Hydraulic Fracturing Market by Well Type (Horizontal Well, and Vertical Well), Technology (Plug and Perf, and Sliding Sleeve), Application (Shale gas, Tight Oil, and Tight gas), and Region - Global Trends and Forecast to 2026

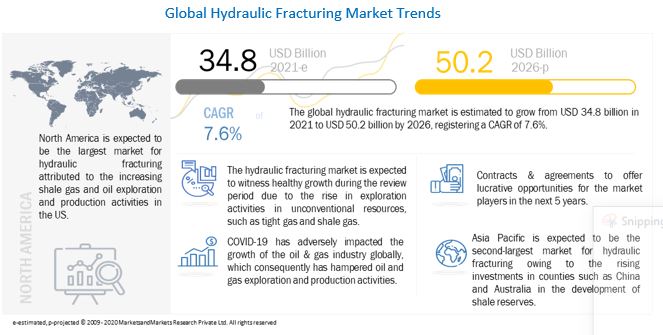

The global hydraulic fracturing market in terms of revenue was estimated to be worth $34.1 billion in 2021 and is poised to reach $50.2 billion by 2026, growing at a CAGR of 7.6% from 2021 to 2026. Increasing efforts by upstream companies to enhance the production from unconventional resources is driving the hydraulic fracturing market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Hydraulic Fracturing Market

The propagation of the COVID-19 worldwide has slowed down the growth of numerous industries. The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the spread of the virus, have resulted in a significant and swift reduction in the demand for oil and gas. As of May 28, 2020, 212 countries had been impacted by the pandemic, and the governments of individual countries had ordered nationwide lockdowns. This resulted in a considerable decline in transportation and related activities, which impacted the demand for oil and gas. According to the International Energy Agency (IEA) report, the geopolitical events increased the supply of low-priced oil to the global market, and at the same time, the demand declined due to the outbreak of the pandemic, leading to a collapse in oil prices in March 2020. These events together adversely affected the demand for oil and natural gas, as well as for hydraulic fracturing services and products, and caused significant volatility in the oil prices.

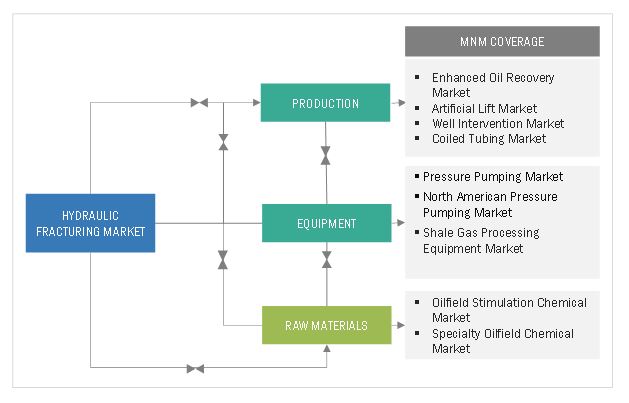

Market Interconnection

Hydraulic Fracturing Market Dynamics

Driver: Increasing shale exploration and production activities globally

Shale reservoirs are highly impermeable, which makes the extraction process difficult. Shale reservoirs require high intervention processes to optimize oil production. Thus, horizontal drilling and hydraulic fracturing activities are performed to extract shale oil and gas. The majority of shale reserves are based in North America, with the US dominating the regional market, and in some parts of Europe and Asia. According to the US Energy Information Administration (EIA), the US oil production from seven major shale formations witnessed a rise of about 29,000 barrels per day (bpd) in January 2020, which is ~9.14 million barrels per day of shale oil production. The increasing shale oil and gas production from the North Dakota basin, Montana’s Bakken formations, and Permian basin, and the rising shale developments are responsible for the shale boom in the US, making it the largest oil-producing country in the world, ahead of Saudi Arabia and Russia.

Restraints: High water usage and environmental concerns associated with hydraulic fracturing

The fracturing fluid comprises 99.5% water, which is used from nearby rivers and lakes or industrial wastewater treatment plants. The availability of water plays a vital role in the performance of fracturing operations. However, the water used in fracturing operations gets mixed with various fracturing chemicals, although in minute quantity, which can cause water pollution if disposed of or gets mixed into water bodies. Contamination of water is another issue that has to be solved at every stage of fracturing. In each stage of the hydraulic fracturing water cycle, companies have to ensure that well integrity is maintained and there are no leaks of fluid.

Opportunities: Capability of foams of providing waterless fracking

With their excellent properties, such as high viscosity and low liquid content, foams find applications in many processes of the petroleum industry. They utilize less water than traditional fracturing and could help companies in addressing public concerns over the environmental effects of fracturing. As a process, fracturing takes up a large percentage of the total water required in well drilling—roughly 89%. This presents a good opportunity for players to include waterless fracking in their product portfolio to capture maximum market share.

Challenges: Health and environmental impacts of fracking chemicals

The advancements in hydraulic fracturing technology have fueled the domestic energy supply. However, the substances used in the fracking process, e.g., formaldehyde, benzene, toluene, ethylbenzene, and xylene, are toxic in nature. There are considerable risks associated with the release of these substances on the environment. For instance, blow-outs have occurred during fracking operations, and spills of fracking fluids and other chemicals have led to pollution in streams and lakes. Thus, fracking is a suspected cause of groundwater contamination in nearby areas of wells. The pollution caused by fracking also impacts the health of animals. It can lead to diseases, deaths, and genetic defects. Contaminants from fracking have been found at levels that pose a threat to human health.

By technology, the plug & perf segment is expected to make the largest contribution to the hydraulic fracturing market during the forecast period.

The plug & perf technology can be used in both vertical and horizontal wells. It is the most preferred and common fracturing technology used for unconventional wells. The plug & perf segment is estimated to witness significant growth as it is the most commonly used technology owing to ease of operation and competitive cost. It delivers higher performance in production and helps to lower the production cost.

By application, the shale gas segment is expected to grow at the fastest rate during the forecast period.

The shale gas segment is expected to grow at the fastest rate during the forecast period. There are a large number of shale reserves across the globe. According to the EIA, in total, there are 48 shale gas basins in 32 countries, containing almost 70 shale gas formations. For instance, China has 21.8 tcm technically recoverable shale gas reserve and 764.3 bcm proved shale gas reserve, mainly in marine facies in the Sichuan basin. Likewise, Argentina’s technically recoverable shale gas reserves stand at 802 billion cubic feet, whereas Algeria has the world’s third-largest untapped shale gas resources with 20 tcm of technically recoverable shale gas. Such large reserves are driving the hydraulic fracturing market.

By well type, the horizontal wells segment is expected to dominate the hydraulic fracturing market during the forecast period.

The horizontal well segment is expected to dominate the global hydraulic fracturing market owing to the booming shale production, which requires hydraulic fracturing which is one of the major drivers for market. Furthermore, it is also increasing the focus on enhancing the primary production and reducing the total number of wells to develop an entire oilfield.

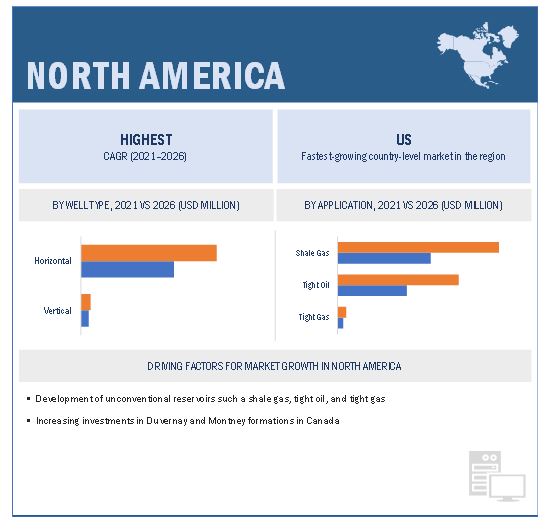

North America is expected to be the largest market during the forecast period.

North America, Europe, Latin America, Asia Pacific, Middle East & Africa are the major regions considered for the study of the hydraulic fracturing market. North America is estimated to be the largest market from 2021 to 2026, driven by the growth in unconventional resources in the US and Canada.

Key Market Players

The key players profiled in this report are Halliburton (US), Schlumberger (US),Baker Hughes (US), Calfrac Well Services (Canada), NexTier Oilfield Solutions(US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Well Type, Technology and Application |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Halliburton (US), Schlumberger (US), Baker Hughes (US), NexTier Oilfield Solutions(US), Calfrac Well Service (Canada), Trican Well Service (Canada), STEP Energy Services(Canada), Nine Energy Services(US), FTS International (US), U.S. Well Services (US), Petro Welt Technologies AG (Austria), AFG Holdings, Inc (US), Liberty Oilfield Services (US), Patterson-UTI Energy, Inc. (US), RPC Inc. (US), ProPetro Holding Corp. (US), National Energy Services Reunited Corp. (US), Tacrom Services Srl (Romania), Anton Oilfield Services Group (China), TAM International, Inc. (US), Legend Energy Services (US), and ProFrac (US)

|

This research report categorizes the hydraulic fracturing market based on technology, well type, application, and region.

Based on Technology:

- Plug & Perf

- Sliding Sleeve

Based on Application:

- Shale Gas

- Tight Oil

- Tight Gas

Based on Well Type:

- Horizontal Well

- Vertical Well

Based on the region:

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East & Africa

Recent Developments

- In August 2021, NexTier Oilfield Solutions has acquired Alamo Pressure Pumping, LLC. With this acquisition, NexTier Oilfield Solutions will operate the third-largest base of active hydraulic horsepower across the US and the largest base of next-generation equipment in the Permian Basin.

- In July 2021, Schlumberger and Vedanta Ltd’s subsidiary Cairn Oil & Gas have collaborated to start a project on the production of tight oil at Aishwariya Barmer Hill (ABH) in Rajasthan, India. The Aishwariya Barmer Hill is India’s largest lateral fracking program.

- In March 2021, FTS International has partnered with KCF Technologies to deploy MachineIQ (MIQ) on an active hydraulic fracturing site. The first production run was on the Devon Energy site in Oklahoma. MIQ successfully identified the sources of equipment issues and executed corrective actions to rebalance the system.

- In October 2020, Halliburton launched SmartFleet, an intelligent automated fracturing system. SmartFleet helps operators to control real-time fracturing while pumping by providing subsurface fracture measurements, live 3D visualization, and real-time fracture commands.

Frequently Asked Questions (FAQ):

What is the current size of the hydraulic fracturing market?

The current market size of global hydraulic fracturing market is USD 33.3 billion in 2020.

What are the major drivers?

Increasing exploration of shale reservoirs and Growing demand for hydraulic fracturing technology with increasing requirement for energy are some of the major drivers driving the market of hydraulic fracturing.

Which is the fastest-growing region during the forecasted period?

North America is the fastest-growing region during the forecasted period owing to rise in shale gas & tight oil production, favorable regulations related to the licensing of exploration & production activities, and an increase in well count.

Which is the fastest-growing segment, by well type during the forecasted period?

The horizontal segment, by well type is the fastest-growing segment during the forecasted period due to increasing exploration and production of shale reserves.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF STUDY

1.2 DEFINITION

1.2.1 HYDRAULIC FRACTURING MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 HYDRAULIC FRACTURING MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

2.2.2.1 Key industry insights

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.3 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

2.3 HYDRAULIC FRACTURING MARKET SIZE ESTIMATION

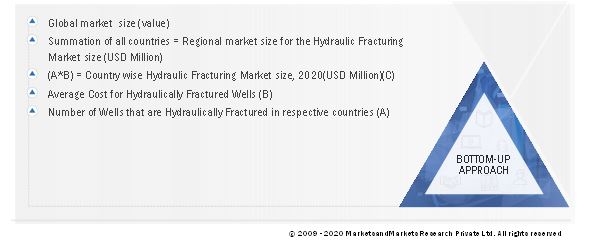

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DEMAND SIDE METRICS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ASSESSING DEMAND FOR HYDRAULIC FRACTURING

2.4.1 CALCULATION FOR DEMAND SIDE METRICS

2.4.2 RESEARCH ASSUMPTIONS FOR DEMAND SIDE METRICS

2.5 SUPPLY SIDE ANALYSIS

FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF HYDRAULIC FRACTURING

FIGURE 8 HYDRAULIC FRACTURING MARKET: SUPPLY SIDE ANALYSIS, 2020

2.5.1 CALCULATIONS FOR SUPPLY SIDE

2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 1 HYDRAULIC FRACTURING MARKET SNAPSHOT

FIGURE 9 SHALE GAS SEGMENT TO DOMINATE MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 10 HORIZONTAL SEGMENT TO DOMINATE MARKET, BY WELL TYPE, DURING FORECAST PERIOD

FIGURE 11 PLUG & PERF SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 12 NORTH AMERICA DOMINATED MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN HYDRAULIC FRACTURING MARKET

FIGURE 13 INCREASING SHALE EXPLORATION AND PRODUCTION ACTIVITIES TO DRIVE GROWTH OF MARKET FROM 2021 TO 2026

4.2 MARKET, BY WELL TYPE

FIGURE 14 HORIZONTAL SEGMENT DOMINATED MARKET IN 2020

4.3 MARKET, BY APPLICATION

FIGURE 15 SHALE GAS SEGMENT DOMINATED MARKET IN 2020

4.4 MARKET, BY TECHNOLOGY

FIGURE 16 PLUG & PERF SEGMENT DOMINATED MARKET IN 2020

4.5 MARKET IN NORTH AMERICA, BY WELL TYPE AND COUNTRY

FIGURE 17 HORIZONTAL SEGMENT AND US DOMINATED NORTH AMERICAN MARKET IN 2020

4.6 MARKET, BY REGION (VALUE)

FIGURE 18 NORTH AMERICA TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19 GLOBAL PROPAGATION

FIGURE 20 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 21 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 23 HYDRAULIC FRACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing shale exploration and production activities globally

5.5.1.1.1 Presence of large shale-proved reserves globally

TABLE 2 TOP COUNTRIES WITH RECOVERABLE SHALE RESOURCES, 2019

5.5.1.1.2 Increasing shale gas drilling activities

FIGURE 24 US DRY NATURAL GAS PRODUCTION, BY TYPE, 2000–2050 (TRILLION CUBIC FEET)

5.5.1.2 Growing demand for hydraulic fracturing technology with increasing requirement for energy

FIGURE 25 GLOBAL OIL DEMAND, 2019–2026 (THOUSAND BARRELS PER DAY)

FIGURE 26 GLOBAL NATURAL GAS DEMAND, BY REGION, 2010–2019 (BILLION CUBIC METERS)

5.5.2 RESTRAINTS

5.5.2.1 High water usage and environmental concerns associated with hydraulic fracturing

FIGURE 27 WATER USAGE IN SHALE PLAYS ACROSS US (MILLION/YR)

FIGURE 28 HYDRAULIC FRACTURING WATER CYCLE AND ITS IMPACT ON WATER SUPPLIES

FIGURE 29 FRACTURING FLUID COMPOSITION

5.5.2.2 Growing concerns regarding seismic activities due to hydraulic fracturing

5.5.2.3 Local ban and suspensions on hydraulic fracturing

TABLE 3 HYDRAULIC FRACTURING: NATIONAL POLICY REGARDING SHALE OIL AND GAS PRODUCTION

5.5.3 OPPORTUNITIES

5.5.3.1 Capability of foams of providing waterless fracking

FIGURE 30 APPLICATIONS OF FOAM IN OIL & GAS INDUSTRY—SINCE 1950 TILL DATE

TABLE 4 WATER-BASED FRACTURING FLUIDS FEATURE HIGHER RECYCLING PROPERTIES

5.5.4 CHALLENGES

5.5.4.1 Health and environmental impacts of fracking chemicals

5.5.4.2 Disruptions in hydraulic fracturing operations and demand shock attributed to COVID-19

5.6 TRENDS/DISRUPTIONS IMPACTING SERVICE PROVIDERS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HYDRAULIC FRACTURING SERVICE PROVIDERS

FIGURE 31 REVENUE SHIFT FOR HYDRAULIC FRACTURING MARKET

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 32 SUPPLY CHAIN ANALYSIS: MARKET

TABLE 5 MARKET: SUPPLY CHAIN/ECOSYSTEM

5.7.1 KEY INFLUENCERS

5.7.1.1 Raw material suppliers

5.7.1.2 Service providers

5.7.1.3 Oilfield operators

5.8 MARKET MAP

FIGURE 33 HYDRAULIC FRACTURING: MARKET MAP

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS FOR HYDRAULIC FRACTURING

TABLE 6 HYDRAULIC FRACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF SUBSTITUTES

5.9.2 BARGAINING POWER OF BUYERS

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 THREAT OF NEW ENTRANTS

5.9.5 INTENSITY OF RIVALRY

5.10 MARKET: PATENT REGISTRATIONS

TABLE 7 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2020–2021

5.11 MARKET: REGULATIONS

TABLE 8 HYDRAULIC FRACTURING MARKET: REGULATIONS

5.12 CASE STUDY ANALYSIS

5.12.1 Multistage system optimized hydraulic fracturing of high-pressure and high temperature (HPHT) tight formations

5.12.1.1 Problem statement

5.12.1.2 Solution

6 HYDRAULIC FRACTURING MARKET, BY APPLICATION (Page No. - 80)

6.1 INTRODUCTION

FIGURE 35 HYDRAULIC FRACTURING MARKET SHARE, BY APPLICATION, 2020

TABLE 9 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

6.2 SHALE GAS

6.2.1 LARGE PRESENCE OF SHALE RESERVES ON GLOBAL LEVEL TO DRIVE GROWTH OF SHALE GAS APPLICATION SEGMENT

TABLE 10 MARKET FOR SHALE GAS, BY REGION, 2019–2026 (USD MILLION)

6.3 TIGHT OIL

6.3.1 INCREASING DEMAND FOR CRUDE OIL TO BOOST GROWTH OF TIGHT OIL SEGMENT

TABLE 11 HYDRAULIC FRACTURING MARKET FOR TIGHT OIL, BY REGION, 2019–2026 (USD MILLION)

6.4 TIGHT GAS

6.4.1 INCREASING INVESTMENTS IN DEVELOPMENT OF TIGHT GAS FIELDS TO DRIVE GROWTH OF SEGMENT

TABLE 12 MARKET FOR TIGHT GAS, BY REGION, 2019–2026 (USD MILLION)

7 HYDRAULIC FRACTURING MARKET, BY WELL TYPE (Page No. - 85)

7.1 INTRODUCTION

FIGURE 36 HYDRAULIC FRACTURING MARKET SHARE, BY WELL TYPE, 2020

TABLE 13 MARKET, BY WELL TYPE, 2019–2026 (USD MILLION)

7.2 HORIZONTAL

7.2.1 SHALE DEVELOPMENTS TO BOOST GROWTH OF HORIZONTAL WELL SEGMENT

TABLE 14 MARKET FOR HORIZONTAL WELLS, BY REGION, 2019–2026 (USD MILLION)

7.3 VERTICAL

7.3.1 GROWING NEED TO INCREASE EFFICIENCY AND OUTPUT OF VERTICAL WELLS TO DRIVE MARKET GROWTH

TABLE 15 HYDRAULIC FRACTURING MARKET FOR VERTICAL WELLS, BY REGION, 2019–2026 (USD MILLION)

8 HYDRAULIC FRACTURING MARKET, BY TECHNOLOGY (Page No. - 89)

8.1 INTRODUCTION

FIGURE 37 MARKET SHARE, BY TECHNOLOGY, 2020

TABLE 16 MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

8.2 PLUG & PERF

8.2.1 EASE OF OPERATION AND ACCESSIBILITY TO BOOST DEMAND FOR PLUG & PERF TECHNOLOGY

TABLE 17 HYDRAULIC FRACTURING MARKET FOR PLUG & PERF, BY REGION, 2019–2026 (USD MILLION)

8.3 SLIDING SLEEVE

8.3.1 INCREASING INVESTMENTS IN DEVELOPMENT OF SLIDING SLEEVE TECHNOLOGY TO DRIVE MARKET GROWTH

TABLE 18 MARKET FOR SLIDING SLEEVE, BY REGION, 2019–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 93)

9.1 INTRODUCTION

FIGURE 38 HYDRAULIC FRACTURING MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 39 MARKET SHARE, BY REGION, 2020 (%)

TABLE 19 MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 40 SNAPSHOT: NORTH AMERICA LED MARKET IN 2020

9.2.1 MACRO TRENDS

9.2.1.1 Shale gas reserves

TABLE 20 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN NORTH AMERICA, BY COUNTRY (TCF)

9.2.1.2 Shale/tight oil reserves

TABLE 21 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN NORTH AMERICA, BY COUNTRY (BILLION BBL)

9.2.1.3 Crude oil production

TABLE 22 CRUDE OIL PRODUCTION IN NORTH AMERICA, BY COUNTRY (THOUSAND BARRELS DAILY)

9.2.2 BY APPLICATION

TABLE 23 HYDRAULIC FRACTURING MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.3 BY WELL TYPE

TABLE 24 MARKET IN NORTH AMERICA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.2.3.1 Well type, by country

TABLE 25 HORIZONTAL MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 26 VERTICAL MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4 BY TECHNOLOGY

TABLE 27 HYDRAULIC FRACTURING MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.4.1 Technology, by country

TABLE 28 MARKET FOR PLUG & PERF IN NORTH AMERICA,BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 MARKET FOR SLIDING SLEEVE IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.5 BY COUNTRY

TABLE 30 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.5.1 US

9.2.5.1.1 Increasing production from shale and tight oil reserves in US to drive growth of market

9.2.5.1.2 Macro trends

TABLE 31 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN US (TCF)

TABLE 32 SHALE/TIGHT OIL PROVED RESERVES FROM SELECTED US TIGHT PLAYS, 2019, IN US (BILLION BBL)

TABLE 33 CRUDE OIL PRODUCTION IN US (THOUSAND BARRELS DAILY)

9.2.5.1.3 By well type

TABLE 34 HYDRAULIC FRACTURING MARKET IN US, BY WELL TYPE, 2019–2026 (USD MILLION)

9.2.5.1.4 By technology

TABLE 35 MARKET IN US, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.5.2 Canada

9.2.5.2.1 Increasing investments in Duvernay and Montney formations to drive growth of market

9.2.5.2.2 Macro trends

TABLE 36 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN CANADA, BY COUNTRY, (TCF)

TABLE 37 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN CANADA (BILLION BBL)

TABLE 38 CRUDE OIL PRODUCTION IN CANADA (THOUSAND BARRELS DAILY)

9.2.5.2.3 By well type

TABLE 39 HYDRAULIC FRACTURING MARKET IN CANADA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.2.5.2.4 By technology

TABLE 40 MARKET IN CANADA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 41 SNAPSHOT: ASIA PACIFC MARKET, 2020

9.3.1 MACRO TRENDS

9.3.1.1 Shale gas reserves

TABLE 41 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ASIA PACIFIC, BY COUNTRY (TCF)

9.3.1.2 Shale/ tight oil reserves

TABLE 42 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ASIA PACIFIC, BY COUNTRY (BILLION BBL)

9.3.1.3 Crude oil production

TABLE 43 CRUDE OIL PRODUCTION IN ASIA PACIFIC, BY COUNTRY (THOUSAND BARRELS DAILY)

9.3.2 BY APPLICATION

TABLE 44 HYDRAULIC FRACTURING MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3 BY WELL TYPE

TABLE 45 MARKET IN ASIA PACIFIC, BY WELL TYPE,2019–2026 (USD MILLION)

9.3.3.1 Well type, by country

TABLE 46 HORIZONTAL MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 VERTICAL MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4 BY TECHNOLOGY

TABLE 48 MARKET IN ASIA PACIFIC, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.4.1 Technology, by country

TABLE 49 MARKET FOR PLUG & PERF IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 HYDRAULIC FRACTURING MARKET FOR SLIDING SLEEVE IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.5 BY COUNTRY

TABLE 51 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.5.1 China

9.3.5.1.1 Increasing exploration and production from unconventional resources to fuel growth of Chinese market

9.3.5.1.2 Macro trends

TABLE 52 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN CHINA (TCF)

TABLE 53 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN CHINA (BILLION BBL)

TABLE 54 CRUDE OIL PRODUCTION IN CHINA (THOUSAND BARRELS DAILY)

9.3.5.1.3 By well type

TABLE 55 MARKET IN CHINA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.3.5.1.4 By technology

TABLE 56 MARKET IN CHINA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.5.2 Australia

9.3.5.2.1 Presence of significant unconventional shale resources to create growth opportunities for market

9.3.5.2.2 Macro trends

TABLE 57 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN AUSTRALIA (TCF)

TABLE 58 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN AUSTRALIA (BILLION BBL)

TABLE 59 CRUDE OIL PRODUCTION IN AUSTRALIA (THOUSAND BARRELS DAILY)

9.3.5.2.3 By well type

TABLE 60 MARKET IN AUSTRALIA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.3.5.2.4 By technology

TABLE 61 MARKET IN AUSTRALIA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.5.3 Rest of Asia Pacific

9.3.5.3.1 Macro trends

TABLE 62 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN INDIA (TCF)

TABLE 63 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN TURKEY (TCF)

TABLE 64 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN INDIA (BILLION BBL)

TABLE 65 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN TURKEY (BILLION BBL)

TABLE 66 CRUDE OIL PRODUCTION IN REST OF ASIA PACIFIC (THOUSAND BARRELS DAILY)

9.3.5.3.2 By well type

TABLE 67 MARKET IN REST OF ASIA PACIFIC, BY WELL TYPE, 2019–2026 (USD MILLION)

9.3.5.3.3 By technology

TABLE 68 MARKET IN REST OF ASIA PACIFIC, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.4 LATIN AMERICA

9.4.1 MACRO TRENDS

9.4.1.1 Shale gas reserves

TABLE 69 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN LATIN AMERICA, BY COUNTRY (TCF)

9.4.1.2 Shale/tight oil reserves

TABLE 70 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN LATIN AMERICA, BY COUNTRY (BILLION BBL)

9.4.1.3 Crude oil production

TABLE 71 CRUDE OIL PRODUCTION IN LATIN AMERICA, BY COUNTRY (THOUSAND BARRELS DAILY)

9.4.2 BY APPLICATION

TABLE 72 MARKET IN LATIN AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3 BY WELL TYPE

TABLE 73 MARKET IN LATIN AMERICA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.4.3.1 Well type, by country

TABLE 74 HORIZONTAL MARKET IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 75 VERTICAL MARKET IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4 BY TECHNOLOGY

TABLE 76 MARKET IN LATIN AMERICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.4.1 Technology, by country

TABLE 77 MARKET FOR PLUG & PERF IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 MARKET FOR SLIDING SLEEVE IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.5 BY COUNTRY

TABLE 79 MARKET IN LATIN AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.5.1 Argentina

9.4.5.1.1 Shale developments in Vaca Meurta field to create high demand for hydraulic fracturing services in Argentina

9.4.5.1.2 Macro trends

TABLE 80 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ARGENTINA (TCF)

TABLE 81 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ARGENTINA (BILLION BBL)

TABLE 82 CRUDE OIL PRODUCTION IN ARGENTINA (THOUSAND BARRELS DAILY)

9.4.5.1.3 By well type

TABLE 83 MARKET IN ARGENTINA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.4.5.1.4 By technology

TABLE 84 MARKET IN ARGENTINA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.5.2 Mexico

9.4.5.2.1 Increasing investments by major companies in maximizing production through shale developments to boost market growth

9.4.5.2.2 Macro trends

TABLE 85 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN MEXICO (TCF)

TABLE 86 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN MEXICO (BILLION BBL)

TABLE 87 CRUDE OIL PRODUCTION IN MEXICO (THOUSAND BARRELS DAILY)

9.4.5.2.3 By well type

TABLE 88 MARKET IN MEXICO, BY WELL TYPE, 2019–2026 (USD MILLION)

9.4.5.2.4 By technology

TABLE 89 MARKET IN MEXICO, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.5.3 Rest of Latin America

9.4.5.3.1 Macro trends

TABLE 90 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN COLOMBIA (TCF)

TABLE 91 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN CHILE (TCF)

TABLE 92 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN COLOMBIA (BILLION BBL)

TABLE 93 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN CHILE (BILLION BBL)

TABLE 94 CRUDE OIL PRODUCTION IN REST OF LATIN AMERICA (THOUSAND BARRELS DAILY)

9.4.5.3.2 By well type

TABLE 95 MARKET IN REST OF LATIN AMERICA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.4.5.3.3 By technology

TABLE 96 MARKET IN REST OF LATIN AMERICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.5 EUROPE

9.5.1 MACRO TRENDS

9.5.1.1 Shale gas reserves

TABLE 97 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN EUROPE, BY COUNTRY (TCF)

9.5.1.2 Shale/ tight oil reserves

TABLE 98 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN EUROPE, BY COUNTRY (BILLION BBL)

9.5.1.3 Crude oil production

TABLE 99 CRUDE OIL PRODUCTION IN EUROPE, BY COUNTRY (THOUSAND BARRELS DAILY)

9.5.2 BY APPLICATION

TABLE 100 MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.3 BY WELL TYPE

TABLE 101 MARKET IN EUROPE, BY WELL TYPE, 2019–2026 (USD MILLION)

9.5.3.1 Well Type, By Country

TABLE 102 HORIZONTAL MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 103 VERTICAL MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4 BY TECHNOLOGY

TABLE 104 MARKET IN EUROPE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.4.1 Technology, by country

TABLE 105 MARKET FOR PLUG & PERF IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 106 MARKET FOR SLIDING SLEEVE IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.5 BY COUNTRY

TABLE 107 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.5.1 Russia

9.5.5.1.1 Depletion of conventional resources to create potential demand for hydraulic fracturing services in Russia

9.5.5.1.2 Macro trends

TABLE 108 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN RUSSIA (TCF)

TABLE 109 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN RUSSIA (BILLION BBL)

TABLE 110 CRUDE OIL PRODUCTION IN RUSSIA (THOUSAND BARRELS DAILY)

9.5.5.1.3 By well type

TABLE 111 MARKET IN RUSSIA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.5.5.1.4 By technology

TABLE 112 MARKET IN RUSSIA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.5.2 Ukraine

9.5.5.2.1 Presence of untapped unconventional reserves to boost market growth

9.5.5.2.2 Macro Trends

TABLE 113 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN UKRAINE (TCF)

TABLE 114 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN UKRAINE (BILLION BBL)

9.5.5.2.3 By Well Type

TABLE 115 MARKET IN UKRAINE, BY WELL TYPE, 2019–2026 (USD MILLION)

9.5.5.2.4 By Technology

TABLE 116 MARKET IN UKRAINE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.5.3 Rest of Europe

9.5.5.3.1 Macro trends

TABLE 117 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN POLAND (TCF)

TABLE 118 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ROMANIA (TCF)

TABLE 119 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN SWEDEN (TCF)

TABLE 120 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN UK (TCF)

TABLE 121 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN POLAND (BILLION BBL)

TABLE 122 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ROMANIA (BILLION BBL)

TABLE 123 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN UK (BILLION BBL)

TABLE 124 CRUDE OIL PRODUCTION IN REST OF EUROPE (THOUSAND BARRELS DAILY)

9.5.5.3.2 By well type

TABLE 125 MARKET IN REST OF EUROPE, BY WELL TYPE, 2019–2026 (USD MILLION)

9.5.5.3.3 By technology

TABLE 126 MARKET IN REST OF EUROPE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MACRO TRENDS

9.6.1.1 Shale gas reserves

TABLE 127 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN MIDDLE EAST & AFRICA, BY COUNTRY (TCF)

9.6.1.2 Shale/ tight oil reserves

TABLE 128 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN MIDDLE EAST & AFRICA, BY COUNTRY (BILLION BBL)

9.6.1.3 Crude oil production

TABLE 129 CRUDE OIL PRODUCTION IN MIDDLE EAST & AFRICA, BY COUNTRY (THOUSAND BARRELS DAILY)

9.6.2 BY APPLICATION

TABLE 130 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.3 BY WELL TYPE

TABLE 131 MARKET IN MIDDLE EAST & AFRICA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.6.3.1 Well type, by country

TABLE 132 HORIZONTAL MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 133 VERTICAL MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.4 BY TECHNOLOGY

TABLE 134 MARKET IN MIDDLE EAST & AFRICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.4.1 Technology, by country

TABLE 135 MARKET FOR PLUG & PERF IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 136 MARKET FOR SLIDING SLEEVE IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.5 BY COUNTRY

TABLE 137 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.5.1 Algeria

9.6.5.1.1 Initiatives to increase exploration activities to support growth of market in Algeria

9.6.5.1.2 Macro trends

TABLE 138 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN ALGERIA (TCF)

TABLE 139 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN ALGERIA (BILLION BBL)

TABLE 140 CRUDE OIL PRODUCTION IN ALGERIA (THOUSAND BARRELS DAILY)

9.6.5.1.3 By well type

TABLE 141 MARKET IN ALGERIA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.6.5.1.4 By technology

TABLE 142 MARKET IN ALGERIA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.5.2 Jordan

9.6.5.2.1 Increasing investments in Risha gas field to boost market growth

9.6.5.2.2 Macro trends

TABLE 143 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN JORDAN (TCF)

TABLE 144 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN JORDAN (BILLION BBL)

9.6.5.2.3 By well type

TABLE 145 MARKET IN JORDAN, BY WELL TYPE, 2019–2026 (USD MILLION)

9.6.5.2.4 By technology

TABLE 146 MARKET IN JORDAN, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.5.3 Saudi Arabia

9.6.5.3.1 Increasing initiatives for exploration and production from shale gas reserves to fuel market growth

9.6.5.3.2 Macro trends

TABLE 147 CRUDE OIL PRODUCTION IN SAUDI ARABIA (THOUSAND BARRELS DAILY)

9.6.5.3.3 By well type

TABLE 148 MARKET IN SAUDI ARABIA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.6.5.3.4 By technology

TABLE 149 MARKET IN SAUDI ARABIA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.5.4 South Africa

9.6.5.4.1 Presence of large shale gas reserves in Karoo basin to drive market growth

9.6.5.4.2 Macro trends

TABLE 150 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN SOUTH AFRICA (TCF)

9.6.5.4.3 By well type

TABLE 151 MARKET IN SOUTH AFRICA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.6.5.4.4 By technology

TABLE 152 MARKET IN SOUTH AFRICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.6.5.5 Rest of Middle East & Africa

9.6.5.5.1 Macro trends

TABLE 153 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN LIBYA (TCF)

TABLE 154 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN EGYPT (TCF)

TABLE 155 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN OMAN (TCF)

TABLE 156 TOTAL TECHNICALLY RECOVERABLE SHALE GAS RESERVES IN UAE (TCF)

TABLE 157 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN LIBYA (BILLION BBL)

TABLE 158 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVESIN EGYPT (BILLION BBL)

TABLE 159 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN OMAN (BILLION BBL)

TABLE 160 TOTAL TECHNICALLY RECOVERABLE SHALE/TIGHT OIL RESERVES IN UAE (BILLION BBL)

TABLE 161 CRUDE OIL PRODUCTION IN REST OF MIDDLE EAST & AFRICA (THOUSAND BARRELS DAILY)

9.6.5.5.2 By well type

TABLE 162 MARKET IN REST OF MIDDLE EAST & AFRICA, BY WELL TYPE, 2019–2026 (USD MILLION)

9.6.5.5.3 By technology

TABLE 163 MARKET IN REST OF MIDDLE EAST & AFRICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 157)

10.1 KEY PLAYERS STRATEGIES

FIGURE 42 KEY DEVELOPMENTS IN MARKET, 2017–2021

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 164 MARKET: DEGREE OF COMPETITION

FIGURE 43 MARKET SHARE ANALYSIS, 2020

10.3 MARKET EVALUATION FRAMEWORK

TABLE 165 MARKET EVALUATION FRAMEWORK

10.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 44 TOP FIVE PLAYERS IN MARKET FROM 2016 TO 2020

10.5 COMPANY EVALUATION QUADRANT

10.5.1 MARKET SCOPE

10.5.2 MARKET SEGMENTATION

10.5.3 REGIONAL SCOPE

10.5.4 YEARS CONSIDERED FOR STUDY

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

11 COMPANY PROFILES (Page No. - 164)

(Business and financial overview, Products/Services/Solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 RESEARCH METHODOLOGY

TABLE 166 HALLIBURTON: BUSINESS OVERVIEW

FIGURE 46 HALLIBURTON: COMPANY SNAPSHOT BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 168 HALLIBURTON: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 169 HALLIBURTON: DEALS

TABLE 170 HALLIBURTON: OTHERS

11.1.2 Key industry insights

TABLE 171 SCHLUMBERGER: BUSINESS OVERVIEW

FIGURE 47 SCHLUMBERGER: COMPANY SNAPSHOT

TABLE 172 SCHLUMBERGER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 173 SCHLUMBERGER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 174 SCHLUMBERGER: DEALS

TABLE 175 SCHLUMBERGER: OTHERS

11.1.3 TOP-DOWN APPROACH

TABLE 176 BAKER HUGHES COMPANY: BUSINESS OVERVIEW

FIGURE 48 BAKER HUGHES: COMPANY SNAPSHOT

TABLE 177 BAKER HUGHES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 178 BAKER HUGHES: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 179 BAKER HUGHES: DEALS

TABLE 180 BAKER HUGHES: OTHERS

11.1.4 SUPPLY SIDE ANALYSIS

TABLE 181 NEXTIER OILFIELD SOLUTIONS: BUSINESS OVERVIEW

FIGURE 49 NEXTIER OILFIELD SOLUTIONS: COMPANY SNAPSHOT

TABLE 182 NEXTIER OILFIELD SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 183 NEXTIER OILFIELD SOLUTIONS: DEALS

11.1.5 FORECAST

TABLE 184 FTS INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 50 FTS INTERNATIONAL: COMPANY SNAPSHOT

TABLE 185 FTS INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 186 FTS INTERNATIONAL: DEALS

11.1.6 PLUG & PERF SEGMENT TO HOLD LARGEST SHARE OF HYDRAULIC FRACTURING MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

TABLE 187 TRICAN WELL SERVICE: BUSINESS OVERVIEW

FIGURE 51 TRICAN WELL SERVICE: COMPANY SNAPSHOT

TABLE 188 TRICAN WELL SERVICE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 189 TRICAN WELL SERVICE: DEALS

TABLE 190 TRICAN WELL SERVICE: OTHERS

11.1.7 HORIZONTAL SEGMENT DOMINATED HYDRAULIC FRACTURING MARKET IN 2020

TABLE 191 NINE ENERGY SERVICES: BUSINESS OVERVIEW

FIGURE 52 NINE ENERGY SERVICES: COMPANY SNAPSHOT

TABLE 192 NINE ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 193 NINE ENERGY SERVICES: DEALS

TABLE 194 NINE ENERGY SERVICES: OTHERS

11.1.8 HORIZONTAL SEGMENT AND US DOMINATED NORTH AMERICAN HYDRAULIC FRACTURING MARKET IN 2020

TABLE 195 RPC, INC.: BUSINESS OVERVIEW

FIGURE 53 RPC, INC.: COMPANY SNAPSHOT

TABLE 196 RPC, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.9 INTRODUCTION

TABLE 197 STEP ENERGY SERVICES: BUSINESS OVERVIEW

FIGURE 54 STEP ENERGY SERVICES: COMPANY SNAPSHOT

TABLE 198 STEP ENERGY SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 199 STEP ENERGY SERVICES: DEALS

11.1.10 COVID-19 PROPAGATION IN SELECTED COUNTRIES

TABLE 200 NATIONAL ENERGY SERVICES REUNITED CORP.: BUSINESS OVERVIEW

FIGURE 55 NATIONAL ENERGY SERVICES REUNITED CORP.: COMPANY SNAPSHOT

TABLE 201 NATIONAL ENERGY SERVICES REUNITED CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 202 NATIONAL ENERGY SERVICES REUNITED CORP.: DEALS

11.1.11 DRIVERS

TABLE 203 TECHNIPFMC: BUSINESS OVERVIEW

FIGURE 56 TECHNIPFMC: COMPANY SNAPSHOT

TABLE 204 TECHNIPFMC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.12 Increasing shale gas drilling activities

TABLE 205 CALFRAC WELL SERVICES: BUSINESS OVERVIEW

FIGURE 57 CALFRAC WELL SERVICES: COMPANY SNAPSHOT

TABLE 206 CALFRAC WELL SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.13 GLOBAL NATURAL GAS DEMAND, BY REGION, 2010–2019 (BILLION CUBIC METERS)

TABLE 207 PATTERSON-UTI ENERGY, INC.: BUSINESS OVERVIEW

FIGURE 58 PATTERSON-UTI ENERGY, INC.: COMPANY SNAPSHOT

TABLE 208 PATTERSON-UTI ENERGY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 209 PATTERSON-UTI ENERGY, INC.: DEALS

11.1.14 FRACTURING FLUID COMPOSITION

TABLE 210 LIBERTY OILFIELD SERVICES: BUSINESS OVERVIEW

FIGURE 59 LIBERTY OILFIELD SERVICES: COMPANY SNAPSHOT

TABLE 211 LIBERTY OILFIELD SERVICES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 212 LIBERTY OILFIELD SERVICES: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 213 LIBERTY OILFIELD SERVICES: DEALS

11.1.15 APPLICATIONS OF FOAM IN OIL & GAS INDUSTRY—SINCE 1950 TILL DATE

TABLE 214 PROPETRO HOLDING CORP.: BUSINESS OVERVIEW

FIGURE 60 PROPETRO HOLDING CORP.: COMPANY SNAPSHOT

TABLE 215 PROPETRO HOLDING CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 216 PROPETRO HOLDING CORP.: DEALS

11.1.16 TRENDS/DISRUPTIONS IMPACTING SERVICE PROVIDERS

TABLE 217 PETRO WELT TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 61 PETRO WELT TECHNOLOGIES AG: COMPANY SNAPSHOT

TABLE 218 PETRO WELT TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.2 OTHER PLAYERS

11.2.1 HYDRAULIC FRACTURING MARKET: SUPPLY CHAIN/ECOSYSTEM

11.2.2 KEY INFLUENCERS

11.2.3 Raw material suppliers

11.2.4 Service providers

*Details on Business and financial overview, Products/Services/Solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 224)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

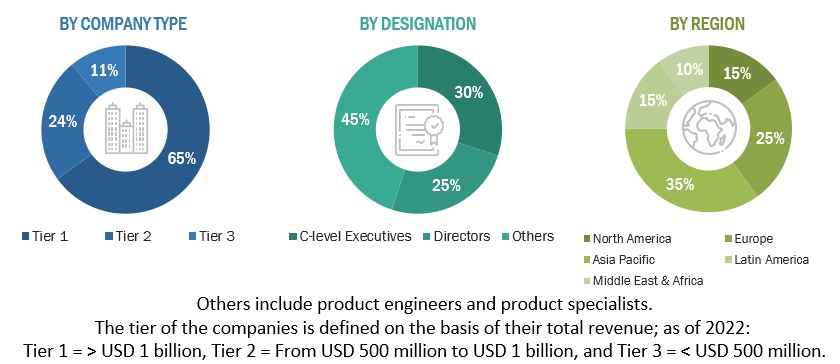

This study involved four major activities in estimating the current size of the hydraulic fracturing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the hydraulic fracturing market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, the World Bank, and BP Statistical Review of World Energy, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The hydraulic fracturing market comprises several stakeholders, such as end-product manufacturers and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as drilling service providers, upstream operators, and others. The supply-side is characterized by hydraulic fracturing service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global hydraulic fracturing market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Hydraulic fracturing Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the hydraulic fracturing market on the basis of well type, technology, application, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the five main regions (Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa)

- To provide detailed information regarding Porter’s five forces, supply chain, product pricing trade, and revenue shift trends pertaining to the hydraulic fracturing market

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments such as contracts & agreements, mergers & acquisitions, investments & expansions, and product launches and developments in the hydraulic fracturing market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydraulic Fracturing Market