Land Survey Equipment Market Size, Share & Industry Growth Analysis Report by Application, Solution (Hardware, Software, and Services), End User (Commercial, Defense, Service Providers), Industry, and Region (North America, Europe, Asia Pacific, MEA, and Latin America), Global Forecast to 2026

Updated on : May 10, 2023

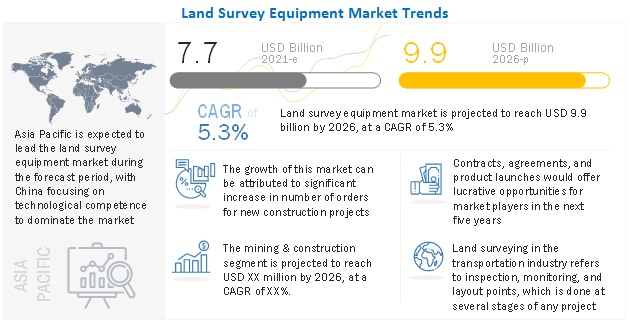

The Land Survey Equipment Market is projected to reach USD 9.9 billion by 2026, at a CAGR of 5.3% during the forecast period. The Land Survey Equipment Industry is driven by factors such as increasing adoption of land survey equipment in construction, mining, oil & gas, renewable energy, utilities, forestry, scientific & geological research, disaster management, precision farming and transportation for various applications like inspection, monitoring, volumetric calculations and layout points.

To know about the assumptions considered for the study, Request for Free Sample Report

The mining & construction segment of the land survey equipment market by Industry is projected to reach USD XXbillion by 2026, at thehighest CAGR of XX%. The commercialend use segment is projected to reach USD XXbillion by 2026, at a CAGR of XX% during the forecast period.

Land Survey Equipment Market Segment Overview

UAV to Lead the Land Survey Equipment Market by Hardware Solutions During the Forecast Period

Unmanned Aerial Vehicles (UAVs) are remotely piloted aerial vehicles that have significant roles in commercial as well as defense sectors.

Commercial UAVs are used for varied applications such as mapping, surveying, aerial imagery, and aerial photogrammetry, among others. The capabilities of UAVs in providing a wide range of platforms for potential applications in the civil & commercial sectors have led to enormous developments, and significant R&D investments in UAVs have led to widened UAV applicability in mining, 3D mapping, and oil & gas sectors, among others.

In agricultural applications, UAVs are primarily utilized for precision farming. UAVs, especially when equipped with infrared imagers and other sensors, can be used to monitor livestock and crops, detect diseases, determine plant ripeness, and schedule harvesting. Due to these advantages, the demand for UAVs has grown exponentially.

For aerial mapping and surveying, UAVs help in data inspection, surveillance, and 3D mapping. For instance, MetaVR utilizes small UAV-mounted systems to use geospatial data for the generation of terrain maps. UAVs offer the ability to quickly deliver high temporal, spatial resolution image information and 3D geo-information in crucial situations. UAV photogrammetry is considered the most suitable and efficient method to collect surveillance data for 3D mapping. Several companies are developing software to map the 3D data collected by UAVs. UAVs provide an excellent platform for cartography and geophysical and photometric surveys, allowing an aerial perspective for archaeologists. UAVs can also be used for data relays or inspection and help in the maintenance of bridges and other structures.

Technical Services to Command the Land Survey Equipment Market by Services During the Forecast Period

Technical services include all the services related to surveying. Most leading players in the global market take contracts for surveying various projects.

Under the contract, experts from the company do the surveying using the survey equipment. Technical services are used across all industries. The advantage of using technical services is that instead of buying the survey equipment and hiring the person who can operate this equipment, the manufacturing company with experts does the complete survey for the project.

The Desktop Application Used in Land Survey Equipment to Command the Market by Software During the Forecast Period

Desktop applications are mainly used for gathering, analyzing, processing, and storing the data collected by the land survey equipment.

Desktop applications play an important role in planning construction projects. They gather data from devices like GNSS, UAVs, and theodolites and use it to generate the inspection results, which helps in planning the project.

The Asia Pacific Market is Projected to Contribute the Largest Share

Asia Pacific is estimated to account for the largest share of 37.65% of the market in 2021. The market in Asia pacific is projected to reach USD XX million by 2026, growing at a CAGR XX% during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Emerging Land Survey Equipment Industry Trends

UAVs are used extensively for surveys and offer significant flexibility in gathering object images and low cost. With the help of advanced airborne systems, it is possible to accurately map and model remote geographic areas.

Moreover, small and lightweight systems enable the use of smaller aircraft that are cost-efficient. UAVs are being used in places where physical access is difficult and are beneficial as these can scan wide stretches of terrain quickly and fly at high speeds while still being able to maneuver easily and get accurate scans. Drones have the added benefit of being versatile and can be equipped with conventional survey equipment, such as high-resolution cameras or remote sensing technologies, such as LiDAR, to collect information about the terrain below. Leading UAV manufacturers are collaborating with land survey equipment manufacturers to provide UAVs with improved capabilities to carry out surveys. According to Investor’s Business Daily, in 2017, the Federal Aviation Authority (FAA) permitted four companies, namely, Trimble Navigation, VDOS Global, Clayco, and Woolpert, to perform aerial surveys, construction site monitoring, and oil rig flare stack inspection. UAVs can also be used to survey volcanoes to enhance disaster response.

Top 6 Key Market Players in Land Survey Equipment Market

The Land Survey Equipment Companies are dominated by globally established players such as

- Hexagon AB (Sweden),

- Trimble inc, (US),

- Topcon (Japan),

- CHC-Navigation (China),

- Hi-Target. China) and

- U-bloxHoldings AG (Switzerland)

Other key players in the market include Robert Bosch GmBH (Germany), GeoTech (Russia), and Hudaco Industries (South Africa). The report covers various industry trends and new technological innovations in the land survey equipment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Land Survey Equipment Market Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 7.7 Billion |

| Projected Market Size | USD 9.9 Billion |

| Growth Rate | 5.3% |

| Forecast period | 2021-2026 |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2021 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Application, By Industry, By Solution, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Hexagon AB (Sweden), Trimble Inc. (US), Topcon (Japan), CHC-Navigation (China), and Hi-Target (China) |

Land Survey Equipment Market Dynamics

Driver: Advancements in Networking for GNSS Applications

Global Navigation Satellite System (GNSS) refers to the technical interoperability and compatibility between various satellite navigation systems, such as modernized GPS and Galileo, among others.

Wireless communication and network systems offer a new line of GNSS applications by sending differential position corrections to GNSS users. Timing accuracy provides overall improvements in system performance in terms of quality and efficiency. The GNSS technology is selectively used in wireless networks as most protocols and algorithms in wireless networks are operation-specific for position information. Advancements in networking have benefited survey end users in terms of data accuracy.

Opportunity: Integration of Terrestrial Laser Scanners With Land Survey Equipment

Survey equipment is available with features that enable the measurement of slope distance and the horizontal and vertical range at a job site, which has made surveying faster and convenient.

Digital cameras are integrated into a telescope, sharing a common axis with the optics of EDM devices. The digital camera documents the site, while the digital pen can be used to input the data on the screen of the total station. As a result, the need for office-based post-processing is reduced, and images are stored along with coordinates captured by survey equipment and target points, which can be created. In addition, Terrestrial Laser Scanners (TLS) have gained significant acceptance as these operate without prisms and use pulsed laser or range measurement through phase shifts. Land survey equipment with TLS ability can be deployed to collect a point cloud that can be displayed on the screen in real-time horizontal or vertical. Moreover, the data is captured at a faster rate with the help of TLS, which is an additional feature of total stations.

Challenges: Lack of Skilled Manpower and Technical Knowledge of the Latest Equipment

The growth in demand for land survey equipment during the last decade has led to the requirement of skilled manpower qualified to operate this equipment. Manpower development is critical to further developing a solid, efficient, and balanced industrial base.

Highly skilled manpower can support the development of innovative technologies, provide policy support for increased market access, and develop markets for space applications and services.

The adoption of advanced land survey equipment involves significant challenges in training operators. Implementation of advanced land survey equipment requires operators to learn new methods of construction. Though it does not take long for operators to understand the benefits of the latest instruments and accept the related challenges, the implementation of these instruments in construction projects is still often met with resistance. In-depth knowledge regarding the capabilities of the latest land survey equipment would help maximize operator efficiency, particularly for larger projects that require a significant number of skilled operators. Thus, operator training on the latest land survey equipment is necessary to ensure the accuracy and precision required for the progress of projects at construction sites.

Land Survey Equipment Industry Categorization

The study categorizes the Land survey equipment market based on Application, Industry, Solution, End User, and Region.

Land Survey Equipment Market, By Application

- Inspection

- Monitoring

- Volumetric Calculations

- Layout Points

- Others

By Industry

- Transportation

- Energy & Power

- Mining & Construction

- Forestry

- Scientific & Geological Research

- Precision Agriculture

- Disaster Management

- Others

By Solution

- Hardware

- Software

- Services

By End User

- Commercial

- Defense

- Service Providers

Land Survey Equipment Market, By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

Recent Developments in Land Survey Equipment Market

- In December 2021, Trimble introduced the latest version of its core geospatial automated monitoring software-Trimble® 4D Control version 6.3. The software provides automated movement detection to enable informed decisions about infrastructure for surveying, construction, and monitoring professionals. Version 6.3 adds new capabilities for the software to work in combination with the Trimble SX Series Scanning Total Stations’ advanced imaging and measurement capabilities. This version also supports industry-leading vibration and weather station sensors and a streamlined workflow between the Trimble Access Monitoring Module in the field with the new T4D Access Edition used in the office.

- In November 2021, Topcon Positioning Group announced its MC-Max machine control solution. Based on its MC-X machine control platform and backed by Sitelink3D - the company’s real-time, cloud-based data management ecosystem - MC-Max is a scalable solution for mixed-fleet heavy equipment environments. It is designed to adapt to owners’ machine control and data integration needs as their fleets and workflows expand.

Frequently Asked Questions (FAQ):

What Are Your Views on the Growth Prospect of the Land Survey Equipment Market?

The Land survey equipment market is expected to grow substantially owing to the technological development in designing of the new and compact missiles.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Land Survey Equipment Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Land survey equipment market. The major players Trimble Inc. (US), Hexagon AB (Sweden), Topcon (Japan), CHC-Navigation (China), Hi-Target (China)., these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What Are the New Emerging Technologies and Use Cases Disrupting the Land Survey Equipment Market?

Some of the major emerging technologies and use cases disrupting the market include UAV based survey equipment, Total stations, Multistations, etc.

Who Are the Key Players and Innovators in the Ecosystem of the Land Survey Equipment Market?

The key players in the Land survey equipment market include Trimble Inc. (US), Hexagon AB (Sweden), Topcon (Japan), CHC-Navigation (China), Hi-Target (China).

Which Region is Expected to Hold the Highest Market Share in the Land Survey Equipment Market?

Land survey equipment market in The Asia Pacific region is estimated to account for the largest share of 38.0% of the market in 2021. The market in the asia pacific region is expected to grow at the highest CAGR of 38.0% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LAND SURVEY EQUIPMENT MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

TABLE 1 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 LAND SURVEY EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.1.2.2 Breakdown of primaries

2.1.3 DEMAND-SIDE INDICATORS

2.1.3.1 UAVs & drones for land surveys

2.1.4 SUPPLY-SIDE ANALYSIS

2.1.4.1 LiDAR technology for land survey equipment

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.2.1.1 Key industry insights

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 2 LAND SURVEY EQUIPMENT MARKET ESTIMATION PROCEDURE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.1 COVID-19 impact on market analysis

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 MARKET: DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR RESEARCH STUDY

2.7 LIMITATIONS

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 7 HARDWARE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 LAYOUT POINTS SEGMENT ESTIMATED TO LEAD THE MARKET DURING FORECAST PERIOD

FIGURE 9 MINING & CONSTRUCTION SEGMENT ESTIMATED TO LEAD THE MARKET DURING FORECAST PERIOD

FIGURE 10 COMMERCIAL SEGMENT ESTIMATED TO LEAD THE MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC ESTIMATED TO LEAD LAND SURVEY EQUIPMENT MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 12 INCREASE IN NUMBER OF CONSTRUCTION PROJECTS TO DRIVE THE MARKET

4.2 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION

FIGURE 13 HARDWARE SEGMENT TO LEAD THE MARKET DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 14 LAYOUT POINTS SEGMENT TO LEAD THE MARKET FROM DURING FORECAST PERIOD

4.4 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY

FIGURE 15 MINING & CONSTRUCTION SEGMENT TO THE MARKET DURING FORECAST PERIOD

4.5 MARKET, BY END USER

FIGURE 16 COMMERCIAL SEGMENT TO THE MARKET FROM DURING FORECAST PERIOD

4.6 MARKET, BY COUNTRY

FIGURE 17 RUSSIA PROJECTED TO BE FASTEST GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 LAND SURVEY EQUIPMENT: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Need for modern land survey equipment

5.2.1.2 Increasing number of construction projects in Asia Pacific

FIGURE 19 GDP GENERATED FROM CONSTRUCTION BY ASIA PACIFIC COUNTRIES IN 2020

5.2.1.3 Benefits of electronic devices in land surveys

5.2.1.4 Advancements in networking for GNSS applications

FIGURE 20 GLOBAL INSTALLED BASE FOR GNSS DEVICES (2012-2023)

5.2.1.5 Technological advancements in land survey equipment

5.2.2 RESTRAINTS

5.2.2.1 Rental and leasing service providers of land survey equipment

5.2.3 OPPORTUNITIES

5.2.3.1 Upgrading data management systems in surveys

5.2.3.2 Integration of terrestrial laser scanners with land survey equipment

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled manpower and technical knowledge of latest equipment

5.3 COVID-19 IMPACT SCENARIOS

5.4 IMPACT OF COVID-19 ON LAND SURVEY EQUIPMENT MARKET

FIGURE 21 IMPACT OF COVID-19 ON MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to August 2021

TABLE 3 KEY DEVELOPMENTS IN MARKET, 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 TECHNICAL SERVICES PROVIDED BY LEADING LAND SURVEY EQUIPMENT MANUFACTURERS

FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 23 LAND SURVEY EQUIPMENT ECOSYSTEM

TABLE 4 LAND SURVEY EQUIPMENT MARKET ECOSYSTEM

5.7 PRICING ANALYSIS

TABLE 5 AVERAGE SELLING PRICE ANALYSIS OF LAND SURVEY EQUIPMENT IN 2020

5.8 TARIFF REGULATORY LANDSCAPE FOR CONSTRUCTION INDUSTRY

5.9 TRADE DATA

5.9.1 TRADE ANALYSIS

TABLE 6 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

5.10 VALUE CHAIN ANALYSIS OF LAND SURVEY EQUIPMENT MARKET

FIGURE 24 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES MODEL

TABLE 8 MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 COMPETITION IN THE INDUSTRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 ROV-BASED SURVEY EQUIPMENT FOR SUBSEA ENVIRONMENTS

5.13 USE CASES

5.13.1 ANAVIA’S HT-100 SURVEYING UAV

5.14 OPERATIONAL DATA

TABLE 9 COUNTRY-WISE REVENUE GENERATED FROM CONSTRUCTION INDUSTRY, 2015-2019

6 INDUSTRY TRENDS (Page No. - 83)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 26 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 MOBILE TECHNOLOGY FOR LAND SURVEYS

6.3.2 UAVS & DRONES FOR LAND SURVEYS

6.3.3 LIDAR TECHNOLOGY FOR LAND SURVEY EQUIPMENT

6.4 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 10 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS, 2016-2021

6.5 IMPACT OF MEGATREND

6.5.1 ELECTRONIFICATION OF LAND SURVEY EQUIPMENT COMPONENTS

6.5.1.1 Electronic distance measurement (EDM)

6.5.1.2 Electronic theodolites

6.5.1.3 Microprocessors

6.5.1.4 Storage

6.5.1.5 Others (display, prism, accessories)

7 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION (Page No. - 87)

7.1 INTRODUCTION

FIGURE 27 HARDWARE SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 12 MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

7.2 HARDWARE

7.2.1 7.2.1 RAPID URBANIZATION TO DRIVE THE SEGMENT

FIGURE 28 UAVS SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 13 LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 14 MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

7.2.2 GNSS SYSTEMS

7.2.2.1 Integrated smart antennas

7.2.2.2 Modular GNSS systems

7.2.2.3 GNSS network solutions

7.2.3 TOTAL STATIONS & THEODOLITES

7.2.3.1 Standard/manual total stations

7.2.3.2 Robotic total stations

7.2.3.3 Multi-stations

7.2.4 LEVELS

7.2.4.1 Digital levels

7.2.4.2 Automatic levels

7.2.5 3D LASER SCANNERS

7.2.6 LASERS

7.2.6.1 Leveling lasers

7.2.6.2 Dual-grade lasers

7.2.6.3 Pipe lasers

7.2.7 UNMANNED AERIAL VEHICLES

7.2.8 MACHINE CONTROL SYSTEM

7.3 SOFTWARE

7.3.1 NEED FOR HIGHER ACCURACY TO DRIVE THE SEGMENT

FIGURE 29 DESKTOP APPLICATION SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2018–2020 (USD MILLION)

TABLE 16 MARKET, BY SOFTWARE, 2021–2026 (USD MILLION)

7.3.2 DESKTOP APPLICATION

7.3.3 MOBILE APPLICATION

7.3.4 REMOTE SENSING SOFTWARE

7.3.5 DEVELOPER APPLICATION

7.4 SERVICES

7.4.1 DEMAND FOR END-TO-END SERVICES TO DRIVE THE SEGMENT

FIGURE 30 TECHNICAL SERVICES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 LAND SURVEY EQUIPMENT MARKET, BY SERVICES, 2018–2020 (USD MILLION)

TABLE 18 MARKET, BY SERVICES, 2021–2026 (USD MILLION)

7.4.2 TECHNICAL SERVICES

7.4.3 CALIBRATION SERVICES

7.4.4 SOFTWARE DEVELOPMENT SERVICES

8 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 31 MINING & CONSTRUCTION SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 20 MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

8.2 TRANSPORTATION

8.3 ENERGY & POWER

FIGURE 32 GLOBAL GDP GENERATED FROM ENERGY & POWER INDUSTRY (2015 TO 2019)

8.3.1 OIL & GAS

8.3.2 UTILITIES

8.3.3 RENEWABLE ENERGY

8.4 MINING & CONSTRUCTION

FIGURE 33 GLOBAL GDP GENERATED FROM MINING & CONSTRUCTION INDUSTRY (2015 TO 2019)

8.5 FORESTRY

8.6 SCIENTIFIC & GEOLOGICAL RESEARCH

8.7 PRECISION FARMING

8.8 DISASTER MANAGEMENT

8.9 OTHERS

9 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION (Page No. - 103)

9.1 INTRODUCTION

FIGURE 34 INSPECTION APPLICATION SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 22 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 INSPECTION

9.3 MONITORING

9.4 VOLUMETRIC CALCULATIONS

9.5 LAYOUT POINTS

9.6 OTHERS

10 LAND SURVEY EQUIPMENT MARKET, BY END USER (Page No. - 107)

10.1 INTRODUCTION

FIGURE 35 COMMERCIAL SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 24 MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2 COMMERCIAL

10.3 DEFENSE

10.4 SERVICE PROVIDERS

11 LAND SURVEY EQUIPMENT MARKET, BY REGION (Page No. - 110)

11.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC ESTIMATED TO HOLD LARGEST SHARE OF MARKET IN 2021

11.2 IMPACT OF COVID-19

FIGURE 37 IMPACT OF COVID-19 ON LAND SURVEY EQUIPMENTS MARKET

TABLE 25 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 LAND SURVEY EQUIPMENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 38 NORTH AMERICA: COUNTRY-WISE GDP GENERATED FROM MINING & CONSTRUCTION INDUSTRY

FIGURE 39 NORTH AMERICA: COUNTRY-WISE GDP GENERATED FROM ENERGY & POWER INDUSTRY

11.3.1 COVID-19 IMPACT ON NORTH AMERICA

11.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 40 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

TABLE 27 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 28 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 30 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 32 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY SOFTWARE, 2018–2020 (USD MILLION)

TABLE 34 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY SERVICES, 2018–2020 (USD MILLION)

TABLE 36 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 38 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.3.3 US

11.3.3.1 Increasing adoption of modern surveying techniques in construction industry to drive the market

TABLE 43 US: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 44 US: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 45 US: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 46 US: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 47 US: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 48 US: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 49 US: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 50 US: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2021–2026 (USD MILLION)

11.3.4 CANADA

11.3.4.1 Increasing use of machine control systems in mining industry to drive the market

TABLE 51 CANADA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 52 CANADA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 53 CANADA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 54 CANADA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 55 CANADA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 56 CANADA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 57 CANADA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 58 CANADA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4 EUROPE

FIGURE 41 EUROPE: COUNTRY-WISE GDP GENERATED FROM MINING & CONSTRUCTION INDUSTRY

FIGURE 42 EUROPE: COUNTRY-WISE GDP GENERATED FROM ENERGY & POWER INDUSTRY

11.4.1 COVID-19 IMPACT ON EUROPE

11.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 43 EUROPE: LAND SURVEY EQUIPMENTS MARKET SNAPSHOT

TABLE 59 EUROPE: LAND SURVEY EQUIPMENT, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 60 EUROPE: LAND SURVEY EQUIPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 61 EUROPE: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 62 EUROPE: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 63 EUROPE: LAND SURVEY EQUIPMENT, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 64 EUROPE: LAND SURVEY EQUIPMENT, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 65 EUROPE: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2018–2020 (USD MILLION)

TABLE 66 EUROPE: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: LAND SURVEY EQUIPMENT, BY SERVICES, 2018–2020 (USD MILLION)

TABLE 68 EUROPE: LAND SURVEY EQUIPMENT, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 70 EUROPE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 71 EUROPE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 72 EUROPE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 73 EUROPE: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 74 EUROPE: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Advancements in scientific & geological surveying techniques to drive the market

TABLE 75 UK: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 76 UK: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 77 UK: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 78 UK: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 79 UK: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 80 UK: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 81 UK: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 82 UK: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4.4 RUSSIA

11.4.4.1 Rapid growth in mining & construction industry to drive the market

TABLE 83 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 84 RUSSIA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 85 RUSSIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 86 RUSSIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 87 RUSSIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 88 RUSSIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 89 RUSSIA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 90 RUSSIA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4.5 FRANCE

11.4.5.1 Presence of large tourism industry to drive the market

TABLE 91 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 92 FRANCE: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 94 FRANCE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 96 FRANCE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 98 FRANCE: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4.6 ITALY

11.4.6.1 Growing transportation industry to drive the market

TABLE 99 ITALY: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 100 ITALY: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 101 ITALY: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 102 ITALY: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 103 ITALY: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 104 ITALY: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 105 ITALY: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 106 ITALY: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4.7 GERMANY

11.4.7.1 Technological advancements in construction, transportation, and energy & power to drive the market

TABLE 107 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 108 GERMANY: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 109 GERMANY: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 110 GERMANY: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 111 GERMANY: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 112 GERMANY: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 113 GERMANY: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 114 GERMANY: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 115 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 116 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 117 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 118 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 119 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 120 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 121 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 122 REST OF EUROPE: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: COUNTRY-WISE GDP GENERATED FROM MINING & CONSTRUCTION INDUSTRY

FIGURE 45 ASIA PACIFIC: COUNTRY-WISE GDP GENERATED FROM ENERGY & POWER INDUSTRY

11.5.1 COVID-19 IMPACT ON ASIA PACIFIC

11.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: LAND SURVEY EQUIPMENTS MARKET SNAPSHOT

TABLE 123 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2018–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SERVICES, 2018–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5.3 CHINA

11.5.3.1 Presence of large construction industry to drive the market

TABLE 139 CHINA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 140 CHINA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 141 CHINA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 142 CHINA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 143 CHINA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 144 CHINA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 145 CHINA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 146 CHINA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5.4 INDIA

11.5.4.1 Rapid growth in precision farming to drive the market

TABLE 147 INDIA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 148 INDIA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 149 INDIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 150 INDIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 151 INDIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 152 INDIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 153 INDIA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 154 INDIA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5.5 JAPAN

11.5.5.1 Implementation and monitoring of advanced transportation services to drive the market

TABLE 155 JAPAN: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 156 JAPAN: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 157 JAPAN: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 158 JAPAN: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 159 JAPAN: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 160 JAPAN: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 161 JAPAN: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 162 JAPAN: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5.6 SOUTH KOREA

11.5.6.1 Increasing use of advanced inspection techniques involving UAVs to drive the market

TABLE 163 SOUTH KOREA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 164 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 165 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 166 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 167 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 168 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 169 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 170 SOUTH KOREA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5.7 AUSTRALIA

11.5.7.1 Rapid development of tourism industry to drive the market

TABLE 171 AUSTRALIA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 172 AUSTRALIA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 173 AUSTRALIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 174 AUSTRALIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 175 AUSTRALIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 176 AUSTRALIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 177 AUSTRALIA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 178 AUSTRALIA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.5.8 REST OF ASIA PACIFIC

TABLE 179 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 185 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

FIGURE 47 MIDDLE EAST & AFRICA: COUNTRY-WISE GDP GENERATED FROM MINING & CONSTRUCTION INDUSTRY

FIGURE 48 MIDDLE EAST & AFRICA: COUNTRY-WISE GDP GENERATED FROM ENERGY & POWER INDUSTRY

11.6.1 COVID-19 IMPACT ON MIDDLE EAST

11.6.2 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 49 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENTS MARKET SNAPSHOT

TABLE 187 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2018–2020 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SERVICES, 2018–2020 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6.3 SAUDI ARABIA

11.6.3.1 Development of energy & power industry to drive the market

TABLE 203 SAUDI ARABIA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 204 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 205 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 206 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 207 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 208 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 209 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 210 SAUDI ARABIA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6.4 TURKEY

11.6.4.1 Recent growth in construction industry to drive the market

TABLE 211 TURKEY: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 212 TURKEY: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 213 TURKEY: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 214 TURKEY: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 215 TURKEY: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 216 TURKEY: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 217 TURKEY: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 218 TURKEY: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6.5 UAE

11.6.5.1 Presence of large oil & gas industry to drive the market

TABLE 219 UAE: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 220 UAE: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 221 UAE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 222 UAE: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 223 UAE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 224 UAE: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 225 UAE: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 226 UAE: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6.6 ISRAEL

11.6.6.1 Demand from transportation industry to drive the market

TABLE 227 ISRAEL: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 228 ISRAEL: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 229 ISRAEL: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 230 ISRAEL: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 231 ISRAEL: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 232 ISRAEL: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 233 ISRAEL: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 234 ISRAEL: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6.7 SOUTH AFRICA

11.6.7.1 Fast improving tourism infrastructure to drive the market

TABLE 235 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 236 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 237 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 238 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 239 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 240 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 241 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 242 SOUTH AFRICA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.6.8 REST OF MIDDLE EAST & AFRICA

TABLE 243 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 244 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 246 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 247 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 249 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY END USER, 2018–2020 (USD MILLION)

TABLE 250 REST OF MIDDLE EAST & AFRICA: LAND SURVEY EQUIPMENT, BY END USER, 2021–2026 (USD MILLION)

11.7 LATIN AMERICA

FIGURE 50 LATIN AMERICA: COUNTRY-WISE GDP GENERATED FROM MINING & CONSTRUCTION INDUSTRY

FIGURE 51 LATIN AMERICA: COUNTRY-WISE GDP GENERATED FROM ENERGY & POWER INDUSTRY

11.7.1 COVID-19 IMPACT ON LATIN AMERICA

11.7.2 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 52 LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET SNAPSHOT

TABLE 251 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 252 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 253 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 254 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 255 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 256 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 257 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2018–2020 (USD MILLION)

TABLE 258 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 259 LATIN AMERICA: LAND SURVEY EQUIPMENT, BY SERVICES, 2018–2020 (USD MILLION)

TABLE 260 LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 261 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 262 LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 263 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 264 LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 265 LATIN AMERICA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 266 LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2021–2026 (USD MILLION)

11.7.3 MEXICO

11.7.3.1 Growing construction industry to drive the market

TABLE 267 MEXICO: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 268 MEXICO: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 269 MEXICO: MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 270 MEXICO: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 271 MEXICO: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 272 MEXICO: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 273 MEXICO: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 274 MEXICO: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2021–2026 (USD MILLION)

11.7.4 BRAZIL

11.7.4.1 Requirements in forestry and disaster management to drive the market

TABLE 275 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 276 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 277 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 278 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 279 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 280 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 281 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 282 BRAZIL: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2021–2026 (USD MILLION)

11.7.5 REST OF LATIN AMERICA

TABLE 283 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY SOLUTION, 2018–2020 (USD MILLION)

TABLE 284 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 285 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY INDUSTRY, 2018–2020 (USD MILLION)

TABLE 286 REST OF LATIN AMERICA: MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 287 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 288 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 289 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 290 REST OF LATIN AMERICA: LAND SURVEY EQUIPMENTS MARKET, BY END USER, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 216)

12.1 INTRODUCTION

TABLE 291 KEY DEVELOPMENTS BY LEADING PLAYERS IN LAND SURVEY EQUIPMENT MARKET BETWEEN 2018 AND 2021

12.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS 2020

TABLE 292 DEGREE OF COMPETITION

FIGURE 53 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

12.3 RANK ANALYSIS, 2020

FIGURE 54 REVENUE GENERATED BY MAJOR PLAYERS IN LAND SURVEY EQUIPMENTS MARKET, 2020

TABLE 293 COMPANY REGION FOOTPRINT

TABLE 294 COMPANY SOLUTION FOOTPRINT

TABLE 295 COMPANY APPLICATION FOOTPRINT

12.4 COMPETITIVE EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

FIGURE 55 LAND SURVEY EQUIPMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

12.5 START-UP/SME EVALUATION QUADRANT

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 STARTING BLOCKS

12.5.4 DYNAMIC COMPANIES

FIGURE 56 LAND SURVEY EQUIPMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING (SME)

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 296 NEW PRODUCT LAUNCHES, DECEMBER 2019–DECEMBER 2021

13 COMPANY PROFILES (Page No. - 235)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 HEXAGON AB

TABLE 297 HEXAGON AB: BUSINESS OVERVIEW

FIGURE 57 HEXAGON AB: COMPANY SNAPSHOT

13.2.2 TOPCON

TABLE 298 TOPCON: BUSINESS OVERVIEW

FIGURE 58 TOPCON: COMPANY SNAPSHOT

13.2.3 TRIMBLE INC.

TABLE 299 TRIMBLE INC.: BUSINESS OVERVIEW

FIGURE 59 TRIMBLE INC.: COMPANY SNAPSHOT

13.2.4 HI-TARGET

TABLE 300 HI-TARGET: BUSINESS OVERVIEW

FIGURE 60 HI-TARGET: COMPANY SNAPSHOT

13.2.5 CHC NAVIGATION

TABLE 301 CHC-NAVIGATION: BUSINESS OVERVIEW

FIGURE 61 CHC-NAVIGATION: COMPANY SNAPSHOT

13.2.6 U-BLOX HOLDING AG

TABLE 302 U-BLOX HOLDING AG: BUSINESS OVERVIEW

FIGURE 62 U-BLOX HOLDING AG: COMPANY SNAPSHOT

13.2.7 HUDACO INDUSTRIES LTD.

TABLE 303 HUDACO INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 63 HUDACO INDUSTRIES LTD.: COMPANY SNAPSHOT

13.2.8 SUZHOU FOIF

TABLE 304 SUZHOU: BUSINESS OVERVIEW

13.2.9 STONEX

TABLE 305 STONEX: BUSINESS OVERVIEW

13.2.10 SOUTH SURVEYING & MAPPING INSTRUMENTS

TABLE 306 SOUTH SURVEYING & MAPPING INSTRUMENTS: BUSINESS OVERVIEW

13.2.11 CST/BERGER

TABLE 307 CST/BERGER: BUSINESS OVERVIEW

13.2.13 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY

TABLE 308 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY: BUSINESS OVERVIEW

13.2.14 PRODUCTS OFFERED

13.2.15 GUANGDONG KOLIDA INSTRUMENT

TABLE 309 GUANGDONG KOLIDA INSTRUMENT: BUSINESS OVERVIEW

13.2.16 BEIJING UNISTRONG SCIENCE & TECHNOLOGY CO. LTD.

TABLE 310 BEIJING UNISTRONG SCIENCE & TECHNOLOGY CO. LTD.: BUSINESS OVERVIEW

13.2.17 GEOTECH

TABLE 311 GEOTECH: BUSINESS OVERVIEW

FIGURE 64 GEOTECH: COMPANY SNAPSHOT

13.3 OTHER KEY PLAYERS

13.3.1 ROBERT BOSCH GMBH

TABLE 312 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

13.3.2 HEMISPHERE

TABLE 313 HEMISPHERE: BUSINESS OVERVIEW

13.3.3 ENTEK INSTRUMENTS INDIA PVT. LTD.

TABLE 314 ENTEK INSTRUMENTS INDIA PVT. LTD.: BUSINESS OVERVIEW

13.3.4 SAMAH AERIAL SURVEY CO., LTD.

TABLE 315 SAMAH AERIAL SURVEY CO., LTD.: BUSINESS OVERVIEW

13.3.5 EOS POSITIONING SYSTEMS

TABLE 316 EOS POSITIONING SYSTEMS: BUSINESS OVERVIEW

13.3.6 PENTAX PRECISION

TABLE 317 PENTAX PRECISION: BUSINESS OVERVIEW

13.3.6.2 Products offered

13.3.7 SATLAB GEOSOLUTIONS AB

TABLE 318 SATLAB GEOSOULTONS AB: BUSINESS OVERVIEW

13.3.8 THEIS FEINWERKTECHNIK GMBH

TABLE 319 THEIS FEINWERKTECHNIK: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 293)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

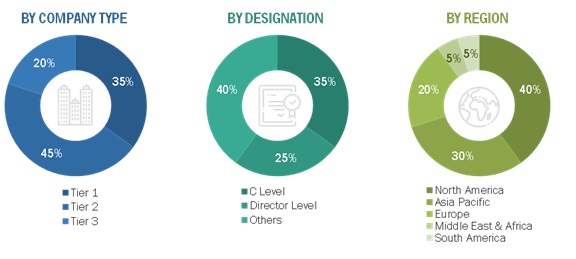

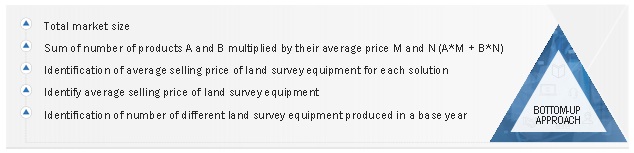

The study involved four major activities in estimating the current size of the Land survey equipment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from land survey equipment vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using land survey equipment were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of land survey equipment and future outlook of their business which will affect the overall market.

|

Land survey equipment OEMS |

Others |

|

Trimble inc. |

Stonex |

|

Topcon |

Robert Bosch GmbH |

|

Hi-Target |

Emid Ltd. |

|

CHC-Navigation |

CST/Berger |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Land survey equipment market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Land survey equipment market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Land survey equipment market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the Land survey equipment market.

Report Objectives

- To define, describe, and forecast the land survey equipment market by solution, application, industry, end user, and region

- To analyze the demand- and supply-side indicators influencing the growth of the land survey equipment market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and industry-specific challenges, which influence the growth of the land survey equipment market

- To forecast the size of various segments of the land survey equipment market across four main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze micromarkets 1 with respect to individual growth trends, prospects, and their contribution to the land survey equipment market

- To analyze technological advancements and new product launches in the land survey equipment market

- To strategically profile key players in the land survey equipment market and comprehensively analyze their core competencies 2

- To identify products and key developments of leading companies operating in the land survey equipment market

- To provide a comprehensive analysis of business and corporate strategies adopted by key players operating in the land survey equipment market

- To provide a detailed competitive landscape of the land survey equipment market, along with market share ranking of leading players in the market

Available Customization

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific requirements. The following customization options are available for the report:

- Country-level analysis

- Market sizing and forecasting for other countries of the Rest of the World

- Additional company profiles (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Land Survey Equipment Market

Data on the growth of geo surveying in developing countries?