High-speed Separator (HSS) Market by Type (Centrifugal separators, Filter centrifuges), Application, capacity( Small Capacity separators, Medium capacity separators, Large capacity separators) and Region - Global Forecast to 2028

High-Speed Separator Market

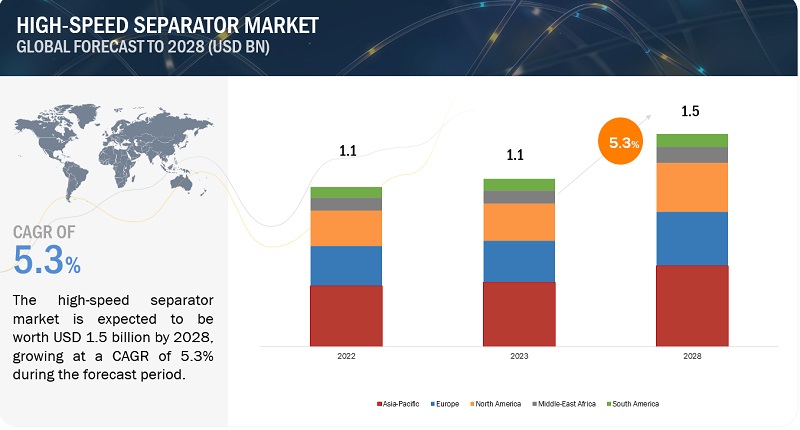

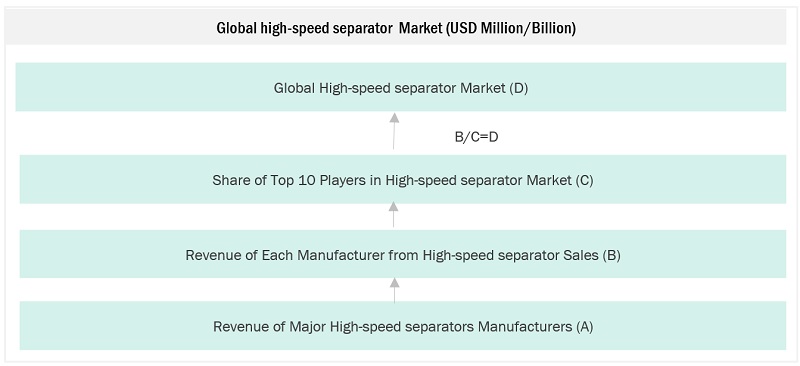

The global high-speed separator market is valued at USD 1.1 billion in 2023 and is projected to reach USD 1.5 billion by 2028, growing at a cagr 5.3% from 2023 to 2028. The study involved four major activities in estimating the market size of the high-speed separator market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Attractive Opportunities in the High-Speed Separator Market

To know about the assumptions considered for the study, Request for Free Sample Report

High-Speed Separator Market Dynamics

Driver: Increasing industrialization and manufacturing activities.

The growth of the high-speed separator (HSS) market is driven by the continual expansion of industrial and manufacturing activities across various sectors. This expansion creates a demand for efficient separation processes, leading to the increased adoption of high-speed separators. Several sectors, including oil and gas, food and beverages, pharmaceuticals, chemicals, and wastewater treatment, prominently contribute to this market growth.

Growing focus on mining and mineral sector.

High-speed separators are essential in the mining and mineral sector, providing efficient separation solutions for various applications. They play a crucial role in ore processing, tailings management, slurry separation, fine particle separation, mineral concentration, and environmental remediation. These separators enable the efficient extraction of valuable minerals, facilitate resource recovery, and contribute to environmental sustainability in mining operations. With their high-speed operation, superior separation capabilities, and continuous performance, high-speed separators optimize mineral processing, minimize waste, and support the responsible use of resources in the mining and mineral industry.

Environmental regulations and sustainability initiatives:

The adoption of high-speed separators is driven by stringent environmental regulations and sustainability initiatives. By facilitating effective component separation, these separators enable proper waste treatment, emissions control, resource utilization, energy efficiency, and water conservation. Their implementation helps industries meet regulatory requirements, reduce environmental impact, and contribute to sustainable practices.

Technological advancement to drive the market for HSS.

Technological advancements play a significant role in driving the growth of the high-speed separator market by improving performance, efficiency, and usability. These advancements include enhanced bowl design, advanced automation and control systems, and the integration of state-of-the-art sensors for real-time monitoring.

Restraint: High maintenance coupled with high energy consumption.

Optimal performance of high-speed separators necessitates regular maintenance and skilled operators. The associated maintenance costs and the requirement for trained personnel can be significant, posing challenges for smaller businesses with limited resources. High-speed separators often rely on powerful motors and components to achieve the desired rotational speeds. As a result, they consume more energy compared to conventional separators. This higher energy consumption leads to increased operational costs and raises concerns regarding environmental sustainability.

Regulatory compliances

HSS technologies may generate waste materials, emissions or byproducts that needs to be managed according to the environmental regulations. HSS systems may require certifications or conformity assessment to demonstrate compliances with applicable product safety standards. HSS systems often incorporate electrical systems and machinery necessitating compliances with electrical and machinery safety standards. These standards comprise of electrical safety, mechanical safety, and performance criteria. Compliance with relevant standards such as International Electrochemical Commission (ICE), Environmental Protection Agency (EPA), National Electrical Safety Codes (NESC), helps safe operation of HSS systems.

Opportunity: Renewable energy industry to create new revenue pockets for the PVOH market

An emerging sector where high-speed separators (HSS) are being increasingly utilized is the renewable energy industry, particularly in the field of biofuel production and biogas generation. High-speed separators play a vital role in the efficient separation and purification of biofuels and biogas, contributing to the sustainability and decarbonization efforts in the energy sector. High-speed separators are used in the production of biofuels such as biodiesel and bioethanol. These separators help separate impurities, water, and other contaminants from the raw materials, such as vegetable oils or agricultural feedstocks, during the production process. By efficiently separating and purifying the biofuel components, high-speed separators contribute to improving the quality and energy content of the final biofuel product.

Challenge: Intense competition and cost pressure.

The HSS market is characterized by intense competition, with numerous manufacturers offering similar products. This level of competition puts pressure on manufacturers to differentiate their offerings, improve product features, and provide superior customer support. Price sensitivity is another significant challenge in the HSS market. Customers, particularly those in cost-sensitive industries, prioritize affordable solutions. Manufacturers face the challenge of balancing the need to provide high-quality and efficient separators while keeping costs competitive.

Impact of recession on the end use industries employing HSS.

During a recession, end-use industries employing high-speed separators can experience reduced demand, investment constraints, delayed projects and maintenance, cost optimization measures, and a shift in industry priorities. The decrease in overall demand and financial constraints can lead to lower production levels and postponed equipment acquisition. Industries may delay projects, including separator installations, and prioritize cost-cutting measures. The severity of the impact varies across industries and regions, with some experiencing increased demand. Government support measures can also influence the extent of the impact on high-speed separators.

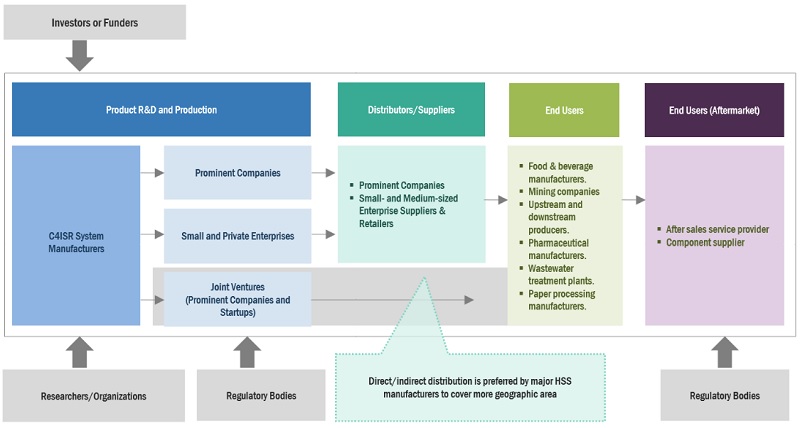

High-Speed Separator Market Ecosystem

A market ecosystem refers to the interconnected network of individuals, businesses, and other organizations participating in a particular market. It includes various stakeholders such as producers, distributors, retailers, customers, and regulatory bodies that interact with each other to exchange goods, services, and information. Prominent companies in the market are the ones who are well-established and financially stable and have state-of-the-art technologies and a strong global marketing network and sales record. The key players in this market are GEA Group Aktiengesellschaft (Germany), Flottweg SE (Germany), Alfa Laval (Sweden), SPX Flow (US), IHI Rotating Machinery Engineering Co. Ltd. (Japan), tetra Pak (Sweden), Mitsubishi Kakoki Kaisha (Japan), TOMOE Engineering Co. Ltd. (Japan), Pieralisi Maip SP (Italy), Trucent (US).

"Centrifugal separators is the largest type of high-speed separators in 2023, in terms of value."

Centrifugal separators accounted for the largest market share in the global high-speed separator market, in terms of value, in 2023. The segment is also projected to grow at the highest CAGR in value in 2023. These separators excel at separating solid particles from liquids or gases, improving process efficiency, and ensuring high-quality products. They find utility in industries such as oil and gas, chemicals, pharmaceuticals, food and beverage, and wastewater treatment, thanks to their adaptability to different tasks and production capacities.

With their continuous operation, centrifugal separators ensure uninterrupted processes and high throughput, enhancing productivity. Their compact design allows easy integration into existing systems, even in limited spaces. Additionally, they require minimal maintenance, providing reliable and cost-effective long-term operation.

Centrifugal separators achieve high separation efficiency by effectively removing fine particles or droplets, enhancing product quality, and reducing downstream processing requirements. Automation and control system integration enable precise control, improving operational efficiency and consistency.

Energy efficiency is a notable feature, as centrifugal separators are designed to minimize energy consumption while maintaining high separation efficiency, resulting in cost savings. Their wide range of applications in industries like oil and gas refining, chemicals, pharmaceuticals, water treatment, and food and beverage drive their demand.

"Oil & gas was the largest application for high-speed separator market in 2023, in terms of value."

The demand for high-speed separators in the oil and gas industry is rising due to several factors. These separators are sought after for their efficient separation capabilities, ensuring the extraction of clean and marketable oil and gas products. The growing global energy demand, driven by population growth and industrialization, is a key driver for the expansion of the oil and gas industry. As exploration and production activities increase to meet this demand, high-speed separators play a crucial role in separating impurities from extracted hydrocarbons.

Additionally, high-speed separators are essential in enhanced oil recovery (EOR) techniques, which aim to maximize oil recovery from reservoirs. These separators efficiently separate impurities from the recovered fluids, enabling efficient EOR operations and enhancing production rates. Moreover, stringent quality standards and regulations in the industry necessitate the use of high-speed separators to maintain product consistency, reliability, and compliance.

The oil and gas industry itself is experiencing growth, driven by factors such as global energy demand, economic growth, technological advancements, and exploration of new reserves. It plays a vital role in powering various sectors and supports activities ranging from upstream exploration and production to midstream transportation and storage, and downstream refining and distribution. With the continuous development of new reserves and increasing global energy consumption, the oil and gas industry is expected to further expand in the future.

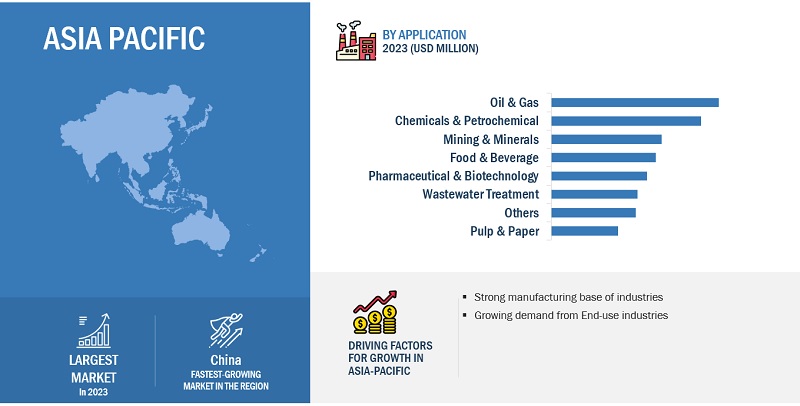

"Asia Pacific was the largest market for high-speed separator in 2023, in terms of value."

Asia Pacific was the largest market for the global high-speed separator market, in terms of value, in 2023. China is the largest market in the Asia Pacific. It is projected to witness the highest growth during the forecast period considering of huge mining and chemical industry along with the increasing population and urbanization. The major players operating in the Asia Pacific region are IHI Rotating Machinery Engineering Co. Ltd. (Japan), Mitsubishi Kakoki Kaisha (Japan), TOMOE Engineering Co. Ltd. (Japan), among others.

To know about the assumptions considered for the study, download the pdf brochure

High-Speed Separator Market Players

The key players in this market are GEA Group Aktiengesellschaft (Germany), Flottweg SE (Germany), Alfa Laval (Sweden), SPX Flow (US), IHI Rotating Machinery Engineering Co. Ltd. (Japan), tetra Pak (Sweden), Mitsubishi Kakoki Kaisha (Japan), TOMOE Engineering Co. Ltd. (Japan), Pieralisi Maip SP (Italy), Trucent (US).

Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of high-speed separators have opted for new product launches to sustain their market position.

High-Speed Separator Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.1 billion |

|

Revenue Forecast in 2028 |

USD 1.5 billion |

|

CAGR |

5.3% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023-2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

Type, Application, Capacity and Region |

|

Regions |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies |

GEA Group Aktiengesellschaft (Germany), Flottweg SE (Germany), Alfa Laval (Sweden), SPX Flow (US), IHI Rotating Machinery Engineering Co. Ltd. (Japan), tetra Pak (Sweden), Mitsubishi Kakoki Kaisha (Japan), TOMOE Engineering Co. Ltd. (Japan), Pieralisi Maip SP (Italy), Trucent (US). |

This report categorizes the global high-speed separator market based on type, application, capacity and region.

On the basis of type, the market has been segmented as follows:

- Centrifugal separators.

- Filter centrifuges.

- Others.

On the basis of capacity, the market has been segment as follows:

- Small Capacity separators.

- Medium capacity separtors.

- Large capacity separators.

- Extra-large capacity separators.

On the basis of application, the market has been segmented as follows:

- Oil & gas.

- Chemical & petrochemicals.

- Food & beverages.

- Pharmaceuticals & biotechnology.

- Wastewater treatment.

- Mining & minerals.

- Pulp & paper.

- Others.

On the basis of region, the market has been segmented as follows:

- Asia Pacific.

- Europe.

- North America.

- Middle East & Africa.

- South America.

Recent Developments

- In May 2023, GEA announced that by the end of 2024, GEA will spend around EUR 50 million upgrading its German centrifuge production plants in Oelde (North Rhine-Westphalia) and Niederahr (Rhineland-Palatinate).

- In January 2023 Alfa Laval launched the first biofuel-ready separators for the marine industry offered by Alfa Laval. Biofuels are a modern and widely available fuel source that can assist marine clients in reducing their carbon footprint. Biofuels do lessen the carbon footprint, but they also provide new operational difficulties. Alfa Laval is the first company on the market to address them with separator modifications and biofuel-optimized separators.

- In August 2022, SPX FLOW, Inc., joined forces with family-run separation technology company Flottweg. The collaboration enables both businesses to develop complete plant-based process solutions for clients in the dietary supplement, health, food, and beverage sectors.

- In March 2022 the newest addition to the Flottweg family is the separator, the AC1700. The Flottweg AC1700 separator rounds out their line of products for the food and beverage industry and fits between our well-liked AC1500 and AC2000 series. With a clarity area of over 70,000 m2 (753,474 ft2) and an acceleration of 11,000 g, the compact separator guarantees a finished product that is optimally clarified and has a high throughput.

- In February 2021, Trucent invested more than $10 million in its new Van Wert facility. It is carried under their subsidiary Trucent Renewable Chemicals.

- In February 2021, A new Seital centrifuge line for dairy has been introduced by SPX FLOW, Inc., wherein the direct drive variants have been added.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the high-speed separator market?

This study's forecast period for the high-speed separator market is 2023-2028. The market is expected to grow at a CAGR of 5.3%, in terms of value, during the forecast period.

Who are the major key players in the high-speed separator market?

The key players in this market are GEA Group Aktiengesellschaft (Germany), Flottweg SE (Germany), Alfa Laval (Sweden), SPX Flow (US), IHI Rotating Machinery Engineering Co. Ltd. (Japan), tetra Pak (Sweden), Mitsubishi Kakoki Kaisha (Japan), TOMOE Engineering Co. Ltd. (Japan), Pieralisi Maip SP (Italy), Trucent (US).

What are the major regulations of the high-speed separator market in various countries?

Environmental protection agencies of different countries have laid down certain regulations for the proper use of high-speed separators. Compliance with relevant standards such as International Electrochemical Commission (ICE), Environmental Protection Agency (EPA), National Electrical Safety Codes (NESC) are also required for HSS systems.

What are the drivers and opportunities for the high-speed separator market?

The drivers are increasing industrialization and manufacturing activities, growing focus on the mining and mineral sector, environmental regulations and sustainability initiatives and technological advancements. The opportunity being renewable energy industry to create new revenue pockets for the HSS market.

Which are the key technology trends prevailing in the high-speed separator market?

Automation is a significant trend in the high-speed separator market. Advanced control systems and automation technologies allow for precise control over the separation process, optimizing performance and reducing manual intervention. Automated monitoring and control enhance efficiency, accuracy, and consistency. High-speed separators are increasingly equipped with integrated sensors and monitoring systems to provide real-time data on operating conditions, process parameters, and performance indicators. This enables proactive maintenance, optimization of operational parameters, and early detection of potential issues, leading to improved reliability and uptime. The integration of digitalization and data analytics is transforming the high-speed separator market. Data-driven insights, predictive analytics, and machine learning algorithms are being employed to optimize separator performance, identify operational inefficiencies, and enable predictive maintenance. Digitalization enhances process efficiency, reliability, and overall equipment effectiveness. High-speed separators are increasingly being equipped with remote monitoring capabilities and connectivity features. This allows operators to remotely monitor and control separator performance, access real-time data, and receive notifications or alarms. Remote monitoring enables proactive maintenance, troubleshooting, and decision-making, leading to improved operational efficiency and reduced downtime. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the high-speed separator market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The high-speed separator market comprises several stakeholders in the value chain, which include raw material procurement, HSS manufacturers, packaging and distributors & end users industries. Various primary sources from the supply and demand sides of the high-speed separator market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the high-speed separator industry.

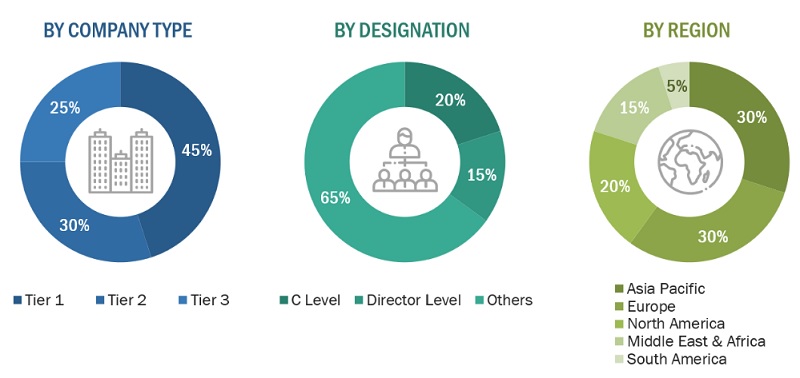

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, capacity and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of high-speed separators and the future outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Flottweg SE (Germany) |

Individual Industry Expert |

|

Alfa Laval (Sweden) |

Sales Manager |

|

SPX Flow (US) |

Director |

|

TOMOE Engineering Co. Ltd. (Japan) |

Marketing Manager |

|

Trucent (US) |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the high-speed separator market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

High-Speed Separator Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

High-Speed Separator Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

A high-speed separator is a specialized equipment used in various industries to separate and remove solid particles or impurities from liquid or gas streams by utilizing centrifugal force. It operates at high rotational speeds to generate strong centrifugal forces, which cause the heavier particles to move towards the outer walls of the separator, allowing the clean fluid or gas to be extracted from the center. The high-speed separator is designed to achieve efficient and effective separation, offering fast processing times, high throughput, and enhanced separation efficiency. High-speed separators contribute to improved product quality, process efficiency, and compliance with environmental regulations.

Key Stakeholders

- Raw material suppliers.

- Hig-speed separator manufacturers.

- High-speed separators traders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions..

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the hig-speed separator market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, application, capacity and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in High-speed Separator (HSS) Market