IDaaS Market by Component (Provisioning, Single Sign-On, Advanced authentication, Audit, Compliance, and Governance, Directory service, and Password management), Organization Size, Deployment Type, Vertical and Region - Global Forecast to 2027

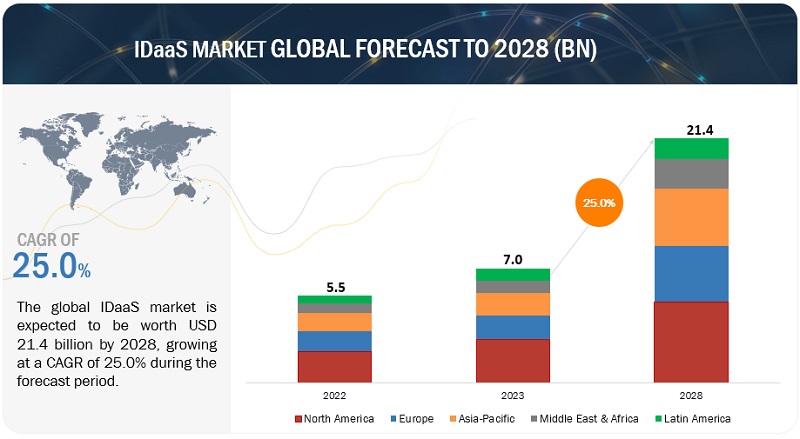

MarketsandMarkets forecasts the global IDaaS market size is estimated to be USD 5.6 billion in 2022 and projected to reach USD 16.8 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 24.7% from 2022 to 2027. Government policies and initiatives supporting the transition of digital identities, government rules and the requirement for compliance, and the rise in identity and authentication frauds are some of the drivers fueling the market's growth. However, businesses' unwillingness to adopt cloud-based security and a lack of consumer data information security is anticipated to restrain market expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 impact

The pandemic has accelerated digital business and increased the trend for the cyber-savvy board. Enterprises around the world have recorded a 37% increase in cybersecurity attacks including data breaches, money laundering, identity thefts, ransomware, and many more during the COVID-19 pandemic and are bound to adopt advanced security solutions like IDaaS for streamlining their corporate governance and disclosures, workplace health and safety, data privacy, supply chain, and working capital, which are disturbed due to COVID-19. Security teams are asked to secure countless forms of digital transformation and other new technologies. Enterprises such as Accenture are providing online compliance and risk training to help enterprises tackle business disruptions due to COVID-19. Innovative antivirus solutions have become incredibly important in the recent COVID-19 crisis to facilitate live streaming, eLearning, and more throughout the day as everyone is working from home. The ongoing benefits of antivirus technology in extending a Wi-Fi footprint to meet the rising demand for internet access accelerate the IDaaS solutions market growth. COVID-19 has fast-tracked the shift toward cloud adoption, and as a result, risks and threats have evolved. Security solutions such as IDaaS are gaining prominence and the trend is expected to remain strong during the forecast period.

Market Dynamics

Driver: Rise in identity and authentication frauds

Cybercrimes on essential applications and infrastructures are a persistent threat to organisations across all industries. Every single day, the complexity of cyberattacks grows. According to a firm, it loses roughly 5% of its total yearly sales through fraud on a global scale. In 2019, the total yearly revenue loss for companies was estimated to reach USD 4.2 trillion. Threats might come from outside or within the organization, such as an employee going rogue. These cyberattacks can result in operational outages, data leaks, and financial loss. These earnings provide enormous financial issues for corporations, and their reputations are continually compromised.

These scams have the potential to damage consumer relationships and destroy trust by causing payment interruption, bank account fraud, and service deterioration. Organizations also experience indirect costs such as a decline in productivity, low staff morale, and a deterioration of the brand image, in addition to reputational damage and financial losses. Identity management now occupies a central position in an organization's IT operations due to the increasing threat of cyberattacks. If implemented across enterprises, IDaaS can reduce the likelihood of such scams and the loss of income.

Restraint: Lack of information security of consumer data

A significant portion of people utilises banking applications worldwide. Failure or violated user privacy in the case of breaches occurring in the banking business is a serious problem. The BFSI business has already embraced cutting-edge technologies for both information and physical security. However, worries about insecure endpoints like desktops, laptops, and mobile devices are tied to the growing internal and external user populations as well as the increased volume and complexity of transactions. These endpoints are the main targets of cyberattacks since they offer simple access that may be used for several attack vectors. Therefore, there is a lack of user knowledge of complex threats and system vulnerabilities. Businesses must constantly communicate with customers and educate them on the security of their data. Better solutions are therefore needed to develop the security infrastructure of an organization.

Opportunity: Integration of AI, ML, and blockchain technologies to enhance digital identities

The integration of cutting-edge technology like blockchain, AI, and machine learning is a trending concept. The workforce is being replaced by designed automated systems, reducing potential consequences. These innovations make it possible for computers to discover hidden insights without explicit programming and automate the construction of analytical models. Vendors of IDaaS solutions can use ML-based analytics to analyse vast amounts of data and access-related behaviours. By precisely monitoring and reporting on a user, account, application, department, and organisational risk posture aids in lowering identity attack surfaces. The implementation of risk-based access certificates, which assist in the identification and authentication procedures, is also facilitated by the exposure of anomaly processes. Various industries, including the BFSI, the automotive, and the government, have begun to use these techniques. It aids in the planning of strategic and remedial actions for companies. Therefore, utilizing technology is anticipated to provide IDaaS companies with several development opportunities.

Challenge: Outsourcing of critical applications

A cloud-based authentication infrastructure, IDaaS offers all the benefits of the cloud, such as a more flexible range of integration options, easier management, and a smaller on-site infrastructure. For enterprises, it offers the difficulty of compliance and control, though. Despite the fact that compliance configurations can greatly alleviate a company's workload, they also suggest that security and compliance are not totally under the corporation's control. This suggests that should the provider encounter any technical issues or security issues, it might have a bad consequence for the company in the form of a security breach, a non-compliance fine, or even worse. While migrating our identity management service requirements to the cloud, the corporate firewalls no longer protect them and they become available to the general public on the internet. A company must ensure the security of the infrastructure and data if it intends to use an IDaaS system.

Shifting identity management to the cloud raises a range of issues in terms of auditing, ensuring regulatory compliance, and the possibility of leaks. There are no laws that specify how an identity provider must provide safeguards against data breaches. The majority of terms and conditions and SLAs from cloud providers are different from what we would have in an office setting. Adopting IDaaS solutions by migrating to the cloud offers a problem from the perspective of regulatory compliance and may result in a considerable increase in risk.

IDaaS Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By Component, Single-Sign-on has the largest CAGR during the forecast period

In an organization, Single-Sign-on (SSO) solves critical business concerns by increasing security and compliance, improving usability and enhancing productivity, and lowering IT expenses. The expansion of cloud apps and services in enterprises, frequently alongside on-premises ones, has resulted in severe fragmentation issues. It is a problem for both IT and individuals. The IT has to manage the enterprise's multiple programmes as well as deal with shadow IT. Owing to this, employees are required to log in to and move between various applications and websites every day to do their work. To get rid of the enterprise fragmentation issues, SSO comes to the organization’s rescue. Additionally, SSO decreases the number of attack surfaces. It also aids with regulatory compliance. SSO is a method of meeting data access and antivirus protection needs. SSO requires users to remember only one set of credentials, minimizing the number of assistance tickets. Furthermore, most SSO systems allow users to update their own passwords, removing the requirement for IT intervention. Thus, with these several benefits, SSO is widely in use and anticipated to have the largest CAGR during the forecasted period.

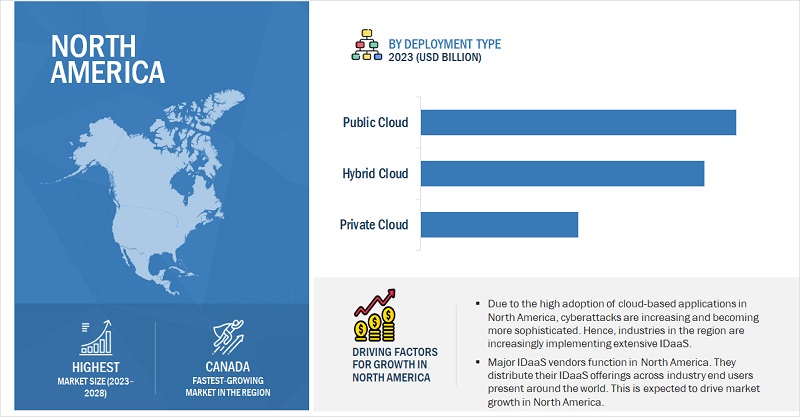

By deployment mode, the public cloud has the highest market size during the forecast period.

Based on deployment modes, the IDaaS market is segmented into public cloud, private cloud, and hybrid cloud. The resources made accessible to client businesses via the public cloud deployment include Applications, storage, Virtual servers, and Hardware. The services provided through the public cloud can be obtained for no cost or with a subscription. Utilizing a public cloud comes with certain benefits like simplicity in deployment and ease and convenience to use. Additionally, the deployment's initial expenditure is low, and there are no duties associated with operating the infrastructure. The public cloud is becoming more popular as the ideal deployment model for managed services such as business services, network services, and data centre services. It is mainly preferred by organizations for its cost efficiency, scalability, flexibility, less operability, and location-independent services. Thus, the public cloud is anticipated to have the highest market share during the forecasted period.

By vertical, Government is to grow at the highest CAGR during the forecast period

The government sector is the prime target for cybercriminals to obtain sensitive national data. Web and mobile apps are being used by governments in developing economies to better serve their residents. Due to this, government agencies and the public sector manage sensitive customer data and identities more effectively. To obtain sensitive data, these applications are increasingly being targeted by intruders. Identity theft, asset misappropriation, bribery, corruption, accounting fraud, data theft, and money laundering are all forms of identity fraud happening in the government sector. As a consequence of an increase in identity theft cases aimed to access confidential government information, IDaaS solutions are being adopted widely among government organizations, and public sectors. Thus, the government vertical is anticipated to have the highest CAGR during the forecasted period.

By region, North America is to have the highest market size during the forecast period

North America dominates the global IDaaS market with a large number of IDaaS vendors from the region such as Okta, Idaptive, Sail Point, Ping Identity, Microsoft, CA Technologies, Oracle, IBM, and OneLogin resulting in the adoption of IDaaS solutions in the region. The extensive observance of data compliance rules and cloud deployments are the main growth drivers for IDaaS in the region The other drivers for the growing demand for IDaaS solutions in the region include the rise in cyberattacks aimed at gaining access to private consumer data, changing workforce needs, and the adoption of bring your own device (BYOD), and mobile practices, pushing North American businesses to adopt IDaaS solutions. Hence, industries in North America are increasingly implementing extensive security solutions such as IDaaS. The widespread use of personal devices, like smartphones and laptops, to help businesses carry on with their operations, and work from home amid the pandemic, is expected to significantly accelerate the adoption of IDaaS solutions in the region. These factors result in North America to be having the highest market size in the forecasted period.

Key Market Players

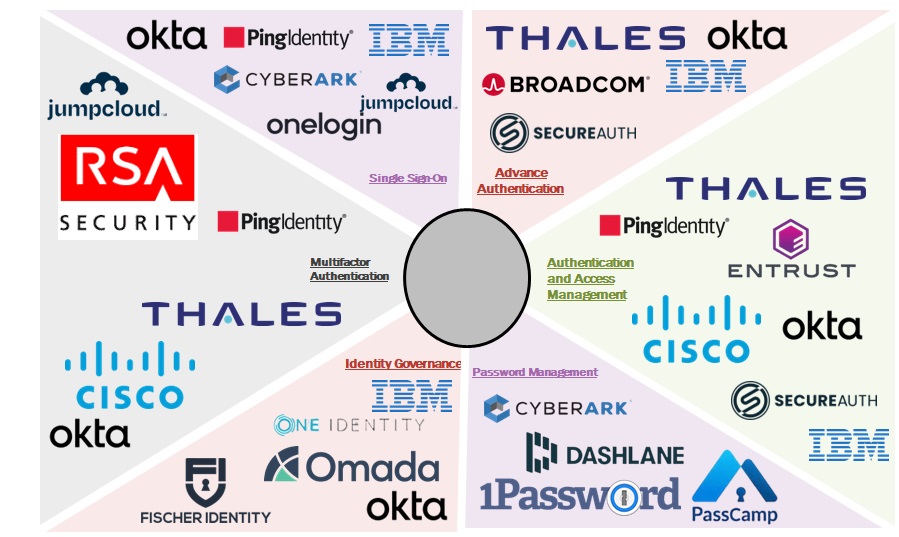

The key players in the global IDaaS market include Okta (US), CyberArk (US), Thales (France), Microsoft (US), Ping Identity (US), OneLogin (US), IBM (US), Oracle (US), Google (US), and SailPoint (US), JumpCloud (US), SecureAuth (US), Auth0 (US), OpenText (Canada), Ilantus (US), LoginRadius (Canada), Delinea (US), Optimal IdM (US), Fischer Identity (US), Atos (France), Avatier (US), Simeio Solutions (US), HCL (India), Capgemini (France), Broadcom (US), Salesforce (US), Jumio (US), Signicat (Norway), Ubisecure (UK), and EmpowerID (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ USD Billion) |

|

Segments covered |

|

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America |

|

Major companies covered |

Major vendors in the global IDaaS market include Okta (US), CyberArk (US), Thales (France), Microsoft (US), Ping Identity (US), OneLogin (US), IBM (US), Oracle (US), Google (US), and SailPoint (US), JumpCloud (US), SecureAuth (US), Auth0 (US), OpenText (Canada), Ilantus (US), LoginRadius (Canada), Delinea (US), Optimal IdM (US), Fischer Identity (US), Atos (France), Avatier (US), Simeio Solutions (US), HCL (India), Capgemini (France), Broadcom (US), Salesforce (US), Jumio (US), Signicat (Norway), Ubisecure (UK), and EmpowerID (US). |

The study categorizes the IDaaS market based on component, deployment type, organization size, and vertical at the regional and global levels.

By Component

- Provisioning

- Single-Sign-On

- Advanced Authentication

- Audit, Compliance, and Governance

- Directory Services

- Password Management

By Deployment Type

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- IT and ITeS

- Energy and Utilities

- Government

- Manufacturing

- Healthcare

- Retail and Consumer Goods

- Other Verticals (Education, Media and entertainment, Transportation and logistics, Travel and hospitality, and Aerospace and defense)

Region

- North America

- Europe

- Middle East and Africa

- Asia pacific

- Latin America

Recent Development

- In June 2022, IBM enhanced its solution named IBM Security Verify Governance V10.0.1 Fix Pack 1 to offer one platform for enterprises to investigate, define, and manage access risks. To enable line-of-business managers, auditors, and risk managers to control access and assess regulatory compliance across corporate applications and services, this solution uses business-centric rules, actions, and procedures.

- In May 2022, Microsoft launched a new solution named Microsoft Entra. Microsoft Entra Permissions Management is a solution created to give users and workload identities visibility over permissions. It gives security teams a way to identify unused and excessive rights more effectively to enforce the concept of least privilege and maintain a top-down view of identities across all cloud services, including Microsoft Azure, Amazon Web Services, and Google Cloud Platform.

- In February 2022, Ping Identity launched a new product named PingOne DaVinci. It is a vendor-neutral product, allowing businesses to combine and coordinate identity services from several suppliers. It has a collection of more than 100 pre-built connections for various identification, IT, and automation services. It speeds up the integration and deployment of identity services, making it simpler to develop digital user journeys across many apps and ecosystems.

- In October 2021, Okta enhanced its product named Okta Workflows. Okta Workflows has added features that address a broadened set of identity automation use cases beyond Lifecycle Management capabilities, including advanced security orchestration and DevOps. The new features offer customers the additional capability to speed up innovation and automate identity procedures.

Frequently Asked Questions (FAQ):

What is the definition of the Identity as a Service market?

MarketsandMarkets defines Identity as a Service (IDaaS) as Identity and Access Management (IAM) services that are offered through the cloud or Software-as-a-Service (SaaS) on a subscription basis. IDaaS enables users to connect and use identity management services from the cloud. It comprises cloud-based solutions that provide IAM and access governance capabilities as a service, ranging from Single Sign-On (SSO) to identity provisioning and access governance.

What is the projected market value of the global Identity as a Service market?

The global IDaaS market size is expected to grow from an estimated value of USD 5.6 billion in 2022 to 16.8 billion USD by 2027, at a Compound Annual Growth Rate (CAGR) of 24.7% from 2022 to 2027.

Who are the key companies influencing the market growth of the Identity as a Service market?

Okta (US), CyberArk (US), Thales (France), Microsoft (US), Ping Identity (US), OneLogin (US), IBM (US), Oracle (US), Google (US), and SailPoint (US), JumpCloud (US), SecureAuth (US), Auth0 (US), OpenText (Canada), Ilantus (US), LoginRadius (Canada), Delinea (US), Optimal IdM (US), Fischer Identity (US), Atos (France), Avatier (US), Simeio Solutions (US), HCL (India), Capgemini (France), Broadcom (US), Salesforce (US), Jumio (US), Signicat (Norway), Ubisecure (UK), and EmpowerID (US) are the leaders in the IDaaS market and are recognized as the star players. These companies account for a major share of the IDaaS market. They offer wide solutions related to IDaaS solutions and services. These vendors offer customized solutions per user requirements and adopt growth strategies to consistently achieve the desired growth and make their presence in the market.

What is the COVID-19 impact on the IDaaS market?

During the pandemic, SMEs and big enterprises switched their whole operations to an online digital platform. Due to lockdown constraints, industries like IT, BFSI, and healthcare used cloud-based solutions and apps to provide customized services to clients. This aspect has considerably increased the amount of personal and sensitive information available on online platforms, raising data security concerns. Due to these security issues, companies throughout the world have expanded their use of IDaaS solutions to protect sensitive data and secure their clients' personal information.

What are some of the mandates for IDaaS?

There are several stringent regulations and policies in Europe, North America, and Asia Pacific countries such as GDPR, SOX Act, SOC2, Know your customer (KYC), and Anti-Money Laundering (AML). These set of regulations and policies are meant to protect individuals and organizations from cybercrime activities such as identity theft, money laundering, ransomware, digital fraud and many other such activities and mandate the incorporation of advanced security solutions like IDaaS in organizations and also for individuals. In case of any security breach or cyber crime, heavy penalties and fines are imposed on organizations if they do not adhere to these mandates. Thus, stringent government policies and regulations drive the adoption of IDaaS solutions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

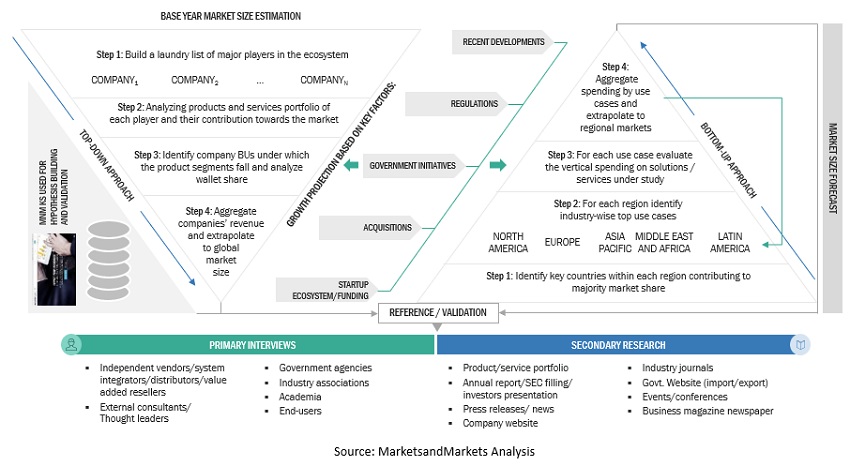

FIGURE 1 IDENTITY AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

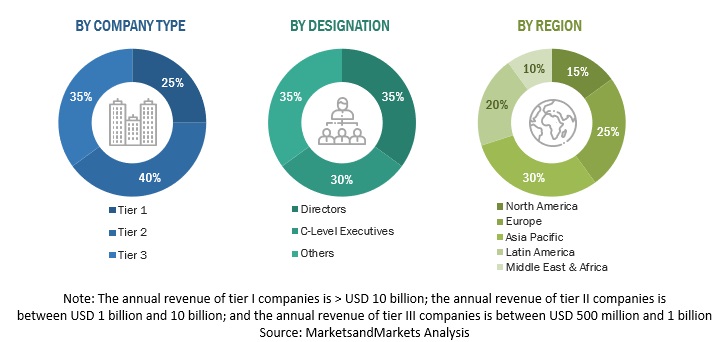

FIGURE 2 BREAKUP OF PRIMARY SOURCES BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

FIGURE 3 KEY INDUSTRY INSIGHTS

2.2 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION PROCESS

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 3 IDENTITY AS A SERVICE MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 4 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 6 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IDENTITY AS A SERVICE MARKET

FIGURE 7 INCREASING NUMBER OF IDENTITY THEFTS ACROSS VERTICALS TO FUEL MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 8 PROVISIONING SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODE

FIGURE 9 PUBLIC CLOUD TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY ORGANIZATION SIZE

FIGURE 10 LARGE ENTERPRISES TO HOLD GREATER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET SHARE OF TOP THREE VERTICALS AND REGIONS

FIGURE 11 BFSI AND NORTH AMERICA HOLD HIGHEST MARKET SHARES IN 2022

4.6 MARKET INVESTMENT SCENARIO

FIGURE 12 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 IDENTITY AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Government initiatives and regulations to support digital identity transformation

5.2.1.2 Government regulations and need for compliance to drive adoption of IDaaS

5.2.1.3 Rise in identity and authentication frauds

5.2.2 RESTRAINTS

5.2.2.1 Reluctance of organizations to adopt cloud-based security

5.2.2.2 Lack of information security of consumer data

5.2.3 OPPORTUNITIES

5.2.3.1 Rising trend of cost shift and complexity reduction

5.2.3.2 Integration of AI, ML, and blockchain technologies to enhance digital identities

5.2.3.3 Adopting advanced authentication techniques across verticals

5.2.4 CHALLENGES

5.2.4.1 Outsourcing critical applications

5.2.4.2 Ownership and privacy challenges

5.3 USE CASES

5.3.1 USE CASE 1: OPTIMAL IDM HELPED LARGE BEVERAGE RETAILERS WITH DEDICATED PRIVATE IDAAS OFFERING

5.3.2 USE CASE 2: THALES GROUP HELPED A MAJOR TELECOM OPERATOR WITH DIGITAL IDENTITY PLATFORM SETUP

5.3.3 USE CASE 3: LOGINRADIUS HELPED ITS CLIENT ESTABLISH IAM SOLUTIONS

5.4 VALUE CHAIN ANALYSIS

FIGURE 14 IDENTITY AS A SERVICE MARKET: VALUE CHAIN

5.5 MARKET ECOSYSTEM

FIGURE 15 MARKET: ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES IMPACT ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 PRICING ANALYSIS

5.7.1 INDICATIVE PRICING BY KEY PLAYERS

5.7.2 AVERAGE SELLING PRICE SET BY KEY PLAYERS

5.8 TECHNOLOGY ANALYSIS

5.8.1 ZERO TRUST

5.8.2 BLOCKCHAIN

5.9 PATENT ANALYSIS

FIGURE 17 IDENTITY AS A SERVICE MARKET: PATENTS GRANTED

5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 18 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.11 REGULATORY LANDSCAPE

5.11.1 GENERAL DATA PROTECTION REGULATION

5.11.2 SARBANES-OXLEY ACT (SOX)

5.11.3 SOC2

5.11.4 ELECTRONIC IDENTIFICATION, AUTHENTICATION, AND TRUST SERVICES

5.11.5 KNOW YOUR CUSTOMER

5.11.6 ANTI-MONEY LAUNDERING

5.11.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 8 MARKET: LIST OF CONFERENCES AND EVENTS, 2022–2023

6 IDENTITY AS A SERVICE MARKET, BY COMPONENT (Page No. - 69)

6.1 INTRODUCTION

FIGURE 20 SINGLE SIGN-ON AND ADVANCED AUTHENTICATION SEGMENTS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 9 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 10 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 PROVISIONING

6.2.1 AUTOMATION OF IDENTITY LIFECYCLE MANAGEMENT TO DRIVE GROWTH

6.2.2 PROVISIONING: MARKET DRIVERS

TABLE 11 PROVISIONING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 12 PROVISIONING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SINGLE SIGN-ON

6.3.1 EASE OF PASSWORDLESS AUTHENTICATION TO BOOST SINGLE SIGN-ON IMPLEMENTATION

6.3.2 SINGLE SIGN-ON: IDENTITY AS A SERVICE MARKET DRIVERS

TABLE 13 SINGLE SIGN-ON: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 14 SINGLE SIGN-ON: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 ADVANCED AUTHENTICATION

6.4.1 MULTIPLE VALIDATION CHECKS AND GROWING NEED FOR RISK BASED VALIDATION TO BOOST GROWTH

6.4.2 ADVANCED AUTHENTICATION: MARKET DRIVERS

TABLE 15 ADVANCED AUTHENTICATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 16 ADVANCED AUTHENTICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 AUDIT, COMPLIANCE, AND GOVERNANCE

6.5.1 IMPROVED E-KYC, DIGITAL ONBOARDING, AND IDENTITY GOVERNANCE

6.5.2 AUDIT, COMPLIANCE, AND GOVERNANCE: MARKET DRIVERS

TABLE 17 AUDIT, COMPLIANCE, AND GOVERNANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 AUDIT, COMPLIANCE, AND GOVERNANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 DIRECTORY SERVICES

6.6.1 DIRECTORY SERVICES TO IMPROVE ADAP AND LDAP IMPLEMENTATION

6.6.2 DIRECTORY SERVICES: IDENTITY AS A SERVICE MARKET DRIVERS

TABLE 19 DIRECTORY SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 DIRECTORY SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.7 PASSWORD MANAGEMENT

6.7.1 GROWING NEED FOR ENCRYPTION TO DRIVE GROWTH

6.7.2 PASSWORD MANAGEMENT: MARKET DRIVERS

TABLE 21 PASSWORD MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 PASSWORD MANAGEMENT: RVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

7 IDaaS Market, BY DEPLOYMENT TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 21 PRIVATE CLOUD SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 23 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 24 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 PUBLIC CLOUD

7.2.1 LOWER COST, NO MAINTENANCE, AND HIGH SCALABILITY

7.2.2 PUBLIC CLOUD: MARKET DRIVERS

TABLE 25 PUBLIC CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 PUBLIC CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PRIVATE CLOUD

7.3.1 HIGH DEPLOYEMENT CONTROL AND SELF COMPLIANT TO REDUCE RISK

7.3.2 PRIVATE CLOUD: IDENTITY AS A SERVICE MARKET DRIVERS

TABLE 27 PRIVATE CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 PRIVATE CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 HYBRID CLOUD

7.4.1 OFFERS CONTROL AND FLEXIBILITY ALONG WITH COST EFFECTIVENESS

7.4.2 HYBRID CLOUD: MARKET DRIVERS

TABLE 29 HYBRID CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 HYBRID CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 IDENTITY AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 22 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

TABLE 31 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 32 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

8.2.1 CLOUD HOSTING SERVICES EMPOWER ORGANIZATIONS TO HOST APPLICATIONS

8.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 EMERGENCE OF DIGITAL BANKING CHANNELS AND E-COMMERCE TO TRIGGER INVESTMENTS

8.3.2 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 IDaaS Market, BY VERTICAL (Page No. - 91)

9.1 INTRODUCTION

FIGURE 23 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 37 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 38 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

9.2.1 CLOUD HOSTING TO DEVELOP CUSTOMER-CENTRIC BUSINESS MODELS

9.2.2 BFSI: MARKET DRIVERS

TABLE 39 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 INFORMATION TECHNOLOGY (IT) AND INFORMATION TECHNOLOGY-ENABLED SERVICES (ITES)

9.3.1 INVESTMENT IN NEW IDENTITY TECHNOLOGIES TO DRIVE ITES SEGMENT

9.3.2 IT AND ITES: MARKET DRIVERS

TABLE 41 IT AND ITES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 ENERGY AND UTILITIES

9.4.1 CLOUD SOFTWARE APPLICATIONS TO ENHANCE PRODUCTIVITY AND EFFICIENCY

9.4.2 ENERGY AND UTILITIES: IDENTITY AS A SERVICE MARKET DRIVERS

TABLE 43 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 GOVERNMENT

9.5.1 NEED FOR PROCESSING LARGE UNSTRUCTURED DATA AND STORAGE TO ACCELERATE ADOPTION OF IDAAS

9.5.2 GOVERNMENT: MARKET DRIVERS

TABLE 45 GOVERNMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 MANUFACTURING

9.6.1 MIGRATION OF APPLICATIONS TO CLOUD ENVIRONMENT ENABLES MANUFACTURERS TO ADOPT SMART MANUFACTURING TECHNOLOGIES

9.6.2 MANUFACTURING: MARKET DRIVERS

TABLE 47 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 HEALTHCARE

9.7.1 HEALTHCARE: IDENTITY AS A SERVICE MARKET DRIVERS

TABLE 49 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 RETAIL AND CONSUMER GOODS

9.8.1 RETAIL AND CONSUMER GOODS: MARKET DRIVERS

TABLE 51 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 53 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 IDENTITY AS A SERVICE MARKET, BY REGION (Page No. - 104)

10.1 INTRODUCTION

FIGURE 24 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 25 NORTH AMERICA: MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

10.2.3.1 High level of technology awareness and presence of identity solution and service vendors

TABLE 65 US: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 66 US: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 67 US: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 68 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 69 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 70 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 71 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 72 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Opening of data center in Montreal to boost identity security

TABLE 73 CANADA: IDaaS MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 74 CANADA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 75 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 76 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 77 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 78 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 79 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 80 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: IDaaS Market DRIVERS

10.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 81 EUROPE: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Higher adoption rate of cloud technologies

TABLE 91 UK: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 92 UK: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 93 UK: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 94 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 95 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 96 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 97 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 98 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Increasing adoption of private cloud to boost demand

TABLE 99 GERMANY: IDaaS Market, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Strict government regulations and increasing spending on cloud

TABLE 107 FRANCE: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 108 FRANCE: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 109 FRANCE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 111 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 112 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 113 FRANCE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 115 REST OF EUROPE: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC (APAC)

10.4.1 ASIA PACIFIC: IDENTITY AS A SERVICE MARKET DRIVERS

10.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 123 ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 China-based software and outsourcing companies to adopt cloud-based technologies

TABLE 133 CHINA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 134 CHINA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 135 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 136 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 137 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 138 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 139 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 140 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Adoption of IDaaS services and hybrid cloud

TABLE 141 JAPAN: IDaaS Market, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 147 JAPAN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 148 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.5 INDIA

10.4.5.1 Several SMEs moving toward cloud SaaS adoption

TABLE 149 INDIA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 150 INDIA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 151 INDIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 152 INDIA: IDaaS Market, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 153 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 154 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 155 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 156 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.6 AUSTRALIA

10.4.6.1 Government programs to boost IDaaS adoption

TABLE 157 AUSTRALIA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 158 AUSTRALIA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 159 AUSTRALIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 160 AUSTRALIA: IDaaS Market, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 161 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 162 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 163 AUSTRALIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 164 AUSTRALIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC (APAC)

TABLE 165 REST OF ASIA PACIFIC: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: IDaaS Market, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: IDENTITY AS A SERVICE MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 173 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 UAE

10.5.3.1 Governments to support SMEs for cloud technology adoption

TABLE 183 UAE: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 184 UAE: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 185 UAE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 186 UAE: IDaaS Market, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 187 UAE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 188 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 189 UAE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 190 UAE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.4 SAUDI ARABIA

10.5.4.1 Growing investment in healthcare, tourism, media and entertainment industry

TABLE 191 SAUDI ARABIA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 192 SAUDI ARABIA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 193 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 194 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 195 SAUDI ARABIA: IDaaS Market, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 196 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 197 SAUDI ARABIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 198 SAUDI ARABIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 199 REST OF MIDDLE EAST AND AFRICA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 202 REST OF MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST AND AFRICA: IDaaS Market, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 204 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 205 REST OF MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 206 REST OF MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: IDENTITY AS A SERVICE MARKET DRIVERS

10.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 207 LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: IDaaS Market, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Retail and consumer goods verticals to drive growth

TABLE 217 BRAZIL: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 218 BRAZIL: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 219 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 220 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 221 BRAZIL: IDaaS Market, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 222 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 223 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 224 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.4 MEXICO

10.6.4.1 Mexican government’s initiative toward adoption of cloud security and digital identity transformation

TABLE 225 MEXICO: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 226 MEXICO: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 227 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 228 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 229 MEXICO: IDaaS Market, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 230 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 231 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 232 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 233 REST OF LATIN AMERICA: IDENTITY AS A SERVICE MARKET, BY SOLUTION TYPE, 2016–2021 (USD MILLION)

TABLE 234 REST OF LATIN AMERICA: MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 235 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 236 REST OF LATIN AMERICA: IDaaS Market, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 237 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 238 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 239 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 240 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 190)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 27 MARKET EVALUATION FRAMEWORK: 2019–2022 WITNESSED MARKET EXPANSION AND CONSOLIDATION

11.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 28 IDENTITY AS A SERVICE MARKET: REVENUE ANALYSIS

11.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 241 MARKET: DEGREE OF COMPETITION

11.5 HISTORICAL REVENUE ANALYSIS

FIGURE 29 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2017–2021 (USD MILLION)

11.6 RANKING OF KEY PLAYERS

FIGURE 30 MARKET KEY PLAYER RANKING, 2022

11.7 KEY COMPANY EVALUATION MATRIX

11.7.1 KEY COMPANY EVALUATION MATRIX (DEFINITIONS AND METHODOLOGY)

11.7.2 STARS

11.7.3 EMERGING LEADERS

11.7.4 PERVASIVE PLAYERS

11.7.5 PARTICIPANTS

FIGURE 31 IDENTITY AS A SERVICE MARKET, KEY PLAYER EVALUATION QUADRANT, 2022

11.8 COMPETITIVE BENCHMARKING

11.8.1 EVALUATION CRITERIA OF KEY COMPANIES

TABLE 242 EVALUATION CRITERIA

TABLE 243 COMPANY INDUSTRY FOOTPRINT

TABLE 244 COMPANY REGION FOOTPRINT

11.9 STARTUP/SME EVALUATION MATRIX

FIGURE 32 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 245 DETAILED LIST OF SME/STARTUP

TABLE 246 SME/STARTUP COMPANY REGION FOOTPRINT

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 33 IDENTITY AS A SERVICE MARKET, STARTUP/SME EVALUATION MATRIX, 2022

11.10 COMPETITIVE SCENARIO

11.10.1 PRODUCT/SOLUTION LAUNCHES

TABLE 247 MARKET: NEW PRODUCT/SOLUTION LAUNCHES 2019–2022

11.10.2 DEALS

TABLE 248 MARKET: DEALS 2019–2022

12 COMPANY PROFILES (Page No. - 214)

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

12.1 KEY PLAYERS

12.1.1 OKTA

TABLE 249 OKTA: BUSINESS OVERVIEW

FIGURE 34 OKTA: COMPANY SNAPSHOT

TABLE 250 OKTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 251 OKTA: PRODUCT LAUNCHES

TABLE 252 OKTA: DEALS

12.1.2 CYBERARK

TABLE 253 CYBERARK: BUSINESS OVERVIEW

FIGURE 35 CYBERARK: COMPANY SNAPSHOT

TABLE 254 CYBERARK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 255 CYBERARK: PRODUCT LAUNCHES

TABLE 256 CYBERARK: DEALS

12.1.3 THALES

TABLE 257 THALES: BUSINESS OVERVIEW

FIGURE 36 THALES: COMPANY SNAPSHOT

TABLE 258 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 259 THALES: PRODUCT LAUNCHES

TABLE 260 THALES: DEALS

12.1.4 MICROSOFT

TABLE 261 MICROSOFT: BUSINESS OVERVIEW

FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

TABLE 262 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263 MICROSOFT: PRODUCT LAUNCHES

TABLE 264 MICROSOFT: DEALS

12.1.5 PING IDENTITY

TABLE 265 PING IDENTITY: BUSINESS OVERVIEW

FIGURE 38 PING IDENTITY: COMPANY SNAPSHOT

TABLE 266 PING IDENTITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 267 PING IDENTITY: PRODUCT LAUNCHES

TABLE 268 PING IDENTITY: DEALS

12.1.6 ONELOGIN

TABLE 269 ONELOGIN: BUSINESS OVERVIEW

TABLE 270 ONELOGIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 ONELOGIN: PRODUCT LAUNCHES

TABLE 272 ONELOGIN: DEALS

12.1.7 IBM

TABLE 273 IBM: BUSINESS OVERVIEW

FIGURE 39 IBM: COMPANY SNAPSHOT

TABLE 274 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 IBM: PRODUCT LAUNCHES

TABLE 276 IBM: DEALS

12.1.8 ORACLE

TABLE 277 ORACLE: BUSINESS OVERVIEW

FIGURE 40 ORACLE: COMPANY SNAPSHOT

TABLE 278 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 279 ORACLE: PRODUCT LAUNCHES

TABLE 280 ORACLE: DEALS

12.1.9 GOOGLE

TABLE 281 GOOGLE: BUSINESS OVERVIEW

TABLE 282 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 283 GOOGLE: DEALS

12.1.10 SAILPOINT

TABLE 284 SAILPOINT: BUSINESS OVERVIEW

TABLE 285 SAILPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 286 SAILPOINT: PRODUCTS LAUNCHED

TABLE 287 SAILPOINT: DEALS

12.1.11 JUMPCLOUD

12.1.12 SECUREAUTH

12.1.13 AUTH0

12.1.14 OPENTEXT

12.1.15 ILANTUS

12.1.16 LOGINRADIUS

12.1.17 DELINEA

12.1.18 OPTIMAL IDM

12.1.19 FISCHER IDENTITY

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ATOS

12.2.2 AVATIER

12.2.3 SIMEIO SOLUTIONS

12.2.4 HCL

12.2.5 CAPGEMINI

12.2.6 BROADCOM

12.2.7 SALESFORCE

12.2.8 JUMIO

12.2.9 SIGNICAT

12.2.10 UBISECURE

12.2.11 EMPOWERID

13 ADJACENT MARKETS (Page No. - 279)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 288 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 IDENTITY AS A SERVICE: ADJACENT MARKETS

13.3.1 DIGITAL IDENTITY SOLUTIONS MARKET

TABLE 289 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 290 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 291 SOLUTIONS: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 292 SOLUTIONS: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 293 SERVICES: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 294 SERVICES: DIGITAL IDENTITY SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3.2 MULTI-FACTOR AUTHENTICATION MARKET

TABLE 295 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2016–2021 (USD MILLION)

TABLE 296 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2022–2027 (USD MILLION)

TABLE 297 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 298 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 299 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 300 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 301 FOUR-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 302 FOUR-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 303 FIVE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 304 FIVE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 285)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size for the IDaaS market. Exhaustive secondary research was done to collect information on the IDaaS industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, and bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the IDaaS market.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of IDaaS software and service vendors, forums, certified publications and white papers. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major IDaaS solution providers.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the IDaaS market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of IDaaS market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down and bottom-up approaches were used to estimate and validate the size of the global IDaaS market and estimate the size of various other dependent sub-segments in the overall IDaaS market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives, All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the IDaaS market based on Component, Deployment Type, Organization Size, Vertical, and Region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market.

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the IDaaS market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the IDaaS market.

- To profile the key players of the IDaaS market and comprehensively analyze their market size and core competencies in the market.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global IDaaS market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IDaaS Market

What could be role of AI in the Identity as a Service (IDaaS) Market?