Hot & Cold Systems Market by Raw Material (Plastic, Metallic, Metalized Plastic), Application (Water Plumbing Pipes, Radiator Connection Pipes, Underfloor Surface Heating & Cooling), Components, End-Users, And Region - Global Forecast to 2028

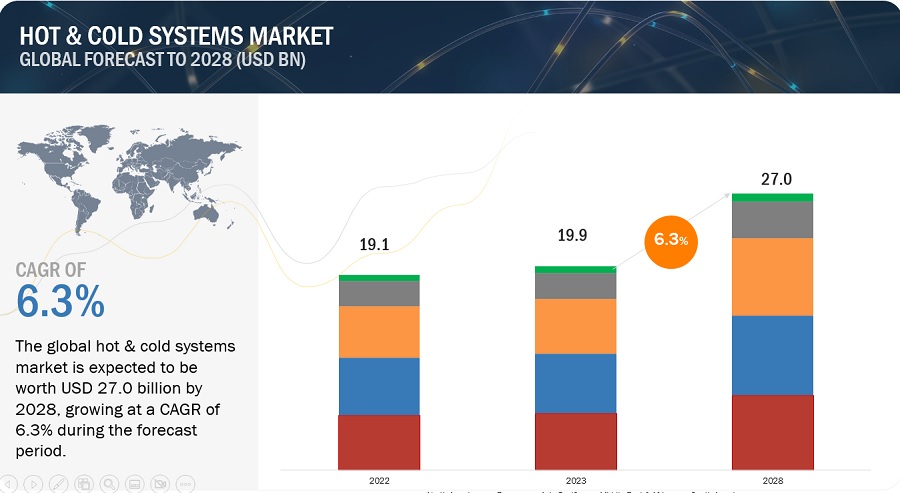

The global hot & cold systems market size is projected to reach USD 27.0 billion by 2028 from USD 19.9 billion in 2023, at a CAGR of 6.3% during the forecast period. The demand for hot & cold systems is being driven by the increasing demand for energy-efficient solutions and sustainable solutions in residential, commercial, and infrastructural sectors ensuring thermal comfort, energy efficiency, and precise temperature control.

Global Hot & Cold Systems Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Hot & cold systems Market Dynamics

Driver: Urbanization and infrastructure development in the emerging economies

The robust urbanization and infrastructure development observed in emerging economies creates a compelling market opportunity for hot and cold pipe systems. As cities expand and new buildings are constructed, there is an increased demand for efficient and reliable piping systems to deliver hot and cold water for various purposes in residential, commercial, and industrial sectors. This growth in urbanization and infrastructure projects is particularly evident in emerging economies such as China, India, Brazil, Indonesia, Nigeria, and Mexico, where rapid urbanization rates are transforming skylines and increasing the need for modern plumbing systems to ensure a steady and efficient water supply.

Restraint: Cost of material and installation of metal pipes

The cost of materials, installation, and maintenance is a significant restraint in the hot and cold pipe systems market. One of the main factors contributing to the cost is the requirement for high-quality materials. Hot and cold systems often need to withstand high temperatures, pressure, and corrosive substances. Therefore, durable and reliable materials such as CPVC PEX, SS or copper are commonly used, which can be more expensive than other options. Additionally, skilled labor is crucial for the proper installation and maintenance of these systems. Plumbing professionals with expertise in working with hot and cold pipe systems are in demand, and their services come at a premium. The complexity of the installation process, including tasks such as pipe routing, joint welding, and insulation, requires skilled workers who command higher wages. Maintenance costs also add to the overall expenses. Regular inspections, repairs, and replacements of components are necessary to ensure the optimal functioning and longevity of the hot and cold systems. These ongoing maintenance activities involve labor costs and may force temporary shutdowns of certain parts of the system, which can affect the overall operational efficiency of the facility.

Opportunity: Expansion of the construction industry

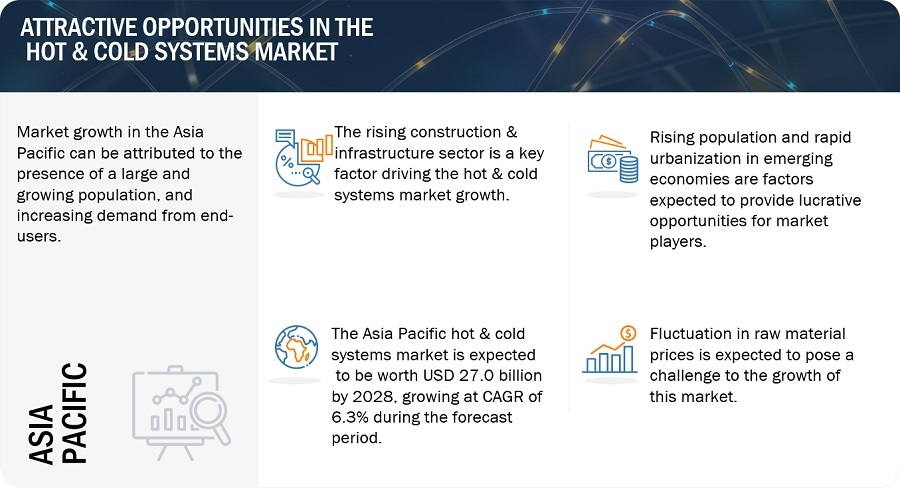

The expansion of the construction industry presents significant opportunities for the hot and cold systems market. As construction activities increase, there is a higher demand for plumbing systems, including hot and cold-water distribution, HVAC systems, and other related infrastructure. This drives the need for quality hot and cold system components such as pipes, valves, fittings, manifolds, temperature control, and insulation materials. The construction industry offers a wide range of projects, including residential buildings, commercial complexes, industrial facilities, and infrastructure development. Each of these projects requires well-designed and efficient hot and cold systems to ensure proper water supply, temperature control, and overall comfort. The growing emphasis on energy efficiency and sustainability in construction also opens avenues for the hot and cold systems market. There is a rising demand for environmentally friendly and energy-efficient systems, such as high-efficiency boilers, heat pumps, and water-saving fixtures. To capitalize on these opportunities, businesses in the hot and cold systems market should actively engage with construction companies, architects, and contractors. By offering innovative and energy-efficient solutions, they can align themselves with the evolving needs of the construction industry and contribute to sustainable building practices.

Challenges: Fluctuation in raw material prices

Fluctuations in raw material prices pose significant challenges to the hot and cold systems market. As the prices of raw materials, such as metals and plastics, fluctuate, it directly impacts the production cost of hot and cold system components like pipes, fittings, valves, and insulation materials. This can lead to increased manufacturing costs for system manufacturers and distributors, potentially resulting in higher prices for consumers. Moreover, volatile raw material prices make it challenging for businesses in the hot and cold systems market to forecast and plan their budgets accurately. It becomes difficult to estimate production costs and maintain consistent pricing strategies. This uncertainty can also affect investment decisions, production capacity, and supply chain management within the industry.

Hot & Cold Systems Market: Ecosystem

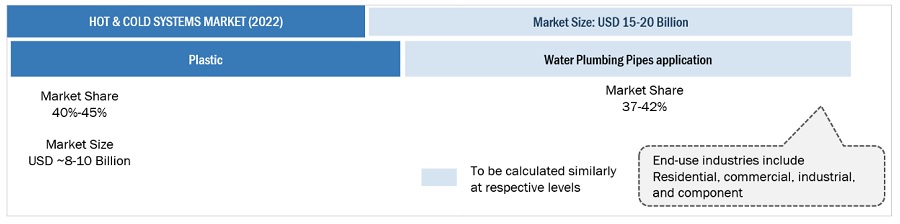

By application, water plumbing pipes are estimated to be the fastest-growing segment during the forecast period in the hot & cold systems market

Water plumbing pipes are expected to have high growth in the hot and cold systems market due to their vital role in residential, commercial, and industrial plumbing applications. The increasing demand for modern infrastructure and urbanization drives the need for efficient water distribution and plumbing systems. Water plumbing pipes play a crucial role in delivering clean water for drinking, sanitation, and various industrial processes, making them an essential component with significant growth potential in the hot and cold systems market.

By raw material, plastic pipes are estimated to be the fastest-growing segment during the forecast period in the hot & cold systems market

Plastic pipes are estimated to grow at the fastest rate during the forecast period due to their lightweight nature, ease of installation, resistance to corrosion, durability, and cost-effectiveness. Additionally, the increasing adoption of plastic pipes in various applications, such as plumbing, irrigation, and industrial processes, is driving their growth in the hot & cold systems market.

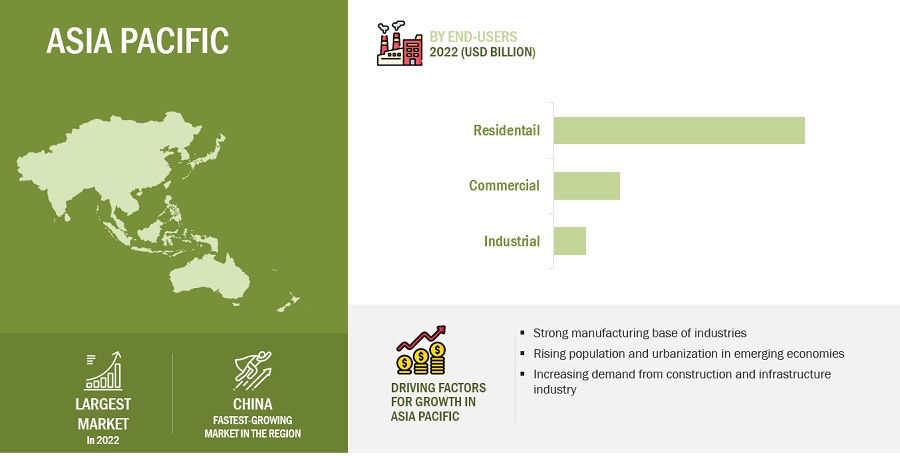

By end-use industry, the residential sector is estimated to be the fastest-growing segment during the forecast period in the hot & cold systems market

The residential sector is estimated to be the fastest-growing segment in hot and cold systems due to multiple factors. These include increasing urbanization, population growth, rising disposable incomes, and the demand for improved living standards. As more residential buildings and housing complexes are being constructed, there is a significant need for efficient hot and cold systems to cater to the growing residential population, driving the growth of this segment.

Asia Pacific is projected to be the fastest growing amongst other regions in the hot & cold systems market, in terms of value.

Asia Pacific is projected to be the fastest-growing market for hot & cold systems due to rapid industrialization in recent years, particularly in countries like China, India, and South Korea. This has led to an increase in demand for hot & cold systems, which are used in various applications in the residential, commercial, and industrial sectors. Residential buildings utilize hot and cold systems to provide thermal comfort and ensure a consistent supply of hot water for various domestic activities such as bathing, washing, and cooking. These systems are designed to regulate and distribute hot and cold fluids efficiently, enhancing the overall living experience and meeting the heating and plumbing needs of residents in their homes.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the hot & cold systems market include RWC (US), Orbia (Mexico), Georg Fischer Limited (Switzerland), Geberit (Switzerland), Watts Water Technologies (US), Chevron Phillips Chemical LLC (US), Wienerberger (Austria), Aalberts (Netherlands), Aliaxis (Belgium), Lesso (China), Rehau (Switzerland), Zurn (US), Uponor (Finland), and Silmar Group (Italy), among others. The hot & cold systems market report analyzes the key growth strategies, such as new product launch, partnerships, expansions, and acquisitions adopted by the leading market players between 2018 and 2023.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Thousand Units) |

|

Segments |

Raw Material, Components, Application, End-users, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

RWC (US), Orbia (Mexico), Georg Fischer Limited (Switzerland), Geberit (Switzerland), Watts Water Technologies (US), Chevron Phillips Chemical LLC (US), Wienerberger (Austria), Aalberts (Netherlands), Aliaxis (Belgium), Lesso (China), Rehau (Switzerland), Zurn (US), Uponor (Finland), and Silmar Group (Italy) are the key players in the market. |

This report categorizes the global hot & cold systems market based on raw materials, components, applications, end-users, and region.

On the basis of raw material, the hot & cold systems market has been segmented as follows:

- Plastic

- Metallic

- Metalized Plastic

On the basis of components, the hot & cold systems market has been segmented as follows:

- Pipe

- Fixtures & connectors

- Multifold

- Temperature Control

- Local distribution

- Solvent Cement

- Others

On the basis of application, the hot & cold systems market has been segmented as follows:

- Water plumbing pipes

- Radiator connection pipes

- Underfloor surface heating & cooling

- Others

On the basis of end-users, the hot & cold systems market has been segmented as follows:

- Residential

- Commercial

- Industrial

On the basis of region, the hot & cold systems market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2023, RWC launched two new product ranges i.e., SharkBite Max fittings and PEX-a pipe in the Americas to cater to the unmet demand in the country. This launch was aimed at offering a reliable and leak-free connection for various plumbing applications, including pipes, valves, and fixtures.

- In March 2023, Chevron Phillips invested USD 45 million in Closed Loop Partners' Circular Plastics Fund to manufacture recycling system for PE, PP and flexible plastics for high-quality recycled material.

- In April 2023, Wienerberger acquired Wideco Sweden AB to extend its smart solutions business in sustainable building and energy.

Frequently Asked Questions (FAQ):

What is the current size of the global hot & cold systems market?

The global hot & cold systems market is projected to reach USD 27.0 billion by 2028, at a CAGR of 6.3% from USD 19.9 billion in 2023.

Who are the winners in the global hot & cold systems market?

Companies such as RWC (US), Orbia (Mexico), Georg Fischer Limited (Switzerland), Geberit (Switzerland), Watts Water Technologies (US), Chevron Phillips Chemical LLC (US), Wienerberger (Austria), Aalberts (Netherlands), Aliaxis (Belgium), Lesso (China), Rehau (Switzerland), Zurn (US), Uponor (Finland), and Silmar Group (Italy). They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing demand in the construction & infrastructure sector drives the market.

Which segment on the basis of application is expected to garner the highest traction within the hot & cold systems market?

Based on application, Water plumbing pipes parts segment held the largest share of the hot & cold systems market in 2022.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use new product launch, partnerships, expansions, and acquisitions as important growth tactics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the hot & cold systems market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, trade directories, certified publications, articles from recognized authors, construction data websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The hot & cold systems market comprises several stakeholders in the value chain, which include raw material suppliers, hot & cold systems manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the hot & cold systems market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the hot & cold systems industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to raw materials, components, applications, and regions. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of hot & cold systems and the future outlook of their business which will affect the overall market.

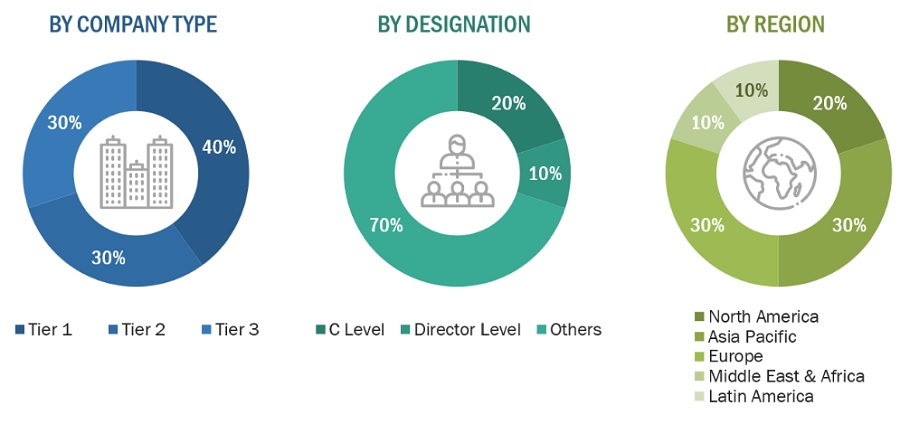

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Astral pipes |

Sales Director |

|

Georg Fischer Limited |

Sales Manager |

|

Uponor |

Director |

|

Finolex |

Marketing Manager |

|

Rehau |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the hot & cold systems market.

- The key players in the industry have been identified through extensive secondary research.

- The components of the industry have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Hot & Cold Systems Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Hot & Cold Systems Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The hot and cold systems market refers to the industry segment that encompasses the design, manufacturing, installation, and maintenance of systems used for heating and cooling purposes in various applications. These systems include components such as pipes, fixtures & connections, manifold, temperature control, local distribution, solvent cement, and control systems, which are designed to transport and regulate the flow of hot and cold fluids, to meet the thermal comfort and process requirements in residential, commercial, and industrial sectors.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the hot & cold systems market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on raw materials, components, applications, end-users, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as partnerships, expansions, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Hot & Cold Systems Market