TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: INCLUSIONS AND EXCLUSIONS

1.3.2 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 IMPACT OF RECESSION: INTRODUCTION

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

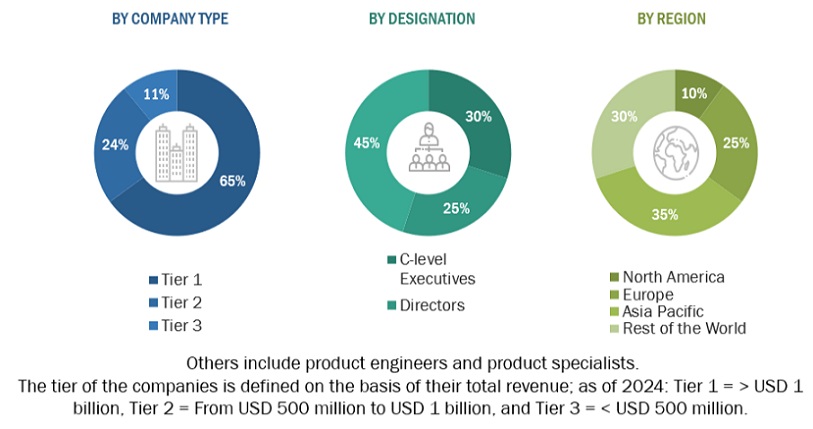

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

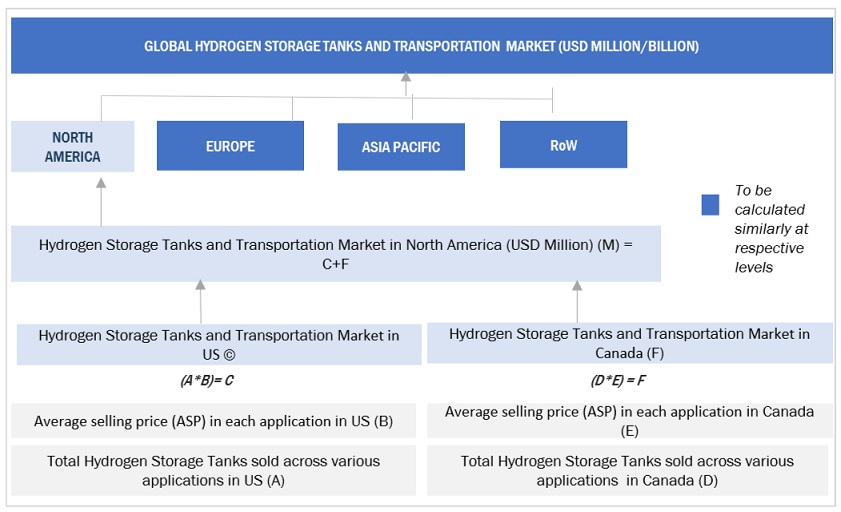

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 6 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: DEMAND-SIDE ANALYSIS

FIGURE 7 METRICS CONSIDERED FOR ANALYZING DEMAND FOR HYDROGEN STORAGE TANKS AND TRANSPORTATION

2.3.3.1 Assumptions for demand-side analysis

TABLE 1 RESEARCH ASSUMPTION FOR NUMBER OF TANKS IN EACH APPLICATION

TABLE 2 RESEARCH ASSUMPTION FOR COST OF TANKS, BY TANK TYPE

2.3.3.2 Calculations for demand-side analysis

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 8 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF HYDROGEN STORAGE TANKS AND TRANSPORTATION PROVIDERS

FIGURE 9 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: SUPPLY-SIDE ANALYSIS

FIGURE 10 INDUSTRY CONCENTRATION, 2021

2.3.5 GROWTH FORECAST ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

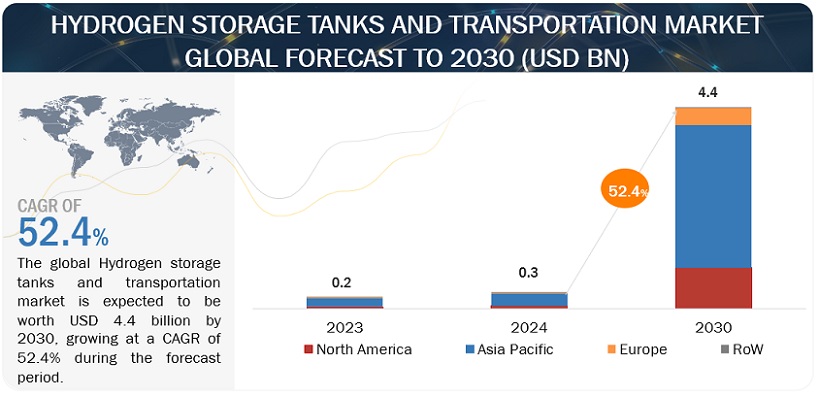

TABLE 3 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: SNAPSHOT

FIGURE 11 ASIA PACIFIC DOMINATED HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN 2021

FIGURE 12 HYDROGEN FUEL STORAGE SYSTEMS TO LEAD HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, DURING FORECAST PERIOD

FIGURE 13 ABOVE 500 BAR SEGMENT TO HOLD LARGEST MARKET SHARE, BY PRESSURE, DURING FORECAST PERIOD

FIGURE 14 TYPE 4 SEGMENT TO HOLD LARGEST MARKET SHARE, BY TANK TYPE, DURING FORECAST PERIOD

FIGURE 15 VEHICLES SEGMENT TO DOMINATE HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET

FIGURE 16 GOVERNMENT INITIATIVES AIMING TO BOOST HYDROGEN ECONOMY TO DRIVE MARKET

4.2 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION

FIGURE 17 NORTH AMERICA TO RECORD FASTEST GROWTH IN HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET DURING FORECAST PERIOD

4.3 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION AND COUNTRY

FIGURE 18 VEHICLES SEGMENT AND CHINA DOMINATED ASIA PACIFIC HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN 2021

4.4 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE

FIGURE 19 HYDROGEN FUEL STORAGE SYSTEMS SEGMENT DOMINATED HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN 2021

4.5 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY PRESSURE

FIGURE 20 ABOVE 500 BAR SEGMENT DOMINATED HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN 2021

4.6 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE

FIGURE 21 TYPE 4 SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN 2030

4.7 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION

FIGURE 22 VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN 2030

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

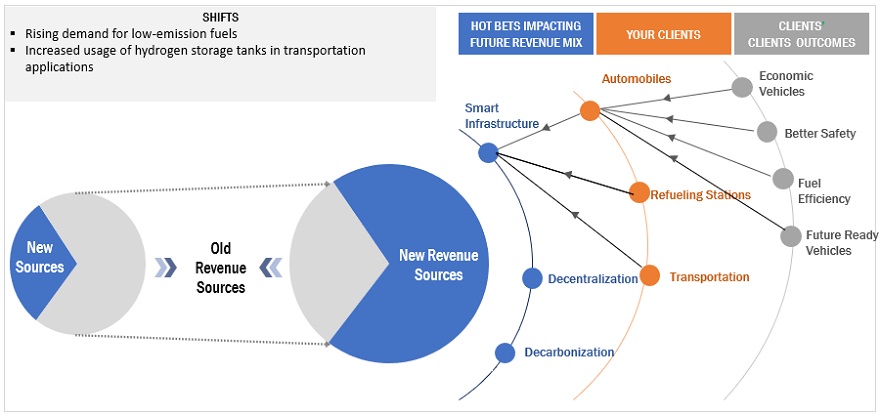

5.2.1.1 Rising demand for low-emission fuels

5.2.1.2 Increasing usage of hydrogen storage tanks in transportation applications

FIGURE 24 FUEL CELL ELECTRIC VEHICLES, BY MODE AND COUNTRY, 2020

5.2.1.3 Development of hydrogen infrastructure across various countries

5.2.2 RESTRAINTS

5.2.2.1 Less efficient compared with other storage technologies in terms of power storage

5.2.2.2 High cost of composite material-based tanks and strict regulatory approvals

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing efforts by governments for installation of hydrogen fueling stations

FIGURE 25 GLOBAL HYDROGEN REFUELING STATIONS, 2020

5.2.3.2 Increasing government initiatives to support development of hydrogen economy

TABLE 4 POLICIES BY MAJOR ECONOMIES TO STIMULATE HYDROGEN DEMAND

5.2.4 CHALLENGES

5.2.4.1 Impact of fluctuating oil prices on hydrogen storage tanks market

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HYDROGEN STORAGE TANKS AND TRANSPORTATION PROVIDERS

FIGURE 26 REVENUE SHIFT FOR HYDROGEN STORAGE TANKS AND TRANSPORTATION PROVIDERS

5.4 VALUE/SUPPLY CHAIN ANALYSIS

FIGURE 27 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: SUPPLY CHAIN ANALYSIS

TABLE 5 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: VALUE CHAIN

5.5 MARKET MAP

FIGURE 28 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET MAP

5.6 TECHNOLOGY ANALYSIS

FIGURE 29 HYDROGEN STORAGE TECHNOLOGY

5.7 PATENT ANALYSIS

5.7.1 LIST OF MAJOR PATENTS

TABLE 6 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2016–AUGUST 2022

5.8 TRADE ANALYSIS

5.8.1 EXPORT SCENARIO

TABLE 7 EXPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019–2021 (USD)

FIGURE 30 EXPORT DATA BY TOP 5 COUNTRIES, 2019–2021 (USD THOUSANDS)

5.8.2 IMPORT SCENARIO

TABLE 8 IMPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019–2021 (USD)

FIGURE 31 IMPORT DATA BY TOP 5 COUNTRIES, 2019–2021 (USD THOUSAND)

5.9 INDICATIVE PRICING ANALYSIS

5.9.1 INDICATIVE PRICING ANALYSIS FOR TYPE 4 H2 STORAGE SYSTEMS

FIGURE 32 COST BREAKDOWN FOR TYPE 4 700 BAR H2 SINGLE TANK STORAGE SYSTEMS

5.9.2 INDICATIVE PRICING ANALYSIS, BY TANK TYPE

5.10 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 9 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 CASE STUDY ANALYSIS

5.11.1 HYDROGEN-POWERED MINE TRUCK FOR ANGLO AMERICAN MINE

5.11.1.1 Problem Statement

5.11.1.2 Solution

5.11.2 WITH RENEWABLE HYDROGEN TECHNOLOGY, ELECTRIC HYDROGEN PARTNERSHIP HOPES TO REPEAT ITS SUCCESS

5.11.2.1 Problem Statement

5.11.2.2 Solution

5.12 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.1 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: REGULATORY FRAMEWORK

TABLE 13 REGULATORY FRAMEWORK: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION

5.12.2 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: REGULATORY STANDARDS

TABLE 14 REGULATORY STANDARDS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET

5.13 PORTER'S FIVE FORCES ANALYSIS

FIGURE 33 PORTER'S FIVE FORCES ANALYSIS FOR HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET

TABLE 15 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: PORTER'S FIVE FORCES ANALYSIS

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP APPLICATION

TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP APPLICATION (%)

5.14.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 17 KEY BUYING CRITERIA FOR TOP 3 APPLICATION

5.15 DIMENSION INSIGHTS BY KEY MANUFACTURERS

TABLE 18 DIMENSION INSIGHTS

6 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MATERIAL TYPE (Page No. - 70)

6.1 INTRODUCTION

6.2 METALS

6.2.1 EASY AVAILABILITY OF METALS AS RAW MATERIAL FOR HYDROGEN STORAGE TANKS

6.3 GLASS FIBERS

6.3.1 LIGHTWEIGHT GLASS FIBER COMPOSITES PREFERRED IN FCEVS

6.4 CARBON FIBERS

6.4.1 CARBON FIBERS USED IN HIGH-VALUE APPLICATIONS

7 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE (Page No. - 73)

7.1 INTRODUCTION

FIGURE 36 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2021 (%)

TABLE 19 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (UNITS)

TABLE 20 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (USD THOUSAND)

7.2 HYDROGEN FUEL STORAGE SYSTEMS

7.2.1 RISING ADOPTION OF HYDROGEN FUEL CELL VEHICLES TO BOOST DEMAND

TABLE 21 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 22 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

TABLE 23 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 24 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

7.3 HYDROGEN DISTRIBUTION SYSTEMS

7.3.1 INCREASING NUMBER OF HYDROGEN REFUELING STATIONS TO DRIVE SEGMENT

TABLE 25 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 26 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

TABLE 27 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 28 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 29 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY CONTAINER STORAGE CAPACITY, 2020–2030 (USD THOUSAND)

8 HYDROGEN STORAGE TANKS AND TRANSPORTATION, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 37 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2021

TABLE 30 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 31 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

8.2 VEHICLES

8.2.1 GLOBAL SHIFT TOWARD CLEAN FUEL TO DRIVE MARKET

TABLE 32 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 33 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 34 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 35 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

8.3 RAILWAY

8.3.1 NEED FOR FAST DECARBONIZATION OF ENTIRE ENERGY SYSTEM TO DRIVE MARKET

TABLE 36 RAILWAY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 37 RAILWAY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 38 RAILWAY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 39 RAILWAY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

8.4 MARINE

8.4.1 LOW VOLUMETRIC ENERGY DENSITY OF HYDROGEN UNDER STANDARD CONDITIONS TO DRIVE SEGMENT GROWTH

TABLE 40 MARINE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 41 MARINE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 42 MARINE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 43 MARINE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

8.5 STATIONARY STORAGE

8.5.1 INCREASING NUMBER OF REFUELING STATIONS TO ENHANCE SEGMENT GROWTH

TABLE 44 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 45 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 46 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: BY REGION, 2020–2030 (UNITS)

TABLE 47 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: BY REGION, 2020–2030 (USD THOUSAND)

8.6 TRAILERS FOR H2 TRANSPORTATION

8.6.1 DEVELOPMENT IN TECHNOLOGY TO DRIVE SEGMENT

TABLE 48 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 49 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 50 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 51 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

9 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE (Page No. - 90)

9.1 INTRODUCTION

FIGURE 38 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2021

TABLE 52 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 53 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

9.2 TYPE 1

9.2.1 LOW COST AND SIMPLE CONSTRUCTION TO FUEL MARKET GROWTH

TABLE 54 TYPE 1: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 55 TYPE 1: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

9.3 TYPE 2

9.3.1 DEMAND FOR HYDROGEN STORAGE IN CHEMICAL INDUSTRY TO BOOST MARKET

TABLE 56 TYPE 2: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 57 TYPE 2: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

9.4 TYPE 3

9.4.1 SUITABILITY FOR HEAVY-DUTY VEHICULAR APPLICATIONS TO FUEL MARKET GROWTH

TABLE 58 TYPE 3: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 59 TYPE 3: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

9.5 TYPE 4

9.5.1 LIGHTWEIGHT AND SUITABILITY TO BE USED IN PASSENGER CARS TO CONTRIBUTE TO MARKET GROWTH

TABLE 60 TYPE 4: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 61 TYPE 4: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

10 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY PRESSURE (Page No. - 97)

10.1 INTRODUCTION

FIGURE 39 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: BY PRESSURE, 2021

TABLE 62 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY PRESSURE, 2020–2030 (USD MILLION)

10.2 BELOW 200 BAR

10.2.1 DEVELOPMENT OF HIGHER STORAGE CAPACITY TRAILERS EXPECTED TO DRIVE SEGMENT

TABLE 63 BELOW 200 BAR: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

10.3 200–500 BAR

10.3.1 RISING DEMAND FOR HYDROGEN FUEL CELL-BASED APPLICATIONS TO DRIVE SEGMENT

TABLE 64 200–500 BAR: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

10.4 ABOVE 500 BAR

10.4.1 INCREASING NUMBER OF HYDROGEN REFUELING STATIONS EXPECTED TO BOOST SEGMENT

TABLE 65 ABOVE 500 BAR: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

11 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION (Page No. - 101)

11.1 INTRODUCTION

FIGURE 40 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2021 (%)

FIGURE 41 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN NORTH AMERICA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

TABLE 66 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (UNITS)

TABLE 67 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY REGION, 2020–2030 (USD THOUSAND)

11.2 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET SNAPSHOT

11.2.1 RECESSION IMPACT: ASIA PACIFIC

11.2.2 BY MODULAR STORAGE

TABLE 68 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (UNITS)

TABLE 69 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (USD THOUSAND)

TABLE 70 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 71 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 72 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 73 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 74 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY CONTAINER STORAGE CAPACITY, 2020–2030 (USD THOUSAND)

11.2.3 BY APPLICATION

TABLE 75 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 76 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 77 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 78 RAILWAY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 79 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 80 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.2.4 BY TANK TYPE

TABLE 81 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 82 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.2.5 BY PRESSURE

TABLE 83 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY PRESSURE, 2020–2030 (USD THOUSAND)

11.2.6 BY COUNTRY

TABLE 84 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY COUNTRY, 2020–2030 (UNITS)

TABLE 85 ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

11.2.6.1 China

11.2.6.1.1 Carbon neutrality targets to drive energy management systems market in China

TABLE 86 CHINA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 87 CHINA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.2.6.2 South Korea

11.2.6.2.1 Growing investments in hydrogen technology and adoption of hydrogen fuel cell vehicles to drive market

TABLE 88 SOUTH KOREA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 89 SOUTH KOREA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.2.6.3 Japan

11.2.6.3.1 National hydrogen strategies to achieve emission reduction targets to boost market

TABLE 90 JAPAN: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 91 JAPAN: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.2.6.4 India

11.2.6.4.1 Plans to produce hydrogen for mobility and investments in fuel cell manufacturing to propel market

TABLE 92 INDIA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 93 INDIA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.2.6.5 Rest of Asia Pacific

TABLE 94 REST OF ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 95 REST OF ASIA PACIFIC: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.3 NORTH AMERICA

FIGURE 43 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET SNAPSHOT

11.3.1 RECESSION IMPACT: NORTH AMERICA

11.3.2 BY MODULAR STORAGE

TABLE 96 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (UNITS)

TABLE 97 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (USD THOUSAND)

TABLE 98 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 99 HYDROGEN FUEL STORAGE SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 100 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 101 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 102 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY CONTAINER STORAGE CAPACITY, 2020–2030 (USD THOUSAND)

11.3.3 BY APPLICATION

TABLE 103 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 104 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 105 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN NORTH AMERICA, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 106 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN NORTH AMERICA, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 107 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN NORTH AMERICA, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.3.4 BY TANK TYPE

TABLE 108 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 109 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.3.5 BY PRESSURE

TABLE 110 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY PRESSURE, 2020–2030 (USD THOUSAND)

11.3.6 BY COUNTRY

TABLE 111 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY COUNTRY, 2020–2030 (UNITS)

TABLE 112 NORTH AMERICA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

11.3.6.1 US

11.3.6.1.1 Rise in hydrogen refueling stations and fuel cell vehicles to propel market growth

TABLE 113 US: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 114 US: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.3.6.2 Canada

11.3.6.2.1 Initiatives to strengthen hydrogen supply chains to drive market growth

TABLE 115 CANADA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 116 CANADA: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

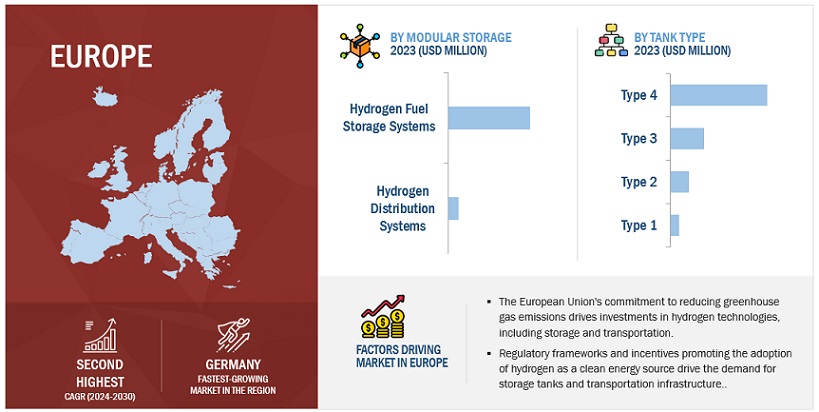

11.4 EUROPE

11.4.1 RECESSION IMPACT: EUROPE

11.4.2 BY MODULAR STORAGE

TABLE 117 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (UNITS)

TABLE 118 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (USD THOUSAND)

TABLE 119 HYDROGEN FUEL STORAGE SYSTEMS MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 120 HYDROGEN FUEL STORAGE SYSTEMS MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 121 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN FUEL STORAGE SYSTEMS MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 122 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN FUEL STORAGE SYSTEMS MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 123 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN FUEL STORAGE SYSTEMS MARKET, BY CONTAINER STORAGE CAPACITY, 2020–2030 (USD THOUSAND)

11.4.3 BY APPLICATION

TABLE 124 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 125 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 126 VEHICLES: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN EUROPE, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 127 RAILWAY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN EUROPE, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 128 MARINE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN EUROPE, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 129 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN EUROPE, BY TANK TYPE, 2020–2030 (USD THOUSAND)

TABLE 130 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN EUROPE, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.4.4 BY TANK TYPE

TABLE 131 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 132 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.4.5 BY PRESSURE

TABLE 133 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.4.6 BY COUNTRY

TABLE 134 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY COUNTRY, 2020–2030 (UNITS)

TABLE 135 EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY COUNTRY, 2020–2030 (USD THOUSAND)

11.4.6.1 Italy

11.4.6.1.1 Government incentives to boost market

TABLE 136 ITALY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 137 ITALY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.4.6.2 UK

11.4.6.2.1 Investments in hydrogen refueling technologies to drive market

TABLE 138 UK: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 139 UK: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.4.6.3 Germany

11.4.6.3.1 Growing adoption of hydrogen fuel cells in automobiles and railways to propel market growth

TABLE 140 GERMANY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 141 GERMANY: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.4.6.4 France

11.4.6.4.1 Planned hydrogen refueling stations across the country to drive market growth

TABLE 142 FRANCE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 143 FRANCE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.4.6.5 Netherlands

11.4.6.5.1 Favorable government strategies promoting use of hydrogen fuel cell vehicles to accelerate market growth

TABLE 144 NETHERLANDS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 145 NETHERLANDS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.4.6.6 Rest of Europe

TABLE 146 REST OF EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 147 REST OF EUROPE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

11.5 REST OF THE WORLD

11.5.1 RECESSION IMPACT: ROW

11.5.2 BY MODULAR STORAGE

TABLE 148 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (UNITS)

TABLE 149 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY MODULAR STORAGE, 2020–2030 (USD THOUSAND)

TABLE 150 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN REST OF THE WORLD, BY APPLICATION, 2020–2030 (UNITS)

TABLE 151 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN REST OF THE WORLD, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 152 HYDROGEN DISTRIBUTION SYSTEMS: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY CONTAINER STORAGE CAPACITY, 2020–2030 (USD THOUSAND)

11.5.3 BY APPLICATION

TABLE 153 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (UNITS)

TABLE 154 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY APPLICATION, 2020–2030 (USD THOUSAND)

TABLE 155 STATIONARY STORAGE: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE IN REST OF THE WORLD, 2020–2030 (USD THOUSAND)

TABLE 156 TRAILERS FOR H2 TRANSPORTATION: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET IN REST OF THE WORLD, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.5.4 BY TANK TYPE

TABLE 157 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (UNITS)

TABLE 158 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY TANK TYPE, 2020–2030 (USD THOUSAND)

11.5.5 BY PRESSURE

TABLE 159 REST OF THE WORLD: HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, BY PRESSURE, 2020–2030 (USD THOUSAND)

11.5.5.1 South America

11.5.5.1.1 Increasing hydrogen production to help market growth

11.5.5.2 Middle East & Africa

11.5.5.2.1 Growing private investments to propel market growth

12 COMPETITIVE LANDSCAPE (Page No. - 146)

12.1 OVERVIEW

FIGURE 44 KEY DEVELOPMENTS IN HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, 2018 TO 2022

FIGURE 45 INDUSTRY CONCENTRATION OF TOP PLAYERS IN HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET, 2021

12.2 MARKET EVALUATION FRAMEWORK

TABLE 160 MARKET EVALUATION FRAMEWORK, 2018–2021

12.3 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 46 SEGMENTAL REVENUE ANALYSIS, 2017–2021

12.4 RECENT DEVELOPMENTS

12.4.1 DEALS

TABLE 161 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: DEALS, 2018–2022

12.4.2 OTHERS

TABLE 162 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: OTHERS, 2018–2022

12.5 COMPANY EVALUATION MATRIX/QUADRANT

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 47 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET (GLOBAL) KEY COMPANY EVALUATION MATRIX, 2021

12.6 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: COMPANY FOOTPRINT

TABLE 163 COMPANY FOOTPRINT, BY TYPE

TABLE 164 COMPANY FOOTPRINT, BY MODULAR STORAGE

TABLE 165 COMPANY FOOTPRINT, BY PRESSURE

TABLE 166 COMPANY FOOTPRINT, BY APPLICATION

TABLE 167 COMPANY FOOTPRINT, BY REGION

12.7 START-UP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 48 HYDROGEN STORAGE TANKS AND TRANSPORTATION MARKET: START-UP/SME EVALUATION QUADRANT, 2021

12.8 COMPETITIVE BENCHMARKING

TABLE 169 COMPANY FOOTPRINT, BY TYPE (START-UPS/SMES)

TABLE 170 COMPANY FOOTPRINT, BY MODULAR STORAGE (START-UPS/SMES)

TABLE 171 COMPANY FOOTPRINT, BY PRESSURE (START-UPS/SMES)

TABLE 172 COMPANY FOOTPRINT, BY APPLICATION (START-UPS/SMES)

TABLE 173 COMPANY FOOTPRINT, BY REGION (START-UPS/SMES)

13 COMPANY PROFILES (Page No. - 160)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 HEXAGON PURUS

TABLE 174 HEXAGON PURUS: BUSINESS OVERVIEW

FIGURE 49 HEXAGON PURUS: COMPANY SNAPSHOT

TABLE 175 HEXAGON PURUS: PRODUCT/SERVICE/SOLUTION OFFERED

TABLE 176 HEXAGON PURUS: DEALS

TABLE 177 HEXAGON PURUS: OTHERS

13.2 NPROXX

TABLE 178 NPROXX: BUSINESS OVERVIEW

TABLE 179 NPROXX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 180 NPROXX: PRODUCT LAUNCHES

TABLE 181 NPROXX: DEALS

13.3 WORTHINGTON INDUSTRIES

TABLE 182 WORTHINGTON INDUSTRIES: BUSINESS OVERVIEW

FIGURE 50 WORTHINGTON INDUSTRIES: COMPANY SNAPSHOT

TABLE 183 WORTHINGTON INDUSTRIES: PRODUCT/SERVICE/SOLUTION OFFERED

TABLE 184 WORTHINGTON INDUSTRIES: PRODUCT LAUNCHES

TABLE 185 WORTHINGTON INDUSTRIES: DEALS

TABLE 186 WORTHINGTON INDUSTRIES: OTHERS

13.4 TENARIS

TABLE 187 TENARIS.: BUSINESS OVERVIEW

FIGURE 51 TENARIS: COMPANY SNAPSHOT

TABLE 188 TENARIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 189 TENARIS: PRODUCT LAUNCHES

TABLE 190 TENARIS: DEALS

13.5 PLASTIC OMNIUM

TABLE 191 PLASTIC OMNIUM: BUSINESS OVERVIEW

FIGURE 52 PLASTIC OMNIUM: COMPANY SNAPSHOT

13.6 QUANTUM FUEL SYSTEMS LLC.

TABLE 194 QUANTUM FUEL SYSTEMS LLC.: BUSINESS OVERVIEW

TABLE 195 QUANTUM FUEL SYSTEMS LLC.: PRODUCT/SERVICE/SOLUTION OFFERED

TABLE 196 QUANTUM FUEL SYSTEMS LLC.: DEALS

13.7 COMPOSITE ADVANCED TECHNOLOGIES, LLC.

TABLE 197 COMPOSITE ADVANCED TECHNOLOGIES, LLC. : BUSINESS OVERVIEW

TABLE 198 COMPOSITE ADVANCED TECHNOLOGIES, LLC.: PRODUCT/SERVICE/SOLUTION OFFERED

13.8 PRAGMA INDUSTRIES

TABLE 199 PRAGMA INDUSTRIES: BUSINESS OVERVIEW

TABLE 200 PRAGMA INDUSTRIES: PRODUCT/SERVICE/SOLUTION OFFERED

13.9 TAIAN STRENGTH EQUIPMENTS CO., LTD.

TABLE 201 TAIAN STRENGTH EQUIPMENTS CO., LTD.: BUSINESS OVERVIEW

TABLE 202 TAIAN STRENGTH EQUIPMENTS CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERED

13.10 WELDSHIP CORPORATION

TABLE 203 WELDSHIP CORPORATION: BUSINESS OVERVIEW

TABLE 204 WELDSHIP CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERED

13.11 UMOE ADVANCED COMPOSITES

TABLE 205 UMOE ADVANCED COMPOSITES: BUSINESS OVERVIEW

TABLE 206 UMOE ADVANCED COMPOSITES: PRODUCT/SERVICE/SOLUTION OFFERED

TABLE 207 UMOE ADVANCED COMPOSITES: OTHERS

13.12 LUXFER GAS CYLINDERS

TABLE 208 LUXFER GAS CYLINDERS: BUSINESS OVERVIEW

TABLE 209 LUXFER GAS CYLINDERS: PRODUCT/SERVICE/SOLUTION OFFERED

TABLE 210 LUXFER GAS CYLINDERS: DEALS

13.13 BAYOTECH

TABLE 211 BAYOTECH: BUSINESS OVERVIEW

TABLE 212 BAYOTECH: PRODUCT/SERVICE/SOLUTION OFFERED

TABLE 213 BAYOTECH: DEALS

TABLE 214 BAYOTECH: OTHERS

13.14 MARINE SERVICE NOORD

TABLE 215 MARINE SERVICE NOORD: BUSINESS OVERVIEW

TABLE 216 MARINE SERVICE NOORD: PRODUCT/SERVICE/SOLUTION OFFERED

13.15 STEELHEAD COMPOSITES, INC.

TABLE 217 STEELHEAD COMPOSITES, INC.: BUSINESS OVERVIEW

TABLE 218 STEELHEAD COMPOSITES, INC.: PRODUCT/SERVICE/SOLUTION OFFERED

13.16 MAHYTEC

TABLE 219 MAHYTEC.: BUSINESS OVERVIEW

TABLE 220 MAHYTEC: PRODUCT/SERVICE/SOLUTION OFFERED

13.17 OTHER PLAYERS

13.17.1 DOOSAN MOBILITY INNOVATION

13.17.2 AMS COMPOSITE CYLINDERS

13.17.3 BNH GAS TANKS LLP

13.17.4 SHIJIAZHUANG ENRIC GAS EQUIPMENT CO., LTD.

13.17.5 CALVERA HYDROGEN

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 195)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrogen Storage Tanks and Transportation Market