Household Robots Market by Offering (Products, Services), Type (Domestic, Entertainment & Leisure), Distribution Channel (Online, Offline), Application (Vacuuming, Lawn Mowing, Pool Cleaning) and Geography – Global Forecast to 2027

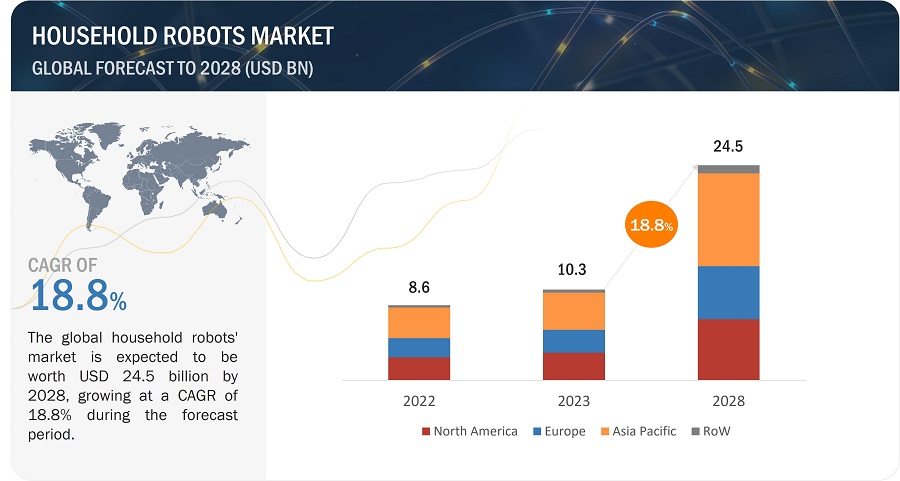

The global household robots market size is projected reach USD 19.3 billion by 2027, at a CAGR of 16.0% during the forecast period. The growth of this market is driven by the increasing demand for robots in the domestic segment, growing demand for autonomous robots, rising use of IoT in robots for cost-effective predictive maintenance, and increasing government initiatives for the development of robotic technologies.

However, concerns regarding data privacy in AI platforms, unreliability of AI algorithms, and availability of limited structured data to train and develop efficient AI systems are the challenges for the household robots industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of Household Robots Market

Drivers: Growing demand for autonomous robots

Many companies are taking advantage of automation technologies like app integration and smart navigation to reduce intervention by users to give a seamless experience to their customers. For instance, initial product offerings in robotic vacuums had to be manually switched on and charged. Their navigation system was inefficient, i.e., it did not cover the locations inside a house uniformly. However, the new systems have more efficient navigation algorithms.

Some can even work in the dark, map out the floor, clean a particular area, and deal with obstacles better. They can be enabled with voice commands or remote chat. They have functions such as self-recharge and auto clean owing to the integration of AI services, such as Amazon Alexa, Google Assistant, and Facebook Messenger. Integrating AI services allows two-way communication between the user and the device. Neato Robotics (US), a key player in this segment, has granted consumers many of the requested features by introducing laser navigation, app connectivity for smartphones and smartwatches through Wi-Fi, and voice assistant integration into their robotic vacuums, which were later introduced by its competitors.

Similarly, the upgraded robotic lawn mowers from Robomow (Israel) can detect rain and automatically withdraw their operations. Robotic pool cleaners from Maytronics (Israel) can clean the walls of a pool and work on various types of pool surfaces, such as rough or slippery surfaces.

Restraints: Legal safety and data protection regulations

Families worldwide have integrated robots into households due to the rapidly developing robotics industry. Robotic devices assist in the simplification of bothersome chores, such as vacuuming, cleaning gutters, mowing a lawn, or ironing. Apart from household activities, home robots nowadays also help with waking up, interacting with family members, or protecting property.

However, despite the potential benefits associated with household robots, a vivid discussion about security and privacy risks related to using such machines has become an object of public discussion. Some of the privacy and security risks associated with household robots are risks related to the interconnection of the household robots with other devices, data collection and disclosure abilities of household robots, physical interactions of household robots, infection of household robots with malware, and psychological attacks conducted by household robots.

Opportunities: Focus on improving endurance of robots

One of the significant areas of improvement for robots would be to increase their endurance capability, which would, in turn, allow for large area coverage and serviceability. Currently, these robots can operate for a short period of 1–2 hours when fully charged and return to a charging station to be recharged for further operations.

Currently, these robots use NiMH batteries as their power source to save costs. The popular Li-ion battery used in every smartphone can hold the same power with several key advantages. In the smartphone marketplace, various technologies like Quick Charge, developed by Qualcomm (US), allow the battery to be charged faster over USB. Household robots can take advantage of fast charging by switching to Li-ion batteries, which support Quick Charge technology.

With the transition of the automotive industry to electric vehicles, battery technology is being developed at a rapid pace. Tesla (US) uses Li-ion batteries to power its cars, and various automakers are developing technology to improve various parameters of such batteries. When applied to robot batteries, these innovations will significantly decrease their downtime and boost their operational run time.

Challenges: Programming robots for human safety

The market for household robots is likely to grow at a tremendous pace owing to practical innovations and the integration of artificial intelligence. The application of service robots has been escalating for domestic applications, such as house cleaning and companionship, through innovations at a rapid pace. However, making service robots safe for routine interaction with humans at an affordable price is a major technological challenge faced by the industry.

With the development of robotic applications expected to interact closely with humans, the safety of humans and other occupants is a major concern. This means that the hardware and software of robots should be very safe, and there should be no risk of malfunctioning or causing unintentional damage. Efforts are made to program robots so that they can adjust to humans, environment, and varying conditions.

Household robots market for vacuuming application to retain largest market share during forecast period

In terms of value, the vacuuming application held the largest share of 57% of the overall household robots market in 2021. The market size for robotic vacuum cleaners outweighs other household robots since robotic vacuum cleaners can be deployed in all households, regardless of the floor type. With the increase in nuclear families and the global population, the number of households has increased, generating more demand for vacuuming robots. The increase in the aging population in countries such as China and Japan and affordable prices drive the market for vacuum robots.

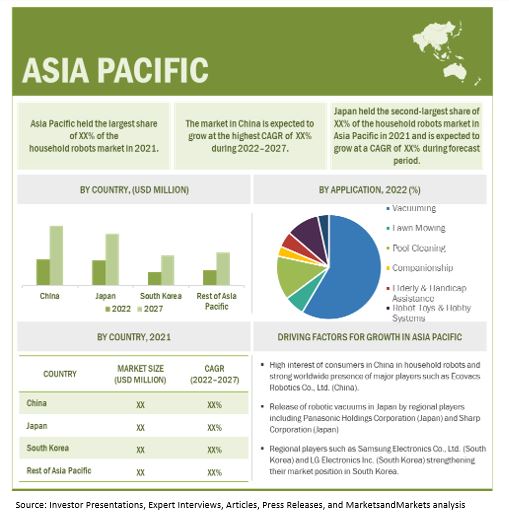

Household robots market in Asia Pacific to account for largest market share

Asia Pacific is expected to witness the largest share of the household robots market during 2019–2024. The growth of household robots in the region strongly correlates with consumer demand. An increase in investment in household robots, especially in countries such as China, Japan, and South Korea, drives the market in this region. China is expected to register the highest growth compared with other countries in Asia Pacific. However, developing countries in the region, such as India, present limited market penetration and growth scope.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Houshold Robots Market

Some of the key household robots companies are iRobot Corporation (US), Ecovacs Robotics Co., Ltd. (China), Xiaomi Corporation (China), Maytronics, Ltd. (Israel), Samsung Electronics Co., Ltd. (South Korea), Neato robotics, Inc. (US), Dyson Limited (Singapore), LG Electronics Inc. (South Korea), LEGO A/S (Denmark), Hayward Holdings, Inc. (US), etc.

Household Robots Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 9.2 billion in 2022 |

| Projected Value | USD 19.3 billion by 2027 |

| Growth Rate | CAGR of 16.0% |

|

Years Considered |

2022–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Offering, Type, Distribution Channel, Application, and Geography |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

iRobot Corporation (US), Ecovacs Robotics Co., Ltd. (China), Xiaomi Corporation (China), Maytronics, Ltd (Israel), Samsung Electronics Co., Ltd. (South Korea), Neato robotics, Inc. (US), Dyson Limited (Singapore), LG Electronics Inc. (South Korea), LEGO A/S (Denmark), Hayward Holdings, Inc. (US), etc. |

In this research report, the household robots market has been segmented based on offering, type, distribution channel, application, and geography.

Household Robots Market, By Offering:

- Products

- Services

Market, By Type:

- Domestic

- Entertainment and Leisure

Market, By Distribution Channel:

- Online Channel

- Offline Channel

Market, By Application:

- Vacuuming

- Lawn Mowing

- Pool Cleaning

- Companionship

- Elderly Assistance and Handicap Assistance

- Robot Toys and Hobby Systems

- Others (Window Cleaning, Robotic Kitchens, and Laundry Robots)

Market, By Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- China

- South Korea

- Japan

- Rest of Asia Pacific

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments in household robots

- In August 2022, Amazon.com, Inc. (US) and iRobot Corporation announced a definitive merger agreement under which Amazon will acquire iRobot under its expansion plan with a USD 1.7 billion offer. The acquisition will bolster its line of smart home products and add to the vast store of consumer data.

- In March 2022, Ecovacs Robotics Co., Ltd. launched DEEBOT X1 Family offering multiple solutions for easier home cleaning. The DEEBOT family features the DEEBOT X1 OMNI and DEEBOT X1 TURBO, as well as the all-in-one base station, X1 Station, all of which combine function and design to provide premium home cleaning services.

- In June 2021, Samsung Electronics Co., Ltd. introduced its robot vacuum cleaner, Jet Bot AI+. The robot vacuum is equipped with an Intel AI solution, which powers its Jet AI Object Recognition technology. It comes with an active stereo-type 3D sensor, which accurately scans a wide area1 to avoid small, hard-to-detect objects on the floor. Its 3D depth camera—equivalent to 256,000 distance sensors—can precisely detect obstacles as small2 as 1cm.

Frequently Asked Questions (FAQs):

What is the current size of the global household robots market?

The global household robots market is projected to grow from USD 9.2 billion in 2022 to USD 19.3 billion by 2027, at a CAGR of 16.0% during the forecast period from 2022 to 2027.

Who are the winners in the global household robots market?

Some of the key companies in the household robots market are iRobot Corporation (US), Ecovacs Robotics Co., Ltd. (China), Xiaomi Corporation (China), Maytronics, Ltd. (Israel), Samsung Electronics Co., Ltd. (South Korea), Neato Robotics (US), Dyson Limited (Singapore), LG Electronics Inc. (South Korea), LEGO A/S (Denmark), Hayward Holdings, Inc. (US), etc.

What are the major drivers for the household robots market?

The growth of this market is driven by factors such as the Increasing demand for robots in the domestic segment, growing demand for autonomous robots, rising use of IoT in robots for cost-effective predictive maintenance, and increasing government initiatives for the development of robotic technologies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

TABLE 1 LIST OF MAJOR SECONDARY SOURCES

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Primary interviews with experts

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach used to capture market size from supply side

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 6 HOUSEHOLD ROBOTS MARKET FOR PRODUCTS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 7 DOMESTIC ROBOTS TO CONTINUE TO HOLD LARGER SHARE OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

FIGURE 8 VACUUMING APPLICATION TO HOLD LARGEST SHARE OF HOUSEHOLD ROBOTS MARKET IN 2027

FIGURE 9 HOUSEHOLD ROBOTS MARKET IN ASIA PACIFIC TO HOLD LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MAJOR OPPORTUNITIES FOR PLAYERS IN HOUSEHOLD ROBOTS MARKET

FIGURE 10 GROWING DEMAND FOR ROBOTIC VACUUMS TO DRIVE GROWTH OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

4.2 HOUSEHOLD ROBOTS MARKET FOR DOMESTIC ROBOTS, BY APPLICATION

FIGURE 11 HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 HOUSEHOLD ROBOTS MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

FIGURE 12 VACUUMING AND CHINA EXPECTED TO ACCOUNT FOR LARGEST SHARES OF MARKET IN 2027

4.4 HOUSEHOLD ROBOTS MARKET, BY GEOGRAPHY

FIGURE 13 HOUSEHOLD ROBOTS MARKET IN MIDDLE EAST & AFRICA IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 HOUSEHOLD ROBOTS MARKET, BY APPLICATION

FIGURE 14 HOUSEHOLD ROBOTS MARKET FOR ELDERLY AND HANDICAP ASSISTANCE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 HOUSEHOLD ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for robots in domestic segment

5.2.1.2 Growing demand for autonomous robots

5.2.1.3 Surging use of IoT in robots for cost-effective predictive maintenance

5.2.1.4 Increasing government initiatives for development of robotic technologies

5.2.2 RESTRAINTS

5.2.2.1 Legal safety and data protection regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Growing focus on improving endurance capability of robots

5.2.3.2 Various upgrades to household robots in elderly assistance applications

FIGURE 16 GROWING ELDERLY (65 & ABOVE) US POPULATION FROM 1900 TO 2060

5.2.4 CHALLENGES

5.2.4.1 Programming robots to work safely with humans

5.2.4.2 Making household robots affordable and available globally

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HOUSEHOLD ROBOT PROVIDERS

FIGURE 17 REVENUE SHIFT FOR HOUSEHOLD ROBOTS MARKET

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE OF HOUSEHOLD ROBOTS, BY OFFERING (KEY PLAYERS)

FIGURE 18 AVERAGE SELLING PRICES OF HOUSEHOLD ROBOTS OFFERED BY KEY PLAYERS FOR TOP THREE PRODUCTS

TABLE 2 AVERAGE SELLING PRICES OF HOUSEHOLD ROBOTS OFFERED BY KEY PLAYERS FOR TOP THREE PRODUCTS (USD)

5.4.2 AVERAGE SELLING PRICE TREND

FIGURE 19 HOUSEHOLD ROBOTS MARKET: AVERAGE PRICE OF HOUSEHOLD ROBOTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY R&D AND MANUFACTURING STAGES

5.6 ECOSYSTEM/MARKET MAP

TABLE 3 HOUSEHOLD ROBOTS MARKET: ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTEGRATION OF AI INTO ROBOTS

5.7.2 RESEARCH ON STANDARD OPERATING SYSTEM FOR ROBOTS

5.7.3 GROWTH OF ROBOT AS SERVICE BUSINESS MODEL

5.8 PATENT ANALYSIS

FIGURE 21 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 4 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 22 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

5.8.1 LIST OF MAJOR PATENTS

TABLE 5 LIST OF MAJOR PATENTS IN HOUSEHOLD ROBOTS MARKET

5.9 TRADE AND TARIFF ANALYSIS

5.9.1 TRADE ANALYSIS

5.9.1.1 Trade data for HS code 850860

FIGURE 23 IMPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

FIGURE 24 EXPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

5.9.2 TARIFF ANALYSIS

TABLE 6 MFN TARIFF FOR VACUUM CLEANERS, INCL. DRY CLEANERS AND WET VACUUM CLEANERS (EXCLUDING WITH SELF-CONTAINED ELECTRIC MOTORS) EXPORTED BY US, 2021

TABLE 7 MFN TARIFF FOR VACUUM CLEANERS, INCL. DRY CLEANERS AND WET VACUUM CLEANERS (EXCLUDING WITH SELF-CONTAINED ELECTRIC MOTORS) EXPORTED BY CHINA, 2021

5.10 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 8 HOUSEHOLD ROBOTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 REGULATORY LANDSCAPE

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 IMPACT OF PORTER’S FIVE FORCES ON HOUSEHOLD ROBOTS MARKET

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: HOUSEHOLD ROBOTS MARKET

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITION RIVALRY

5.13 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 HOUSEHOLD ROBOTS MARKET, BY OFFERING (Page No. - 73)

6.1 INTRODUCTION

FIGURE 27 HOUSEHOLD ROBOTS MARKET, BY OFFERING

FIGURE 28 PRODUCTS TO LEAD HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

TABLE 11 HOUSEHOLD ROBOTS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 12 HOUSEHOLD ROBOTS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 PRODUCTS

6.2.1 PRODUCT SEGMENT TO DOMINATE HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

6.3 SERVICES

6.3.1 SERVICES SEGMENT TO MAINTAIN LOWER SHARE OF HOUSEHOLD ROBOTS MARKET

7 HOUSEHOLD ROBOTS MARKET, BY TYPE (Page No. - 76)

7.1 INTRODUCTION

FIGURE 29 HOUSEHOLD ROBOTS MARKET, BY TYPE

FIGURE 30 DOMESTIC ROBOTS TO CONTINUE TO HOLD LARGER SIZE OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

TABLE 13 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 15 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 16 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2022–2027 (MILLION UNITS)

7.2 DOMESTIC

7.2.1 BUSY LIFESTYLES AND INCREASING AUTOMATION HAVE LED TO INCREASE IN SALES OF DOMESTIC ROBOTS

TABLE 17 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 18 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 19 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 20 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

7.3 ENTERTAINMENT AND LEISURE ROBOTS

7.3.1 EASE OF FUNCTION AND INCREASED FASCINATION AMONG END-USERS TO DRIVE DEMAND FOR HOME ENTERTAINMENT AND LEISURE ROBOTS

TABLE 21 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 23 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 24 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

8 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 83)

8.1 INTRODUCTION

FIGURE 31 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 32 ONLINE CHANNEL TO CONTINUE TO HOLD LARGER SIZE OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

TABLE 25 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION)

TABLE 26 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

8.2 ONLINE

8.2.1 GLOBAL PANDEMIC HAS BOOSTED SALES OF HOUSEHOLD ROBOTS THROUGH ONLINE CHANNEL

TABLE 27 ONLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 ONLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 OFFLINE

8.3.1 HOUSEHOLD ROBOTS MARKET FOR OFFLINE CHANNEL TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 29 OFFLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 OFFLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

9 HOUSEHOLD ROBOTS MARKET, BY APPLICATION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 33 HOUSEHOLD ROBOTS MARKET, BY APPLICATION

FIGURE 34 VACUUMING APPLICATIONS TO HOLD LARGEST SIZE OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

TABLE 31 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 33 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 34 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

9.2 VACUUMING

9.2.1 VACUUMING APPLICATIONS DOMINATED HOUSEHOLD ROBOTS MARKET IN 2021

TABLE 35 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 38 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 39 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 41 EUROPE: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 42 EUROPE: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 44 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 45 ROW: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 ROW: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

9.3 LAWN MOWING

9.3.1 RISING ADOPTION OF ROBOTIC LAWN MOWERS IN HOUSEHOLDS TO DRIVE MARKET DURING FORECAST PERIOD

TABLE 47 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 50 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 51 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 EUROPE: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 54 EUROPE: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATIONS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 56 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 57 ROW: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 ROW: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.4 POOL CLEANING

9.4.1 SMARTPHONE CONNECTIVITY AND INTEGRATION OF INTELLIGENT SENSORS BROADEN CAPABILITIES OF POOL CLEANING ROBOTS

TABLE 59 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 62 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 63 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATIONS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 69 ROW: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 ROW: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY REGION, 2022–2027 (USD MILLION)

9.5 COMPANIONSHIP

9.5.1 MOBILITY AND PRACTICALITY INCREASINGLY SOUGHT-AFTER FEATURES IN COMPANIONSHIP ROBOTS

TABLE 71 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 73 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 74 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 75 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 78 EUROPE: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 ROW: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 ROW: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP, BY REGION, 2022–2027 (USD MILLION)

9.6 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS

9.6.1 ELDERLY ASSISTANCE ROBOTS HELP ELDERS WITH SOCIAL INTERACTION

TABLE 83 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 86 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 87 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 93 ROW: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 ROW: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS, BY REGION, 2022–2027 (USD MILLION)

9.7 ROBOT TOYS AND HOBBY SYSTEMS

9.7.1 HOBBY SYSTEMS DESIGNED TO PERFORM SIMPLE TASKS AND ARE HIGHLY CUSTOMIZABLE

TABLE 95 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 97 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 98 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 99 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 105 ROW: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 ROW: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHERS

TABLE 107 OTHERS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 OTHERS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 109 OTHERS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 110 OTHERS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 111 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 114 EUROPE: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR OTHER, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 ROW: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 ROW: HOUSEHOLD ROBOTS MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 120)

10.1 INTRODUCTION

FIGURE 35 HOUSEHOLD ROBOTS MARKET: BY REGION

FIGURE 36 ASIA PACIFIC TO CONTINUE TO HOLD LARGEST SHARE OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

TABLE 119 HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 121 HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 122 HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY COUNTRY

FIGURE 38 NORTH AMERICA: SNAPSHOT OF HOUSEHOLD ROBOTS MARKET

TABLE 123 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION)

TABLE 128 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US held largest share in North American market in 2021

10.2.2 CANADA

10.2.2.1 Availability of robotic vacuums enabled with High-Efficiency Particulate Air filters to boost market

10.2.3 MEXICO

10.2.3.1 Domestic players expected to have significant impact on market

10.3 EUROPE

FIGURE 39 EUROPE: HOUSEHOLD ROBOTS MARKET, BY COUNTRY

FIGURE 40 EUROPE: SNAPSHOT OF HOUSEHOLD ROBOTS MARKET

TABLE 129 EUROPE: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 EUROPE: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 131 EUROPE HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 EUROPE: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 133 EUROPE: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION)

TABLE 134 EUROPE: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 UK to continue to hold largest share in European market during forecast period

10.3.2 GERMANY

10.3.2.1 Presence of global household robot manufacturers to boost market growth

10.3.3 FRANCE

10.3.3.1 Changing consumer behavior to lead to increased acceptance of household robots

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY COUNTRY

FIGURE 42 ASIA PACIFIC: SNAPSHOT OF HOUSEHOLD ROBOTS MARKET

TABLE 135 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Surging demand from middle-class population for domestic cleaning to drive market

10.4.2 JAPAN

10.4.2.1 Growing need for elderly assistance due to increase in aging population to boost market growth

10.4.3 SOUTH KOREA

10.4.3.1 Positive sentiment toward household robots from Consumers to boost market

10.4.4 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 43 ROW: HOUSEHOLD ROBOTS MARKET, BY REGION

TABLE 141 ROW: HOUSEHOLD ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 ROW: HOUSEHOLD ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 143 ROW: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 ROW: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 ROW: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2018–2021 (USD MILLION)

TABLE 146 ROW: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 South America to hold larger share of market in RoW in 2027

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 High disposable income of people in this region to drive market

11 COMPETITIVE LANDSCAPE (Page No. - 141)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HOUSEHOLD ROBOTS MARKET

11.3 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 44 3-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN HOUSEHOLD ROBOTS MARKET, 2019–2021

11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN HOUSEHOLD ROBOTS MARKET IN 2021

FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS IN HOUSEHOLD ROBOTS MARKET IN 2021

TABLE 148 HOUSEHOLD ROBOTS MARKET: DEGREE OF COMPETITION

TABLE 149 HOUSEHOLD ROBOTS MARKET RANKING ANALYSIS

11.5 COMPANY EVALUATION QUADRANT, 2021

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 46 HOUSEHOLD ROBOTS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.6 COMPETITIVE BENCHMARKING

TABLE 150 COMPANY FOOTPRINT, BY TYPE (20 COMPANIES)

TABLE 151 COMPANY FOOTPRINT, BY APPLICATION (20 COMPANIES)

TABLE 152 COMPANY FOOTPRINT, BY REGION (20 COMPANIES)

TABLE 153 COMPANY PRODUCT FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT, 2021

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 47 HOUSEHOLD ROBOTS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

TABLE 154 HOUSEHOLD ROBOTS MARKET: LIST OF KEY STARTUPS/SMES

TABLE 155 HOUSEHOLD ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 COMPETITIVE SCENARIO AND TRENDS

11.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 156 HOUSEHOLD ROBOTS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2021

11.8.2 DEALS

TABLE 157 HOUSEHOLD ROBOTS MARKET: DEALS, 2021–2022

12 COMPANY PROFILES (Page No. - 157)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 IROBOT CORPORATION

TABLE 158 IROBOT CORPORATION: BUSINESS OVERVIEW

FIGURE 48 IROBOT CORPORATION: COMPANY SNAPSHOT

TABLE 159 IROBOT CORPORATION: PRODUCT LAUNCHES

TABLE 160 IROBOT CORPORATION: DEALS

12.2.2 ECOVACS ROBOTICS CO., LTD.

TABLE 161 ECOVACS ROBOTICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 49 ECOVACS ROBOTICS CO., LTD.: COMPANY SNAPSHOT

TABLE 162 ECOVACS ROBOTICS CO., LTD.: PRODUCT LAUNCHES

TABLE 163 ECOVACS ROBOTICS CO., LTD.: DEALS

12.2.3 XIAOMI CORPORATION

TABLE 164 XIAOMI CORPORATION: BUSINESS OVERVIEW

FIGURE 50 XIAOMI CORPORATION: COMPANY SNAPSHOT

TABLE 165 XIAOMI CORPORATION: PRODUCT LAUNCHES

12.2.4 MAYTRONICS, LTD

TABLE 166 MAYTRONICS, LTD: BUSINESS OVERVIEW

FIGURE 51 MAYTRONICS, LTD: COMPANY SNAPSHOT

TABLE 167 MAYTRONICS, LTD: DEALS

12.2.5 SAMSUNG ELECTRONICS CO., LTD.

TABLE 168 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 52 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

TABLE 169 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

12.2.6 NEATO ROBOTICS, INC.

TABLE 170 NEATO ROBOTICS, INC.: BUSINESS OVERVIEW

TABLE 171 NEATO ROBOTICS, INC.: PRODUCT LAUNCHES

12.2.7 DYSON LIMITED

TABLE 172 DYSON LIMITED: BUSINESS OVERVIEW

TABLE 173 DYSON LIMITED: DEALS

12.2.8 LG ELECTRONICS INC.

TABLE 174 LG ELECTRONICS INC.: BUSINESS OVERVIEW

FIGURE 53 LG ELECTRONICS INC.: COMPANY SNAPSHOT

TABLE 175 LG ELECTRONICS INC.: DEALS

12.2.9 LEGO A/S

TABLE 176 LEGO A/S: BUSINESS OVERVIEW

TABLE 177 LEGO A/S: DEALS

12.2.10 HAYWARD HOLDINGS, INC.

TABLE 178 HAYWARD HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 54 HAYWARD HOLDINGS, INC.: COMPANY SNAPSHOT

TABLE 179 HAYWARD HOLDINGS, INC.: DEALS

12.3 OTHER KEY PLAYERS

12.3.1 UBTECH ROBOTICS, INC.

12.3.2 HUSQVARNA GROUP

12.3.3 MIELE

12.3.4 ROBOMOW

12.3.5 CECOTEC INNOVACIONES S.L.

12.3.6 MONOPRICE, INC.

12.3.7 TEMI

12.3.8 DEERE & COMPANY

12.3.9 BOBSWEEP

12.3.10 ILIFE INNOVATION LIMITED

12.3.11 SHARP CORPORATION

12.3.12 SHARKNINJA OPERATING LLC

12.3.13 BISSELL, INC.

12.3.14 BLUE FROG ROBOTICS

12.3.15 BEIJING ROBOROCK TECHNOLOGY CO. LTD.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 199)

13.1 DISCUSSION GUIDE

13.1.1 FOR OEMS

13.1.2 ADDITIONAL QUESTIONS FOR DISTRIBUTORS

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

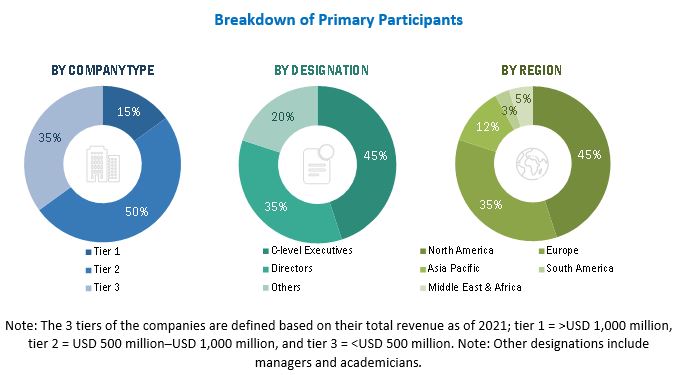

The study involved 4 major activities in estimating the size of the household robots market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Further, market breakdown and data triangulation were used to determine the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Robotics Business Review, International Federation of Robotics (IFR), Association for Unmanned Vehicle Systems International (AUVSI), IEEE Robotics and Automation Society, The Robotics Society of Japan, Chinese Association of Automation, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the household robots market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (commercial application providers) and supply-side (equipment manufacturers and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (South America, Middle East & Africa). Approximately 75% and 25% of primary interviews were conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In canvassing primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

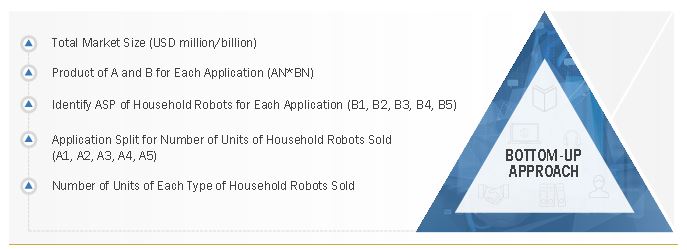

Both top-down and bottom-up approaches were used to estimate and validate the total size of the household robots market. These methods were also extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- In terms of value, the supply chain and market size were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been considered while calculating and forecasting the market size.

Global Household Robots Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To describe, segment, and forecast the household robots market, by offering, type, distribution channel, and application, in terms of value

- To describe, segment, and forecast the household robots market, by type and application, in terms of volume

- To describe and forecast the market for various segments by region—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the growth of the household robots market

- To provide a detailed overview of the value chain pertaining to the household robots ecosystem

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall household robots market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the household robots market

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as acquisitions, product launches and developments, and research and developments in the household robots market

Note:

1. Micromarkets are defined as further segments and subsegments of the household robots market included in the report.

2. Core competencies of the companies are defined in terms of their key developments, products offered, and key strategies adopted by them to sustain in the

market.

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Future of Household Robots and the Domestic Robots Market

The future of household robots and domestic robots is expected to be promising, with advancements in technology and the increasing demand for automation and convenience in our daily lives. Some potential developments in this field include:

Increased autonomy: Future household robots are likely to become more autonomous, with the ability to perform tasks without human intervention. They could be equipped with sensors and artificial intelligence to navigate their surroundings and adapt to changing situations.

Enhanced functionality: Household robots of the future are likely to have enhanced functionality, with the ability to perform a wider range of tasks. For example, a cleaning robot could also be able to cook meals or perform basic repairs.

Integration with smart homes: Future household robots are likely to be integrated with smart home technology, allowing them to interact with other devices and systems in the home. They could be controlled through voice commands or mobile apps and could communicate with other devices to coordinate tasks.

Personalization: Future household robots are likely to be more personalized, with the ability to learn from their interactions with users and adapt to their preferences. They could also be customized with different accessories or software to suit the needs of individual users.

Cost reduction: As technology advances and production processes become more efficient, the cost of household robots is likely to decrease. This could make them more accessible to a wider range of consumers, further increasing their adoption and use.

Top Companies in Domestic Robots Market

The domestic robots market is rapidly growing, with many companies investing in the development and production of innovative home robots. Here are some of the top companies in the domestic robots market:

iRobot: A leader in the domestic robots market, iRobot is best known for its Roomba line of robotic vacuum cleaners. The company also produces other home robots, including the Braava floor-mopping robot and the Terra lawn-mowing robot.

Samsung: Samsung has entered the domestic robots market with its Bot series, which includes the Bot Handy, a robot that can pick up objects and do simple chores, and the Bot Care, which can monitor users' health.

LG: LG has developed a range of home robots, including the CLOi SuitBot, a wearable robot designed to assist people with mobility issues, and the CLOi Home, which can control other smart home devices.

Ecovacs: Ecovacs is a Chinese company that produces robotic vacuum cleaners, including the popular Deebot series. The company also produces other home robots, such as the Atmobot, a robot that can purify the air in your home.

Neato Robotics: Neato Robotics produces robotic vacuum cleaners that use laser mapping technology to navigate and clean your home. Its flagship product is the Neato D7 Connected.

SharkNinja: SharkNinja produces a range of cleaning products, including the Shark IQ Robot Vacuum and the Shark Ion Robot Vacuum. The company also produces other home appliances, such as blenders and air purifiers.

Eufy: Eufy is a subsidiary of Anker, a company that produces electronics and accessories. Eufy produces robotic vacuum cleaners, including the popular RoboVac series.

Roborock: Roborock is a Chinese company that produces robotic vacuum cleaners and mops, including the popular Roborock S6 and S7.

Ecobee: Ecobee is best known for its smart thermostats, but the company has also entered the home robotics market with its Haven home security system, which includes a camera-equipped robot that can patrol your home.

Temi: Temi produces a home robot that can serve as a personal assistant and entertainment system. The robot can make video calls, play music, and control other smart home devices.

The market scope of home robot also includes various applications such as:

Personal assistants: Home robots can be used as personal assistants, helping users manage their daily schedules, make phone calls, send messages, and more.

Entertainment: Home robots can serve as entertainment systems, playing music, videos, and games.

Home security: Home robots can be equipped with cameras and sensors to monitor the home and alert users to potential security threats.

Elder care: Home robots can assist older adults with tasks such as medication reminders, monitoring health conditions, and providing companionship.

Pet care: Home robots can provide pet owners with assistance in feeding, playing, and monitoring their pets.

Smart home integration: Home robots can integrate with other smart home devices, allowing users to control their lights, thermostats, and other devices with voice commands or through a mobile app.

Lawn care: Home robots can be designed to mow the lawn or perform other outdoor tasks, such as cleaning the pool or watering the plants.

Education: Home robots can be used as educational tools, teaching children new skills and providing interactive learning experiences.

Cooking: Home robots can be designed to assist with cooking and meal preparation, helping users to plan menus, shop for groceries, and prepare meals.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Household Robots Market