HVDC Capacitor Market by Product Type (Plastic Film Capacitors, Aluminum Electrolytic Capacitors), Technology (LCC, VSC), Installation Type, Application (Energy and Power, Industrial, Commercial) and Geography - Global Forecast to 2030

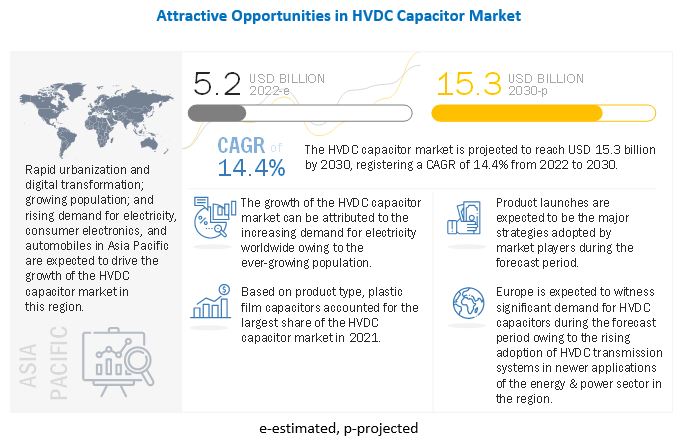

[242 Pages Report] The global HVDC capacitor market is projected to reach USD 15.3 billion by 2030 from an estimated USD 5.2 billion in 2022, at a CAGR of 14.4% from 2022 to 2030.

The growth of the HVDC capacitor industry can be attributed to rising demand for HVDC transmission systems and increasing adoption of renewable energy sources with rising energy consumption.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics of HVDC Capacitor Market

Drivers: HVDC transmission system increases the demand for HVDC capacitors

An HVDC capacitor is among the core component of the HVDC transmission system and plays a significant role in converting AC to DC, transporting power between HVDC converter stations, and changing DC back to AC so that electricity can be fed into the power grid. They help maintain voltage stability, improve power quality, and control power flow instantly. They also decrease the possibility of short-circuiting current by swiftly managing the power flow in the transmission lines. Furthermore, capacitor banks protect and ensure the AC output voltage is steady and ready to be fed into the power grid at the receiving converter station at the end of the HVDC link. Thus, the increase in the demand for HVDC transmission systems propels the growth of the market for HVDC capacitors.

Restraints: Hazardous effects of HVDC capacitors

HV capacitors may store hazardous energy even after the equipment has been de-energized and build a dangerous residual charge without an external source. The liquid dielectric in several capacitors, or its combustion products, may be toxic. An arc fault is generated when dielectric or metal interconnection failures occur in HV capacitors. The dielectric fluid vaporizes within oil-filled units and results in case bulging and rupture. In addition, HV vacuum capacitors can produce soft X-rays even while operating normally. These factors are hazardous for human beings and the environment.

Opportunities: Increase in demand for electric vehicles

In EVs, an HVDC capacitor is mainly used to prevent ripple currents from reaching back to the power source and improve DC bus voltage stability. They are also used to protect semiconductor components and for decoupling purposes when EVs supply energy through batteries. DC link capacitors assist in counterbalancing the effects of inductance in inverters, motor controllers, and battery systems in EV applications. They also safeguard EV subsystems from voltage spikes, surges, and electromagnetic interference by acting as filters (EMI). According to EV-volumes, the global sales of EVs, including passenger vehicles, light trucks, and light commercial vehicles, was 6.75 million in 2021, 108% up compared to 3.24 million in 2020. Thus, the rising adoption of EVs is likely to spur the demand for HVDC capacitors in the near future.

Challenges: Catastrophic explosion of capacitor banks

The capacitor banks may explode catastrophically while functioning, and it is challenging to find out the exact cause of the failure of capacitor banks. Some major reasons for the explosion of the capacitor banks are mentioned below:

- The capacitor units are connected in series with inductors in the capacitor bank. When the voltage across the capacitor units exceeds the design values, the capacitor bank fails catastrophically due to inadequate voltage rating.

- A short-circuit in the capacitor unit due to over current and voltage may result in fuse blowing. The fuse failure may occur due to improper branch protection, fatigue, or incorrect capacitor unit application.

- The capacitor banks interact with the source or transformer inductance and produce ferroresonance. This can produce undamped oscillations in the current or voltage, depending on the type of resonance

- Failure due to internal and external stress.

HVDC Capacitor Ecosystem

The ceramic capacitor segment is projected to register the highest CAGR 2022 to 2030

Ceramic capacitors can operate at high temperatures, providing high stability and capacitance and compensating for the effect of temperature. Due to this, they are widely used as a smoothing snubber for electric vehicles and hybrid electric vehicle motor drive inverters, as well as a resonant circuit for non-contact recharging equipment. In addition, MLCCs are essential electronic components for ensuring stable operations of electronic circuits. Hence, they are widely used in consumer electronic devices such as smartphones, personal computers, and tablets. As the demand for highly advanced consumer electronic devices and electric and hybrid vehicles is increasing globally, the demand for ceramic capacitors is expected to increase during the forecast period. Thus, the ceramic capacitor segment is projected to register the highest CAGR 2022 to 2030.

VSC technology is projected to register a higher CAGR during the forecast

VSC is a newer technology based on power transistors. It reduces commutation risk failure due to low voltage requirements. Moreover, it is an ideal technology for submarine/land cable interconnection, integrating renewables, offshore, and urban infeed applications. Hence, VSC technology is projected to register a higher CAGR during the forecast.

Pole-mounted segment is projected to register the highest CAGR during the forecast period

Pole-mounted capacitor banks are single-step fixed banks or automated banks. These banks offer several benefits, including improved voltage regulation and power factor, simple design, and low equipment cost, as well as the requirement for less space for installation. Thus, they are found for agriculture load, induction furnace, distribution transformer, and heavy industrial load applications. These capacitor banks can be installed at high altitudes from the ground for transmitting power through long distances using a pole-mount structure. Owing to this, the pole-mounted segment is projected to register the highest CAGR during the forecast period.

Asia Pacific is expected to register the highest growth in the HVDC capacitor market during the forecast period

The HVDC capacitor market in the Asia Pacific is expected to register the highest growth during the forecast period, as it is an ideal solution to reduce power loss and improve efficiency during long distance point to point power transmission in the region. Moreover, the rising industrial transformation in the region is also contributing to the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Hitachi, Ltd. (Japan), General Electric Company (us), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), LIFASA, International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany) are some of the key players in the HVDC capacitor companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2030 |

|

Forecast unit |

Value (USD Million/Billion) |

|

Segments covered |

By Product Type, By Technology, By Installation Type, By Application, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Hitachi, Ltd. (Japan), General Electric Company (us), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), LIFASA, International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany) are some of the key players in the HVDC capacitor market. |

This research report categorizes the HVDC capacitor market based on product type, technology, installation type, application, and geography.

Based on Product Type

- Plastic Film Capacitors

- Aluminum Electrolytic Capacitors

- Ceramic Capacitors

- Tantalum Wet Capacitors

- Others

Based on Technology

- Line-commutated Converter (LCC)

- Voltage-source Converter (VSC)

Based on Installation Type

-

Open Rack Capacitor Banks

- Internally Fused Capacitor Banks

- Externally Fused Capacitor Banks

- Fuseless Capacitor Banks

-

Enclosed Rack Capacitor Banks

- Fixed Capacitor Banks

- Automatic Capacitor Banks

- Pole-mounted Capacitor Banks

Based on Application

- Commercial

-

Industrial

- Heavy Manufacturing

- Mining

- Steel Manufacturing

- Petrochemical

- Others

-

Energy and Power

- Power Transmission

- Power Distribution

-

Renewable Power Generation

- Solar Plants

- Wind Plants

- Aerospace and Defense

- Others

Based on Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Sweden

- UK

- Germany

- Norway

- Rest of Europe

-

Aisa Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the world

- Middle East and Africa

- South America

Recent Developments

- In June 2022, Hitachi Energy, a subsidiary of Hitachi, Ltd., collaborated with Petrofac, a leading international service provider to the energy industry, to provide joint grid integration and associated infrastructure to support the rapidly growing offshore wind market. The collaboration includes the supply of high-voltage direct current (HVDC) and high-voltage alternating current (HVAC) solutions.

- In May 2022, TDK Corporation is expected to construct a new production building on the premises of the Kitakami Factory (Kitakami city, Japan) of TDK Electronics Factories Corporation to enhance multilayer ceramic capacitors production. The construction of the new building is likely to start in March 2023 and be completed in June 2024. The new production buildings are intended to strengthen the production of highly reliable MLCCs for electric vehicles (EVs), automatic driving, and ADAS with increasing demand.

- In March 2022, KYOCERA AVX Corporation acquired ROHM Semiconductor’s tantalum and polymer capacitor businesses to expand the existing portfolio of electrolytic capacitor solutions for medical, military, and aerospace applications.

- In November 2021, Vishay Intertechnology, Inc. launched a new line of vPolyTan surface-mount polymer tantalum molded chip capacitors designed to work reliably in high-temperature and high-humidity environments. The capacitors have a strong design with improved hermeticity for greater protection in hostile situations.

- In September 2021, TDK Corporation expanded its CN series of multilayer ceramic capacitors (MLCCs), offering capacitance from 10 to 22 µF for automotive applications.

Frequently Asked Questions (FAQ):

Which is the potential market for HVDC capacitors in terms of the region?

Europe is expected to dominate the HVDC capacitor market due to the presence of numerous consumers and suppliers of HVDC capacitors.

Which are the major companies in the global HVDC capacitor market? What are their major strategies to strengthen their market presence?

Hitachi, Ltd. (Japan), General Electric Company (us), TDK Corporation (Japan), Eaton (US), and KYOCERA Corporation (Japan), are some of the key players in the HVDC capacitor market. These players have adopted various growth strategies such as product launches, contracts, mergers and acquisitions, expansions, collaborations, and partnerships to expand their global presence and increase their share in the global HVDC capacitor market.

What are the major opportunities for the HVDC capacitor market?

Rising adoption of HVDC capacitors by industrial consumers in Asia Pacific and escalating demand for electric vehicles are among the key opportunities that are expected to support market growth in future.

What are the growing applications in the HVDC capacitor market?

The HVDC capacitor market is led by energy and power segment. Besides, the demand from industrial and commercial segments is expected to generate huge demand for HVDC capacitors in future.

Which is the majorly used HVDC capacitor market?

Plastic film capacitors are widely used HVDC capacitors for almost all commercial, industrial, energy and power, and aerospace and defense applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HVDC CAPACITOR MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 HVDC CAPACITOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.1.3.4 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF HVDC CAPACITORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN HVDC CAPACITOR MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR HVDC CAPACITORS, BY PRODUCT TYPE

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market size using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market size using top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 CERAMIC CAPACITORS TO EXHIBIT HIGHEST CAGR IN HVDC CAPACITOR MARKET FROM 2022 TO 2030

FIGURE 10 POLE-MOUNTED CAPACITOR BANKS TO RECORD HIGHEST CAGR IN HVDC CAPACITOR MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC LIKELY TO BE FASTEST-GROWING MARKET FOR HVDC CAPACITORS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES FOR HVDC CAPACITOR MARKET PLAYERS

FIGURE 12 RISING ELECTRICITY DEMAND WITH GROWING POPULATION WORLDWIDE TO FUEL MARKET GROWTH FROM 2022 TO 2030

4.2 HVDC CAPACITOR MARKET, BY PRODUCT TYPE

FIGURE 13 PLASTIC FILM CAPACITORS TO HOLD MAJORITY OF SHARE OF GLOBAL HVDC CAPACITOR MARKET IN 2022

4.3 HVDC CAPACITOR MARKET, BY TECHNOLOGY

FIGURE 14 LCC TECHNOLOGY TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

4.4 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE

FIGURE 15 ENCLOSED RACK CAPACITOR BANKS TO CAPTURE LARGEST MARKET SHARE IN 2030

4.5 HVDC CAPACITOR MARKET, BY APPLICATION

FIGURE 16 ENERGY AND POWER SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HVDC CAPACITOR MARKET, BY APPLICATION, IN 2030

4.6 HVDC CAPACITOR MARKET, BY REGION

FIGURE 17 EUROPE TO CAPTURE LARGEST SHARE OF GLOBAL HVDC CAPACITOR MARKET IN 2030

4.7 HVDC CAPACITOR MARKET, BY COUNTRY

FIGURE 18 CHINA TO WITNESS HIGHEST CAGR IN GLOBAL HVDC CAPACITOR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 HVDC CAPACITOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for HVDC transmission systems

5.2.1.2 Increasing adoption of renewable energy sources with rising energy consumption

5.2.1.3 Ongoing government initiatives to improve energy infrastructure

FIGURE 20 HVDC CAPACITOR MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Hazardous effects of HV capacitors on humans and environment

FIGURE 21 HVDC CAPACITOR MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Rising adoption of HVDC capacitors by industrial consumers in Asia Pacific

5.2.3.2 Escalating demand for electric vehicles

FIGURE 22 HVDC CAPACITOR MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Catastrophic explosion of capacitor banks

FIGURE 23 HVDC CAPACITOR MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 HVDC CAPACITOR VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 25 HVDC CAPACITOR ECOSYSTEM

TABLE 1 LIST OF HVDC CAPACITOR AND CAPACITOR BANK MANUFACTURERS

5.5 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICES OF HVDC CAPACITORS, BY PRODUCT TYPE

FIGURE 26 AVERAGE SELLING PRICES OF HVDC CAPACITORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

TABLE 3 AVERAGE SELLING PRICES OF HVDC CAPACITORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

FIGURE 27 AVERAGE SELLING PRICE TREND FOR HVDC CAPACITORS, 2018–2030 (USD)

5.6 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HVDC CAPACITOR MARKET PLAYERS

FIGURE 28 REVENUE SHIFT IN HVDC CAPACITOR MARKET PLAYERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGIES

5.7.1.1 HVDC technology

5.7.1.2 Flat winding technology

5.7.1.3 HVDC power film technology

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 HVDC CAPACITOR MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

5.8.1 INTENSITY OF COMPETITIVE RIVALRY

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 THREAT OF NEW ENTRANTS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MAJOR APPLICATIONS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MAJOR APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

TABLE 6 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

5.10 CASE STUDY ANALYSIS

TABLE 7 HITACHI ENERGY HELPED TRANSGRID TO IMPROVE POWER QUALITY OF QNI

TABLE 8 HITACHI ABB POWER GRIDS HELPED MINNESOTA POWER INCREASE AVAILABILITY OF CLEAN POWER TO ITS CUSTOMERS IN REGION

TABLE 9 CONDIS SUPPORTED ZHANGBEI PROJECT WITH ITS HIGH- VOLTAGE CAPACITORS

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

TABLE 10 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 32 HVDC CAPACITOR: IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

5.11.2 EXPORT SCENARIO

TABLE 11 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 33 HVDC CAPACITOR: EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

5.12 PATENT ANALYSIS

FIGURE 34 PATENTS GRANTED WORLDWIDE, 2012–2021

TABLE 12 TOP 20 PATENT OWNERS IN US, 2012–2021

FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2021

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 13 HVDC CAPACITOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TARIFFS AND REGULATIONS

5.14.1 TARIFFS

5.14.2 REGULATORY COMPLIANCE

5.14.2.1 North America

5.14.2.2 Europe

5.14.3 STANDARDS

6 HVDC CAPACITOR MARKET, BY PRODUCT TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 36 HVDC CAPACITOR MARKET, BY PRODUCT TYPE

FIGURE 37 PLASTIC FILM CAPACITORS TO HOLD LARGEST MARKET SHARE IN 2030

TABLE 14 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 15 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (USD MILLION)

TABLE 16 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (MILLION UNITS)

TABLE 17 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (MILLION UNITS)

6.2 PLASTIC FILM CAPACITORS

6.2.1 SUITABLE FOR ENERGY AND POWER APPLICATIONS DUE TO LONG SERVICE LIFE AND HIGH RELIABILITY

FIGURE 38 CONSTRUCTION OF PLASTIC FILM CAPACITORS

TABLE 18 DIFFERENT CHARACTERISTICS OF DIELECTRICS IN PLASTIC FILM CAPACITORS

TABLE 19 PLASTIC FILM CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 PLASTIC FILM CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

6.3 ALUMINUM ELECTROLYTIC CAPACITORS

6.3.1 IDEAL FOR APPLICATIONS REQUIRING LARGER CAPACITANCE VALUES

FIGURE 39 CONSTRUCTION OF ALUMINUM ELECTROLYTIC CAPACITORS

TABLE 21 ALUMINUM ELECTROLYTIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 ALUMINUM ELECTROLYTIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

6.4 CERAMIC CAPACITORS

6.4.1 WIDELY USED FOR ELECTROSTATIC DISCHARGE (ESD) PROTECTION IN AUTOMOTIVE APPLICATIONS

FIGURE 40 CONSTRUCTION OF MULTILAYER CERAMIC CAPACITORS (MLCC)

FIGURE 41 COMMERCIAL APPLICATION TO HOLD LARGEST SHARE OF HVDC CAPACITOR MARKET THROUGHOUT FORECAST PERIOD

TABLE 23 CERAMIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 CERAMIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

6.5 TANTALUM WET CAPACITORS

6.5.1 PREFERRED IN INDUSTRIAL AND MILITARY APPLICATIONS DUE TO HIGH RELIABILITY AND STABILITY

FIGURE 42 CONSTRUCTION OF TANTALUM WET CAPACITORS

TABLE 25 TANTALUM WET CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 TANTALUM WET CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

6.6 OTHERS

FIGURE 43 CONSTRUCTION OF GLASS CAPACITORS

TABLE 27 OTHERS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 28 OTHERS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD THOUSAND)

7 HVDC CAPACITOR MARKET, BY TECHNOLOGY (Page No. - 99)

7.1 INTRODUCTION

FIGURE 44 HVDC CAPACITOR MARKET, BY TECHNOLOGY

FIGURE 45 LCC SEGMENT TO HOLD LARGER SHARE OF HVDC CAPACITOR MARKET FROM 2022 TO 2030

TABLE 29 HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 30 HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

7.2 LINE-COMMUTATED CONVERTER (LCC)

7.2.1 WELL-ESTABLISHED TECHNOLOGY FOR LARGE-CAPACITY POWER TRANSMISSION WITH LOW LOSS

TABLE 31 LCC: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 LCC: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

7.3 VOLTAGE-SOURCE CONVERTER (VSC)

7.3.1 LIKELY TO REGISTER HIGHER CAGR IN HVDC CAPACITOR MARKET DURING FORECAST PERIOD

TABLE 33 VSC: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 VSC: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

8 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE (Page No. - 104)

8.1 INTRODUCTION

FIGURE 46 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE

FIGURE 47 ENCLOSED RACK CAPACITOR BANKS TO CAPTURE LARGEST SHARE OF HVDC CAPACITOR MARKET IN 2022

TABLE 35 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 36 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2022–2030 (USD MILLION)

8.2 OPEN RACK CAPACITOR BANKS

8.2.1 HELP REDUCE POWER LOSSES AND IMPROVE VOLTAGE STABILITY IN TRANSMISSION AND DISTRIBUTION NETWORKS

TABLE 37 OPEN RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 OPEN RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

8.2.2 INTERNALLY FUSED CAPACITOR BANKS

FIGURE 48 INTERNALLY FUSED CAPACITOR BANK DESIGN

8.2.3 EXTERNALLY FUSED CAPACITOR BANKS

FIGURE 49 EXTERNALLY FUSED CAPACITOR BANK DESIGN

8.2.4 FUSELESS CAPACITOR BANKS

FIGURE 50 FUSELESS CAPACITOR BANK DESIGN

8.3 ENCLOSED RACK CAPACITOR BANKS

8.3.1 LIKELY TO LEAD HVDC CAPACITOR MARKET

FIGURE 51 COMMERCIAL APPLICATIONS TO RECORD HIGHEST CAGR IN MARKET FOR ENCLOSED CAPACITOR BANKS FROM 2022 TO 2030

TABLE 39 ENCLOSED RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 ENCLOSED RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

8.3.2 FIXED CAPACITOR BANKS

8.3.3 AUTOMATIC CAPACITOR BANKS

8.4 POLE-MOUNTED CAPACITOR BANKS

8.4.1 SUITABLE FOR ENERGY AND POWER APPLICATIONS

TABLE 41 POLE-MOUNTED CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 POLE-MOUNTED CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9 HVDC CAPACITOR MARKET, BY APPLICATION (Page No. - 115)

9.1 INTRODUCTION

FIGURE 52 HVDC CAPACITOR MARKET, BY APPLICATION

FIGURE 53 ENERGY AND POWER APPLICATIONS TO LEAD HVDC CAPACITOR MARKET FROM 2022 TO 2030

TABLE 43 HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.2 COMMERCIAL

9.2.1 REQUIRES CAPACITORS THAT MEET AEC-Q200 STANDARDS

TABLE 45 COMMERCIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 46 COMMERCIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (USD MILLION)

TABLE 47 COMMERCIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 48 COMMERCIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2022–2030 (USD MILLION)

FIGURE 54 EUROPE TO CAPTURE LARGEST SHARE OF HVDC CAPACITOR MARKET FOR COMMERCIAL APPLICATIONS IN 2030

TABLE 49 COMMERCIAL: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 COMMERCIAL: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

9.3 INDUSTRIAL

TABLE 51 INDUSTRIAL: HVDC CAPACITOR MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 52 INDUSTRIAL: HVDC CAPACITOR MARKET, BY SUBAPPLICATION, 2022–2030 (USD MILLION)

TABLE 53 INDUSTRIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 54 INDUSTRIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (USD MILLION)

TABLE 55 INDUSTRIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 56 INDUSTRIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2022–2030 (USD MILLION)

TABLE 57 INDUSTRIAL: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 INDUSTRIAL: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

9.3.1 HEAVY MANUFACTURING

9.3.1.1 Likely to lead HVDC capacitor market for industrial applications

9.3.2 MINING

9.3.2.1 Increasing utilization of mining power inverters to create need for HVDC capacitors

9.3.3 STEEL MANUFACTURING

9.3.3.1 Requirement for power factor correction and high-quality electricity to promote use of HVDC capacitors

9.3.4 PETROCHEMICAL

9.3.4.1 Need to reduce CO2 emissions and energy consumption to boost adoption of HVDC capacitors

9.3.5 OTHERS

9.4 ENERGY AND POWER

TABLE 59 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 60 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY SUBAPPLICATION, 2022–2030 (USD MILLION)

FIGURE 55 PLASTIC FILM CAPACITORS TO CAPTURE LARGEST SHARE OF HVDC CAPACITOR MARKET FOR ENERGY AND POWER APPLICATIONS IN 2022

TABLE 61 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 62 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (USD MILLION)

TABLE 63 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 64 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2022–2030 (USD MILLION)

TABLE 65 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

9.4.1 POWER TRANSMISSION

9.4.1.1 Elevating demand for integrated networks and bulk power transmission to boost market growth

9.4.2 POWER DISTRIBUTION

9.4.2.1 Surging use of HVDC capacitors to convert DC power to AC power to propel market growth

9.4.3 RENEWABLE POWER GENERATION

FIGURE 56 WIND POWER PLANTS TO REGISTER HIGHER CAGR IN HVDC CAPACITOR MARKET FROM 2022 TO 2030

TABLE 67 RENEWABLE POWER GENERATION: HVDC CAPACITOR MARKET, BY SUBAPPLICATION, 2018–2021 (USD MILLION)

TABLE 68 RENEWABLE POWER GENERATION: HVDC CAPACITOR MARKET, BY SUBAPPLICATION, 2022–2030 (USD MILLION)

9.4.3.1 Wind power plants

9.4.3.1.1 Increasing offshore wind power capacity to support market growth

FIGURE 57 GLOBAL OFFSHORE WIND CAPACITY IN OPERATION, 2012–2021 (MW)

9.4.3.2 Solar power plants

9.4.3.2.1 Rising installed solar energy capacity to boost demand for HVDC capacitors

FIGURE 58 INSTALLED SOLAR ENERGY CAPACITY WORLDWIDE, 2012–2021 (MW)

9.5 AEROSPACE AND DEFENSE

9.5.1 NEED FOR HVDC CAPACITORS TO BE DEPLOYED IN RADAR SYSTEMS, POWER SUPPLIES, GUIDANCE SYSTEMS, ETC.

TABLE 69 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 70 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (USD MILLION)

TABLE 71 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 72 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2022–2030 (USD MILLION)

TABLE 73 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

9.6 OTHERS

TABLE 75 OTHERS: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 76 OTHERS: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2022–2030 (USD MILLION)

TABLE 77 OTHERS: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 78 OTHERS: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2022–2030 (USD MILLION)

TABLE 79 OTHERS: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 OTHERS: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

10 HVDC CAPACITOR MARKET, BY REGION (Page No. - 137)

10.1 INTRODUCTION

FIGURE 59 REGIONAL SPLIT OF HVDC CAPACITOR MARKET

FIGURE 60 EUROPE TO LEAD GLOBAL HVDC CAPACITOR MARKET IN 2022

TABLE 81 HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 83 HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 84 HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 61 NORTH AMERICA: HVDC CAPACITOR MARKET SNAPSHOT

FIGURE 62 US TO REGISTER HIGHEST CAGR IN NORTH AMERICAN HVDC CAPACITOR MARKET FROM 2022 TO 2030

TABLE 85 NORTH AMERICA: HVDC CAPACITOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: HVDC CAPACITOR MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 87 NORTH AMERICA: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

10.2.1 US

10.2.1.1 Focuses on expansion of electricity networks to achieve net-zero emission target by 2050

TABLE 89 US: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 90 US: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Ranks second in North American HVDC capacitor market

TABLE 91 CANADA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 92 CANADA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Witnesses high demand for electric and hybrid vehicles

TABLE 93 MEXICO: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 94 MEXICO: HVDC CAPACITOR MARKET, BY TYPE, 2022–2030 (USD MILLION)

10.3 EUROPE

FIGURE 63 EUROPE: HVDC CAPACITOR MARKET SNAPSHOT

TABLE 95 EUROPE: HVDC CAPACITOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: HVDC CAPACITOR MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

FIGURE 64 ENERGY AND POWER SEGMENT TO WITNESS FASTEST GROWTH IN HVDC CAPACITOR MARKET FROM 2022 TO 2030

TABLE 97 EUROPE: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 EUROPE: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

10.3.1 SWEDEN

10.3.1.1 Cross-country transmission projects to create requirement for HVDC capacitors

TABLE 99 SWEDEN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 100 SWEDEN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.3.2 UK

10.3.2.1 Ongoing offshore wind projects to create opportunities for HVDC technology providers

TABLE 101 UK: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 102 UK: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Technological innovations in automotive sector to boost market

TABLE 103 GERMANY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 104 GERMANY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.3.4 NORWAY

10.3.4.1 Ongoing HVDC projects to accelerate market growth

TABLE 105 NORWAY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 106 NORWAY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 107 REST OF EUROPE: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 108 REST OF EUROPE: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 65 ASIA PACIFIC: HVDC CAPACITOR MARKET SNAPSHOT

FIGURE 66 CHINA TO LEAD HVDC CAPACITOR MARKET IN ASIA PACIFIC FROM 2022 TO 2030

TABLE 109 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 111 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Strong need for smooth power distribution at transportation hubs to augment market growth

TABLE 113 CHINA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 114 CHINA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Thriving transportation and consumer electronics sectors to spur market growth

TABLE 115 JAPAN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 116 JAPAN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Huge investments in renewable energy projects to generate demand for HVDC capacitors

TABLE 117 INDIA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 118 INDIA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 119 REST OF ASIA PACIFIC: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.5 ROW

FIGURE 67 SOUTH AMERICA TO REGISTER HIGHER CAGR THAN MIDDLE EAST & AFRICA FROM 2022 TO 2030

TABLE 121 ROW: HVDC CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 ROW: HVDC CAPACITOR MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 123 ROW: HVDC CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 ROW: HVDC CAPACITOR MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 To account for larger share of HVDC capacitor market in RoW

TABLE 125 MIDDLE EAST & AFRICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 To record higher CAGR during review period

TABLE 127 SOUTH AMERICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 128 SOUTH AMERICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 166)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 129 REVIEW OF STRATEGIES ADOPTED BY KEY HVDC CAPACITOR MANUFACTURERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2021

FIGURE 68 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN HVDC CAPACITOR MARKET, 2021

TABLE 130 MARKET SHARE ANALYSIS OF TOP 5 COMPANIES (2021)

11.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 69 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN HVDC CAPACITOR MARKET, 2017–2021

11.5 COMPANY EVALUATION MATRIX/QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 70 COMPANY EVALUATION QUADRANT, 2021

11.6 START-UP/SME EVALUATION MATRIX/QUADRANT

11.6.1 COMPETITIVE BENCHMARKING

TABLE 131 HVDC CAPACITOR MARKET: DETAILED LIST OF KEY START-UP/SME PLAYERS

TABLE 132 HVDC CAPACITOR MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UP/SME COMPANIES)

11.6.2 PROGRESSIVE COMPANIES

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

11.6.5 STARTING BLOCKS

FIGURE 71 START-UP/SME EVALUATION QUADRANT, 2021

TABLE 133 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 134 COMPANY APPLICATION FOOTPRINT

TABLE 135 COMPANY REGION FOOTPRINT

TABLE 136 COMPANY FOOTPRINT

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES

TABLE 137 PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2022

11.7.2 DEALS

TABLE 138 DEALS, JANUARY 2019–DECEMBER 2022

11.7.3 OTHERS

TABLE 139 OTHERS, JANUARY 2019–DECEMBER 2022

12 COMPANY PROFILES (Page No. - 187)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 HITACHI, LTD. (HITACHI ENERGY LTD.)

TABLE 140 HITACHI, LTD. (HITACHI ENERGY LTD.): BUSINESS OVERVIEW

FIGURE 72 HITACHI, LTD. (HITACHI ENERGY LTD.): COMPANY SNAPSHOT

12.1.2 GENERAL ELECTRIC COMPANY

TABLE 141 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 73 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

12.1.3 TDK CORPORATION (TDK ELECTRONICS)

TABLE 142 TDK CORPORATION (TDK ELECTRONICS): BUSINESS OVERVIEW

FIGURE 74 TDK CORPORATION (TDK ELECTRONICS): COMPANY SNAPSHOT

12.1.4 EATON

TABLE 143 EATON: BUSINESS OVERVIEW

FIGURE 75 EATON: COMPANY SNAPSHOT

12.1.5 KYOCERA CORPORATION (KYOCERA AVX CORPORATION)

TABLE 144 KYOCERA CORPORATION (KYOCERA AVX CORPORATION): BUSINESS OVERVIEW

FIGURE 76 KYOCERA CORPORATION (KYOCERA AVX CORPORATION): COMPANY SNAPSHOT

12.1.6 YAGEO CORPORATION (KEMET CORPORATION)

TABLE 145 YAGEO CORPORATION (KEMET CORPORATION): BUSINESS OVERVIEW

FIGURE 77 YAGEO CORPORATION (KEMET CORPORATION): COMPANY SNAPSHOT

12.1.7 VISHAY INTERTECHNOLOGY, INC.

TABLE 146 VISHAY INTERTECHNOLOGY, INC.: BUSINESS OVERVIEW

FIGURE 78 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

12.1.8 GENERAL ATOMICS

TABLE 147 GENERAL ATOMICS: BUSINESS OVERVIEW

12.1.9 LIFASA, INTERNATIONAL CAPACITORS, S.A.

TABLE 148 LIFASA, INTERNATIONAL CAPACITORS, S.A.: BUSINESS OVERVIEW

12.1.10 ELECTRONICON KONDENSATOREN GMBH

TABLE 149 ELECTRONICON KONDENSATOREN GMBH: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 SIEYUAN ELECTRIC CO., LTD.

12.2.2 KUNSHAN GUOLI ELECTRONIC TECHNOLOGY CO., LTD.

12.2.3 CONDIS GROUP

12.2.4 SAMHWA CAPACITOR CO., LTD.

12.2.5 API CAPACITORS LTD.

12.2.6 SHANGHAI YONGMING ELECTRONIC CO., LTD.

12.2.7 WUXI CRE NEW ENERGY TECHNOLOGY CO., LTD.

12.2.8 ISOFARAD LTD.

12.2.9 HVP HIGH VOLTAGE PRODUCTS GMBH

12.2.10 ZEZ SILKO, S.R.O.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 236)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

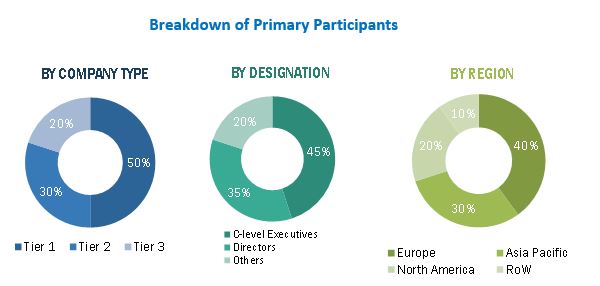

The study involved four major activities in estimating the size of the HVDC capacitor market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry's supply chain, value chain of the market, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the HVDC capacitor market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and Rest of the World (South America, the Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which consists 80% of total primary interviews; however, questionnaires and e-mails have also been used to collect the data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been implemented to arrive at the overall size of the HVDC capacitor market from the revenues of the key players in the market. Calculations based on the revenue of the key players identified in the market led to the overall market size.

- Identifying various key players offering different types of HVDC capacitors

- Analyzing each HVDC capacitor offered by major market players

- Estimating the market for HVDC capacitors, by product type

- Tracking the ongoing and upcoming installation of HVDC capacitors by end users and forecasting the market based on these developments and other critical parameters

- Undertaking multiple discussions with key opinion leaders to understand different types of HVDC capacitors and their applications, which helped analyze the impact of developments undertaken by each major company to increase their share in the HVDC capacitor market

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEOs), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for the company- and region-specific developments undertaken in the HVDC capacitor market

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from the secondary and primary research processes.

- Focusing initially on the high investments and expenditures undertaken in the ecosystem of HVDC capacitors; further splitting into product type, technology, installation type, application, and region and listing key developments in major market areas

- Identifying all major players in the HVDC capacitor market and the deployment of their products for various applications and verifying the findings through secondary research and brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key end-use applications of HVDC capacitors to estimate and arrive at the percentage splits

- Discussing these splits with industry experts to validate the information and identify key growth pockets across all major segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedure has been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe, segment, and forecast the HVDC capacitor market based on technology, installation type, and application, in terms of value

- To describe and forecast the market size for different types of HVDC capacitors, in terms of value and volume

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the HVDC capacitor market

- To provide a detailed overview of the value chain pertaining to the HVDC capacitor ecosystem, along with the average selling prices of different types of HVDC capacitors

- To strategically analyze the ecosystem, Porter’s five forces, technology analysis, tariffs and regulations, patent landscape, trade landscape, key conferences and events, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, collaborations, partnerships, contracts, expansions, and mergers and acquisitions in the HVDC capacitor market

- To strategically profile the key players in the HVDC capacitor market and comprehensively analyze their market ranking and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in HVDC Capacitor Market

I would like to know what the future of Tantalum capacitors looks like, upcoming trends and its share of the market.