Hydraulics Market by Components (Motors, Pumps, Cylinders, Valves, Filters, Accumulators, Transmissions), Type (Mobile Hydraulics, Industrial Hydraulics), End User (Construction, Agriculture, Material Handling), Sensors & Region - Global Forecast to 2027

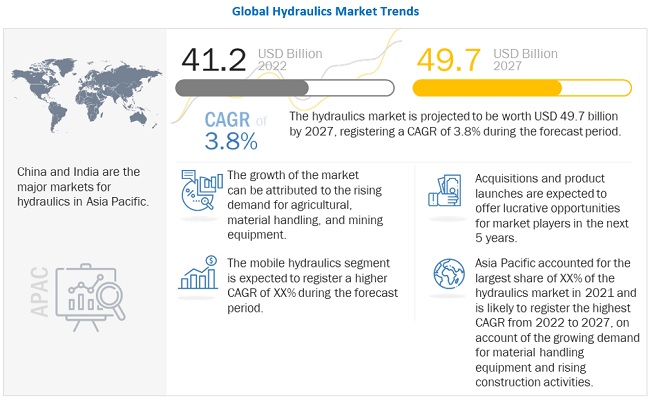

[210 Pages Report]The global hydraulics market size is estimated to be USD 41.2 billion in 2022 and is projected to reach USD 49.7 billion by 2027, at a CAGR of 3.8%. Growing potential of construction industry, increasing demand for material handling equipment, and expansion of process industries are the major factors driving the growth of the hydraulics market. Moreover, technological advancements leading to increasing demand for smart hydraulics equipment is promoting the growth of hydraulics equipment.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

COVID-19 has severely impacted the global economy and all the industries throughout the globe. During the initial 1 to 2 months of 2020, the outbreak of the pandemic affected the growth of the hydraulics market. In major countries such as the US, Germany, China, and the UK, the pandemic has led to disruptions in the operations of the companies, thereby affecting the entire hydraulic industry. This has adversely affected the financial positions of the companies. Furthermore, several companies have undergone revenue losses owing to the disruptions in the global supply chain.

However, post-pandemic, there has been significant revival in the hydraulics industry. Many of the projects which were halted owing to the effect of the pandemic have been resumed and hence the demand for the hydraulics equipment is increasing and has almost reached pre-pandemic levels. In major countries like the US, China, and Germany, there has been consistent revival in the value chain of the hydraulics market post the pandemic. Considerable increase in the demand for smart hydraulics equipment across industries such as agriculture, material handling, aerospace, metals & machinery manufacturing, automotive, mining, marine, and oil & gas are driving the market growth in the post-pandemic period.

Hydraulics Market Dynamics

DRIVERS: Increasing requirement for material handling equipment

Companies across the world are facing problems related to increasing labor costs. Increasing labor costs lead to decreasing relative productivity. Several factors are influencing the increase in labor costs, which include government regulations, supply–demand mismatch, and the shortage of skilled workforce. With the increase in labor costs, companies are finding it feasible to invest in automated solutions. The increasing demand for automated solutions in various industries such as automotive, metal, construction, and mining is expected to drive the material handling equipment market. Hydraulics is increasingly used to improve the function, controllability, power, and safety of material handling equipment. Thus, the increasing demand for material handling equipment is driving the demand for the hydraulics industry.

RESTRAINT: Increased concerns regarding oil leaks

Hydraulic cylinders operate on hydraulic fluids, mainly oil. Various factors, such as inappropriate fittings and connections and environmental parameters, including vibrations, shocks, and temperature variations, lead to oil leakage in hydraulic cylinders. In industries such as mining and construction, which require extensive earthworks and the deployment of large fixed and mobile plants in an environmentally sensitive location, the problem of leakage persists largely. This leakage is not only expensive but also hazardous to the environment and personnel. Additionally, in the aerospace industry, unexpected leakage causes delays, resulting in prohibitive expenses, especially when these events occur on sites. Further, it damages the environment as industries such as the marine, forestry, mining, and agriculture end up releasing this fluid (oil) into rivers, lakes, or soil, for which the cleanup cost paid by governments is quite high.

OPPORTUNITIES: Continuous R&D and technological advancements in hydraulic cylinders

One of the key strategies employed by industry players is increased investment in the research and development (R&D) of hydraulic cylinders to create advanced variants to suit the market requirements. Manufacturers such as Danfoss, KYB Corporation, and Parker-Hannifin Corporation have been significantly investing in R&D activities to improve their hydraulic technology. For instance, KYB Corporation has developed hydraulic cylinders with reinforced chromium plating to provide better resistance against wear. Similarly, many major companies such as SMC Corporation, Parker-Hannifin Corporation, and Bosch Rexroth provide customized hydraulic cylinders to meet customer requirements. For instance, Weber-Hydraulik has developed custom hydraulic cylinders for use in Liebherr Telescopic Mobile (LTM) cranes, which are the world’s largest cranes with the ability to carry up to 1,200 tons and reach heights of 188 meters.

CHALLENGES: Availability of substitute products

Contamination in the surroundings is caused due to leage of fluids, mostly oil. This is one of the most important concerns regarding the utilization of hydraulics equipment. Therefore, there is an increasing demand for substitute products such as pneumatic system, which uses the pressure of compressed gas to generate a force in a reciprocating linear motion.. Since a pneumatic system makes use of gases, even if there is any leakage, it does not contaminate the surrounding. Pneumatic systems are used in agriculture and material handling applications, which require personnel to be in close proximity to these systems. Thus, the availability of cleaner substitute products, such as pneumatic systems, acts as a challenge for the growth of the hydraulics market.

Cylinders accounted for largest share of hydraulics market in 2021

Hydraulic cylinders find applications in industrial and mobile equipment used in various industries, including construction, aerospace & defense, automotive, agricultural, mining, oil & gas, and marine. Smart hydraulic cylinders are integrated with electronics, which leads to an increase in the functionality, accuracy, and improvements in the controlled movement of the piston of hydraulic cylinders, thereby fuelling the demand for smart hydraulic cylinders across industries.

Mobile hydraulics held larger share of hydraulics market in 2021

The mobile type of hydraulic segment held a larger share of the hydraulics market in 2021. Several mobile hydraulic equipment such as cranes and excavators require hydraulic cylinders to operate. Hydraulics in the mobile equipment industry are used across multiple applications such as material handling and mining. Growing potential of construction industry and the increasing urbanization and industrialization are expected to fuel the demand for hydraulics equipment in mobile applications.

Agriculture industry held the second largest share and is expected to grow at the highest CAGR during the forecast period

High-tech agricultural machinery is ideal for the production of crops and livestock management. Operations of the agricultural industry rely on these components and systems to operate at maximum efficiency, which limits downtime and keeps productivity high. Demand for these modern agricultural machines with smart hydraulics is high as they offer high reliability and flexibility, as well as ease of operation.

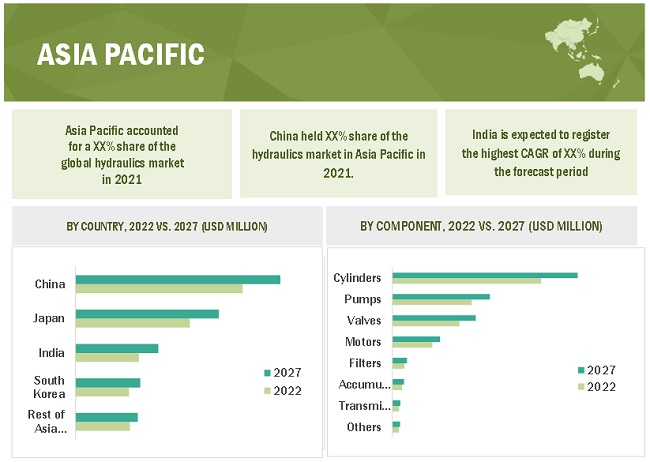

Asia Pacific held the largest share of the hydraulics market in 2021

The growing urbanization and industrialization in Asia Pacific leading to the growing potential of industries in the region such as construction, agriculture, and mining is promoting the growth of the hydraulics market in the region. Many major OEMs (Original Equipment Manufacturers) in the region are facing challenges owing to rising labor costs and enhanced lead time due involvement of manual processes. Therefore, manufacturers across the region, especially in countries like China, Japan, and Australia are adopting automated and semi-automated material handling equipment for increasing productivity and reducing downtime. Increase in demand for material handling equipment is further promoting the growth of hydraulics market in the region. The growing demand for agricultural, construction, and mining equipment in this region is supporting the growth of the hydraulics market. Japan is one of the major markets for hydraulics in Asia Pacific. Japan is home to major automobile manufacturers and suppliers who are witnessing challenges such as rising labor costs and higher lead time associated with manual processes. To overcome these challenges, companies are adopting automated and semi-automated material handling equipment.

To know about the assumptions considered for the study, download the pdf brochure

The hydraulics companies is dominated by a few globally established players such as Parker-Hannifin Corporation (US), Bosch Rexroth (Germany), and Danfoss (Denmark).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Component, and End User |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Bosch Rexroth (Germany), Danfoss (Denmark), Parker-Hannifin Corporation (US), Enerpac Tool Group (US), HYDAC (Germany), Kawasaki Heavy Industries (Japan), KYB Corporation (Japan), SMC Corporation (Japan), Wipro Enterprises (India), and Caterpillar (US), among other – Total 25 players have been covered. |

This research report segments the hydraulics market based on type, component, end user, and region.

By Type:

- Industrial Hydraulics

- Mobile Hydraulics

By Component:

- Motors

- Pumps

- Valves

- Cylinders

- Filters

- Accumulators

- Transmissions

- Others

By End User:

- Construction

- Aerospace

- Agriculture

- Metals & Machinery Manufacturing

- Automotive

- Mining

- Marine

- Oil & Gas

- Material Handling

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In August 2021, SMC Corporation launched an updated Pin Cylinder product line to have a shorter overall length, which will make the machine compact and thereby enable a significant reduction in the installation space.

- In June 2021, Enerpac launched the RC-Series hydraulic cylinders. These cylinders offer improved resistance against damage and corrosion due to the use of four high-performance bands.

- In August 2020, Parker-Hannifin Corporation launched a cylinder sizing design tool, which is an intuitive online software tool that enables users to specify and apply linear actuators by measuring basic operating parameters such as fluid media, operating temperatures, mounting requirements, and available pressure.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the hydraulics market during 2022-2027?

The global hydraulics market is expected to record a CAGR of 3.8% from 2022–2027.

Does this report include the impact of COVID-19 on the hydraulics equipment?

Yes, the report includes the impact of COVID-19 on the hydraulics market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the hydraulics market?

Growing construction activities, increasing demand for material handling equipment, and growing adaptation of hydraulics equipments across various industries such as agricutlure, construction, and material handling are the major driving factors.

Which are the significant players operating in the hydraulics market?

Parker-Hannifin Corporation (US), Bosch Rexroth (Germany), and Danfoss (Denmark) are some of the major companies operating in the hydraulics market.

Which region will lead the hydraulics market in the future?

APAC is expected to lead the hydraulics market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

210

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 HYDRAULICS MARKET: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 HYDRAULICS MARKET: SEGMENTATION

1.4.2 HYDRAULICS MARKET, BY REGION

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 HYDRAULICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF COMPANIES FROM HYDRAULICS COMPONENTS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 4 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 5 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 8 ANALYSIS OF IMPACT OF COVID–19 ON HYDRAULICS MARKET

FIGURE 9 CYLINDERS TO ACCOUNT FOR LARGEST SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

FIGURE 10 MOBILE SEGMENT TO HOLD LARGER SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

FIGURE 11 AGRICULTURE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC HYDRAULICS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR HYDRAULICS MARKET

FIGURE 13 HYDRAULICS MARKET TO WITNESS LUCRATIVE GROWTH OPPORTUNITIES IN ASIA PACIFIC

4.2 HYDRAULICS MARKET, BY COMPONENT

FIGURE 14 CYLINDERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 HYDRAULICS MARKET, BY END USER

FIGURE 15 CONSTRUCTION SEGMENT TO HOLD LARGEST SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

4.4 HYDRAULICS MARKET, BY TYPE

FIGURE 16 MOBILE SEGMENT TO HOLD MAJOR SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

4.5 HYDRAULICS MARKET, BY GEOGRAPHY

FIGURE 17 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 HYDRAULICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 19 IMPACT ANALYSIS: DRIVERS

5.2.1.1 Accelerating construction activities leading to demand for hydraulic equipment

5.2.1.2 Increasing requirement for material handling equipment

5.2.1.3 Mounting demand for advanced agriculture equipment

5.2.1.4 Increasing penetration of hydraulic equipment across various industries

5.2.1.5 Expanding process industries

5.2.2 RESTRAINTS

FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

5.2.2.1 Intensifying concerns regarding oil leaks

5.2.2.2 High manufacturing and maintenance costs

5.2.3 OPPORTUNITIES

FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

5.2.3.1 Surging adoption of lifting equipment in shipping industry

5.2.3.2 Development of smart hydraulic equipment

5.2.3.3 Continuous R&D and technological advancements in hydraulic cylinders

5.2.3.4 Increasing uptake of electric vehicles

5.2.4 CHALLENGES

FIGURE 22 IMPACT ANALYSIS: CHALLENGES

5.2.4.1 Availability of substitute products

5.3 VALUE CHAIN

FIGURE 23 HYDRAULICS MARKET: VALUE CHAIN ANALYSIS

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 MANUFACTURERS

5.3.3 DISTRIBUTORS

5.3.4 END-USER INDUSTRIES

5.3.5 AFTER-SALES SERVICE PROVIDERS

5.4 ECOSYSTEM

FIGURE 24 HYDRAULICS MARKET: ECOSYSTEM

TABLE 2 HYDRAULICS MARKET: ECOSYSTEM

5.5 PRICING MODEL OF HYDRAULICS MARKET PLAYERS

TABLE 3 AVERAGE SELLING PRICE BASED ON CYLINDER TYPE

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 IMPACT OF IOT ON HYDRAULIC ECOSYSTEM

5.6.2.1 Introduction

5.6.2.2 IoT empowers control in hydraulic applications

FIGURE 25 MONITORING OF HYDRAULIC-BASED MACHINERY USING IOT

5.6.2.3 IoT offers remote control of plant systems

5.6.2.4 Integration of IoT with fluid power

5.6.2.5 IoT Sensors in hydraulics

5.6.3 INCREASING DIGITIZATION OF MOBILE HYDRAULIC PRODUCT PORTFOLIO

5.6.4 INCREASING USE OF DIFFERENT SENSOR TECHNOLOGIES IN MOBILE HYDRAULICS

5.6.4.1 Position sensors have become vital in mobile hydraulic solutions

5.6.5 IMPACT OF 5G TECHNOLOGY ON HYDRAULIC ECOSYSTEM

5.6.6 SHIFT OF FUNCTIONALITY IN SOFTWARE ARCHITECTURE USED FOR INDUSTRY 4.0

5.6.7 SOFTWARE & SERVICES

5.6.7.1 Software to help automate various tasks involved in running and monitoring devices

5.7 PORTER’S FIVE FORCE ANALYSIS

TABLE 4 IMPACT OF EACH FORCE ON HYDRAULICS MARKET

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 CASE STUDIES

5.8.1 GENAN ADOPTED BOSCH REXROTH’S HYDRAULICS TO EXTEND TIRE LIFE AND PRODUCTIVITY

5.8.2 ECO GREEN CONTRACTED PARKER-HANNIFIN CORPORATION TO ACHIEVE BOTH VOLUME AND HIGH-QUALITY CRUMB RUBBER IN ONE MACHINE

5.9 TRADE ANALYSIS

5.9.1 EXPORT SCENARIO FOR HYDRAULIC MOTORS & LINEAR ACTING CYLINDERS

FIGURE 26 EXPORT DATA FOR HS CODE 841221, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.9.2 IMPORT SCENARIO FOR HYDRAULIC MOTORS & LINEAR ACTING CYLINDERS

FIGURE 27 IMPORT DATA FOR HS CODE 841221, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.10 PATENT ANALYSIS

FIGURE 28 ANALYSIS OF PATENTS GRANTED IN HYDRAULICS MARKET

TABLE 5 SOME PATENTS PERTAINING TO HYDRAULICS MARKET, 2019–2021

5.11 REGULATORY IMPLICATIONS

5.11.1 ISO 4413:2010

5.11.2 ISO 4409:2007

5.11.3 ISO 4401:2005

6 HYDRAULICS MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 75)

6.1 INTRODUCTION

6.2 RADIOFREQUENCY

6.3 BLUETOOTH

6.4 WI-FI

6.5 4G/5G CELLULAR

7 HYDRAULICS MARKET, BY TYPE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 29 HYDRAULICS MARKET, BY TYPE

TABLE 6 HYDRAULICS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 7 HYDRAULICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 30 MOBILE SEGMENT TO HOLD LARGER SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

7.2 MOBILE

7.2.1 NEED FOR HYDRAULIC POWER AT REMOTE AND DIFFICULT TERRAINS LEADS TO INSTALLATION OF MOBILE EQUIPMENT

TABLE 8 MOBILE HYDRAULICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 9 MOBILE HYDRAULICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 10 MOBILE HYDRAULICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 11 MOBILE HYDRAULICS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 INDUSTRIAL

7.3.1 INDUSTRIAL HYDRAULICS USED TO MANAGE EXTREMELY HEAVY LOADS

TABLE 12 INDUSTRIAL HYDRAULICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 13 INDUSTRIAL HYDRAULICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 14 INDUSTRIAL HYDRAULICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 INDUSTRIAL HYDRAULICS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 HYDRAULICS MARKET, BY SENSOR (Page No. - 84)

8.1 INTRODUCTION

FIGURE 31 HYDRAULICS MARKET, BY SENSOR

TABLE 16 HYDRAULICS MARKET, BY SENSOR, 2018–2021 (USD MILLION)

TABLE 17 HYDRAULICS MARKET, BY SENSOR, 2022–2027 (USD MILLION)

8.2 TILT SENSORS

8.2.1 GROWING USE OF TILT SENSORS IN MINING AND CONSTRUCTION INDUSTRIES DRIVES MARKET

8.3 POSITION SENSORS

8.3.1 ACCELERATED TREND OF INDUSTRIAL AUTOMATION DRIVES DEMAND FOR POSITION SENSORS

8.4 PRESSURE SENSORS

8.4.1 LARGE-SCALE ADOPTION OF IOT AND REMOTE CONNECTIVITY TO INCREASE DEMAND FOR PRESSURE SENSORS

8.5 TEMPERATURE SENSORS

8.5.1 RISING NEED FOR REAL-TIME TEMPERATURE MONITORING IN HYDRAULICS TO BOOST DEMAND FOR TEMPERATURE SENSORS

8.6 LEVEL SENSORS

8.6.1 INTEGRATION OF IOT IN HYDRAULICS FUELS DEMAND FOR LEVEL SENSORS

8.7 FLOW SENSORS

8.7.1 RISING AUTOMATION OF PROCESS INDUSTRIES FUELS DEMAND FOR FLOW METERS

9 HYDRAULICS MARKET, BY COMPONENT (Page No. - 89)

9.1 INTRODUCTION

FIGURE 32 HYDRAULICS MARKET, BY COMPONENT

FIGURE 33 CYLINDERS TO HOLD LARGEST SHARE OF HYDRAULICS MARKET DURING FORECAST PERIOD

TABLE 18 HYDRAULICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 19 HYDRAULICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

9.2 MOTORS

9.2.1 MOTORS ARE ROTARY ACTUATORS THAT CONVERT HYDRAULIC ENERGY TO MECHANICAL POWER

TABLE 20 HYDRAULICS MARKET FOR MOTORS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 HYDRAULICS MARKET FOR MOTORS, BY TYPE, 2022–2027 (USD MILLION)

9.3 PUMPS

9.3.1 HYDRAULIC PUMPS ARE GENERALLY USED IN MOBILE APPLICATIONS

TABLE 22 HYDRAULICS MARKET FOR PUMPS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 HYDRAULICS MARKET FOR PUMPS, BY TYPE, 2022–2027 (USD MILLION)

9.4 CYLINDERS

9.4.1 CYLINDERS USE STORED ENERGY OF HYDRAULIC FLUIDS AND CONVERT THIS ENERGY INTO LINEAR DIRECTION FORCE

TABLE 24 HYDRAULICS MARKET FOR CYLINDERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 HYDRAULICS MARKET FOR CYLINDERS, BY TYPE, 2022–2027 (USD MILLION)

9.5 VALVES

9.5.1 VALVES ARE USED TO MAINTAIN FLOW OF HYDRAULIC FLUIDS WITHIN HYDRAULIC CIRCUITS

TABLE 26 HYDRAULICS MARKET FOR VALVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 27 HYDRAULICS MARKET FOR VALVES, BY TYPE, 2022–2027 (USD MILLION)

9.6 TRANSMISSIONS

9.6.1 HYDRAULIC TRANSMISSIONS ARE USED FOR OPERATING HEAVY-DUTY MACHINERY

TABLE 28 HYDRAULICS MARKET FOR TRANSMISSIONS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 29 HYDRAULICS MARKET FOR TRANSMISSIONS, BY TYPE, 2022–2027 (USD MILLION)

9.7 ACCUMULATORS

9.7.1 ACCUMULATORS STORE AND DISCHARGE ENERGY IN FORM OF PRESSURIZED FLUIDS

TABLE 30 HYDRAULICS MARKET FOR ACCUMULATORS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 31 HYDRAULICS MARKET FOR ACCUMULATORS, BY TYPE, 2022–2027 (USD MILLION)

9.8 FILTERS

9.8.1 HYDRAULIC FILTERS ARE USED TO LIMIT SYSTEM FAILURES IN VARIOUS END-USE INDUSTRIES

TABLE 32 HYDRAULICS MARKET FOR FILTERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 HYDRAULICS MARKET FOR FILTERS, BY TYPE, 2022–2027 (USD MILLION)

9.9 OTHERS

TABLE 34 HYDRAULICS MARKET FOR OTHER COMPONENTS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 HYDRAULICS MARKET FOR OTHER COMPONENTS, BY TYPE, 2022–2027 (USD MILLION)

10 HYDRAULICS MARKET, BY END USER (Page No. - 100)

10.1 INTRODUCTION

FIGURE 34 HYDRAULICS MARKET, BY END USER

FIGURE 35 CONSTRUCTION SEGMENT TO HOLD LARGEST SIZE OF HYDRAULICS MARKET DURING FORECAST PERIOD

TABLE 36 HYDRAULICS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 37 HYDRAULICS MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 CONSTRUCTION

10.2.1 CONSTRUCTION INDUSTRY TO LEAD HYDRAULICS MARKET DURING FORECAST PERIOD

TABLE 38 HYDRAULICS MARKET FOR CONSTRUCTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 HYDRAULICS MARKET FOR CONSTRUCTION, BY REGION, 2022–2027 (USD MILLION)

10.3 AEROSPACE

10.3.1 INCREASING DEMAND FOR ELECTRO-HYDRAULIC COMPONENTS IN AIRCRAFT TO FUEL GROWTH OF HYDRAULICS MARKET

TABLE 40 HYDRAULICS MARKET FOR AEROSPACE, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 HYDRAULICS MARKET FOR AEROSPACE, BY REGION, 2022–2027 (USD MILLION)

10.4 MATERIAL HANDLING

10.4.1 MATERIAL HANDLING SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 42 HYDRAULICS MARKET FOR MATERIAL HANDLING, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 HYDRAULICS MARKET FOR MATERIAL HANDLING, BY REGION, 2022–2027 (USD MILLION)

10.5 AGRICULTURE

10.5.1 GROWING USE OF HIGH-TECH AGRICULTURAL MACHINERY AND EQUIPMENT TO FUEL DEMAND FOR HYDRAULICS

TABLE 44 HYDRAULICS MARKET FOR AGRICULTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 HYDRAULICS MARKET FOR AGRICULTURE, BY REGION, 2022–2027 (USD MILLION)

10.6 MINING

10.6.1 BENEFITS OF HYDRAULICS TO PROPEL ADOPTION IN MINING INDUSTRY

TABLE 46 HYDRAULICS MARKET FOR MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 HYDRAULICS MARKET FOR MINING, BY REGION, 2022–2027 (USD MILLION)

10.7 AUTOMOTIVE

10.7.1 INCREASING APPLICATION OF HYDRAULICS IN AUTOMOTIVE INDUSTRY TO CREATE LUCRATIVE GROWTH OPPORTUNITIES

TABLE 48 HYDRAULICS MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 HYDRAULICS MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10.8 MARINE

10.8.1 ASIA PACIFIC EXPECTED TO BE FASTEST-GROWING HYDRAULICS MARKET FOR MARINE DURING FORECAST PERIOD

TABLE 50 HYDRAULICS MARKET FOR MARINE, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 HYDRAULICS MARKET FOR MARINE, BY REGION, 2022–2027 (USD MILLION)

10.9 METAL & MACHINERY MANUFACTURING

10.9.1 FOCUS ON PREDICTIVE MAINTENANCE IN MANUFACTURING INDUSTRY TO PROPEL DEMAND FOR SMART HYDRAULICS

TABLE 52 HYDRAULICS MARKET FOR METAL & MACHINERY MANUFACTURING, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 HYDRAULICS MARKET FOR METAL & MACHINERY MANUFACTURING, BY REGION, 2022–2027 (USD MILLION)

10.10 OIL & GAS

10.10.1 RUGGED HYDRAULIC CYLINDERS AND OTHER COMPONENTS INCREASE PRODUCTIVITY OF OIL & GAS OPERATIONS

TABLE 54 HYDRAULICS MARKET FOR OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 HYDRAULICS MARKET FOR OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

10.11 OTHERS

TABLE 56 HYDRAULICS MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 HYDRAULICS MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

11 REGIONAL ANALYSIS (Page No. - 115)

11.1 INTRODUCTION

FIGURE 36 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL HYDRAULICS MARKET DURING FORECAST PERIOD

TABLE 58 HYDRAULICS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 HYDRAULICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: HYDRAULICS MARKET SNAPSHOT

11.2.1 US

11.2.1.1 US to hold largest size of North American market during forecast period

11.2.2 CANADA

11.2.2.1 Growth of Canadian market to be driven by expanding mining industry

11.2.3 MEXICO

11.2.3.1 Mexican market growth fueled by growing oil & gas industry

TABLE 60 HYDRAULICS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 61 HYDRAULICS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 62 HYDRAULICS MARKET IN NORTH AMERICA, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 63 HYDRAULICS MARKET IN NORTH AMERICA, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 64 HYDRAULICS MARKET IN NORTH AMERICA, BY END USER, 2018–2021 (USD MILLION)

TABLE 65 HYDRAULICS MARKET IN NORTH AMERICA, BY END USER, 2022–2027 (USD MILLION)

TABLE 66 HYDRAULICS MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 HYDRAULICS MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 38 EUROPE: HYDRAULICS MARKET SNAPSHOT

11.3.1 GERMANY

11.3.1.1 Significant presence of leading manufacturers of hydraulic equipment in Germany to drive market growth

11.3.2 FRANCE

11.3.2.1 Towering demand for material handling equipment to drive market growth in France

11.3.3 UK

11.3.3.1 Expanding marine industry to boost demand for hydraulics in UK

11.3.4 REST OF EUROPE

TABLE 68 HYDRAULICS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 HYDRAULICS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 HYDRAULICS MARKET IN EUROPE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 71 HYDRAULICS MARKET IN EUROPE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 72 HYDRAULICS MARKET IN EUROPE, BY END USER, 2018–2021 (USD MILLION)

TABLE 73 HYDRAULICS MARKET IN EUROPE, BY END USER, 2022–2027 (USD MILLION)

TABLE 74 HYDRAULICS MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 HYDRAULICS MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: HYDRAULICS MARKET SNAPSHOT

11.4.1 JAPAN

11.4.1.1 Presence of large number of hydraulic equipment suppliers to fuel market growth

11.4.2 CHINA

11.4.2.1 Industrialization and urbanization in China to foster hydraulics market growth

11.4.3 INDIA

11.4.3.1 Heightened demand for hydraulics in construction industry to boost market growth

11.4.4 SOUTH KOREA

11.4.4.1 Expansion of shipbuilding industry in South Korea to generate demand for hydraulic components

11.4.5 REST OF ASIA PACIFIC

TABLE 76 HYDRAULICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 HYDRAULICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 HYDRAULICS MARKET IN ASIA PACIFIC, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 79 HYDRAULICS MARKET IN ASIA PACIFIC, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 80 HYDRAULICS MARKET IN ASIA PACIFIC, BY END USER, 2018–2021 (USD MILLION)

TABLE 81 HYDRAULICS MARKET IN ASIA PACIFIC, BY END USER, 2022–2027 (USD MILLION)

TABLE 82 HYDRAULICS MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 HYDRAULICS MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

11.5.1 SOUTH AMERICA

11.5.1.1 Continued growth of construction industry and favorable political scenario to drive market growth in South America

11.5.2 MIDDLE EAST

11.5.2.1 Rising investments in oil & gas industry to underpin market growth in Middle East

11.5.3 AFRICA

11.5.3.1 Surging requirement for mining equipment to create demand for hydraulics in Africa

TABLE 84 HYDRAULICS MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 HYDRAULICS MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 HYDRAULICS MARKET IN REST OF THE WORLD, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 87 HYDRAULICS MARKET IN REST OF THE WORLD, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 HYDRAULICS MARKET IN REST OF THE WORLD, BY END USER, 2018–2021 (USD MILLION)

TABLE 89 HYDRAULICS MARKET IN REST OF THE WORLD, BY END USER, 2022–2027 (USD MILLION)

TABLE 90 HYDRAULICS MARKET IN REST OF THE WORLD, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 HYDRAULICS MARKET IN REST OF THE WORLD, BY TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 140)

12.1 INTRODUCTION

12.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 40 TOP PLAYERS IN HYDRAULICS MARKET, 2017–2021

12.3 MARKET SHARE ANALYSIS

TABLE 92 HYDRAULICS MARKET: MARKET SHARE OF KEY COMPANIES

12.4 COMPANY EVALUATION QUADRANT, 2021

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 41 HYDRAULICS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

12.5 SMALL- AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

12.5.1 PROGRESSIVE COMPANY

12.5.2 RESPONSIVE COMPANY

12.5.3 DYNAMIC COMPANY

12.5.4 STARTING BLOCK

FIGURE 42 HYDRAULICS MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

12.5.5 HYDRAULICS MARKET: COMPANY FOOTPRINT

TABLE 93 END-USER FOOTPRINT

TABLE 94 REGIONAL FOOTPRINT

TABLE 95 COMPANY FOOTPRINT

12.6 COMPETITIVE SCENARIO

12.6.1 PRODUCT LAUNCHES

TABLE 96 HYDRAULICS MARKET: PRODUCT LAUNCHES, FEBRUARY 2020–AUGUST 2021

12.6.2 DEALS

TABLE 97 HYDRAULICS MARKET: DEALS, JANUARY 2020–NOVEMBER 2021

12.6.3 OTHERS

TABLE 98 HYDRAULICS MARKET: OTHERS, FEBRUARY 2020–MARCH 2021

13 COMPANY PROFILES (Page No. - 151)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 ENERPAC TOOL GROUP

TABLE 99 ENERPAC TOOL GROUP: BUSINESS OVERVIEW

FIGURE 43 ENERPAC TOOL GROUP: COMPANY SNAPSHOT

TABLE 100 ENERPAC TOOL GROUP: PRODUCT OFFERINGS

TABLE 101 ENERPAC TOOL GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

13.2.2 BOSCH REXROTH AG

TABLE 102 BOSCH REXROTH AG: BUSINESS OVERVIEW

FIGURE 44 BOSCH REXROTH AG: COMPANY SNAPSHOT

TABLE 103 BOSCH REXROTH AG: PRODUCT OFFERINGS

TABLE 104 BOSCH REXROTH AG: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 105 BOSCH REXROTH AG: DEALS

TABLE 106 BOSCH REXROTH AG: OTHERS

13.2.3 DANFOSS

TABLE 107 DANFOSS: BUSINESS OVERVIEW

FIGURE 45 DANFOSS: COMPANY SNAPSHOT

TABLE 108 DANFOSS: PRODUCT OFFERINGS

TABLE 109 DANFOSS: DEALS

13.2.4 HYDAC

TABLE 110 HYDAC: BUSINESS OVERVIEW

TABLE 111 HYDAC: PRODUCT OFFERINGS

13.2.5 KAWASAKI HEAVY INDUSTRIES

TABLE 112 KAWASAKI HEAVY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 46 KAWASAKI HEAVY INDUSTRIES: COMPANY SNAPSHOT

TABLE 113 KAWASAKI HEAVY INDUSTRIES: PRODUCT OFFERINGS

13.2.6 KYB CORPORATION

TABLE 114 KYB CORPORATION: BUSINESS OVERVIEW

FIGURE 47 KYB CORPORATION: COMPANY SNAPSHOT

TABLE 115 KYB CORPORATION: PRODUCT OFFERINGS

13.2.7 SMC CORPORATION

TABLE 116 SMC CORPORATION: BUSINESS OVERVIEW

FIGURE 48 SMC CORPORATION: COMPANY SNAPSHOT

TABLE 117 SMC CORPORATION: PRODUCT OFFERINGS

TABLE 118 SMC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

13.2.8 PARKER-HANNIFIN CORPORATION

TABLE 119 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 49 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT

TABLE 120 PARKER-HANNIFIN CORPORATION: PRODUCT OFFERINGS

TABLE 121 PARKER-HANNIFIN CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 122 PARKER-HANNIFIN CORPORATION: OTHERS

13.2.9 WIPRO ENTERPRISES

TABLE 123 WIPRO ENTERPRISES: BUSINESS OVERVIEW

FIGURE 50 WIPRO ENTERPRISES: COMPANY SNAPSHOT

TABLE 124 WIPRO ENTERPRISES: PRODUCT OFFERINGS

13.2.10 CATERPILLAR

TABLE 125 CATERPILLAR: BUSINESS OVERVIEW

FIGURE 51 CATERPILLAR: COMPANY SNAPSHOT

TABLE 126 CATERPILLAR: PRODUCT OFFERINGS

TABLE 127 CATERPILLAR: DEALS

13.3 OTHER KEY PLAYERS

13.3.1 ADVANCED HYDRAULICS, LLC

13.3.2 AGGRESSIVE HYDRAULICS, INC.

13.3.3 BAILEY INTERNATIONAL, LLC

13.3.4 HOLMATRO

13.3.5 PRINCE MANUFACTURING

13.3.6 KAPPA ENGINEERING

13.3.7 LEHIGH FLUID POWER, INC.

13.3.8 LIGON HYDRAULIC CYLINDER GROUP

13.3.9 MARREL

13.3.10 PACOMA GMBH

13.3.11 STANDEX INTERNATIONAL

13.3.12 TEXAS HYDRAULICS

13.3.13 VALARM

13.3.14 WEBER-HYDRAULIK

13.3.15 YUASA CO., LTD.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 187)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 INDUSTRIAL VALVES MARKET, BY TYPE

TABLE 128 INDUSTRIAL VALVES MARKET, BY TYPE, 2017–2020 (USD BILLION)

TABLE 129 INDUSTRIAL VALVES MARKET, BY TYPE, 2021–2026 (USD BILLION)

14.4 BALL VALVES

14.4.1 BALL VALVES WOULD CONTINUE ACCOUNTING FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 130 BALL VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 131 BALL VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.4.1.1 Trunnion-mounted ball valves

14.4.1.2 Floating ball valves

14.4.1.3 Rising stem ball valves

14.5 BUTTERFLY VALVES

14.5.1 BUTTERFLY VALVES ACCOUNT FOR MAJOR MARKET SHARE OWING TO THEIR RELIABLE FIELD OPERATIONS, TIGHT SHUT-OFF, AND PRECISE CONTROL

TABLE 132 BUTTERFLY VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 133 BUTTERFLY VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.5.1.1 Zero-offset butterfly valves

14.5.1.2 Double-offset butterfly valves

14.5.1.3 Triple-offset butterfly valves

14.6 CHECK VALVES

14.6.1 CHECK VALVES ARE ADOPTED FOR APPLICATIONS REQUIRING UNIDIRECTIONAL FLOW CONTROL

TABLE 134 CHECK VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 135 CHECK VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.7 DIAPHRAGM VALVES

14.7.1 DIAPHRAGM VALVES ARE ADOPTED IN PHARMACEUTICALS AND CHEMICALS INDUSTRIES TO AVOID CONTAMINATION

TABLE 136 DIAPHRAGM VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 137 DIAPHRAGM VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.8 GATE VALVES

14.8.1 GATE VALVES ARE WIDELY ADOPTED FOR ON/OFF APPLICATIONS

TABLE 138 GATE VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 139 GATE VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.8.1.1 Standard plate gate valves

14.8.1.2 Wedge-type gate valves

14.8.1.3 Knife gate valves

14.9 GLOBE VALVES

14.9.1 GLOBE VALVES TO HOLD SECOND-LARGEST MARKET SIZE BY 2026

TABLE 140 GLOBE VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 141 GLOBE VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.10 PLUG VALVES

14.10.1 MARKET FOR PLUG VALVES TO WITNESS SUBSTANTIAL GROWTH IN NEXT FEW YEARS

TABLE 142 PLUG VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 143 PLUG VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

14.11 SAFETY VALVES

14.11.1 SAFETY VALVES ARE ADOPTED IN OIL & GAS, ENERGY & POWER, AND CHEMICALS INDUSTRIES

TABLE 144 SAFETY VALVES MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 145 SAFETY VALVES MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 203)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

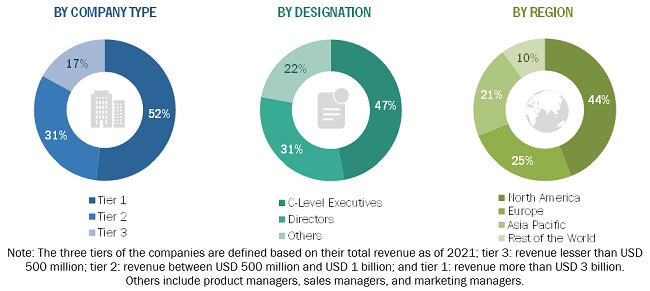

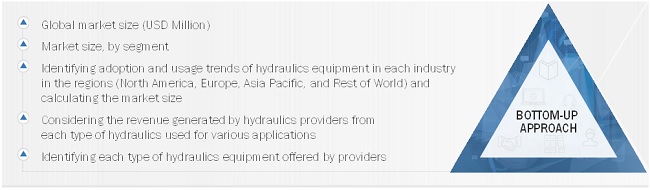

The study involved four major activities in estimating the current size of the hydraulics market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the hydraulics ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall hydraulics market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the hydraulics market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the hydraulics market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global hydraulics market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides, including the impact of COVID-19. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the hydraulics market size, in terms of value, based on type, component, end user, and region

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the hydraulics ecosystem

- To provide a detailed analysis of the impact of the COVID-19 crisis on the hydraulics market, its segments, and market players

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydraulics Market