Humanoid Robot Market by Component (Hardware, Software), Motion Type (Biped, Wheel Drive), Application (Education and Entertainment, Research and Space Exploration, Personal Assistance and Caregiving) and Region - 2028

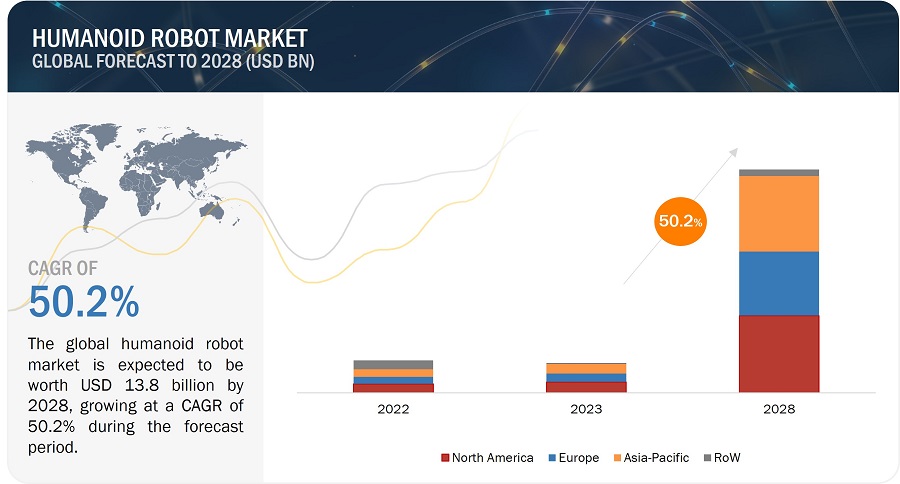

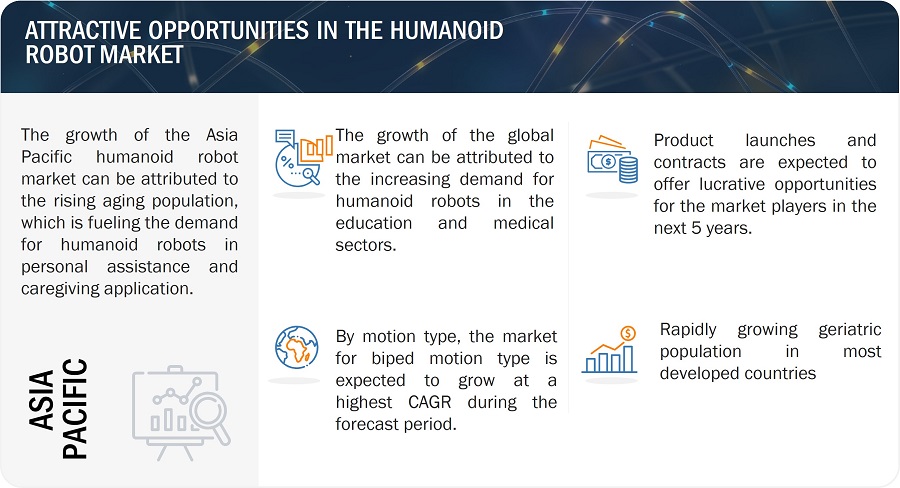

[220 Pages Report] The humanoid robot market size is projected to grow from USD 1.8 billion in 2023 to USD 13.8 billion by 2028, growing at a CAGR of 50.2% from 2023 to 2028. Rising demand for humanoid robots from the medical sector and Growing development of humanoid robots with advanced features drive market growth during the forecast period. Factors such as the rapidly growing baby boomers in developed countries provide market growth opportunities for the humanoid robot market.

Humanoid Robot Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Humanoid Robot Market Dynamics

Driver: Rising demand for humanoid robots from the medical sector

The healthcare sector has witnessed an increasing demand for humanoid robots due to their ability to assist medical professionals and enhance patient care. These robots are widely deployed in hospitals and medical centers, performing various tasks and functions. One significant application is the collection of patient information, allowing humanoid robots to interact with patients and gather vital data. This reduces the need for direct human contact, thereby minimizing the risk of infections and ensuring the safety of both patients and healthcare providers. Additionally, humanoid robots can be programmed to deliver medical supplies, food, and other essential items to patients, alleviating the workload of healthcare staff and promoting social distancing measures.

Another important use case for humanoid robots in healthcare is conducting preliminary screenings and assessments. These robots can screen patients for symptoms, measure vital signs like body temperature, and ensure adherence to safety protocols like wearing face masks. By automating these processes, humanoid robots enable healthcare professionals to allocate their time and resources more effectively, focusing on critical tasks that require their expertise. This streamlines operations enhances patient flow, and optimizes the utilization of healthcare resources.

In addition to their practical functionalities, humanoid robots equipped with advanced technologies such as facial recognition and natural language processing can provide companionship and emotional support to patients. They engage in conversations, offer information, and even lead activities to alleviate loneliness and promote mental well-being, valuable for patients in isolation or long-term care, as humanoid robots can bridge the gap between patients and their social interactions, improving their overall well-being and quality of life. By integrating these humanoid robots into the healthcare setting, patients receive personalized care and attention, enhancing their overall experience.

The increasing demand for humanoid robots in healthcare is driven by the desire for improved efficiency, reduced contact, and enhanced patient experiences. These robots have the potential to complement healthcare professionals, optimize resource allocation, and provide tailored care to patients. Softbank Robotics developed the humanoid robot Pepper, and was deployed at St. Marien Hospital. Pepper's responsibilities at the hospital included providing information, answering frequently asked questions, and entertaining patients and visitors. The presence of Pepper resulted in improved engagement and personalized experiences, fostering a positive and welcoming environment.

Restraint: Safety Concerns in Humanoid Robot Adoption

Safety concerns are a significant hindrance in adopting humanoid robots in human environments. As these robots operate alongside humans, there is a need to ensure their safe interaction and minimize the risk of accidents or malfunctions that could cause harm to humans or property. Accidents involving humanoid robots can lead to injuries or damage, raising regulatory concerns and creating hesitancy in their widespread.

Humanoid robots are complex machines with various moving parts, sensors, and capabilities. The potential risks associated with their operation include collisions, falls, entanglement, or even unintended physical contact with humans. Ensuring the safety of humanoid robots requires implementing robust safety features, such as collision detection and avoidance systems, emergency stop mechanisms, and compliance with safety standards.

Regulatory bodies are increasingly focused on defining safety guidelines and standards for humanoid robots to mitigate potential risks. Adhering to these regulations helps ensure the safety of humans and builds trust in the technology. Additionally, addressing safety concerns through thorough testing, risk assessments, and continuous monitoring of humanoid robots' performance is crucial for successfully integrating into human environments.

Overcoming safety concerns is essential to gain wider acceptance and accelerate the adoption of humanoid robots across industries. By prioritizing safety and addressing potential risks, stakeholders can work towards establishing a safe and secure environment for humans and robots to coexist and collaborate effectively.

Opportunity: Increasing demand for robots in different fields of rescue operations

A long-standing goal of robotic rescue is to allow robots to work in unreachable environments or conditions that are too hazardous for humans. The search and rescue domain’s applications have been increasing due to robotic rescue's growing use. Robotic rescue increases human rescuer capability and the safety of operations. Using humanoid robots in search and rescue operations helps save numerous lives and reduces thousands of casualties worldwide. The impact of earthquakes, hurricanes, flooding, and other natural disasters is increasing. It has generated the need for autonomous rescue by robots in all the phases of a disaster—from prevention to response and recovery.

Boston Dynamics has developed a bipedal humanoid robot named Atlas, funded by Defense Advanced Research Projects Agency (DARPA). This humanoid robot performs various search and rescue tasks, such as walking over rubble, turning valves, and opening doors.

The demand for autonomous grounded vehicles has grown significantly in different military applications, such as mine detection and landing site surveying. Besides this, the need for service robots is escalating with increasing demand from defense, security, and military sectors as the overall military expenditure rose in Asia, the Middle East, Eastern Europe, and Africa. Furthermore, the demand for humanoid robots in commercial applications, especially logistics and space exploration, has also increased. This increasing demand for robots in different fields for rescue has opened opportunities for humanoid robots to grow in the search and rescue domain. THORMANG3 by ROBOTIS INC. (Japan), Atlas by Boston Dynamics (US), and Whole Body Adaptive Locomotion and Manipulation (WALK-MAN)—a project funded by the European Union—are the notable humanoid robots used for rescue applications.

Apart from these, other search and rescue projects are TRADR: long-term human-robot teaming for disaster response; SHERPA: a mixed ground and aerial robotic platform; ICARUS: unmanned search and rescue (SAR) technologies for detecting, locating, and rescuing humans; and the DARPA Robotics Challenge (DRC), among others.

Challenge: Limited Market Awareness Hindering Humanoid Robot Adoption

The limited market awareness of humanoid robots poses a significant challenge to their widespread adoption across industries. Many potential end-users and organizations have limited knowledge and understanding of humanoid robots' capabilities and potential benefits. This lack of awareness can be attributed to factors such as limited exposure to real-world applications, inadequate marketing efforts, and the novelty of the technology.

The consequence of this challenge is the hesitancy or reluctance to embrace humanoid robots in various industries. Decision-makers may not fully grasp the value proposition or specific use cases where humanoid robots can bring significant advantages. As a result, organizations may miss out on opportunities to optimize their operations, enhance productivity, and improve customer experiences.

To address this challenge, industry stakeholders need to prioritize awareness-building initiatives. Comprehensive marketing campaigns, educational programs, and demonstrations of successful implementations can help showcase humanoid robots' benefits and potential cost savings. Organizations can overcome the limited market awareness barrier and foster wider adoption of humanoid robots across industries by raising awareness and providing practical guidance on integrating these robots into existing workflows; by addressing the challenge of limited market awareness, the potential of humanoid robots can be fully realized, leading to improved efficiency, enhanced customer service, and innovative solutions in various sectors.

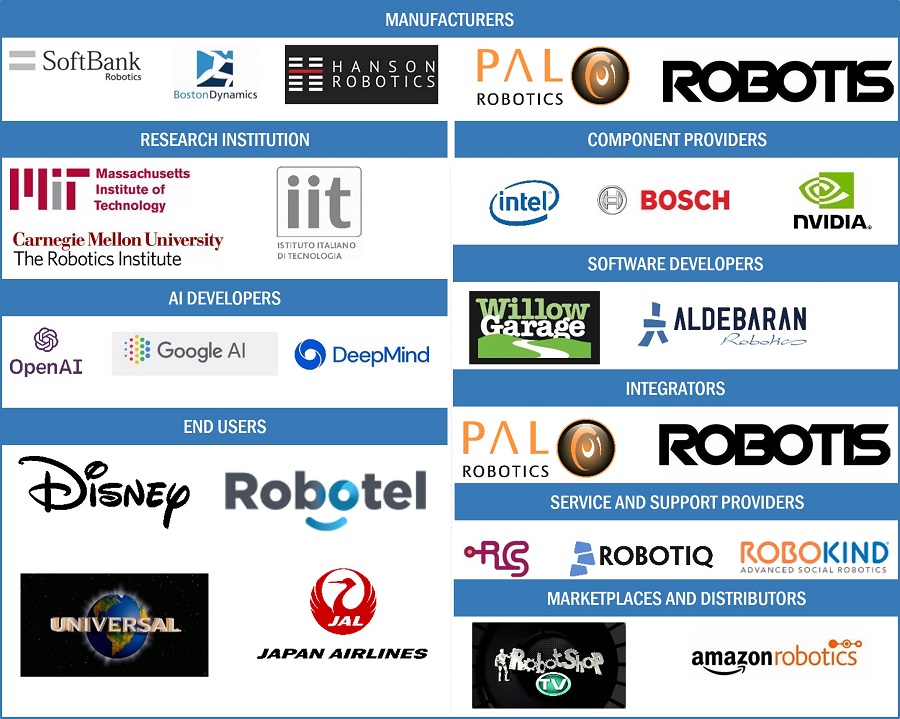

Humanoid Robot Market Ecosystem

The humanoid robot market is highly competitive. It is marked by the presence of a few tier-1 companies, such as SoftBank Robotics (Japan), Honda Motor Co., Ltd. (Japan), and Toyota Motor Corporation (Japan). These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable humanoid robot solutions.

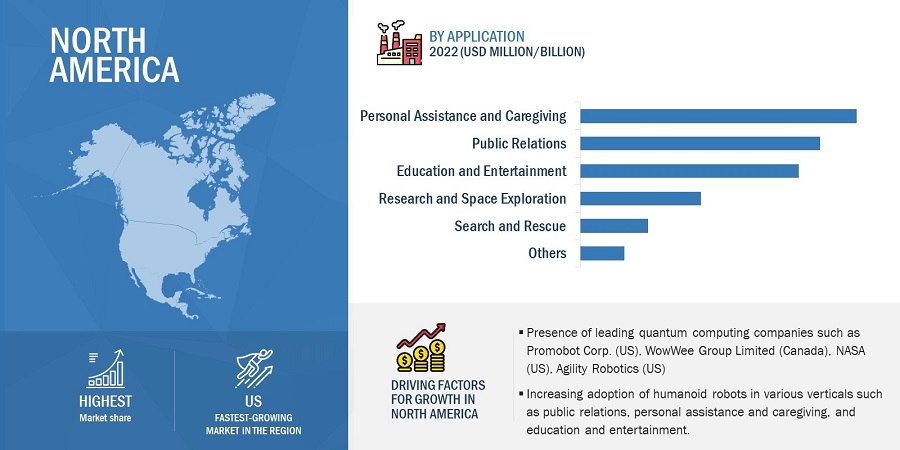

Personal assistance and caregiving application segment to hold the highest market share

The humanoid robot market for the personal assistance and caregiving application segment accounted for the largest share in the overall market in 2022, as they are ideal for personal assistance and caregiving to patients and old-aged people at hospitals and homes. In hospitals and homes, humanoids take care of patients and older people and assist them in their daily routine, e.g., providing them with medicines on time. They are programmed to handle the routine tasks caregivers are usually responsible for, such as checking vital signs, administering medication, assisting with feedings, and alerting healthcare professionals in an emergency. Humanoids help people in the kitchen, daily activities, and household chores in homes. Various research bodies focus on creating humanoids to assist people with reduced mobility. Also, humanoid robots, owing to their social characteristics, play an important role in helping people with disabilities.

Wheel drive segment to hold the second-largest market share during the forecast period

Wheel-drive robots have significantly contributed to robotics, offering efficient mobility and versatile maneuverability. A few instances include Pepper by SoftBank Robotics (Japan), a humanoid robot with a wheeled base and advanced AI capabilities for human interaction. UBTECH's (China) Alpha Mini is a small humanoid robot with wheels for smooth movement and interactive functionalities. MIP by WowWee (US) is a compact wheel-drive robot for entertainment and education. These diverse wheel-drive robots have significantly expanded the possibilities in robotics, enabling applications in customer service, education, research, and entertainment fields.

Software segment to register higher CAGR in the humanoid robot market during the forecast period

The software used in a humanoid robot is a set of coded commands and a list of instructions that are proposed to program robots according to the task required to be performed by them. The robotic software offers operating system-like functionality, hardware abstraction, low-level device control, implementation of generally used functionality, message-passing between processes, and package management services.

North America by region to hold the larger share during the forecast period

North America accounted for the largest global humanoid robot market share in 2022. The region is the early adopter of humanoids for all the major applications, such as public relations, personal assistance and caregiving, and education and entertainment, resulting in the maximum demand for robots. A few of the humanoid robot manufacturers based in North America are Promobot Corp. (US), WowWee Group Limited (Canada), Kindred Inc. (US), Agility Robotics (US), and the National Aeronautics and Space Administration (NASA) (US).

Humanoid Robot Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The humanoid robot companies is dominated by globally established players such as SoftBank Robotics (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), ROBOTIS (South Korea), KAWADA ROBOTICS CORPORATION (Japan), UBTECH Robotics Corp. Ltd. (China), HANSON ROBOTICS LTD. (Hong Kong), PAL Robotics (Spain), HYULIM Robot Co., Ltd (South Korea), Hajime Research Institute, Ltd. (Japan), Engineered Arts Limited (UK), National Aeronautics and Space Administration (NASA) (US), ROBO GARAGE Co., Ltd. (Japan), Istituto Italiano di Tecnologia (IIT) (Italy), Robotics Lab (Spain), Samsung Electronics Co., Ltd. (South Korea), Promobot Corp.( US), EZ-Robot (Canada), Macco Robotics (Spain), Boston Dynamics (US), Advanced Telecommunications Research Institute International (ATR) (Japan), Wowwee Group limited (Hong Kong), Kindred, Inc. (US), Tesla (US), and Agility Robotics (US). These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions for growth in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Component, By Motion Type, By Application, and By Region |

|

Region covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

The key players in the humanoid robot market are SoftBank Robotics (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), ROBOTIS (South Korea), KAWADA ROBOTICS CORPORATION (Japan), UBTECH Robotics Corp. Ltd. (China), HANSON ROBOTICS LTD. (Hong Kong), PAL Robotics (Spain), HYULIM Robot Co., Ltd (South Korea), Hajime Research Institute, Ltd. (Japan), Engineered Arts Limited (UK), National Aeronautics and Space Administration (NASA) (US), ROBO GARAGE Co., Ltd. (Japan), Istituto Italiano di Tecnologia (IIT) (Italy), Robotics Lab (Spain), Samsung Electronics Co., Ltd. (South Korea), Promobot Corp.( US), EZ-Robot (Canada), Macco Robotics (Spain), Boston Dynamics (US), Advanced Telecommunications Research Institute International (ATR) (Japan), Wowwee Group limited (Hong Kong), Kindred, Inc. (US), Tesla (US), and Agility Robotics (US). |

Humanoid Robot Market Highlights

The study categorizes the humanoid robot market based motion type, component, application, and region

|

Segment |

Subsegment |

|

By Motion Type |

|

|

By Component |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In March 2023, SoftBank Robotics (Japan) released a new robot app called "Let's Dance!". This app allows users to make the Pepper robot dance using preset popular dance moves or create unique dance routines with a combination of motions.

- In September 2022, KAWADA ROBOTICS CORPORATION (Japan) launched NEXTAGE Fillie OPEN, a dual-arm robot. It is part of the NEXTAGE series of humanoid robots and is a research robot platform. The robot is designed for research and development, offering versatility and compatibility with open-source robot middleware (ROS).

- In October 2022, Hanson Robotics (China) partnered with Playasia ((Hong Kong)) to create and market merchandise featuring SOPHIA Humanoid Robots. The merchandise line includes apparel, artwork, posters, and collectibles.

Frequently Asked Questions (FAQ):

Which are the major companies in the humanoid robot market? What are their major strategies to strengthen their market presence?

SoftBank Robotics (Japan), Honda Motor Co., Ltd. (Japan), and Toyota Motor Corporation (Japan) are some of the major companies operating in the humanoid robot market. Partnerships were the key strategies these companies adopted to strengthen their humanoid robot market presence.

What are the drivers for the humanoid robot market?

Drivers for the humanoid robot market are:

- Growing development of humanoid robots with advanced features

- Increasing use of humanoids as educational robots

- Surging demand for humanoid robots from the retail industry for personal assistance

- Rising demand for humanoid robots from the medical sector

What are the challenges in the humanoid robot market?

Lack of high-level interfacing results in robots' unpredictable performance in untested environments, and Limited Market Awareness Hindering Humanoid Robot Adoption are among the challenges faced by the humanoid robot market.

What are the technological trends in the humanoid robot market?

The Artificial Intelligence (AI) Advancements, Advancements in sensor technology, Cloud Connectivity and Data Sharing, Mobility, and Locomotion, and Human-Robot Interaction (HRI) Enhancements are a few of the key technology trends in the humanoid robot market.

What is the total CAGR expected to be recorded for the humanoid robot market from 2023 to 2028?

The CAGR is expected to record a CAGR of 50.2% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

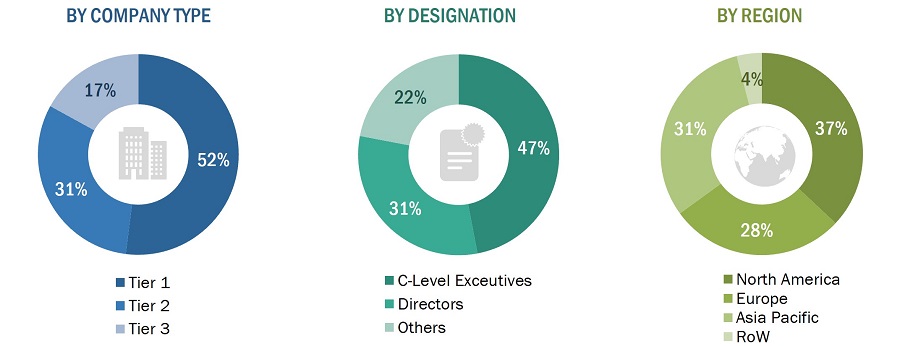

The study involved four major activities in estimating the size of the humanoid robot market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were referred to in the secondary research process for identifying and collecting information pertinent to this study. Secondary sources included annual reports, press releases, investor presentations, white papers, journals & certified publications, articles by recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the humanoid robot supply chain, value chain, the total pool of the key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary sources used for this research study included government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the major companies and organizations operating in the humanoid robot market.

After the complete market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at in this process. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by the players operating in the humanoid robot market.

Extensive primary research was conducted after gaining knowledge about the current scenario of the humanoid robot market through secondary research. Several primary interviews were conducted with the market experts from the demand- (humanoid robot users) and supply (service and system providers) sides across four key regions: North America, Europe, Asia Pacific, and RoW. Approximately 20% and 80% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the humanoid robot market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying verticals that are either using or will use humanoid robots

- Tracking the leading companies and system integrators catering to various applications

- Deriving the size of the humanoid robot market through the data sanity method, analyzing revenues of more than 25 key providers through their annual reports and press releases, and summing them up to estimate the overall market size

- Conducting multiple discussions with key opinion leaders to understand the demand for humanoid robots and analyzing the breakup of the scope of work carried out by each major company

- Carrying out the market trend analysis to obtain the CAGR of the humanoid robot market by understanding the industry penetration rate and analyzing the demand and supply of humanoid robots in different applications

- Assigning a percentage to the overall revenue or, in a few cases, to segmental revenues of each company to derive their revenues from the sale of humanoid robots. This percentage for each company has been assigned based on their product portfolios.

- Verifying and crosschecking estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operation managers, and with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

- Tracking the ongoing and identifying the upcoming projects related to humanoid robots by companies and forecasting the market size based on these developments and other critical parameters

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall size of the humanoid robot market from the market size estimation processes explained above, the total market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends, and the market size has been validated using top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To describe and forecast the humanoid robot market based on component, motion type, application, and region.

- To describe and forecast the humanoid robot market based on four regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To provide a detailed overview of the process flow of the humanoid robot market

- To analyze opportunities for stakeholders by identifying high-growth segments of the humanoid robot market

- To study the complete value chain of the humanoid robot market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size.

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies2

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the humanoid robot market

Market Definition

A humanoid robot is a robot that resembles the human body in shape. It has a torso, a head, arms, and legs; however, some humanoid robots replicate only a part of the human body. It is a complex machine with hardware and software that can perform various tasks in different environments. Humanoid robots are mainly used in education, entertainment, scientific research, complex medical surgeries, and household chores.

Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Traders and suppliers

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Forums, alliances, and associations

- Technology investors

- Research institutes and organizations

- Analysts and strategic business planners

- Market research and consulting firms

Research Objectives

- To define, describe, and forecast the humanoid robot market size, component, motion type application, and region in terms of value

- To forecast the market size, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify the drivers, restraints, opportunities, and challenges impacting the growth of the market and submarkets

- To analyze the humanoid robot value chain and identify opportunities for the value chain participants

- To provide key technology trends and patent analysis related to the humanoid robot market

- To provide information regarding trade data related to the humanoid robot market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the humanoid robot ecosystem

- To strategically profile the key players in the humanoid robot market and comprehensively analyze their market shares and core competencies in each segment

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as product launches, alliances and partnerships, joint ventures, and mergers and acquisitions in the humanoid robot market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Humanoid Robot Market

We are interested in researching more capable social or service robots. Could you tell us your coverage for the humanoid robot market?

In the context of a growing market and a very strong competitive environment, we are always looking for solutions and services to make a difference for our clients and potential clients. Humanoid Robot is a very interesting subject that we are willing to discover in order to find areas where we can develop and implement.