Heavy Construction Equipment Market by Type (Earthmoving, Material Handling, Heavy Construction Vehicles), End-Use Industry (Construction & Manufacturing, Public Work & Rail Road, Mining), Application, and Region - Global Forecast to 2021

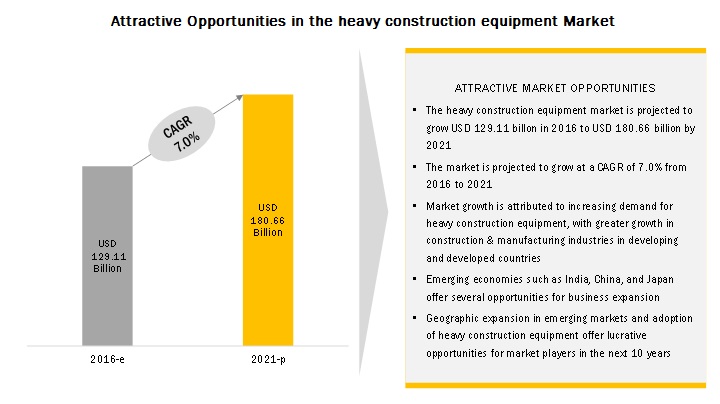

The heavy construction equipment market is projected to reach USD 180.66 billion by 2021, at a CAGR of 7.0%. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021. The heavy construction equipment market is gaining momentum in the modern construction industry due to factors such as geographical expansion in emerging markets and adoption of heavy construction equipment offers lucrative opportunities for market player in the next 10 years. Other factors driving the heavy construction equipment market are rapid urbanization and increase in investments in the construction and manufacturing industry.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

“The excavation & demolition segment, by application, held a considerably larger market share in the heavy construction equipment market”

The excavation & demolition segment, by application, is estimated to dominate the heavy construction equipment market and is projected to be the fastest-growing segment during the forecast period. The CAGR for this segment is projected to grow at a higher rate over the next five years, owing to the increase in mining activities of precious minerals and metals across the globe and increase in natural calamities where excavators are used in rescue operations.

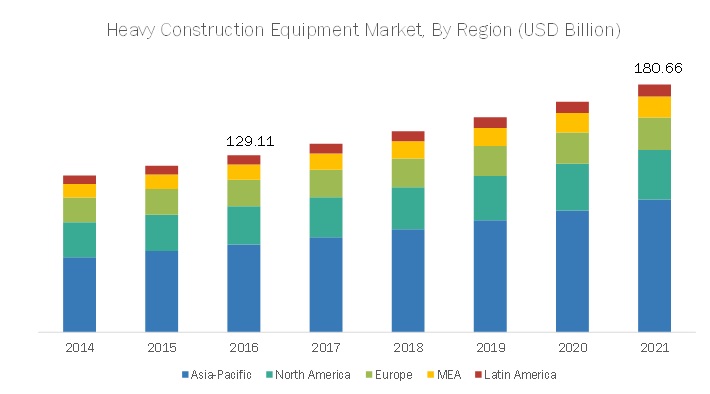

“Asia-Pacific is expected to witness a steady growth during the forecast period”

In 2015, Asia-Pacific accounted for a larger market share of the total heavy construction equipment market, in terms of value, followed by the Middle East & Africa. The European market is projected to grow at a comparatively lower rate than other regions as a result of weak construction demand in the region due to sub-performing economic condition. Asia-Pacific is projected to register the highest growth from 2016 to 2021, while India is projected to be fastest-growing country-level market in the region for the heavy construction equipment market. The Middle-East & Africa region is projected to grow at the second-highest CAGR between 2016 and 2021, with South Africa registering the highest growth rate in the region.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Heavy Construction Equipment Market Dynamics

Driver: Increasing investment in the construction industry

The demand for heavy construction equipment is fueled by the increasing investment in construction activities. For instance, China is expected to invest USD 13.1 billion for the development and construction of the Beijing International Airport, which is designed to handle about 45 million people annually from 2019 to 2025 as stated by the spokesperson of Beijing New Airport Construction Headquarters. Likewise, an 81-story 480m super tower, Vincom Landmark-81 Tall Tower, is under construction in Ho Chi Minh City of Vietnam, which is set for completion in 2017. Governments around the world are pumping money to create demand for goods & services by producing jobs through higher spending in physical and social infrastructure. The 2020 Olympics to be held in Tokyo (Japan) and the 2022 FIFA World Cup to be held in Qatar are fueling construction spending in the Asian and Middles Eastern regions. Qatar’s local organization plans to build nine new stadiums and renovate three existing stadiums for the event. Spending on such capital-intensive projects and infrastructure is expected to continue to grow significantly in the next decade, thus driving growth of the heavy construction equipment market

Restraint: Stringent government regulations

One of the major obstacles faced by heavy construction equipment players is region-specific government regulations. For a company to start heavy construction, it needs to undergo a lengthy and rigorous process of obtaining a permit after various required checks.

For instance, since the construction industry uses more diesel engines than any other industry, in order to meet EU emissions regulations, proper baseline data is collected to adequately characterize the environmental condition of the area. Surveys are carried out related to cultural and historical resources, soil, vegetation, wildlife, surface & groundwater hydrology, climatology, and wetlands. After the permit is prepared and submitted to the regulatory agency, it goes through completeness and technical reviews.

Companies are required to adhere to the following Acts/Regulations to perform heavy construction activities:

- National Environmental Policy Act (1970)

- Federal Land Policy and Management Act (1976)

- Clean Air Act (1963)

- Federal Water Pollution Control Act (1972)

- Toxic Substance Control Act (1976)

Such lengthy, time-consuming, and often varying regulations act as a restraint to the heavy construction equipment market.

Opportunity: Renting or leasing of equipment

Renting or leasing of heavy construction equipment is considered beneficial to construction contract companies, as it fulfils the client’s requirement of the equipment without paying its entire cost. One of the advantages associated with renting/leasing is that this can be according to the user’s preference, their specific equipment needs, and revenue expectation. Renting/leasing of heavy construction equipment depends on factors such as the duration of use of the asset, changes in technologies over the period of time it is to be used, and tax benefits involved in leasing/renting of equipment. Due to such factors, contractors find it more economical to rent rather than buy, unless the equipment can be utilized for more than 75% of the year. By leasing, contractors are also able to access more and different types of equipment while utilizing the best technology available. Thus, this serves as an opportunity for players in the heavy construction equipment market to use the machinery without having to bear the purchase costs.

Challenge: Lack of skilled labor force, and maintenance & repair-related issues

Maintenance, Repair, and Operation (MRO) involves performing routine activities to keep the machinery in working order. High costs are involved in the maintenance and repair of heavy equipment. Preventive maintenance is necessary to prevent breakdown, with minor work such as tire inspection, vehicle or lube job inspection, being performed regularly for this. Corrective maintenance is carried out after breakdown of the equipment. To operate such heavy equipment, a highly skilled labor force is required. In developing countries such as India, such skilled labor force is limited, which leads to the requirement of intensive training of the workforce, resulting in higher costs and posing a challenge for market growth.

Heavy Construction Equipment Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2014-2021 |

|

Base year considered |

2015 |

|

Forecast period |

2016-2021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

By Type, End-Use Industry, Application & Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and South America |

|

Companies covered |

Caterpillar Inc. (U.S.), Liebherr AG (Switzerland), Terex (U.S.), Volvo Construction Equipment AB (Sweden), Komatsu (Japan), Doosan Infracoe (South Korea), Hitachi Machinery Construction (Japan), JCB (U.K.), Sany (China), and CNH (U.K.) and others |

The research report segments the heavy construction equipment market into the following submarkets:

By type:

- Earth moving equipment

- Material handling Equipement

- Heavy construction vehicles

- Others( Pavers/Asphalt Finishers/Compactors and Road Rollers)

By application:

- Excavation & demolition

- Heavy lifting

- Material Handling

- Tunneling

- Transportation

- Recycling & waste management

By end-use sector:

- Construction & manufacturing

- Oil & gas

- Public works & rail road

- Infrastructure

- Mining

- Forestry & agriculture

- Others

By region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Key Heavy Construction Equipment Market Players

Caterpillar Inc. (U.S.), Liebherr AG (Switzerland), Terex (U.S.), Volvo Construction Equipment AB (Sweden), Komatsu (Japan), Doosan Infracoe (South Korea), Hitachi Machinery Construction (Japan), JCB (U.K.), Sany (China), and CNH (U.K.) and others

Recent Developments in Heavy Construction Equipment Market

- In June 2014, Volvo acquired the hauler business of Terex Corporation (U.S.) on a debt-free basis for USD 160 million. This deal included takeover of the production facility in Motherwell, Scotland, which offer articulated and rigid haulers.

- In June 2016, Caterpillar Inc.- New Cat 816K landfill compactor was built on the established performance, durability, and reliability that the model 816 has demonstrated since 1972. The new K Series model, designed with heavy-duty main structures that supported multiple life cycles, featured a fuel-efficient Cat C7.1 ACERT engine, single-lever steering, pressurized cab, and wheel/tip options that provided extended service life. Available Cat COMPACT Technologies, such as Compaction Control, further enhanced compaction performance and consistency by providing accurate compaction values and 3D mapping.

- In August 2014, CNH Industrial N.V. invested USD 24 million to expand its business in Burlington, Iowa (U.S). The company also added a new crawler dozer product line to its new Iowa manufacturing plant.

- In June 2013, JCB invested about USD 70 million to start a production of six cylinder engines as an addition to its existing. Dieselmax 672 line-up. The new engines followed Stage II emission standards and were targeted for the Russian, Brazilian, and Chinese markets.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Heavy construction equipment market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

How big is the heavy construction equipment market industry?

The heavy construction equipment market is projected to grow from USD 129.1 billion in 2016 to USD 180.7 billion by 2021 at a CAGR of 7.0%.

Who leading market players in heavy construction equipment industry?

The major players in the heavy construction equipment market are Caterpillar Inc. (US), Liebherr AG (Switzerland), Terex Corporation (US), Volvo Construction Equipment AB (Sweden), and Komatsu Ltd. (Japan). These players have adopted several strategies such as mergers & acquisitions, expansions, new product launches, and partnerships to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for The Study

1.4 Currency

1.5 Units

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Emerging Economies Offer Attractive Opportunities in The Heavy Construction Equipment Market

4.2 Heavy Construction Equipment Market, By Machinery Type

4.3 Market, By Application

4.4 Market, By End-Use Industry

4.5 Asia Pacific: Heavy Construction Equipment Market By Machinery Type and Country

4.6 Market: Geographic Snapshot

5 Market Overview

5.1 Introduction

5.1.1 Evolution

5.2 Market Segmentation

5.2.1 By Machinery Type

5.2.2 By End-Use Industry

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Investments in The Construction Industry

5.3.1.2 Rapid Urbanization

5.3.1.3 Rising Demand from Developing Countries

5.3.1.4 Rapid Technology Advancement

5.3.2 Restraints

5.3.2.1 Stringent Government Regulations

5.3.2.2 Socio-Economic Effects of Heavy Construction Activities

5.3.3 Opportunities

5.3.3.1 Renting or Leasing of Equipment

5.3.3.2 Agreements & Contracts, Joint Ventures, and Mergers & Acquisitions

5.3.4 Challenges

5.3.4.1 High Cost of Equipment

5.3.4.2 Lack of Skilled Labor Force, and Maintenance & Repair-Related Issues

5.4 Macro Economic Indicator

5.4.1 Trends and Forecast of The Construction Industry and GDP

5.4.2 U.K. and Germany to Spend The Largest Amount for Growth of The Construction Industry, in Europe

5.4.3 China and India to Spend The Largest Amount for The Construction Industry in Asia-Pacific

5.4.4 Saudi Arabia to Spend The Largest Amount for Construction Industry in The Middle East & Africa

5.4.5 Brazil to Spend The Largest Amount for Construction Industry in Latin America

6 Heavy Construction Equipment Market, By Machinery Type

6.1 Introduction

6.1.1 Key Market Trend

6.1.2 Market Size and Forecast

6.2 Earthmoving Equipment

6.2.1 Key Market Trend

6.2.2 Market Size and Forecast

6.2.2.1 Excavators

6.2.2.1.1 Crawler Excavators

6.2.2.1.2 Mini Excavators

6.2.2.1.3 Wheeled Excavators

6.2.2.2 Loaders

6.2.2.2.1 Wheeled Loaders

6.2.2.2.2 Skid-Steer Loaders

6.2.2.3 Dozers

6.2.2.4 Motor Graders

6.2.2.5 Others

6.3 Material-Handling Equipment

6.3.1 Key Market Trend

6.3.2 Market Size and Forecast

6.3.2.1 Cranes

6.3.2.1 Telescopic Handlers

6.4 Heavy Construction Vehicle

6.4.1 Key Market Trend

6.4.2 Market Size and Forecast

6.4.2.1 Dumpers

6.4.2.1 Tippers

6.5 Other Heavy Construction Equipment

6.5.1 Key Market Trend

6.5.2 Market Size and Forecast

6.5.2.1 Compactors & Road Rollers

6.5.2.2 Pavers/Asphalt Finishers

6.5.2.3 Other

7 Heavy Construction Equipment Market, By Application

7.1 Introduction

7.1.1 Key Market Trend

7.1.2 Market Size and Forecast

7.2 Excavation & Demolition

7.3 Heavy Lifting

7.4 Material Handling

7.5 Tunneling

7.6 Transportation

7.7 Recycling & Waste Management

8 Heavy Construction Equipment Market, By End-Use Industry

8.1 Introduction

8.1.1 Key Market Trend

8.1.2 Market Size and Forecast

8.2 Construction & Manufacturing

8.3 Infrastructure

8.4 Oil & Gas

8.5 Public Work, Rail & Roads

8.6 Mining

8.7 Forestry & Agriculture)

8.8 Others

9 Heavy Construction Equipment Market, By Region

9.1 Introduction

9.1.1 Key Market Trend

9.1.2 Market Size and Forecast

9.2 North America

9.2.1 North America: Heavy Construction Equipment Market, By Country

9.2.2 North America: Market, By Machinery Type

9.2.3 North America: Market, By End-Use Industry

9.2.4 U.S.

9.2.4.1 U.S.: Heavy Construction Equipment Market, By Machinery Type

9.2.4.2 U.S.: Market, By End-Use Industry

9.2.5 Canada

9.2.5.1 Canada: Heavy Construction Equipment Market, By Machinery Type

9.2.5.2 Canada: Market, By End-Use Industry

9.2.6 Mexico

9.2.6.1 Mexico: Heavy Construction Equipment Market, By Machinery Type

9.2.6.2 Mexico: Market, By End-Use Industry

9.3 Europe

9.3.1 Europe: Heavy Construction Equipment Market, By Country

9.3.2 Europe: Market, By Machinery Type

9.3.3 Europe: Market, By End-Use Industry

9.3.4 Germany

9.3.4.1 Germany: Heavy Construction Equipment Market, By Machinery Type

9.3.4.2 Germany: Market, By End-Use Industry

9.3.5 U.K.

9.3.5.1 U.K.: Heavy Construction Equipment Market, By Machinery Type

9.3.5.2 U.K.: Market, By End-Use Industry

9.3.6 France

9.3.6.1 France: Heavy Construction Equipment Market, By Machinery Type

9.3.6.2 France: Market, By End-Use Industry

9.3.7 Russia

9.3.7.1 Russia: Heavy Construction Equipment Market, By Machinery Type

9.3.7.2 Russia: Market, By End-Use Industry

9.3.8 Rest of Europe

9.3.8.1 Rest of Europe: Heavy Construction Equipment Market, By Machinery Type

9.3.8.2 Rest of Europe: Market, By End-Use Industry

9.4 Asia-Pacific

9.4.1 Asia-Pacific: Heavy Construction Equipment Market, By Country

9.4.2 Asia-Pacific: Market, By Machinery Type

9.4.3 Asia-Pacific: Market, By End-Use Industry

9.4.4 China

9.4.4.1 China: Heavy Construction Equipment Market, By Machinery Type

9.4.4.2 China: Market, By End-Use Industry

9.4.5 Japan

9.4.5.1 Japan: Heavy Construction Equipment Market, By Machinery Type

9.4.5.2 Japan: Market, By End-Use Industry

9.4.6 India

9.4.6.1 India: Heavy Construction Equipment Market, By Machinery Type

9.4.6.2 India: Market, By End-Use Industry

9.4.7 Australia

9.4.7.1 Australia: Heavy Construction Equipment Market, By Machinery Type

9.4.7.2 Australia: Market, By End-Use Industry

9.4.8 Rest of Asia-Pacific

9.4.8.1 Rest of Asia-Pacific: Heavy Construction Equipment Market, By Machinery Type

9.4.8.2 Rest of Asia-Pacific: Market, By End-Use Industry

9.5 Middle East & Africa (Mea)

9.5.1 Middle East & Africa (MEA): Heavy Construction Equipment Market, By Country

9.5.2 Middle East & Africa (MEA): Market, By Machinery Type

9.5.3 Middle East & Africa (MEA): Market, By End-Use Industry

9.5.4 South Africa

9.5.4.1 South Africa: Heavy Construction Equipment Market, By Machinery Type

9.5.4.2 South Africa: Market, By End-Use Industry

9.5.5 Saudi Arabia

9.5.5.1 Saudi Arabia: Heavy Construction Equipment Market, By Machinery Type

9.5.5.2 Saudi Arabia: Market, By End-Use Industry

9.5.6 Qatar

9.5.6.1 Qatar: Heavy Construction Equipment Market, By Machinery Type

9.5.6.2 Qatar: Market, By End-Use Industry

9.5.7 UAE

9.5.7.1 UAE: Heavy Construction Equipment Market, By Machinery Type

9.5.7.2 UAE: Market, By End-Use Industry

9.5.8 Rest of Middle East & Africa

9.5.8.1 Rest of Middle East & Africa: Heavy Construction Equipment Market, By Machinery Type

9.5.8.2 Rest of Middle East & Africa: Market, By End-Use Industry

9.6 Latin America

9.6.1 Latin America: Heavy Construction Equipment Market, By Country

9.6.2 Latin America: Market, By Machinery Type

9.6.3 Latin America: Market, By End-Use Industry

9.6.4 Brazil

9.6.4.1 Brazil: Heavy Construction Equipment Market, By Machinery Type

9.6.4.2 Brazil: Market, By End-Use Industry

9.6.5 Argentina

9.6.5.1 Argentina: Heavy Construction Equipment Market, By Machinery Type

9.6.5.2 Argentina: Market, By End-Use Industry

9.6.6 Chile

9.6.6.1 Chile: Heavy Construction Equipment Market, By Machinery Type

9.6.6.2 Chile: Market, By End-Use Industry

9.6.7 Peru

9.6.7.1 Peru: Heavy Construction Equipment Market, By Machinery Type

9.6.7.2 Peru: Market, By End-Use Industry

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America: Heavy Construction Equipment Market, By Machinery Type

9.6.8.2 Rest of Latin America: Market, By End-Use Industry

10 Competitive Landscape

10.1 Overview

10.2 Market Share of Key Players

10.2.1 Caterpillar Inc.

10.2.2 Liebherr AG

10.2.3 Volvo Construction Equipment

10.2.4 Komatsu

10.2.5 Hitachi

10.3 Competitive Situation & Trends

10.3.1 New Product Developments Was The Key Strategy Adopted By Major Players in The Heavy Construction Equipment Market

10.5 New Product Developments

10.6 Agreements, Contracts, and Joint Ventures

10.7 Investments & Expansions

10.8 Mergers & Acquisitions

11 Company Profile

(Business Overview, Financials^, Products & Services, Key Strategy, and Recent Developments)

11.1 Caterpillar Inc.

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 Swot Analysis

11.1.5 MNM View

11.2 Liebherr AG

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 Swot Analysis

11.2.5 MNM View

11.3 Terex Corporation

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 Swot Analysis

11.3.5 MNM View

11.4 Volvo Construction Equipment

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 Swot Analysis

11.4.5 MNM View

11.5 Komatsu Ltd.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 Swot Analysis

11.5.5 MNM View

11.6 Doosan Infracore Ltd.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.7 Hitachi Construction Machinery Co. Ltd.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.8 JCB Ltd.

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.9 Sany Heavy Equipment International Holdings Co. Ltd

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.1 CNH Industrial N.V.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Developments, 2012–2016

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: MarketsandMarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (152 Tables)

Table 1 North America: Construction Contribution to GDP, By Country, 2014–2021 (USD Billion)

Table 2 North America: GDP, By Country, 2014–2021 (USD Billion)

Table 3 Europe: Construction Contribution to GDP, By Country, 2014–2021 (USD Billion)

Table 4 Europe: GDP, By Country, 2014–2021 (USD Billion)

Table 5 Asia-Pacific: Construction Contribution to GDP, By Country, 2014–2021 (USD Billion)

Table 6 Asia-Pacific: GDP, By Country, 2014–2021 (USD Billion)

Table 7 Middle East & Africa: Construction Contribution to GDP, 2014–2021 (USD Billion)

Table 8 Middle East & Africa: GDP, By Country GDP, 2014–2021 (USD Billion)

Table 9 South America: Construction Contribution to GDP, By Country, 2014–2021 (USD Billion)

Table 10 Latin America: GDP, By Country, 2014–2021 (USD Billion)

Table 11 Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 12 Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 13 Earthmoving Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 14 Earthmoving Equipment Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 15 Excavation Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 16 Excavation Equipment Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 17 Loading Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 18 Loading Equipment Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 19 Material-Handling Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 20 Material-Handling Equipment Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 21 Heavy Construction Vehicles Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 22 Heavy Construction Vehicles Market Size, 2014–2021 (Thousand Units)

Table 23 Other Heavy Construction Equipment Market Size, 2014–2021 (USD Billion)

Table 24 Other Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 25 Heavy Construction Equipment Market Size, By Application, 2014–2021 (USD Billion)

Table 26 Market Size, By Application, 2014–2021 (Thousand Units)

Table 27 Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 28 Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 29 Market Size, By Region, 2014–2021 (USD Billion)

Table 30 Market Size By Country, 2014–2021 (Thousand Units)

Table 31 North America: Heavy Construction Equipment Market Size, By Country, 2014–2021 (USD Billion)

Table 32 North America: Market Size By Country, 2014–2021 (Thousand Units)

Table 33 North America: Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 34 North America: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 35 North America: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 36 North America: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 37 U.S: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 38 U.S.: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 39 U.S.: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 40 U.S.: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 41 Canada: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 42 Canada: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 43 Canada: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 44 Canada: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 45 Mexico: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 46 Mexico: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 47 Mexico: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 48 Mexico: Market Size, By End-Use Industry, 2014–2021 (Thousand)

Table 49 Europe: Heavy Construction Equipment Market Size, By Country, 2014–2021 (USD Billion)

Table 50 Europe: Market Size, By Country, 2014–2021 (Thousand Units)

Table 51 Europe: Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 52 Europe: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 53 Europe: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 54 Europe: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 55 Germany: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 56 Germany: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 57 Germany: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 58 Germany: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 59 U.K.: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 60 U.K.: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 61 U.K.: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 62 U.K.: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 63 France: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 64 France: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 65 France: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 66 France: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 67 Russia: Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 68 Russia: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 69 Russia: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 70 Rest of Europe: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 71 Rest of Europe: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 72 Rest of Europe: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 73 Rest of Europe: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 74 Asia-Pacific: Heavy Construction Equipment Market Size, By Country, 2014–2021 (USD Billion)

Table 75 Asia-Pacific: Market Size, By Country, 2014–2021 (Thousand Units)

Table 76 Asia-Pacific: Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 77 Asia-Pacific: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 78 Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 79 Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 80 China: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 81 China: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 82 China: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 83 China: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 84 Japan: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 85 Japan: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 86 Japan: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 87 Japan: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 88 India: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 89 India: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 90 India: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 91 India: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 92 Australia: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 93 Australia: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 94 Australia: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 95 Australia: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 96 Rest of Asia-Pacific: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 97 Rest of Asia-Pacific: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 98 Rest of Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 99 Rest of Asia-Pacific: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 100 MEA: Heavy Construction Equipment Market Size, By Country, 2014–2021 (USD Billion)

Table 101 MEA: Market Size, By Country, 2014–2021 (Thousand Units)

Table 102 MEA: Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 103 MEA: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 104 MEA: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 105 MEA: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 106 South Africa: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 107 South Africa: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 108 South Africa: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 109 South Africa: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 110 Saudi Arabia: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 111 Saudi Arabia: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 112 Saudi Arabia: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 113 Saudi Arabia: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 114 Qatar: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 115 Qatar: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 116 Qatar: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 117 Qatar: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 118 UAE: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 119 UAE: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 120 UAE: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 121 UAE: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 122 Rest of MEA: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 123 Rest of MEA: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 124 Rest of MEA: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 125 Rest of MEA: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 126 Latin America: Heavy Construction Equipment Market Size, By Country, 2014–2021 (USD Billion)

Table 127 Latin America: Market Size, By Country, 2014–2021 (Thousand Units)

Table 128 Latin America: Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 129 Latin America: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 130 Latin America: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 131 Latin America: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 132 Argentina: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 133 Argentina: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 134 Argentina: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 135 Argentina: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 136 Chile: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 137 Chile: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 138 Chile: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 139 Chile: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 140 Peru: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 141 Peru: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 142 Peru: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 143 Peru: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 144 Rest of Latin America: Heavy Construction Equipment Market Size, By Machinery Type, 2014–2021 (USD Billion)

Table 145 Rest of Latin America: Market Size, By Machinery Type, 2014–2021 (Thousand Units)

Table 146 Rest of Latin America: Market Size, By End-Use Industry, 2014–2021 (USD Billion)

Table 147 Rest of Latin America: Market Size, By End-Use Industry, 2014–2021 (Thousand Units)

Table 148 New Product Developments: The Key Strategy, 2012–2016

Table 149 New Product Developments, 2012-2016

Table 150 Agreements, Contracts, and Joint Ventures, 2012-2016

Table 151 Investments & Expansions, 2012–2016

Table 152 Mergers & Acquisitions, 2012-2016

List of Figures (49 Figures)

Figure 1 Heavy Construction Equipment System: Market Segmentation

Figure 2 Heavy Construction Equipment Market, By Region

Figure 3 Heavy Construction Equipment Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Earthmoving Equipment Segment is Projected to Remain The Largest Through 2021

Figure 8 Excavation & Demolition is Estimated to be The Largest Segment in The Heavy Construction Equipment Market Through 2021

Figure 9 Construction & Manufacturing is Expected to Lead The Market for Heavy Construction Equipment Through 2021

Figure 10 Asia-Pacific Dominated The Heavy Construction Equipment Market in 2015

Figure 11 Developed Economies to Witness Higher Demand for Heavy Construction Equipment

Figure 12 Earthmoving Equipment to Lead The Market for Heavy Construction Equipment Through 2021

Figure 13 Heavy Lifting to Grow at The Highest Rate During The Forecast Period

Figure 14 Construction & Manufacturing Segment to Grow at The Highest Rate During The Forecast Period

Figure 15 The Earthmoving Segment Captured The Largest Share in The Asia Pacific Market in 2015

Figure 16 Market in China and India is Projected to Grow at The Highest Rate from 2016 to 2021

Figure 17 Heavy Construction Equipment Market Has Evolved Significantly Since The Early 1900s

Figure 18 Increasing Investments in The Construction Industry is The Main Driver for Growth of The Heavy Construction Equipment Market

Figure 19 Impact Analysis of Short–, Mid-, Long–Term Market Drivers & Restraints

Figure 20 Material-Handling Segment is Projected to Grow at The Highest Rate from 2016 to 2021

Figure 21 Excavator Segment is Projected to Grow at Highest CAGR from 2016 to 2021

Figure 22 Wheeled Excavators Segment is Projected to Have The Highest Rate from 2016 to 2021

Figure 23 Wheeled Loaders Segment is Projected to Grow at The Highest Rate from 2016 to 2021

Figure 24 Cranes Segment in Material-Handling Equipment is Projected to Grow at The Highest Rate from 2016 to 2021

Figure 25 Compactors & Road Rollers Segment is Projected to Grow at The Higher Rate from 2016 to 2021

Figure 26 Excavation & Demolition is Projected to Grow at The Highest Rate from 2016 to 2021

Figure 27 Construction & Manufacturing is Projected to Grow at The Highest Rate from 2016 to 2021

Figure 28 Geographic Snapshot (2016–2021): The Market in India is Projected to Grow at The Highest Rate, in Terms of Value

Figure 29 North America: Heavy Construction Equipment Market Snapshot: The U.S. is Projected to be The Fastest-Growing Market Between 2016 & 2021

Figure 30 Europe Snapshot

Figure 31 Asia-Pacific: Heavy Construction Equipment Market Snapshot: China is Projected to be The Fastest-Growing Market Between 2016 & 2021

Figure 32 Companies Adopted New Product Developments as The Key Growth Strategy Between 2012 and 2016

Figure 33 Heavy Construction Equipment Market, 2015

Figure 34 2014 Was an Active Year for The Companies in The Heavy Construction Equipment Market, in Terms of Developments

Figure 35 New Product Developments and Agreements, Contracts, and Joint Ventures Fueled Growth of The Heavy Construction Equipment Market, 2012–2016

Figure 36 Caterpillar Inc.: Company Snapshot

Figure 37 Caterpillar Inc.: Swot Analysis

Figure 38 Liebherr Ag: Company Snapshot

Figure 39 Liebherr Ag: Swot Analysis

Figure 40 Terex Corporation: Company Snapshot

Figure 41 Terex Corporation: Swot Analysis

Figure 42 Volvo Construction Equipment AB : Company Snapshot

Figure 43 Volvo Construction Equipment: Swot Analysis

Figure 44 Komatsu Ltd.: Company Snapshot

Figure 45 Komatsu Ltd.: Swot Analysis

Figure 46 Doosan Infracore Ltd. : Company Snapshot

Figure 47 Hitachi Construction Machinery Co. Ltd.: Company Snapshot

Figure 48 Sany Heavy Equipment International Holdings Co. Ltd : Company Snapshot

Figure 49 CNH Industrial N.V.: Company Snapshot

Growth opportunities and latent adjacency in Heavy Construction Equipment Market