Heat Pump Water Heater Market by type (Air Source, Geothermal), Storage (Up to 500 L, 500–1000 L, Above 1000 L), Capacity (Up to 10 kW, above 10 kW), Refrigerant (R410A, R407C, R744), End-User (Residential, Commercial, Industrial), Region - Global Forecast to 2026

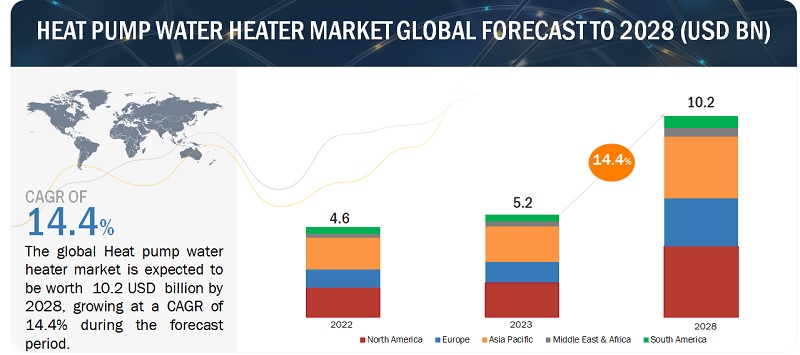

The global heat pump water heater market in terms of revenue was values at $1.4 billion in 2020 and to reach $2.1 billion by 2026, growing at a CAGR of 6.8 % from 2021 to 2026. Factors driving the growth of the heat pump water heater market include the energy efficient technology along with the usage of non conventional sources of energy to heat the water. In addition, supportive regulations and grants for using renewable sources of energy in different applications are also expected to play a key role in the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Heat Pump Water Heater Market Dynamics

Driver: Reduction in CO2 Emission

The production and consumption of energy lead to the emission of carbon dioxide (CO2), which is released in substantial amounts through the burning of fossil fuels, such as coal, oil, and natural gas. Many countries are aiming to reduce their primary energy demand due to the increasing CO2 emissions and implement policies to restrict the emission of greenhouse gases. Heat pump water heater is one of the most promising technologies for reducing greenhouse gas emissions. A heat pump water heater offers an energy-efficient way to provide heating through aerothermal and geothermal technologies. Exhaust air, groundwater, and surface water (lake, river, or pond) are the other examples of commonly used heat sources. Heat pump water heaters take the ambient heat from air, water, and ground at low temperatures and increase the water temperature level through energy input, mostly from electricity. To heat the water, air source or water source heat pump uses 66 to 80% of the heat from renewable heat sources in the environment and 20 to 33% electrical energy for the heat pump compressor. Hence, carbon emissions associated with energy consumption and generation can be reduced significantly by using heat pump water heater systems instead of fossil fuel-based systems. This is driving the increase in the number of installation of heat pump water heaters in residential, commercial, and industrial segments.

Restraint: Lack of awareness regarding benefits of heat pump water heaters in developing and underdeveloped countries

The awareness regarding energy efficiency, cost efficiency, and environmental benefits of heat pump water heaters is low among all end user segments. This is because they are typically perceived to be expensive, which acts as a restraint for market penetration in developing as well as underdeveloped economies. There is also a lack of awareness regarding the opportunities that heat pump water heaters provide for energy conservation and reduction of CO2 emissions.

According to a report published by the United Nations Environment Programme, there is a lack of awareness among the contractors regarding the International Organization for Standardization (ISO) standards for heat pumps. Thus, the lack of awareness of heat pump technology across the entire supply chain (technicians, consultants, engineers, contractors, and end users) is a barrier to the adoption of heat pump water heaters in developing and underdeveloped countries.

Opportunity: Integration of Iot with heat pump water heaters

Internet of Things (IoT)-enabled heat pump water heater systems are expected to offer real-time monitoring, predictive maintenance, and remote diagnostics for heat pump water heaters. IoT-enabled heat pump water heater systems consist of smart thermostats that help in monitoring environmental changes and communicating with the heat pump water heater equipment. Technologically advanced software enable heat pump water heater systems to leverage data for continuous improvements in efficiency and energy-savings. For instance, building management systems (BMS) involve the installation of sensors, software, a network, and a cloud-based data store. Their functions include the management of boilers, chillers, pumps, air handling units, rooftop units, heat pumps, VAV boxes, radiators, fan coil units, exhaust fans, and security & safety operations. Such systems help facility managers to easily manage heat pump water heater systems, thus saving time and cost. Integration with IoT helps in tracking the abnormalities in heat pump water heaters, subsequently reducing system failure. Thus, the integration of IoT with heat pump water heaters is providing significant opportunities for the growth of the market.

Challenge: High installation cost

Heat pump water heater systems are used to increase the energy-efficiency, reduce energy costs, and lower the carbon emissions in residential, commercial, and industrial sectors. Heat pump water heaters are of two types: aerothermal heat pumps (air source heat pumps) and geothermal heat pumps (ground source heat pumps). Air source heat pump water heaters are more common, as they are less expensive and efficient enough to service most homes and small commercial buildings. Geothermal heat pump water heaters are typically costlier to install because of underground installation. High-density polyethylene pipes are required to be put in the ground, which takes a team of specialists at least three days to install the pipes and the entire system, although they are more efficient and can service bigger buildings.

The installation cost of heat pump water heater equipment for residential, commercial, and industrial applications depends on various factors. For instance, in the residential application, the installation cost of all heat pump systems depends on the size of homes, additional ductwork, type of equipment, and British Thermal Unit (BTU) value of the equipment. The cost of installation of a heat pump water heater also depends on the complexity, type, brand, and size of the heat pump. Thus, the high installation cost is a challenge that can hamper the growth of the heat pump market.

By type, the air source segment is the largest contributor in the heat pump water heaters market during the forecast period.

The air source segment is estimated to be the largest- segment of the heat pump water heate market, by type, from 2020 to 2026. The demand for air source heat pump is growing majorly in the residential sector owing to its low installation cost and environmental friendly technology. They are mainly used in Asia Pacific owing to the fact that countries such as China, Australia, Thailand, and New Zealand are focusing on limiting their carbon footprint resulting from the use of fossil fuels.

By storage tank capacity, the up to 500 LT segment is expected to grow at the fastest rate during the forecast period.

Heat pump water heaters falling under this category are compact and hence, are easy to install. They provide ample hot water for almost all small commercial applications and residential sector. Hence, water heaters with this capacity are suitable for less hot water requirement applications in small commercial establishments and residential sector that includes homes and multi family buildings. Small individual heat pump water heaters of up to 500 liters capacity are used in the hospitality sector for holiday homes and motels as they ensure interruption-free availability of hot water for bathing, personal laundry, etc. applications.

By rated capacity, the 10–20 kW segment is expected to be the largest contributor during the forecast period.

The 10–20kW segment is estimated to dominate the market from 2020 to 2026. In the residential sector, the requirement of instant hot water has been rising at a significant rate. This led to the deployment of low-powered heat pump water heater to cater to this instant hot water requirements majorly for residential sector. Heat pump water heater with 10–20 kW rated capacity are easy to use, offer high operational efficiency.

By refrigerant type, R410A segment is expected to be the largest market during the forecast period.

The R410A is expected to be the largest market from 2020 to 2026. R410A is a low-pressure gas that is stored in copper coils. When incorporated with copper, it absorbs the heat that passes through various copper components. R410A is a gas which is used as a refrigerant in HVAC for heating and cooling applications. It used in heat pump water heater as it does not contribute to ozone depletion and is non toxic in nature.

By end user, residential sector is expected to be the largest market during the forecast period.

The residential segment of the heat pump water heater market, by end user, is expected to contribute the largest share in the market during the forecast period. The adoption of heat pump water heaters is increasing in the residential sector, majorly due to its energy-efficiency technology and various government initiatives in the form of subsidy or tax benefit offered in order to enhance the demand for heat pump water heater.

Asia Pacific is expected to account for the fastest growing market size during the forecast period.

Asia Pacific is expected to dominate the heat pump water heater market during the forecast period as owing to the increase in the use of renewable energy and energy efficient products. Several leading players in the heat pump water heater market such as A.O. Smith Corporation, Midea Group, RHEEM Manufacturing, and Mitsubishi Electric have their manufacturing facilities in countries such as China, India, and Thailand. The region is home to a number of emerging economies such as China, India, New Zealand, and Malaysia. These countries are taking various initiatives to enhance the installation of het pump water heater in order to increase the energy efficiency and reduce environmental pollution. The figure below shows the projected market sizes of various regions with respective CAGRs for 2026.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the heat pump water heater market include Midea Group (China), RHEEM Manufacturing Company (US), Daikin (Japan), A.O. Smith Corporation (US), Bosch Industries (Germany), and Ingersoll Rand (US), etc. and other players such as Viessmann Group (Germany), NIBE Energy Systems (Sweden), Valliant Group (Germany), Daikin (Japan), Mitsubishi Electric (Japan), Glen Dimplex (Ireland), Stiebel Eltron (Germany), and more

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2016–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Storage Tank Capacity, Rated Capacity, End User and Region. |

|

Geographies covered |

Asia Pacific, South America, North America, Europe. |

|

Companies covered |

Midea Group (China), RHEEM Manufacturing Company (US), Daikin (Japan), A.O. Smith Corporation (US), Bosch Industries (Germany), and Ingersoll Rand (US), etc. (25 total) |

This research report categorizes the heat pump water heater market based on Type, Storage Tank Capacity, Rated Capacity, end user, and Region.

Based on the Type :

- Air source

- Geothermal

Based on the Rated Capacity:

- Up to 10 kW

- 10?20 kW

- 20?30 kW

- 30?100 kW

- 10–150 kW

- Above 150 kW

Based on the Storage Tank Capacity:

- Up to 500 LT

- 500?1,000 LT

- Above 1,000 LT

Based on the region:

- Asia Pacific

- Europe

- North America

- South America

Recent Developments

- In July 2020, Daikin launched Daikin SmartSource, a dedicated outdoor air system (DOAS) for heat pumps that enables efficient and cost effective cooling and heating in all conditions using 100% fresh outside air. It also taps a water source heat pump's hot gas reheat coil in addition to the unit's primary DX coil; to enhances the efficiency of the heat pump

- In August 2020, Panasonic Corporation partnered with Systemair on technology to launch heating and cooling products for offering its customers with more options related to HVAC products, including heat pumps. Both companies will have their separate sales channels and branding for these products.

- RHEEM Manufacturing Company acquired Intergas, which was into the manufacturing of high-efficiency residential gas boilers and water heaters. The acquisition will help the company to obtain a first-class platform in the European heating and hot water market and an increase in the market share.

Frequently Asked Questions (FAQ):

What is the current size of the heat pump water heater market?

The size of the global heat pump water heater market is USD 1.5 billion in 2019.

What are the major drivers for the heat pump water heater market?

Factors driving the growth of the heat pump water heater market include the energy efficient technology along with the usage of non conventional sources of energy to heat the water. In addition, supportive regulations and grants for using renewable sources of energy in different applications are also expected to play a key role in the growth of this market during the forecast period.

Which region dominates during the forecasted period in the heat pump water heater market?

Asia Pacific is the largest and the fastest growing region during the forecasted duration and countries such as China, Indonesia, and Australia are the fastest-growing markets in the Asia Pacific region, owing to the increased emphasis on renewable based technology and energy efficiency.

Which is the fastest-growing type segment during the forecasted period in the heat pump water heater market?

The air source segment is the fastest-growing during the forecasted period due to the increased awareness about the usage of renewable technology in water heating for residential, commercial, and industrial sector. Additionally, supportive grants, incentives, and regulations are also helping this market to grow at a healthy pace.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 HEAT PUMP WATER HEATER MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 1 MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

TABLE 2 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 HEAT PUMP WATER HATER MARKET: DATA TRIANGULATION AND RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 BREAK-UP OF PRIMARIES

2.2 SCOPE

FIGURE 2 MAIN METRICS CONSIDERED WHILE ASSESSING GLOBAL DEMAND FOR HEAT PUMP WATER HEATERS

2.3 MARKET SIZE ESTIMATION

2.3.1 APPROACH 1: DEMAND-SIDE ANALYSIS THROUGH BOTTOM-UP APPROACH

FIGURE 3 YEAR-ON-YEAR ADDITION OF TYPES OF HEAT PUMP WATER HEATERS ACROSS COUNTRIES IS THE KEY DETERMINING FACTOR FOR MARKET SIZE ESTIMATION

2.3.2 KEY ASSUMPTIONS

2.3.3 CALCULATIONS

2.3.4 FORECAST

2.3.5 APPROACH 2: SUPPLY-SIDE ANALYSIS

FIGURE 4 REVENUE OF KEY MANUFACTURERS OF HEAT PUMP WATER HEATERS ACROSS DIFFERENT REGIONS IS THE KEY DETERMINING FACTOR FOR MARKET SIZE ESTIMATION

2.3.6 SUPPLY-SIDE CALCULATION

FIGURE 5 MARKET SIZE ESTIMATION FROM REVENUE ANALYSIS OF KEY PLAYERS IN MARKET

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 3 HEAT PUMP WATER HEATER MARKET SNAPSHOT

FIGURE 6 AIR SOURCE SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY TYPE, DURING THE FORECAST PERIOD

FIGURE 7 UP TO 500 LITERS SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY STORAGE TANK CAPACITY, DURING THE FORECAST PERIOD

FIGURE 8 10–20 KW SEGMENT IS EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET, BY RATED CAPACITY, DURING THE FORECAST PERIOD

FIGURE 9 R410A SEGMENT IS EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET, BY REFRIGERANT TYPE, DURING THE FORECAST PERIOD

FIGURE 10 RESIDENTIAL SEGMENT IS EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET, BY END USER, DURING THE FORECAST PERIOD

FIGURE 11 ASIA PACIFIC DOMINATED THE MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 12 ENVIRONMENT-FRIENDLY HEATING TECHNOLOGY AND FAVORABLE GOVERNMENT INCENTIVES ARE EXPECTED TO DRIVE THE MARKET FROM 2020 TO 2026

4.2 MARKET, BY REGION

FIGURE 13 ASIA PACIFIC MARKET IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET, BY TYPE

FIGURE 14 AIR SOURCE SEGMENT DOMINATED THE MARKET, BY TYPE, IN 2019

4.4 MARKET, BY STORAGE TANK CAPACITY

FIGURE 15 UP TO 500 LITERS SEGMENT DOMINATED THE MARKET, BY STORAGE TANK CAPACITY, IN 2019

4.5 MARKET, BY RATED CAPACITY

FIGURE 16 10–20 KW SEGMENT DOMINATED THE MARKET, BY RATED POWER, IN 2019

4.6 MARKET, BY REFRIGERANT TYPE

FIGURE 17 R410A SEGMENT DOMINATED THE MARKET, BY REFRIGERANT TYPE, IN 2019

4.7 MARKET, BY END USER

FIGURE 18 RESIDENTIAL SEGMENT DOMINATED THE MARKET, BY END USER, IN 2019

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Reduction in CO2 emissions

5.2.1.2 Governmental incentives and regulations to enhance energy efficiency

TABLE 4 LATEST POLICIES/INCENTIVES

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness regarding benefits of heat pump water heaters in developing and underdeveloped countries

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of IoT with heat pump water heaters

5.2.3.2 Positive outlook toward use of geothermal energy

5.2.4 CHALLENGES

5.2.4.1 High installation costs

5.2.4.2 COVID-19 impact

6 WATER HEATER HEAT PUMP MARKET, BY TYPE (Page No. - 65)

6.1 INTRODUCTION

6.2 INSIGHTS OF INDUSTRY EXPERTS

FIGURE 20 WATER HEATER HEAT PUMP MARKET, BY TYPE, 2019

TABLE 5 MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

6.3 AIR SOURCE

6.3.1 LOW INSTALLATION COST IS BOOSTING DEMAND FOR AIR SOURCE HEAT PUMPS

TABLE 6 AIR SOURCE MARKET, BY REGION, 2016–2026 (USD THOUSAND)

6.4 GEOTHERMAL HEAT PUMP

6.4.1 HIGH EFFICIENCY AND GOVERNMENT SUBSIDIES ARE EXPECTED TO DRIVE THE MARKET FOR GEOTHERMAL HEAT PUMPS

TABLE 7 GEOTHERMAL MARKET, BY REGION, 2016–2026 (USD THOUSAND)

7 HEAT PUMP WATER HEATER MARKET, BY RATED CAPACITY (Page No. - 69)

7.1 INTRODUCTION

7.2 INSIGHTS OF INDUSTRY EXPERTS

FIGURE 21 MARKET, BY RATED CAPACITY, 2019

TABLE 8 MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

7.3 UP TO 10 KW

7.3.1 SUITABILITY FOR SINGLE-FAMILY HOUSES IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 9 UP TO 10 KW: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

7.4 10–20 KW

7.4.1 GROWING DEMAND FROM RESIDENTIAL SECTOR IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 10 10–20 KW: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

7.5 20–30 KW

7.5.1 ABILITY TO MEET HEATING DEMAND OF COMMERCIAL SECTOR IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 11 20–30 KW: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

7.6 30–100 KW

7.6.1 DEMAND FROM SMALL AND MEDIUM-SIZED COMMERCIAL BUILDINGS IS EXPECTED TO DRIVE THE MARKET

TABLE 12 30–100 KW: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

7.7 100–150 KW

7.7.1 HEATING DEMAND OF LARGE COMMERCIAL OPERATORS AND GOVERNMENT INITIATIVES ARE EXPECTED TO DRIVE THE MARKET

TABLE 13 100–150 KW: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

7.8 ABOVE 150 KW

7.8.1 HIGH-VOLUME HOT WATER DEMAND IN INDUSTRIES IS DRIVING THE MARKET

TABLE 14 ABOVE 150 KW: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

8 WATER HEATER HEAT PUMP MARKET, BY REFRIGERANT TYPE (Page No. - 76)

8.1 INTRODUCTION

8.2 INSIGHTS OF INDUSTRY EXPERTS

FIGURE 22 WATER HEATER HEAT PUMP MARKET, BY REFRIGERANT TYPE, 2019

TABLE 15 WATER HEATER HEAT PUMP MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

8.3 R410A

8.3.1 NO CONTRIBUTION TO OZONE DEPLETION IS EXPECTED TO DRIVE THE MARKET FOR THE R410 SEGMENT

TABLE 16 R410A: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

8.4 R407C

8.4.1 HIGHER TEMPERATURE OPERATIONS IS EXPECTED TO DRIVE THE MARKET FOR THIS SEGMENT

TABLE 17 R407C: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

8.5 R744

8.5.1 ECO-FRIENDLY OPERATIONAL CHARACTERISTIC IS EXPECTED TO DRIVE THE MARKET FOR R744 SEGMENT

TABLE 18 R744: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

8.6 OTHERS

TABLE 19 OTHERS: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

9 HEAT PUMP WATER HEATER MARKET, BY STORAGE TANK CAPACITY (Page No. - 81)

9.1 INTRODUCTION

9.2 INSIGHTS OF INDUSTRY EXPERTS

FIGURE 23 MARKET, BY STORAGE TANK CAPACITY, 2019

TABLE 20 MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

9.3 UP TO 500 LITERS

9.3.1 GOVERNMENT SUBSIDIES FOR RESIDENTIAL HEAT PUMPS ARE DRIVING THE MARKET

TABLE 21 UP TO 500 LITERS: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

9.4 500–1,000 LITERS

9.4.1 ABILITY TO PROVIDE HEATING TO SMALL COMMERCIAL INDUSTRIES IS DRIVING THE MARKET

TABLE 22 500–1,000 LITERS: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

9.5 ABOVE 1,000 LITERS

9.5.1 NEED TO REPLACE CONVENTIONAL HEATING TECHNOLOGIES WITH ENERGY-EFFICIENT SOURCE IS EXPECTED TO DRIVE THE SEGMENT

TABLE 23 ABOVE 1,000 LITERS: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

10 WATER HEATER HEAT PUMP MARKET, BY END USER (Page No. - 86)

10.1 INTRODUCTION

10.2 INSIGHTS OF INDUSTRY EXPERTS

FIGURE 24 WATER HEATER HEAT PUMP MARKET, BY END USER, 2019

TABLE 24 WATER HEATER HEAT PUMP MARKET, BY END USER, 2016–2026 (USD THOUSAND)

10.3 RESIDENTIAL

10.3.1 GOVERNMENT INITIATIVES FOR ENERGY EFFICIENCY ARE LIKELY TO BOOST DEMAND FOR WATER HEATER HEAT PUMPS

TABLE 25 RESIDENTIAL: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

10.4 COMMERCIAL

10.4.1 NEED TO ADOPT RENEWABLE ENERGY SOURCES FOR COMMERCIAL OPERATIONS IS DRIVING THE MARKET

TABLE 26 COMMERCIAL: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

10.5 INDUSTRIAL

10.5.1 WATER HEATER HEAT PUMPS ENHANCE ENERGY EFFICIENCY IN MULTIPLE INDUSTRIAL APPLICATIONS

TABLE 27 INDUSTRIAL: MARKET, BY REGION, 2016–2026 (USD THOUSAND)

11 HEAT PUMP WATER HEATER MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

FIGURE 25 REGIONAL SNAPSHOT: ASIA PACIFIC MARKET IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 26 MARKET SHARE, BY REGION, 2019

11.1.1 GLOBAL MARKET, BY REGION

TABLE 28 MARKET, BY REGION, 2020–2026 (USD THOUSAND)

11.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: REGIONAL SNAPSHOT (2019)

11.2.1 DISTRIBUTION CHANNEL ANALYSIS

11.2.2 IMPORT AND EXPORT DATA

TABLE 29 NORTH AMERICA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.2.3 BY TYPE

TABLE 30 NORTH AMERICA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.2.4 BY STORAGE TANK CAPACITY

TABLE 31 NORTH AMERICA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.2.5 BY RATED CAPACITY

TABLE 32 NORTH AMERICA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.2.6 BY REFRIGERANT TYPE

TABLE 33 NORTH AMERICA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.2.7 BY END USER

TABLE 34 NORTH AMERICA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.2.8 BY COUNTRY

TABLE 35 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2026 (USD THOUSAND)

11.2.9 US

11.2.9.1 Increasing demand for energy-efficient heating of water in residential and commercial sectors is driving the market

11.2.9.2 General Market Trends

TABLE 36 US: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.2.9.3 Average selling price, 2019

FIGURE 28 US: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.2.9.4 Key manufacturers, 2019

TABLE 37 US: KEY PLAYERS IN MARKET, 2019

11.2.9.5 Key distributors, 2019

TABLE 38 US: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.2.9.6 Key consultants, 2019

TABLE 39 US: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS. 2019

11.2.9.7 Import and Export data

TABLE 40 US: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.2.9.8 By type

TABLE 41 US: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.2.9.9 By storage tank capacity

TABLE 42 US: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.2.9.10 By rated capacity

TABLE 43 US: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.2.9.11 By refrigerant type

TABLE 44 US: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.2.9.12 By End User

TABLE 45 US: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.2.10 CANADA

11.2.10.1 Government regulations and policies to reduce pollution will enhance demand for heat pump water heaters

11.2.10.2 General market trends, 2019

TABLE 46 CANADA: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.2.10.3 Average selling price, 2019

FIGURE 29 CANADA: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.2.10.4 Key players, 2019

TABLE 47 CANADA: KEY PLAYERS IN MARKET, 2019

11.2.10.5 Key distrbutors, 2019

TABLE 48 CANADA: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.2.10.6 Key consultants, 2019

TABLE 49 CANADA: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.2.10.7 Import and export data

TABLE 50 CANADA: IMPORT & EXPORT DATA FOR MARKET, 2016-2019 (USD THOUSAND)

11.2.10.8 By type

TABLE 51 CANADA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.2.10.9 By storage tank capacity

TABLE 52 CANADA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.2.10.10 By rated capacity

TABLE 53 CANADA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.2.10.11 By refrigerant type

TABLE 54 CANADA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.2.10.12 By End User

TABLE 55 CANADA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.2.11 MEXICO

11.2.11.1 Growing Initiatives for the renewable sector will boost the demand for heat pump water heaters

11.2.11.2 general market trents, 2019

TABLE 56 MEXICO: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.2.11.3 Average selling price, 2019

FIGURE 30 MEXICO: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.2.11.4 Key players, 2019

TABLE 57 MEXICO: KEY PLAYERS IN MARKET, 2019

11.2.11.5 Key distributors, 2019

TABLE 58 MEXICO: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.2.11.6 Key consultants, 2019

TABLE 59 MEXICO: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.2.11.7 Import and export data

TABLE 60 MEXICO: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.2.11.8 By type

TABLE 61 MEXICO: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.2.11.9 By storage tank capacity

TABLE 62 MEXICO: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.2.11.10 By rated capacity

TABLE 63 MEXICO: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.2.11.11 By refrigerant type

TABLE 64 MEXICO: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.2.11.12 By End User

TABLE 65 MEXICO: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.3 EUROPE

11.3.1 DISTRIBUTION CHANNEL ANALYSIS

11.3.2 IMPORT AND EXPORT

TABLE 66 EUROPE: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.3.3 BY TYPE

TABLE 67 EUROPE: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.3.4 BY STORAGE TANK CAPACITY

TABLE 68 EUROPE: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.3.5 BY RATED CAPACITY

TABLE 69 EUROPE: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.3.6 BY REFRIGERANT TYPE

TABLE 70 EUROPE: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.3.7 BY END USER

TABLE 71 EUROPE: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.3.8 BY COUNTRY

TABLE 72 EUROPE: MARKET, BY COUNTRY, 2016–2026 (USD THOUSAND)

11.3.9 UK

11.3.9.1 Growth in the private housing and demand for renewable heat generation are driving the market

11.3.9.2 General market trends, 2019

TABLE 73 UK: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.3.9.3 Average selling price, 2019

FIGURE 31 UK: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.3.9.4 Key players, 2019

TABLE 74 UK: KEY PLAYERS IN MARKET, 2019

11.3.9.5 Key distributors, 2019

TABLE 75 UK: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.3.9.6 Key consultants, 2019

TABLE 76 UK: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.3.9.7 Import and export data

TABLE 77 UK: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.3.9.8 By type

TABLE 78 UK: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.3.9.9 By storage tank capacity

TABLE 79 UK: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.3.9.10 By rated capacity

TABLE 80 UK: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.3.9.11 By refrigerant type

TABLE 81 UK: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.3.9.12 By End User

TABLE 82 UK: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.3.10 ITALY

11.3.10.1 Government schemes to enhance the installation of heat pump water heaters will positively impact the market

11.3.10.2 General market trends, 2019

TABLE 83 ITALY: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.3.10.3 Average selling price, 2019

FIGURE 32 ITALY: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.3.10.4 Key players, 2019

TABLE 84 ITALY: KEY PLAYERS IN MARKET, 2019

11.3.10.5 key distributors, 2019

TABLE 85 ITALY: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.3.10.6 Key consultants, 2019

TABLE 86 ITALY: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.3.10.7 Import and export data

TABLE 87 ITALY: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.3.10.8 By type

TABLE 88 ITALY: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.3.10.9 By storage capacity

TABLE 89 ITALY: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.3.10.10 By rated capacity

TABLE 90 ITALY: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.3.10.11 By refrigerant type

TABLE 91 ITALY: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.3.10.12 By End User

TABLE 92 ITALY: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: REGIONAL SNAPSHOT (2019)

11.4.1 DISTRIBUTION CHANNEL ANALYSIS

11.4.2 IMPORT AND EXPORT

TABLE 93 ASIA PACIFIC: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.3 BY TYPE

TABLE 94 ASIA PACIFIC: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.4 BY STORAGE TANK CAPACITY

TABLE 95 ASIA PACIFIC: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.5 BY RATED CAPACITY

TABLE 96 ASIA PACIFIC: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.6 BY REFRIGERANT TYPE

TABLE 97 ASIA PACIFIC: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.7 BY END USER

TABLE 98 ASIA PACIFIC: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.8 BY COUNTRY

TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2026 (USD THOUSAND)

11.4.9 INDIA

11.4.9.1 Government initiatives towards renewables are expected to drive the market in the country

11.4.9.2 By general market trends, 2019

TABLE 100 INDIA: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.9.3 Average selling price, 2019

FIGURE 34 INDIA: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.9.4 Key players, 2019

TABLE 101 INDIA: KEY PLAYERS IN MARKET, 2019

11.4.9.5 Key distributor, 2019

TABLE 102 INDIA: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.9.6 Key consultants, 2019

TABLE 103 INDIA: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.9.7 Import and export data

TABLE 104 INDIA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.9.8 By type

TABLE 105 INDIA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.9.9 By storage tank capacity

TABLE 106 INDIA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.9.10 By rated capacity

TABLE 107 INDIA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.9.11 By refrigerant type

TABLE 108 INDIA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.9.12 By End User

TABLE 109 INDIA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.10 CHINA

11.4.10.1 Growing urban population and initiatives to minimize pollution will create demand for heat pump water heaters

11.4.10.2 General market trends, 2019

TABLE 110 CHINA: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.10.3 Average selling price, 2019

FIGURE 35 CHINA: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.10.4 Key players, 2019

TABLE 111 CHINA: KEY PLAYERS IN MARKET, 2019

11.4.10.5 Key distributors, 2019

TABLE 112 CHINA: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.10.6 Key consultants, 2019

TABLE 113 CHINA: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.10.7 Import and export data

TABLE 114 CHINA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.10.8 By type

TABLE 115 CHINA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.10.9 By storage tank capacity

TABLE 116 CHINA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.10.10 By rated capacity

TABLE 117 CHINA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.10.11 By refrigerant type

TABLE 118 CHINA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.10.12 By End User

TABLE 119 CHINA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.11 AUSTRALIA

11.4.11.1 Favorable environmental conditions and focus toward the renewable sector are expected to drive the market

11.4.11.2 General market trends, 2019

TABLE 120 AUSTRALIA: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.11.3 Average selling price, 2019

FIGURE 36 AUSTRALIA: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.11.4 Key players, 2019

TABLE 121 AUSTRALIA: KEY PLAYERS IN MARKET, 2019

11.4.11.5 Key distributors, 2019

TABLE 122 AUSTRALIA: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.11.6 Key consultants, 2019

TABLE 123 AUSTRALIA: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.11.7 Import and export data

TABLE 124 AUSTRALIA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.11.8 By type

TABLE 125 AUSTRALIA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.11.9 By storage tank capacity

TABLE 126 AUSTRALIA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.11.10 By rated capacity

TABLE 127 AUSTRALIA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.11.11 By refrigerant type

TABLE 128 AUSTRALIA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.11.12 By End User

TABLE 129 AUSTRALIA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.12 THAILAND

11.4.12.1 Government initiatives to encourage the installation of heat pump water heaters will drive the market

11.4.12.2 General market trends, 2019

TABLE 130 THAILAND: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.12.3 Average selling price, 2019

FIGURE 37 THAILAND: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.12.4 Key players, 2019

TABLE 131 THAILAND: KEY PLAYERS IN MARKET, 2019

11.4.12.5 Key distributors, 2019

TABLE 132 THAILAND: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.12.6 Key consultants, 2019

TABLE 133 THAILAND: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.12.7 Import and export data

TABLE 134 THAILAND: IMPORT & EXPORT DATA FOR MARKET, 2016–2019

11.4.12.8 By type

TABLE 135 THAILAND: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.12.9 By storage tank capacity

TABLE 136 THAILAND: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.12.10 By rated capacity

TABLE 137 THAILAND: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.12.11 By refrigerant type

TABLE 138 THAILAND: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.12.12 By End User

TABLE 139 THAILAND: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.13 NEW ZEALAND

11.4.13.1 Government initiatives for residential and commercial sector heat pump operations are expected to boost the market

11.4.13.2 General market trends, 2019

TABLE 140 NEW ZEALAND: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.13.3 Average selling price, 2019

FIGURE 38 NEW ZEALAND: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.13.4 Key players, 2019

TABLE 141 NEW ZEALAND: KEY PLAYERS IN MARKET, 2019

11.4.13.5 Key distributors, 2019

TABLE 142 NEW ZEALAND: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.13.6 Key consultants, 2019

TABLE 143 NEW ZEALAND: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.13.7 Import and export data

TABLE 144 NEW ZEALAND: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.13.8 By type

TABLE 145 NEW ZEALAND: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.13.9 By storage tank capacity

TABLE 146 NEW ZEALAND: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.13.10 By rated capacity

TABLE 147 NEW ZEALAND: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.13.11 By refrigerant type

TABLE 148 NEW ZEALAND: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.13.12 By End User

TABLE 149 NEW ZEALAND: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.14 SINGAPORE

11.4.14.1 Growing demand for energy efficiency is expected to propel the market of heat pump water heaters

11.4.14.2 General market trends, 2019

TABLE 150 SINGAPORE: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.14.3 Average selling price, 2019

FIGURE 39 SINGAPORE: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.14.4 Key players, 2019

TABLE 151 SINGAPORE: KEY PLAYERS IN MARKET, 2019

11.4.14.5 Key distributors, 2019

TABLE 152 SINGAPORE: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.14.6 Key consultants, 2019

TABLE 153 SINGAPORE: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.14.7 Import and export data

TABLE 154 SINGAPORE: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.14.8 By type

TABLE 155 SINGAPORE: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.14.9 By storage tank capacity

TABLE 156 SINGAPORE: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.14.10 By rated capacity

TABLE 157 SINGAPORE: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.14.11 By refrigerant type

TABLE 158 SINGAPORE: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.14.12 By End User

TABLE 159 SINGAPORE: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.15 INDONESIA

11.4.15.1 Extensive focus toward the consumption of renewable energy will drive the demand for heat pump water heaters

11.4.15.2 General market trends, 2019

TABLE 160 INDONESIA: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.15.3 Average selling price, 2019

FIGURE 40 INDONESIA: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.15.4 Key players, 2019

TABLE 161 INDONESIA: KEY PLAYERS IN MARKET, 2019

11.4.15.5 Key distributors, 2019

TABLE 162 INDONESIA: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.15.6 Key consultants, 2019

TABLE 163 INDONESIA: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.15.7 Import and export data

TABLE 164 INDONESIA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.15.8 By type

TABLE 165 INDONESIA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.15.9 By storage tank capacity

TABLE 166 INDONESIA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.15.10 By rated capacity

TABLE 167 INDONESIA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.15.11 By refrigerant type

TABLE 168 INDONESIA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.15.12 By End User

TABLE 169 INDONESIA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.16 TAIWAN

11.4.16.1 Government initiatives for energy efficiency will boost the market for heat pump water heaters

11.4.16.2 General market trends, 2019

TABLE 170 TAIWAN: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.16.3 Average selling price, 2019

FIGURE 41 TAIWAN: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.16.4 Key players, 2019

TABLE 171 TAIWAN: KEY PLAYERS IN MARKET, 2019

11.4.16.5 Key distributors and consultants, 2019

TABLE 172 TAIWAN: KEY DISTRIBUTORS AND CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.16.6 By type

TABLE 173 TAIWAN: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.16.7 By storage tank capacity

TABLE 174 TAIWAN: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.16.8 By rated capacity

TABLE 175 TAIWAN: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.16.9 By refrigerant type

TABLE 176 TAIWAN: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.16.10 By End User

TABLE 177 TAIWAN: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.4.17 MALAYSIA

11.4.17.1 Government’s focus on increasing renewable energy generation is expected to increase the demand for heat pump water heaters

11.4.17.2 General market trends, 2019

TABLE 178 MALAYSIA: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.4.17.3 Average selling price, 2019

FIGURE 42 MALAYSIA: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.4.17.4 Key players, 2019

TABLE 179 MALAYSIA: KEY PLAYERS IN MARKET, 2019

11.4.17.5 Key distributors, 2019

TABLE 180 MALAYSIA: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.4.17.6 Key consultants, 2019

TABLE 181 MALAYSIA: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.4.17.7 Import and export data

TABLE 182 MALAYSIA: IMPORT & EXPORT DATA FOR MARKET, 2016–2019 (USD THOUSAND)

11.4.17.8 By type

TABLE 183 MALAYSIA: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.4.17.9 By storage tank capacity

TABLE 184 MALAYSIA: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.4.17.10 By rated capacity

TABLE 185 MALAYSIA: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.4.17.11 By refrigerant type

TABLE 186 MALAYSIA: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.4.17.12 By End User

TABLE 187 MALAYSIA: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.1.1 Government policies for energy efficiency and growth in the renewable sector will propel the market

11.5.1.2 General market trends, 2019

TABLE 188 BRAZIL: GENERAL MARKET TRENDS FOR HEAT PUMP WATER HEATERS, 2019

11.5.1.3 Average selling price, 2019

FIGURE 43 BRAZIL: AVERAGE SELLING PRICE OF HEAT PUMP WATER HEATERS, 2019

11.5.1.4 Key players, 2019

TABLE 189 BRAZIL: KEY PLAYERS IN MARKET, 2019

TABLE 190 BRAZIL: KEY DISTRIBUTORS OF HEAT PUMP WATER HEATERS, 2019

11.5.1.5 Key distributors, 2019

11.5.1.6 Key consultants, 2019

TABLE 191 BRAZIL: KEY CONSULTANTS FOR HEAT PUMP WATER HEATERS, 2019

11.5.1.7 Distribution channel analysis

11.5.2 EXPORT AND IMPORT

TABLE 192 BRAZIL: IMPORT & EXPORT DATA FOR HEAT PUMP WATER HEATERS, 2016–2019 (USD THOUSAND)

11.5.3 BY TYPE

TABLE 193 BRAZIL: MARKET, BY TYPE, 2016–2026 (USD THOUSAND)

11.5.4 BY CAPACITY

TABLE 194 BRAZIL: MARKET, BY STORAGE TANK CAPACITY, 2016–2026 (USD THOUSAND)

11.5.5 BY RATED POWER

TABLE 195 BRAZIL: MARKET, BY RATED CAPACITY, 2016–2026 (USD THOUSAND)

11.5.6 BY REFRIGERANT TYPE

TABLE 196 BRAZIL: MARKET, BY REFRIGERANT TYPE, 2016–2026 (USD THOUSAND)

11.5.7 BY END USER

TABLE 197 BRAZIL: MARKET, BY END USER, 2016–2026 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 189)

12.1 OVERVIEW

FIGURE 44 KEY DEVELOPMENTS IN THE HEAT PUMP WATER HEATER MARKET, JANUARY 2016–JULY 2020

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 STAR

12.2.2 EMERGING LEADER

12.2.3 PERVASIVE

12.2.4 PARTICIPANTS

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING

12.3 MARKET SHARE, 2019

FIGURE 46 MIDEA GROUP LED THE MARKET IN 2019

12.4 COMPETITIVE SCENARIO

12.4.1 NEW PRODUCT LAUNCHES

12.4.2 MERGERS & ACQUISITIONS

12.4.3 CONTRACTS & AGREEMENTS

12.4.4 INVESTMENTS & EXPANSIONS

12.4.5 OTHERS

13 COMPANY PROFILES (Page No. - 199)

(Business overview, Products/Solutions/Services Offered, Recent Developments, COVID-19-Related Developments, MNM view)*

13.1 PANASONIC CORPORATION

TABLE 198 PANASONIC CORPORATION: OFFICES AND MANUFACTURING LOCATIONS

FIGURE 47 PANASONIC C0RPORATION: COMPANY SNAPSHOT

13.2 LG ELECTRONICS

FIGURE 48 LG ELECTRONICS: COMPANY SNAPSHOT

13.3 JOHNSON CONTROLS-HITACHI AIR CONDITIONING

13.4 MITSUBISHI ELECTRIC

TABLE 199 MITSUBISHI ELECTRIC: OFFICES AND MANUFACTURING LOCATIONS

FIGURE 49 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

13.5 INGERSOLL RAND (TRANE TECHNOLOGIES)

FIGURE 50 INGERSOLL RAND (TRANE TECHNOLOGIES): COMPANY SNAPSHOT

13.6 FUJITSU GENERAL

TABLE 200 FUJITSU GENERAL: OFFICES AND MANUFACTURING LOCATIONS

FIGURE 51 FUJITSU GENERAL: COMPANY SNAPSHOT

13.7 LENNOX INTERNATIONAL

TABLE 201 US AND CANADA SALES OFFICE LOCATIONS

FIGURE 52 LENNOX INTERNATIONAL: COMPANY SNAPSHOT

13.8 HAIER

FIGURE 53 HAIER: COMPANY SNAPSHOT

13.9 UNITED TECHNOLOGIES CORPORATION (CARRIER GLOBAL)

FIGURE 54 UNITED TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

13.10 RHEEM MANUFACTURING COMPANY

13.11 A.O. SMITH CORPORATION

TABLE 202 A.O. SMITH CORPORATION: OFFICES AND MANUFACTURING LOCATIONS

FIGURE 55 A. O. SMITH CORPORATION: COMPANY SNAPSHOT

13.12 BOSCH INDUSTRIES

FIGURE 56 BOSCH INDUSTRIES: COMPANY SNAPSHOT

13.13 VAILLANT GROUP

13.14 MIDEA GROUP

13.15 DAIKIN

TABLE 203 DAIKIN: OFFICES AND MANUFACTURING LOCATIONS

FIGURE 57 DAIKIN: COMPANY SNAPSHOT

13.16 VIESSMANN GROUP

13.17 STIEBEL ELTRON

13.18 GLEN DIMPLEX

13.19 NIBE ENERGY SYSTEMS

13.20 GREE ELECTRIC APPLIANCES

13.21 EMERSON

13.22 NORTEK GLOBAL HVAC

13.23 GUANGZHOU SPRSUN NEW ENERGY TECHNOLOGY DEVELOPMENT

13.24 ARISTON THERMO

13.25 EVO ENERGY TECHNOLOGIES

*Details on Business overview, Products/Solutions/Services Offered, Recent Developments, COVID-19-Related Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 254)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

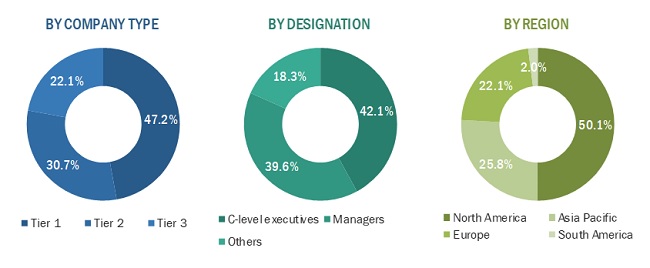

This study involved four major activities in estimating the current market size for heat pump water heaters. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global heat pump water heaters market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The heat pump water heater market comprises several stakeholders, such as service providers, contractors, and third-party vendors. The demand side of this market is characterized by the huge demand for digitalization from operators/service providers. Advancements in new technology in heat pump water heaters characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following—

To know about the assumptions considered for the study, download the pdf brochure

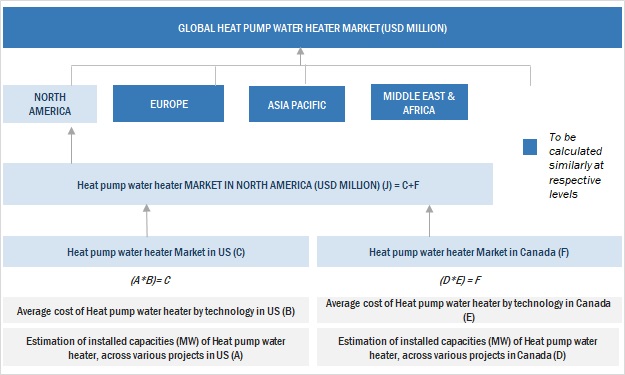

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global heat pump water heater market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the resective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global heat pump water heaters market by type, by storage tank capacity, by rated capacity, by refrigerant,, by end user and region

- To provide detailed information on the major factors influencing the growth of the heat pump water heater market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the heat pump water heaters market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the heat pump water heaters market with respect to the major regions (Asia Pacific, Europe, North America, and South America)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and partnerships in the heat pump water heater market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Heat Pump Water Heater Market