Healthcare Simulation Market by Product and Service (Anatomical Models, Patient Simulators (High Fidelity, Low Fidelity), Task Trainer, Surgical Simulators, Software, Services), End User (Academic Institutes, Hospital) & Region - Global Forecast to 2027

Updated on : April 18, 2023

The global healthcare simulation market in terms of revenue was estimated to be worth $1.9 billion in 2022 and is poised to reach $4.2 billion by 2027, growing at a CAGR of 16.1% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The major factors driving the growth of this market includes the need to maintain regulatory compliance, rising need to curtail healthcare costs, and growing demand for patient-centric healthcare. However, dearth of skilled IT professionals, and security concerns is challenging the growth of the global medical simulation market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Simulation Market Dynamics

Driver: Increasing focus on patient safety

The increased adoption of simulation-based training and certification of healthcare professionals is an efficient means to improve patient safety and outcomes. This would result in a significantly larger addressable market than the current market, which is primarily education-based. According to a 2019 article published by the WHO, about 2.6 million people die every year in low- and middle-income countries due to patient harm in healthcare, making it the 14th leading cause of morbidity and mortality. Most detrimental errors are related to diagnosis and treatments. Training through simulation can help clinicians gain confidence, knowledge, and expertise for improving patient safety in a risk-free environment. Moreover, the Accreditation Council for Graduate Medical Education is evolving toward outcome-based assessment with specific benchmarks to measure and compare performance, which favors the adoption of simulation products and training.

The rising number of medical errors and the need to ensure patient safety and high-quality care have become key priorities for healthcare organizations worldwide. According to a 2019 article from the WHO, unsafe surgical care procedures cause complications in about 25% of patients globally. Also, according to the University Health Network, preventable medical errors killed more than 28,000 Canadians in 2019. As per the Journal of Patient Safety, in the US, between 210,000 and 440,000 fatalities occur each year due to preventable medical errors; they accounted for one-sixth of the annual deaths in the US in 2019. The cost of these errors is around USD 1 trillion annually. The global medication error reporting market was worth ~USD 326 million in 2018. Of this, one-third was due to knowledge-based errors.

Opportunity: Growing awareness about simulation training in emerging economies

Simulation for medical education in well-resourced settings has grown exponentially but remains uncommon in low-income countries. Emerging countries, such as Brazil, India, China, and South Africa, are expected to provide immense growth opportunities for the players operating in the healthcare simulation market. According to the World Bank Group, healthcare spending in low- and middle-income countries has increased from 5.01% in 2011 to 5.32% in 2019. More than half the world’s population resides in India and China, and these markets are home to a large patient base. The growing economy, rising private investments, untapped rural sector; rising prevalence of non-communicable lifestyle-related diseases; increasing focus on medical education, training, and research; and the growing number of academic medical institutions are the key factors driving the growth of the market in these countries.

The growth of the healthcare industry in emerging countries is also driven by rising government investments in healthcare and increasing public-private partnerships in medicine, which provide a favorable environment for the healthcare simulation market. Several new projects have been undertaken in emerging countries to provide high-quality training environments for medical professionals. For instance, China has invested in constructing a 15-km Beijing International Medical Centre, including a medical university, business school of medicine, international nursing hospital, medical simulation training center, and national clinical drug testing research center. This world-class project is expected to be completed by 2023 and will be the largest medical center in the world. This center will be equipped with simulation labs to train medical professionals on advanced and complex medical procedures. Such developments in emerging countries are expected to provide opportunities for growth in the medical simulation market.

Restraint: Poorly designed medical simulators

Simulation in healthcare creates a safe learning environment that allows researchers and practitioners to test new clinical processes and enhance individual and team skills before encountering patients. Many simulation applications involve manikins in which symptoms can be induced that respond to the simulated treatment. However, human systems are very complex, and therefore, models and instruments cannot completely match human functioning. The simulation models have to be constructed and manipulated by facilitators and simulation engineers to replicate a physiological response that is desired under specific circumstances. Manipulating these systems in accordance with the desired simulation goals is often cumbersome.

Poorly designed simulators might lead to negative learning, which can further lead to medical errors in judgments in the future. For instance, if physical and physiological symptoms are missing in the simulation, students may neglect to check for these symptoms. Simulation-based learning may also encourage shortcuts, such as omitting patient consent and safety procedures and may foster artificial rather than genuine communication skills. Participants will always approach a simulator differently from real life, which affects the attitude of learners. Two common changes in attitude can occur—hypervigilance, which causes excessive concern because one knows an event is about to occur, and cavalier behavior, which occurs because it is clear no human life is at stake. These factors may affect the growth of the market to an extent.

Challenge: Operational challenges

Most medical procedures involve interactions with various tissues. Tissues are usually heterogeneous and exhibit highly non-linear and anisotropic activities. A successful medical model must be computable instantaneously so that its responses to operator inputs are instantly accessible. For instance, in a simple incision process, the scalpel passes through the skin (which comprises different tissues), then through the adipose tissue, muscle tissue, and into or through an organ. In this case, the scalpel will cause blood vessels to release blood. Going forward, the scalpel will pass through more than ten different tissues. In each case, the tissue responses (visual, haptic, and olfactory) must be appropriate for enabling a more realistic medical training environment. The application of physics-based modeling and simulation approaches to tissue modeling can develop more realistic behaviors in patients. However, they lack the sensitivity to produce a real-time performance of various types of tissues.

Healthcare practitioners have to implement a multidisciplinary approach to tackle critical medical conditions. Simulators are required to be multimodal to demonstrate critical conditions. Although the latest technologies, such as virtual reality and haptic technology, have improved medical simulation and training of healthcare practitioners to a certain level, a multidisciplinary approach is not achievable in certain areas of medical treatments, such as complex situations in neurosurgeries.

The web-based simulation segment registered the highest growth in the healthcare simulation market, by product & service

On the basis of type, Based on the type, the web-based simulation segment registered the highest growth of this market during the forecast period. Factors responsible for the growth of this segment is the controlled and predictable learning environments, and controlled access to simulation procedures.

Hospitals registered highest growth by the end user of healthcare simulation market

Hospitals segment is projected to grow at the highest growth rate of this market. The increasing focus on patient safety and the growing demand for minimally invasive surgeries are the factors attributed to the growth of the segment.

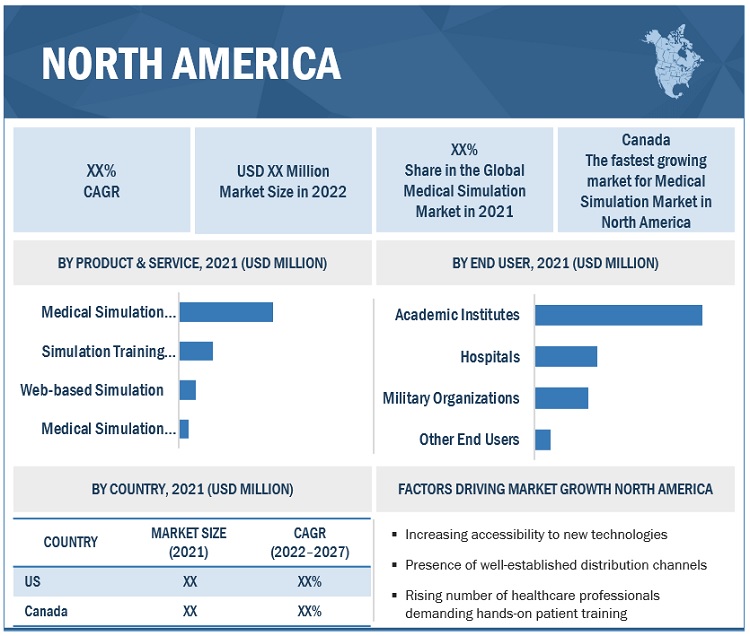

North America accounted for the largest share of the healthcare simulation market during the forecast period.

North America holds the largest share of this market. Growth in the North American medical simulation market can be attributed to factors such growing access to technologies, well-established distribution channels, the rising number of healthcare professionals demanding hands-on patient training, and the rise in demand for virtual and online training, and the presence of leading market players in the region.

To know about the assumptions considered for the study, download the pdf brochure

The healthcare simulation market is dominated by a few globally established players such as CAE (Canada), Laerdal Medical (Norway), Gaumard Scientific Co. (US), Limbs & Things (UK), Surgical Science Sweden AB (Sweden), Kyoto Kagaku (Japan), Mentice AB (Sweden), Intelligent Ultrasound Group Plc (UK), Simulab Corp. (US), Simulaids (US), Operative Experience Inc. (US), Cardionics Inc. (US), VirtaMed AG (Switzerland), Altay Scientific (Italy), IngMar Medical (US), TruCorp Ltd. (Ireland), Medical-X (Netherlands), KaVo Dental GmbH (Germany), Simendo B.V. (Netherlands), VRMagic Holding AG (Germany), Symgery (Canada), HRV Simulation (France), Synaptive Medical (Canada), and Inovus Medical (UK).

Healthcare Simulation Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.9 billion |

|

Projected Revenue by 2027 |

$4.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 16.1% |

|

Market Driver |

Increasing focus on patient safety |

|

Market Opportunity |

Growing awareness about simulation training in emerging economies |

This study categorizes the global Healthcare Simulation Market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

-

Medical Simulation Anatomical Models

-

Patient Simulators

- High Fidelity Simulators

- Medium Fidelity Simulators

- Low Fidelity Simulators

- Task Trainer

-

Interventional Surgical Simulators

- Laparoscopic Surgical Simulators

- Gynecology Simulators

- Cardiovascular Simulators

- Orthopedic Simulators

- Spine Surgical Simulators

- Other Interventional /Surgical Simulators

- Endovascular Simulators

- Ultrasound Simulators

- Dental Simulators

- Eye Simulators

-

Patient Simulators

- Web-Based Simulation

- Medical Simulation Software

-

Simulation Training Services

- Vendor Based Training

- Education Societies

- Custom Consulting Services

By End User

- Introduction

- Academic institutes

- Hospitals

- Military Organizations

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments:

- In August 2021, Surgical Science Sweden AB acquired Simbionix (US) to provide the highest standard in training for medical professionals with their respective technologies.

- In July 2021, CAE Inc. partnered with Rush Center for Clinical Skills and Simulation (RCCSS) to help the companies improve patient safety and enhance healthcare education.

- In June 2021, Mentice AB collaborated with Thomas Jefferson University Hospitals to establish a Simulation Center of Excellence to elevate and promote clinical training and introduce advanced Virtual Reality-based simulation solutions for physicians.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare simulation market?

The global healthcare simulation market boasts a total revenue value of $4.2 billion by 2027.

What is the estimated growth rate (CAGR) of the global healthcare simulation market?

The global market for healthcare simulation has an estimated compound annual growth rate (CAGR) of 16.1% and a revenue size in the region of $1.9 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET SEGMENTATION

FIGURE 1 HEALTHCARE SIMULATION MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 HEALTHCARE SIMULATION MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION: HEALTHCARE SIMULATION MARKET

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE ANALYSIS OF TOP 3 PUBLIC COMPANIES: MEDICAL SIMULATION MARKET (2021)

FIGURE 8 BOTTOM-UP APPROACH: SEGMENTAL EXTRAPOLATION

FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: MEDICAL SIMULATION MARKET

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 12 HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MEDICAL SIMULATION MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MEDICAL SIMULATION MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 HEALTHCARE SIMULATION MARKET OVERVIEW

FIGURE 16 ADVANCEMENTS IN MEDICAL TECHNOLOGIES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MEDICAL SIMULATION MARKET, BY PRODUCT & SERVICE AND COUNTRY (2021)

FIGURE 17 MEDICAL SIMULATION ANATOMICAL MODELS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.3 MEDICAL SIMULATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.4 REGIONAL MIX: HEALTHCARE SIMULATION MARKET

FIGURE 19 NORTH AMERICA TO DOMINATE MEDICAL SIMULATION MARKET DURING FORECAST PERIOD

4.5 MEDICAL SIMULATION MARKET: DEVELOPING VS. DEVELOPED COUNTRIES

FIGURE 20 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 HEALTHCARE SIMULATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 2 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Limited access to patients during medical training

5.2.1.2 Rising technological advancements in medical education

5.2.1.3 Growing demand for minimally invasive treatments

FIGURE 22 TOTAL CASE NUMBERS REPORTED BY GENERAL SURGERY RESIDENTS FOR OPEN SURGERIES: 16-YEAR ANALYSIS (2003–2019)

FIGURE 23 TOTAL CASE NUMBERS REPORTED BY GENERAL SURGERY RESIDENTS FOR LAPAROSCOPIC SURGERIES: 16-YEAR ANALYSIS (2003–2019)

5.2.1.4 Increasing focus on patient safety

FIGURE 24 GLOBAL MEDICATION ERROR REPORTING MARKET SHARE, 2018 VS. 2026

5.2.1.5 Growing preference for virtual interaction

5.2.2 RESTRAINTS

5.2.2.1 Limited availability of funds

5.2.2.2 Poorly designed medical simulators

5.2.3 OPPORTUNITIES

5.2.3.1 Shortage of healthcare personnel

5.2.3.2 Growing awareness about simulation training in emerging economies

5.2.4 CHALLENGES

5.2.4.1 High cost of simulators

5.2.4.2 Operational challenges

6 INDUSTRY INSIGHTS (Page No. - 66)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 USE OF VIRTUAL REALITY (VR) AND AUGMENTED REALITY (AR) IN MEDICAL SIMULATION

6.2.2 HIGH-FIDELITY TECHNOLOGICAL ADVANCEMENTS

6.2.3 MULTIMODAL APPROACH IN DEVELOPMENT OF SIMULATORS

6.2.4 UTILIZATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING SOFTWARE IN SURGICAL PROCEDURES

6.2.5 GROWING USE OF HCIT/EMR

6.3 REGULATORY ANALYSIS

6.3.1 MEDICAL SIMULATION PRODUCTS

6.3.1.1 North America

6.3.1.1.1 US

TABLE 3 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

6.3.1.1.1 Canada

6.3.1.2 Europe

6.3.1.3 Asia Pacific

6.3.1.3.1 Japan

TABLE 4 CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY IN JAPAN

6.3.1.3.2 China

TABLE 5 NMPA MEDICAL DEVICE CLASSIFICATION

6.3.1.3.3 India

6.3.2 INTEROPERABILITY STANDARDS

TABLE 6 KEY STANDARDS FOR INTEROPERABILITY IN DIGITAL HEALTH SPECTRUM

TABLE 7 QUALITATIVE ANALYSIS OF WIDELY USED DATA TRANSMISSION STANDARDS IN DIGITAL HEALTH SPECTRUM

6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES ANALYSIS

6.4.1 THREAT OF NEW ENTRANTS

6.4.2 THREAT OF SUBSTITUTES

6.4.3 BARGAINING POWER OF SUPPLIERS

6.4.4 BARGAINING POWER OF BUYERS

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

6.5 PRICING ANALYSIS

TABLE 10 PRICE RANGE FOR MEDICAL SIMULATION SOLUTIONS

6.6 TECHNOLOGY ANALYSIS

6.7 ECOSYSTEM ANALYSIS

6.7.1 MEDICAL SIMULATION MARKET: ECOSYSTEM ANALYSIS

6.8 PATENT ANALYSIS

6.8.1 PATENT PUBLICATION TRENDS FOR MEDICAL SIMULATION

FIGURE 25 PATENT PUBLICATION TRENDS (JANUARY 2012–AUGUST 2022)

6.8.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 26 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR MEDICAL SIMULATION PATENTS (JANUARY 2012 TO AUGUST 2022)

FIGURE 27 TOP APPLICANT COUNTRIES/REGIONS FOR MEDICAL SIMULATION PATENTS (JANUARY 2012 TO AUGUST 2022)

6.9 VALUE CHAIN ANALYSIS

FIGURE 28 MEDICAL SIMULATION MARKET: VALUE CHAIN ANALYSIS

6.10 CASE STUDY

6.11 KEY CONFERENCES AND EVENTS

TABLE 11 HEALTHCARE/MEDICAL SIMULATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

6.12.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 13 KEY BUYING CRITERIA FOR TOP 3 END USERS

7 HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE (Page No. - 87)

7.1 INTRODUCTION

TABLE 14 HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

7.2 MEDICAL SIMULATION ANATOMICAL MODELS

TABLE 15 MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 PATIENT SIMULATORS

TABLE 17 PATIENT SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 18 PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 19 PATIENT SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.1 High-fidelity simulators

7.2.1.1.1 Growing adoption of high-fidelity simulators in educational training to drive growth

TABLE 20 HIGH-FIDELITY SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 21 HIGH-FIDELITY PATIENT SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.2 Medium-fidelity simulators

7.2.1.2.1 Cost benefits of medium-fidelity simulation to drive demand

TABLE 22 MEDIUM-FIDELITY SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 23 MEDIUM-FIDELITY PATIENT SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1.3 Low-fidelity simulators

7.2.1.3.1 Budgetary constraints and ease of use to drive demand

TABLE 24 LOW-FIDELITY SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 25 LOW-FIDELITY PATIENT SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 TASK TRAINERS

7.2.2.1 Inability to imitate emotional attributes of patients to restrain growth

TABLE 26 TASK TRAINERS OFFERED BY KEY MARKET PLAYERS

TABLE 27 TASK TRAINERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3 INTERVENTIONAL/SURGICAL SIMULATORS

TABLE 28 INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

7.2.3.1 Laparoscopic surgical simulators

7.2.3.1.1 Increasing preference for minimally invasive surgeries to drive growth

TABLE 30 LAPAROSCOPIC SURGICAL SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 31 LAPAROSCOPIC SURGICAL SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.2 Gynecology simulators

7.2.3.2.1 Increasing incidence of fibroids and polyps in women to drive demand for gynecology simulators

TABLE 32 GYNECOLOGY SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 33 GYNECOLOGY SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.3 Cardiovascular simulators

7.2.3.3.1 Increasing prevalence of obesity and diabetes to boost demand

TABLE 34 CARDIOVASCULAR SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 35 CARDIOVASCULAR SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.4 Orthopedic surgical simulators

7.2.3.4.1 Growing number of orthopedic surgeries to drive demand

TABLE 36 ORTHOPEDIC SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 37 ORTHOPEDIC SURGICAL SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.5 Spine surgical simulators

7.2.3.5.1 Increasing incidence of spinal injuries to boost growth

TABLE 38 SPINE SURGICAL SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 39 SPINE SURGICAL SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3.6 Other surgical simulators

TABLE 40 OTHER SURGICAL SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 41 OTHER SURGICAL SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.4 ENDOVASCULAR SIMULATORS

7.2.4.1 Endovascular simulators help in reducing mortality rates

TABLE 42 ENDOVASCULAR SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 43 ENDOVASCULAR SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.5 ULTRASOUND SIMULATORS

7.2.5.1 Inferior quality images resulting from low dynamics and spatial resolution to restrain growth

TABLE 44 ULTRASOUND SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 45 ULTRASOUND SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.6 DENTAL SIMULATORS

7.2.6.1 Expanding dental tourism industry to drive growth

TABLE 46 DENTAL SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 47 DENTAL SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.7 EYE SIMULATORS

7.2.7.1 Increasing incidence of eye disorders to drive growth

TABLE 48 EYE SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 49 EYE SIMULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 WEB-BASED SIMULATION

7.3.1 RISING TECHNOLOGICAL ADVANCEMENTS DRIVING ADOPTION OF WEB-BASED SIMULATION

TABLE 50 WEB-BASED SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 51 WEB-BASED SIMULATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 MEDICAL SIMULATION SOFTWARE

7.4.1 KEY ADVANTAGES OFFERED BY MEDICAL SIMULATION SOFTWARE TO DRIVE ADOPTION

TABLE 52 MEDICAL SIMULATION SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 53 MEDICAL SIMULATION SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 SIMULATION TRAINING SERVICES

TABLE 54 MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 MEDICAL SIMULATION TRAINING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5.1 VENDOR-BASED TRAINING

7.5.1.1 High focus on patient safety to drive demand

TABLE 56 VENDOR-BASED TRAINING SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 57 VENDOR-BASED TRAINING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5.2 EDUCATIONAL SOCIETIES

7.5.2.1 Growing need for proper training and authenticity of knowledge to drive growth

TABLE 58 EDUCATIONAL SOCIETIES SIMULATORS OFFERED BY KEY MARKET PLAYERS

TABLE 59 EDUCATIONAL SOCIETIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5.3 CUSTOM CONSULTING SERVICES

7.5.3.1 Growing need to limit errors associated with traditional medical training systems to drive growth

TABLE 60 CUSTOM CONSULTING SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 61 CUSTOM CONSULTING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 HEALTHCARE SIMULATION MARKET, BY END USER (Page No. - 126)

8.1 INTRODUCTION

TABLE 62 MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 ACADEMIC INSTITUTES

8.2.1 GROWING NEED FOR SKILLED MEDICAL PROFESSIONALS TO DRIVE DEMAND

TABLE 63 MEDICAL SIMULATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 HOSPITALS

8.3.1 RISING FOCUS ON MINIMIZING MEDICAL ERRORS TO DRIVE DEMAND

TABLE 64 MEDICAL SIMULATION MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 MILITARY ORGANIZATIONS

8.4.1 FOCUS ON EXPLORING NEW METHODS OF MEDICAL CARE DURING WARFARE TO DRIVE DEMAND

TABLE 65 MEDICAL SIMULATION MARKET FOR MILITARY ORGANIZATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 OTHER END USERS

TABLE 66 MEDICAL SIMULATION MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

9 HEALTHCARE SIMULATION MARKET, BY REGION (Page No. - 133)

9.1 INTRODUCTION

TABLE 67 MEDICAL SIMULATION MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: HEALTHCARE SIMULATION MARKET SNAPSHOT (2021)

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing demand for virtual tutors and high healthcare spending to boost growth

TABLE 75 US: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 76 US: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 US: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 US: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 US: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing funding and surgical capabilities to drive growth

TABLE 81 CANADA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 82 CANADA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 CANADA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 CANADA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 CANADA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 CANADA: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 87 EUROPE: hEALTHCARE SIMULATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 88 EUROPE: MEDICAL SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 89 EUROPE: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 EUROPE: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 EUROPE: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 EUROPE: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 EUROPE: HEALTHCARE SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Rising number of healthcare simulation centers and hospitals to drive growth

TABLE 94 UK: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 95 UK: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 UK: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 UK: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 UK: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 UK: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Growing focus on use of innovative methods in medical training to drive growth

TABLE 100 FRANCE: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 101 FRANCE: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 FRANCE: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 FRANCE: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 FRANCE: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 FRANCE: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 GERMANY

9.3.3.1 High healthcare spending to drive growth

TABLE 106 GERMANY: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 107 GERMANY: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 GERMANY: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 GERMANY: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 GERMANY: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 GERMANY: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Shortage of trained healthcare personnel to drive growth

TABLE 112 ITALY: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 113 ITALY: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 ITALY: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 ITALY: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 ITALY: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 ITALY: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing number of surgical procedures to boost growth

TABLE 118 SPAIN: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 119 SPAIN: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 SPAIN: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 SPAIN: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 SPAIN: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 SPAIN: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 124 ROE: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 125 ROE: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 ROE: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 ROE: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 ROE: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 ROE: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET SNAPSHOT (2021)

TABLE 130 ASIA PACIFIC: MEDICAL SIMULATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Increasing demand for virtual tutors and technologically advanced simulators to drive growth

TABLE 137 JAPAN: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 138 JAPAN: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 JAPAN: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 JAPAN: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 141 JAPAN: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 142 JAPAN: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing demand for trained medical professionals to drive growth

TABLE 143 CHINA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 144 CHINA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 CHINA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 CHINA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 CHINA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 CHINA: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing awareness regarding patient safety due to healthcare negligence to drive growth

TABLE 149 INDIA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 150 INDIA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 INDIA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 INDIA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 INDIA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 INDIA: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 155 ROAPAC: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 156 ROAPAC: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 ROAPAC: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 ROAPAC: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 ROAPAC: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 ROAPAC: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

TABLE 161 LATIN AMERICA: HEALTHCARE SIMULATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MEDICAL SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 163 LATIN AMERICA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 LATIN AMERICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 LATIN AMERICA: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 High incidence of chronic diseases to drive growth

TABLE 168 BRAZIL: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 169 BRAZIL: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 BRAZIL: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 BRAZIL: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 BRAZIL: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 BRAZIL: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Disruptive technologies and public-private partnerships to boost growth

TABLE 174 MEXICO: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 175 MEXICO: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 MEXICO: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 MEXICO: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 MEXICO: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 MEXICO: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 180 ROLA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 181 ROLA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 ROLA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 ROLA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 ROLA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 ROLA: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE TO DRIVE GROWTH

TABLE 186 MIDDLE EAST & AFRICA: HEALTHCARE SIMULATION MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MEDICAL SIMULATION ANATOMICAL MODELS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: PATIENT SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: INTERVENTIONAL/SURGICAL SIMULATORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MEDICAL SIMULATION TRAINING SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MEDICAL SIMULATION MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 199)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 192 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2019 AND SEPTEMBER 2022

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

10.4 MARKET SHARE ANALYSIS

FIGURE 34 MEDICAL SIMULATION MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

10.4.1 SURGICAL SIMULATORS MARKET RANKING ANALYSIS

FIGURE 35 SURGICAL SIMULATORS MARKET RANKING ANALYSIS, BY KEY PLAYER, 2021

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 36 HEALTHCARE SIMULATION MARKET: COMPETITIVE LEADERSHIP MAPPING FOR KEY PLAYERS (2021)

10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

10.6.1 PROGRESSIVE COMPANIES

10.6.2 DYNAMIC COMPANIES

10.6.3 STARTING BLOCKS

10.6.4 RESPONSIVE COMPANIES

FIGURE 37 HEALTHCARE SIMULATION MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2021)

10.7 COMPETITIVE SCENARIO

TABLE 194 KEY DEALS, JANUARY 2019 TO SEPTEMBER 2022

TABLE 195 OTHER KEY DEVELOPMENTS, JANUARY 2019 TO SEPTEMBER 2022

10.8 COMPETITIVE BENCHMARKING

TABLE 196 PRODUCT & SERVICE FOOTPRINT OF COMPANIES (25 COMPANIES)

TABLE 197 REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

11 COMPANY PROFILES (Page No. - 213)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 CAE INC.

TABLE 198 CAE INC.: BUSINESS OVERVIEW

FIGURE 38 CAE INC.: COMPANY SNAPSHOT (2021)

11.1.2 LAERDAL MEDICAL

TABLE 199 LAERDAL MEDICAL: BUSINESS OVERVIEW

11.1.3 GAUMARD SCIENTIFIC CO.

TABLE 200 GAUMARD SCIENTIFIC: BUSINESS OVERVIEW

11.1.4 KYOTO KAGAKU

TABLE 201 KYOTO KAGAKU: BUSINESS OVERVIEW

11.1.5 LIMBS & THINGS

TABLE 202 LIMBS & THINGS: BUSINESS OVERVIEW

11.1.6 MENTICE AB

TABLE 203 MENTICE AB: BUSINESS OVERVIEW

FIGURE 39 MENTICE AB: COMPANY SNAPSHOT (2021)

11.1.7 SIMULAB CORPORATION

TABLE 204 SIMULAB CORPORATION: BUSINESS OVERVIEW

11.1.8 SIMULAIDS

TABLE 205 SIMULAIDS: BUSINESS OVERVIEW

11.1.9 INTELLIGENT ULTRASOUND GROUP PLC

TABLE 206 INTELLIGENT ULTRASOUND GROUP PLC.: BUSINESS OVERVIEW

FIGURE 40 INTELLIGENT ULTRASOUND GROUP PLC: COMPANY SNAPSHOT (2021)

11.1.10 OPERATIVE EXPERIENCE INC.

TABLE 207 OPERATIVE EXPERIENCE INC.: BUSINESS OVERVIEW

11.1.11 SURGICAL SCIENCE SWEDEN AB

TABLE 208 SURGICAL SCIENCE SWEDEN AB: BUSINESS OVERVIEW

FIGURE 41 SURGICAL SCIENCE SWEDEN AB: COMPANY SNAPSHOT (2021)

11.1.12 CARDIONICS INC. (SUBSIDIARY OF 3B SCIENTIFIC)

TABLE 209 CARDIONICS INC.: BUSINESS OVERVIEW

11.1.13 VIRTAMED AG

TABLE 210 VIRTAMED AG: BUSINESS OVERVIEW

11.1.14 SYNBONE AG

TABLE 211 SYNBONE AG: BUSINESS OVERVIEW

11.1.15 INGMAR MEDICAL

TABLE 212 INGMAR MEDICAL: BUSINESS OVERVIEW

11.1.16 MEDICAL-X

TABLE 213 MEDICAL-X: BUSINESS OVERVIEW

11.1.17 KAVO DENTAL GMBH

TABLE 214 KAVO DENTAL GMBH: BUSINESS OVERVIEW

11.1.18 ALTAY SCIENTIFIC

TABLE 215 ALTAY SCIENTIFIC: BUSINESS OVERVIEW

11.1.19 TRUCORP LTD.

TABLE 216 TRUCORP LTD.: BUSINESS OVERVIEW

11.1.20 SIMENDO B.V.

TABLE 217 SIMENDO B.V.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 HAAG-STREIT SIMULATION

11.2.2 SYMGERY

11.2.3 HRV SIMULATION

11.2.4 SYNAPTIVE MEDICAL

11.2.5 INOVUS MEDICAL

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 301)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

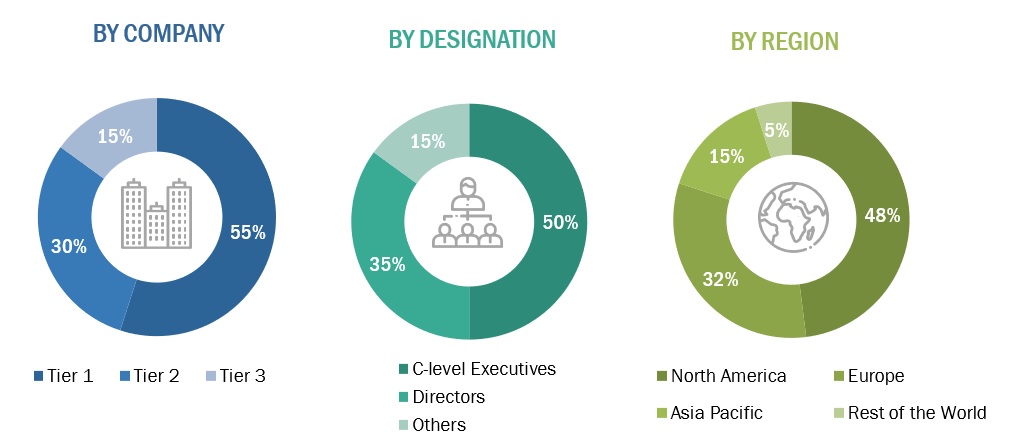

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved the use of secondary sources; directories; databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers; annual reports; and Companies’ House documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the healthcare simulation market. It was also used to obtain important information about the top players, market classification, segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side include CEOs, vice presidents & managing directors, marketing heads, directors and sales directors, marketing managers, regional/area sales managers, product managers, technology experts of medical simulation software solutions. Primary sources from the demand side include industry experts such as directors of hospitals, academic institutes, military organizations, and emergency care centers.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

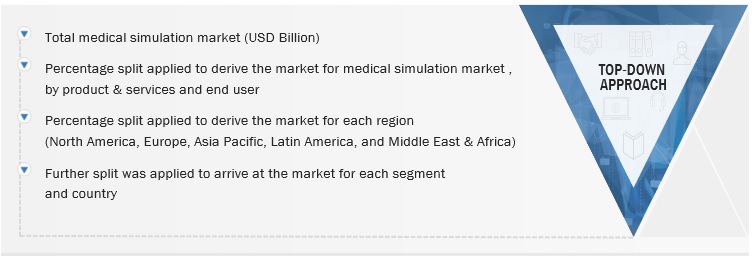

Market Size Estimation

The total size of the healthcare simulation market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of approaches was taken based on the level of assumptions used.

Data Triangulation

The size of the healthcare simulation market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Major players across the endovascular simulators segment were determined through secondary sources (validated through primary respondents).

- The approximate revenue share of top players, such as Mentice AB, in the endovascular simulators segment was collected through secondary sources.

- The total share of the endovascular simulators segment was determined in the medical simulation anatomical models segment to derive its revenue.

The total revenue in the global healthcare simulation market was determined by extrapolating the medical simulation anatomical models segment revenue.

Global Healthcare Simulation Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, and forecast the medical simulation market based on product & service, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa (along with country-wise segmentation)

- To profile the key players and comprehensively analyze their market shares and core competencies2 in the medical simulation market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, alliances, mergers and acquisitions, new product developments, geographic expansions, and R&D activities in the medical simulation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe healthcare simulation market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific healthcare simulation market into Vietnam, Pakistan, New Zealand, Australia, South Korea, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Simulation Market

Which are the top companies hold the market share in medical simulation market?

What are the key trends in the healthcare simulation market report?