and development activities, product launches, expansions, and partnerships, and forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the technologies used in head-up displays, raw materials used to develop them, and products wherein they are deployed, and analyze the break-up of the scope of work carried out by key manufacturers of head-up displays and related software solution providers

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The main objectives of this study are as follows:

- To define, describe, segment, and forecast the head-up display (HUD) market, in terms of value, based on component, type, application, and region

- To forecast the head-up display market, in terms of volume, based on application

- To forecast the size of the market and its segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors influencing market growth, such as drivers, restraints, opportunities, and challenges

- To provide a detailed analysis of the head-up display supply chain

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies2

- To analyze key growth strategies such as expansions, contracts, joint ventures, acquisitions, product launches and developments, and research and development activities undertaken by players operating in the head-up display market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

Further breakdown of the market in different regions to the country-level

Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Head-up Display Market

The demand for HUDs is high in automotive as well as in aerospace sector. I would like to know in detail, which of these sectors would grow at a high rate and where would the return on investment (RoI) be high? Is this aspect of comparative analysis between these two applications been covered in detail in your report?

What would be the major differentiating factors between AR HUD and conventional HUDs? Which would be the one preferred by the car makers considering their features, avaialability, as well as pricing? Would you be able to provide the major players producing both these HUDs and their product features?

The European region leads in production of high-end cars. Will this also be in line with the demand of HUDs? I would like to know the regionwise demand of HUDs and the key reasons behind the analysis. Does your report cover the regionwise data of HUDs and analysis?