Hydrogen Energy Storage Market by State (Gas, Liquid, Solid), Technology (Compression, Liquefaction, Material Based), Application (Stationary Power, Transportation), End User (Electric Utilities, Industrial, Commercial), Region - Global Forecast to 2027

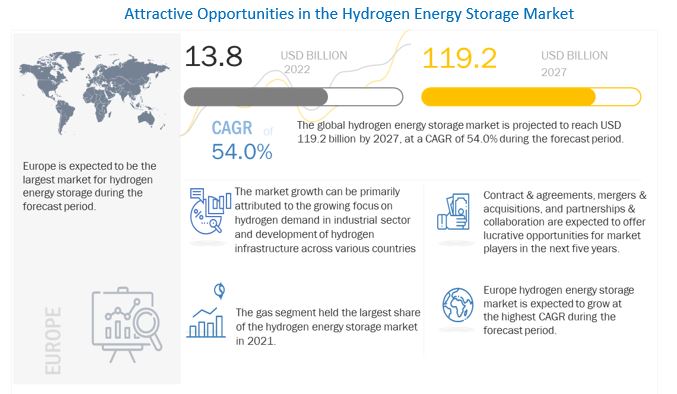

[209 Pages Report] The global hydrogen energy storage market in terms of revenue was estimated to be worth $13.8 billion in 2022 and is poised to reach $119.2 billion by 2027, growing at a CAGR of 54.0% from 2022 to 2027. The factors driving the growth for hydrogen energy storage market is increasing demand of hydrogen in industrial sector and rising demand of stationary and mobile power applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrogen Energy Storage Market Dynamics

Driver: Increased hydrogen demand in the industrial sector

Hydrogen is used in various industrial applications including glass, fertilizer, metal refining, and chemical. All these industries are in an immediate need of reducing their carbon footprints driven by environmental legislation and customer preferences. Traditional fossil-fuel-fired melting systems have reached their peak capability, thus meeting stringent CO2, NOx, and SOx emission regulations is a challenge. For instance, within glass industry, even with the deployment of complex and expensive add-on technologies, meeting targets is becoming increasingly challenging. Hence, the usage of alternative fuels such as hydrogen heating appear to be the most feasible and practical solution. This might be accomplished by combining electrical furnace boosting with a hybrid melting system or going all electric. Various hydrogen energy storage system providers are aiming for the transition of glass manufacturing towards ‘zero emission processes, with many alternatives in consideration. Different countries are focusing on reducing their carbon footprints in order to have a clean energy generation. For instance, the Federal Association of the German Glass Industry (BV Glas) is investigating how green hydrogen can be used as fuel in glass manufacturing through its Hyglass project in Essen. This project is in collaboration with the Gas and Heating Institute (GWI) and is laying the foundations for using hydrogen in industrial plants. Glass is an important raw material, so by replacing natural gas with hydrogen in the melting process, will result into a reduction of CO2 emissions of around 3.3 million tonnes per year could be achieved across Germany.

Hydrogen energy storage system plays a very important role in refining sector. Hydrogen is mostly used in oil refining and ammonia synthesis. While some hydrogen is created as a by-product of the refining process in refineries, this by-product hydrogen is usually insufficient to supply entire refinery hydrogen needs. As a result, on-site hydrogen production utilizing natural gas or naphtha reforming is frequently required. Natural gas reforming units are often constructed on-site to supply the refinery's overall hydrogen needs over its lifetime.

Thus, increasing demand for hydrogen energy storage system in various end-use industries is likely to create demand for hydrogen energy storage market within these industries.

Restraint: High capital cost for hydrogen energy storage

Hydrogen can be stored in 3 ways, that is, in high-pressure tanks as compressed gas, in dewars as liquid at –253°C, and in chemical form by either reacting or absorbing with chemicals, or metal compounds. Electricity can be stored in the form of hydrogen by using the electrolysis process. The stored hydrogen can then be used again as electricity, but the round-trip productivity, as of now, is comparatively lower than other storage technologies. Having said that, the interest in hydrogen energy storage is increasing rapidly owing to its higher storage capacity compared to batteries.

Hydrogen energy storage at present is more expensive than fossil fuel. Liquid hydrogen as an energy transporter has a higher density than gaseous hydrogen and involves liquefaction, which requires a complex mechanical plant with added cost. Hydrogen storage also provides an alternative to physical storage, wherein hydrogen is stored in solids on surfaces. Most of these hydrogen storage systems are either in the initial or developmental phase. The cost and time for charging and discharging hydrogen in these systems are high along with the process costs. Hydrogen acts as a promising fuel for the future unless the storage costs are diminished, in which case it would act as a restraint.

Opportunities: Growing commercialization of power-to-gas technologies

The commercialization of power-to-gas technologies is the next big thing as it adds flexibility to the energy systems, and thereby allows efficient integration of volatile renewables in the energy markets. In the commercial sector, hydrogen is used for fuel cell-based transport and space heating purposes. According to the International Energy Agency (IEA) in 2030, up to 4 Mt of potential hydrogen, which is expected to be used for heating purposes, would come from renewable energy resources and, in turn, help reduce carbon dioxide emissions. Hydrogen holds a large amount of energy, which makes it rather efficient for space heating purposes. The following table shows the renewable capacity addition by various resources from 2019 to 2021. Power-to-gas technology also offers a wide range of opportunities for green hydrogen for fuel cell vehicles and space heating purposes. In the long run, power-to-gas technology may play a crucial role in providing large scale and long-term storage of hydrogen to balance seasonal variations in the commercial sector. For instance, in April 2019, Nikola Motor awarded a contract to Nel Hydrogen for 448 electrolyzers and associated fueling equipment in the US. This was done so that Nikola could roll out a fueling network of 30 hydrogen fueling stations in the US, to support commercial and passenger vehicles operating on hydrogen fuel cells.

Challenges: Increasing investments in battery storage technologies

Because of the technological advancements and the rising demand for electric vehicles, battery storage prices are going down, as battery storage is cheaper than hydrogen energy storage. Major players in Asia Pacific, Europe, and North America are focusing on increasing investments in manufacturing lithium-ion batteries to cater to the need of electric vehicles and other power applications. Moreover, according to the Energy Information Administration (EIA) forecast in 2019, the solar, wind, and other nonhydroelectric renewables would be the fastest growing areas of the energy portfolio for the upcoming 2 years. This is expected to trigger further the interest in energy storage technologies, particularly lithium-ion batteries, which is evenly poised to be more than just a player in the grid.

The drop in the cost of electricity from the batteries compared with the likes of lithium-ion has got them attention from the plants, particularly natural gas plants, which require a high electricity supply. Consequently, batteries are being used to make brief and quick adjustments to uphold the power levels in various regions. Lithium-ion batteries are likely to be a foremost technology in the upcoming years, and continuous improvement in batteries gives them the advantage of storing energy for an additional 4–8 hours. Thus, increasing uses of batteries could be a major challenge for the hydrogen energy storage systems in the near future.

Market Map:

To know about the assumptions considered for the study, download the pdf brochure

The gas is expected to be the largest segment of the hydrogen energy storage market, by state, during the forecast period

The hydrogen energy storage market, by state, is segmented into Gas, Liquid and Solid. Gas segment holds the largest share in the market, followed by Liquid. Hydrogen as a gas is colorless, highly flammable, and lightest of all other elements, because of which there are multiple cost-effective methods to store hydrogen as a gas via compression this is expected to drive state segment of the market during the forecast period.

The compression is expected to be the largest contributor to the market, by technologies, during the forecast period

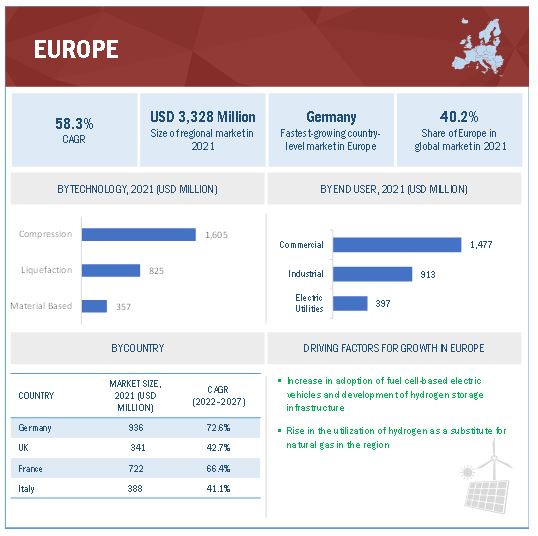

The hydrogen energy storage market, by technologies, is segmented into compression, liquification and material based. The compression segment accounted for a 58.3% share of the market in 2021. Easy and cost-efficient hydrogen storage via compression is likely to generate its demand in the hydrogen energy storage during the forecast period.

The transportation segment is expected to be the fastest-growing market, by application, during the forecast period

The hydrogen energy storage market, by application, is segmented into stationary power and transportation. The transportation segment accounted to be the fastest growing share at CAGR of 63.7% of the hydrogen energy storagemarket in 2021. Growing focus to increase the decarbonizing the transportation sector is driving the application segment, hence, increase the demand of hydrogen energy storage in the coming years.

The industrial segment is expected to be the largest contributor to the market, by end-user, during the forecast period

The hydrogen energy storage market, by end-user, is segmented into electric utilities, industrial and commercial. The industrial segment accounted for a 45.1% share of the market in 2021. Increasing applications of hydrogen energy storage in the chemical industry & fertilizers are likely to foster its demand in the hydrogen energy storage during the forecast period.

Europe is expected to dominate the global hydrogen energy storage market

The Europe region is estimated to be the largest market for the hydrogen energy storage market, followed by Asia Pacific. The European region is projected to be the fastest-growing market during the forecast period. The growth of the Europe market is expected to be driven by increasing number of fuel cell projects and following government initiatives for its implementation in residential and commercial sectors.

Hydrogen Energy Storage Market Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 13.8 billion |

|

Estimated Value by 2027 |

USD 119.2 billion |

|

Growth Rate |

Poised to grow at a CAGR of 54.0% |

|

Largest Share Segments |

|

|

Market Report Segmentation |

State, Technologies, Application, End-User, Region |

|

Growth Drivers |

|

| Growth Opportunities |

|

|

Geographies covered |

North America, South America, Europe, Asia Pacific, Middle East & Africa |

|

Companies covered |

Siemens Energy (Germany), Linde plc (Ireland), ENGIE (France), Air Liquide (France), Air Products Inc. (Pennsylvania), Nel ASA (Norway), Chart Industries (Georgia), GENH2 (Florida), Hexagon Purus (Norway), FuelCell Energy Inc. (US), ITM Power (UK), McPhy Energy S.A. (France), Hydrogenious LOHC Technologies (Germany), Hygear (Gelderland), Cockerill Jingli Hydrogen (China), Pragma Industries (France), Plug Power Inc. (US), INOX India Pvt Ltd (India), HPS Home Power Solutions GmbH (Germany), HYDROGEN IN MOTION (British Columbia) |

This research report categorizes the hydrogen energy storage market by state, technologies, application, end-user, region.

On the basis of by state:

- Gas

- Liquid

- Solid

On the basis of by technologies:

- Compression

- Liquification

- Material based

On the basis of by application:

- Stationary power

- Transportation

On the basis of by end use:

- Industrial

- Commercial

- Electric utilities

On the basis of region:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In January 2022, Linde plc signed an agreement with Yara to construct and deliver a 24 MW green hydrogen plant.

- In December 2021, Chart Industries collaborated with Howden to deliver advance hydrogen solution and incorporated gas compression system of Howden into offerings of chart hydrogen.

- In February 2021, Siemen Energy partnered with Air Liquide to provide an expertise in PEM (Proton Exchange Membrane) electrolysis technology and develop a large scale electrolyzer for hydrogen production.

Frequently Asked Questions (FAQ):

What is the Growth of Hydrogen Energy Storage Market?

Hydrogen Energy Storage Market Size is projected to grow to $119.2 Billion by 2027 at a CAGR of 54.0%.

What is the major drivers?

The factors driving the growth for market are the growing focus on Increasing demand of hydrogen in industrial sector and rising demand of stationary and mobile power applications.

Which is the fastest-growing region during the forecasted period?

Europe region is expected to grow at the highest CAGR during the forecast period, driven mainly by increasing number of fuel cell projects and following government initiatives for its implementation in residential and commercial sectors.

Which is the fastest-growing segment, by state during the forecasted period?

The gas segment is estimated to have the largest market share and is expected to grow at the highest rate during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 HYDROGEN ENERGY STORAGE MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4.1 REGIONAL SCOPE

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 DEMAND-SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR HYDROGEN ENERGY STORAGE

2.3.1.1 Assumptions for demand side

2.3.1.2 Calculation for demand side

2.3.2 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF MARKET

FIGURE 7 MARKET: SUPPLY-SIDE ANALYSIS

2.3.2.1 Assumptions and calculation

2.3.3 FORECAST

FIGURE 8 COMPANY REVENUE ANALYSIS, 2021

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 2 MARKET SNAPSHOT

FIGURE 9 EUROPE HELD LARGEST SHARE OF MARKET IN 2021

FIGURE 10 COMPRESSION SEGMENT PROJECTED TO LEAD MARKET, BY TECHNOLOGY, IN 2027

FIGURE 11 STATIONARY POWER SEGMENT PROJECTED TO HOLD LARGEST SHARE OF MARKET, BY APPLICATION, IN 2027

FIGURE 12 INDUSTRIAL SEGMENT EXPECTED TO HOLD LARGEST SHARE OF MARKET, BY END USER, IN 2027

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 13 CONTRIBUTION OF HYDROGEN IN REDUCING CARBON FOOTPRINT TO BOOST MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY REGION

FIGURE 14 EUROPE MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 EUROPE MARKET, BY END USER AND COUNTRY

FIGURE 15 INDUSTRIAL END USER AND GERMANY HELD LARGEST SHARES OF MARKET IN EUROPE IN 2021

4.4 MARKET, BY STATE

FIGURE 16 GAS TO ACCOUNT FOR LARGEST MARKET SHARE, BY STATE, IN 2027

4.5 MARKET, BY APPLICATION

FIGURE 17 STATIONARY POWER SEGMENT TO HOLD LARGER MARKET SHARE, BY APPLICATION, IN 2027

4.6 MARKET, BY END USER

FIGURE 18 INDUSTRIAL SEGMENT TO DOMINATE MARKET, BY END USER, IN 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: MARKET DRIVERS

5.2.1 DRIVERS

5.2.1.1 Increased demand for hydrogen in industrial sector

FIGURE 20 ELECTRICITY CONSUMPTION (TWH), 2017–2020

5.2.1.2 Rising demand for hydrogen in stationary and mobile power applications

TABLE 3 FOSSIL FUEL EMISSION LEVELS (POUNDS PER BILLION BTU OF ENERGY), 2021

5.2.1.3 Development of hydrogen infrastructure across various countries

5.2.2 RESTRAINTS

5.2.2.1 High capital costs associated with hydrogen energy storage

5.2.3 OPPORTUNITIES

5.2.3.1 Growing commercialization of power-to-gas technologies

FIGURE 21 RENEWABLE NET CAPACITY ADDITION, BY RESOURCE (GW), 2019–2021

5.2.3.2 Increasing demand for hydrogen as vehicle fuel

FIGURE 22 STOCK OF FUEL CELL VEHICLES IN 2020

5.2.3.3 Rising government initiatives to support development of hydrogen economy

TABLE 4 POLICIES BY MAJOR ECONOMIES TO STIMULATE HYDROGEN DEMAND

5.2.4 CHALLENGES

5.2.4.1 Increasing investments in battery storage technologies

FIGURE 23 DOMINANCE OF LITHIUM-ION IN ENERGY STORAGE TECHNOLOGIES

5.2.4.2 Technical challenges related to production of energy from hydrogen

5.3 IMPACT OF COVID-19

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 24 REVENUE SHIFT OF HYDROGEN ENERGY STORAGE PROVIDERS

5.5 PRICING ANALYSIS

5.5.1 INDICATIVE PRICING ANALYSIS

TABLE 5 HYDROGEN ENERGY STORAGE COST FOR HYDROGEN SALT CAVERNS

5.6 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.6.1 RAW MATERIAL SUPPLIERS

5.6.2 HYDROGEN ENERGY STORAGE SYSTEM PROVIDERS

5.6.3 DISTRIBUTORS

5.6.4 END USERS

5.7 TECHNOLOGY ANALYSIS

FIGURE 26 ELEMENTS OF HYDROGEN ENERGY STORAGE SYSTEM

5.8 TRADE ANALYSIS

5.8.1 EXPORT SCENARIO

TABLE 6 EXPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019–2021 (USD)

5.8.2 IMPORT SCENARIO

TABLE 7 IMPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019–2021 (USD)

5.9 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 8 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

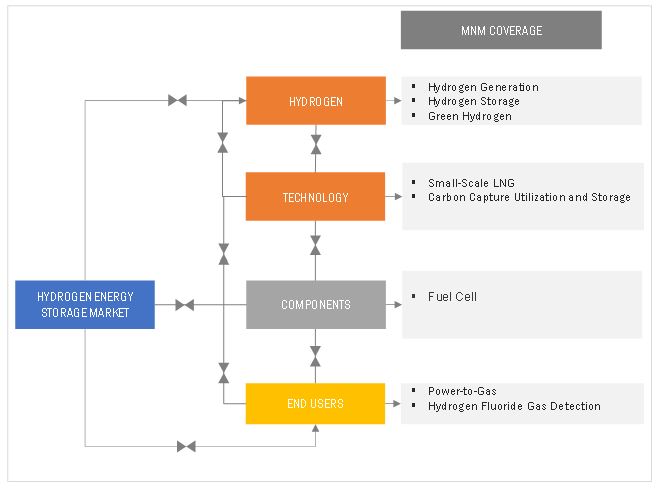

5.10 MARKET MAP

FIGURE 27 HYDROGEN ENERGY STORAGE SYSTEM: MARKET MAP

5.11 INNOVATIONS & PATENT REGISTRATION

TABLE 9 MARKET: INNOVATIONS AND PATENT REGISTRATIONS

5.12 CASE STUDY ANALYSIS

5.12.1 WITH RENEWABLE HYDROGEN TECHNOLOGY, THE ELECTRIC HYDROGEN PARTNERSHIP HOPES TO REPEAT ITS SUCCESS

5.13 TARIFFS AND REGULATORY FRAMEWORK

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 MARKET: REGULATORY FRAMEWORK

TABLE 13 REGULATORY FRAMEWORK: MARKET BY REGION

5.14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 14 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 BARGAINING POWER OF SUPPLIERS

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 THREAT OF SUBSTITUTES

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USER

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USER (%)

5.15.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP 4 END USERS

TABLE 16 KEY BUYING CRITERIA, BY END USER

6 HYDROGEN ENERGY STORAGE MARKET, BY STATE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 31 MARKET, BY STATE, 2021

TABLE 17 MARKET, BY STATE, 2016–2019 (USD MILLION)

TABLE 18 MARKET, BY STATE, 2020–2027 (USD MILLION)

6.2 GAS

6.2.1 STORING HYDROGEN IN GAS FORM IS COST EFFICIENT

6.3 LIQUID

6.3.1 LIQUID HYDROGEN HAS HIGH ENERGY DENSITY AND WIDE INDUSTRIAL APPLICATIONS

6.4 SOLID

6.4.1 LARGE QUANTITIES OF HYDROGEN CAN BE STORED IN SMALLER VOLUMES IN SOLID FORM

7 HYDROGEN ENERGY STORAGE MARKET, BY TECHNOLOGY (Page No. - 80)

7.1 INTRODUCTION

FIGURE 32 MARKET, BY TECHNOLOGY, 2021

TABLE 19 MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 20 MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

7.2 COMPRESSION

7.2.1 COMPRESSION IS EASY AND COST-EFFICIENT HYDROGEN STORAGE TECHNOLOGY

TABLE 21 COMPRESSION: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 COMPRESSION: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 LIQUEFACTION

7.3.1 HIGHER VOLUMETRIC STORAGE AND FEWER EVAPORATION LOSSES TO FOSTER DEMAND FOR LIQUEFACTION

TABLE 23 LIQUEFACTION: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 LIQUEFACTION: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 MATERIAL BASED

7.4.1 HIGHER HYDROGEN STORAGE CAPACITY AND GREATER RELIABILITY OF MATERIAL-BASED HYDROGEN STORAGE TECHNOLOGY ARE LIKELY TO DRIVE ITS DEMAND

7.4.2 METAL HYDRIDES

7.4.2.1 Metal hydrides facilitate on-site storage of hydrogen for extended period of time

7.4.3 CARBON ABSORPTION

7.4.3.1 High interaction force between carbon atom and hydrogen molecule provides effective hydrogen energy storage

TABLE 25 MATERIAL BASED: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 MATERIAL BASED: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 HYDROGEN ENERGY STORAGE MARKET, BY APPLICATION (Page No. - 86)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2021

TABLE 27 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 28 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 STATIONARY POWER

8.2.1 ADOPTION OF HYDROGEN FUEL CELLS FOR BACK-UP POWER GENERATION DURING GRID OUTAGES TO BOOST MARKET GROWTH

TABLE 29 STATIONARY POWER: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 STATIONARY POWER: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 TRANSPORTATION

8.3.1 FOCUS ON DECARBONIZING TRANSPORTATION SECTOR TO DRIVE MARKET GROWTH

TABLE 31 TRANSPORTATION: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 TRANSPORTATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 HYDROGEN ENERGY STORAGE MARKET, BY END USER (Page No. - 91)

9.1 INTRODUCTION

FIGURE 34 MARKET, BY END USER, 2021

TABLE 33 MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 34 MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 ELECTRIC UTILITIES

9.2.1 GROWING RENEWABLE POWER GENERATION TO DRIVE DEMAND FOR HYDROGEN ENERGY STORAGE SYSTEMS

TABLE 35 ELECTRIC UTILITIES: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 ELECTRIC UTILITIES: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 INDUSTRIAL

9.3.1 RISING APPLICATIONS OF HYDROGEN IN CHEMICALS INDUSTRY TO FOSTER DEMAND FOR HYDROGEN STORAGE SYSTEMS

TABLE 37 INDUSTRIAL: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 INDUSTRIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 COMMERCIAL

9.4.1 USE OF HYDROGEN FOR COMMERCIAL SPACE HEATING TO DRIVE COMMERCIAL SEGMENT

TABLE 39 COMMERCIAL: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 COMMERCIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 REGIONAL ANALYSIS (Page No. - 97)

10.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC LIKELY TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

FIGURE 36 MARKET SHARE (VALUE), BY REGION, 2021

TABLE 41 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 EUROPE

FIGURE 37 EUROPE: MARKET SNAPSHOT

10.2.1 BY TECHNOLOGY

TABLE 43 EUROPE: MARKET, BY TECHNOLOGY, 2016–2019 (USD– MILLION)

TABLE 44 EUROPE: HYDROGEN ENERGY STORAGE, BY TECHNOLOGY, 2020–2027 (USD MILLION)

10.2.2 BY APPLICATION

TABLE 45 EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 46 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.3 BY END USER

TABLE 47 EUROPE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4 BY COUNTRY

TABLE 49 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.4.1 Germany

10.2.4.1.1 Increase in adoption of fuel cell-based electric vehicles driving market

TABLE 51 GERMANY: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 52 GERMANY: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 53 GERMANY: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 54 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4.2 UK

10.2.4.2.1 Focus on reducing natural gas imports to favor market growth

TABLE 55 UK: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 56 UK: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 57 UK: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 58 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4.3 France

10.2.4.3.1 Investment in renewable energy generation to underpin market growth

TABLE 59 FRANCE: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 60 FRANCE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 61 FRANCE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 62 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4.4 Italy

10.2.4.4.1 Huge potential of hydrogen export is driving market in Italy

TABLE 63 ITALY: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 64 ITALY: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 65 ITALY: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 66 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4.5 Netherlands

10.2.4.5.1 Focus on decarbonizing energy sector to propel demand for hydrogen energy storage

TABLE 67 NETHERLANDS: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 68 NETHERLANDS: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 69 NETHERLANDS: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 70 NETHERLANDS: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4.6 Rest of Europe

TABLE 71 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 72 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 73 REST OF EUROPE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 74 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

10.3.1 BY TECHNOLOGY

TABLE 75 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

10.3.2 BY APPLICATION

TABLE 77 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.3 BY END USER

TABLE 79 ASIA PACIFIC: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 BY COUNTRY

TABLE 81 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.4.1 China

10.3.4.1.1 China to dominate market during forecast period

TABLE 83 CHINA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 84 CHINA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 85 CHINA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 86 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4.2 India

10.3.4.2.1 Increasing investments in hydrogen economy driving market growth

TABLE 87 INDIA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 88 INDIA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 89 INDIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 90 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4.3 Australia

10.3.4.3.1 Focus on transition to renewable energy to support market

TABLE 91 AUSTRALIA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 92 AUSTRALIA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 93 AUSTRALIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 94 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4.4 Japan

10.3.4.4.1 Increase in use of hydrogen fuel cell vehicles is driving market

TABLE 95 JAPAN: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 96 JAPAN: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 97 JAPAN: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 98 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4.5 South Korea

10.3.4.5.1 Mandates to decarbonize energy sector expected to increase the demand for hydrogen energy storage

TABLE 99 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 100 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 101 SOUTH KOREA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 102 SOUTH KOREA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4.6 Rest of Asia Pacific

TABLE 103 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 104 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 NORTH AMERICA

10.4.1 BY TECHNOLOGY

TABLE 107 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

10.4.2 BY APPLICATION

TABLE 109 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.3 BY END USER

TABLE 111 NORTH AMERICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 BY COUNTRY

TABLE 113 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.4.1 US

10.4.4.1.1 Increasing usage of hydrogen in oil refineries and chemicals industry to augment demand for hydrogen energy storage

TABLE 115 US: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 116 US: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 117 US: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 118 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4.2 Canada

10.4.4.2.1 Ongoing oil sand processing, gas to liquids, and coal gasification projects to support market growth

TABLE 119 CANADA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 120 CANADA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 121 CANADA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 122 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4.3 Mexico

10.4.4.3.1 Production of hydrogen for consumption in ammonia production is expected to drive demand for hydrogen energy storage

TABLE 123 MEXICO: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 124 MEXICO: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 125 MEXICO: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 126 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY TECHNOLOGY

TABLE 127 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

10.5.2 BY APPLICATION

TABLE 129 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.3 BY END USER

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.4 BY COUNTRY

TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.4.1 South Africa

10.5.4.1.1 Focus on reducing greenhouse emissions to support market growth

TABLE 135 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 136 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 137 SOUTH AFRICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 138 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.4.2 Saudi Arabia

10.5.4.2.1 Rising demand for low-sulfur fuel for transportation is expected to boost market growth

TABLE 139 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 140 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 141 SAUDI ARABIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 142 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.4.3 Rest of Middle East & Africa

TABLE 143 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 144 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 145 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 146 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY TECHNOLOGY

TABLE 147 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 148 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

10.6.2 BY APPLICATION

TABLE 149 SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 150 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.3 BY END USER

TABLE 151 SOUTH AMERICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 152 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.4 BY COUNTRY

TABLE 153 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.4.1 Brazil

10.6.4.1.1 Rising demand for hydrogen for producing ammonia is expected to propel market growth

TABLE 155 BRAZIL: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 156 BRAZIL: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 157 BRAZIL: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 158 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.4.2 Argentina

10.6.4.2.1 Rise in oil refining activities is expected to boost market growth

TABLE 159 ARGENTINA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 160 ARGENTINA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 161 ARGENTINA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 162 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.4.3 Rest of South America

TABLE 163 REST OF SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 164 REST OF SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 165 REST OF SOUTH AMERICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 166 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 149)

11.1 OVERVIEW

FIGURE 39 KEY DEVELOPMENTS IN MARKET, 2018 TO 2022

11.2 SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 167 MARKET: DEGREE OF COMPETITION

FIGURE 40 SHARE ANALYSIS OF TOP PLAYERS IN MARKET, 2021

11.3 MARKET EVALUATION FRAMEWORK

TABLE 168 MARKET EVALUATION FRAMEWORK, 2018–2021

11.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 41 SEGMENTAL REVENUE ANALYSIS, 2018–2021

11.5 RECENT DEVELOPMENTS

11.5.1 DEALS

TABLE 169 MARKET: DEALS, 2018–2022

11.5.2 OTHERS

TABLE 170 MARKET: OTHERS, 2018–2022

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 42 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 171 COMPANY STATE FOOTPRINT

TABLE 172 COMPANY END USER FOOTPRINT

TABLE 173 COMPANY REGION FOOTPRINT

11.7 START-UP/SME EVALUATION QUADRANT, 2021

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCK

FIGURE 43 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

11.8 COMPETITIVE BENCHMARKING

TABLE 174 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 175 COMPANY STATE FOOTPRINT: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

TABLE 176 COMPANY END USER FOOTPRINT: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

TABLE 177 COMPANY REGION FOOTPRINT: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

12 COMPANY PROFILES (Page No. - 164)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 SIEMENS ENERGY

TABLE 178 SIEMENS ENERGY: BUSINESS OVERVIEW

FIGURE 44 SIEMENS ENERGY: COMPANY SNAPSHOT

TABLE 179 SIEMENS ENERGY: DEALS

12.1.2 LINDE PLC

TABLE 180 LINDE PLC: BUSINESS OVERVIEW

FIGURE 45 LINDE PLC: COMPANY SNAPSHOT

TABLE 181 LINDE PLC: DEALS

TABLE 182 LINDE PLC: OTHERS

12.1.3 ENGIE

TABLE 183 ENGIE: BUSINESS OVERVIEW

FIGURE 46 ENGIE: COMPANY SNAPSHOT

TABLE 184 ENGIE: DEALS

12.1.4 AIR LIQUIDE

TABLE 185 AIR LIQUIDE: BUSINESS OVERVIEW

FIGURE 47 AIR LIQUIDE: COMPANY SNAPSHOT

TABLE 186 AIR LIQUIDE: DEALS

12.1.5 AIR PRODUCTS INC.

TABLE 187 AIR PRODUCTS INC.: BUSINESS OVERVIEW

FIGURE 48 AIR PRODUCTS INC.: COMPANY SNAPSHOT

TABLE 188 AIR PRODUCTS INC.: DEALS

12.1.6 CHART INDUSTRIES

TABLE 189 CHART INDUSTRIES: BUSINESS OVERVIEW

FIGURE 49 CHART INDUSTRIES: COMPANY SNAPSHOT

TABLE 190 CHART INDUSTRIES: PRODUCTS/SERVICES OFFERED

TABLE 191 CHART INDUSTRIES: DEALS

12.1.7 NEL ASA

TABLE 192 NEL ASA: BUSINESS OVERVIEW

FIGURE 50 NEL ASA: COMPANY SNAPSHOT

TABLE 193 NEL ASA: DEALS

TABLE 194 NEL ASA: OTHERS

12.1.8 HEXAGON PURUS

TABLE 195 HEXAGON PURUS: BUSINESS OVERVIEW

FIGURE 51 HEXAGON PURUS: COMPANY SNAPSHOT

12.1.9 FUELCELL ENERGY INC.

TABLE 196 FUELCELL ENERGY INC.: BUSINESS OVERVIEW

FIGURE 52 FUELCELL ENERGY INC.: COMPANY SNAPSHOT

12.1.10 ITM POWER

TABLE 197 ITM POWER: BUSINESS OVERVIEW

FIGURE 53 ITM POWER: COMPANY SNAPSHOT

12.1.11 HYDROGENIOUS LOHC TECHNOLOGIES

12.1.11.1 Business and financial overview

TABLE 198 HYDROGENIOUS LOHC TECHNOLOGIES: BUSINESS OVERVIEW

12.1.12 GENH2

TABLE 199 GENH2: BUSINESS OVERVIEW

12.1.13 HYGEAR

TABLE 200 HYGEAR: BUSINESS OVERVIEW

12.1.14 HPS HOME POWER SOLUTIONS GMBH

TABLE 201 HPS HOME POWER SOLUTIONS GMBH: BUSINESS OVERVIEW

12.1.15 HYDROGEN IN MOTION

TABLE 202 HYDROGEN IN MOTION: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 PRAGMA INDUSTRIES

12.2.2 INOX INDIA PVT LTD

12.2.3 COCKERILL JINGLI HYDROGEN

12.2.4 PLUG POWER

12.2.5 MCPHY ENERGY S.A.

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 200)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

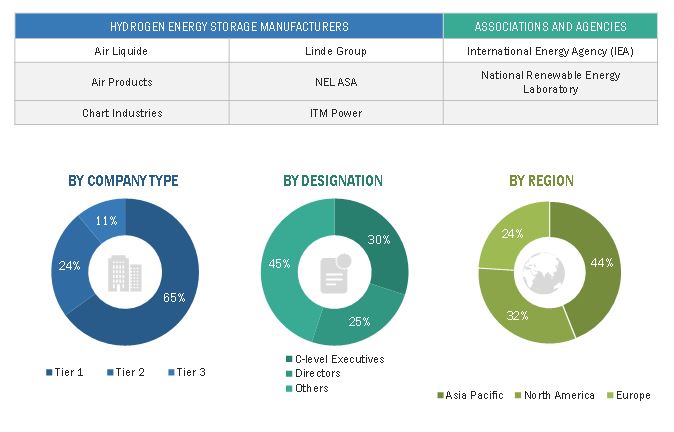

This study involved four major activities in estimating the current size of the hydrogen energy storage market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as water and wastewater management data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and water & environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the hydrogen energy storage market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The hydrogen energy storage market comprises several stakeholders such as companies related to the industry, component manufacturing companies for large-scale natural refrigerant heat pump, government & research organizations, organizations, forums, alliances & associations, hydrogen energy storage providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the residential, commercial, and industrial sector. The supply side is characterized by investments & expansion and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global hydrogen energy storage market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Hydrogen energy storage Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the hydrogen energy storage market.

Objectives of the Study

- To forecast and describe the hydrogen energy storage market size, by state, technologies, application, end use, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micromarkets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the hydrogen energy storage market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrogen Energy Storage Market

Interested in the crucial market acquisition strategies and the subsegments with respect to individual growth trends applied by the companies of the global hydrogen energy storage market for the period of 2022-2030

Hydrogen Energy Storage Market report is primarily a demand-based coverage that states the Historic, Current and Future revenues of SMR at a regional and country level for which we had contacted several primary respondents from supply and demand side of the business to obtain the qualitative and quantitative information. We have forecasted the market size in terms of Value (USD Billion); Volume (Units) till year 2027, which is broken down by State, Technologies, Application, End-User, Region

Our report on Hydrogen Energy Storage was updated last month June 2022, and it covers the market trends and growth factors with respect to Hydrogen Energy Storage Market. It also covered the Market estimations of Hydrogen Energy Storage in terms of Value by State/ Technology/ Application/ End User at regional and country level for the period 2016-2027. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis.