Human Machine Interface Market by Product (Hardware (Basic HMI, Advanced PC Based HMI, Advanced Panel Based HMI) and Software(On Premise HMI and Cloud Based HMI), Configuration (Embedded HMI, Standalone HMI) and Region - Global Forecast to 2027

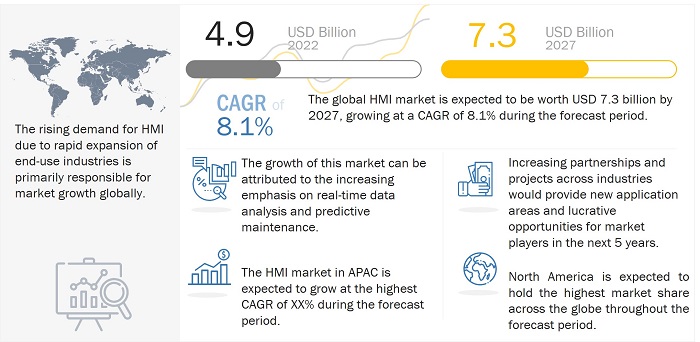

Human Machine Interface Market Size by 2027

[210 Pages Report] The global Human Machine Interface Market size is estimated to be USD 4.9 billion in 2022 and is projected to reach USD 7.3 billion by 2027, at a CAGR of 8.1%.

Human Machine Interface Market Share

Increasing adoption of industrial automation in the manufacturing process and increasing emphasis on real-time data analysis are the major factors driving the growth of the HMI market. Moreover, increasing demand for safety compliance automation solutions is another key factor for the growth of the human machine interface industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Latest technological Trends in HMI Market

Bioacoustic Sensing

Bioacoustic sensing uses digital technology to record and analyze sounds. One of the main methods in bioacoustics sensing is listening. Bioacoustic sensing can be incorporated with human machine interface by programming the HMI in accordance with the sound. For example, if the equipment is broken and generates a unique sound, it immediately informs the operator. This helps in avoiding any delays and provides faster action time. For instance, Skinput is an input technology that uses bioacoustic sensing to understand finger taps on the skin; this device provides a user interface on the skin for direct manipulation. A similar technology can be created for HMI in industries wherein a physical control panel is not required, but a virtual control panel gets displayed on the operator’s skin that can be used from any location.

Augmented Reality

The implementation and adoption of Augmented Reality are growing. The combination of Augmented Reality and HMI can help view accurate details related to any context, receive guidance on the operation on-site, and provide on-spot solutions while troubleshooting. Augmented Reality can help make quick decisions by immediately connecting the operator to the control system without them trying to reach their workstation. Augmented Reality is bound to increase the adoption of human machine interface in industries further.

Human Machine Interface Market Dynamics

DRIVERS: Surging adoption of industrial automation in manufacturing process

Automation ensures various advantages, such as superior quality, uniformity, enhanced productivity, increased safety, improved accuracy, and minimized operating costs. Hence, it has become the most important part of the modern industrial sector. The integration of advanced HMI solutions and connectivity technology with various industrial automation equipment has tremendously increased the quality, productivity, and mobility of plant assets. Therefore, the adoption of industrial automation equipment, such as human machine interface, field devices, and smart equipment, has increased significantly among manufacturers from various industries such as food & beverages, oil & gas, metal & mining, automotive, semiconductor & electronics, and A&D.

RESTRAINT: High installation and maintenance costs

The installation cost of an human machine interface system is high, which acts as a major restraint for the growth of the market across cost-sensitive markets such as APAC and South America. The high installation cost of the HMI system is due to the involvement of various stages, such as consultation, acquisition, implementation, and running costs, that further increases the expenditure of the installing company. The introduction of smart manufacturing results in the adoption of advanced industrial automation equipment such as smart field devices and industrial robots. To communicate with these types of equipment, HMIs need to be more advanced with the latest functional technologies such as voice recognition, gesture recognition, and multi-touch screen, which further increases the cost of the system.

OPPORTUNITIES: Adoption of emerging technologies such as IIoT and cloud computing in industrial environments

IoT has transformed the operations of various industries, including manufacturing. The application of IoT across manufacturing industries can be termed Industrial IoT (IIoT). It is revolutionizing manufacturing plants by connecting a wide network of intelligent devices with the help of SCADA systems. As a result, a fully digital plant is established. IIoT makes industrial processes efficient, productive, and innovative, as the architecture provides information about operational and business systems on a real-time basis. The manufacturers investing in IIoT are gaining benefits such as increased and efficient productivity through connectivity, automation, and analytics. IIoT provides complete visibility of assets, resources, processes, and products to plant managers.

Moreover, innovations in the cloud have offered new business capabilities and opportunities to enterprises. The use of IoT in manufacturing processes generates a large amount of data, which requires a place to store. Here, cloud computing plays a vital role. Cloud computing leverages the power of the Internet to eliminate the need for purchasing, installing, and maintaining independent data centers and networks.

CHALLENGES: Increasing security risks associated with cloud-HMI platform

Cloud-HMI platforms are gaining popularity as they can reduce initial cost, provide easy access, and quick deployment. However, security concerns associated with cloud computing are a major concern for end users. On a cloud-based platform, many customers can use the same service, which raises issues of data vulnerability. It is risky to share critical business information with third-party service providers, as information leaks can cause huge losses to the company. Furthermore, increasing occurrences of viruses and hacking lead to security concerns.

Human machine interface software market is projected to witness the highest growth during forecast period

The ability of HMI software to offer flexibility and reliability and enhance the efficiency of the production process is expected to drive the demand for HMI software during the forecast period. As the software models are dedicated to specific organizations, it helps with data storage regulations and reduces security concerns while allowing organizations to make changes in the process if and when required.

Embedded HMI market is projected to witness the highest growth during forecast period

Embedded HMIs offer an integrated environment that is simpler and user-friendly, further enhancing operator efficiency. Technological innovations and increasing demand for integrated solutions are factors expected to encourage the growth of the embedded human machine interface market.

Automotive industry held the largest share of the human machine interface market

Increasing demand for automobiles in developing countries, technological innovations in the automotive industry, such as electric cars, fuel-efficient cars, and connected cars, and growing competition in the market are factors expected to drive the growth of the automotive segment. In the automotive sector, HMI solutions help in production sequencing, production dispatching, production operations, support, monitoring, and control. HMI ensures proper sequencing of products according to specific requirements during production.

Oil & gas industry held the largest share of the HMI market

The oil & gas industry always poses a great demand for safety and reliability. In the supply chain of the oil & gas industry, from exploration through delivery, there is a vast demand for automation, industry expertise, and an extensive partner network, which help integrate information, control, power, and safety solutions to respond to the global demand for affordable energy supply, to meet stringent government regulations and drive down costs.

North America held the largest share of the human machine interface market

R&D in the application areas of HMI is growing owing to the adoption of IIoT and machine-to-machine (M2M) communication by various industries in the region. The rising demand for HMI solutions in industrial, automotive, power, oil & gas, pharmaceutical, and healthcare sectors to improve performance efficiency and reduce the overall operational cost is expected to boost the growth of the HMI market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The human machine interface companies is dominated by a few globally established players such as Rockwell Automation Inc. (US), Siemens AG (Germany), Schneider Electric SE (France), ABB (Switzerland), and Honeywell International Inc. (US).

Scope of Human Machine Interface Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 4.9 Billion |

| Projected Market Size | USD 7.3 Billion |

| Growth Rate | CAGR of 8.1% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Surging Adoption of Industrial Automation in Manufacturing Process |

| Largest Growing Region | North America (NA) |

| Largest Market Share Segment | Oil and Gas, Automotive Industry |

| Highest CAGR Segment | HMI Software |

This research report segments the HMI market based on product, configuration, industry, and region.

Based on Product, the HMI Market been Segmented as follows:

- Hardware

- Software

Based on Configuration, the Human Machine Interface Market been Segmented as follows:

- Embedded HMI

- Standalone HMI

Based on Industry, the HMI Market been Segmented as follows:

- Process Industry

- Discrete Industry

Based on Region, the Human Machine Interface Market been Segmented as follows:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In November 2022, Mitsubishi Electric launched two new Graphic Operation Terminals (GOTs), which come as the latest addition to its GOT2000 Series Wide Model lineup, that help meet customers’ needs for a wider screen to show more information about the factory, process, utility, and other automation applications.

- In October 2022, Emerson Electric Co. acquired the Progea Group, an industry-leading provider of HMI, SCADA, and PLC solutions. This acquisition is likely to bring new capabilities and resources and create opportunities to deliver end-to-end hardware and software solutions to Emerson’s customers.

- In July 2021, General Electric Company updated its Proficy Plant application to enhance order execution, non-conformance tracking, and in-process word order editor. The new version will drive continuous improvements with robust manufacturing execution system (MES), HMI/SCADA, analytics, and industrial data management solutions in different manufacturing and process industries.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the HMI market during 2022-2027?

The global HMI market is expected to record a CAGR of 8.1% from 2022–2027.

What are the driving factors for the HMI market?

The increasing demand for industrial automation solutions in manufacturing processes and the increasing necessity for real-time data analysis and predictive maintenance are key driving factors.

Which are the significant players operating in the HMI market?

Rockwell Automation Inc. (US), Siemens AG (Germany), Schneider Electric SE (France), ABB (Switzerland), and Honeywell International Inc. (US) are some of the major companies operating in the HMI market.

Which region will lead the HMI market in the future?

North America is expected to lead the HMI market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HUMAN MACHINE INTERFACE MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 HMI MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: (SUPPLY SIDE): REVENUE GENERATED THROUGH SOLUTIONS/SERVICES IN MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at market share using bottom-up analysis (demand side)

FIGURE 4 HUMAN MACHINE INTERFACE MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to capture market share using top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 7 HMI SOFTWARE MARKET ANTICIPATED TO WITNESS HIGHER CAGR

FIGURE 8 MARKET FOR EMBEDDED HMI TO GROW AT HIGHER CAGR

FIGURE 9 MARKET FOR AUTOMOTIVE TO BE DOMINANT DURING FORECAST PERIOD

FIGURE 10 HUMAN MACHINE INTERFACE MARKET FOR OIL & GAS TO HOLD LARGEST MARKET SHARE

FIGURE 11 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 12 INCREASING USE OF INDUSTRIAL AUTOMATION IN MANUFACTURING TO BOOST ADOPTION OF HMI SOLUTIONS

4.2 HMI MARKET, BY PRODUCT

FIGURE 13 MARKET FOR SOFTWARE TO GROW AT HIGHER CAGR

4.3 MARKET, BY PROCESS INDUSTRY

FIGURE 14 OIL & GAS TO HOLD LARGEST SIZE IN 2022

4.4 MARKET, BY DISCRETE INDUSTRY

FIGURE 15 AUTOMOTIVE TO DOMINATE MARKET IN 2022

4.5 MARKET, BY COUNTRY/REGION

FIGURE 16 US TO HOLD LARGEST SHARE OF HUMAN MACHINE INTERFACE MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 18 DRIVERS FOR GLOBAL HMI MARKET AND THEIR IMPACT

5.2.1.1 Surging adoption of industrial automation in manufacturing process

5.2.1.2 Increasing emphasis on real-time data analysis and predictive maintenance

5.2.1.3 Strategic initiatives by governments to promote adoption of operational technologies

5.2.1.4 Growing adoption of Industry 4.0

5.2.2 RESTRAINTS

FIGURE 19 RESTRAINTS FOR GLOBAL MARKET AND THEIR IMPACT

5.2.2.1 High installation and maintenance costs

5.2.2.2 Requirement of maintenance and frequent software upgrades

5.2.2.3 Lack of skilled professionals

5.2.3 OPPORTUNITIES

FIGURE 20 OPPORTUNITIES FOR GLOBAL MARKET AND THEIR IMPACT

5.2.3.1 Increased demand for safety compliance automation solutions

5.2.3.2 Adoption of emerging technologies such as IIoT and cloud computing in industrial environments

5.2.3.3 Increasing investments in renewable power projects

5.2.4 CHALLENGES

FIGURE 21 CHALLENGES FOR GLOBAL MARKET AND THEIR IMPACT

5.2.4.1 Lack of standardization in industrial communication protocols and interfaces

5.2.4.2 Increasing security risks associated with cloud-HMI platform

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 HUMAN MACHINE INTERFACE MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 23 MARKET: ECOSYSTEM

5.5 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 1 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.6 TECHNOLOGY TRENDS

5.6.1 SPATIAL COMPUTING

5.6.2 TRANSPARENT DISPLAYS

5.6.3 BIOACOUSTIC SENSING

5.6.4 MACHINE LEARNING

5.6.5 GESTURE CONTROL DEVICES

5.6.6 FLEXIBLE DISPLAY

5.6.7 AUGMENTED REALITY

5.6.8 SENSOR FUSION

5.6.9 VIRTUAL REALITY

5.6.10 DIGITALIZATION AND INDUSTRIAL INTERNET OF THINGS (IIOT)

5.6.11 INDUSTRY 4.0

5.6.12 ARTIFICIAL INTELLIGENCE (AI)

5.6.13 INTERNET OF THINGS (IOT)

5.7 STANDARDS & REGULATORY LANDSCAPE

5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7.2 REGULATORY STANDARDS

5.7.2.1 IEC TS 62832-1: 2020

5.7.2.2 ISO/IEC TR 63306-1:2020

5.7.2.3 ISO 55001: 2014

5.7.2.4 Industrial safety standards

6 HUMAN MACHINE INTERFACE MARKET, BY TECHNOLOGY TYPE (Page No. - 67)

6.1 INTRODUCTION

6.2 MOTION HMI

6.3 BIONIC HMI

6.4 TACTILE HMI

6.5 ACOUSTIC HMI

7 HMI MARKET, BY PRODUCT (Page No. - 68)

7.1 INTRODUCTION

FIGURE 24 MARKET, BY PRODUCT

TABLE 6 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 7 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.2 HARDWARE

TABLE 8 MARKET, BY HARDWARE, 2018–2021 (USD MILLION)

TABLE 9 MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

7.2.1 BASIC HMI

7.2.1.1 High demand for simple and price-sensitive applications

7.2.2 ADVANCED PANEL-BASED HMI

7.2.2.1 Ability to implement high-performance visualization

FIGURE 25 ADVANCED PC-BASED HMI TO HOLD LARGEST MARKET SHARE

7.2.3 ADVANCED PC-BASED HMI

7.2.3.1 Advanced PC-based HMI offers IoT and cloud connectivity for big data analytics

TABLE 10 HUMAN MACHINE INTERFACE MARKET, BY HARDWARE, 2018–2021 (MILLION UNITS)

TABLE 11 HMI MARKET, BY HARDWARE, 2022–2027 (MILLION UNITS)

7.3 SOFTWARE

7.3.1 ON-PREMISE HMI

7.3.1.1 Data security and customization to encourage adoption of on-premise HMI solutions

7.3.2 CLOUD-BASED HMI

7.3.2.1 Low installation cost to encourage adoption of cloud-based HMI by small enterprises

FIGURE 26 CLOUD-BASED HMI TO GROW AT HIGHER CAGR

TABLE 12 MARKET, BY SOFTWARE, 2018–2021 (USD MILLION)

TABLE 13 MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

7.4 SERVICES

8 HMI MARKET, BY CONFIGURATION (Page No. - 77)

8.1 INTRODUCTION

FIGURE 27 MARKET, BY CONFIGURATION

TABLE 14 MARKET, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY CONFIGURATION, 2022–2027 (USD MILLION)

FIGURE 28 EMBEDDED HMI TO HOLD LARGER MARKET SHARE BETWEEN 2022 AND 2027

8.2 EMBEDDED HMI

8.2.1 OFFERS SEVERAL BENEFITS TO END USERS

TABLE 16 MARKET FOR EMBEDDED HMI, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 17 HUMAN MACHINE INTERFACE MARKET FOR EMBEDDED HMI, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 18 MARKET FOR EMBEDDED HMI, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 19 MARKET FOR EMBEDDED HMI, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

8.3 STANDALONE HMI

8.3.1 COST-EFFICIENT FOR SMALL ENTERPRISES

TABLE 20 MARKET FOR STANDALONE HMI, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR STANDALONE HMI, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 22 MARKET FOR STANDALONE HMI, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR STANDALONE HMI, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

9 HUMAN MACHINE INTERFACE MARKET, BY SALES CHANNEL (Page No. - 84)

9.1 INTRODUCTION

FIGURE 29 SALES CHANNELS OF HUMAN-MACHINE INTERFACE SOLUTIONS

9.2 DIRECT SALES CHANNELS

9.3 INDIRECT SALES CHANNELS

9.3.1 HMI PRODUCTS TO WITNESS INCREASED SALES THROUGH ONLINE SALES CHANNELS

10 HMI MARKET, BY END-USER INDUSTRY (Page No. - 86)

10.1 INTRODUCTION

FIGURE 30 GLOBAL MARKET, BY END-USER INDUSTRY

TABLE 24 MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.2 PROCESS INDUSTRY

FIGURE 31 MARKET, BY PROCESS INDUSTRY

TABLE 26 MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 28 MARKET FOR PROCESS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 HUMAN MACHINE INTERFACE MARKET FOR PROCESS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

FIGURE 32 NORTH AMERICA TO HOLD LARGEST MARKET FOR PROCESS INDUSTRY DURING FORECAST PERIOD

TABLE 30 MARKET FOR PROCESS INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR PROCESS INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.1 OIL & GAS

10.2.1.1 Increasing demand for remote monitoring solutions

TABLE 32 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 MARKET FOR OIL AND GAS INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR OIL AND GAS INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.2 FOOD & BEVERAGES

10.2.2.1 Stringent quality requirements

TABLE 36 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 39 HUMAN MACHINE INTERFACE MARKET FOR FOOD & BEVERAGES INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.3 PHARMACEUTICALS

10.2.3.1 Complex manufacturing processes in pharmaceutical plants

TABLE 40 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 MARKET FOR PHARMACEUTICALS INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR PHARMACEUTICALS INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.4 CHEMICALS

10.2.4.1 Focus of chemical manufacturers on increasing operational efficiency

TABLE 44 HMI MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 MARKET FOR CHEMICALS INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 47 HUMAN MACHINE INTERFACE MARKET FOR CHEMICALS INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.5 ENERGY & POWER

10.2.5.1 Surging demand for advanced monitoring solutions

TABLE 48 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 MARKET FOR ENERGY & POWER INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR ENERGY & POWER INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.6 METALS & MINING

10.2.6.1 High risks associated with mining operations

TABLE 52 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 MARKET FOR METALS & MINING INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR METALS & MINING INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.7 WATER & WASTEWATER

10.2.7.1 Technological advancements in water treatment operations

TABLE 56 MARKET FOR WATER & WASTEWATER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR WATER & WASTEWATER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 MARKET FOR WATER & WASTEWATER INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR WATER & WASTEWATER INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.2.8 OTHERS

TABLE 60 MARKET FOR OTHER PROCESS INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR OTHER PROCESS INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 MARKET FOR OTHER PROCESS INDUSTRIES, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 63 HUMAN MACHINE INTERFACE MARKET FOR OTHER PROCESS INDUSTRIES, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3 DISCRETE INDUSTRY

FIGURE 33 MARKET, BY DISCRETE INDUSTRY

TABLE 64 MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 66 MARKET FOR DISCRETE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 MARKET FOR DISCRETE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

FIGURE 34 MARKET FOR DISCRETE INDUSTRY IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 68 MARKET FOR DISCRETE INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 69 MARKET FOR DISCRETE INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3.1 AUTOMOTIVE

10.3.1.1 Technological innovations in automotive industry

TABLE 70 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 MARKET FOR AUTOMOTIVE INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 73 HMI MARKET FOR AUTOMOTIVE INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3.2 AEROSPACE

10.3.2.1 Adoption of HMI solutions to ensure reliability of equipment

TABLE 74 HUMAN MACHINE INTERFACE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 MARKET FOR AEROSPACE INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 77 MARKET FOR AEROSPACE INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3.3 PACKAGING

10.3.3.1 Increasing emphasis on packaging of products

TABLE 78 MARKET FOR PACKAGING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET FOR PACKAGING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 80 MARKET FOR PACKAGING INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 81 MARKET FOR PACKAGING INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3.4 MEDICAL DEVICES

10.3.4.1 Unrelenting need to monitor medical device manufacturing processes

TABLE 82 MARKET FOR MEDICAL DEVICES INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 MARKET FOR MEDICAL DEVICES INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 84 MARKET FOR MEDICAL DEVICES INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 85 MARKET FOR MEDICAL DEVICES INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3.5 SEMICONDUCTOR & ELECTRONICS

10.3.5.1 High competition in semiconductor & electronics industry

TABLE 86 HUMAN MACHINE INTERFACE MARKET FOR SEMICONDUCTOR & ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 MARKET FOR SEMICONDUCTOR & ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 MARKET FOR SEMICONDUCTOR & ELECTRONICS INDUSTRY, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 89 MARKET FOR SEMICONDUCTOR & ELECTRONICS INDUSTRY, BY CONFIGURATION, 2022–2027 (USD MILLION)

10.3.6 OTHERS

TABLE 90 MARKET FOR OTHER DISCRETE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 MARKET FOR OTHER DISCRETE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 MARKET FOR OTHER DISCRETE INDUSTRIES, BY CONFIGURATION, 2018–2021 (USD MILLION)

TABLE 93 MARKET FOR OTHER DISCRETE INDUSTRIES, BY CONFIGURATION, 2022–2027 (USD MILLION)

11 HUMAN MACHINE INTERFACE MARKET, BY REGION (Page No. - 121)

11.1 INTRODUCTION

FIGURE 35 GEOGRAPHIC SNAPSHOT: HMI MARKET

TABLE 94 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 36 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

11.2 NORTH AMERICA

TABLE 96 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 98 NORTH AMERICA: MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Growing focus of key players on developing innovative HMI products

11.2.2 CANADA

11.2.2.1 Growing processed food industry

11.2.3 MEXICO

11.2.3.1 Expansions by key players

11.3 EUROPE

TABLE 102 EUROPE: HUMAN MACHINE INTERFACE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 38 EUROPE: MARKET SNAPSHOT

TABLE 104 EUROPE: MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Rising automation in food & beverage industry

11.3.2 GERMANY

11.3.2.1 Increasing adoption of advanced technologies in automotive industry

11.3.3 FRANCE

11.3.3.1 Government initiatives and support

11.3.4 REST OF EUROPE

11.4 ASIA PACIFIC

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 110 ASIA PACIFIC: MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: HMI MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increasing labor costs in China to encourage adoption of advanced automation technologies

11.4.2 JAPAN

11.4.2.1 Increasing production of automotives

11.4.3 INDIA

11.4.3.1 Growth of manufacturing industry to create opportunities

11.4.4 REST OF ASIA PACIFIC

11.4.4.1 Smart manufacturing initiatives

11.5 ROW

FIGURE 40 ROW: HUMAN MACHINE INTERFACE MARKET

TABLE 114 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 115 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 116 ROW: MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 117 ROW: MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 118 ROW: MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 119 ROW: MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST

11.5.1.1 High adoption of HMI solutions in oil & gas industry

11.5.2 AFRICA

11.5.2.1 Digitalization of mines to propel growth

11.5.3 SOUTH AMERICA

11.5.3.1 Rising demand for automation products and instrumentation

12 COMPETITIVE LANDSCAPE (Page No. - 146)

12.1 OVERVIEW

TABLE 120 KEY DEVELOPMENTS IN HMI (2020 TO 2022)

12.2 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 41 TOP 5 PLAYERS IN MARKET, 2017–2021

12.3 MARKET SHARE ANALYSIS: MARKET (2021)

TABLE 121 HUMAN MACHINE INTERFACE MARKET: MARKET SHARE ANALYSIS

12.4 COMPETITIVE LEADERSHIP MAPPING, 2021

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE PLAYERS

12.4.4 PARTICIPANTS

FIGURE 42 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

12.5 START-UP/SME EVALUATION QUADRANT, 2021

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

FIGURE 43 HMI MARKET: START-UP/SME QUADRANT, 2021

12.6 COMPETITIVE BENCHMARKING

TABLE 122 HUMAN MACHINE INTERFACE MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 123 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.7 COMPETITIVE SITUATIONS AND TRENDS

12.7.1 PRODUCT LAUNCHES

TABLE 124 MARKET: PRODUCT LAUNCHES, JULY 2020–DECEMBER 2021

12.7.2 DEALS

TABLE 125 MARKET: DEALS, JANUARY 2020–DECEMBER 2021

13 COMPANY PROFILES (Page No. - 156)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 ABB LTD.

TABLE 126 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB LTD.: COMPANY SNAPSHOT

13.1.2 ADVANTECH CO., LTD.

TABLE 127 ADVANTECH CO., LTD.: BUSINESS OVERVIEW

FIGURE 45 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

13.1.3 EMERSON ELECTRIC CO.

TABLE 128 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 46 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

13.1.4 GENERAL ELECTRIC CO.

TABLE 129 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 47 GENERAL ELECTRIC CO.: COMPANY SNAPSHOT

13.1.5 HONEYWELL INTERNATIONAL, INC.

TABLE 130 HONEYWELL INTERNATIONAL, INC.: BUSINESS OVERVIEW

FIGURE 48 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

13.1.6 MITSUBISHI ELECTRIC CORPORATION

TABLE 131 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 49 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

13.1.7 ROCKWELL AUTOMATION, INC.

TABLE 132 ROCKWELL AUTOMATION INC: BUSINESS OVERVIEW

FIGURE 50 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

13.1.8 SCHNEIDER ELECTRIC SE

TABLE 133 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 51 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

13.1.9 SIEMENS AG

TABLE 134 SIEMENS: BUSINESS OVERVIEW

FIGURE 52 SIEMENS AG: COMPANY SNAPSHOT

13.1.10 YOKOGAWA ELECTRIC CORPORATION

TABLE 135 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 53 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

13.2 OTHER KEY PLAYERS

13.2.1 BECKHOFF AUTOMATION

13.2.2 BEIJER ELECTRONICS GROUP

13.2.3 EATON

13.2.4 EXOR INTERNATIONAL

13.2.5 KONTRON AG

13.2.6 OMRON CORPORATION

13.2.7 RED LION

13.2.8 ROBERT BOSCH GMBH

13.2.9 TEXAS INSTRUMENTS INCORP.

13.2.10 WEINTEK LABS., INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 197)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 INDUSTRIAL PC MARKET, BY TYPE

TABLE 136 INDUSTRIAL PC MARKET, IN TERMS OF VOLUME, 2017–2026

TABLE 137 INDUSTRIAL PC MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 138 INDUSTRIAL PC MARKET, BY TYPE, 2021–2026 (USD MILLION)

14.3.1 PANEL IPC

14.3.1.1 Growing adoption of automated manufacturing technologies drives demand for panel IPC

TABLE 139 PANEL INDUSTRIAL PC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 140 PANEL INDUSTRIAL PC MARKET, BY REGION, 2021–2026 (USD MILLION)

14.3.2 RACK MOUNT IPC

14.3.2.1 Surging need for compact designs in space-constrained applications accelerates demand for rack mount IPC

TABLE 141 RACK MOUNT INDUSTRIAL PC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 142 RACK MOUNT INDUSTRIAL PC MARKET, BY REGION, 2021–2026 (USD MILLION)

14.3.3 BOX IPC

14.3.3.1 Rising demand for highest level of reliability and performance supports adoption of box IPC in industrial applications

TABLE 143 BOX INDUSTRIAL PC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 144 BOX INDUSTRIAL PC MARKET, BY REGION, 2021–2026 (USD MILLION)

14.3.4 DIN RAIL IPC

14.3.4.1 Increasing use of rugged and scalable DIN rail IPC for maintenance-free and continuous operations

TABLE 145 DIN RAIL INDUSTRIAL PC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 146 DIN RAIL INDUSTRIAL PC MARKET, BY REGION, 2021–2026 (USD MILLION)

14.3.5 EMBEDDED IPC

14.3.5.1 North America to account for largest share of embedded IPC market during forecast period

TABLE 147 EMBEDDED INDUSTRIAL PC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 148 EMBEDDED INDUSTRIAL PC MARKET, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 204)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 CUSTOMIZATION OPTIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

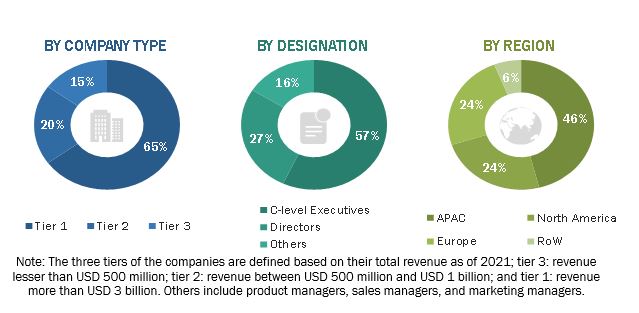

The study involved four major activities in estimating the current size of the HMI market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the HMI ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall HMI market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the HMI market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the HMI market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global HMI market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the HMI market, in terms of value, based on type, product, application, and vertical

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the HMI ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Human Machine Interface Market

In addition to the above mentioned brands, I think some other HMI products are also good, such as Proface and Hitech. Although the market share is not as good as Schneider, but in fact the product is quite good.