Heat Pump Market by Type (Air-to-Air, Air-to-Water, Water Source, Geothermal, Hybrid) Refrigerant (R410A, R407C, R744) Rated Capacity (Up to 10 kW, 10-20 kW, 20-30 kW, >30 kW) End User (Residential, Commercial, Industrial) Region (2022-2026)

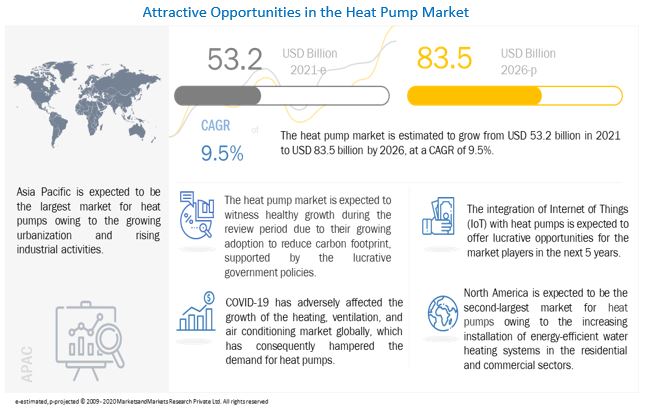

[197 Pages Report] The global heat pump market in terms of revenue was estimated to be worth $53.2 billion in 2021 and is poised to reach $83.5 billion by 2026, growing at a CAGR of 9.5% from 2021 to 2026. The factors driving the growth for heat pump market are the supportive government laws and subsidies to enhance energy efficiency.

To know about the assumptions considered for the study, Request for Free Sample Report

Heat Pump Market Dynamics

Driver: Contribution of heat pump technology to reduce carbon footprint

Energy is an essential power source in homes, hospitals, and schools, among others. However, its production and usage result in the emission of greenhouse gases in significant volumes. Thus, major economies across the globe are aiming to reduce their dependency on non-renewable energy sources and are gradually inclining toward renewable energy sources to restrict the emission of greenhouse gases.

The heat pump technology is a promising solution for lowering greenhouse gas emissions. Heat pumps through aerothermal and geothermal technologies offer an energy-efficient approach to space heating. The heat pump is often regarded as a sustainable technology when used in heating, ventilation, and air conditioning (HVAC) systems. In the residential, commercial, and industrial sectors, heat pumps are widely used for space heating, cooling, and heating water. Air and land have massive reserves of thermal energy. Heat pumps extract the ambient heat from the air and land at low temperatures and increase the temperature through energy input, mainly electricity. The heat pump is cable of extracting up to 77% of the energy from the air. Thus, the use of heat pump can bring down the fossil fuel consumption considerably when compared to alternate mediums of heat transfer, subsequently lowering the carbon footprint. This factor is increasing the number of heat pump installations across all sectors and driving market growth.

Restraint: Less awareness regarding advantages associated with heat pumps in emerging economies

The heat pump is technically complex equipment. The awareness regarding the energy efficiency, cost efficiency, and environmental benefits associated with heat pumps, as well as technical know-how, are limited among end users from developing and underdeveloped economies. This factor is expected to hamper their penetration rate in emerging economies.

According to a report published by the United Nations Environment Program, there is a lack of awareness among contractors regarding the International Organization for Standardization (ISO) standards for heat pumps. The ISO standards play a crucial role in the quality assurance and safety of the products or services offered. For instance, ISO 13612-2:2014 provides a calculation method under steady conditions that corresponds to one calculation step. The results of this calculation are incorporated in larger building models and take into account the influence of the external conditions. Thus, lack or limited awareness regarding the advantages of using heat pumps and related ISO standards is expected to restrain the market growth to an extent.

Opportunities: Increasing integration of Internet of Things (IoT) and other advanced technologies with heat pumps

Internet of Things (IoT)-based heat pumps enable real-time monitoring, predictive maintenance, and remote diagnostics of components. The Internet of Things (IoT)-based heat pumps consist of smart thermostats that help monitor environmental changes and communicate with their water heater equipment. End users from different sectors are increasingly adopting heat pumps. However, their designs and operations have remained unchanged. Automation and remote operations have been top priorities in developing next-generation heat pumps for ease of operations. Presently, heat pumps are equipped with LCDs and warning indicators to make them understandable. The major market players such as Panasonic and Samsung are focusing on integrating different technologies into their heat pumps to ensure ease of operations and maintenance. Research is also being conducted globally for incorporating machine learning and artificial intelligence in heat pumps to reduce electricity consumption and enhance efficiency. As an instance, the researchers at Swiss Federal Institute of Technology Lausanne (EPFL) are using AI to design a compressor, aiming to reduce electricity consumption by 25%. The team employed machine-learning methods to produce equations for heat pump design charts based on the outcome of 500,000 simulations. The heat pumps integrated with machine learning and artificial intelligence can study consumers’ usage patterns and analyze their operational time and duration, thereby eliminating the requirement of switching them on or off physically. These factors are expected to fuel the demand for heat pumps and create lucrative opportunities for the market players.

Challenges: High initial installation costs

Heat pumps are widely used in the residential, commercial, and industrial sectors as they help in increasing energy efficiency, reducing energy costs, and lowering carbon emissions. The demand for air-source heat pumps is high as they are less expensive and efficient to offer heating services to homes and small commercial buildings. Geothermal heat pumps are typically costlier to install; however, they are more efficient and can cater to large buildings. High-density polyethylene pipes are needed to be installed underground for geothermal heat pumps, which takes at least 3 days for a team of specialists.

The installation cost of heat pump equipment for residential, commercial, and industrial applications depends on numerous factors. For instance, in the residential application, the installation cost of all the types of heat pumps depends on the size of the house, additional ductwork, type of equipment, and British Thermal Unit (BTU) value of the equipment. It also depends on the complexity, type, brand, and size of the heat pump.

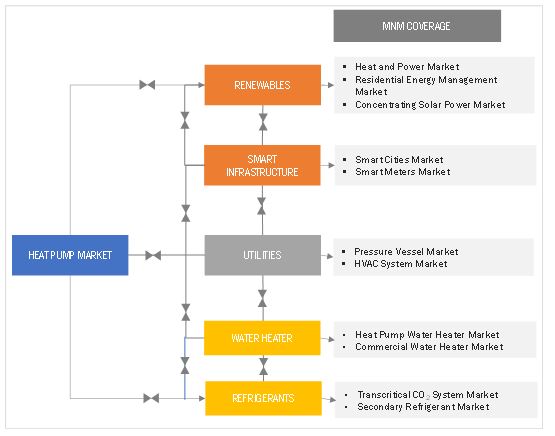

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

The Water source type segment is expected to be the largest segment of the heat pump market, by type, during the forecast period

The market, by type, is segmented into air-to-air heat pumps, air-to-water heat pumps, water source heat pumps, ground source (geothermal) heat pumps, and hybrid heat pumps. Water source heat pump are the fastest-growing segment of the heat pump industry, by heat pump type. Their high operating efficiency with respect to other heat pumps will be main driving factor for the market. Water source heat pump extracts thermal energy from water and turns it to heat. The main advantage asssosciated with water source heat pump is that they can operate on water having low temperature than air temperature.

The R410A refrigerant type segment is expected to be the largest segment of the heat pump market, by refrigerant type, during the forecast period

The market, by refrigerant type, is segmented into R410A, R407C, R744, and others. The R410A segment holds the largest share in the market, followed by R407C. The R410A refrigerant can boost the system efficiency rating. Furthermore, refilling the system using R410A is less expensive. The minimum effect on the ozone layer is expected to drive the R410A refrigerant segment of the heat pump market during the forecast period.

The up to 10 kW is expected to be the largest contributor to the heat pump market, by rated capacity, during the forecast period

The market, by rated capacity, is segmented into up to 10 kW, 10–20 kW, 20–30 kW, and above 30 kW. The up to 10 kW rated capacity segment accounted for a 47.5% share of the market in 2020. The major advantages, suitability for single-family residential houses is expected to drive the up to 10 kW segment, which consequently increases the demand for heat pump market during the forecast period.

The residential segment is expected to be the fastest-growing market, by end user, during the forecast period

The market, by end user, is segmented into residential, commercial, and industrial. The residential segment accounted for the largest share of 71.3% of the market in 2020. Government initiatives to enhance energy efficiency in the residential sector is expected to drive the residential segment during the forecast period. For instance, The federal tax credit for new residential ground source heat pumps was recently extended through the end of 2022 in the United States.

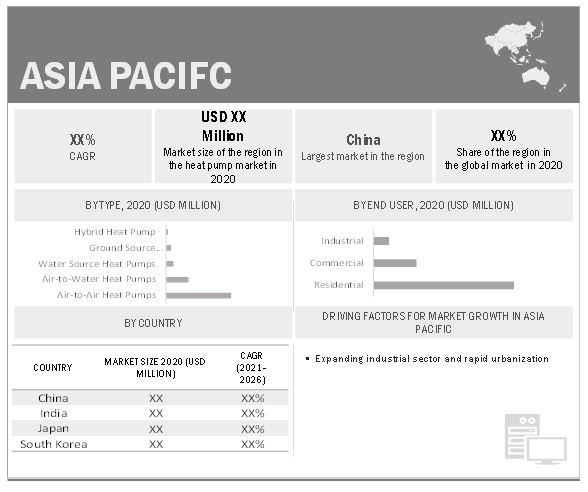

Asia Pacific is expected to dominate the global heat pump market

The Asia Pacific region is estimated to be the largest market for the heat pump market, followed by North America. The growth of the North American heat pump market is expected to be driven by government-led initiatives to reduce air pollution caused by the conventional sources of energy used for heating in the residential, commercial, and industrial sectors.

Key Market Players

The major players in the heat pump market are SAMSUNG (South Korea), DENSO CORPORATION (Japan), Midea Group (China), Panasonic Corporation (Japan), and Mitsubishi Electric Corporation (Japan). Between 2017 and 2021, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Coverage |

Details |

|

Market size: |

USD 53.2 billion in 2021 to USD 83.5 billion by 2026 |

|

Growth Rate: |

9.5% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2021-2026 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Type, Rated Capacity, Refrigerant Type, End User, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Increasing integration of Internet of Things (IoT) and other advanced technologies with heat pumps |

|

Key Market Drivers: |

Contribution of heat pump technology to reduce carbon footprint |

This research report categorizes the heat pumps market by type, rated capacity, refrigerant type, end user, and region.

On the basis of by type, the heat pumps market has been segmented as follows:

- Air-to-Air heat pump

- Air-to-Water heat pump

- Water Source heat pump

- Ground Source (Geothermal) heat pump

- Hybrid heat pump

On the basis of by rated capacity, the heat pumps market has been segmented as follows:

- Up to 10 kW

- 10 – 20 kW

- 20 – 30 kW

- Above 30 kW

On the basis of by refrigerant type, the heat pumps market has been segmented as follows:

- R410A

- R407C

- R744

- Others

On the basis of by end user, the heat pumps market has been segmented as follows:

- Residential

- Commercial

- Industrial

On the basis of region, the heat pumps market has been segmented as follows:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In January 2022, Johnson Controls has acquired FogHorn, a leading developer of Edge AI software for industrial and commercial Internet of Things (IoT) solutions. This development will help Johnson Controls to boost its building solutions business.

- In Oc 2021, Carrier Global acquired Nlyte Software, a leader in data center infrastructure management (DCIM) software. The development will add automated solutions to the HVAC business segment.

- In June 2021, DENSO and NTT Data announced the completion of a joint verification test to improve mobility experiences by leveraging data on vehicle and human flows. The test aims to improve mobility experiences and services, as well as to assist businesses in attracting potential clients with the changing consumer behavior.

- In September 2021, Carrier China, a part of Carrier Global, collaborated with Huadian Corporation for providing centrifugal chillers, which will be installed at Guangzhou Wanbo Central Energy Station, in China.

Frequently Asked Questions (FAQ):

What is the Growth of Heat Pump Market?

The global heat pump market is expected to grow at a CAGR of 9.5% during the forecast period, from an estimated USD 53.2 billion in 2021 to USD 83.5 billion by 2026.

What is the major drivers for the heat pump market?

The factors driving the growth for heat pump market are the Contribution of heat pump technology to reduce carbon footprint and the Government laws and subsidies to enhance energy efficiency.

Which is the fastest-growing region during the forecasted period in heat pump market?

North America region is expected to grow at the highest CAGR during the forecast period, driven mainly by activities in US and Canada.

Which is the fastest-growing segment, by end user during the forecasted period in heat pump market?

The residential end user segment is estimated to have the largest market share and is expected to grow at the highest rate during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF STUDY

1.2 DEFINITION

1.2.1 HEAT PUMP MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET, BY RATED CAPACITY: INCLUSIONS AND EXCLUSIONS

1.2.3 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 HEAT PUMP MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DEMAND SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYZING DEMAND FOR HEAT PUMPS

2.4.1 METRICS CONSIDERED TO ANALYZE DEMAND FOR HEAT PUMPS INCLUDE:

TABLE 1 YEAR-ON-YEAR SALES OF HEAT PUMPS ACROSS COUNTRIES IS KEY DETERMINING FACTOR FOR MARKET SIZE ESTIMATION

2.4.2 ASSUMPTIONS FOR DEMAND SIDE ANALYSIS

2.4.3 DEMAND SIDE ANALYSIS CALCULATION

2.5 SUPPLY SIDE ANALYSIS

FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF HEAT PUMPS

FIGURE 7 HEAT PUMP MARKET: SUPPLY SIDE ANALYSIS

2.5.1 CALCULATIONS FOR SUPPLY SIDE

2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

FIGURE 8 COMPANY REVENUE ANALYSIS, 2020

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 2 HEAT PUMP MARKET SNAPSHOT

FIGURE 9 AIR-TO-AIR HEAT PUMP SEGMENT TO DOMINATE MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 10 UP TO 10 KW SEGMENT TO DOMINATE MARKET, BY RATED CAPACITY, DURING FORECAST PERIOD

FIGURE 11 R410A TO HOLD LARGEST SHARE OF MARKET, BY REFRIGERANT TYPE, DURING FORECAST PERIOD

FIGURE 12 RESIDENTIAL TO HOLD LARGEST SHARE OF MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC DOMINATED MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN HEAT PUMP MARKET

FIGURE 14 GOVERNMENT INITIATIVES TO INCREASE INSTALLATION OF HEAT PUMPS TO DRIVE GROWTH OF MARKET FROM 2021 TO 2026

4.2 MARKET, BY REGION

FIGURE 15 NORTH AMERICA TO WITNESS HIGHEST GROWTH IN GLOBAL MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TYPE

FIGURE 16 AIR-TO-AIR HEAT PUMP SEGMENT DOMINATED MARKET IN 2020

4.4 MARKET, BY END USER

FIGURE 17 RESIDENTIAL SEGMENT DOMINATED MARKET IN 2020

4.5 MARKET, BY RATED CAPACITY

FIGURE 18 UP TO 10 KW SEGMENT DOMINATED MARKET IN 2020

4.6 MARKET, BY REFRIGERANT TYPE

FIGURE 19 R410A SEGMENT DOMINATED MARKET IN 2020

4.7 MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

FIGURE 20 RESIDENTIAL SEGMENT AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 COVID-19 GLOBAL PROPAGATION

FIGURE 22 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 COMPARISON OF GDP FOR SELECTED G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 24 HEAT PUMP MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Contribution of heat pump technology to reduce carbon footprint

5.4.1.2 Government laws and subsidies to enhance energy efficiency

5.4.2 RESTRAINTS

5.4.2.1 Less awareness regarding advantages associated with heat pumps in emerging economies

5.4.3 OPPORTUNITIES

5.4.3.1 Increasing integration of Internet of Things (IoT) and other advanced technologies with heat pumps

5.4.3.2 Positive outlook toward use of geothermal energy

5.4.4 CHALLENGES

5.4.4.1 High initial installation costs

5.4.4.2 Impact of COVID-19 on heat pump market

5.5 A2L REFRIGERANT

5.6 HEAT PUMP REPLACING CONVENTIONAL HEATING METHODS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 25 HEAT PUMP MARKET: SUPPLY CHAIN ANALYSIS

TABLE 3 MARKET: SUPPLY CHAIN

5.7.1 RAW MATERIAL SUPPLIERS

5.7.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

5.7.3 DISTRIBUTORS

5.7.4 END USERS

5.8 INNOVATIONS & PATENT REGISTRATION

5.9 TECHNOLOGY ANALYSIS

5.10 MARKET: REGULATIONS

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 HEAT PUMP MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF SUBSTITUTES

5.11.5 DEGREE OF COMPETITION

5.12 PRICING ANALYSIS

TABLE 5 AVERAGE UNIT COST OF HEAT PUMP, BY TYPE

5.13 CASE STUDY ANALYSIS

5.13.1 HIGH TEMPERATURE HEAT PUMP FOR 17TH CENTURY COTTAGE AT CORNWALL

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.14.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN HEAT PUMP MARKET

FIGURE 27 REVENUE SHIFT OF HEAT PUMP PROVIDERS

5.15 MARKET MAP

FIGURE 28 HEAT PUMP: MARKET MAP

5.16 TRADE ANALYSIS

5.16.1 EXPORT SCENARIO

TABLE 6 EXPORT SCENARIO FOR HS CODE: 8418, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.16.2 IMPORT SCENARIO

TABLE 7 IMPORT SCENARIO FOR HS CODE: 8418, BY COUNTRY, 2016–2020 (USD THOUSAND)

6 HEAT PUMP MARKET, BY TYPE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 29 HEAT PUMP MARKET, BY TYPE, 2020

TABLE 8 MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2 AIR-TO-AIR HEAT PUMP

6.2.1 LOW INSTALLATION COST ASSOCIATED WITH AIR-TO-AIR HEAT PUMPS IS FUELING THEIR DEMAND

TABLE 9 MARKET FOR AIR-TO-AIR HEAT PUMP, BY REGION, 2019–2026 (USD MILLION)

6.3 AIR-TO-WATER HEAT PUMP

6.3.1 LOW EMISSION OF CO2 TO BE MAJOR FACTOR FUELING DEMAND FOR AIR-TO-WATER HEAT PUMPS

TABLE 10 MARKET FOR AIR-TO-WATER PUMP, BY REGION, 2019–2026 (USD MILLION)

6.4 WATER SOURCE HEAT PUMP

6.4.1 HIGH COEFFICIENT OF PERFORMANCE (COP) OF WATER SOURCE HEAT PUMPS TO BOOST MARKET GROWTH

TABLE 11 MARKET FOR WATER SOURCE HEAT PUMP, BY REGION, 2019–2026 (USD MILLION)

6.5 GROUND SOURCE (GEOTHERMAL) HEAT PUMP

6.5.1 HIGH EFFICIENCY ASSOCIATED WITH GEOTHERMAL PUMPS IS DRIVING THEIR DEMAND GLOBALLY

TABLE 12 MARKET FOR GROUND SOURCE (GEOTHERMAL) HEAT PUMP, BY REGION, 2019–2026 (USD MILLION)

6.6 HYBRID HEAT PUMP

6.6.1 GROWING INCLINATION TOWARD USE OF RENEWABLE ENERGY SOURCES FOR HEATING TO DRIVE GROWTH OF HYBRID MARKET

TABLE 13 MARKET FOR HYBRID HEAT PUMP, BY REGION, 2019–2026 (USD MILLION)

7 HEAT PUMP MARKET, BY REFRIGERANT TYPE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 30 MARKET, BY REFRIGERANT TYPE, 2020

TABLE 14 MARKET, BY REFRIGERANT TYPE, 2019–2026 (USD MILLION)

7.2 R410A

7.2.1 R410A DOES NOT LEAD TO OZONE DEPLETION

TABLE 15 MARKET FOR R410A, BY REGION, 2019–2026 (USD MILLION)

7.3 R407C

7.3.1 R407C IS ENVIRONMENTALLY FRIENDLY REFRIGERANT

TABLE 16 MARKET FOR R407C, BY REGION, 2019–2026 (USD MILLION)

7.4 R744

7.4.1 HIGH VOLUMETRIC COOLING CAPACITY OF R744 IS FUELING ITS DEMAND GLOBALLY

TABLE 17 MARKET FOR R744, BY REGION, 2019–2026 (USD MILLION)

7.5 OTHERS

TABLE 18 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

8 HEAT PUMP MARKET, BY RATED CAPACITY (Page No. - 82)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY RATED CAPACITY, 2020

TABLE 19 MARKET, BY RATED CAPACITY, 2019–2026 (USD MILLION)

8.2 UP TO 10 KW

8.2.1 SUITABILITY FOR SINGLE-FAMILY HOUSES TO DRIVE GROWTH OF MARKET FOR UP TO 10 KW RATED CAPACITY

TABLE 20 MARKET FOR UP TO 10 KW, BY REGION, 2019–2026 (USD MILLION)

8.3 10–20 KW

8.3.1 GROWING DEMAND FOR HEAT PUMPS WITH RATED CAPACITIES FROM 10–20 KW IN RESIDENTIAL SECTOR TO DRIVE MARKET GROWTH

TABLE 21 MARKET FOR 10–20 KW, BY REGION, 2019–2026 (USD MILLION)

8.4 20–30 KW

8.4.1 ABILITY OF HEAT PUMPS WITH 20–30 KW RATED CAPACITIES TO MEET HEATING DEMAND IN COMMERCIAL SECTOR TO DRIVE MARKET GROWTH

TABLE 22 MARKET FOR 20–30 KW, BY REGION, 2019–2026 (USD MILLION)

8.5 ABOVE 30 KW

8.5.1 GROWING ADOPTION OF HEAT PUMPS WITH ABOVE 30 KW RATED CAPACITIES IN INDUSTRIAL AND COMMERCIAL SECTORS TO DRIVE MARKET GROWTH

TABLE 23 MARKET FOR ABOVE 30 KW, BY REGION, 2019–2026 (USD MILLION)

9 HEAT PUMP MARKET, BY END USER (Page No. - 87)

9.1 INTRODUCTION

FIGURE 32 MARKET, BY END USER, 2020

TABLE 24 MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 RESIDENTIAL

9.2.1 INCREASING GOVERNMENT INITIATIVES TO ENHANCE ENERGY EFFICIENCY TO FUEL DEMAND FOR HEAT PUMPS

TABLE 25 MARKET FOR RESIDENTIAL, BY REGION, 2019–2026 (USD MILLION)

9.3 COMMERCIAL

9.3.1 HIGH TEMPERATURE HEATING REQUIREMENT IN COMMERCIAL SECTOR TO BOOST DEMAND FOR HEAT PUMPS

TABLE 26 MARKET FOR COMMERCIAL, BY REGION, 2019–2026 (USD MILLION)

9.4 INDUSTRIAL

9.4.1 INCREASING DEMAND FOR HEAT PUMPS IN INDUSTRIAL SECTOR DUE TO THEIR ENERGY EFFICIENCY FEATURE TO DRIVE MARKET GROWTH

TABLE 27 MARKET FOR INDUSTRIAL, BY REGION, 2019–2026 (USD MILLION)

10 HEAT PUMP MARKET, BY REGION (Page No. - 92)

10.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: NORTH AMERICA MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34 HEAT PUMP MARKET SHARE, BY REGION, 2020

TABLE 28 MARKET VOLUME, BY REGION, 2019–2026 (MILLION UNITS)

TABLE 29 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: REGIONAL SNAPSHOT

10.2.1 BY TYPE

TABLE 30 MARKET IN ASIA PACIFIC, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 BY REFRIGERANT TYPE

TABLE 31 MARKET IN ASIA PACIFIC, BY REFRIGERANT TYPE, 2019–2026 (USD MILLION)

10.2.3 BY RATED CAPACITY

TABLE 32 HEAT PUMP MARKET IN ASIA PACIFIC, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 33 MARKET FOR UP TO 10 KW IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 MARKET FOR 10 – 20 KW IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 35 MARKET FOR 20 – 30 KW IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 36 MARKET FOR ABOVE 30 KW IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.4 BY END USER

TABLE 37 MARKET IN ASIA PACIFIC, BY END USER, 2019–2026 (USD MILLION)

TABLE 38 MARKET FOR RESIDENTIAL IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 39 MARKET FOR COMMERCIAL IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 MARKET FOR INDUSTRIAL IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 41 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION))

10.2.5.1 China

10.2.5.1.1 Growing urban population and initiatives to minimize pollution to fuel demand for heat pumps in China

TABLE 42 MARKET IN CHINA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 43 MARKET IN CHINA, BY END USER, 2019–2026 (USD MILLION)

10.2.5.2 India

10.2.5.2.1 Government initiatives for increasing use of renewables to drive market growth in India

TABLE 44 MARKET IN INDIA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 45 MARKET IN INDIA, BY END USER, 2019–2026 (USD MILLION)

10.2.5.3 Japan

10.2.5.3.1 Energy conservation initiatives by government and technological advancements to drive market growth in Japan

TABLE 46 HEAT PUMP MARKET IN JAPAN, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 47 MARKET IN JAPAN, BY END USER, 2019–2026 (USD MILLION)

10.2.5.4 South Korea

10.2.5.4.1 Growing demand for energy-efficient heating technology to drive market growth

TABLE 48 MARKET IN SOUTH KOREA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 49 MARKET IN SOUTH KOREA, BY END USER, 2019–2026 (USD MILLION)

10.2.5.5 Australia

10.2.5.5.1 Favorable environmental conditions and expanding renewable sector are expected to drive market growth

TABLE 50 MARKET IN AUSTRALIA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 51 MARKET IN AUSTRALIA, BY END USER, 2019–2026 (USD MILLION)

10.2.5.6 Rest of Asia Pacific

TABLE 52 MARKET IN REST OF ASIA PACIFIC, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 53 MARKET IN REST OF ASIA PACIFIC, BY END USER, 2019–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: REGIONAL SNAPSHOT

10.3.1 BY TYPE

TABLE 54 MARKET IN NORTH AMERICA, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 BY REFRIGERANT TYPE

TABLE 55 MARKET IN NORTH AMERICA, BY REFRIGERANT TYPE, 2019–2026 (USD MILLION)

10.3.3 BY RATED CAPACITY

TABLE 56 HEAT PUMP MARKET IN NORTH AMERICA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 57 MARKET FOR UP TO 10 KW IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 MARKET FOR 10 – 20 KW IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 MARKET FOR 20 – 30 KW IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 60 MARKET FOR ABOVE 30 KW IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.4 BY END USER

TABLE 61 MARKET IN NORTH AMERICA, BY END USER, 2019–2026 (USD MILLION)

TABLE 62 MARKET FOR RESIDENTIAL IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 MARKET FOR COMMERCIAL IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 MARKET FOR INDUSTRIAL IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 65 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.5.1 US

10.3.5.1.1 Increasing demand for energy-efficient water heating systems in residential and commercial sectors to drive US market growth

TABLE 66 MARKET IN US, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 67 MARKET IN US, BY END USER, 2019–2026 (USD MILLION)

10.3.5.2 Canada

10.3.5.2.1 Government regulations and policies to reduce pollution to fuel demand for heat pumps in Canada

TABLE 68 MARKET IN CANADA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 69 MARKET IN CANADA, BY END USER, 2019–2026 (USD MILLION)

10.4 EUROPE

10.4.1 BY TYPE

TABLE 70 MARKET IN EUROPE, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 BY REFRIGERANT TYPE

TABLE 71 MARKET IN EUROPE, BY REFRIGERANT TYPE, 2019–2026 (USD MILLION)

10.4.3 BY RATED CAPACITY

TABLE 72 HEAT PUMP MARKET IN EUROPE, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 73 MARKET FOR UP TO 10 KW IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 74 MARKET FOR 10 – 20 KW IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 75 MARKET FOR 20 - 30 KW IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 MARKET FOR ABOVE 30 KW IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.4 BY END USER

TABLE 77 MARKET IN EUROPE, BY END USER, 2019–2026 (USD MILLION)

TABLE 78 MARKET FOR RESIDENTIAL IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 79 MARKET FOR COMMERCIAL IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 80 MARKET FOR INDUSTRIAL IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 81 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION))

10.4.5.1 France

10.4.5.1.1 Rising demand for energy-efficient heating systems to boost growth of French heat pump market

TABLE 82 MARKET IN FRANCE, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 83 MARKET IN FRANCE, BY END USER, 2019–2026 (USD MILLION)

10.4.5.2 Italy

10.4.5.2.1 Government-led schemes to increase installation of heat pumps to boost market growth in Italy

TABLE 84 MARKET IN ITALY, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 85 MARKET IN ITALY, BY END USER, 2019–2026 (USD MILLION)

10.4.5.3 Spain

10.4.5.3.1 Energy conservation initiatives by government and technological advancements to drive growth of Spain market

TABLE 86 MARKET IN SPAIN, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 87 MARKET IN SPAIN, BY END USER, 2019–2026 (USD MILLION)

10.4.5.4 UK

10.4.5.4.1 Growth of residential sector and rising demand for renewable heat generation are driving market growth

TABLE 88 MARKET IN UK, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 89 MARKET IN UK, BY END USER, 2019–2026 (USD MILLION)

10.4.5.5 Rest of Europe

TABLE 90 MARKET IN REST OF EUROPE, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 91 MARKET IN REST OF EUROPE, BY END USER, 2019–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY TYPE

TABLE 92 MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2019–2026 (USD MILLION)

10.5.2 BY REFRIGERANT TYPE

TABLE 93 MARKET IN MIDDLE EAST & AFRICA, BY REFRIGERANT TYPE, 2019–2026 (USD MILLION)

10.5.3 BY RATED CAPACITY

TABLE 94 HEAT PUMP MARKET IN MIDDLE EAST & AFRICA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 95 MARKET FOR UP TO 10 KW IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 96 MARKET FOR 10 – 20 KW IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 97 MARKET FOR 20 – 30 KW IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 98 MARKET FOR ABOVE 30 KW IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.4 BY END USER

TABLE 99 MARKET IN MIDDLE EAST & AFRICA, BY END USER, 2019–2026 (USD MILLION)

TABLE 100 MARKET FOR RESIDENTIAL IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 101 MARKET FOR COMMERCIAL IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 MARKET FOR INDUSTRIAL IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 103 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.5.1 Saudi Arabia

10.5.5.1.1 Rising investments in industrial sector to fuel growth of heat pumps market in Saudi Arabia

TABLE 104 MARKET IN SAUDI ARABIA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 105 MARKET IN SAUDI ARABIA, BY END USER, 2019–2026 (USD MILLION)

10.5.5.2 South Africa

10.5.5.2.1 Increasing investments in different projects to drive demand for heat pumps in South Africa

TABLE 106 MARKET IN SOUTH AFRICA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 107 MARKET IN SOUTH AFRICA, BY END USER, 2019–2026 (USD MILLION)

10.5.5.3 Rest of Middle East & Africa

TABLE 108 MARKET IN REST OF MIDDLE EAST & AFRICA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 109 MARKET IN REST OF MIDDLE EAST & AFRICA, BY END USER, 2019–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 BY TYPE

TABLE 110 MARKET IN LATIN AMERICA, BY TYPE, 2019–2026 (USD MILLION)

10.6.2 BY REFRIGERANT TYPE

TABLE 111 MARKET IN LATIN AMERICA, BY REFRIGERANT TYPE, 2019–2026 (USD MILLION)

10.6.3 BY RATED CAPACITY

TABLE 112 MARKET IN LATIN AMERICA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 113 MARKET FOR UP TO 10 KW IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 114 MARKET FOR 10 - 20 KW IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 115 MARKET FOR 20 - 30 KW IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 116 MARKET FOR ABOVE 30 KW IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.4 BY END USER

TABLE 117 MARKET IN LATIN AMERICA, BY END USER, 2019–2026 (USD MILLION)

TABLE 118 MARKET FOR RESIDENTIAL IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 119 MARKET FOR COMMERCIAL IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 120 MARKET FOR INDUSTRIAL IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 121 MARKET IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION))

10.6.5.1 Mexico

10.6.5.1.1 Energy-saving initiatives to drive demand for heat pumps in Mexico

TABLE 122 MARKET IN MEXICO, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 123 MARKET IN MEXICO, BY END USER, 2019–2026 (USD MILLION)

10.6.5.2 Brazil

10.6.5.2.1 Transition toward renewable power generation to fuel growth of Brazilian market

TABLE 124 HEAT PUMP MARKET IN BRAZIL, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 125 MARKET IN BRAZIL, BY END USER, 2019–2026 (USD MILLION)

10.6.5.3 Rest of Latin America

TABLE 126 HEAT PUMP MARKET IN REST OF LATIN AMERICA, BY RATED CAPACITY, 2019–2026 (USD MILLION)

TABLE 127 MARKET IN REST OF LATIN AMERICA, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 137)

11.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS IN HEAT PUMP MARKET, 2017–2021

11.2 SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 128 HEAT PUMP MARKET: DEGREE OF COMPETITION

FIGURE 38 SHARE ANALYSIS OF TOP PLAYERS IN HEAT PUMP MARKET, 2020

11.3 MARKET EVALUATION FRAMEWORK

TABLE 129 MARKET EVALUATION FRAMEWORK, 2017–2021

11.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 39 TOP PLAYERS DOMINATED MARKET IN LAST 5 YEARS

11.5 RECENT DEVELOPMENTS

11.5.1 DEALS

11.5.1.1 Heat Pump Market: Deals, 2017–2021

11.5.2 OTHERS

11.5.2.1 Heat Pump Market: Others,2017–2021

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 40 HEAT PUMP MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

TABLE 130 COMPANY REGION FOOTPRINT

12 COMPANY PROFILES (Page No. - 146)

12.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 MIDEA GROUP

TABLE 131 MIDEA GROUP: BUSINESS OVERVIEW

FIGURE 41 MIDEA GROUP: COMPANY SNAPSHOT

TABLE 132 MIDEA GROUP: DEALS

TABLE 133 MIDEA GROUP: PRODUCT LAUNCHES

12.1.2 PANASONIC CORPORATION

TABLE 134 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 42 PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 135 PANASONIC CORPORATION: DEALS

TABLE 136 PANASONIC CORPORATION: PRODUCT LAUNCHES

TABLE 137 PANASONIC CORPORATION: OTHERS

12.1.3 MITSUBISHI ELECTRIC CORPORATION

TABLE 138 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 43 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 139 MITSUBISHI ELECTRIC CORPORATION: DEALS

TABLE 140 MITSUBISHI ELECTRIC CORPORATION.: PRODUCT LAUNCHES

12.1.4 DENSO CORPORATION

TABLE 141 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 44 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 142 DENSO CORPORATION: DEALS

12.1.5 SAMSUNG

TABLE 143 SAMSUNG: BUSINESS OVERVIEW

FIGURE 45 SAMSUNG: COMPANY SNAPSHOT

TABLE 144 SAMSUNG: DEALS

TABLE 145 SAMSUNG: PRODUCT LAUNCHES

12.1.6 LG ELECTRONICS

TABLE 146 LG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 46 LG ELECTRONICS: COMPANY SNAPSHOT

TABLE 147 LG ELECTRONICS: PRODUCT LAUNCHES

12.1.7 LENNOX INTERNATIONAL

TABLE 148 LENNOX INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 47 LENNOX INTERNATIONAL: COMPANY SNAPSHOT

12.1.8 FUJITSU GENERAL

TABLE 149 FUJITSU GENERAL: BUSINESS OVERVIEW

FIGURE 48 FUJITSU GENERAL: COMPANY SNAPSHOT

TABLE 150 FUJITSU GENERAL: DEALS

12.1.9 DAIKIN INDUSTRIES, LTD.

TABLE 151 DAIKIN INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 49 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 152 DAIKIN INDUSTRIES, LTD.: PRODUCT LAUNCHES

12.1.10 CARRIER GLOBAL

TABLE 153 CARRIER GLOBAL: BUSINESS OVERVIEW

FIGURE 50 CARRIER GLOBAL: COMPANY SNAPSHOT

TABLE 154 CARRIER GLOBAL: DEALS

12.1.11 JOHNSON CONTROLS

TABLE 155 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 51 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 156 JOHNSON CONTROLS: DEALS

12.1.12 TRANE TECHNOLOGIES

TABLE 157 TRANE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 52 TRANE TECHNOLOGIES: COMPANY SNAPSHOT

12.1.13 THERMAX LIMITED

TABLE 158 THERMAX LIMITED: BUSINESS OVERVIEW

FIGURE 53 THERMAX LIMITED: COMPANY SNAPSHOT

12.1.14 GEA GROUP AKTIENGESELLSCHAFT

TABLE 159 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

FIGURE 54 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

12.1.15 DANFOSS A/S

TABLE 160 DANFOSS: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 GLEN DIMPLEX GROUP

12.2.2 VIESSMANN

12.2.3 NIBE

12.2.4 GUANGZHOU SPRSUN NEW ENERGY TECHNOLOGY DEVELOPMENT

12.2.5 RHEEM

12.2.6 EMERSON ELECTRIC CO.

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 189)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

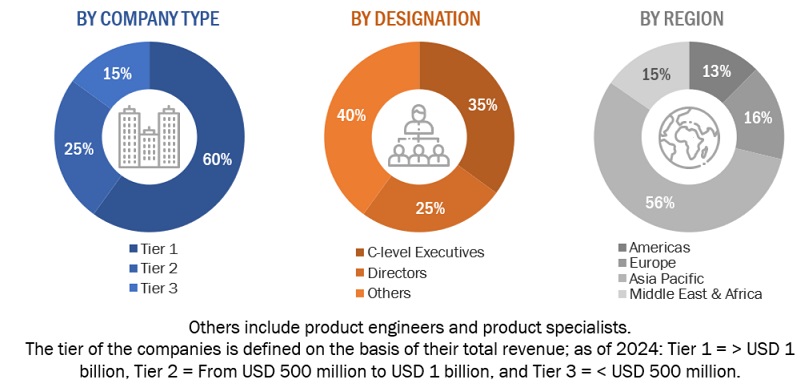

This study involved four major activities in estimating the current size of the heat pumps market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as water and wastewater management data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and water & environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the heat pumps market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The heat pumps market comprises several stakeholders such as companies related to the industry, component manufacturing companies for heat pump, government & research organizations, organizations, forums, alliances & associations, heat pumps providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the residential, commercial, and industrial sector. The supply side is characterized by investments & expansion and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global heat pumps market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Heat pumps Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the heat pumps market.

Objectives of the Study

- To define and describe the heat pump market based on type, rated capacity, refrigerant type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To estimate the size of the market in terms of value

- To strategically analyze micro-markets with respect to individual growth trends, prospects, future expansions, and contributions to the total market

- To provide post-pandemic estimation for the heat pump market size and analyze the impact of COVID-19 outbreak on the overall market

- To forecast the growth of the heat pump market with respect to five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies1

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the heat pump market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Heat Pump Market

We want to know the competitive scenario for the Heat Pump Market? and the Top vendors in the Heat Pump Industry for the Forecast period 2022 to 2026.